Tropical Battery, the energy storage and power generation company is heading to the Jamaica Stock Exchange (JSE) Main Market by the end of this year, the company reported in a release to the JSE.

Tropical currently has operations in Jamaica, the Dominican Republic and the United States.

According to the company directors, “Since our listing on the Junior Market in September 2020, Tropical Battery has experienced substantial growth and is now surpassing the junior market’s $500 million capital requirement.  This strategic move to the Main Market reflects our commitment to continuing this trajectory of success and delivering enhanced value to our shareholders.” They go on to further state “Since our listing, revenue has grown more than threefold, from $1.8 billion to $5.7 billion forecasted for this fiscal year ending September 30, 2024.”

This strategic move to the Main Market reflects our commitment to continuing this trajectory of success and delivering enhanced value to our shareholders.” They go on to further state “Since our listing, revenue has grown more than threefold, from $1.8 billion to $5.7 billion forecasted for this fiscal year ending September 30, 2024.”

The company incurred a large amount of debt in funding recent acquisitions, with long term loans amounting to $2.9 billion and shareholders’ equity of only just $1.14 billion, in addition, the group has short term loans amounting to $1.8 billion. With gross cash flows from operations in 2023 amounting to $260 million and cash on hand of $429 million in March this year, funds on hand and to be generated over twelve months are not likely to be able to pay off the short term borrowings. Regardless, the heavy debt load is unhealthy and the company will need to bring the debt down to be in line with total equity. Accordingly, they will need the avenue of the Main Market to raise around $2 billion in equity to rebalance the financial position.

For the six months to March, the company reported revenues of $2.36 billion with $1.55 billion generated in the March quarter, with the operations producing $100 million in profit before minority interest and $164 million for the half year, excluding $77 million that was expensed relating to the acquisition of a subsidiary.

Tropical Battery to migrate

Blow out profit for Iron Rock

Insurance revenues jumped 40 percent to $1.4 billion and net profit surged 150 percent to $84 million at Iron Rock Insurance for 2023 as insurance results climbed from $63 million to $120 and Investments delivered slightly higher gains of $79 million rising from $64 million in 2022, the company’s long-delayed audited financial statements show.

Operating expenses rose 14.4 percent from $104 million to $119 million as the company generated 39 cents in earnings per share for the year, up from 16 cents in 2022. ICInsider.com had a forecast of 32 cents.

At the end of 2023, shareholders’ equity stood at $748 million. Investments was $630 million, with reinsurance assets of $427 million and Insurance liabilities of $777 million.

The company improved its performance in the March quarter this year, with revenues rising by 29 percent to $401 million. Return on investments rose to $29 from $16 million in 2023. Other operating expenses climbed from $30 million to $37 million. A profit of $5.5 was realised, up from a $12 million loss in 2023, with earnings per share of 3 cents.

At the end of 2023, shareholders’ equity rose to $756 million. Investments stood at $719 million, with reinsurance assets of $312 million and Insurance liabilities of $735 million.

Iron Rock generated positive cash flows of $45 million in the quarter and $254 million for the 2023 fiscal year.

The stock was in the ICTOP10 Junior Market listing but was dropped following the suspension of trading but with projections of 55 cents per share for 2024 it will most likely be back, subject to stock price by week end.

The stock rose 12 cents on Tuesday to $2.30, with just three offers amounting to 115,000 shares, with 7,004 units at $3.30 up to $4.36.

With projected earnings of 55 cents per share, the PE ratio at the last price is just 4.2 times earnings, well below the market average of 12.4.

Profit surged 144% at the Lab

Net Profit for the half year was $49.4 million, up a b 144 percent above the $20 million generated in 2023, at Limners and Bards for the quarter profit rose 71 percent to $23 million from $13.6 million for the same period in 2023.

The improved profit flowed from reduced costs and better margins as revenues fell sharply in the Media segment, with a $100 million reduction to $206 million. Segment profit fell from $43.5 million to $31.9 million. Media was not the only area of contraction, production had a minor drop in revenues to $127 million from $130 in 2023 but delivered a $13 million fall in profit contribution to $50.6 million from $63 million in 2023. The agency segment saw profit contribution jumping $98 million from $86 million in 2023 with revenues rising from $102 million to $113 million.

The improved profit flowed from reduced costs and better margins as revenues fell sharply in the Media segment, with a $100 million reduction to $206 million. Segment profit fell from $43.5 million to $31.9 million. Media was not the only area of contraction, production had a minor drop in revenues to $127 million from $130 in 2023 but delivered a $13 million fall in profit contribution to $50.6 million from $63 million in 2023. The agency segment saw profit contribution jumping $98 million from $86 million in 2023 with revenues rising from $102 million to $113 million.

For the second quarter, total revenues for the company fell 23 percent from $291 million to $226 million and declined 17 percent to $446 million from $539 million in 2023 for the half year.

Although gross profit fell in both periods, to $91.4 in the latest quarter from $100 million in 2023, down 8.6 percent and declined by 6 percent from $193 million for the six months to $180 million. Gross margin grew, with direct costs declining faster than revenues for half of the year, down 23.5 percent to $265 million from $347 million and by 29.4 in the quarter to $135 million from $191 million.

Administrative expenses fell 17 percent to $69 million in the quarter from $84 million in 2023 and declined 18 percent to $138 million in the half year from $169 million in 2023.

Selling and distribution cost expenses declined in the half year and second quarter by 36 percent to $966,245 in the half million from $1.5 million and by xxx percent in the quarter to $484,477 from $810,997 in 2023. Finance cost declined in the quarter, to $2.6 million from $3.5 million in 2023 and from $6.9 million to $5.2 million for the six months. Finance Income rose from $922,872 to $5.33 million in the quarter and for the six months, it moved from $4.5 million to $8.4 million.

Selling and distribution cost expenses declined in the half year and second quarter by 36 percent to $966,245 in the half million from $1.5 million and by xxx percent in the quarter to $484,477 from $810,997 in 2023. Finance cost declined in the quarter, to $2.6 million from $3.5 million in 2023 and from $6.9 million to $5.2 million for the six months. Finance Income rose from $922,872 to $5.33 million in the quarter and for the six months, it moved from $4.5 million to $8.4 million.

Current assets ended the period at $864 million and Current liabilities at of $298 million. The company has cash and bank balances of $559 million, up from $438 million in 2023.

At the end of April, shareholders’ equity amounts to $647 million with loans payable at $106 million.

Earnings per share for the quarter was two cents and 5 cents for the year to date. IC Insider.com computation projects earnings of 10 cents per share for the fiscal year ending August 2024, with a PE of 16 times the current year’s earnings based on the price of $1.56 the stock traded at on the Jamaica Stock Exchange Junior Market. Net asset value ended the period at $0.68 with the stock selling at 3 times book value.

The company in its quarterly report to shareholders, indicates that they have ventured into the risky business of film production. The first production ‘Jenna In Law’, was officially selected to screen at the 2024 Essence Film Festival this summer in New Orleans, Louisiana.

428% dividend hike jolts stock price

Caribbean Assurance Brokers announced a 428 percent jump in dividends to 14.11 cents from just 2.67 cents paid last year. This year’s dividend is payable on September 16, with an ex-dividend date of August 15 and the announcement pushed the stock up 22 percent in a day and 73 percent for the year to date.

The dividend yields 4.8 percent based on Thursday’s closing price of $3.15 and four percent based on Friday’s closing of $3.83, almost twice the junior Market average of 2 percent.

The dividend yields 4.8 percent based on Thursday’s closing price of $3.15 and four percent based on Friday’s closing of $3.83, almost twice the junior Market average of 2 percent.

The increase follows a jump in profits for 2023 to $123 million or 47 cents per share after a charge of $17 million or 6.5 cents per share for doubtful debt which was reversed in the first quarter to March this year with a profit of just $3 million after the credit impairment loss was revered and compares with a profit of $17 million in 2023. Net profit for 2022 was $78 million or 30 cents per share.

Also announcing dividend payment is Salada Foods with an interim dividend of 6.4 cents per stock unit, payable on July 4, 2024, with an ex-dividend date is June 14.

Dolphin Cove the dividend king

The dividend yield on the Junior market listed Dolphin Cove is 10 percent based on Wednesday’s early traded price of $24 and dividends of $2.40 payable since October last year.

Dolphin Cove price paying 60 cents dividend in June.

Dolphin’s shareholders have much more than the high yield to cheer about, with the stock gaining 68 percent in value over the past twelve months in a market that has delivered no increase during the same period. The company reported profit declining from US$1.57 million for the first quarter last year to $1.38 million in the March 2024 quarter with revenues of US$4.9 million up from US$4.85 million with operational expenses jumping by US$300,000. For the year to December 2024, the company reported sales of US$17 million from $15 million in 2023. It generated a profit of US$4.2 million before booking a cost of US$1.13 million in penalties and interest on GCT relating to an earlier period compared with $2.97 million in 2022

The returns for Dolphin are far ahead of a 7 percent yield for Mailpac but in line with Carreras at 10 percent yield and Transjamaican Highway at 6 percent. Scotia Group another high dividend payer is currently 4 percent but that is expected to rise as the year progresses and dividends are increased with rising profit and a return to the traditional pay out ratio of more than 40 percent of profit.

The real virtue of Dolphin over Carreras is that the former continues to record growth while the latter has has little or no growth for years.

The aroma of rising profit

The wonderful aroma of increased profit brewed by Salada Foods ended with an impressive 43 percent jump in earnings in the March quarter, to $68 million from $48 million in 2023. For the six months to March, profit rose by a more sedate but still impressive 31 percent to $99 million from $75 million in 2023.

The latest results follow a moderate rise in profits in 2022 and 2023 and a 42 percent jump in 2021.

The latest results follow a moderate rise in profits in 2022 and 2023 and a 42 percent jump in 2021.

Contributing to the gains in profits was an 8 percent rise in sales revenues for the quarter, to $427 million from $394 million and a 6 percent pop for the year to date, to $727 million from $688 million in 2024.

Gross profit margin slipped to 68 percent from 69 percent in both the second quarter and for the half year, effectively, pushing operating profit 13 percent in the quarter to $138 million from $122 million and 6 percent for the year to date to $229 million from $216 million in 2023.

Increased revenues were not the sole contributor to the solid rise in profits. Administrative expenses fell 11 percent to $36 million in the quarter and slipped two percent in the six months to $74 million. Marketing and sales expenses dropped by a sizeable 29 percent to $17 million for the second quarter and declined by 28 percent for the six months to $32 million. Finance cost jumped to $6 million in the quarter, from $1.4 million in 2023 and from $3.5 million to $7.6 million for the six months.

The operations generated gross cash flows of $189 million after working capital spend and ended with $95 million after paying $62 million in dividends.

Current assets ended the period at $1.2 billion inclusive of trade and other receivables of $305 million, cash, investments and bank balances of $492 million, inventories climbed to $417 million from $374 million at the end of September last year. Current liabilities ended the period at $291 million. Net current assets closed the period at $923 million.

At the end of March, this year, shareholders’ equity amounted to $1.13 billion, with no outstanding loans.

Earnings per share for the quarter was 7 cents and 10 cents for the year to date. IC Insider.com computation projects earnings of 22 cents per share for the fiscal year ending September 2024, with a PE of 16 times the current year’s earnings based on the price of $3.76 the stock traded at on the Jamaica Stock Exchange Main Market. The PE ratio compares with an average of the market of 12.9. Net asset value ended the period at $1.09 with the stock selling at 3.44 times book value.

Lumber Depot buys 35% of Atlantic Hardware

Lumber Depot announced the acquisition of a 35 percent in Atlantic Hardware & Plumbing Company Limited, a 30 year old Jamaican company, engaged in the wholesaling and distribution of hardware, building materials, plumbing, electrical, tools, and supplies to hardware stores, contractors, and developers across Jamaica.

Lumber Depot acquisition announcement.

The business located on “Ashenheim Road in Kingston is led by Managing Director, Deanall Barnes, an experienced business leader in the trading and distribution of building materials”, the release from Lumber Depot states.

There will be no change to the business strategy of Atlantic. Accordingly, it will continue to operate as a dedicated hardware wholesaler and distributor. The acquisition’s purchase price is $210 million and was funded with internal funds.

The investment will account for from May 1, 2024 by Lumber Depot. The majority shareholder of Atlantic is Construct Group, a private investment company.

Lumber Depot did not disclose either revenues nor profitability of the company in which the shares were acquired. ICInsider.com projects the company to get a boost in profits as a result of the investment, that should exceed the returns they were getting on the liquid funds they held. The Lumber Depot netted a 25 percent per annum return on equity up to the February quarter as such, it is unlikely that they did not pay much more than 4 time earnings for the 35 percent acquired and that would boost profit for Lumber Depot around $70 million and earnings per share in the region of 36 cents for the current fiscal year. There are also prospects for economies of scale, particularly in the purchase and importation of goods for resale that could result in cost savings, in the future.

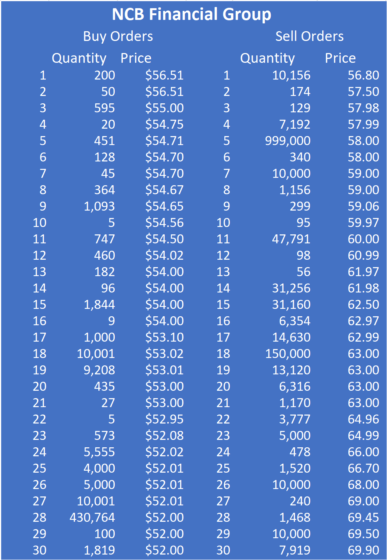

Investors buying into the public offer of NCB Financial Group stock at $65 each in May are hugging up an 18 percent loss on their investment since, with the stock hitting a 52 weeks’ low of $54.66 on Monday and ending at a closing low of $55 after more than 1.5 million shares were traded, following a sizable 3 million share trade on June 17, when the stock closed at $59.

Investors buying into the public offer of NCB Financial Group stock at $65 each in May are hugging up an 18 percent loss on their investment since, with the stock hitting a 52 weeks’ low of $54.66 on Monday and ending at a closing low of $55 after more than 1.5 million shares were traded, following a sizable 3 million share trade on June 17, when the stock closed at $59. NCB is a diversified financial group, providing services in general insurance, life insurance, banking and investments management. The group is also geographically diversified with operations in Trinidad, Bermuda and Jamaica. It has a solid base that it can use to produce increased revenues and profits in the future.

NCB is a diversified financial group, providing services in general insurance, life insurance, banking and investments management. The group is also geographically diversified with operations in Trinidad, Bermuda and Jamaica. It has a solid base that it can use to produce increased revenues and profits in the future.

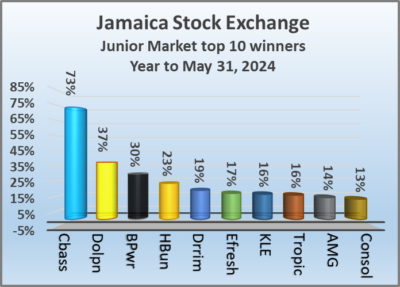

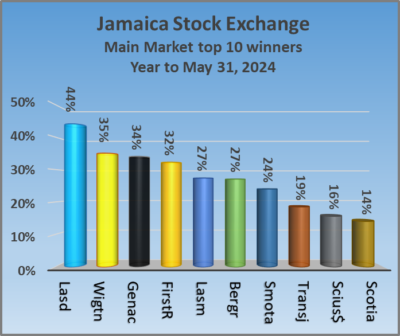

The Jamaica Stock Exchange Main and Junior Markets recorded mild declines for the year to the end of May, at the same time the Top 10 performing stocks all posted double digit gains with Caribbean Assurance Brokers landing a 73 percent increase to be the best performing stock in both markets.

The Jamaica Stock Exchange Main and Junior Markets recorded mild declines for the year to the end of May, at the same time the Top 10 performing stocks all posted double digit gains with Caribbean Assurance Brokers landing a 73 percent increase to be the best performing stock in both markets.  General Accident another former Junior Market stock that migrated last year, up 34 percent, with profit reported in the 2023 audited accounts beating expectations and followed by 30 percent rise in the 2024 first quarter profit before taxation. First Rock gained 32 percent and Lasco Manufacturing with improved full year results over 2023 posted gains of 27 percent.

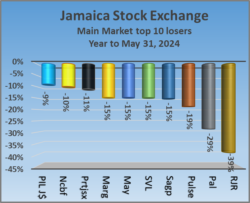

General Accident another former Junior Market stock that migrated last year, up 34 percent, with profit reported in the 2023 audited accounts beating expectations and followed by 30 percent rise in the 2024 first quarter profit before taxation. First Rock gained 32 percent and Lasco Manufacturing with improved full year results over 2023 posted gains of 27 percent. Pulse Investment lost 19 percent and the Sagicor Group 15 percent.

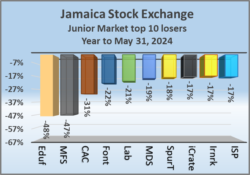

Pulse Investment lost 19 percent and the Sagicor Group 15 percent. Edufocal fell 48 percent to be the worst performing Junior Market stock followed by MFS Partners with a fall of 47 percent and CAC 2000 down 31 percent, following continued poor results. Also declining are Fontana down 22 percent and Limners and Bards had a fall of 21 percent

Edufocal fell 48 percent to be the worst performing Junior Market stock followed by MFS Partners with a fall of 47 percent and CAC 2000 down 31 percent, following continued poor results. Also declining are Fontana down 22 percent and Limners and Bards had a fall of 21 percent

Insurance activities delivered profits of $530 million for the latest quarter, up from $493 million in the previous year. For the half year, it moved to $1.05 billion, from $1.03 billion in the comparative period in 2023. Foreign currency trading gains amount to $2.23 billion in the latest quarter compared with $1.94 billion in 2023 and for the year to date, $4.56 billion in the six months to April versus $4 billion in 2023.

Insurance activities delivered profits of $530 million for the latest quarter, up from $493 million in the previous year. For the half year, it moved to $1.05 billion, from $1.03 billion in the comparative period in 2023. Foreign currency trading gains amount to $2.23 billion in the latest quarter compared with $1.94 billion in 2023 and for the year to date, $4.56 billion in the six months to April versus $4 billion in 2023.