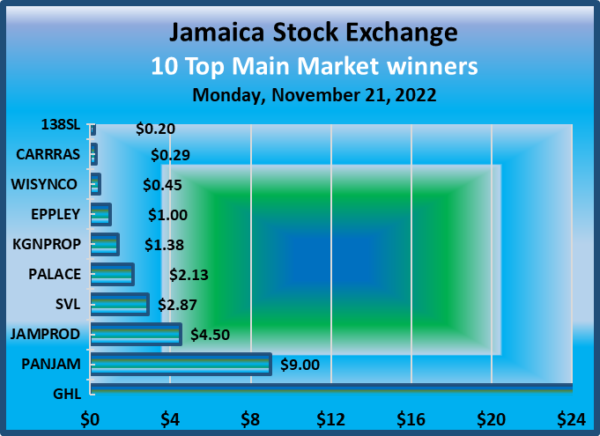

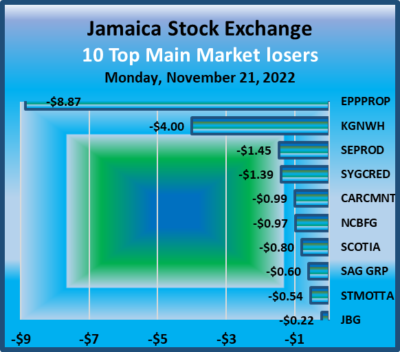

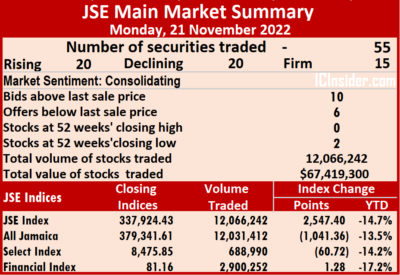

The Jamaica Stock Exchange Main Market ended on Monday after a merger announcement by Pan Jam Investment and Jamaica Producers gained 18 percent and 24 percent respectively and helped push the market higher at the close after the volume of stocks traded jumped 40 percent higher than on Friday but with 5 percent fall in values from the trading in 55 securities compared to 49 on Friday, with 20 rising, 20 declining and 15 ending unchanged.

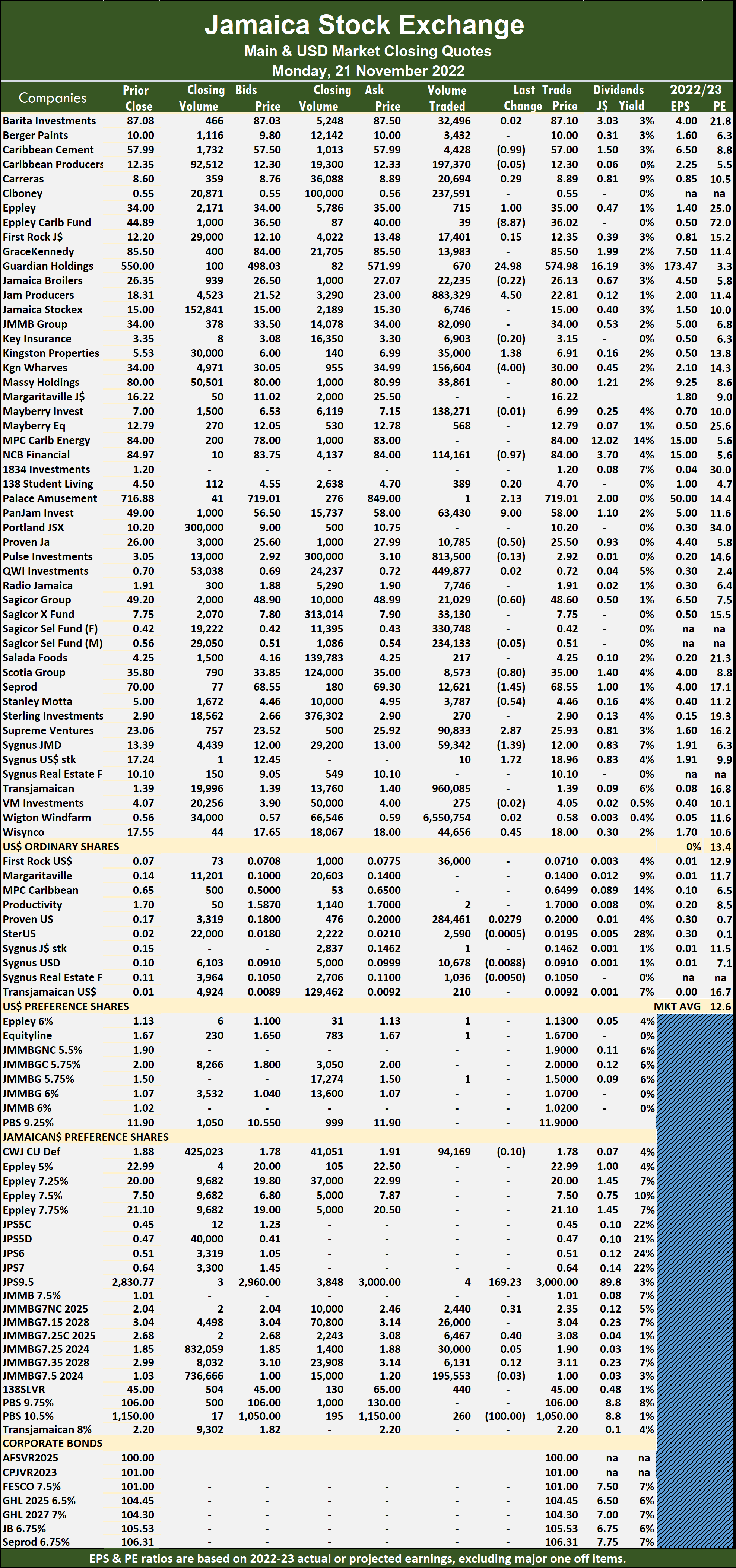

JMMB Group traded at an intraday 52 weeks’ low of $32.50, Key Insurance closed at a 52 weeks’ low of$3.15 and Kingston Wharves closed at a 52 weeks’ low of $30.

JMMB Group traded at an intraday 52 weeks’ low of $32.50, Key Insurance closed at a 52 weeks’ low of$3.15 and Kingston Wharves closed at a 52 weeks’ low of $30.

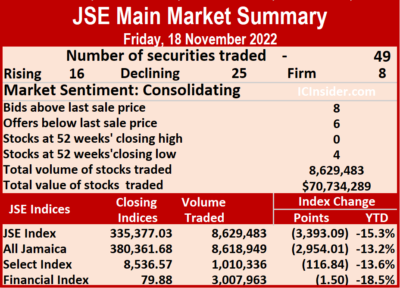

A total of 12,066,242 shares were tradeded for $67,419,300 compared with 8,629,483 units at $70,734,289 on Friday.

Trading averaged 219,386 units at $1,225,805 versus 176,112 shares at $1,443,557 on Friday and month to date, an average of 209,746 units at $1,522,176 versus 209,050 units at $1,543,568 on the previous trading day. October closed with an average of 231,243 units at $1,464,224.

Wigton Windfarm led trading with 6.55 million shares in accounting for 54.3 percent of total volume followed by Transjamaican Highway with 960,085 units for 8 percent of the day’s trade and Jamaica Producers with 883,329 units for 7.3 percent market share.

The All Jamaican Composite Index dropped 1,041.36 points to close at 379,341.61, the JSE Main Index rose 2,547.40 points to 337,924.43 and the JSE Financial Index climbed 1.28 points to 81.16.

The All Jamaican Composite Index dropped 1,041.36 points to close at 379,341.61, the JSE Main Index rose 2,547.40 points to 337,924.43 and the JSE Financial Index climbed 1.28 points to 81.16.

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.4 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and nine with lower offers.

At the close, Caribbean Cement lost 99 cents to close at $57 with an exchange of 4,428 stock units, Eppley rose $1 to $35 with investors transferring 715 units, Eppley Caribbean Property Fund declined $8.87 in closing at $36.02 with a transfer of 39 stocks.  Guardian Holdings popped $24.98 to $574.98 as investors exchanged 670 shares, Jamaica Producers rose $4.50 to $22.81 in trading 883,329 stocks, Kingston Properties gained $1.38 after ending at $6.91 with a transfer of 35,000 stock units. Kingston Wharves shed $4 to end at a 52 weeks’ low of $30 in exchange of 156,604 units, NCB Financial fell 97 cents in closing at $84 trading 114,161 stock units, Palace Amusement advanced $2.13 to close at $719.01 with the swapping of one unit. PanJam Investment climbed $9 to finish at $58 in switching ownership of 63,430 shares, Proven Investments dropped 50 cents to $25.50 with 10,785 stocks changing hands, Sagicor Group declined 60 cents to $48.60 after exchanging 21,029 stock units. Scotia Group lost 80 cents to end at $35 in transferring 8,573 shares, Seprod fell $1.45 to close at $68.55 with the swapping of 12,621 units, Stanley Motta dipped 54 cents to $4.46 with 3,787 stocks crossing the market. Supreme Ventures rallied $2.87 to $25.93 as investors switched ownership of 90,833 stock units, Sygnus Credit Investments USD share popped $1.72 to close at $18.96 with ten stocks changing hands.

Guardian Holdings popped $24.98 to $574.98 as investors exchanged 670 shares, Jamaica Producers rose $4.50 to $22.81 in trading 883,329 stocks, Kingston Properties gained $1.38 after ending at $6.91 with a transfer of 35,000 stock units. Kingston Wharves shed $4 to end at a 52 weeks’ low of $30 in exchange of 156,604 units, NCB Financial fell 97 cents in closing at $84 trading 114,161 stock units, Palace Amusement advanced $2.13 to close at $719.01 with the swapping of one unit. PanJam Investment climbed $9 to finish at $58 in switching ownership of 63,430 shares, Proven Investments dropped 50 cents to $25.50 with 10,785 stocks changing hands, Sagicor Group declined 60 cents to $48.60 after exchanging 21,029 stock units. Scotia Group lost 80 cents to end at $35 in transferring 8,573 shares, Seprod fell $1.45 to close at $68.55 with the swapping of 12,621 units, Stanley Motta dipped 54 cents to $4.46 with 3,787 stocks crossing the market. Supreme Ventures rallied $2.87 to $25.93 as investors switched ownership of 90,833 stock units, Sygnus Credit Investments USD share popped $1.72 to close at $18.96 with ten stocks changing hands.  Sygnus Credit Investments dropped $1.39 to $12 with 59,342 units clearing the market and Wisynco Group advanced 45 cents to end at $18 in exchanging 44,656 shares.

Sygnus Credit Investments dropped $1.39 to $12 with 59,342 units clearing the market and Wisynco Group advanced 45 cents to end at $18 in exchanging 44,656 shares.

In the preference segment, Jamaica Public Service 9.5% rallied $169.23 to $3,000 in an exchange of 4 stock units, JMMB Group 7.25% preference share rose 40 cents in closing at $3.08 after 6,467 stocks cleared the market and Productive Business Solutions 10.5% preference share dropped $100 to $1,050 with a transfer of 260 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

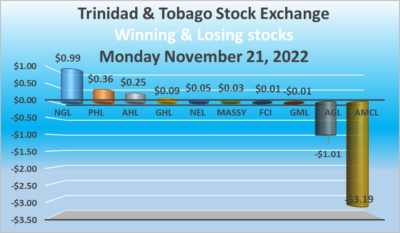

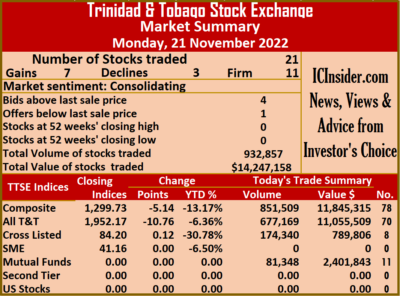

Trading jumps on Trinidad Exchange

Trading picked up sharply Market on the Trinidad and Tobago Stock Exchange on Monday, with a 126 percent rise in the volume of stocks traded that was valued 134 percent more than on Friday and resulted in 21 securities trading compared with 22 on Friday, with prices of seven rising, three declining and 11 remaining unchanged.

Investors traded 932,857 shares for $14,247,158 versus 413,093 stock units at $6,086,851 on Friday. An average of 44,422 units were traded at $678,436 compared with 18,777 shares at $276,675 on Friday, with trading month to date averaging 62,127 shares at $557,481 and tracking closely, the 63,632 units trading at $547,197 on the previous day. The average trade for October amounts to 29,755 at $358,068.

Investors traded 932,857 shares for $14,247,158 versus 413,093 stock units at $6,086,851 on Friday. An average of 44,422 units were traded at $678,436 compared with 18,777 shares at $276,675 on Friday, with trading month to date averaging 62,127 shares at $557,481 and tracking closely, the 63,632 units trading at $547,197 on the previous day. The average trade for October amounts to 29,755 at $358,068.

The Composite Index shed 5.14 points to end at 1,299.73, the All T&T Index dropped 10.76 points to 1,952.17 and the Cross-Listed Index rallied 0.12 points to settle at 84.20.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and one stock with a lower offer.

At the close, Agostini’s dropped $1.01 in closing at $42 after 11,632 shares were exchanged, Angostura Holdings increased 25 cents to $23.50, with 200,045 stocks crossing the market, Ansa McAl shed $3.19 to end at $50 after an exchange of 1,084 stock units. Ansa Merchant Bank ended at $42.20 after trading 107 units, Clico Investment Fund remained at $30 with a transfer of 81,348 stock units, First Citizens Group remained at $50.01, with 6,948 shares changing hands. FirstCaribbean International Bank popped 1 cent in ending at $5.06 after investors swapped 600 units,  Guardian Holdings advanced 9 cents to $25.70 with investors transferring 12,796 stocks, Guardian Media declined 1 cent in closing at $2.99 after exchanging 1,102 units. JMMB Group ended at $1.90 in an exchange of 2,630 shares, Massy Holdings climbed 3 cents to $4.45, with 252,582 stocks clearing the market, National Enterprises gained 5 cents in closing at $3.26, with 49,984 stock units crossing the exchange. National Flour Mills remained at $1.51, with 1,400 stocks passed through the market, NCB Financial ended at $4.56 while trading 171,110 stock units, One Caribbean Media ended at $3.69 as investors exchanged 990 units. Prestige Holdings rallied 36 cents to end at $6.26 trading 723 shares, Republic Financial remained at $136 with an exchange of 30 shares,Scotiabank ended at $77.80 with the swapping of 15,533 stocks. Trinidad & Tobago NGL rose 99 cents in ending at $22 and closed with 76,820 units changing hands, Unilever Caribbean remained at $13.02 while 346 stock units passed through the market and West Indian Tobacco ended at $22 in switching ownership of 45,047 stock units.

Guardian Holdings advanced 9 cents to $25.70 with investors transferring 12,796 stocks, Guardian Media declined 1 cent in closing at $2.99 after exchanging 1,102 units. JMMB Group ended at $1.90 in an exchange of 2,630 shares, Massy Holdings climbed 3 cents to $4.45, with 252,582 stocks clearing the market, National Enterprises gained 5 cents in closing at $3.26, with 49,984 stock units crossing the exchange. National Flour Mills remained at $1.51, with 1,400 stocks passed through the market, NCB Financial ended at $4.56 while trading 171,110 stock units, One Caribbean Media ended at $3.69 as investors exchanged 990 units. Prestige Holdings rallied 36 cents to end at $6.26 trading 723 shares, Republic Financial remained at $136 with an exchange of 30 shares,Scotiabank ended at $77.80 with the swapping of 15,533 stocks. Trinidad & Tobago NGL rose 99 cents in ending at $22 and closed with 76,820 units changing hands, Unilever Caribbean remained at $13.02 while 346 stock units passed through the market and West Indian Tobacco ended at $22 in switching ownership of 45,047 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

PanJam and Jamaica Producers merger

Jamaica Producers and PanJam Investment announced an agreement to amalgamate their businesses to create a new group of companies, with the transaction expected to be completed within the first quarter of 2023 and is expected to take advantage of opportunities both locally and globally.

This arrangement, subject to the approval of the shareholders and the relevant regulators, will result in PanJam acquiring JP’s operating assets in exchange for JP taking a 34.5% interest in PanJam. Following the transaction, PanJam will ultimately hold the combined businesses and will be renamed Pan Jamaica Group Limited. JP will emerge as the largest shareholder of the Group, with its shares in the Group being its principal operating asset. Both companies will remain listed on the Main Market of the Jamaica Stock Exchange.

This arrangement, subject to the approval of the shareholders and the relevant regulators, will result in PanJam acquiring JP’s operating assets in exchange for JP taking a 34.5% interest in PanJam. Following the transaction, PanJam will ultimately hold the combined businesses and will be renamed Pan Jamaica Group Limited. JP will emerge as the largest shareholder of the Group, with its shares in the Group being its principal operating asset. Both companies will remain listed on the Main Market of the Jamaica Stock Exchange.

The combined entity “ is expected to deliver significant value for all shareholders through a strong and diverse portfolio of businesses not only in Jamaica but also internationally,” a release from the companies stated.

Stephen Facey Chairman & Paul Hanworth Chief Operating Officer

The new Group will have substantial holdings in real estate and infrastructure, speciality food and drink manufacturing, agri-business, financial services and a global services network of interests in hotels and attractions, business process outsourcing, shipping, logistics and port operations.

According to JP’s Chief Executive Officer, Jeffrey Hall: “This transaction is not our first opportunity to partner with PanJam. We achieved great commercial success for shareholders in our joint investment in Mavis Bank Coffee Company. We also experienced, first-hand, our compatibility around our shared commitment to integrity, seriousness of purpose, nation building and shareholder returns. JP and PanJam operate businesses that have been tested over time and always come out stronger. With a joint balance sheet of over $100 billion in assets, we will have the scale to be more formidable, more global and more resilient.” PanJam’s Chief Executive Officer, Joanna Banks stated: “PanJam has done exceptionally well by building great partnerships with like-minded entities. The proposed business combination represents the creation of the quintessential Jamaican conglomerate, a geographically and operationally diversified company focused on value creation for all stakeholders through investment in key sectors of the global economy. Our internal analysis points to a future that we are all excited about – one in which our combined enterprises become the regional investment vehicle and investor of choice.”

Jamaica Producers former HQ

The expanded Pan Jamaica Group will be led by JP’s current CEO, Jeffrey Hall, who will hold the position of CEO and Executive Vice Chairman of the Board of Directors. PanJam’s current CEO, Joanna Banks will hold the position of President of Pan Jamaica Group. Stephen Facey will serve as Chairman of the Group’s Board, which will include directors from both JP and PanJam. Charles Johnston, JP’s Chairman, Jeffrey Hall and Alan Buckland, JP’s current Chief Financial Officer, are expected to join the Group’s Board.

Both JP and PanJam have long legacies of investing in and contributing to the growth of Jamaica. JP, founded as a co-operative of banana growers over 90 years ago, has re-positioned itself as a multinational group of companies, with a strong footprint not only in Jamaica through its port operations at Kingston Wharves Limited and its agricultural holdings and food businesses, but also globally, through its European juice holdings, shipping line and global logistics businesses. Charles Johnston, the longstanding Chairman of JP will continue in that role. PanJam has invested in Jamaica for close to 60 years. It has an expansive real estate portfolio comprised of high-end commercial and hospitality properties, and is a well-known leader in real estate management and development. It is also a successful private equity investor with actively-managed and strategic holdings in an array of speciality food manufacturing and distribution, hospitality and business process outsourcing providers. Additionally, PanJam has a significant footprint in the financial services industry through its 30.2% stake in Sagicor Group Jamaica Limited.

The stock prices of both companies rose in the morning session on the Jamaica Stock Exchange, with Jamaica Producers rising 8.3 percent to $22 from a close on Friday of $18.31 and Pan Jam Investment jumping just over 18 percent to $58 form the last traded price of $49.

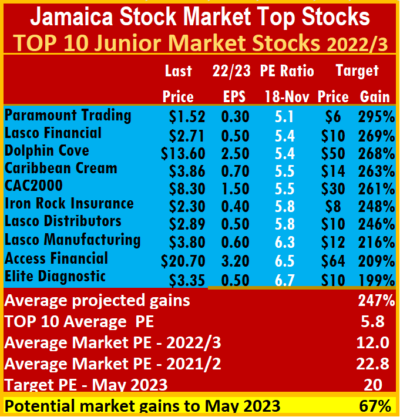

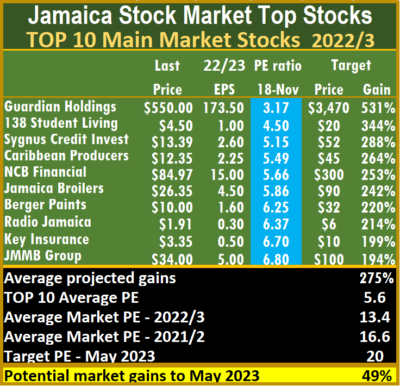

Major shake up of ICTOP10

The Jamaica stock market got hit in the past week as a new Initial Public offer of Regency Petroleum shares open to the public on Thursday. The market decline is now a very pronounced feature of the market as investors seek funds to invest in the new issue and pressure prices of existing stocks and provides opportunities for savvy investors to pick up stocks at depressed prices for the eventual rally after the IPO closes.

NCB Financial Group is now back in the ICTOP10

The pricing of the IPO issue does not provide enough likely gains for it to make the ICTOP10, but it is included in the Stocks to Watch as the price is expected to jump and deliver a decent profit.

In the past two weeks, several company results were released to the public, with varying outturns, some of which led to adjustments to earnings per share for the current fiscal year. Sterling Investments and VM Investments earnings were adjusted downward and fell out of the TOP 10 and were replaced by NCB Financial Group and Key Insurance. Earnings for Berger Paints and JMMB Group were also revised downward, but they remain in the Main Market TOP10. Access Financial and Iron Rock Insurance return to the Junior Market TOP10 as General Accident and Medical Disposables dropped out.

Seven stocks in the Junior Market TOP10 declined between 3 percent and 20 percent, with only one rising. The Main Market list had two stocks gaining for a second week and six declining between four and nine percent.

Seven stocks in the Junior Market TOP10 declined between 3 percent and 20 percent, with only one rising. The Main Market list had two stocks gaining for a second week and six declining between four and nine percent.

Notable price changes during the week include Paramount Trading that dropped 20 percent to an attractive $1.52, Elite Diagnostic and Lasco Financial dipping 10 percent to close at $3.35 and $2.71, respectively, Lasco Distributors lost 10 percent to $3.10 and Caribbean Cream fell 4 percent to $3.86.

In the Main Market, Guardian Holdings rose 10 percent to $550. VVM Investments dropped 7 percent to $4.07 while JMMB Group and 138 Student Living fell 9 percent to $34 and $4.50, respectively, Jamaica Broilers and VM Investments fell 7 percent to $26.35 and $4.07, respectively and Radio Jamaica lost 5 percent in closing at $1.91.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.6, well below the market average of 13.4. At the same time, the Junior Market Top 10 PE sits at 5.8 versus the market at 12, important indicator of the level of undervaluation of the ICTOP10 stocks. The Junior Market is projected to rise by 247 percent and the Main Market TOP10, an average now of 275 percent, to May 2023.

The Junior Market has 13 stocks representing a third of the market, with PEs from 15 to 30, averaging 20 compared with the above average of the market. The top half of the market has an average PE of 17. This data shows the extent of potential gains that the TOP 10 stocks possess. The situation in the Main Market is similar, with the 16 highest valued stocks priced at a PE of 15 to 90, with an average of 27 and 22.6 excluding the highest valued one and 19.4 for the top half excluding the highest valued stock.

The Junior Market has 13 stocks representing a third of the market, with PEs from 15 to 30, averaging 20 compared with the above average of the market. The top half of the market has an average PE of 17. This data shows the extent of potential gains that the TOP 10 stocks possess. The situation in the Main Market is similar, with the 16 highest valued stocks priced at a PE of 15 to 90, with an average of 27 and 22.6 excluding the highest valued one and 19.4 for the top half excluding the highest valued stock.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

JSE USD Market plunges

The JSE US Denominated Equities market suffered a major reversal in trading on Friday, with the market index plunging 29.58 points to 227.27 after the major rise earlier in the week resulting from a big move by Productive Business Solutions was reversed and Proven Investments falling to a 52 weeks’ low as trading ended, with the volume of stocks exchanged rising 174 percent, valued 222 percent more than Thursday’s trades and resulting in an exchange of 10 securities, the same as on Thursday and ended with two rising, two declining and six unchanged.

A total of 182,935 shares were traded for US$22,001 compared to 66,713 units at US$6,828 on Thursday.

A total of 182,935 shares were traded for US$22,001 compared to 66,713 units at US$6,828 on Thursday.

Trading averaged 18,294 units at US$2,200, versus 6,671 shares at US$683 on Thursday, with month to date average of 28,308 shares at US$3,437 versus 29,309 units at US$3,560 on the previous day. October ended with an average of 40,972 units for US$2,277.

The PE Ratio, a measure used in computing appropriate stock values, averages 8.5. The PE ratio uses ICInsider.com earnings forecasts for companies with financial years ending between November and August 2023.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling prices and none with lower offers.

At the close, First Rock Real Estate USD share dipped 0.5 of a cent in closing at 7.1 US cents with an exchange of 20,000 shares, Productive Business Solutions remained at US$1.70 while exchanging ten stocks, Proven Investments lost 1.41 cents to end at a 52 weeks’ low of 17.21 US cents and closed with an exchange of 23,176 units. Sterling Investments rallied 0.1 of a cent to 2 US cents, with 105,000 stock units changing hands,  Sygnus Credit Investments J$ share ended at 14.62 US cents, with investors exchanging three units, Sygnus Real Estate Finance USD share ended at 11 US cents with a transfer of 8,321 shares and Transjamaican Highway remained at 0.92 of one US cent after an exchange of 17,902 stock units.

Sygnus Credit Investments J$ share ended at 14.62 US cents, with investors exchanging three units, Sygnus Real Estate Finance USD share ended at 11 US cents with a transfer of 8,321 shares and Transjamaican Highway remained at 0.92 of one US cent after an exchange of 17,902 stock units.

In the preference segment, Productive Business 9.25% preference share advanced 90 cents to end at US$11.90 after 20 stocks passed through the market, Eppley 6% preference share remained at US$1.13 after a transfer of 3 shares and JMMB Group 5.75% ended at US$1.50 in switching ownership of 8,500 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Guardian finishing strongly in 2022

Guardian Holdings generated a 131 percent surge in profit attributable to shareholders of $1.06 billion for the nine months to September 2022, up from $457 million in the 2021 period, profit jumped 210 percent in the third quarter to $620 million from $201 million in 2021.

Earnings per share amounted to $2.67 for the September quarter and $4.55 for the nine months to September, that should end the year around $7 per share, with a PE of 3.5 times current year’s earnings and a stock price at J$530.

Earnings per share amounted to $2.67 for the September quarter and $4.55 for the nine months to September, that should end the year around $7 per share, with a PE of 3.5 times current year’s earnings and a stock price at J$530.

The vastly improved 2022 results follow a 5.3 percent increase in net premium income to $3.57 billion in the nine months to September, from $3.39 billion in the previous year and a 5.5 percent rise for the quarter to $1.2 billion versus $1.14 billion in 2021. Net income from all activities ended at $2.4 billion in 2022 for the nine months, up 26 percent from $1.89 billion in 2021 and for the September quarter $1.06 billion with a 67 percent increase over $634 million in 2021.

Net income from investment activity slipped 18 percent from $1.15 billion in the nine months to September 2021 to $942 million for the 2022 period. However, the quarterly figures reflect a marginal decline from $383 million in 2021 to 372 million this year.

Operating expenses of $1.15 billion for the nine months of September 2022 rose 6.9 percent from $1.07 billion and increased 33 percent for the quarter to $405 million from $305 million in 2021. Finance charges of $155 million for the nine months to September 2022 popped marginally from $150 million in 2021 and for the quarter $51 million versus $47 million in 2021.

Provision for taxation was $113 million for the year to September 2022, a reduction from the $136 million for the same period in the previous year and $68 million for the quarter in 2022 versus $59 million in 2021.

According to chairman, Patrick Hilton, “the group has been on a transformation journey centred on technology, people and processes. We have invested heavily in technology to bring world class customer service to our markets, leverage of scale of our group and reduce our operating costs. While in recent years, we have reaped some of the benefits, we are now at a resultant juncture where the payback on this investment is rapidly accelerating. In 2022 the group implemented many of these initiatives for our life, health and pension segment, with the alignment of our Trinidad and Jamaican operations bringing to reality operational synergies, cost savings and centres of excellence. These activities result in long-term cost savings which have the effect of creating favourable reserve movements contributing to the exceptional performance recorded in the year to date.”

.

The group has two primary areas of operation. The life health and pension business generated underwriting revenues of $2.97 billion in 2022 and delivered net income from operations of $1.2 billion compared to underrating revenues of $2.77 billion in 2021, with an operating profit of $621 million. The other major segment of property and casualty business generated underwriting revenues of $999 million with an operating profit of $162 million in 2022 versus revenues of $961 million in 2021 with an operating profit of $121 million.

The group has total assets of $34.46 billion as of September compared to three $34.43 billion at the end of September 2021 with shareholders’ equity of $5.4 billion up from $4.87 billion at the end of 2021. The main assets include investment securities at $21 billion, loans and receivables at $2.4 billion, cash and cash equivalent at $3.8 billion dollars and investment property amounting to $1.67 billion. The main liability comprises insurance contracts of $19 billion and financial liability of three-point infant investment contract liabilities and third party mutual funds of $4.1 billion.

Cash flow brought in $1.44 billion to September. After investment activities, the group ended with $375 million before funds were used in financing and other activities and ended with negative flows of $103 million.

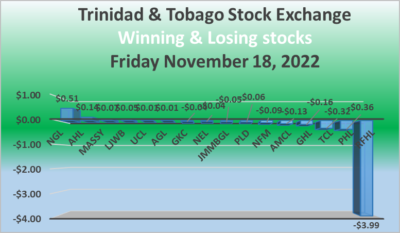

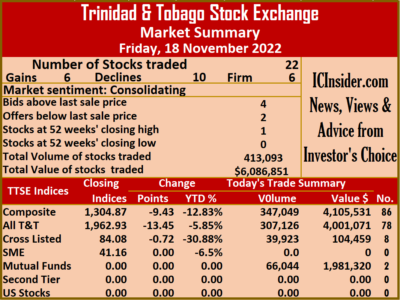

Several price changes on the Trinidad market

Price changes on the Trinidad and Tobago Stock Exchange on Friday were plenty after trading in 22 securities compared with 13 on Thursday, with six stocks rising, ten declining and six remaining unchanged with the volume of stocks traded declining 38 percent with the value falling 30 percent lower than on Thursday.

Investors traded 413,093 shares for $6,086,851 versus 666,325 stock units at $8,724,268 on Thursday.

Investors traded 413,093 shares for $6,086,851 versus 666,325 stock units at $8,724,268 on Thursday.

An average of 18,777 units were traded at $276,675 versus 51,256 shares at $671,098 on Thursday, with trading month to date averaging 63,632 shares at $547,197 versus 68,018 units at $573,648 on the previous day. The average trade for October was 29,755 at $358,068.

The Composite Index dipped 9.43 points to 1,304.87, the All T&T Index lost 13.45 points to close at 1,962.93 and the Cross-Listed Index dipped 0.72 points to 84.08.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s advanced 1 cent to close at $43.01 in switching ownership of 100 shares, Angostura Holdings increased 14 cents to $23.25 while exchanging 480 stocks, Ansa McAl lost 13 cents in closing at $53.19, with 50 units crossing the market. Clico Investment Fund ended at $30 in trading 66,044 stock units, First Citizens Group remained at $50.01 with a transfer of 948 stocks, GraceKennedy shed 4 cents to end at $4.75, with 4,393 units clearing the market. Guardian Holdings fell 16 cents to end at $25.61 in an exchange of 1,100 stock units, JMMB Group declined 5 cents to $1.90, with 29,500 shares crossing the exchange, L.J. Williams B share climbed 5 cents to a 52 weeks’ high of $2.30 as investors exchanged 42 units.  Massy Holdings gained 7 cents in closing at $4.42 after a transfer of 174,578 shares, National Enterprises dipped 4 cents to $3.21, with 2,584 stocks changing hands, National Flour Mills dipped 9 cents to end at $1.51 with trading in 300 shares. NCB Financial ended at $4.56 in exchanging 6,030 units, One Caribbean Media closed at $3.69 with the swapping of 50 stock units, Point Lisas shed 6 cents to close at $3.19, with 1,111 shares crossing the market. Prestige Holdings dipped 36 cents after ending at $5.90 after 5,000 stocks were exchanged, Republic Financial fell $3.99 to $136 trading 152 shares, Scotiabank ended at $77.80 with an exchange of 12,880 units. Trinidad & Tobago NGL rose 51 cents to end at $21.01 with 46,472 stock units passing through the market, Trinidad Cement dropped 32 cents to close at $3.60 with investors transferring 15,133 stocks, Unilever Caribbean popped 1 cent in ending at $13.02 after exchanging 700 stock units and West Indian Tobacco remained at $22 after an exchange of 45,446 shares.

Massy Holdings gained 7 cents in closing at $4.42 after a transfer of 174,578 shares, National Enterprises dipped 4 cents to $3.21, with 2,584 stocks changing hands, National Flour Mills dipped 9 cents to end at $1.51 with trading in 300 shares. NCB Financial ended at $4.56 in exchanging 6,030 units, One Caribbean Media closed at $3.69 with the swapping of 50 stock units, Point Lisas shed 6 cents to close at $3.19, with 1,111 shares crossing the market. Prestige Holdings dipped 36 cents after ending at $5.90 after 5,000 stocks were exchanged, Republic Financial fell $3.99 to $136 trading 152 shares, Scotiabank ended at $77.80 with an exchange of 12,880 units. Trinidad & Tobago NGL rose 51 cents to end at $21.01 with 46,472 stock units passing through the market, Trinidad Cement dropped 32 cents to close at $3.60 with investors transferring 15,133 stocks, Unilever Caribbean popped 1 cent in ending at $13.02 after exchanging 700 stock units and West Indian Tobacco remained at $22 after an exchange of 45,446 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

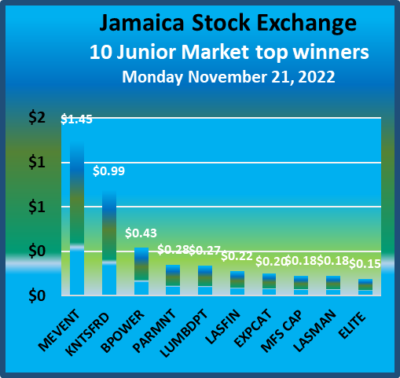

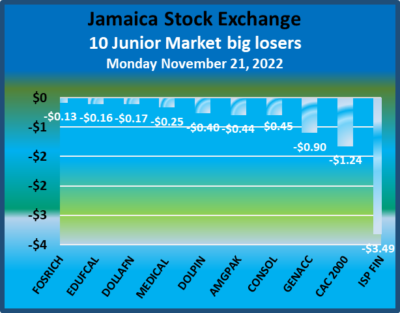

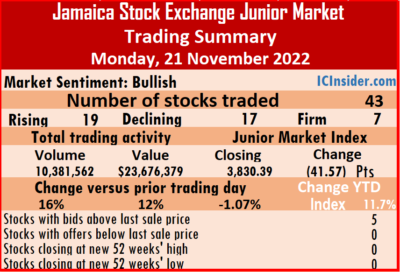

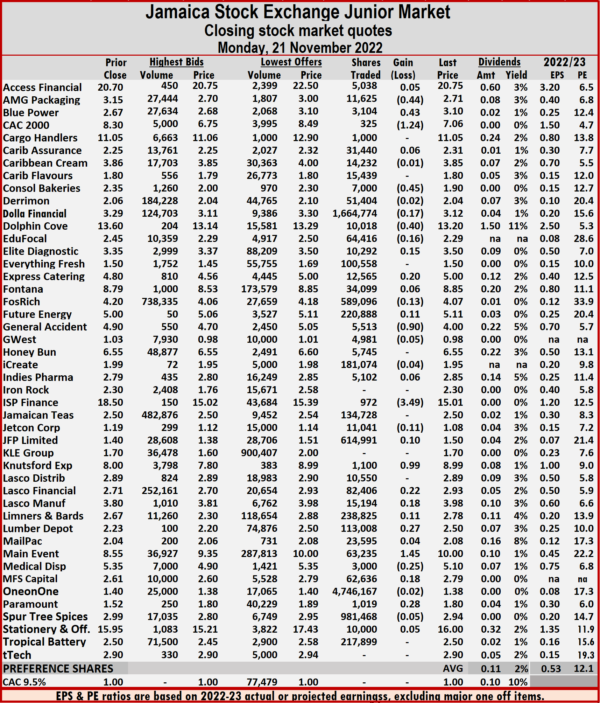

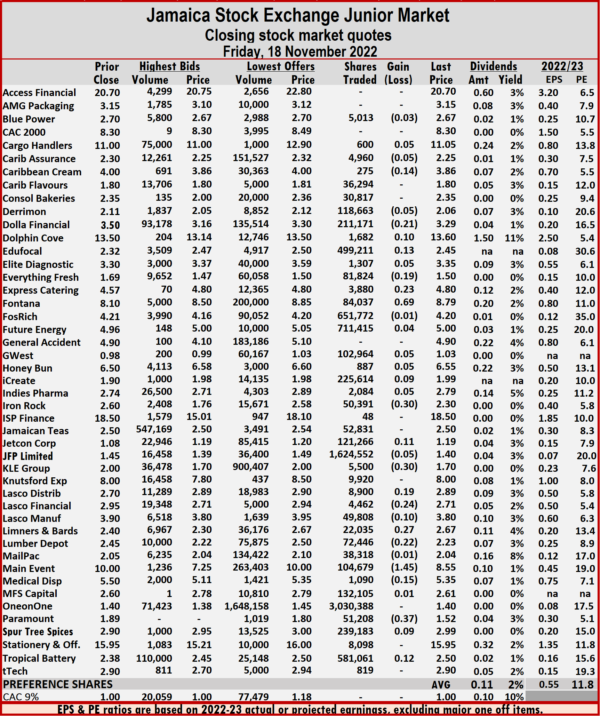

A total of 10,381,562 shares were exchanged for $23,676,379 up from 8,983,578 units at $21,220,946 on Friday.

A total of 10,381,562 shares were exchanged for $23,676,379 up from 8,983,578 units at $21,220,946 on Friday. Junior Market stocks incorporate ICInsider.com projected earnings for companies with financial year end that falls between November this year and August 2023.

Junior Market stocks incorporate ICInsider.com projected earnings for companies with financial year end that falls between November this year and August 2023. Dolphin Cove dropped 40 cents in closing at $13.20, with 10,018 stocks changing hands. EduFocal shed 16 cents to close at $2.29 after 64,416 units crossed the exchange, Elite Diagnostic gained 15 cents in ending at $3.50 after an exchange of 10,292 shares, Express Catering popped 20 cents to $5 after investors traded 12,565 stock units. Fosrich lost 13 cents to end at $4.07 while exchanging 589,096 stocks, Future Energy Source rallied 11 cents to end at $5.11 with the swapping of 220,888 units, General Accident declined 90 cents to $4 with a transfer of 5,513 shares. ISP Finance dropped $3.49 to close at $15.01 with an exchange of 972 stocks, Jetcon Corporation shed 11 cents in closing at $1.08 as investors exchanged 11,041 units, JFP Ltd climbed 10 cents to $1.50, with 614,991 shares clearing the market. Knutsford Express advanced 99 cents to $8.99, with 1,100 stock units crossing the market, Lasco Financial increased 22 cents to $2.93 in exchanging 82,406 stock units, Lasco Manufacturing increased 18 cents to $3.98 after a transfer of 15,194 units. Limners and Bards climbed 11 cents to end at $2.78 in switching ownership of 238,825 shares, Lumber Depot rallied 27 cents to close at $2.50 while 113,008 stocks passed through the market, Main Event jumped $1.45 to $10 after exchanging 63,235 stock units.

Dolphin Cove dropped 40 cents in closing at $13.20, with 10,018 stocks changing hands. EduFocal shed 16 cents to close at $2.29 after 64,416 units crossed the exchange, Elite Diagnostic gained 15 cents in ending at $3.50 after an exchange of 10,292 shares, Express Catering popped 20 cents to $5 after investors traded 12,565 stock units. Fosrich lost 13 cents to end at $4.07 while exchanging 589,096 stocks, Future Energy Source rallied 11 cents to end at $5.11 with the swapping of 220,888 units, General Accident declined 90 cents to $4 with a transfer of 5,513 shares. ISP Finance dropped $3.49 to close at $15.01 with an exchange of 972 stocks, Jetcon Corporation shed 11 cents in closing at $1.08 as investors exchanged 11,041 units, JFP Ltd climbed 10 cents to $1.50, with 614,991 shares clearing the market. Knutsford Express advanced 99 cents to $8.99, with 1,100 stock units crossing the market, Lasco Financial increased 22 cents to $2.93 in exchanging 82,406 stock units, Lasco Manufacturing increased 18 cents to $3.98 after a transfer of 15,194 units. Limners and Bards climbed 11 cents to end at $2.78 in switching ownership of 238,825 shares, Lumber Depot rallied 27 cents to close at $2.50 while 113,008 stocks passed through the market, Main Event jumped $1.45 to $10 after exchanging 63,235 stock units.  Medical Disposables dipped 25 cents to $5.10 after trading 3,000 shares, MFS Capital Partners popped 18 cents to end at $2.79 as 62,636 units passed through the market and Paramount Trading advanced 28 cents in closing at $1.80, with 1,019 stocks crossing the market.

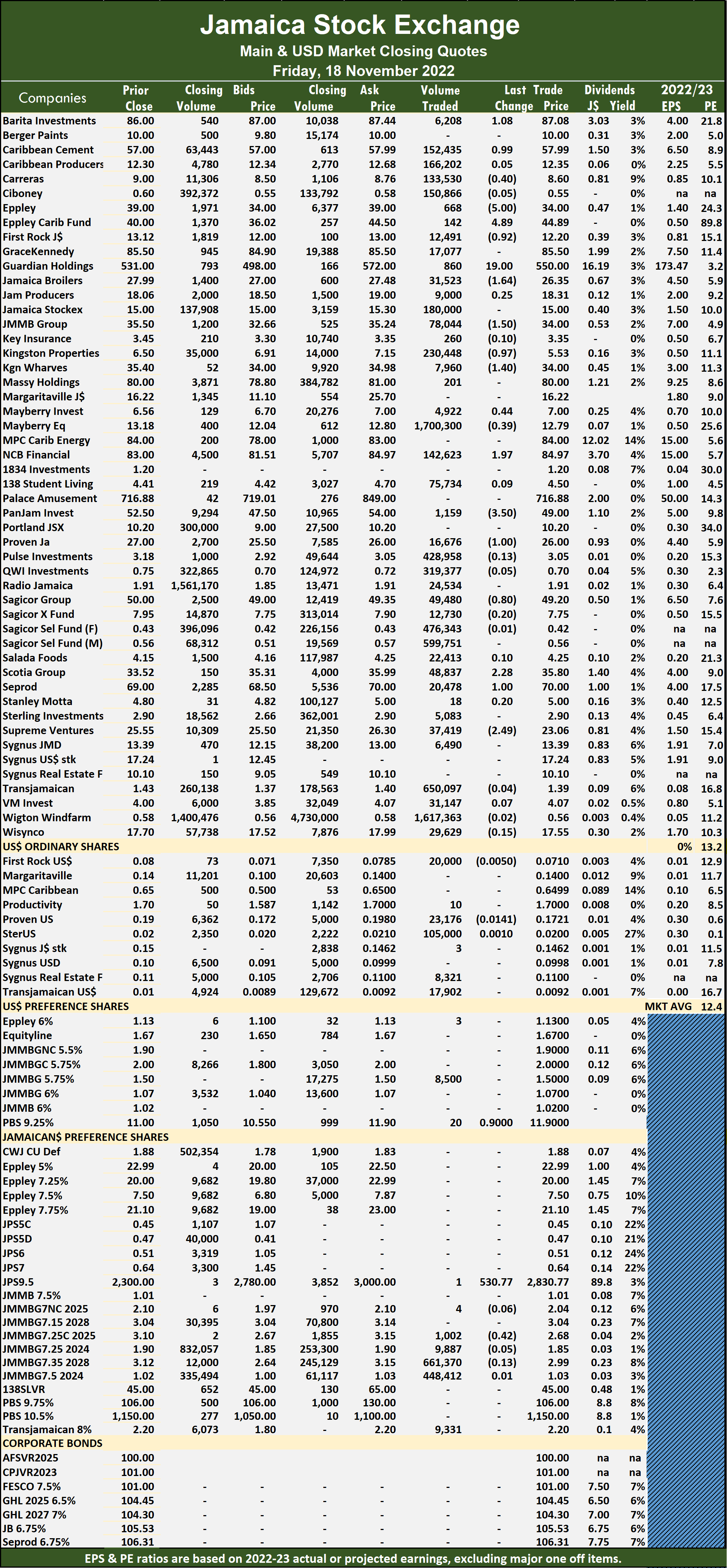

Medical Disposables dipped 25 cents to $5.10 after trading 3,000 shares, MFS Capital Partners popped 18 cents to end at $2.79 as 62,636 units passed through the market and Paramount Trading advanced 28 cents in closing at $1.80, with 1,019 stocks crossing the market. A total of 8,629,483 shares were traded for $70,734,289 compared to 10,480,449 units at $152,509,794 on Thursday.

A total of 8,629,483 shares were traded for $70,734,289 compared to 10,480,449 units at $152,509,794 on Thursday. The PE Ratio, a formula to ascertain appropriate stock values, averages 13.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023.

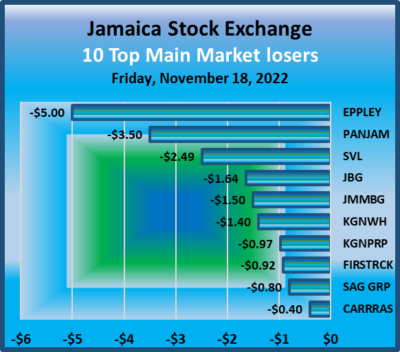

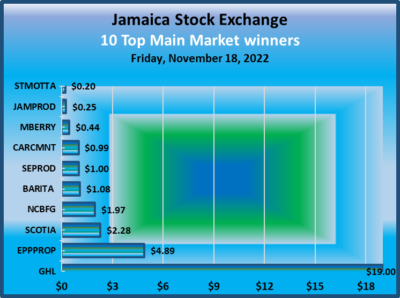

The PE Ratio, a formula to ascertain appropriate stock values, averages 13.2 for the Main Market. The JSE Main and USD Market PE ratios incorporate earnings forecasted by ICInsider.com for companies with the financial year ending between November and August 2023. First Rock Real Estate declined 92 cents to $12.20 with the swapping of 12,491 shares. Guardian Holdings advanced $19 to close at $550 after 860 units crossed the market, Jamaica Broilers dipped $1.64 to $26.35 in trading 31,523 stock units, JMMB Group fell $1.50 to a 52 weeks’ closing low of $34 after a transfer of 78,044 stock units. Kingston Properties lost 97 cents to a 52 weeks’ closing low of $5.53 after exchanging 230,448 stocks, Kingston Wharves shed $1.40 to settle at $34 trading 7,960 units, Mayberry Investments gained 44 cents to end at $7 in switching ownership of 4,922 shares. NCB Financial rose $1.97 to close at $84.97 with 142,623 stock units clearing the market, PanJam Investment dropped $3.50 ending at $49 in an exchange of 1,159 stocks, Proven Investments declined $1 to a 52 weeks’ closing low of $26 in exchanging 16,676 shares. Sagicor Group fell 80 cents to a 52 weeks’ closing low of $49.20 as investors swapped 49,480 units, Scotia Group advanced $2.28 to close at $35.80 in trading 48,837 shares,

First Rock Real Estate declined 92 cents to $12.20 with the swapping of 12,491 shares. Guardian Holdings advanced $19 to close at $550 after 860 units crossed the market, Jamaica Broilers dipped $1.64 to $26.35 in trading 31,523 stock units, JMMB Group fell $1.50 to a 52 weeks’ closing low of $34 after a transfer of 78,044 stock units. Kingston Properties lost 97 cents to a 52 weeks’ closing low of $5.53 after exchanging 230,448 stocks, Kingston Wharves shed $1.40 to settle at $34 trading 7,960 units, Mayberry Investments gained 44 cents to end at $7 in switching ownership of 4,922 shares. NCB Financial rose $1.97 to close at $84.97 with 142,623 stock units clearing the market, PanJam Investment dropped $3.50 ending at $49 in an exchange of 1,159 stocks, Proven Investments declined $1 to a 52 weeks’ closing low of $26 in exchanging 16,676 shares. Sagicor Group fell 80 cents to a 52 weeks’ closing low of $49.20 as investors swapped 49,480 units, Scotia Group advanced $2.28 to close at $35.80 in trading 48,837 shares, Seprod rose $1 to end at $70 with 20,478 units changing hands and Supreme Ventures dropped $2.49 to $23.06 with 37,419 stock units crossing the market.

Seprod rose $1 to end at $70 with 20,478 units changing hands and Supreme Ventures dropped $2.49 to $23.06 with 37,419 stock units crossing the market. The recent decline is mild compared with the fall after the announcement of the Trading climbs on the JSE US dollar market

The recent decline is mild compared with the fall after the announcement of the Trading climbs on the JSE US dollar market  Trading averaged 213,895 shares at $505,261 compared with 775,686 units at $2,384,704 on Thursday. The month to date averaged 290,620 units at $799,120 compared with 296,406 stock units at $821,279 on the previous day. October closed with an average of 264,407 units at $832,036.

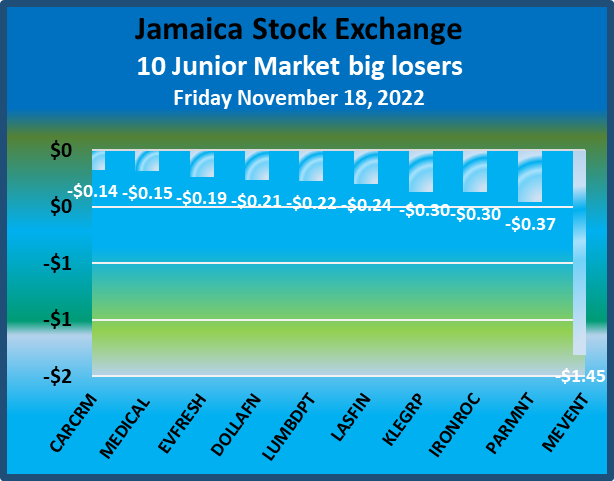

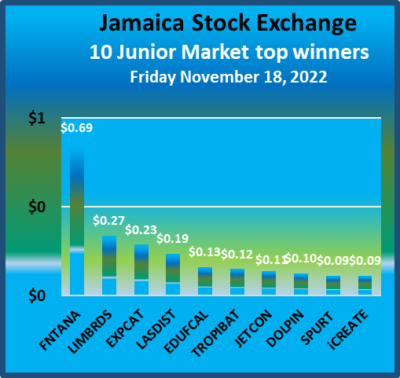

Trading averaged 213,895 shares at $505,261 compared with 775,686 units at $2,384,704 on Thursday. The month to date averaged 290,620 units at $799,120 compared with 296,406 stock units at $821,279 on the previous day. October closed with an average of 264,407 units at $832,036. At the close, Caribbean Cream declined 14 cents to $3.86, with just 275 shares crossing the exchange, Dolla Financial shed 21 cents in closing at $3.29 after an exchange of 211,171 units, Dolphin Cove popped 10 cents to $13.60, with 1,682 stock units crossing the market. EduFocal gained 13 cents in ending at $2.45 while exchanging 499,211 stocks, Everything Fresh fell 19 cents to close at $1.50 after the trading of 81,824 shares, Express Catering advanced 23 cents to $4.80 in switching ownership of 3,880 stock units. Fontana climbed 69 cents to close at $8.79 with 84,037 units changing hands, Iron Rock Insurance lost 30 cents in ending at $2.30 after trading 50,391 stocks, Jetcon Corporation rose 11 cents to $1.19, with 121,266 shares passing through the market. KLE Group dropped 30 cents to $1.70 with a transfer of 5,500 stock units, Lasco Distributors popped 19 cents to $2.89 with investors transferring 8,900 stocks, Lasco Financial dipped 24 cents to $2.71 in exchanging 4,462 units. Lasco Manufacturing declined 10 cents in closing at $3.80 after 49,808 units passed through the market, Limners and Bards rallied 27 cents to end at $2.67 with an exchange of 22,035 shares, but only after hitting a 52 weeks’ intraday low of $2.30,

At the close, Caribbean Cream declined 14 cents to $3.86, with just 275 shares crossing the exchange, Dolla Financial shed 21 cents in closing at $3.29 after an exchange of 211,171 units, Dolphin Cove popped 10 cents to $13.60, with 1,682 stock units crossing the market. EduFocal gained 13 cents in ending at $2.45 while exchanging 499,211 stocks, Everything Fresh fell 19 cents to close at $1.50 after the trading of 81,824 shares, Express Catering advanced 23 cents to $4.80 in switching ownership of 3,880 stock units. Fontana climbed 69 cents to close at $8.79 with 84,037 units changing hands, Iron Rock Insurance lost 30 cents in ending at $2.30 after trading 50,391 stocks, Jetcon Corporation rose 11 cents to $1.19, with 121,266 shares passing through the market. KLE Group dropped 30 cents to $1.70 with a transfer of 5,500 stock units, Lasco Distributors popped 19 cents to $2.89 with investors transferring 8,900 stocks, Lasco Financial dipped 24 cents to $2.71 in exchanging 4,462 units. Lasco Manufacturing declined 10 cents in closing at $3.80 after 49,808 units passed through the market, Limners and Bards rallied 27 cents to end at $2.67 with an exchange of 22,035 shares, but only after hitting a 52 weeks’ intraday low of $2.30,  Lumber Depot fell 22 cents to close at $2.23 after a transfer of 72,446 stocks. Main Event declined $1.45 to end at $8.55, with 104,679 stock units changing hands, Medical Disposables shed 15 cents in ending at $5.35, with 1,090 shares clearing the market, Paramount Trading dipped 37 cents to $1.52 after exchanging 51,208 units and Tropical Battery increased 12 cents in closing at $2.50 as investors exchanged 581,061 stock units.

Lumber Depot fell 22 cents to close at $2.23 after a transfer of 72,446 stocks. Main Event declined $1.45 to end at $8.55, with 104,679 stock units changing hands, Medical Disposables shed 15 cents in ending at $5.35, with 1,090 shares clearing the market, Paramount Trading dipped 37 cents to $1.52 after exchanging 51,208 units and Tropical Battery increased 12 cents in closing at $2.50 as investors exchanged 581,061 stock units.