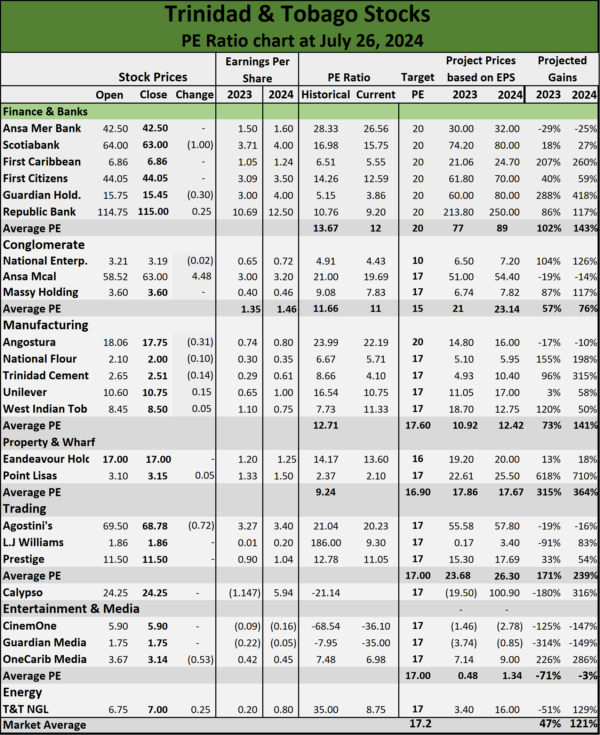

The Trinidad and Tobago Stock Exchange All Trinidad Index fell 12.49 points to close at 1,673.86 for the week ending on Friday, even as Ansa McCal jumped $4.48 to close the week at $63 but Scotiabank drop $1 during the week to be the stock with the biggest decline.

The market closed with eight stocks declining and six rising with Ansa McCal being by far the biggest price mover in a week that saw Republic Financial, Guardian Holdings and JMMB Group closing at 52 weeks’ low and Endeavor closing at a 52 weeks’ high of $17.

The market continues to decline for 2024 to date. This comes with tightness in the financial market in the country. The latest move by the central bank flowing from an unscheduled monetary policy meeting was the lowering of reserves of banks held at the central banks, from 14 percent to 10 percent of prescribed liabilities with effect from the reserve week beginning July 24, 2024. While the central bank kept their repo rate at 3.5 percent they indicate the Treasury bill rates have steadily declined by 27 basis points since February. At the last auction in July the average rates came out at 1.40 percent.

The market continues to decline for 2024 to date. This comes with tightness in the financial market in the country. The latest move by the central bank flowing from an unscheduled monetary policy meeting was the lowering of reserves of banks held at the central banks, from 14 percent to 10 percent of prescribed liabilities with effect from the reserve week beginning July 24, 2024. While the central bank kept their repo rate at 3.5 percent they indicate the Treasury bill rates have steadily declined by 27 basis points since February. At the last auction in July the average rates came out at 1.40 percent.

“Production indicators monitored by the Central Bank during the fourth quarter of 2023 and into the first three months of 2024, such as local sale of cement and new motor vehicle sales, point to vibrancy in some non-energy sectors. Meanwhile, data from the Ministry of Energy and Energy Industries indicate that output of crude oil and natural gas from the mature fields continued to slip over this period.”

PE ratios still show several stocks listed on the Trinidad and Tobago to be undervalued.

Economic uncertainty hitting Trinidad stocks

Stocks to watch with explosive potentials

Better than expected reported profits compared with the prior period has been the driver of local stock prices since last year into the current year. Late last year, Transjamaican Highway and Scotia Group reported a surge in profits over the previous year and investors rewarded them with a jump in their price and they did that for Caribbean Cement that released results early last week.

Last week, investors drove up General Accident shares to a new 52 weeks’ high and so too Caribbean Cement. The above are clear messages that profit growth outweighs interest rates as the driver of stock prices.

Last week, investors drove up General Accident shares to a new 52 weeks’ high and so too Caribbean Cement. The above are clear messages that profit growth outweighs interest rates as the driver of stock prices.

Three companies reported above average profits that should help lift prices over the coming days or weeks and are worth watching.

Caribbean Cement rose from $58 last week to trade as high as a new 52 weeks’ high of $69.90 in response to profits in the first quarter to March this year, from an increase of nearly 12 percent in revenues to $7.6 billion from $6.8 billion in 2023 with profits jumping 546 percent to $1.9 billion compared to a mere $289 million in last year first quarter.

Based on closing quotes buying interest is at the $60 level with a few shares at $61 but offers are at $69 to $70 levels and above. The gap could result in a standoff for a few days, with the stock popped strongly already.

General Accident reported earnings of $0.39 per share in its interim financial report for 2023 but released audited accounts with $0.52 per share earnings instead. The audited accounts show profit revised to $0.71 from $0.53 previously reported in 2022, based on the new accounting standard – IAS17 which requires insurance companies to report income and expenses dramatically differently from the previously used format.

ICInsider.com forecast earnings of $1.10 for the 2024 fiscal year. In the past two months, there was heavy buying in the stock, with 223,053 traded on Friday with the price closing at $6.50. A total of 1,026,154 units were traded during the week. In April, trading amounted to 19.77 million units and 23.8 million shares in March. These numbers suggest that Mayberry Investment disposed of the majority of shares they previously owned. At the close on Friday, there were only 8 offers on the board, amounting to less than 20,000 shares, up to a price of $9.57. There are 300,000 units on the bid over $5.95.

Caribbean Assurance Brokers selling at a PE of just 3 based on current year’s earnings.

Caribbean Assurance Brokers reported solid gains in profit for 2023 compared to 2022. The latest audited results show the company earning $0.47 per share, in line with ICInsdier.com’s projection before the release of the third quarter results that showed a fall in revenues and profit. The company reported earnings of $0.30 per share in the previous year. ICInsdier.com projects earnings of $0.65, for 2024.

Buying is strong at the $2-2.20 level but with the results, many of these bids will move up to meet supply, mostly at $2.55 and above. With the latest results, released after trading on Friday, there should be major adjustments to bid and offer prices at the start of trading on Monday.

Dolphin Cove closed at a 52 weeks’ high of $20.03 and seems to be grudgingly moving higher, with bids mostly under $20 for small amounts. Offers are drying up with just 14 on the board, between $21 and $25, amounting to 144,000 shares. The trendline indicates the price slowly moving towards $23 in the weeks ahead. With the first quarter results due in days, the trajectory could accelerate with tourist traffic and the recently increased dividend payment suggests that profit should be seeing a bounce.

Also to be watched is Caribbean Producers with just 4 bids at the close on Friday, but sellers are overwhelming buyers at the close. The price looks set to fall below $8, before too long.

JMMB Group is another stock under pressure with more sellers than buyers. NCB Financial releases results on Thursday and is expected to declare an interim dividend.

Transjamaican stock doubles in 2023

Transjamaican Highway stock closed trading on Wednesday with a gain of 105 percent at a record close of $2.87 on Wednesday and traded at a record $2.95, up 111 percent on Thursday morning, to be one of only two stocks on the Main Market of the Jamaica Stock Exchange to gain more than 100 percent for the year to date, the other being Ciboney up 139 percent.

New record high for the JSE Junior Market.

Investors in Transjamaican, the operators of Highway 2000 have much more to cheer about as the company raised the dividend to be paid in October by 118 percent to 18.66 cents up from 8.55 cents last year. The dividend adds another 13 percent to their return for 2023 based on the opening price for the year of $1.40. While the 2023 performance is a big reward for investors in the stock, it has been a long wait for early investors who bought in the IPO at $1.41 in February 2020, valued then at a PE ratio of 25 times, when the market was averaging 16 times. Critics of the value at the time indicated the serious overvaluation but supporters hailed it as reasonably priced. Now the stock is trading at less than 10 times 2023 earnings of 30 cents per share and buyers have been less than ecstatic about it, by slowly driving the share price to current levels over several months.

Transjamaican Highway

The stock’s performance is supported by an outstanding jump in profits for the six months to June over the similar period last year, with earnings of 14 cents per share versus just 3 cents for the same period last year, with the profit ballooning 338 percent for the June quarter to US$6 million and 442 percent to US$11 million for the half year. Revenues and profit rose as a result of the acquisition of its new subsidiary, Jamaican Infrastructure Operators which reduced cost considerably as well and the group benefitted from increased revenues from operating the toll road. The stock’s performance was also helped by the declaration of the substantial increase in dividend.

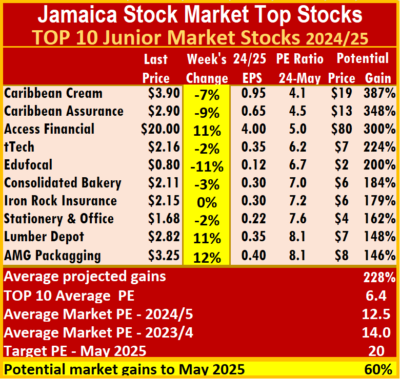

In Junior Market ICTOP10, Consolidated Barkeries rose 14 percent to close at $3.85, Caribbean Cream gained 13 percent to $3.75 and tTech rose 5 percent to $2.50 following a switch in ownership of the company. Access Financial fell 9 percent to $19.95 followed by One Great Studio, down 7 percent to 77 cents.

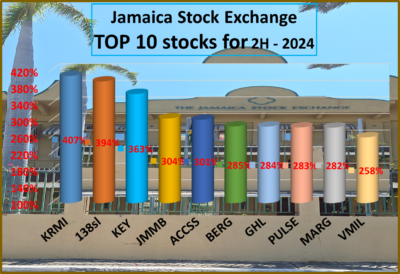

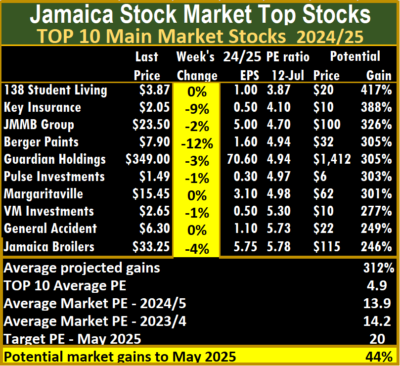

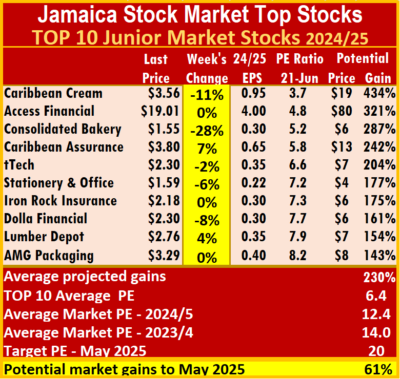

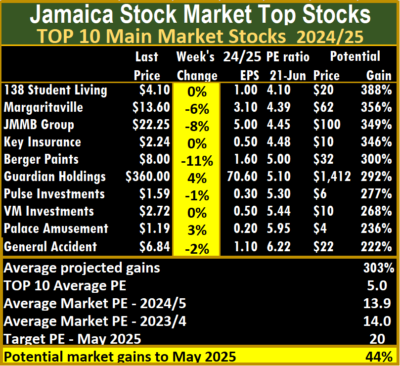

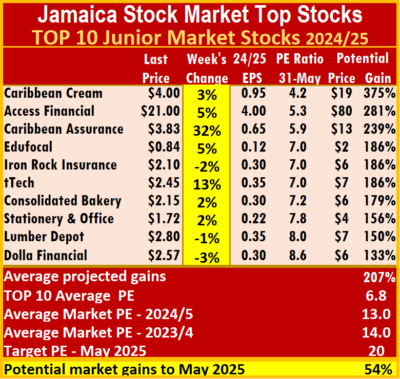

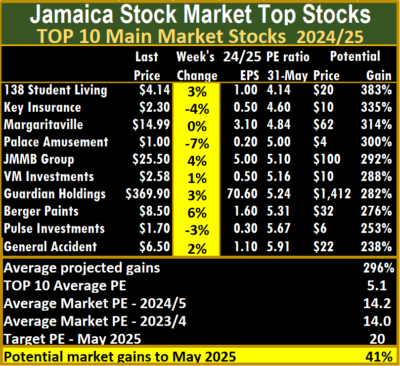

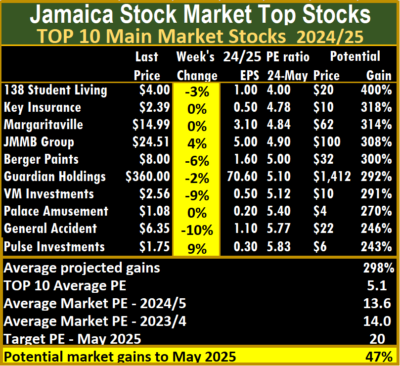

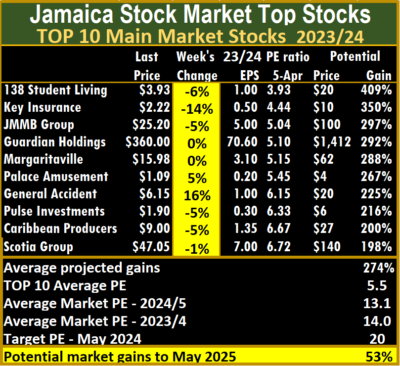

In Junior Market ICTOP10, Consolidated Barkeries rose 14 percent to close at $3.85, Caribbean Cream gained 13 percent to $3.75 and tTech rose 5 percent to $2.50 following a switch in ownership of the company. Access Financial fell 9 percent to $19.95 followed by One Great Studio, down 7 percent to 77 cents. The Main Market ICTOP10 is projected to gain an average of 312 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 312 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. In a week when the Junior Market fell 1.72 percent and the Main Market was down 0.97 percent the ICTOP10 stocks ended with declining stocks outnumbering those rising. JSE Main Market had two winners and three losers of note and just two winners and four losers of note in the Junior Market.

In a week when the Junior Market fell 1.72 percent and the Main Market was down 0.97 percent the ICTOP10 stocks ended with declining stocks outnumbering those rising. JSE Main Market had two winners and three losers of note and just two winners and four losers of note in the Junior Market. The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.4, just over half of the market, with an average of 12.4.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.4, just over half of the market, with an average of 12.4. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

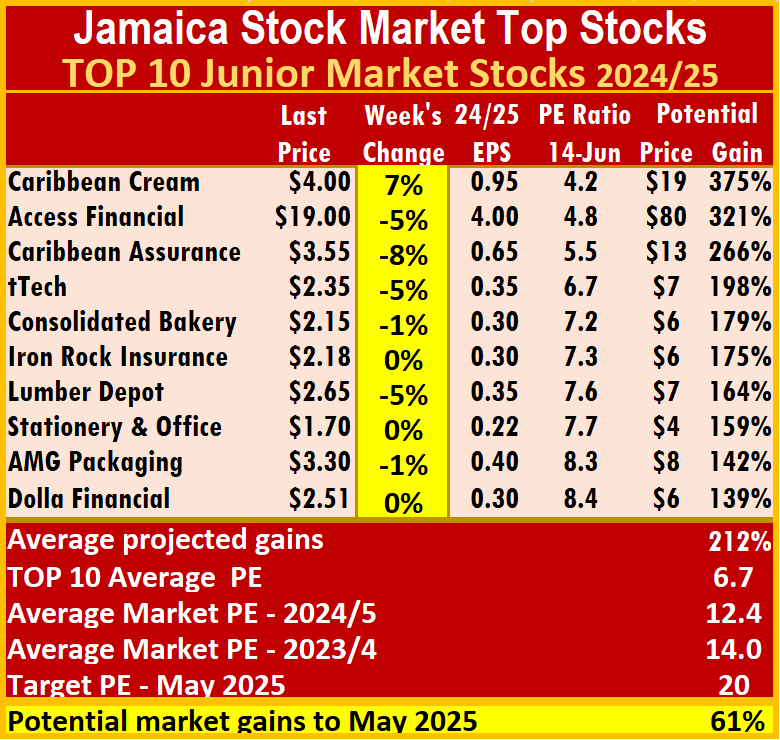

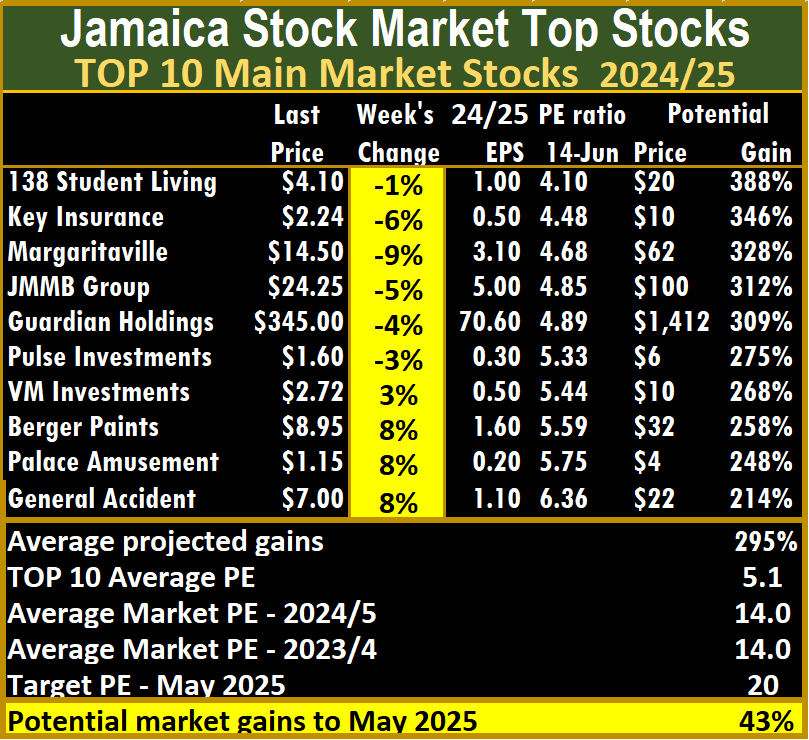

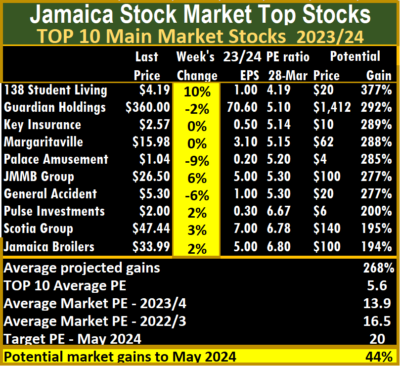

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 14 and the Junior Market TOP10 sits at 6.7, just over half of the market, with an average of 12.4.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 14 and the Junior Market TOP10 sits at 6.7, just over half of the market, with an average of 12.4. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. The Main Market ICTOP10 is projected to gain an average of 296 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 296 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. Dropping from the ICTOP10 are Dolla Financial from the Junior Market and Lasco Manufacturing and Jamaica Broilers from the Main Market.

Dropping from the ICTOP10 are Dolla Financial from the Junior Market and Lasco Manufacturing and Jamaica Broilers from the Main Market.  With the investing environment slowly improving, the company appears set to enjoy a profitable year, accordingly, ICInsider.com’s estimate is for earnings of 50 cents per share, which could be bettered if investments deliver more returns in the next three quarters.

With the investing environment slowly improving, the company appears set to enjoy a profitable year, accordingly, ICInsider.com’s estimate is for earnings of 50 cents per share, which could be bettered if investments deliver more returns in the next three quarters. The average PE in the top half of the market is 17 and is possibly the lowest fair value measure for stocks, currently.

The average PE in the top half of the market is 17 and is possibly the lowest fair value measure for stocks, currently. There were no changes to the list of companies in the Junior Market TOP10 this past week.

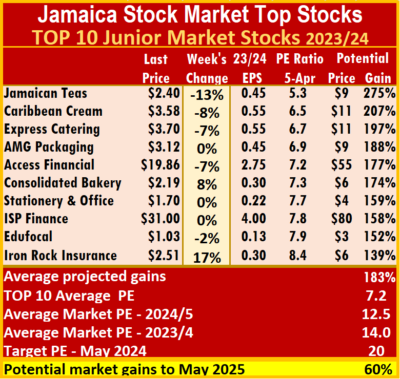

There were no changes to the list of companies in the Junior Market TOP10 this past week. The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.1 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 12.5.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.1 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 12.5. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

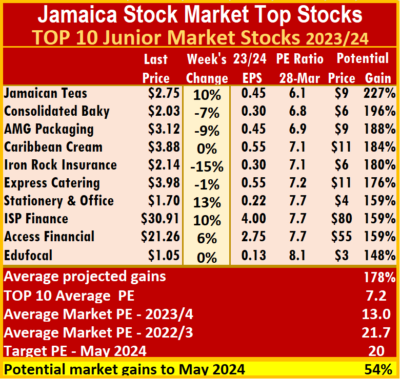

The Main Market ICTOP10 is projected to gain an average of 270 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 178 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 270 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 178 percent over the same period. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.