Kingston Properties (KPREIT) plans to repurchase up to one half of one percent or 4.42 million shares in issue for up to two years to commence in the later part of May this year.

According to the release, “the Board of Directors sees this use of capital as an opportunity to enhance shareholder value through the purchase, from time to time, of undervalued shares”.

According to the release, “the Board of Directors sees this use of capital as an opportunity to enhance shareholder value through the purchase, from time to time, of undervalued shares”.

The repurchase of the shares will be done using the Company’s cash flows and will be conducted on the open market through the Company’s stockbrokers. A fixed price for the repurchase will not be set but will be the market price at the time of the repurchase. In keeping with the requirements of the Companies Act of Jamaica, within 30 days of the dates of the repurchase of shares, Kingston Properties will advise its shareholders of the details of the shares purchased.

The company has 884 million issued shares that were last traded at $8.10 on the Main Market of the Jamaica Stock Exchange with a PE of 10 times last year’s earnings and a book value of $8.40.

A total of 7.5 million shares were traded over the past twelve months for a daily average of 30,000 units.

The company has also declared a dividend of 0.0566 US cents per share, payable on June 5 to shareholders on record at May 17 with the ex-dividend date of May 16, 2024.

The company reported a profit of US$4.65 million in 2023 an increase over 2022 with US$3.8 million from operating revenues of US$4 million in 2023 and US$3.5 million in 2022. Profit was boosted by gains from revaluation and gain on sale of properties of US$3 million in 2023 and US$2.4 million in 2022.

Remittance inflows to Jamaica fall

Remittance inflows to Jamaica continue to decline at the start of 2024 following several months of decline last year, with inflows for January 2024 amounting to US$246 million, down a relatively small 1.1 percent compared with US$248.6 in January 2023.

The decline represents the eighth consecutive month of negative inflows since June last year for the country.

The decline represents the eighth consecutive month of negative inflows since June last year for the country.

Jamaica’s decline of 1.1 percent was in contrast to the growth of 3.8 percent in January last year. Total inflows last year declined by two percent to US$3.37 billion from US$3.44 billion in 2022. Inflows peaked at US$3.497 billion in 2021.

BOJ engineers cut in CDs interest rates

Interest rates on Bank of Jamaica dropped to an average of 10.6 percent at the latest CD auction on Wednesday, April 24, following an offer of $34.5 billion to the public in a competitive price auction. The previous auction of $39 5 billion attracted only $37.8 billion in bids, resulting in an average rate of 11.032 percent.

Interest rates on Bank of Jamaica dropped to an average of 10.6 percent at the latest CD auction on Wednesday, April 24, following an offer of $34.5 billion to the public in a competitive price auction. The previous auction of $39 5 billion attracted only $37.8 billion in bids, resulting in an average rate of 11.032 percent.

In today’s auction bids amounting to just over $55 billion were received from 399 applications but only 257 were satisfied, with rates ranging from 9 to 11 percent. The latest offer brings the total amount of 30 days CDS to $125.7 billion which is down sharply from $155 billion on April 5, this year with the averaget rate then of 11.59 percent.

On April 22 the bank offered $14 billion in a 25 month CD that attracted $29 billion in bids and resulted in an average rate of 8.93 percent and put the total amounts in two year CDs to nearly $60 billion.

Grace up stakes in Spur Tree Spices

The GraceKennedy a wholly owned subsidiary – GK Investments Limited, purchased 60,000,000 units of shares in Spur Tree Spices thereby increasing its ownership to 20.18 percent. this was the objective Grace had before the company went public.

The GraceKennedy a wholly owned subsidiary – GK Investments Limited, purchased 60,000,000 units of shares in Spur Tree Spices thereby increasing its ownership to 20.18 percent. this was the objective Grace had before the company went public.

On Wednesday Spur Tree reported that two directors sold 30 million units each, which seems to have met the demand from Grace, but it may not be the last of the big trades for the company whose products have strong appeal internationally.

The company has been struggling to grow its profit since listing on the Junior Market in 2022. Profit of $116 million fell to $88 million in 2023, with earnings per share of 5 cents last year and 7 cents in 2022.

Spur Three stock traded at $2.42, up 2 cents on the junior Market of the Jamaica Stock Exchange on Thursday.

Jamaica’s NIR at record US$5.14 billion

Jamaica’s Net Internal Reserves surged to a record US$5.14 billion at the end of March buoyed by a hefty US$438 million inflows in March, moving the reserves from US$4.7 billion at the end of February this year. The surge follows a US$770 million build in the reserves in 2023 that saw the total rising to $4.76 billion at the end of 2023.

Jamaica’s Net Internal Reserves surged to a record US$5.14 billion at the end of March buoyed by a hefty US$438 million inflows in March, moving the reserves from US$4.7 billion at the end of February this year. The surge follows a US$770 million build in the reserves in 2023 that saw the total rising to $4.76 billion at the end of 2023.

An examination of the financial statement of Jamaica’ central bank the inflows came from funds received mainly by the government of Jamaica.

ICInsider.com gather that the government was in the process of selling forward 20 years rental income for the two main international airports as such the inflows could well be related to this. The Minister of Finance in his budget presentation alluded to this.

Tourism traffic slows in March

Tourism traffic into Jamaica slowed in March compared with the earlier months of 2024, data for tourist arrivals and departures for Sangster and Norman Manley International airports show.

The data while not the exact outcome of stopover tourist arrivals to the country, provides a good indication of tourist traffic flows into the country.

The data while not the exact outcome of stopover tourist arrivals to the country, provides a good indication of tourist traffic flows into the country.

Traffic through the Montego Bay Airport for March 2024, was up 6.4 percent, with 522,900 passengers passing through up from 491,300 handled in March 2023 data from Grupo Aeroportuario del Pacifico operators of both airports show.

For the first quarter of 2024, Sangster International Montego Bay Airport processed 1,457,300 passengers, a solid 7.9 percent more than the 1,351,000 passengers in the first quarter of 2023.

But Norman Manley Airport suffered a 4.6 percent decline in passenger traffic in March 2024, to 129,700 passengers from 136,000 passengers in March 2023.

For the first three months of 2024, Kingston Airport saw total passengers handled, decrease by 0.6 percent, to 392,000 in 2024 falling from 394,300 in the 2023 first quarter.

The data was taken from Tourism Analytics.com.

BOJ pumps life into J$ with high interest rates

Jamaica’s Central Bank is pumping a great deal of life into the Jamaican dollar, lifting the value from just under J$158 to one United States dollar in February this year, to under $155 currently and driving rates on CDS up by almost 26 percent from a year ago, as the bank moves aggressively to bend year over year inflation within the mandated 4-6 percent, from 6.20 percent to February.

Liquidity in the financial has been drained with BOJ pulling out all available liquidity. At the most recent auction of Certificate of Deposits, the bank offered $42.5 billion to the public and attracted bids amounting to $43.16 billion, resulting in an average yield for successful bids of 11.12 percent, with the rate of 13.29 percent being partial satisfied.

Liquidity in the financial has been drained with BOJ pulling out all available liquidity. At the most recent auction of Certificate of Deposits, the bank offered $42.5 billion to the public and attracted bids amounting to $43.16 billion, resulting in an average yield for successful bids of 11.12 percent, with the rate of 13.29 percent being partial satisfied.

The total outstanding 30-day CDs now amount to $157.5 billion, in contrast, a year ago the total outstanding 30-day CDs was $81.85 billion with the average yield at that auction being 8.85 percent.

Revaluation of the Jamaican dollar is critically important in curbing inflation as it cuts the cost of imported items and, most importantly, the cost of fuel that feeds into a wide array of goods and services. These include petrol for vehicles, electricity for households and businesses and powering the water supply. Of course, it affects other imported items such as foods clothing to name just two.

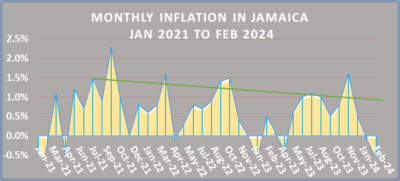

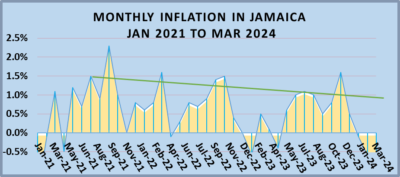

Negative inflation in February

Point-to-point inflation in Jamaica has bent back close to the Bank of Jamaica’s target of 4-6 percent based on the February 2024 data released by the Statistical Institute of Jamaica, with a reading of 6.2 percent following monthly inflation plunging by 0.6 percent for the month and follows a fall of 0.10 percent in January.

Point-to-point inflation in Jamaica has bent back close to the Bank of Jamaica’s target of 4-6 percent based on the February 2024 data released by the Statistical Institute of Jamaica, with a reading of 6.2 percent following monthly inflation plunging by 0.6 percent for the month and follows a fall of 0.10 percent in January.

The decline was influenced by the decreases in the index for the divisions ‘Food and Non Alcoholic Beverages’ (1.1 percent) and ‘Housing, Water, Electricity, Gas and Other Fuels’ (1.6 percent).

The position of Chief Executive Officer is a new one, in addition, the position of Head of Energy which was held by Miss Michelle Chin Lenn will be dispensed with and she will be appointed to the new position of Deputy Chief Executive Officer.

The position of Chief Executive Officer is a new one, in addition, the position of Head of Energy which was held by Miss Michelle Chin Lenn will be dispensed with and she will be appointed to the new position of Deputy Chief Executive Officer. With most businesses having granted healthy wage increases in 2022 and 2023, this publication does not expect there to be much wage pressure on inflation this year. With the inflation rate for the first three months of the year now at negative1.3 percent, which could climb even more in April, the increases in the summer months that usually flow from farm produces is likely to wipe out the gains in the early months but that should set the stage for the point to point to continue to trend to the lower end of BOJ’s mandate of 4 to 6 percent.

With most businesses having granted healthy wage increases in 2022 and 2023, this publication does not expect there to be much wage pressure on inflation this year. With the inflation rate for the first three months of the year now at negative1.3 percent, which could climb even more in April, the increases in the summer months that usually flow from farm produces is likely to wipe out the gains in the early months but that should set the stage for the point to point to continue to trend to the lower end of BOJ’s mandate of 4 to 6 percent. The bank went on to state “the analysis of the inflation numbers shows that the downward movement in the Consumer Price Index, for March 2024 was largely influenced by a 1.8 per cent decline in the index for the heaviest weighted division, Food and Non-Alcoholic Beverages. While the Bank had anticipated a decline for this division, the contraction was larger than expected and reflected reductions in the prices of some agricultural produce, such as tomato, yam, sweet potato, cabbage and carrot.”

The bank went on to state “the analysis of the inflation numbers shows that the downward movement in the Consumer Price Index, for March 2024 was largely influenced by a 1.8 per cent decline in the index for the heaviest weighted division, Food and Non-Alcoholic Beverages. While the Bank had anticipated a decline for this division, the contraction was larger than expected and reflected reductions in the prices of some agricultural produce, such as tomato, yam, sweet potato, cabbage and carrot.”