Kingston Properties (KPREIT) plans to repurchase up to one half of one percent or 4.42 million shares in issue for up to two years to commence in the later part of May this year.

According to the release, “the Board of Directors sees this use of capital as an opportunity to enhance shareholder value through the purchase, from time to time, of undervalued shares”.

According to the release, “the Board of Directors sees this use of capital as an opportunity to enhance shareholder value through the purchase, from time to time, of undervalued shares”.

The repurchase of the shares will be done using the Company’s cash flows and will be conducted on the open market through the Company’s stockbrokers. A fixed price for the repurchase will not be set but will be the market price at the time of the repurchase. In keeping with the requirements of the Companies Act of Jamaica, within 30 days of the dates of the repurchase of shares, Kingston Properties will advise its shareholders of the details of the shares purchased.

The company has 884 million issued shares that were last traded at $8.10 on the Main Market of the Jamaica Stock Exchange with a PE of 10 times last year’s earnings and a book value of $8.40.

A total of 7.5 million shares were traded over the past twelve months for a daily average of 30,000 units.

The company has also declared a dividend of 0.0566 US cents per share, payable on June 5 to shareholders on record at May 17 with the ex-dividend date of May 16, 2024.

The company reported a profit of US$4.65 million in 2023 an increase over 2022 with US$3.8 million from operating revenues of US$4 million in 2023 and US$3.5 million in 2022. Profit was boosted by gains from revaluation and gain on sale of properties of US$3 million in 2023 and US$2.4 million in 2022.

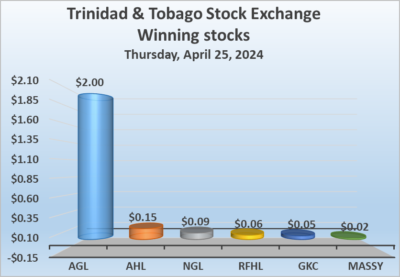

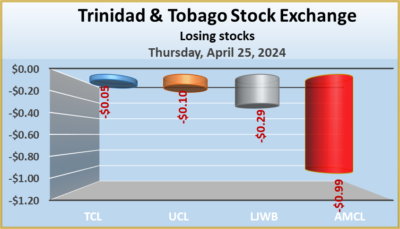

Rising stocks beat decliners on Trinidad Exchange

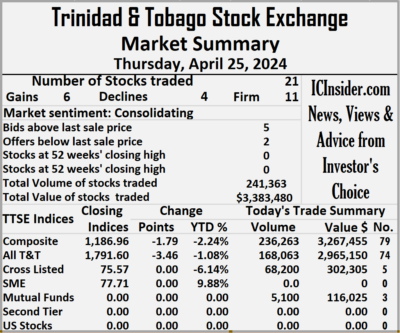

Trading ended on the Trinidad and Tobago Stock Exchange on Thursday, with the volume of stocks traded declining 83 percent, with the value 68 percent lower than on Wednesday, resulting in the trading of 21 securities compared with 22 on Wednesday and ending with prices of six stocks rising, four declining and 11 remaining unchanged.

Trading closed with an exchange of 241,363 shares for $3,383,480 versus 1,416,843 stocks at $10,593,318 on Wednesday.

Trading closed with an exchange of 241,363 shares for $3,383,480 versus 1,416,843 stocks at $10,593,318 on Wednesday.

An average of 11,493 shares were traded at $161,118 down from 64,402 stocks at $481,514 on Wednesday. Trading for the month to date averages 18,437 shares at $188,430 compared to 18,907 units at $190,281 on the previous day and March that ended with an average of 28,236 shares at $236,496.

The Composite Index dipped 1.79 points to 1,186.96, the All T&T Index dropped 3.46 points to 1,791.60, the SME Index remained unchanged at 77.71 and the Cross-Listed Index remained unchanged at 75.57.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s climbed $2 to close at $71 as investors exchanged 510 stock units, Angostura Holdings popped 15 cents to $22.95 after 130 shares passed through the market, Ansa McAl fell 99 cents to end at $55.01 after an exchange of 3,700 units.  Ansa Merchant Bank remained at $45.30 with investors swapping 5 stocks, Calypso Macro Investment Fund ended at $22.75 in swapping 5,100 shares, First Citizens Group remained at $48.30 after a transfer of 658 stocks. FirstCaribbean International Bank ended at $6.95 with 10,000 stock units being traded, GraceKennedy gained 5 cents in closing at $4.05 with investors trading 58,200 stocks, Guardian Holdings remained at $18.05 in an exchange of 25 shares. Guardian Media ended at $1.98 after trading of 5 stock units, L.J. Williams B share shed 29 cents and ended at $1.70 after an exchange of 700 stocks, Massy Holdings rose 2 cents to close at $4.35 with a transfer of 42,346 units. National Enterprises remained at $3.85 after 971 stocks changed hands,

Ansa Merchant Bank remained at $45.30 with investors swapping 5 stocks, Calypso Macro Investment Fund ended at $22.75 in swapping 5,100 shares, First Citizens Group remained at $48.30 after a transfer of 658 stocks. FirstCaribbean International Bank ended at $6.95 with 10,000 stock units being traded, GraceKennedy gained 5 cents in closing at $4.05 with investors trading 58,200 stocks, Guardian Holdings remained at $18.05 in an exchange of 25 shares. Guardian Media ended at $1.98 after trading of 5 stock units, L.J. Williams B share shed 29 cents and ended at $1.70 after an exchange of 700 stocks, Massy Holdings rose 2 cents to close at $4.35 with a transfer of 42,346 units. National Enterprises remained at $3.85 after 971 stocks changed hands,  National Flour Mills ended at $2.20 in an exchange of 12,307 units, Prestige Holdings remained at $13, with 262 shares crossing the market. Republic Financial gained 6 cents in closing at $118.27 with traders dealing in 12,219 stocks, Scotiabank ended at $67.50, after 1,997 shares changed hands, Trinidad & Tobago NGL advanced 9 cents to close at $8.59 with 2,244 units crossing the exchange. Trinidad Cement sank 5 cents to $2.70 with investors dealing in 16,000 stock units, Unilever Caribbean dropped 10 cents to close at $11.20 after 41,042 stock units crossed the market and West Indian Tobacco ended at $11.15 with an exchange of 32,942 shares.

National Flour Mills ended at $2.20 in an exchange of 12,307 units, Prestige Holdings remained at $13, with 262 shares crossing the market. Republic Financial gained 6 cents in closing at $118.27 with traders dealing in 12,219 stocks, Scotiabank ended at $67.50, after 1,997 shares changed hands, Trinidad & Tobago NGL advanced 9 cents to close at $8.59 with 2,244 units crossing the exchange. Trinidad Cement sank 5 cents to $2.70 with investors dealing in 16,000 stock units, Unilever Caribbean dropped 10 cents to close at $11.20 after 41,042 stock units crossed the market and West Indian Tobacco ended at $11.15 with an exchange of 32,942 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

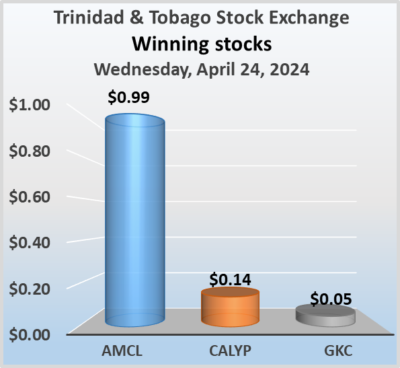

Trading surged on Trinidad & Tobago Stock Exchange

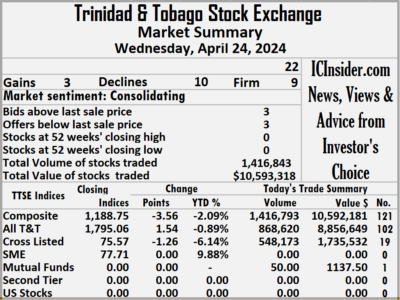

Trading surged on the Trinidad and Tobago Stock Exchange on Wednesday, with a 383 percent rise in the volume of stocks traded with a value that is 190 percent more than on Tuesday and resulting in 22 securities trading up from 19 on Tuesday and ending with prices of three stocks rising, 10 declining and nine remaining unchanged.

The market closed trading with an exchange of 1,416,843 shares worth $10,593,318 compared with 293,585 stocks at $3,647,998 on Tuesday.

The market closed trading with an exchange of 1,416,843 shares worth $10,593,318 compared with 293,585 stocks at $3,647,998 on Tuesday.

An average of 64,402 shares were traded at $481,514 compared with 15,452 units at $192,000 on Tuesday, with trading month to date averaging 18,907 shares at $190,281 compared to 15,432 units at $168,035 on the previous day and an average for March of 28,236 shares at $236,496.

The Composite Index fell 3.56 points to settle at 1,188.75, the All T&T Index popped 1.54 points to 1,795.06, the SME Index ended unchanged at 77.71 and the Cross-Listed Index sank 1.26 points to 75.57.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three with lower offers.

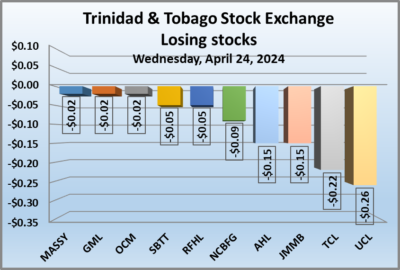

At the close, Agostini’s ended at $69 with investors trading 36,572 shares, Angostura Holdings dipped 15 cents to $22.80 after 1,872 units passed through the market, Ansa McAl increased 99 cents to end at $56 after an exchange of 2,028 stocks. Calypso Macro Investment Fund climbed 14 cents in closing at $22.75 with 50 stock units clearing the market,  First Citizens Group ended at $48.30 after 1,135 shares changed hands, FirstCaribbean International Bank closed at $6.95, after 18,508 units changed hands. GraceKennedy rose 5 cents and ended at $4 with traders dealing in 22,165 stock units, Guardian Holdings ended at $18.05 with 9,565 stock units crossing the market, Guardian Media sank 2 cents to end at $1.98 as investors exchanged 25 shares. JMMB Group dropped 15 cents in closing at $1.28 after an exchange of 2,500 stocks, Massy Holdings shed 2 cents to close at $4.33 with investors swapping 629,985 units, National Enterprises ended at $3.85 with an exchange of 10,091 stock units. National Flour Mills remained at $2.20 with investors trading 2,687 shares, NCB Financial declined 9 cents to $3 with investors exchanging 505,000 units, One Caribbean Media lost 2 cents to finish at $3.70 after an exchange of 1,067 stocks.

First Citizens Group ended at $48.30 after 1,135 shares changed hands, FirstCaribbean International Bank closed at $6.95, after 18,508 units changed hands. GraceKennedy rose 5 cents and ended at $4 with traders dealing in 22,165 stock units, Guardian Holdings ended at $18.05 with 9,565 stock units crossing the market, Guardian Media sank 2 cents to end at $1.98 as investors exchanged 25 shares. JMMB Group dropped 15 cents in closing at $1.28 after an exchange of 2,500 stocks, Massy Holdings shed 2 cents to close at $4.33 with investors swapping 629,985 units, National Enterprises ended at $3.85 with an exchange of 10,091 stock units. National Flour Mills remained at $2.20 with investors trading 2,687 shares, NCB Financial declined 9 cents to $3 with investors exchanging 505,000 units, One Caribbean Media lost 2 cents to finish at $3.70 after an exchange of 1,067 stocks.  Prestige Holdings ended at $13 in trading 11 stock units, Republic Financial slipped 5 cents to end at $118.21 after a transfer of 10,827 shares, Scotiabank fell 5 cents to close at $67.50 after an exchange of 1,991 stocks. Trinidad & Tobago NGL remained at $8.50 in switching ownership of 14,795 units, Trinidad Cement skidded 22 cents and ended at $2.75 with investors dealing in 1,500 stock units, Unilever Caribbean lost 26 cents in closing at $11.30 in an exchange of 108,577 shares and West Indian Tobacco ended at $11.15, with 35,892 units crossing the market.

Prestige Holdings ended at $13 in trading 11 stock units, Republic Financial slipped 5 cents to end at $118.21 after a transfer of 10,827 shares, Scotiabank fell 5 cents to close at $67.50 after an exchange of 1,991 stocks. Trinidad & Tobago NGL remained at $8.50 in switching ownership of 14,795 units, Trinidad Cement skidded 22 cents and ended at $2.75 with investors dealing in 1,500 stock units, Unilever Caribbean lost 26 cents in closing at $11.30 in an exchange of 108,577 shares and West Indian Tobacco ended at $11.15, with 35,892 units crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

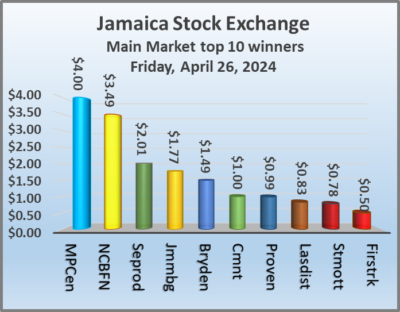

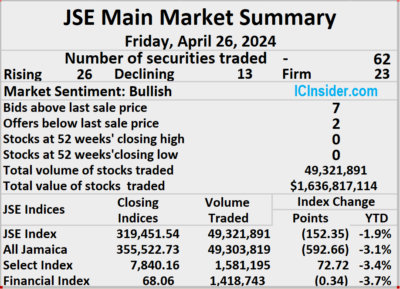

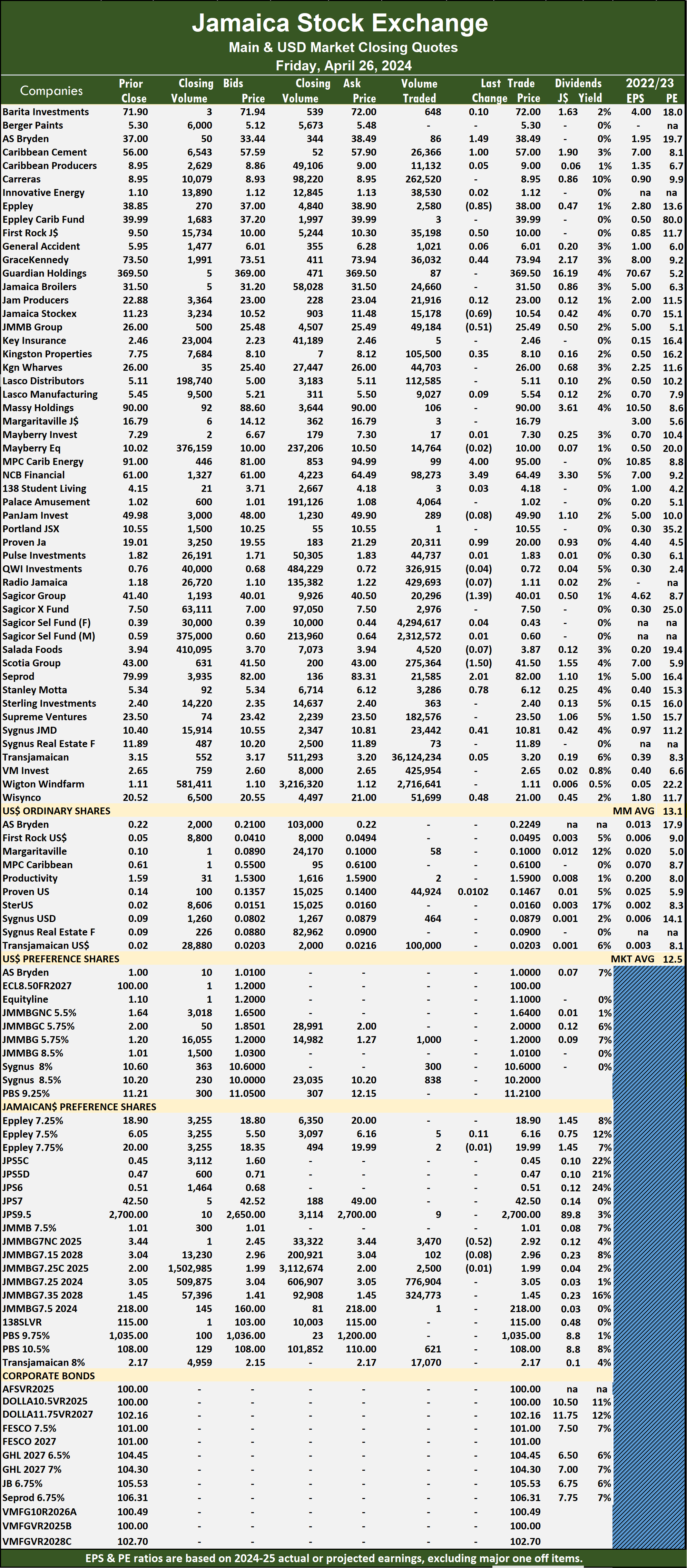

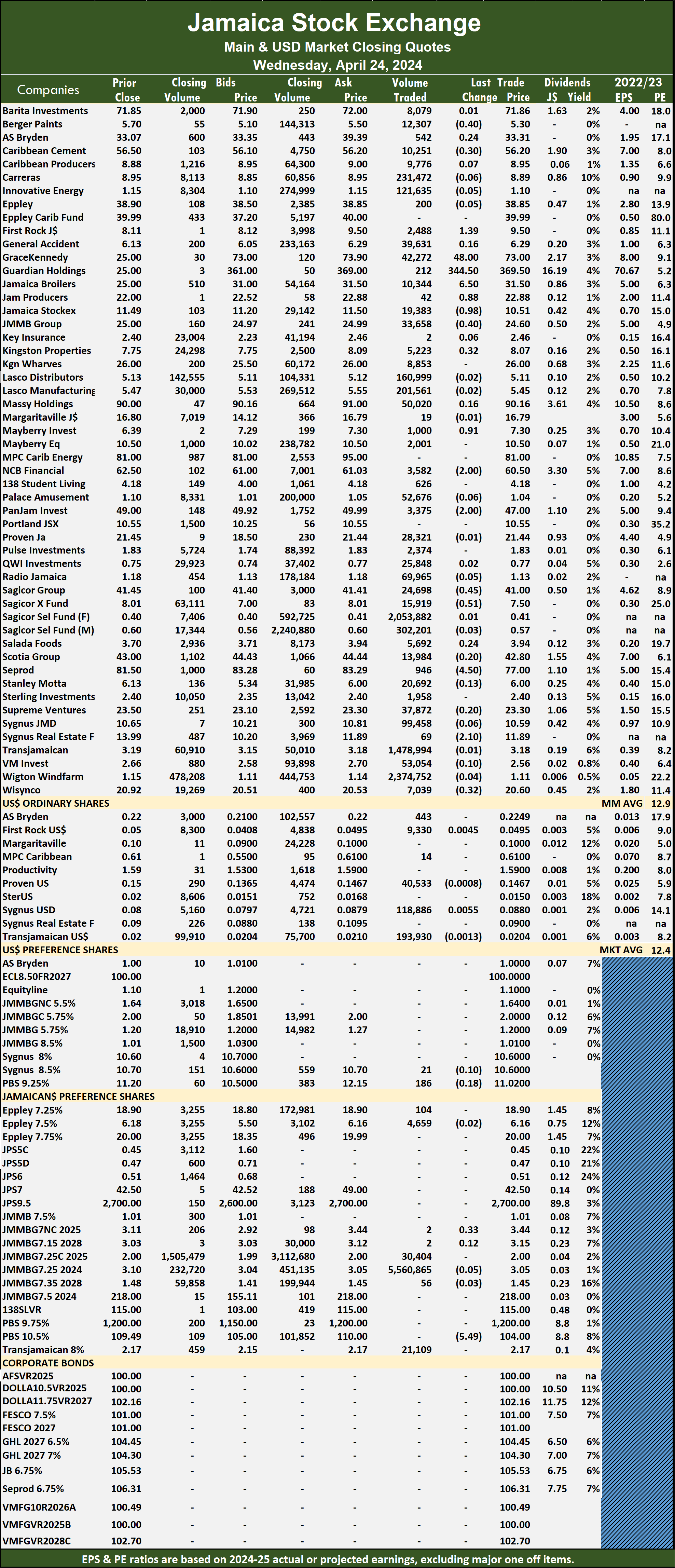

Trading closed with 49,321,891 shares for $163,817,114 up from 14,522,075 units at just $31,656,097 on Thursday.

Trading closed with 49,321,891 shares for $163,817,114 up from 14,522,075 units at just $31,656,097 on Thursday. The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year, ending around August 2025.

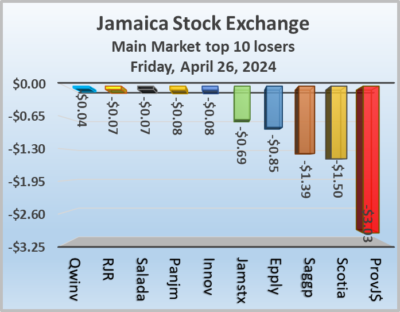

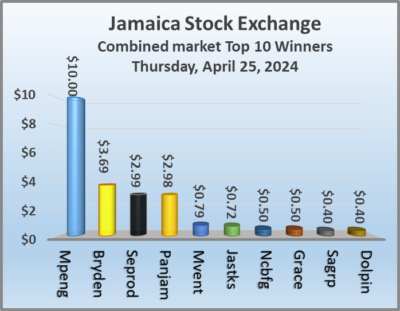

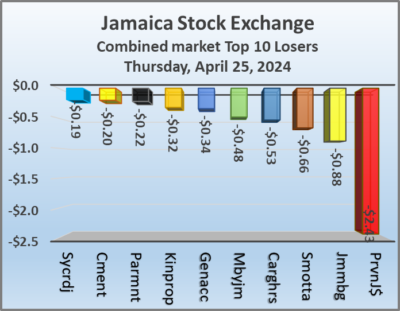

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year, ending around August 2025. NCB Financial rose $3.49 in closing at $64.49, with 98,273 stocks crossing the exchange, Proven Investments gained 99 cents to end at $20 in trading 20,311 shares, Sagicor Group declined $1.39 to close at $40.01 after a transfer of 20,296 units. Scotia Group shed $1.50 to $41.50 with investors exchanging 275,364 shares, Seprod popped $2.01 to end at $82 in an exchange of 21,585 stocks, Stanley Motta gained 78 cents to close at $6.12 with investors trading 3,286 units. Sygnus Credit Investments climbed 41 cents to close at $10.81 after an exchange of 23,442 stock units and Wisynco Group advanced 48 cents and ended at $21 with investors dealing in 51,699 shares.

NCB Financial rose $3.49 in closing at $64.49, with 98,273 stocks crossing the exchange, Proven Investments gained 99 cents to end at $20 in trading 20,311 shares, Sagicor Group declined $1.39 to close at $40.01 after a transfer of 20,296 units. Scotia Group shed $1.50 to $41.50 with investors exchanging 275,364 shares, Seprod popped $2.01 to end at $82 in an exchange of 21,585 stocks, Stanley Motta gained 78 cents to close at $6.12 with investors trading 3,286 units. Sygnus Credit Investments climbed 41 cents to close at $10.81 after an exchange of 23,442 stock units and Wisynco Group advanced 48 cents and ended at $21 with investors dealing in 51,699 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

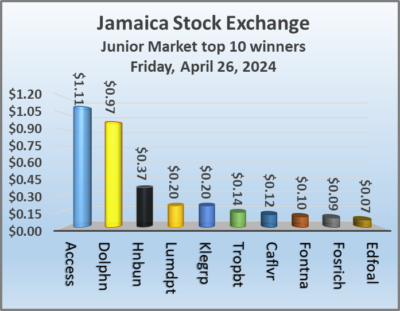

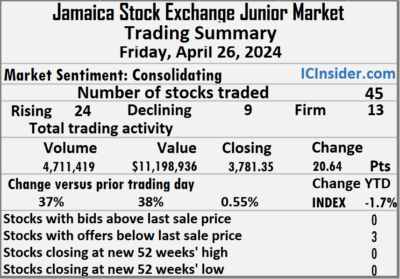

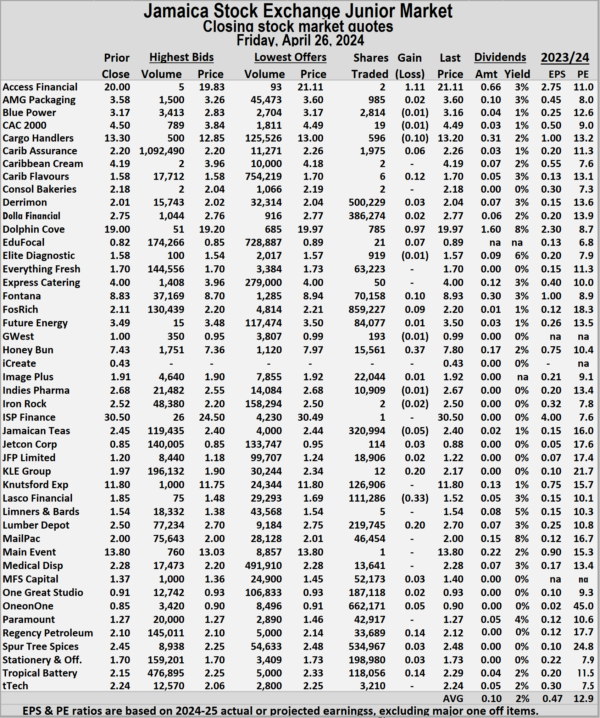

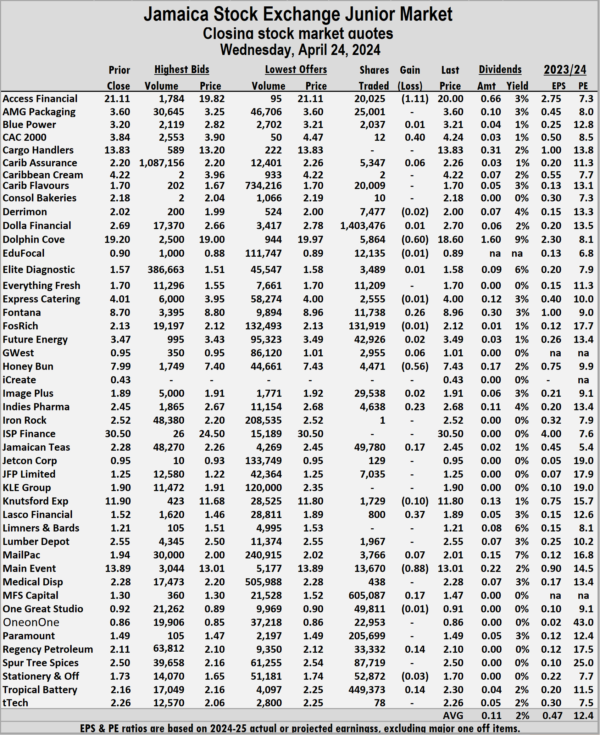

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the Junior Market Index rallied 20.64 points to end the day at 3,781.35.

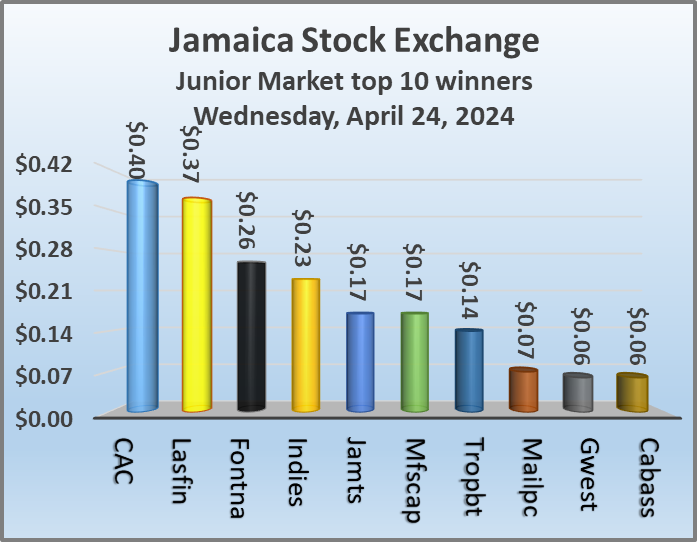

At the close of trading, the Junior Market Index rallied 20.64 points to end the day at 3,781.35. The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

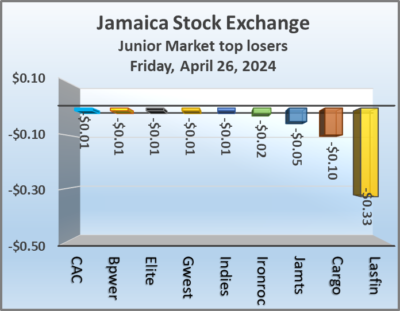

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025. Fontana increased 10 cents to $8.93 in an exchange of 70,158 units, Fosrich climbed 9 cents in closing at $2.20 with investors dealing in 859,227 stock units, Honey Bun popped 37 cents to finish at $7.80 in an exchange of 15,561 shares. Jamaican Teas lost 5 cents and ended at $2.40 with investors trading 320,994 stock units, KLE Group increased 20 cents to close at $2.17 after an exchange of 12 stocks, Lasco Financial slipped 33 cents to end at $1.52 with 111,286 units passing through the market. Lumber Depot climbed 20 cents to $2.70 after a transfer of 219,745 shares, ONE on ONE Educational rose 5 cents to finish at 90 cents as investors exchanged 662,171 units and Tropical Battery rallied 14 cents and ended at $2.29 and closed with an exchange of 118,056 stocks.

Fontana increased 10 cents to $8.93 in an exchange of 70,158 units, Fosrich climbed 9 cents in closing at $2.20 with investors dealing in 859,227 stock units, Honey Bun popped 37 cents to finish at $7.80 in an exchange of 15,561 shares. Jamaican Teas lost 5 cents and ended at $2.40 with investors trading 320,994 stock units, KLE Group increased 20 cents to close at $2.17 after an exchange of 12 stocks, Lasco Financial slipped 33 cents to end at $1.52 with 111,286 units passing through the market. Lumber Depot climbed 20 cents to $2.70 after a transfer of 219,745 shares, ONE on ONE Educational rose 5 cents to finish at 90 cents as investors exchanged 662,171 units and Tropical Battery rallied 14 cents and ended at $2.29 and closed with an exchange of 118,056 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

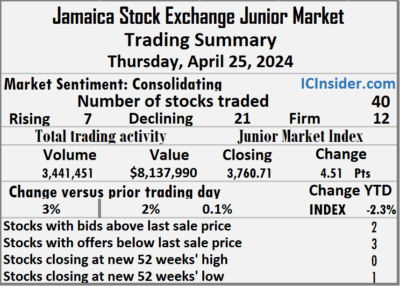

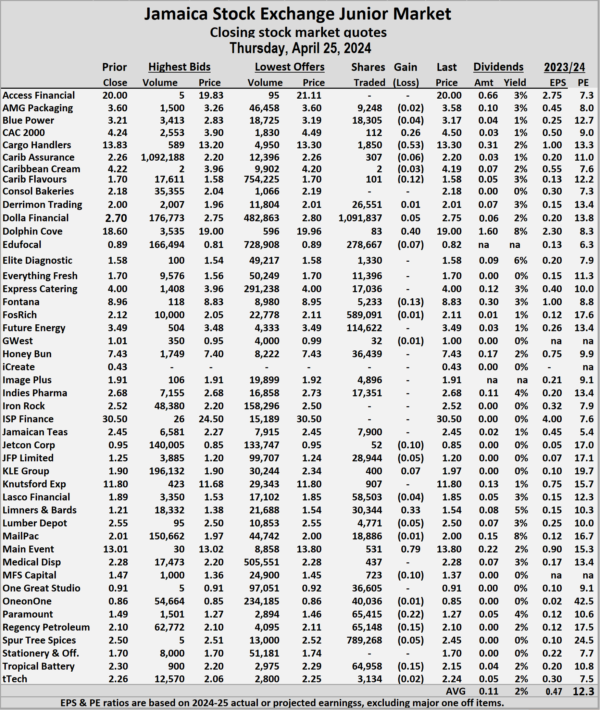

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with trading of 3,441,451 shares for $8,137,990 up from 3,333,072 units at $7,971,094 on Wednesday.

The market closed with trading of 3,441,451 shares for $8,137,990 up from 3,333,072 units at $7,971,094 on Wednesday. Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and three with lower offers.

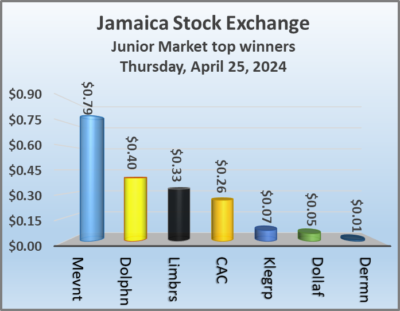

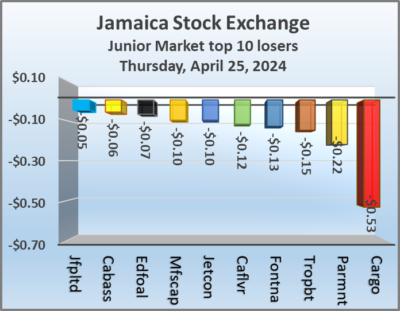

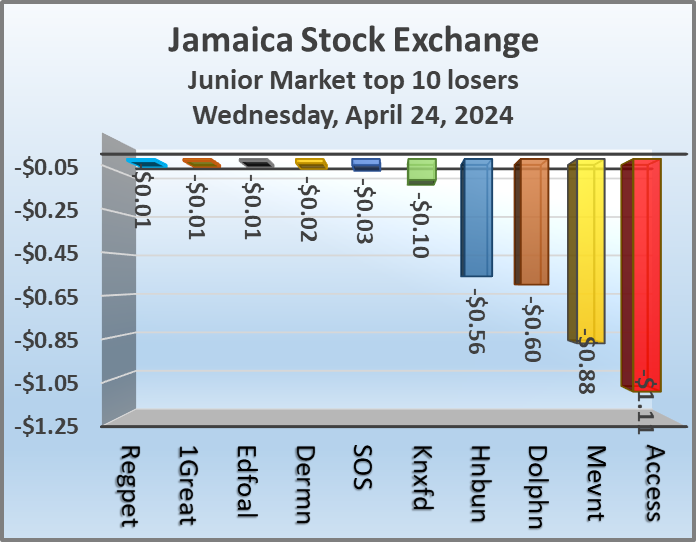

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and three with lower offers. JFP Ltd sank 5 cents to end at $1.20 with investors trading 28,944 stocks, KLE Group increased 7 cents and ended at $1.97 with an exchange of 400 units, Limners and Bards climbed 33 cents to finish at $1.54 with 30,344 stocks passing through the market. Lumber Depot slipped 5 cents to $2.50 and closed with an exchange of 4,771 shares, Main Event popped 79 cents in closing at $13.80 with traders dealing in 531 stock units, MFS Capital Partners dipped 10 cents and ended at $1.37 in switching ownership of 723 stocks. Paramount Trading sank 22 cents to finish at $1.27 with investors swapping 65,415 units, Spur Tree Spices skidded 5 cents to end at $2.45 in an exchange of 789,268 stocks and Tropical Battery lost 15 cents to close at $2.15 in trading 64,958 units.

JFP Ltd sank 5 cents to end at $1.20 with investors trading 28,944 stocks, KLE Group increased 7 cents and ended at $1.97 with an exchange of 400 units, Limners and Bards climbed 33 cents to finish at $1.54 with 30,344 stocks passing through the market. Lumber Depot slipped 5 cents to $2.50 and closed with an exchange of 4,771 shares, Main Event popped 79 cents in closing at $13.80 with traders dealing in 531 stock units, MFS Capital Partners dipped 10 cents and ended at $1.37 in switching ownership of 723 stocks. Paramount Trading sank 22 cents to finish at $1.27 with investors swapping 65,415 units, Spur Tree Spices skidded 5 cents to end at $2.45 in an exchange of 789,268 stocks and Tropical Battery lost 15 cents to close at $2.15 in trading 64,958 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index climbed by 2,382.17 points to 332,588.34, the All Jamaican Composite Index rallied 3,179.32 points to end at 356,115.39, the JSE Main Index jumped 2,452.20 points to end at 319,603.89. The Junior Market Index rose 4.51 points to settle at 3,760.71 and the JSE USD Market Index fell 3.34 points to cease trading at 237.54.

At the close of trading, the JSE Combined Market Index climbed by 2,382.17 points to 332,588.34, the All Jamaican Composite Index rallied 3,179.32 points to end at 356,115.39, the JSE Main Index jumped 2,452.20 points to end at 319,603.89. The Junior Market Index rose 4.51 points to settle at 3,760.71 and the JSE USD Market Index fell 3.34 points to cease trading at 237.54. While in Junior Market trading, Dolla Financial led trading with 1.09 million shares followed by Spur Tree Spices with 789,268 stocks and Fosrich with 589,091 units.

While in Junior Market trading, Dolla Financial led trading with 1.09 million shares followed by Spur Tree Spices with 789,268 stocks and Fosrich with 589,091 units. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

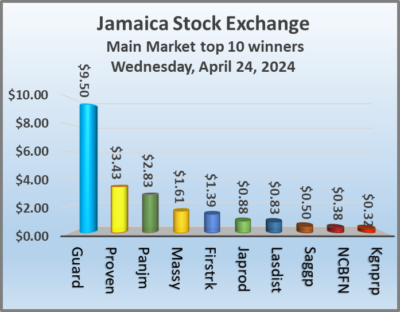

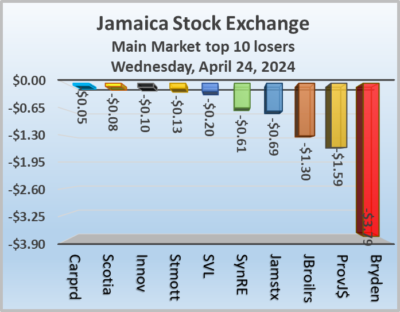

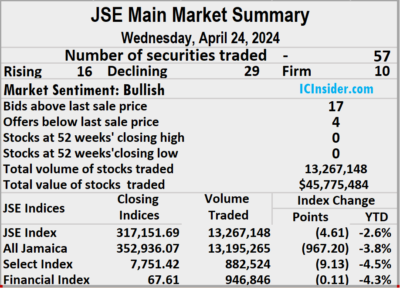

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed on Wednesday with trading of 13,267,148 shares carrying a value of $45,775,484 compared with 13,015,565 units at $53,310,714 on Tuesday.

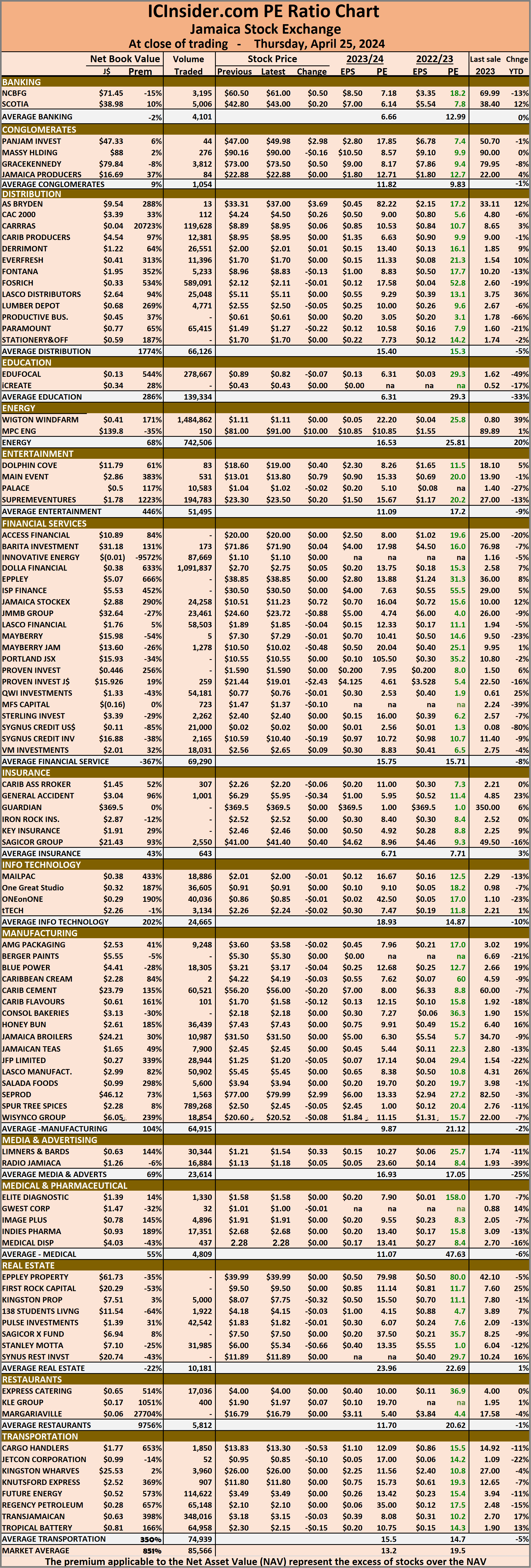

The market closed on Wednesday with trading of 13,267,148 shares carrying a value of $45,775,484 compared with 13,015,565 units at $53,310,714 on Tuesday. The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

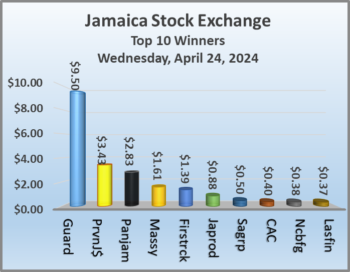

The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Kingston Properties increased 32 cents to $8.07 in trading 5,223 stock units, Massy Holdings popped $1.61 to end at $90.16, with 50,020 units crossing the exchange, NCB Financial rallied 38 cents in closing at $60.50, with 3,582 shares changing hands. Pan Jamaica rallied $2.83 to finish at $47 after investors ended trading 3,375 stock units, Proven Investments rose $3.43 and ended at $21.44 with 28,321 stocks changing hands, Sagicor Group rallied 50 cents to close at $41 after an exchange of 24,698 units and Sygnus Real Estate Finance shed 61 cents to close at $11.89 with investors swapping 69 shares.

Kingston Properties increased 32 cents to $8.07 in trading 5,223 stock units, Massy Holdings popped $1.61 to end at $90.16, with 50,020 units crossing the exchange, NCB Financial rallied 38 cents in closing at $60.50, with 3,582 shares changing hands. Pan Jamaica rallied $2.83 to finish at $47 after investors ended trading 3,375 stock units, Proven Investments rose $3.43 and ended at $21.44 with 28,321 stocks changing hands, Sagicor Group rallied 50 cents to close at $41 after an exchange of 24,698 units and Sygnus Real Estate Finance shed 61 cents to close at $11.89 with investors swapping 69 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with trading of 3,333,072 shares with a value of $7,971,094 compared with 4,944,789 units at $7,691,275 on Tuesday.

The market closed with trading of 3,333,072 shares with a value of $7,971,094 compared with 4,944,789 units at $7,691,275 on Tuesday. The Junior Market ended trading with an average PE Ratio of 12.4, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.4, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025. Jamaican Teas gained 17 cents to close at $2.45 with 49,780 shares clearing the market. Knutsford Express sank 10 cents to end at $11.80 after investors ended trading 1,729 stock units, Lasco Financial rallied 37 cents to finish at $1.89, with just 800 units changing hands, Mailpac Group rose 7 cents and ended at $2.01 after an exchange of 3,766 stock units. Main Event dropped 88 cents to $13.01, with 13,670 units crossing the market, MFS Capital Partners advanced 17 cents after hitting an intraday 52 weeks’ low of $1.10 but ended at $1.47 with a transfer of 605,087 stocks and Tropical Battery popped 14 cents to close at $2.30 as investors exchanged 449,373 shares.

Jamaican Teas gained 17 cents to close at $2.45 with 49,780 shares clearing the market. Knutsford Express sank 10 cents to end at $11.80 after investors ended trading 1,729 stock units, Lasco Financial rallied 37 cents to finish at $1.89, with just 800 units changing hands, Mailpac Group rose 7 cents and ended at $2.01 after an exchange of 3,766 stock units. Main Event dropped 88 cents to $13.01, with 13,670 units crossing the market, MFS Capital Partners advanced 17 cents after hitting an intraday 52 weeks’ low of $1.10 but ended at $1.47 with a transfer of 605,087 stocks and Tropical Battery popped 14 cents to close at $2.30 as investors exchanged 449,373 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

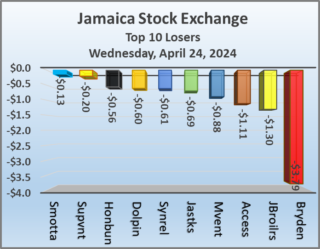

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index slipped 4.61 points to close at 330,206.17, the All Jamaican Composite Index dipped 967.20 points to 352,936.07, the JSE Main Index slipped 87.43 points to end trading at 317,151.69. The Junior Market Index advanced 11.36 points to 3,756.20 and the JSE USD Market Index fell 0.46 points to conclude trading at 240.88.

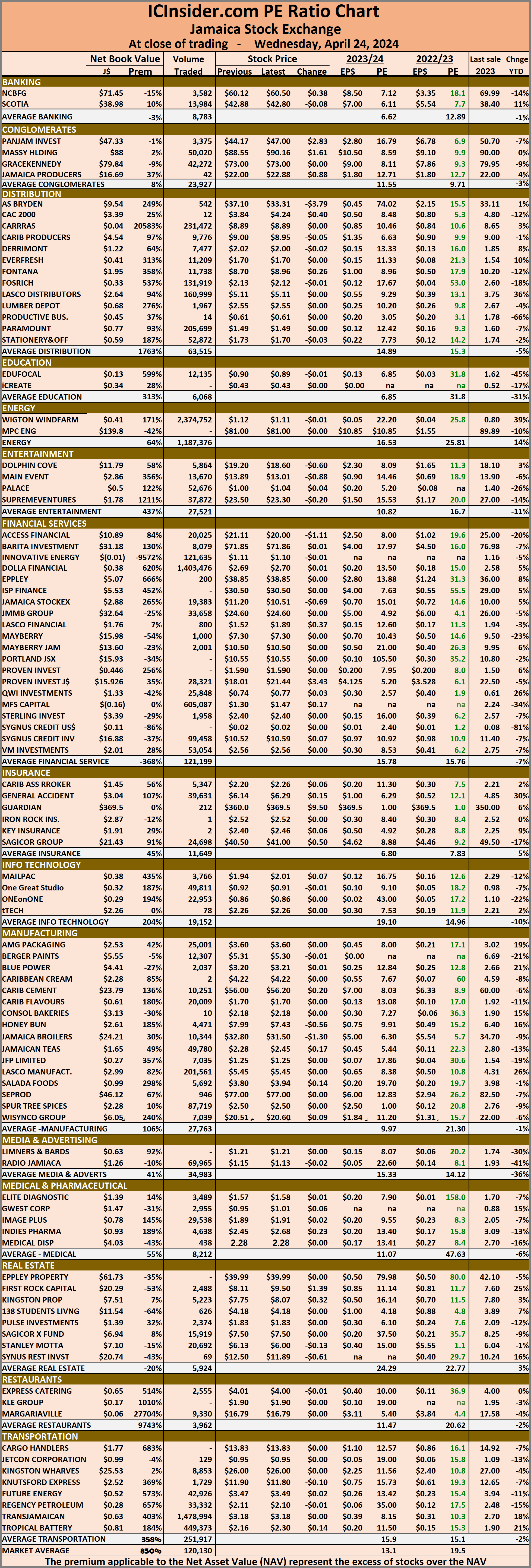

At the close of trading, the JSE Combined Market Index slipped 4.61 points to close at 330,206.17, the All Jamaican Composite Index dipped 967.20 points to 352,936.07, the JSE Main Index slipped 87.43 points to end trading at 317,151.69. The Junior Market Index advanced 11.36 points to 3,756.20 and the JSE USD Market Index fell 0.46 points to conclude trading at 240.88. The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.5 on 2023-24 earnings and 13.1. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.5 on 2023-24 earnings and 13.1. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.