Acquisitions ruled the market this past week with former ICTOP 10 stock Caribbean Producers and current TOP10 listed tTech major shareholding shifting to new owners, with the promise of more shares to be bought by the major shareholders in both cases. These developments had little impact on the overall market during the week but they sent a powerful message to investors, if they care to listen.

In Junior Market ICTOP10, Consolidated Barkeries rose 14 percent to close at $3.85, Caribbean Cream gained 13 percent to $3.75 and tTech rose 5 percent to $2.50 following a switch in ownership of the company. Access Financial fell 9 percent to $19.95 followed by One Great Studio, down 7 percent to 77 cents.

In Junior Market ICTOP10, Consolidated Barkeries rose 14 percent to close at $3.85, Caribbean Cream gained 13 percent to $3.75 and tTech rose 5 percent to $2.50 following a switch in ownership of the company. Access Financial fell 9 percent to $19.95 followed by One Great Studio, down 7 percent to 77 cents.

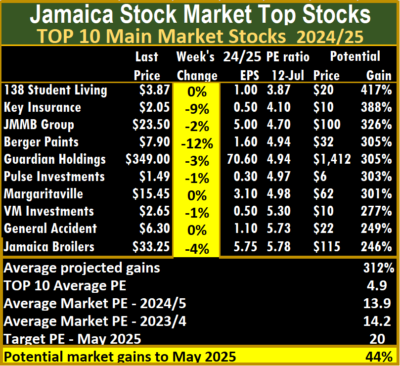

Main Market TOP10 listed Berger Paints fell 12 percent in closing at $7.90 and Key Insurance declined 9 percent to close at $2.05. There were no stocks with gains for the week of note.

Jamaica Broilers returns to the Main Market TOP10, replacing Palace Amusement with a moderate rise to $1.19. The Junior Market had no changes.

The average PE for the JSE Main Market ICTOP 10 stands at 4.9, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.9, just over half of the market, with an average of 12.8.

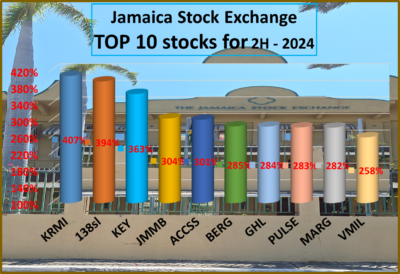

The Main Market ICTOP10 is projected to gain an average of 312 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 312 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 102, with an average of 29 and 19 excluding the highest PE ratios, and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 14 stocks, or 30 percent of the market, with PEs ranging from 15 to 50, averaging 14, well above the market’s average. The average PE for the top half of the market is 17, possibly the lowest fair value measure for stocks currently.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

No Beryl ruffle for ICTOP10

Beryl ruffled no ICTOP10 feathers

Hurricane Beryl while not flattening the Jamaica stock market sucked much life out during the week, with volumes and values falling sharply as the markets held up well following the end of month activity in the prior week, with the Main Market being flat and sight slippage for the Junior Market.

The Junior Market ICTOP10 closed with two stocks rising and two declining with notable losses. The Main Market has three stocks with notable gains and two losses of size.

The Junior Market ICTOP10 closed with two stocks rising and two declining with notable losses. The Main Market has three stocks with notable gains and two losses of size.

The Junior Market ICTOP10, Caribbean Assurance mark and closed the week up 16 percent to close at $3.85, tTech climbed 14 percent to $2.39. Caribbean Cream continues to suffer from a lack of good corporate governance by not providing investors with up-to-date information on its performance in the absence of full year and interim results, accordingly, the stocks keep on meandering between a low of $3 and $4 range, dropping 13 percent to $3.31 followed by One great Studio, down 7 percent to 83 cents.

Margaritaville the best performer in the Main Market TOP10 climbed 14 percent to $15.45, Berger Paints was up 5 percent in closing at $8.98 and Guardian Holdings popped 4 percent to close at $359.99. Declining stocks are General Accident dipping 9 percent to $6.30 and JMMB Group falling 4 percent to $24.

Iron Rock Insurance drops out of the TOP10 with trading in the stock suspended and is replaced by Dolla Financial that fell back in price during the week following the big month end run up last week.

Iron Rock Insurance drops out of the TOP10 with trading in the stock suspended and is replaced by Dolla Financial that fell back in price during the week following the big month end run up last week.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.7, just over half of the market, with an average of 12.9.

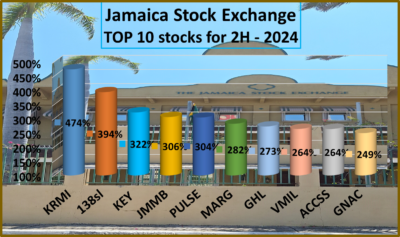

The Main Market ICTOP10 is projected to gain an average of 299 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 212 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 102, with an average of 29 and 19 excluding the highest PE ratios, and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 16 stocks, or 34 percent of the market, with PEs ranging from 15 to 51, averaging 20, well above the market’s average. The average PE for the top half of the market is 18, possibly the lowest fair value measure for stocks currently.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

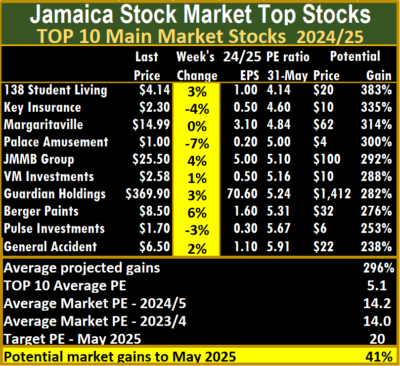

ICTOP10 has a brand new listing

Having fallen badly in the previous week, the Junior Market rallied a solid 5.2 percent the past week to end up above 3,800 points on Thursday and Friday and the Main Market rose 1.2 percent to close out the week, with the Junior Market ICTOP 10 blazing a trail with some lofty gains and the Main Market posting just two stocks with notable gains and a few losses of size, with one new stock entering the TOP10.

Other than the b moves in the TOP10, the market got some good news this past week. For one Jamaica Broilers reported positive full year results that were helped by a $2.3 billion one off gain, excluding those gains normal profits would have been in the order of $4.80 when taxes relating to the capital gains are excluded. The other positive news is that the Bank of Jamaica will officially start to ease the tight monetary policy pursued over the past three years. In reality, they commenced easing in early May, with CD rates falling from 11.59 percent in early April to mostly under 10 percent during June.

Other than the b moves in the TOP10, the market got some good news this past week. For one Jamaica Broilers reported positive full year results that were helped by a $2.3 billion one off gain, excluding those gains normal profits would have been in the order of $4.80 when taxes relating to the capital gains are excluded. The other positive news is that the Bank of Jamaica will officially start to ease the tight monetary policy pursued over the past three years. In reality, they commenced easing in early May, with CD rates falling from 11.59 percent in early April to mostly under 10 percent during June.

The other news of worth is that GDP growth for the March quarter was 1.4 percent, but that reflects a slowdown from last year and an even slower December quarter that was 1.7 percent. The latest GPD data and other available information suggest the evidence of a slow down. These include reduced first quarter results of several companies and a decline in tourist arrivals in the second quarter, suggesting that the second quarter is likely to grow at an even slower pace than the first. The positive take from any economic slowdown is that the tight monetary policy that the country is in will be eased further.

JSE Main Market had three winners and four losers. The Junior Market ended with six winners and three losers.

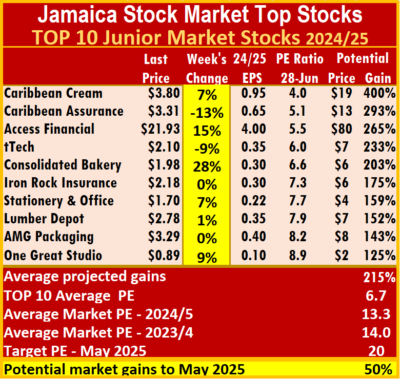

The Junior Market ICTOP10 saw Dolla Financial surging 30 percent to $3 followed by Consolidated Bakeries’ big recovery from last week’s big 28 percent fall and ended with a gain of 28 percent to $1.98, Access Financial gained 15 percent to end at $21.93, Caribbean Cream popped 7 percent to $3.80 and Stationery and Office Supplies rose 7 percent to close at $1.70. Declining stocks include Caribbean Assurance Brokers down 13 percent to close at $3.31 and tTech falling 9 percent to $2.10.

JMMB Group was the star performer in the Main Market TOP10, climbing 13 percent to $25.10 and Berger Paints was up 6 percent in closing at $8.52. Declining stocks are 138 Student Living and Pulse Investments dipping 6 percent to $3.86 and $1.50 respectively and Guardian Holdings dropped 4 percent to close at $345.

JMMB Group was the star performer in the Main Market TOP10, climbing 13 percent to $25.10 and Berger Paints was up 6 percent in closing at $8.52. Declining stocks are 138 Student Living and Pulse Investments dipping 6 percent to $3.86 and $1.50 respectively and Guardian Holdings dropped 4 percent to close at $345.

Dolla Financial with a 30 percent surge, dropped out of the ICTOP10 for the week and is replaced by One Great Studio.

One Great Studio was listed in September 2023 at $1 per share, the price has since slipped to a low of 80 cents per share following first quarter profit that fell 55 percent to $10 million from $23 million in 2023, following a fall in revenues from $115 million to $91 million.

The principal activities of the Group are to provide search engine optimisation, web design and development and software development services, with clients based in Jamaica, the wider Caribbean and other countries. The company is looking to add other services by way of a possible acquisition in the future to benefit from synergies.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.7, just over half of the market, with an average of 13.3.

The Main Market ICTOP10 is projected to gain an average of 303 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 215 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 102, with an average of 30 and 19 excluding the highest PE ratios, and a PE of 24 for the top half and 16 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 14 stocks, or 30 percent of the market, with PEs ranging from 15 to 53, averaging 21, well above the market’s average. The average PE for the top half of the market is 18, possibly the lowest fair value measure for stocks currently.

In the Junior Market IC TOP10 are 14 stocks, or 30 percent of the market, with PEs ranging from 15 to 53, averaging 21, well above the market’s average. The average PE for the top half of the market is 18, possibly the lowest fair value measure for stocks currently.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Big ICTOP10 price movements

The past week saw the return to trading of shares in iCreate and Edufocal, with the former enjoying a bounce in price from 43 cents to close at 60 cents, with the latter falling from 85 cents to 65 cents following the release of the 2023 audited accounts that were highly negative for the stock, with the company posting a big annual loss.

In a week when the Junior Market fell 1.72 percent and the Main Market was down 0.97 percent the ICTOP10 stocks ended with declining stocks outnumbering those rising. JSE Main Market had two winners and three losers of note and just two winners and four losers of note in the Junior Market.

In a week when the Junior Market fell 1.72 percent and the Main Market was down 0.97 percent the ICTOP10 stocks ended with declining stocks outnumbering those rising. JSE Main Market had two winners and three losers of note and just two winners and four losers of note in the Junior Market.

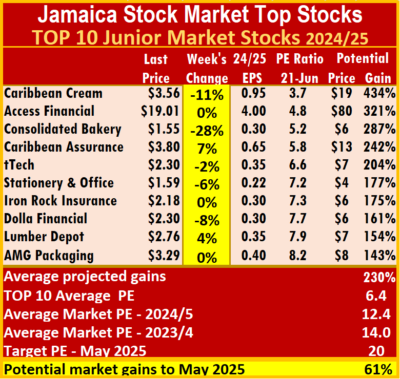

The Junior Market ICTOP10 Caribbean Assurance Brokers rose 7 percent to close at $3.80, followed by Lumber Depot with a rise of 4 percent to $2.76. Consolidated Bakeries suffered a big 28 percent fall to $1.55 but had no bids at the close of the market, Caribbean Cream dropped 11 percent to $3.56, Dolla Financial fell 8 percent to $2.30 and Stationery and Office Supplies lost 6 percent to close at $1.59.

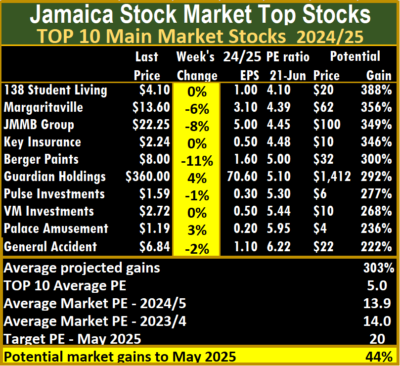

In the Main Market, Guardian Holdings was the only stock with note-worthy gains, with an increase of 4 percent to $360. Berger Paints lost 11 percent in closing at $8, JMMB Group fell 8 percent to $22.25 and Margaritaville dipped 6 percent to close at $13.60.

There are no new additions to the ICTOP10 for the week.

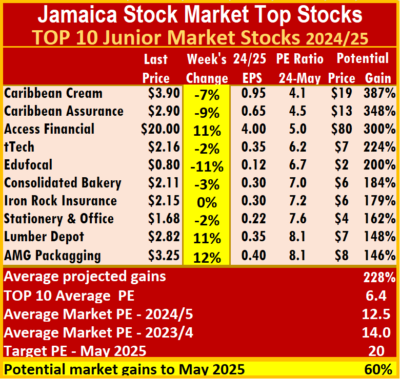

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.4, just over half of the market, with an average of 12.4.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.9 and the Junior Market TOP10 sits at 6.4, just over half of the market, with an average of 12.4.

The Main Market ICTOP10 is projected to gain an average of 303 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 230 percent over the same period.

In the Main Market ICTOP 10, a total of 16 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 103, with an average of 29 and 19 excluding the highest PE ratios, and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 12 stocks, or 26 percent of the market, with PEs ranging from 15 to 45, averaging 20, well above the market’s average. The average PE for the top half of the market is 17, possibly the lowest fair value measure for stocks currently.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Nice price movements in ICTOP10

The listing of Omni Industries on the Junior Market on Tuesday, was the highlight of the Jamaica Stock Exchange during the past week, following a successful offer of share to the public. The market closed with gains in the Main and Junior Market indices, leading to just four stocks rising in the ICTOP10 Main Market and only two in the Junior Market, with gains ranging from three to 12 percent and five with losses in the Junior Market TOP10 and six in the Main Market.

Omni Industries that was never in the TOP10 closed at $1.12, after the price hit a record high of $1.42 on Wednesday, sits in the last quartile of the overall Junior Market, with a fairly healthy PE of 14.

Omni Industries that was never in the TOP10 closed at $1.12, after the price hit a record high of $1.42 on Wednesday, sits in the last quartile of the overall Junior Market, with a fairly healthy PE of 14.

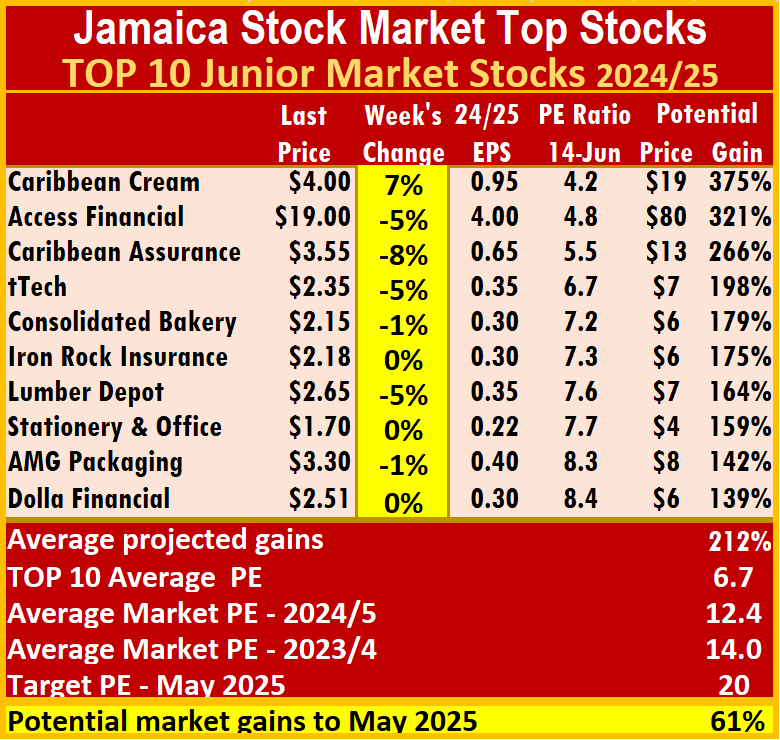

Lasco Financial, last week’s new listing to the Junior Market ICTOP10 climbed 12 percent to $1.70 and dropped out of the listing. Caribbean Cream rallied 7 percent to $4. Caribbean Assurance Brokers fell 8% to close at $3.55, followed by Access Financial, Lumber Depot and tTech falling by 5 percent each to close at $19, $2.65 and $2.35 respectively.

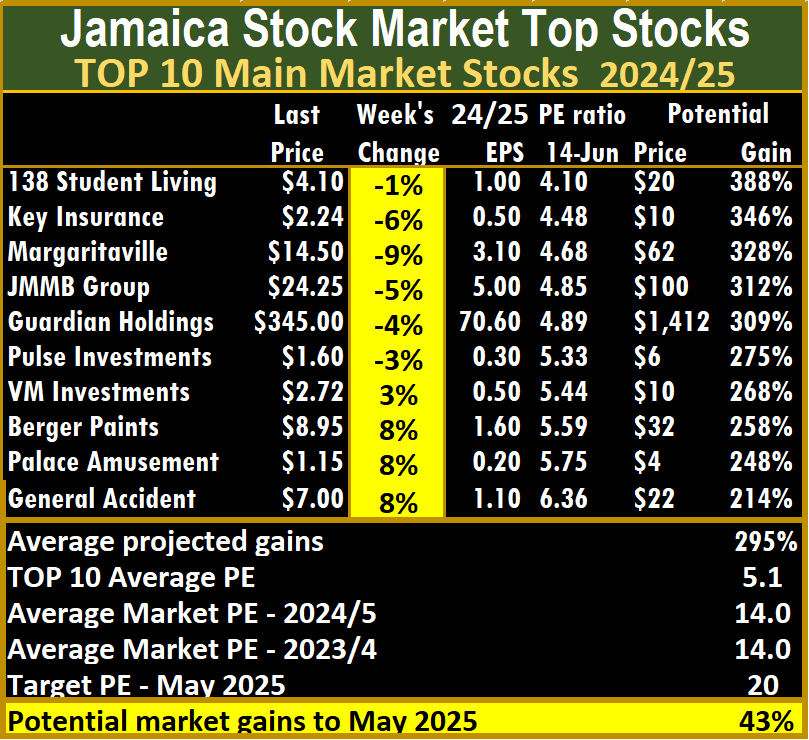

In the Main Market, Berger Paints, General Accident and Palace Amusement rose 8 percent to close at $8.95, $7 and $1.15 respectively. Margaritaville fell 8 percent to close at $14.50, Key Insurance fell 6 percent to $2.24 and JMMB Group dipped 5 percent to $24.25.

The Junior Market listed AMG Packaging is the the only new addition to the ICTOP10 for the week, coming in at $3.30.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 14 and the Junior Market TOP10 sits at 6.7, just over half of the market, with an average of 12.4.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 14 and the Junior Market TOP10 sits at 6.7, just over half of the market, with an average of 12.4.

The Main Market ICTOP10 is projected to gain an average of 295 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 212 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 103, with an average of 30 and 19 excluding the highest PE ratios, and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 12 stocks, or 26 percent of the market, with PEs ranging from 15 to 45, averaging 20, well above the market’s average. The average PE for the top half of the market is 17, possibly the lowest fair value measure for stocks currently.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so.  ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

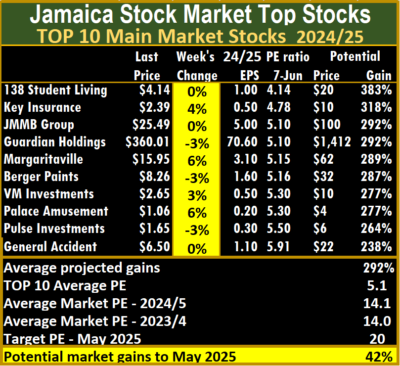

Price volatility low in ICTOP10

Volatility was low in ICTOP10 in the past week with the highest price change coming in at 6 percent, following moderate declines in the Junior Market and the Main Market

The Junior Market ICTOP10, Iron Rock Insurance climbed just 4 percent to $2.18. Caribbean Cream fell 6 percent to $3.75 followed by Access Financial, down 5 percent to $20.

In the Main Market, Margaritaville and Palace Amusement rose by 6 percent to close at $15.95 and $1.06 respectively and Key Insurance fell 4 percent to $2.39. Of note is that Berger Paints fell 3 percent to close at $8.26, trading at a 52 weeks’ high of $10.10 on Friday as the stock closed with a big gap between buyers and sellers.

In the Main Market, Margaritaville and Palace Amusement rose by 6 percent to close at $15.95 and $1.06 respectively and Key Insurance fell 4 percent to $2.39. Of note is that Berger Paints fell 3 percent to close at $8.26, trading at a 52 weeks’ high of $10.10 on Friday as the stock closed with a big gap between buyers and sellers.

Lasco Financial was the only new addition to the ICTOP10 for the week replacing Edufocal that was suspended from trading during the week for not meeting the financial statement filing.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 14.1 and the Junior Market TOP10 sits at 6.8, just over half of the market, with an average of 12.6.

The Main Market ICTOP10 is projected to gain an average of 292 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 209 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 292 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 209 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 103, with an average of 30 and 19 excluding the highest PE ratios, and a PE of 24 for the top half and 16 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 11 stocks, or 24 percent of the market, with PEs ranging from 15 to 47, averaging 21, well above the market’s average. The average PE in the top half of the market is 17 and is possibly the lowest fair value measure for stocks, currently.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Profit continues higher at Scotia Group

Scotia Group had another financially successful quarter ending April this year, with profit climbing a solid 31 percent to $5.4 billion and earnings per share (EPS) of $1.74, up from $4.1 billion in 2023, with EPS of $1.32. For the six months to April, profit rose 14 percent to $8.54 billion with earnings per share (EPS) of $2.74, from a profit of $7.49 billion in 2023 and EPS of $2.41.

Scotia Group head quarters in Kingston.

Total comprehensive income climbed to $6.65 billion in the quarter from $4.79 billion in 2023. For the half year, it fell to $2.76 billion from $3.6 billion in 2023 as other comprehensive income suffered a loss of $5.78 billion in the 2024 period and $3.86 billion in 2023 as a result of an $11 billion increase in defined benefit obligations in 2024 and $9.3 billion in 2023.

Total revenues rose 20 percent for the quarter, to $16.9 billion from $14.1 billion and climbed a solid 18 percent for the year to date, to $33.3 billion from $28.3 billion in 2023. Interest income rose 18 percent in the April quarter to $11.7 billion from $9.9 billion in 2023 and 20.4 percent for the six months to $23.3 billion from $19.4 billion.

The critical and the single most important area of the group’s operation of lending helped to deliver a 17.6 percent increase in a net interest income of $11.24 billion in the second quarter of this year, from $9.56 billion in the prior year and, it rose 18.4 percent to $22.35 billion in the six months from $18.87 billion in the 2023 half year.

According to the group directors, “Our loan portfolio increased by $35.5 billion or 14.4 percent compared to April 2023, with loans net of allowances for credit losses increasing to $282.3 billion. Our core loan book continues to perform well with mortgages increasing year over year by 24 percent, consumer loans by 13 percent, credit cards by 15 percent and commercial loans by 8 percent.” Loans grew 2.2 percent in the January quarter over October, with the pace picking up to 2.25 percent in the April quarter over January, this year, for an annualized growth rate of 10 percent.

Deposits by the public increased by 6 percent or $27 billion to $464 billion. Investment securities increased marginally to $156.5 billion from $151.6 billion last year.

Net income from foreign currency trading, fees, commission and other income went up 22 percent from $3.6 billion to $4.4 billion in the April quarter and rose 14 percent from $7.7 billion in the half year in 2023 to $8.4 billion in the current year.

Insurance activities delivered profits of $530 million for the latest quarter, up from $493 million in the previous year. For the half year, it moved to $1.05 billion, from $1.03 billion in the comparative period in 2023. Foreign currency trading gains amount to $2.23 billion in the latest quarter compared with $1.94 billion in 2023 and for the year to date, $4.56 billion in the six months to April versus $4 billion in 2023.

Insurance activities delivered profits of $530 million for the latest quarter, up from $493 million in the previous year. For the half year, it moved to $1.05 billion, from $1.03 billion in the comparative period in 2023. Foreign currency trading gains amount to $2.23 billion in the latest quarter compared with $1.94 billion in 2023 and for the year to date, $4.56 billion in the six months to April versus $4 billion in 2023.

Credit impairment losses jumped sharply to $1 billion in the April quarter from $665 million last year to $2 billion in the half year, compared with $1.75 billion in 2023.

Segment results show Retail Banking with revenues of $11.06 billion compared with $10.1 billion in 2023 and delivered segment profit of $1.6 billion versus $2.1 billion in 2023. Corporate and Commercial banking had a 13 percent growth in third party revenues to $7.9 billion and net segment results of $7.2 billion compared with revenues of $6.9 billion in 2023 as net results surged sharply over the $5.2 billion in 2023. Treasury generated revenues of $7.7 billion up from $5.8 billion with a net position of $1.13 billion in 2024 compared with $1.03 billion in the prior year.

Investment Management Services generated revenues of $1.5 billion and a net result of $780 million in 2024, with revenues of $1.56 billion in 2023 and a net outturn of $806 million in 2023. Insurance services had a mild increase in revenues to $2.08 billion in 2024 as net results slipped to $2.05 billion, compared with revenues of $2.45 billion in 2023 and net segment results of $2.15 billion.

Salaries and staff benefits rose 12.8 percent to $2.96 billion from $2.63 billion in 2023 and for the half year, it rose by 13 percent from $5.23 billion to $5.9 billion.

Scotia Group traded at a $58 on Friday.

Other operating expenses fell marginally from $3.28 billion to $3.23 billion in the quarter and increased slightly in the nine months to $6.7 billion from $6.55 billion in the previous year. Overall, total operating expenses moved from $6.57 billion in the second quarter last year to $6.78 billion. For the six months to April, it moved by 7 percent to $15.46 billion from $14.4 billion in 2023.

Taxation on profit amounted to $2.38 billion in the April quarter up from $1.89 billion in 2023 and it rose 15 percent to $4.47 billion in the half year from $3.89 billion in 2023.

Shareholders’ equity ended the period at $127 billion, up from $108 billion at the end of March 2023.

IC Insider.com computation projects earnings of $6.50 to $7 per share for the fiscal year ending October 2024, with a PE of 6.5 times the current year’s earnings based on the price of $44.41 the stock traded on the Jamaica Stock Exchange. Net asset value ended the period at $4.78 with the stock selling at xxx book value.

The company declared a dividend of 40 cents which in line with payment in April versus 35 cents in July 2023.

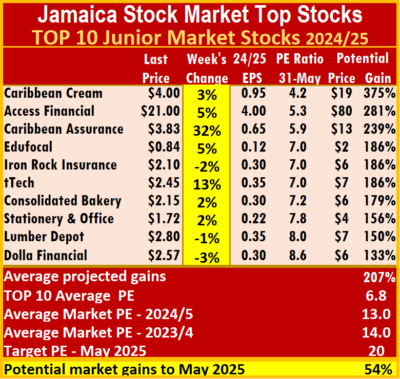

Carib Assurance jumps 32% in ICTOP10

Caribbean Assurance Brokers is this week’s star performer, jumping 32 percent to $3.83, following the announcement of a 428 percent hike in dividend to 14.11 cents from just 2.67 cents last year, with the company reporting earnings of 47 cents per share for 2023, including a $17 million charge for doubtful debt, amounting to 6.5 cents per share which was reversed in the first quarter to March this year, but that did not prevent the first quarter results from falling compared with 2023.

Other stocks with notable price movements are tTech with a 13 percent rise to $2.45 followed by AMG Packaging, which climbed 6 percent to $3.25, while Access Financial and Edufocal rose 5 percent to $21 and 84 cents respectively.

Other stocks with notable price movements are tTech with a 13 percent rise to $2.45 followed by AMG Packaging, which climbed 6 percent to $3.25, while Access Financial and Edufocal rose 5 percent to $21 and 84 cents respectively.

In the Main Market, Berger Paints popped 6 percent to close at $8.50, JMMB Group rose 4 percent to $25.50, Palace Amusement fell 7 percent to close at $1 and Key Insurance slipped 4 percent to $230.

Dropping from the ICTOP10 is AMG Packaging which Dolla Financial replaces in the Junior Market. There are no changes to the Main Market list.

The Junior Market ICTOP10, , followed by Access Financial, with an 11 percent rise to $20. Edufocal dropped 11 percent to 80 cents, while Caribbean Assurance Brokers is down 9 percent to close at $2.90 and Caribbean Cream fell 7 percent to $3.90.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 14.2 and the Junior Market TOP10 sits at 6.8, just over half of the market, with an average of 13.

The Main Market ICTOP10 is projected to gain an average of 296 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 296 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

In the Main Market ICTOP 10, a total of 16 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 96, with an average of 30 and 20 excluding the highest PE ratios, and a PE of 23 for the top half and 17 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 12 stocks, or 26 percent of the market, with PEs ranging from 15 to 53, averaging 21, well above the market’s average. The average PE in the top half of the market is 18, possibly the lowest fair value measure for stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so.  ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

428% dividend hike jolts stock price

Caribbean Assurance Brokers announced a 428 percent jump in dividends to 14.11 cents from just 2.67 cents paid last year. This year’s dividend is payable on September 16, with an ex-dividend date of August 15 and the announcement pushed the stock up 22 percent in a day and 73 percent for the year to date.

The dividend yields 4.8 percent based on Thursday’s closing price of $3.15 and four percent based on Friday’s closing of $3.83, almost twice the junior Market average of 2 percent.

The dividend yields 4.8 percent based on Thursday’s closing price of $3.15 and four percent based on Friday’s closing of $3.83, almost twice the junior Market average of 2 percent.

The increase follows a jump in profits for 2023 to $123 million or 47 cents per share after a charge of $17 million or 6.5 cents per share for doubtful debt which was reversed in the first quarter to March this year with a profit of just $3 million after the credit impairment loss was revered and compares with a profit of $17 million in 2023. Net profit for 2022 was $78 million or 30 cents per share.

Also announcing dividend payment is Salada Foods with an interim dividend of 6.4 cents per stock unit, payable on July 4, 2024, with an ex-dividend date is June 14.

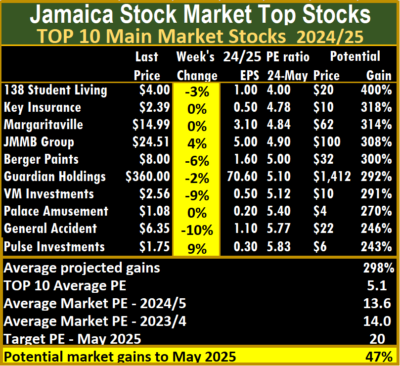

Three additions to ICTOP10

In a week of volatility in the Junior Market and a calmer Main Market, the Junior Market TOP10 has one new addition and the Main Market two after five Junior Market stocks posted notable moves and three in the Main Market.

Dropping from the ICTOP10 are Dolla Financial from the Junior Market and Lasco Manufacturing and Jamaica Broilers from the Main Market.

Dropping from the ICTOP10 are Dolla Financial from the Junior Market and Lasco Manufacturing and Jamaica Broilers from the Main Market.

The Junior Market ICTOP10, AMG Packaging, climbed 12 percent to $3.25, followed by Access Financial, with an 11 percent rise to $20. Edufocal dropped 11 percent to 80 cents, while Caribbean Assurance Brokers is down 9 percent to close at $2.90 and Caribbean Cream fell 7 percent to $3.90.

In the Main Market, Pulse Investments popped 9 percent to close at $1.75, JMMB Group rose 4 percent to $24.51 while Berger Paints fell 6 percent to close at $8.

Lumber Depot is the only new listing for the Junior Market ICTOP10 for the week, this follows the announcement by the company of the purchase of a 35 percent interest in Atlantic Hardware. Earnings per share for the current fiscal year starting June, is projected at 35 cents by ICInsider.com. General Accident and VM Investments are new additions to the Main Market ICTOP10. VMI posted b first quarter results with gains from securities providing the bulk of the profits. Some of these gains are from the one off sale of its associate company.  With the investing environment slowly improving, the company appears set to enjoy a profitable year, accordingly, ICInsider.com’s estimate is for earnings of 50 cents per share, which could be bettered if investments deliver more returns in the next three quarters.

With the investing environment slowly improving, the company appears set to enjoy a profitable year, accordingly, ICInsider.com’s estimate is for earnings of 50 cents per share, which could be bettered if investments deliver more returns in the next three quarters.

The average PE for the JSE Main Market ICTOP 10 stands at 5.1, well below the market average of 13.6 and the Junior Market TOP10 sits at 6.4, just over half of the market, with an average of 12.5.

The Main Market ICTOP10 is projected to gain an average of 298 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 228 percent over the same period.

In the Main Market ICTOP 10, a total of 16 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 86, with an average of 29 and 19 excluding the highest PE ratios, and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 11 stocks, or 24 percent of the market, with PEs ranging from 15 to 43, averaging 21, well above the market’s average. The average PE in the top half of the market is 17 and is possibly the lowest fair value measure for stocks, currently.

The average PE in the top half of the market is 17 and is possibly the lowest fair value measure for stocks, currently.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

- 1

- 2

- 3

- …

- 66

- Next Page »