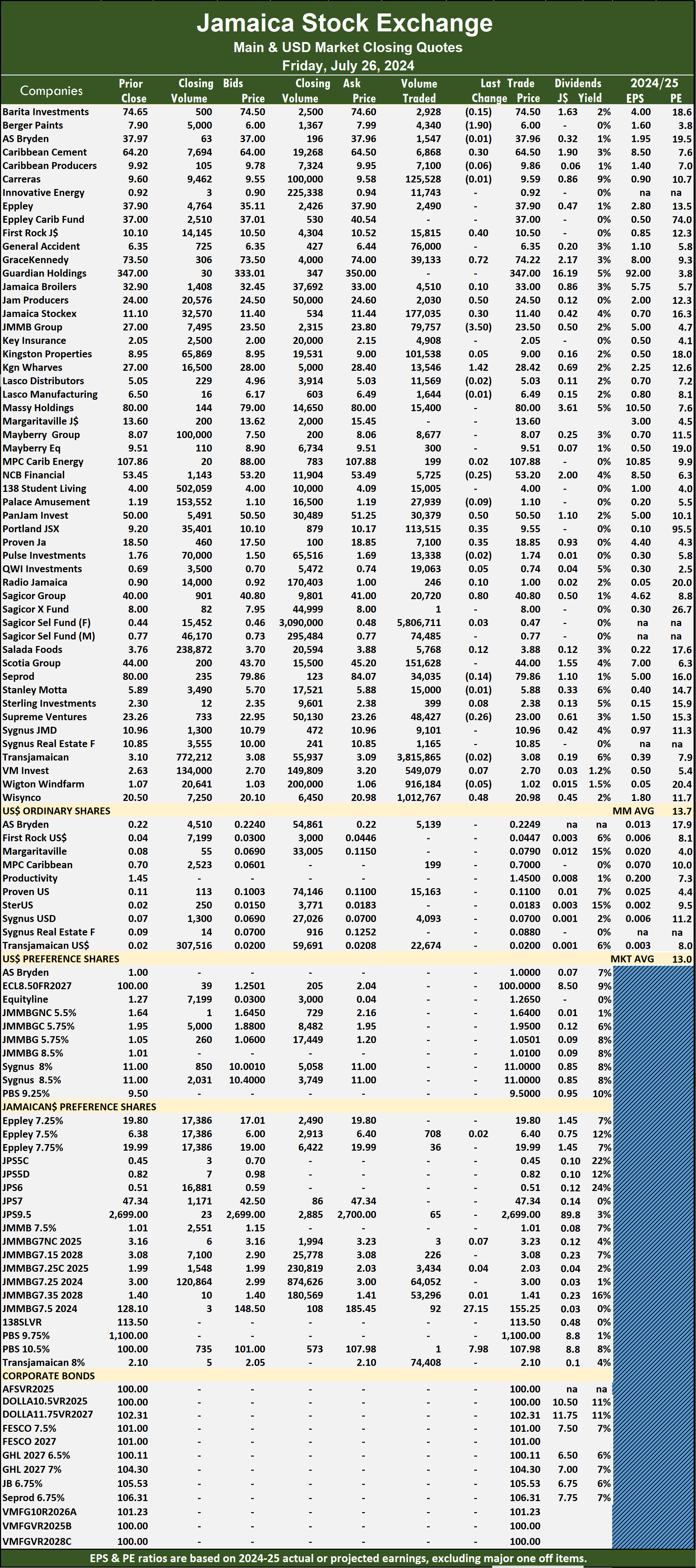

The Main Market of the Jamaica Stock Exchange rose on Friday, for the 4th time this week and ended with rising stocks outpacing those declining by almost 2 to 1 after the volume and value of stocks traded were marginally different than market activity on Thursday and ended with trading in 60 securities compared with 55 on Thursday, with prices of 26 stocks rising, 15 declining and 19 ending unchanged.

The market closed with 13,604,571 shares being traded for $65,580,443 compared with 12,877,172 units at $69,293,990 on Thursday.

The market closed with 13,604,571 shares being traded for $65,580,443 compared with 12,877,172 units at $69,293,990 on Thursday.

Trading averaged 226,743 shares at $1,093,007 compared to 234,130 units at $1,259,891 on Thursday and month to date, an average of 659,733 stocks at $6,104,693 compared with 685,922 units at $6,407,819 on the previous day and June with an average of 246,425 shares at $1,945,941.

Sagicor Select Financial Fund led trading with 5.81 million shares for 42.7 percent of total volume followed by Transjamaican Highway with 3.82 million units for 28 percent of the day’s trade and Wisynco Group with 1.01 million stocks for 7.4 percent of the day’s trade.

The All Jamaican Composite Index rose 1,682.41 points to 356,592.46, the JSE Main Index rallied 1,044.59 points to settle at 314,466.93 and the JSE Financial Index increased 0.42 points to end trading at 66.26.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and five with lower offers.

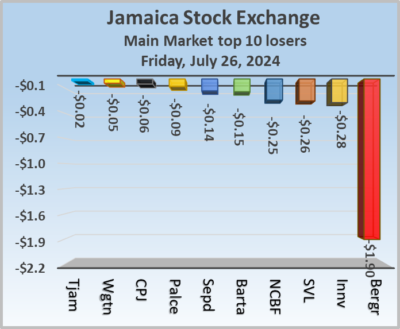

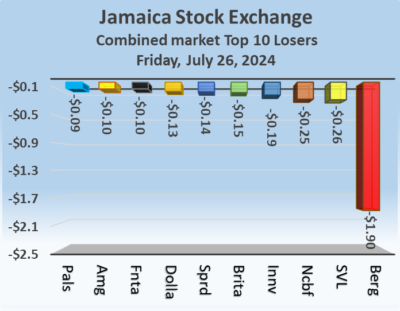

At the close of the market, Berger Paints shed $1.90 to end at $6 with investors trading 4,340 stock units, Caribbean Cement rose 30 cents in closing at $64.50 after an exchange of 6,868 shares, First Rock Real Estate climbed 40 cents to $10.50 after closing with an exchange of 15,815 stocks. GraceKennedy popped 72 cents to close at $74.22 in an exchange of 39,133 units, Jamaica Producers gained 50 cents and ended at $24.50, with 2,030 stocks crossing the market, Jamaica Stock Exchange advanced 30 cents to finish at $11.40 in an exchange of 177,035 units.  Kingston Wharves increased $1.42 and ended at $28.42 with traders dealing in 13,546 shares, Pan Jamaica rallied 50 cents to $50.50 after a transfer of 30,379 stock units, Portland JSX rose 35 cents to close at $9.55 in switching ownership of 113,515 shares. Proven Investments rallied 35 cents in closing at $18.85, with 7,100 stocks crossing the exchange, Sagicor Group popped 80 cents to finish at $40.80 with a transfer of 20,720 units and Wisynco Group advanced 48 cents to end at $20.98 with 1,012,767 stock units clearing the market.

Kingston Wharves increased $1.42 and ended at $28.42 with traders dealing in 13,546 shares, Pan Jamaica rallied 50 cents to $50.50 after a transfer of 30,379 stock units, Portland JSX rose 35 cents to close at $9.55 in switching ownership of 113,515 shares. Proven Investments rallied 35 cents in closing at $18.85, with 7,100 stocks crossing the exchange, Sagicor Group popped 80 cents to finish at $40.80 with a transfer of 20,720 units and Wisynco Group advanced 48 cents to end at $20.98 with 1,012,767 stock units clearing the market.

In the preference segment, 138 Student Living preference share climbed $27.15 in closing at $155.25 with an exchange of 92 shares and Sygnus Credit Investments C10.5% increased $7.98 to $107.98, with jsut 1 unit crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Steady as they go on the JSE USD Market

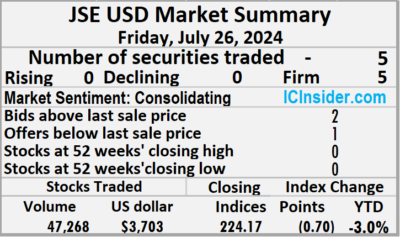

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks changing hands declining 76 percent with a 73 percent lower value than on Thursday, resulting in activity in five securities, down from nine on Thursday and ended with all five stocks ending unchanged.

The market closed with an exchange of 47,268 shares for US$3,703 down from 200,309 stock units at US$13,942 on Thursday.

The market closed with an exchange of 47,268 shares for US$3,703 down from 200,309 stock units at US$13,942 on Thursday.

Trading averaged 9,454 stock units at US$741 down from 22,257 shares at US$1,549 on Thursday, with a month to date average of 32,875 shares at US$2,402 compared with 34,001 units at US$2,482 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index dropped 0.70 points to conclude trading at 224.17.

The PE Ratio, a most used measure for computing appropriate stock values, averages 8.1. The PE ratio is computed based on last traded prices divided by projected earnings done by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden remained at 22.49 US cents with a transfer of 5,139 stock units, MPC Caribbean Clean Energy ended at 70 US cents with investors exchanging 199 shares, Proven Investments remained at 11 US cents in switching ownership of 15,163 units. Sygnus Credit Investments ended at 7 US cents after a transfer of 4,093 stocks and Transjamaican Highway remained at 2 US cents with 22,674 shares crossing the exchange.

At the close, AS Bryden remained at 22.49 US cents with a transfer of 5,139 stock units, MPC Caribbean Clean Energy ended at 70 US cents with investors exchanging 199 shares, Proven Investments remained at 11 US cents in switching ownership of 15,163 units. Sygnus Credit Investments ended at 7 US cents after a transfer of 4,093 stocks and Transjamaican Highway remained at 2 US cents with 22,674 shares crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

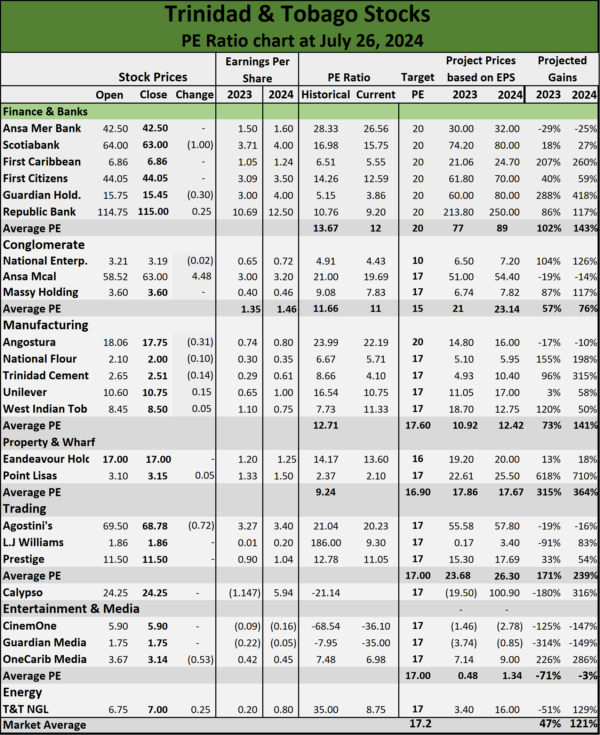

Economic uncertainty hitting Trinidad stocks

The Trinidad and Tobago Stock Exchange All Trinidad Index fell 12.49 points to close at 1,673.86 for the week ending on Friday, even as Ansa McCal jumped $4.48 to close the week at $63 but Scotiabank drop $1 during the week to be the stock with the biggest decline.

The market closed with eight stocks declining and six rising with Ansa McCal being by far the biggest price mover in a week that saw Republic Financial, Guardian Holdings and JMMB Group closing at 52 weeks’ low and Endeavor closing at a 52 weeks’ high of $17.

The market continues to decline for 2024 to date. This comes with tightness in the financial market in the country. The latest move by the central bank flowing from an unscheduled monetary policy meeting was the lowering of reserves of banks held at the central banks, from 14 percent to 10 percent of prescribed liabilities with effect from the reserve week beginning July 24, 2024. While the central bank kept their repo rate at 3.5 percent they indicate the Treasury bill rates have steadily declined by 27 basis points since February. At the last auction in July the average rates came out at 1.40 percent.

The market continues to decline for 2024 to date. This comes with tightness in the financial market in the country. The latest move by the central bank flowing from an unscheduled monetary policy meeting was the lowering of reserves of banks held at the central banks, from 14 percent to 10 percent of prescribed liabilities with effect from the reserve week beginning July 24, 2024. While the central bank kept their repo rate at 3.5 percent they indicate the Treasury bill rates have steadily declined by 27 basis points since February. At the last auction in July the average rates came out at 1.40 percent.

“Production indicators monitored by the Central Bank during the fourth quarter of 2023 and into the first three months of 2024, such as local sale of cement and new motor vehicle sales, point to vibrancy in some non-energy sectors. Meanwhile, data from the Ministry of Energy and Energy Industries indicate that output of crude oil and natural gas from the mature fields continued to slip over this period.”

PE ratios still show several stocks listed on the Trinidad and Tobago to be undervalued.

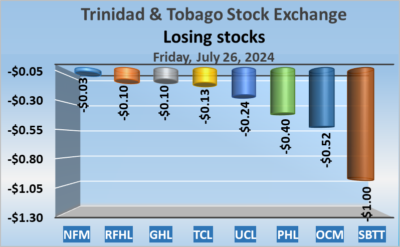

Heavy stock losses on Trinidad Exchange

Winning stocks were absent from the Trinidad and Tobago Stock Exchange on Friday, except for one as declining stocks continue to dominate market that has been in continuous decline for years that closed with a 52 percent drop in the volume of stocks traded, with a 33 percent lower value than on Thursday, resulting in 16 securities trading, down from 20 on Thursday and ending with prices of one stock rising, eight declining and seven ended firm.

Winning stocks were absent from the Trinidad and Tobago Stock Exchange on Friday, except for one as declining stocks continue to dominate market that has been in continuous decline for years that closed with a 52 percent drop in the volume of stocks traded, with a 33 percent lower value than on Thursday, resulting in 16 securities trading, down from 20 on Thursday and ending with prices of one stock rising, eight declining and seven ended firm.

The market closed with trading of 356,474 shares for $2,045,458 compared to 738,069 stock units at $3,061,906 on Thursday.

An average of 22,280 shares were traded at $127,841 compared with 36,903 units at $153,095 on Thursday, with trading month to date averaging 11,550 shares at $144,483 compared with 11,026 units at $145,296 on the previous day and an average for June of 9,110 shares at $119,497.

The Composite Index slipped 2.26 points to 1,118.49, the All T&T Index dropped 3.18 points to wrap up trading at 1,673.86, the SME Index remained unchanged at 78.26 and the Cross-Listed Index dipped 0.18 points to close at 73.37.

The Composite Index slipped 2.26 points to 1,118.49, the All T&T Index dropped 3.18 points to wrap up trading at 1,673.86, the SME Index remained unchanged at 78.26 and the Cross-Listed Index dipped 0.18 points to close at 73.37.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and five with lower offers.

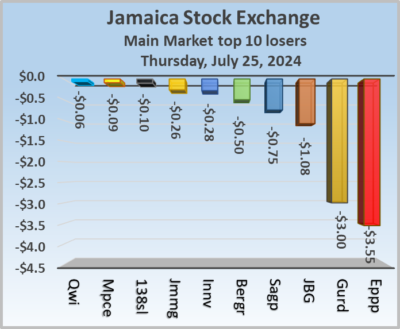

At the close, Ansa McAl remained at $63 after an exchange of 45 stocks, Calypso Macro Investment Fund ended at $24.25, with 1,569 units crossing the market, investors traded 540 shares of First Citizens Group at $44.05 each. FirstCaribbean International Bank ended at $6.86 with an exchange of 10,005 stock units, Guardian Holdings fell 10 cents in closing at a 52 weeks’ low of $15.45 with 100 shares clearing the market, JMMB Group ended at $1.10 with a transfer of 2,095 units. Massy Holdings gained 2 cents in closing at $3.60 following the trading of 318,218 stocks, National Enterprises remained at $3.19 after an exchange of 1,560 stock units, National Flour Mills dipped 3 cents to finish at $2 with investors trading 89 shares.  One Caribbean Media sank 52 cents and ended at $3.14 in switching ownership of 75 units, Prestige Holdings fell 40 cents to end at $11.50 with traders dealing in 1,743 stocks, Republic Financial shed 10 cents to close at a 52 weeks’ low of $115 in an exchange of 4,285 stock units. Scotiabank declined $1 to $63 after 3,250 shares crossed the market, Trinidad Cement lost 13 cents to finish at $2.51 after a transfer of 10,000 stocks, Unilever Caribbean skidded 24 cents and ended at $10.75 as investors exchanged 1,080 units and West Indian Tobacco remained at $8.50 after it closed with 1,820 stock units changing hands.

One Caribbean Media sank 52 cents and ended at $3.14 in switching ownership of 75 units, Prestige Holdings fell 40 cents to end at $11.50 with traders dealing in 1,743 stocks, Republic Financial shed 10 cents to close at a 52 weeks’ low of $115 in an exchange of 4,285 stock units. Scotiabank declined $1 to $63 after 3,250 shares crossed the market, Trinidad Cement lost 13 cents to finish at $2.51 after a transfer of 10,000 stocks, Unilever Caribbean skidded 24 cents and ended at $10.75 as investors exchanged 1,080 units and West Indian Tobacco remained at $8.50 after it closed with 1,820 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading broadens on the JSE USD Market

Trading climbed on the Jamaica Stock Exchange US dollar market on Thursday, with a 696 percent jump in the volume of stocks exchanged along with a 565 percent climb in value trading on Wednesday, resulting from trading in nine securities, compared to six on Wednesday with prices of four rising, three declining and two ending unchanged.

The market closed with an exchange of 200,309 shares for US$13,942 well above the 25,171 units that traded at US$2,096 on Wednesday.

The market closed with an exchange of 200,309 shares for US$13,942 well above the 25,171 units that traded at US$2,096 on Wednesday.

Trading averaged 22,257 stock units at US$1,549 versus 4,195 shares at US$349 on Wednesday, with a month to date average of 34,001 shares at US$2,482 compared with 35,114 units at US$2,571 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index dipped 3.15 points to conclude trading at 224.87.

The PE Ratio, a most used measure for computing stock values, averages 8.1. The PE ratio is calculated based on last traded prices divided by ICInsider.com’s projected earnings for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last prices and one with a lower offer.

At the close of trading, AS Bryden ended at 22.49 US cents with investors trading 2,448 units, First Rock Real Estate USD share rallied 0.44 of one cent to 4.47 US cents and closed with an exchange of 7,469 stocks, MPC Caribbean Clean Energy popped 1 cent to finish at 70 US cents as investors exchanged a mere one share. Proven Investments lost 0.9 of one cent and ended at a 52 weeks’ low of 11 US cents after the trading of 84,198 stock units, Sterling Investments advanced 0.34 of a cent in closing at 1.83 US cents in an exchange of 322 shares, Sygnus Credit Investments remained at 7 US cents with investors trading 10,199 units and Transjamaican Highway declined 0.08 of a cent to 2 US cents with an exchange of 95,546 stocks.

Proven Investments lost 0.9 of one cent and ended at a 52 weeks’ low of 11 US cents after the trading of 84,198 stock units, Sterling Investments advanced 0.34 of a cent in closing at 1.83 US cents in an exchange of 322 shares, Sygnus Credit Investments remained at 7 US cents with investors trading 10,199 units and Transjamaican Highway declined 0.08 of a cent to 2 US cents with an exchange of 95,546 stocks.

In the preference segment, JMMB Group US8.5% preference share shed 14.99 cents to close at US$1.0501, with 30 stock units crossing the market and Sygnus Credit Investments E8.5% rose by 60 cents in closing at US$11 after an exchange of 96 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

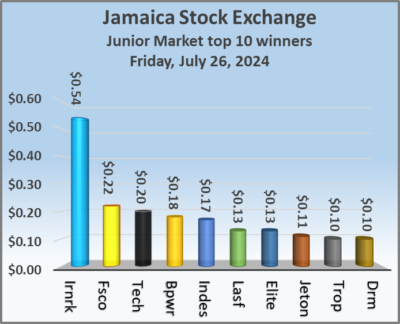

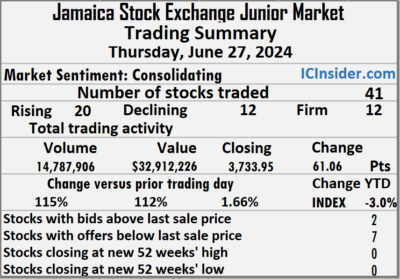

The market closed with trading of 14,787,906 shares for $32,912,226 up from 6,869,011 units at $15,510,430 on Thursday.

The market closed with trading of 14,787,906 shares for $32,912,226 up from 6,869,011 units at $15,510,430 on Thursday. Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and seven with lower offers.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and seven with lower offers. Future Energy rose 22 cents to $3.49 in trading 517,728 units, Indies Pharma gained 17 cents and ended at $2.47 in switching ownership of 328,267 stock units, Iron Rock Insurance rallied 54 cents to end at $3.04, with just 28 shares changing hands. Jetcon Corporation advanced 11 cents in closing at 95 cents, with 370,872 units crossing the exchange, Lasco Financial popped 13 cents to finish at $1.84 in trading 500 stocks, MFS Capital Partners gained 8 cents to close at 85 cents after 121,561 stock units passed through the market. Tropical Battery rose 10 cents to $2.15 in an exchange of 61,526 shares and tTech climbed 20 cents in closing at $2.85, with a mere 3 stock units crossing the market.

Future Energy rose 22 cents to $3.49 in trading 517,728 units, Indies Pharma gained 17 cents and ended at $2.47 in switching ownership of 328,267 stock units, Iron Rock Insurance rallied 54 cents to end at $3.04, with just 28 shares changing hands. Jetcon Corporation advanced 11 cents in closing at 95 cents, with 370,872 units crossing the exchange, Lasco Financial popped 13 cents to finish at $1.84 in trading 500 stocks, MFS Capital Partners gained 8 cents to close at 85 cents after 121,561 stock units passed through the market. Tropical Battery rose 10 cents to $2.15 in an exchange of 61,526 shares and tTech climbed 20 cents in closing at $2.85, with a mere 3 stock units crossing the market. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

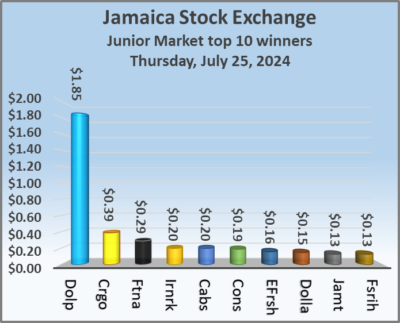

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of the market, the JSE Combined Market Index shot up 1,432.71 points to 327,489.18, the All Jamaican Composite Index rallied 1,682.41 points to 356,592.46, the JSE Main Index popped 1,044.59 points to 314,466.93. The Junior Market Index advanced a solid 61.06 points to end at 3,733.95 and the JSE USD Market Index dipped 0.70 points to close trading at 224.17.

At the close of the market, the JSE Combined Market Index shot up 1,432.71 points to 327,489.18, the All Jamaican Composite Index rallied 1,682.41 points to 356,592.46, the JSE Main Index popped 1,044.59 points to 314,466.93. The Junior Market Index advanced a solid 61.06 points to end at 3,733.95 and the JSE USD Market Index dipped 0.70 points to close trading at 224.17. In Junior Market trading, Jamaican Teas led trading with 4.20 million shares followed by Derrimon Trading with 3.87 million units and EduFocal with 1.42 million stock units.

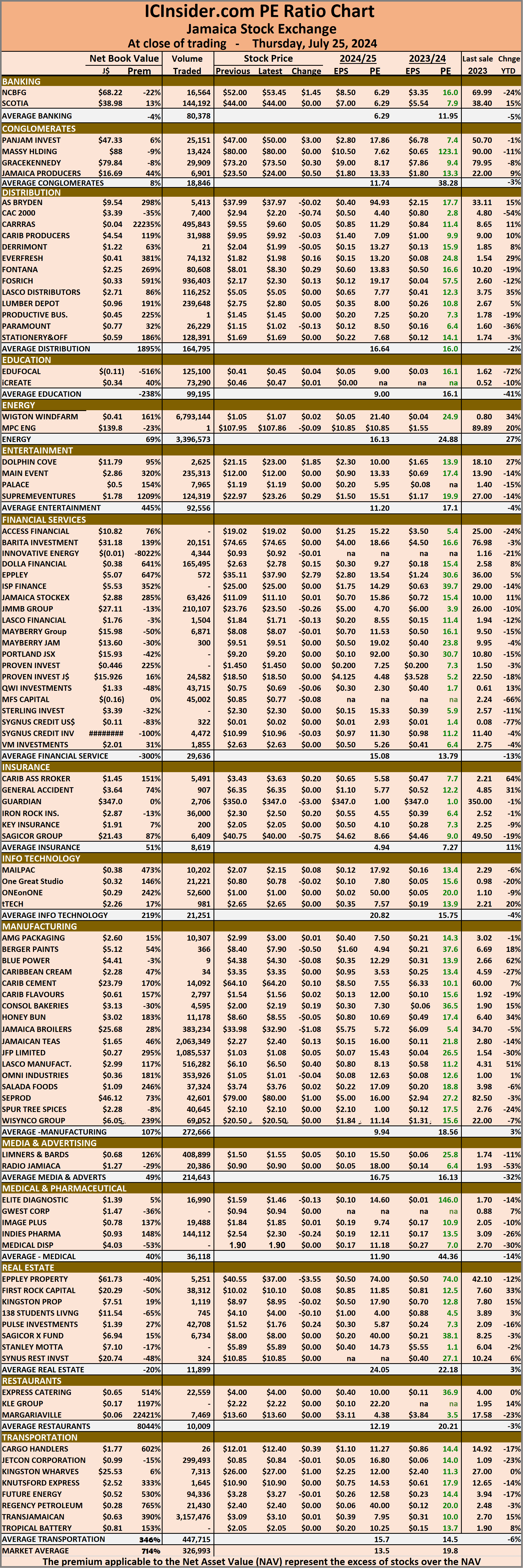

In Junior Market trading, Jamaican Teas led trading with 4.20 million shares followed by Derrimon Trading with 3.87 million units and EduFocal with 1.42 million stock units. The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. Some 12,877,172 shares were traded for $69,293,990 up from 5,083,717 units at $55,164,698 on Wednesday.

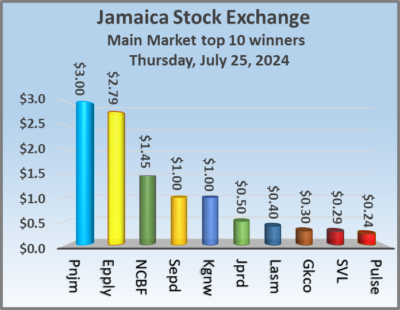

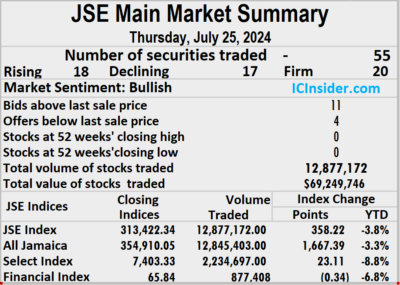

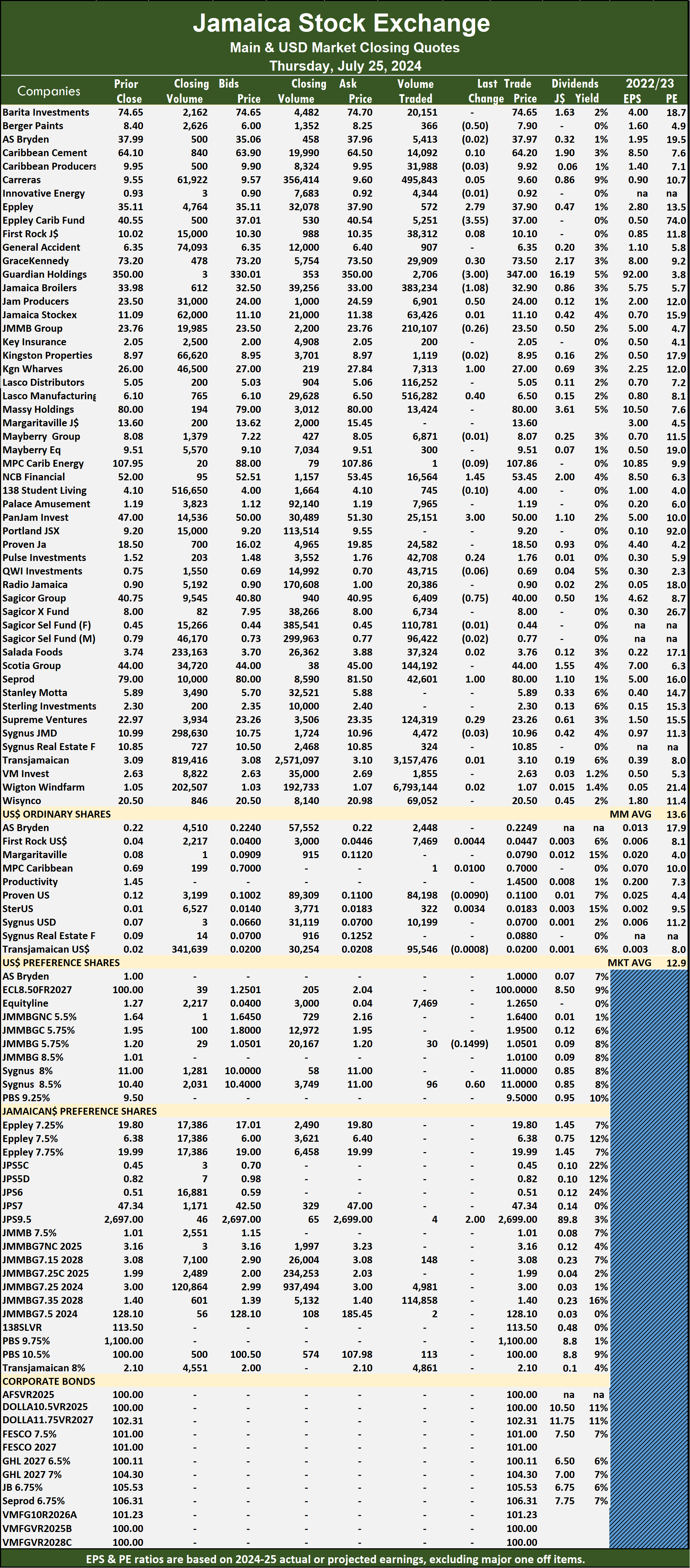

Some 12,877,172 shares were traded for $69,293,990 up from 5,083,717 units at $55,164,698 on Wednesday. The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

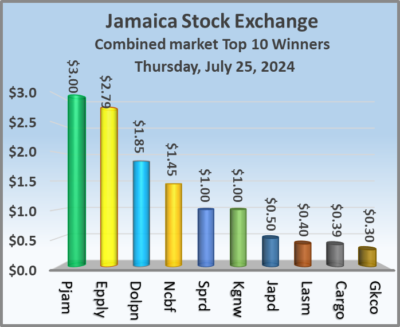

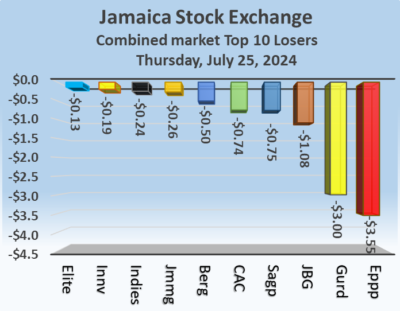

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Jamaica Producers gained 50 cents to close at $24 after a transfer of 6,901 shares, Kingston Wharves rose $1 to finish at $27 after 7,313 stock units passed through the market, Lasco Manufacturing climbed 40 cents and ended at $6.50 after an exchange of 516,282 shares. NCB Financial increased $1.45 in closing at $53.45 with an exchange of 16,564 units, Pan Jamaica advanced $3 to close at $50 with investors trading 25,151 stocks, Sagicor Group dropped 75 cents to end at $40 with an exchange of 6,409 stock units and Seprod popped $1 in closing at $80 with 42,601 shares clearing the market.

Jamaica Producers gained 50 cents to close at $24 after a transfer of 6,901 shares, Kingston Wharves rose $1 to finish at $27 after 7,313 stock units passed through the market, Lasco Manufacturing climbed 40 cents and ended at $6.50 after an exchange of 516,282 shares. NCB Financial increased $1.45 in closing at $53.45 with an exchange of 16,564 units, Pan Jamaica advanced $3 to close at $50 with investors trading 25,151 stocks, Sagicor Group dropped 75 cents to end at $40 with an exchange of 6,409 stock units and Seprod popped $1 in closing at $80 with 42,601 shares clearing the market. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

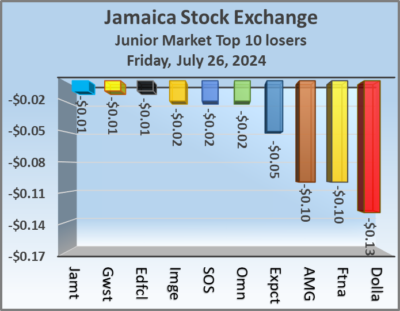

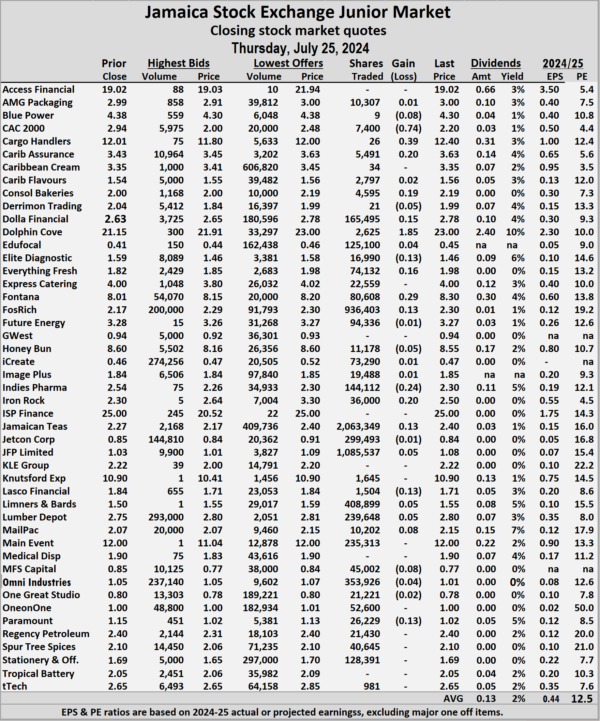

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading closed with an exchange of 6,869,011 shares for $15,510,430 compared with 2,576,485 units at $4,262,470 on Wednesday.

Trading closed with an exchange of 6,869,011 shares for $15,510,430 compared with 2,576,485 units at $4,262,470 on Wednesday. Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and four with lower offers. Everything Fresh rose 16 cents to end at $1.98 after 74,132 stocks passed through the market, Fontana gained 29 cents in closing at $8.30 with an exchange of 80,608 units, Fosrich popped 13 cents to finish at $2.30, with 936,403 stock units changing hands. Honey Bun fell 5 cents and ended at $8.55 with traders dealing in 11,178 shares, Indies Pharma slipped 24 cents to $2.30 in an exchange of 144,112 stock units, Iron Rock Insurance gained 20 cents to close at $2.50 with investors dealing in 36,000 units. Jamaican Teas rose 13 cents to finish at $2.40 with a transfer of 2,063,349 stocks, JFP Ltd advanced 5 cents in closing at $1.08 and closed after 1,085,537 units changed hands, Lasco Financial sank 13 cents to end at $1.71 in trading 1,504 shares. Limners and Bards climbed 5 cents to $1.55 with 408,899 stock units crossing the exchange, Lumber Depot increased 5 cents to end at $2.80 in switching ownership of 239,648 stocks,

Everything Fresh rose 16 cents to end at $1.98 after 74,132 stocks passed through the market, Fontana gained 29 cents in closing at $8.30 with an exchange of 80,608 units, Fosrich popped 13 cents to finish at $2.30, with 936,403 stock units changing hands. Honey Bun fell 5 cents and ended at $8.55 with traders dealing in 11,178 shares, Indies Pharma slipped 24 cents to $2.30 in an exchange of 144,112 stock units, Iron Rock Insurance gained 20 cents to close at $2.50 with investors dealing in 36,000 units. Jamaican Teas rose 13 cents to finish at $2.40 with a transfer of 2,063,349 stocks, JFP Ltd advanced 5 cents in closing at $1.08 and closed after 1,085,537 units changed hands, Lasco Financial sank 13 cents to end at $1.71 in trading 1,504 shares. Limners and Bards climbed 5 cents to $1.55 with 408,899 stock units crossing the exchange, Lumber Depot increased 5 cents to end at $2.80 in switching ownership of 239,648 stocks,  Mailpac Group rallied 8 cents in closing at $2.15 as investors exchanged 10,202 shares. MFS Capital Partners skidded 8 cents and ended at a 52 weeks’ low of 77 cents after a transfer of 45,002 units and Paramount Trading shed 13 cents to finish at $1.02 with investors swapping 26,229 stocks.

Mailpac Group rallied 8 cents in closing at $2.15 as investors exchanged 10,202 shares. MFS Capital Partners skidded 8 cents and ended at a 52 weeks’ low of 77 cents after a transfer of 45,002 units and Paramount Trading shed 13 cents to finish at $1.02 with investors swapping 26,229 stocks. At the close of trading, the JSE Combined Market Index climbed 496.48 points to 326,056.47, the All Jamaican Composite Index rallied 1,667.39 points to 354,910.05, the JSE Main Index rose 358.22 points to 313,422.34. The Junior Market Index popped 21.67 points to 3,672.89 and the JSE USD Market Index fell 3.15 points to end trading at 224.87.

At the close of trading, the JSE Combined Market Index climbed 496.48 points to 326,056.47, the All Jamaican Composite Index rallied 1,667.39 points to 354,910.05, the JSE Main Index rose 358.22 points to 313,422.34. The Junior Market Index popped 21.67 points to 3,672.89 and the JSE USD Market Index fell 3.15 points to end trading at 224.87. The market’s PE ratio, the most popular measure used to value stocks, ended at 19.8 on 2023-24 earnings and 13.5 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to value stocks, ended at 19.8 on 2023-24 earnings and 13.5 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and more detailed daily charts provide investors with regularly updated information to help decision-making. The net asset value of each company is incorporated into the chart. Investors can use this measure in assessing stock values. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is incorporated into the chart. Investors can use this measure in assessing stock values. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.