The Main Market of the Jamaica Stock Exchange slipped 2.3 percent in value in the past week while the Junior Market lost 2.2 percent, primarily due to declines in prices of Cargo Handlers, Caribbean Cream, Express Catering and Indies Pharma. The Main Market was hit with a 13 percent drop in the value of NCB Financial Group shares.

With the decline in the price of NCB Financial, the stock is so close to the TOP10 and is now peeping in but could be a struggle before moving sustainably upwards. The demand for the stock is weak currently and the price could be trading in the $40 region. Technical reading suggests a $45 price is not far-fetched before in finding a bottom.

With the decline in the price of NCB Financial, the stock is so close to the TOP10 and is now peeping in but could be a struggle before moving sustainably upwards. The demand for the stock is weak currently and the price could be trading in the $40 region. Technical reading suggests a $45 price is not far-fetched before in finding a bottom.

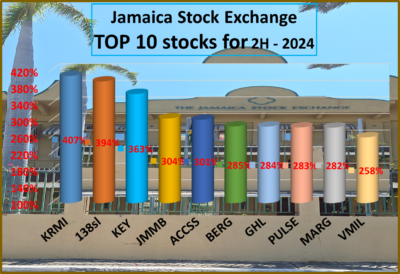

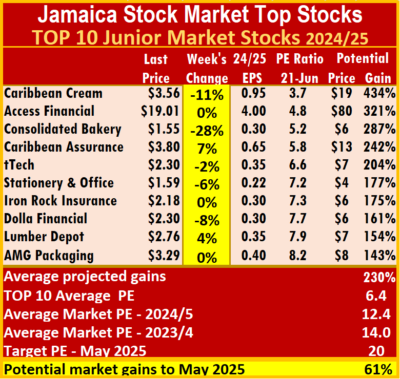

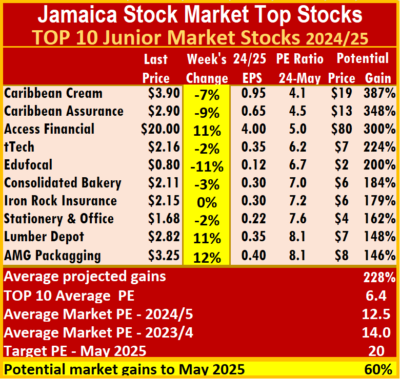

At the end of the week, Dolla Financial rose 12 percent to $2.80 followed by Access Financial closing at $21.96 after gaining 10 percent and tTech up 8 percent to $2.70.

Caribbean Cream and Consolidated Bakeries lost 11 percent each to close at $3.35 and $2.00 respectively and AMG Packaging declined by 5 percent to $3.02. In the Main Market, Berger Paints rose 7 percent to $8.40 to be the leading mover followed by 138 Student Living up 6 percent to $4.09. There are no major declining stocks in the ICTOP10.

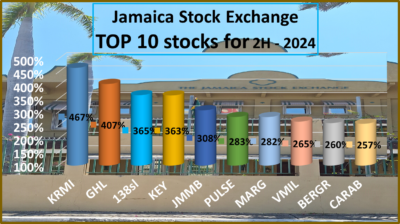

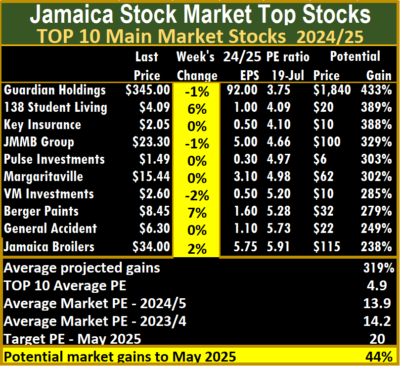

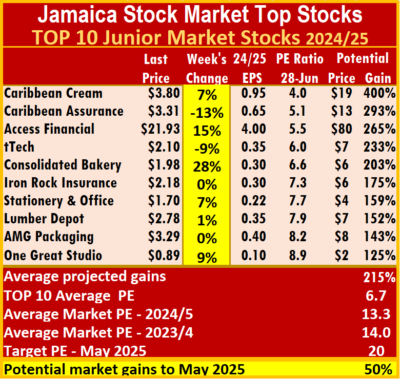

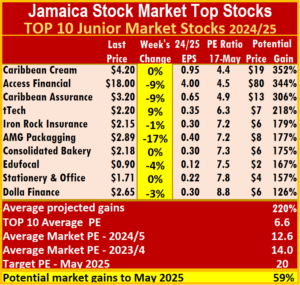

Guardian Holdings moved up on the JSE TOP10 listing, with earnings per share revised from $71 to $92 helped by a fall in the price at the close of the week. Price gain for Access Financial resulted in it moving from the 5th spot last week out of the list this week and Caribbean Assurance Brokers moved into the listing, following price slippage during the week.

Guardian Holdings moved up on the JSE TOP10 listing, with earnings per share revised from $71 to $92 helped by a fall in the price at the close of the week. Price gain for Access Financial resulted in it moving from the 5th spot last week out of the list this week and Caribbean Assurance Brokers moved into the listing, following price slippage during the week.

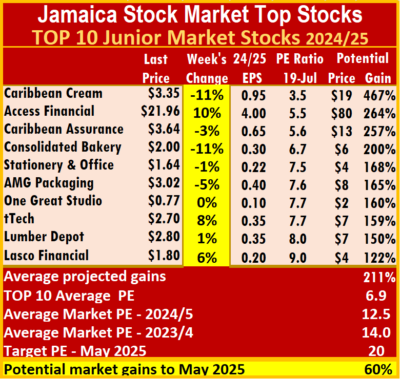

Lasco Financial Services returns to the Junior Market TOP10, replacing Dolla Financial rising appreciably during the week. The Main Market had no changes.

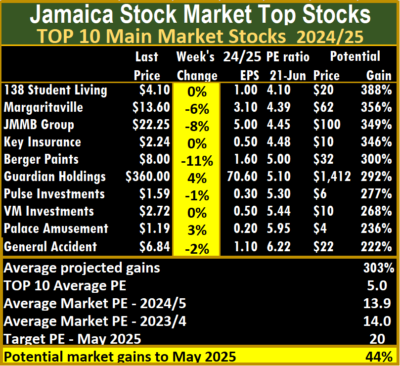

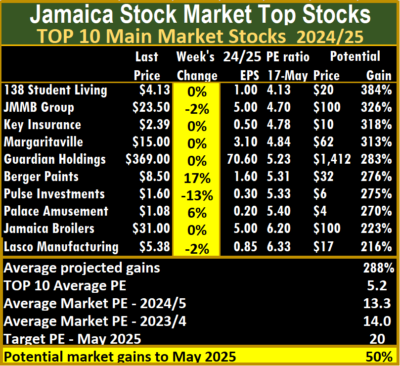

The average PE for the JSE Main Market ICTOP 10 stands at 4.9, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.9, just over half of the market, with an average of 12.5.

The Main Market ICTOP10 is projected to gain an average of 319 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 211 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 92, with an average of 29 and 19 excluding the highest PE ratios, and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 10 stocks, or 21 percent of the market, with PEs ranging from 15 to 20, averaging 18, well above the market’s average. The average PE for the top half of the market is 17, possibly the lowest fair value measure for stocks currently.

In the Junior Market IC TOP10 are 10 stocks, or 21 percent of the market, with PEs ranging from 15 to 20, averaging 18, well above the market’s average. The average PE for the top half of the market is 17, possibly the lowest fair value measure for stocks currently.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

In Junior Market ICTOP10, Consolidated Barkeries rose 14 percent to close at $3.85, Caribbean Cream gained 13 percent to $3.75 and tTech rose 5 percent to $2.50 following a switch in ownership of the company. Access Financial fell 9 percent to $19.95 followed by One Great Studio, down 7 percent to 77 cents.

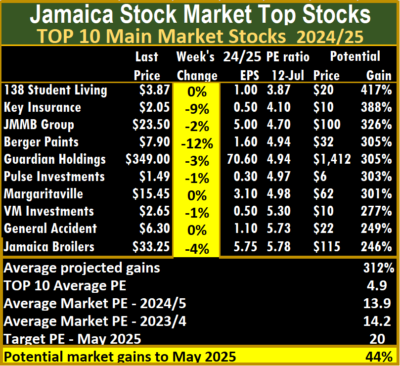

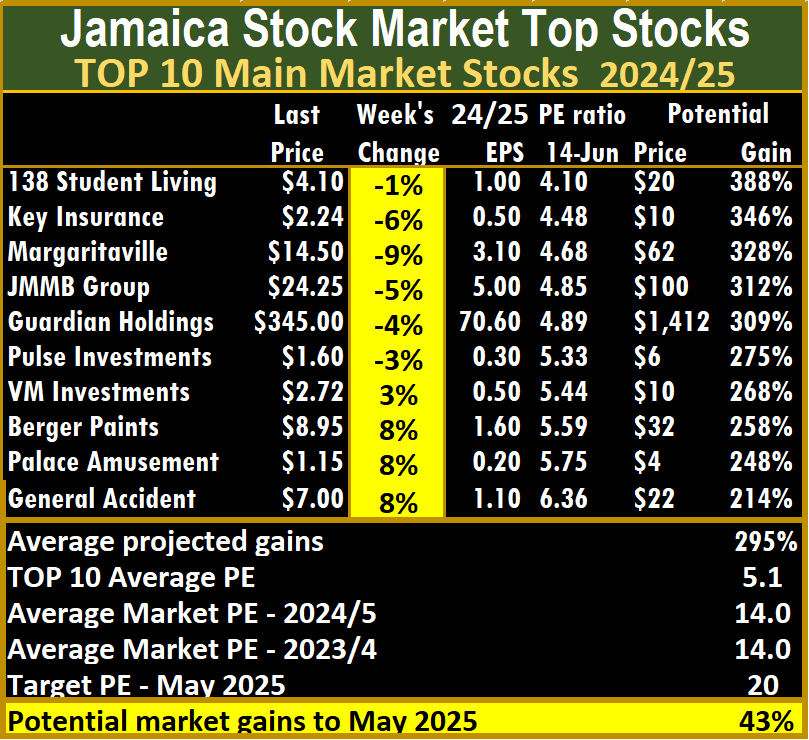

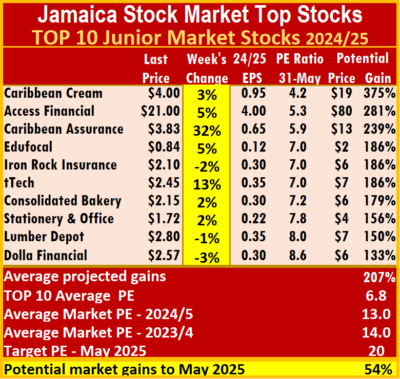

In Junior Market ICTOP10, Consolidated Barkeries rose 14 percent to close at $3.85, Caribbean Cream gained 13 percent to $3.75 and tTech rose 5 percent to $2.50 following a switch in ownership of the company. Access Financial fell 9 percent to $19.95 followed by One Great Studio, down 7 percent to 77 cents. The Main Market ICTOP10 is projected to gain an average of 312 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 312 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. The Junior Market ICTOP10 closed with two stocks rising and two declining with notable losses. The Main Market has three stocks with notable gains and two losses of size.

The Junior Market ICTOP10 closed with two stocks rising and two declining with notable losses. The Main Market has three stocks with notable gains and two losses of size.  Iron Rock Insurance drops out of the TOP10 with trading in the stock suspended and is replaced by Dolla Financial that fell back in price during the week following the big month end run up last week.

Iron Rock Insurance drops out of the TOP10 with trading in the stock suspended and is replaced by Dolla Financial that fell back in price during the week following the big month end run up last week. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. Other than the b moves in the TOP10, the market got some good news this past week. For one Jamaica Broilers reported positive full year results that were helped by a $2.3 billion one off gain, excluding those gains normal profits would have been in the order of $4.80 when taxes relating to the capital gains are excluded. The other positive news is that the Bank of Jamaica will officially start to ease the tight monetary policy pursued over the past three years. In reality, they commenced easing in early May, with CD rates falling from 11.59 percent in early April to mostly under 10 percent during June.

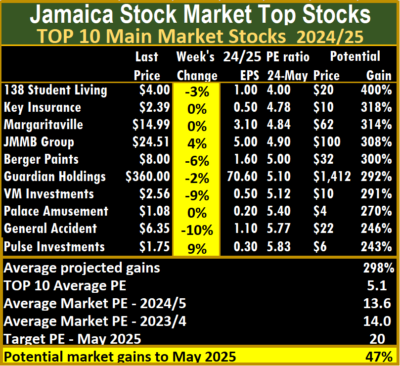

Other than the b moves in the TOP10, the market got some good news this past week. For one Jamaica Broilers reported positive full year results that were helped by a $2.3 billion one off gain, excluding those gains normal profits would have been in the order of $4.80 when taxes relating to the capital gains are excluded. The other positive news is that the Bank of Jamaica will officially start to ease the tight monetary policy pursued over the past three years. In reality, they commenced easing in early May, with CD rates falling from 11.59 percent in early April to mostly under 10 percent during June. JMMB Group was the star performer in the Main Market TOP10, climbing 13 percent to $25.10 and Berger Paints was up 6 percent in closing at $8.52. Declining stocks are 138 Student Living and Pulse Investments dipping 6 percent to $3.86 and $1.50 respectively and Guardian Holdings dropped 4 percent to close at $345.

JMMB Group was the star performer in the Main Market TOP10, climbing 13 percent to $25.10 and Berger Paints was up 6 percent in closing at $8.52. Declining stocks are 138 Student Living and Pulse Investments dipping 6 percent to $3.86 and $1.50 respectively and Guardian Holdings dropped 4 percent to close at $345. In the Junior Market IC TOP10 are 14 stocks, or 30 percent of the market, with PEs ranging from 15 to 53, averaging 21, well above the market’s average. The average PE for the top half of the market is 18, possibly the lowest fair value measure for stocks currently.

In the Junior Market IC TOP10 are 14 stocks, or 30 percent of the market, with PEs ranging from 15 to 53, averaging 21, well above the market’s average. The average PE for the top half of the market is 18, possibly the lowest fair value measure for stocks currently. In a week when the Junior Market fell 1.72 percent and the Main Market was down 0.97 percent the ICTOP10 stocks ended with declining stocks outnumbering those rising. JSE Main Market had two winners and three losers of note and just two winners and four losers of note in the Junior Market.

In a week when the Junior Market fell 1.72 percent and the Main Market was down 0.97 percent the ICTOP10 stocks ended with declining stocks outnumbering those rising. JSE Main Market had two winners and three losers of note and just two winners and four losers of note in the Junior Market. The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.4, just over half of the market, with an average of 12.4.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.4, just over half of the market, with an average of 12.4. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

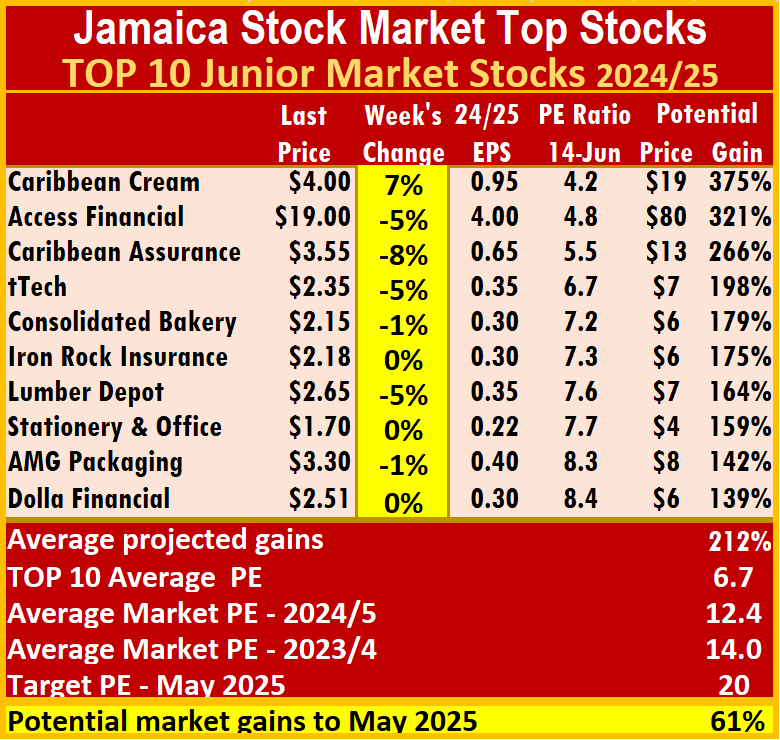

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 14 and the Junior Market TOP10 sits at 6.7, just over half of the market, with an average of 12.4.

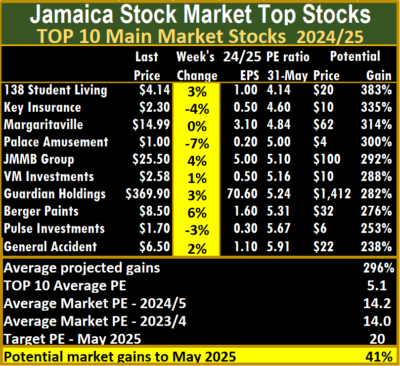

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 14 and the Junior Market TOP10 sits at 6.7, just over half of the market, with an average of 12.4. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

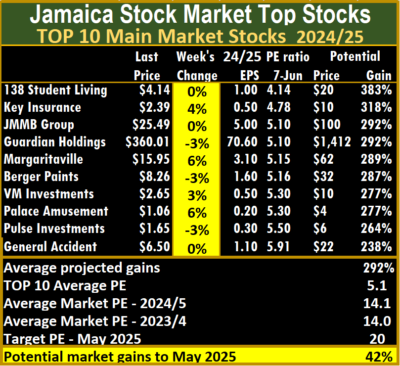

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. In the Main Market, Margaritaville and Palace Amusement rose by 6 percent to close at $15.95 and $1.06 respectively and Key Insurance fell 4 percent to $2.39. Of note is that Berger Paints fell 3 percent to close at $8.26, trading at a 52 weeks’ high of $10.10 on Friday as the stock closed with a big gap between buyers and sellers.

In the Main Market, Margaritaville and Palace Amusement rose by 6 percent to close at $15.95 and $1.06 respectively and Key Insurance fell 4 percent to $2.39. Of note is that Berger Paints fell 3 percent to close at $8.26, trading at a 52 weeks’ high of $10.10 on Friday as the stock closed with a big gap between buyers and sellers. The Main Market ICTOP10 is projected to gain an average of 292 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 209 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 292 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 209 percent over the same period. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. The Main Market ICTOP10 is projected to gain an average of 296 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 296 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. Dropping from the ICTOP10 are Dolla Financial from the Junior Market and Lasco Manufacturing and Jamaica Broilers from the Main Market.

Dropping from the ICTOP10 are Dolla Financial from the Junior Market and Lasco Manufacturing and Jamaica Broilers from the Main Market.  With the investing environment slowly improving, the company appears set to enjoy a profitable year, accordingly, ICInsider.com’s estimate is for earnings of 50 cents per share, which could be bettered if investments deliver more returns in the next three quarters.

With the investing environment slowly improving, the company appears set to enjoy a profitable year, accordingly, ICInsider.com’s estimate is for earnings of 50 cents per share, which could be bettered if investments deliver more returns in the next three quarters. The average PE in the top half of the market is 17 and is possibly the lowest fair value measure for stocks, currently.

The average PE in the top half of the market is 17 and is possibly the lowest fair value measure for stocks, currently. Dropping from the ICTOP10 this week are ISP Finance from the Junior Market and from the Main Market General Accident and Scotia Group. Earnings for ISP Finance were adjusted to $1.60 per share to reflect what the first quarter results suggest. Prices of General Accident and Scotia Group moved up slightly and were replaced by stocks that had lower prices by the end of the week.

Dropping from the ICTOP10 this week are ISP Finance from the Junior Market and from the Main Market General Accident and Scotia Group. Earnings for ISP Finance were adjusted to $1.60 per share to reflect what the first quarter results suggest. Prices of General Accident and Scotia Group moved up slightly and were replaced by stocks that had lower prices by the end of the week. Dolla Financial is the only new listing for the ICTOP10 Junior Market for the week. In the Main Market, Pulse Investments and Lasco Manufacturing which dropped out of the list last week, are now in the ICTOP10.

Dolla Financial is the only new listing for the ICTOP10 Junior Market for the week. In the Main Market, Pulse Investments and Lasco Manufacturing which dropped out of the list last week, are now in the ICTOP10. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.