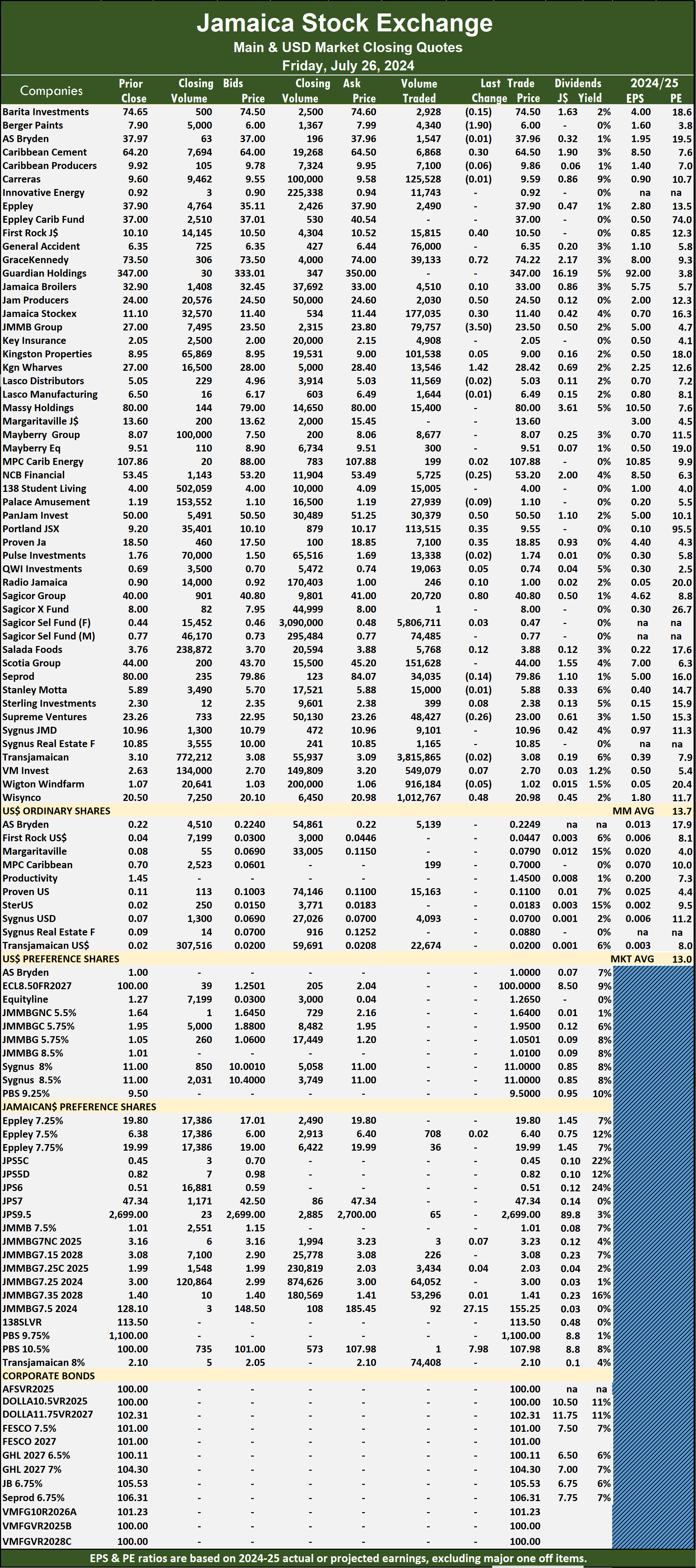

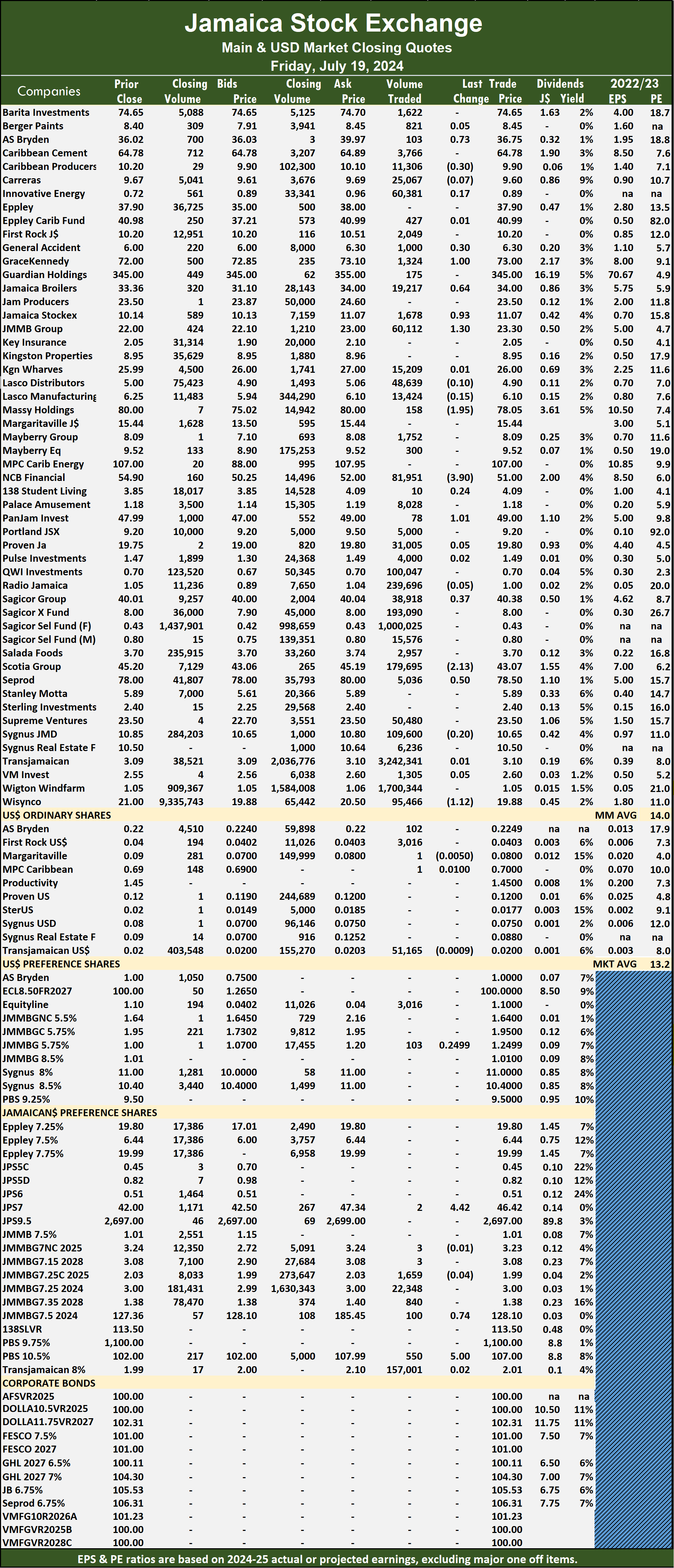

The Main Market of the Jamaica Stock Exchange rose on Friday, for the 4th time this week and ended with rising stocks outpacing those declining by almost 2 to 1 after the volume and value of stocks traded were marginally different than market activity on Thursday and ended with trading in 60 securities compared with 55 on Thursday, with prices of 26 stocks rising, 15 declining and 19 ending unchanged.

The market closed with 13,604,571 shares being traded for $65,580,443 compared with 12,877,172 units at $69,293,990 on Thursday.

The market closed with 13,604,571 shares being traded for $65,580,443 compared with 12,877,172 units at $69,293,990 on Thursday.

Trading averaged 226,743 shares at $1,093,007 compared to 234,130 units at $1,259,891 on Thursday and month to date, an average of 659,733 stocks at $6,104,693 compared with 685,922 units at $6,407,819 on the previous day and June with an average of 246,425 shares at $1,945,941.

Sagicor Select Financial Fund led trading with 5.81 million shares for 42.7 percent of total volume followed by Transjamaican Highway with 3.82 million units for 28 percent of the day’s trade and Wisynco Group with 1.01 million stocks for 7.4 percent of the day’s trade.

The All Jamaican Composite Index rose 1,682.41 points to 356,592.46, the JSE Main Index rallied 1,044.59 points to settle at 314,466.93 and the JSE Financial Index increased 0.42 points to end trading at 66.26.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and five with lower offers.

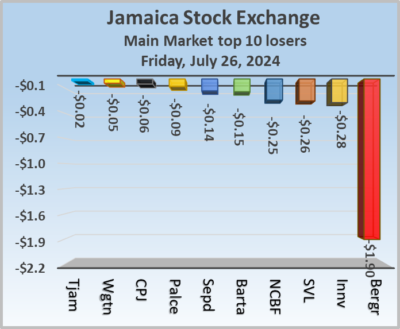

At the close of the market, Berger Paints shed $1.90 to end at $6 with investors trading 4,340 stock units, Caribbean Cement rose 30 cents in closing at $64.50 after an exchange of 6,868 shares, First Rock Real Estate climbed 40 cents to $10.50 after closing with an exchange of 15,815 stocks. GraceKennedy popped 72 cents to close at $74.22 in an exchange of 39,133 units, Jamaica Producers gained 50 cents and ended at $24.50, with 2,030 stocks crossing the market, Jamaica Stock Exchange advanced 30 cents to finish at $11.40 in an exchange of 177,035 units.  Kingston Wharves increased $1.42 and ended at $28.42 with traders dealing in 13,546 shares, Pan Jamaica rallied 50 cents to $50.50 after a transfer of 30,379 stock units, Portland JSX rose 35 cents to close at $9.55 in switching ownership of 113,515 shares. Proven Investments rallied 35 cents in closing at $18.85, with 7,100 stocks crossing the exchange, Sagicor Group popped 80 cents to finish at $40.80 with a transfer of 20,720 units and Wisynco Group advanced 48 cents to end at $20.98 with 1,012,767 stock units clearing the market.

Kingston Wharves increased $1.42 and ended at $28.42 with traders dealing in 13,546 shares, Pan Jamaica rallied 50 cents to $50.50 after a transfer of 30,379 stock units, Portland JSX rose 35 cents to close at $9.55 in switching ownership of 113,515 shares. Proven Investments rallied 35 cents in closing at $18.85, with 7,100 stocks crossing the exchange, Sagicor Group popped 80 cents to finish at $40.80 with a transfer of 20,720 units and Wisynco Group advanced 48 cents to end at $20.98 with 1,012,767 stock units clearing the market.

In the preference segment, 138 Student Living preference share climbed $27.15 in closing at $155.25 with an exchange of 92 shares and Sygnus Credit Investments C10.5% increased $7.98 to $107.98, with jsut 1 unit crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market rises for 4th day for week

Local stocks push Main Market higher

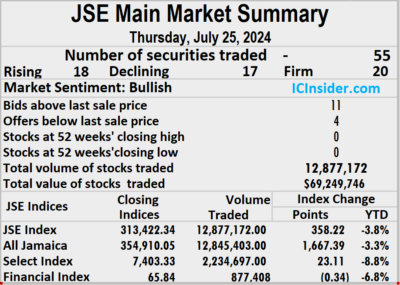

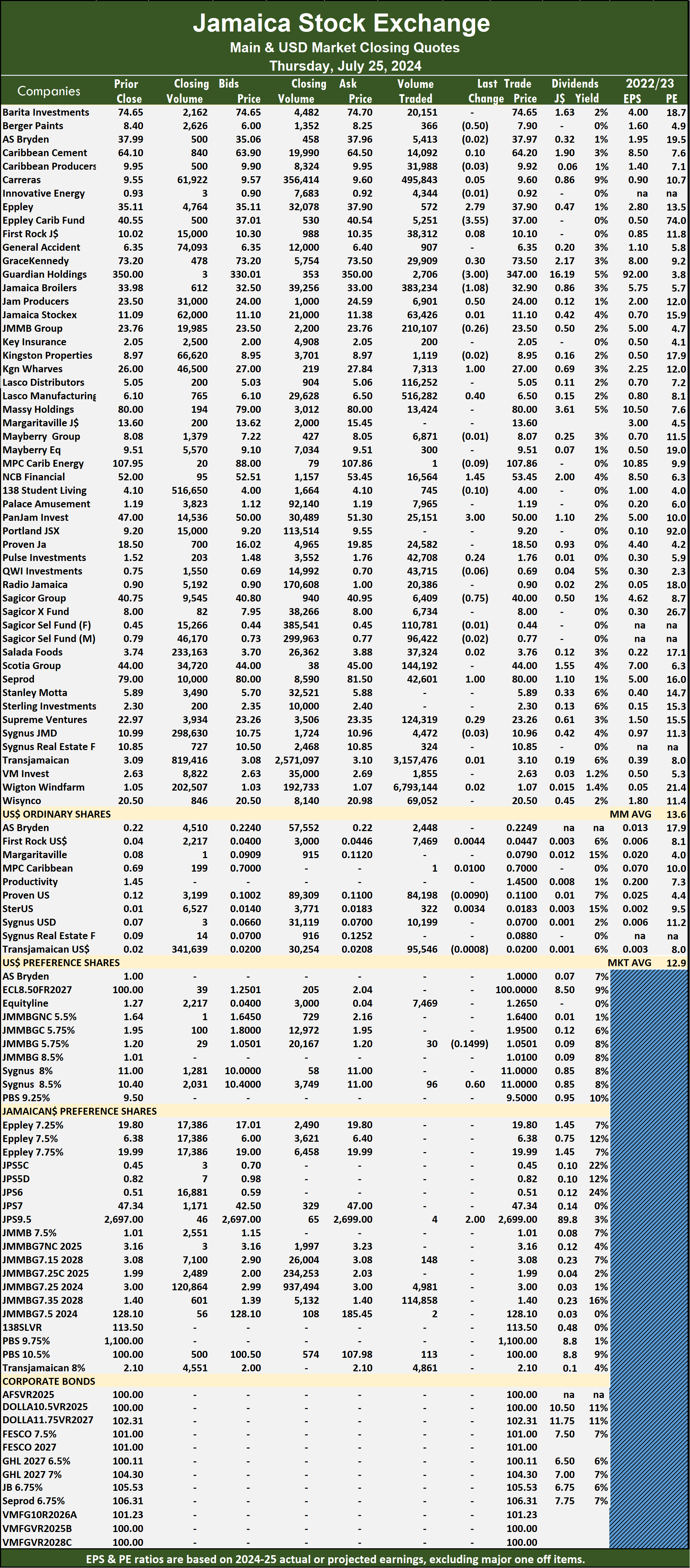

Locally based stocks had a b rally on Thursday at the close of the Jamaica Stock Exchange Main Market, with the volume of stocks traded rising 153 percent and the value 26 percent more than on the prior day, with trading in 55 securities up from 53 on Wednesday, with prices of 18 rising, 17 declining and 20 ending unchanged.

Some 12,877,172 shares were traded for $69,293,990 up from 5,083,717 units at $55,164,698 on Wednesday.

Some 12,877,172 shares were traded for $69,293,990 up from 5,083,717 units at $55,164,698 on Wednesday.

Trading averaged 234,130 shares at $1,259,891 well above the 95,919 units that traded at $1,040,843 on Wednesday, Trading for the month to date, an average of 685,922 units at $6,407,819 down from 712,442 units at $6,709,992 on the previous day, well ahead of the average of 246,425 units at $1,945,941 in June.

Wigton Windfarm led trading with 6.79 million shares for 52.8 percent of total volume followed by Transjamaican Highway with 3.16 million stocks for 24.5 percent of the day’s trade and Lasco Manufacturing with 516,282 units for 4 percent market share.

The All Jamaican Composite Index rallied 1,667.39 points to close at 354,910.05, the JSE Main Index rallied 358.22 points to close trading at 313,422.34 and the JSE Financial Index shed 0.34 points to wrap up trading at 65.84.

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and four with lower offers.

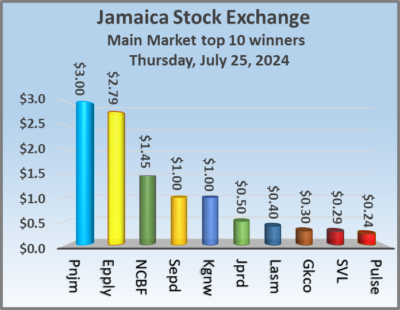

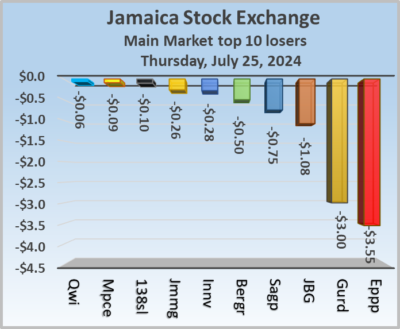

At the close of the market, Berger Paints dipped 50 cents to finish at $7.90 with traders dealing in 366 stock units, Eppley rallied $2.79 and ended at $37.90 in an exchange of 572 shares, Eppley Caribbean Property Fund fell $3.55 to $37 with investors swapping 5,251 stocks. GraceKennedy popped 30 cents in closing at $73.50 with a transfer of 29,909 units, Guardian Holdings slipped $3 to end at $347, with 2,706 stocks changing hands, Jamaica Broilers sank $1.08 to close at $32.90 in trading 383,234 units.  Jamaica Producers gained 50 cents to close at $24 after a transfer of 6,901 shares, Kingston Wharves rose $1 to finish at $27 after 7,313 stock units passed through the market, Lasco Manufacturing climbed 40 cents and ended at $6.50 after an exchange of 516,282 shares. NCB Financial increased $1.45 in closing at $53.45 with an exchange of 16,564 units, Pan Jamaica advanced $3 to close at $50 with investors trading 25,151 stocks, Sagicor Group dropped 75 cents to end at $40 with an exchange of 6,409 stock units and Seprod popped $1 in closing at $80 with 42,601 shares clearing the market.

Jamaica Producers gained 50 cents to close at $24 after a transfer of 6,901 shares, Kingston Wharves rose $1 to finish at $27 after 7,313 stock units passed through the market, Lasco Manufacturing climbed 40 cents and ended at $6.50 after an exchange of 516,282 shares. NCB Financial increased $1.45 in closing at $53.45 with an exchange of 16,564 units, Pan Jamaica advanced $3 to close at $50 with investors trading 25,151 stocks, Sagicor Group dropped 75 cents to end at $40 with an exchange of 6,409 stock units and Seprod popped $1 in closing at $80 with 42,601 shares clearing the market.

In the preference segment, Jamaica Public Service 9.5% rallied $2 to $2,699 after an exchange of 4 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on JSE Main Market

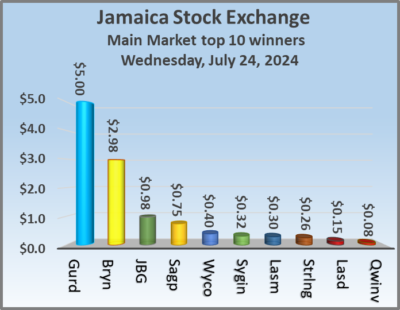

The Main Market of the Jamaica Stock Exchange lost ground on Wednesday, following a 57 percent plunge in the volume of stocks traded with the value slipping by 11 percent from the levels on Tuesday, with trading in 53 securities slightly down from 54 on Tuesday, with prices of 20 stocks rising, 18 declining and 15 ending unchanged.

Trading closed with an exchange of 5,083,717 shares for a total sum of $55,164,698 compared to 11,714,898 units at $61,785,252 on Tuesday.

Trading closed with an exchange of 5,083,717 shares for a total sum of $55,164,698 compared to 11,714,898 units at $61,785,252 on Tuesday.

Trading averaged 95,919 shares at $1,040,843 compared to 216,943 units at $1,144,171 on Tuesday and month to date, an average of 712,442 units at $6,709,992 compared with 749,405 units at $7,049,885 on the previous day and June with an average of 246,425 units at $1,945,941.

Wisynco Group led trading with 2.21 million shares for 43.5 percent of total volume followed by Transjamaican Highway with 1.08 million units for 21.2 percent of the day’s trade and Wigton Windfarm with 467,244 units for 9.2 percent market share.

The All Jamaican Composite Index lost 1,518.48 points to end at 353,242.66, the JSE Main Index dipped 863.93 points to end at 313,064.12 and the JSE Financial Index skidded 0.38 points to 66.18.

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and eight with lower offers.

At the close, AS Bryden gained $2.98 and ended at $37.99 as investors exchanged 120 stock units, Caribbean Cement dipped 70 cents to $64.10 after 6,692 units passed through the market, Eppley sank $2.79 to close at $35.11 in an exchange of 141 shares. Eppley Caribbean Property Fund lost 35 cents to finish at $40.55 after the trading of 1,683 stock units, GraceKennedy shed 40 cents to end at $73.20 with a transfer of 11,564 shares, Guardian Holdings popped $5 in closing at $350, with 86 stock units crossing the market. Jamaica Broilers rallied 98 cents to $33.98 after an exchange of 928 units, Kingston Wharves sank 99 cents to close at $26 with 3,633 stocks changing hands, Lasco Manufacturing gained 30 cents to end at $6.10 with an exchange of 15,387 units.  NCB Financial slipped 40 cents in closing at $52 after closing with an exchange of 6,993 stocks, Pan Jamaica fell $1.99 to $47, with 3,282 shares crossing the exchange, Proven Investments declined $1.19 and ended at $18.50 with investors trading 4,057 stock units. Sagicor Group climbed 75 cents to $40.75 after a transfer of 6,473 shares, Scotia Group skidded $1.24 to end at $44 with traders dealing in 23,673 units, Sygnus Credit Investments rose 32 cents and ended at $10.99 in an exchange of 226 stocks and Wisynco Group advanced 40 cents to close at $20.50 with investors trading 2,210,502 stock units.

NCB Financial slipped 40 cents in closing at $52 after closing with an exchange of 6,993 stocks, Pan Jamaica fell $1.99 to $47, with 3,282 shares crossing the exchange, Proven Investments declined $1.19 and ended at $18.50 with investors trading 4,057 stock units. Sagicor Group climbed 75 cents to $40.75 after a transfer of 6,473 shares, Scotia Group skidded $1.24 to end at $44 with traders dealing in 23,673 units, Sygnus Credit Investments rose 32 cents and ended at $10.99 in an exchange of 226 stocks and Wisynco Group advanced 40 cents to close at $20.50 with investors trading 2,210,502 stock units.

In the preference segment, Sygnus Credit Investments C10.5% popped $9.04 to end at $100 in switching ownership of 2,000 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

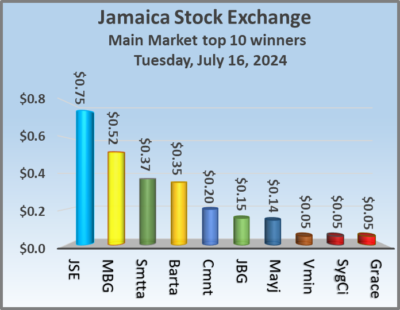

Gains for JSE Main Market

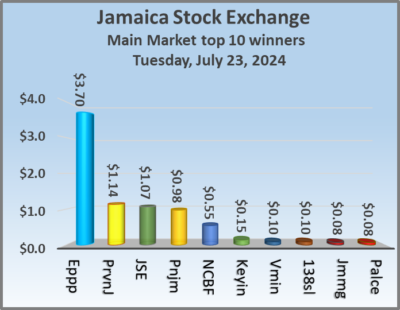

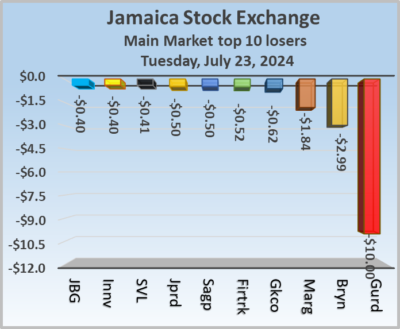

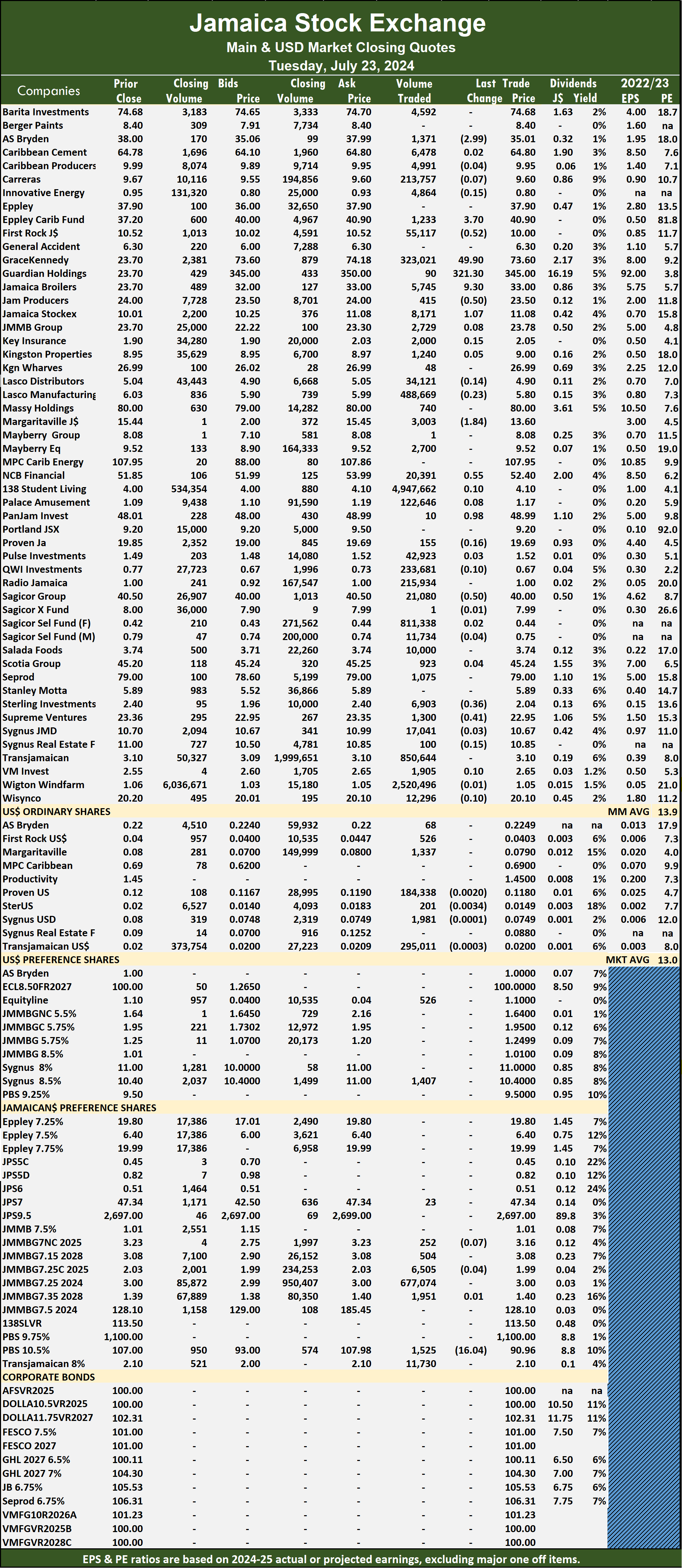

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 34 percent and the value jumping by 113 percent than on Monday, with activity in 54 securities down from 59 on Monday, with prices of 15 stocks rising, 26 declining and 13 ending unchanged.

The market closed with 11,714,898 shares being traded for $61,785,252 compared with 17,740,034 units at $29,050,071 on Monday.

The market closed with 11,714,898 shares being traded for $61,785,252 compared with 17,740,034 units at $29,050,071 on Monday.

Trading averaged 216,943 shares at $1,144,171 compared with 300,679 units at $492,374 on Monday and month to date, an average of 749,405 units at $7,049,885 compared with 784,047 units at $7,434,112 on the previous day and June that ended with an average of 246,425 units at $1,945,941.

138 Student Living led trading with 4.95 million shares for 42.2 percent of total volume followed by Wigton Windfarm with 2.52 million units for 21.5 percent of the day’s trade and Transjamaican Highway with 850,644 units for 7.3 percent market share.

The All Jamaican Composite Index rose 1,008.75 points to end trading at 354,761.14, the JSE Main Index increased 338.01 points to settle at 313,928.05 and the JSE Financial Index increased by just 0.28 points to 66.56.

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, AS Bryden fell $2.99 to close at $35.01 in an exchange of 1,371 units, Eppley Caribbean Property Fund rose $3.70 to $40.90 with traders dealing in 1,233 stocks, First Rock Real Estate dipped 52 cents and ended at $10 after a transfer of 55,117 shares. GraceKennedy lost 62 cents to finish at $73.60 as investors exchanged 323,021 stock units, Guardian Holdings declined $10 in closing at $345 with a transfer of 90 shares, Jamaica Broilers sank 40 cents to end at $33, with 5,745 stock units crossing the market. Jamaica Producers slipped 50 cents in closing at $23.50 with an exchange of 415 stocks, Jamaica Stock Exchange advanced $1.07 to $11.08, with 8,171 units changing hands,  Margaritaville sank $1.84 and ended at $13.60 with investors trading 3,003 stocks. NCB Financial popped 55 cents to finish at $52.40 after an exchange of 20,391 shares, Pan Jamaica climbed 98 cents to close at $48.99 with investors trading 10 stock units, Sagicor Group dropped 50 cents to end at $40 with 21,080 units crossing the exchange. Sterling Investments shed 36 cents to $2.04 with investors swapping 6,903 shares and Supreme Ventures skidded 41 cents to finish at $22.95 in an exchange of 1,300 stock units.

Margaritaville sank $1.84 and ended at $13.60 with investors trading 3,003 stocks. NCB Financial popped 55 cents to finish at $52.40 after an exchange of 20,391 shares, Pan Jamaica climbed 98 cents to close at $48.99 with investors trading 10 stock units, Sagicor Group dropped 50 cents to end at $40 with 21,080 units crossing the exchange. Sterling Investments shed 36 cents to $2.04 with investors swapping 6,903 shares and Supreme Ventures skidded 41 cents to finish at $22.95 in an exchange of 1,300 stock units.

In the preference segment, Sygnus Credit Investments C10.5% sank $16.04 and ended at $90.96 with investors dealing in 1,525 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

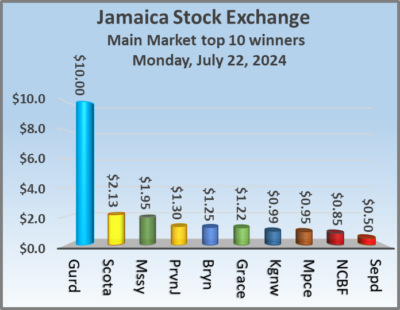

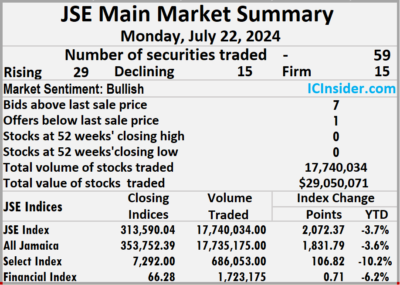

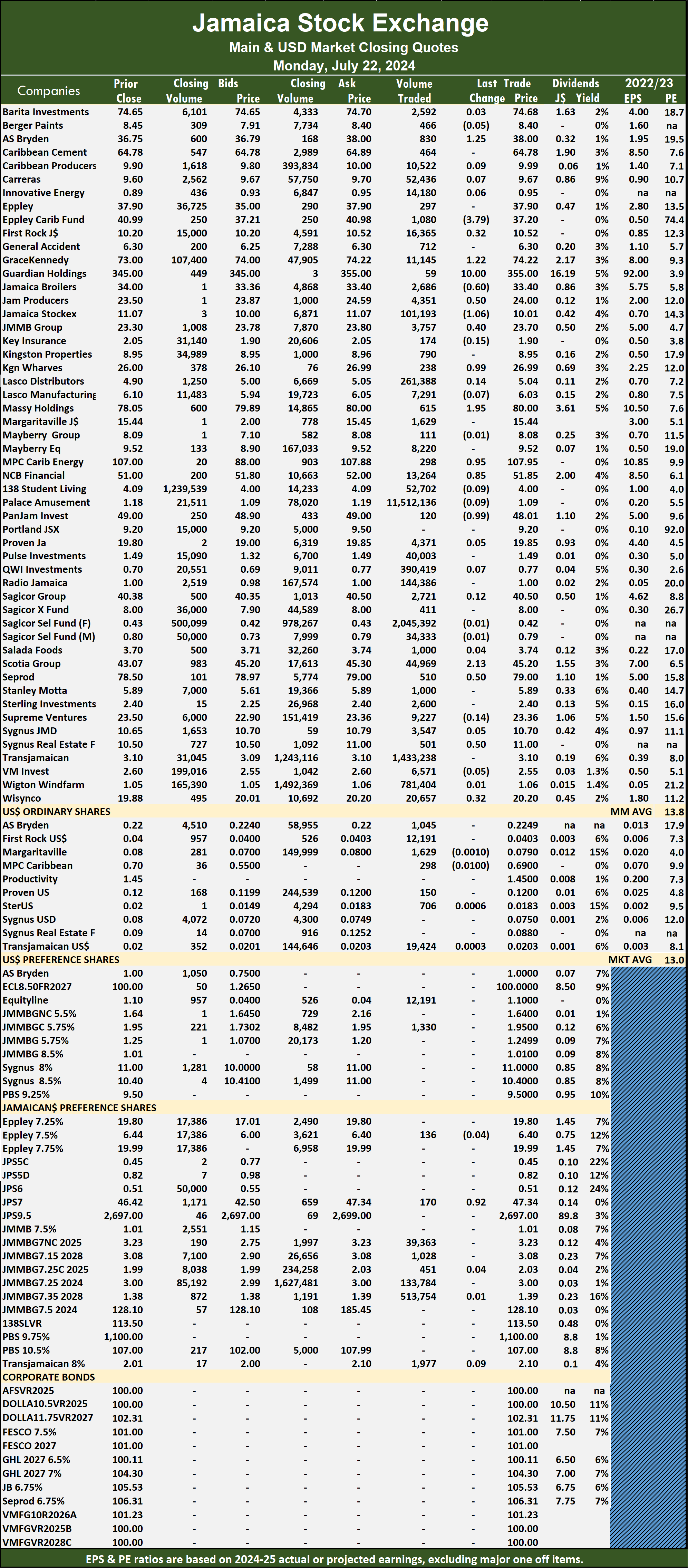

Stocks rose on limited Main Market trading

Trading on the Jamaica Stock Exchange Main Market ended on Monday, with the volume of stocks traded rising 135 percent and the value falling 22 percent lower than on Friday, with trading in 59 securities compared with 53 on Friday, with prices of 29 stocks rising, 15 declining and 15 ending unchanged.

The market closed on Monday with 17,740,034 shares being traded for $29,050,071 compared with 7,561,920 units at $37,357,214 on Friday.

The market closed on Monday with 17,740,034 shares being traded for $29,050,071 compared with 7,561,920 units at $37,357,214 on Friday.

Trading averaged 300,679 shares at $492,374 versus 142,678 shares at $704,853 on Friday and month to date, an average of 784,047 stocks at $7,434,112 down from 821,037 units at $7,965,321 on the previous day and June with an average of 246,425 stock units at $1,945,941.

Palace Amusement led trading with 11.51 million shares for 64.9 percent of total volume followed by Sagicor Select Financial Fund with 2.05 million units for 11.5 percent of the day’s trade and Transjamaican Highway with 1.43 million units for 8.1 percent of the day’s trade.

The All Jamaican Composite Index rose 1,831.79 points to end trading at 353,752.39, the JSE Main Index rallied 2,072.37 points to wrap up trading at 313,590.04 and the JSE Financial Index rose 0.71 points to 66.28.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden rose $1.25 in closing at $38 in an exchange of 830 shares, Eppley Caribbean Property Fund dropped $3.79 to $37.20 in the trading of 1,080 units, First Rock Real Estate gained 32 cents to end at $10.52 in an exchange of 16,365 stocks. GraceKennedy popped $1.22 in closing at $74.22, with 11,145 stock units crossing the market, Guardian Holdings advanced $10 and ended at $355 after an exchange of 59 shares, Jamaica Broilers sank 60 cents to finish at $33.40 with investors trading 2,686 stocks. Jamaica Producers climbed 50 cents to end at $24 after an exchange of 4,351 units, Jamaica Stock Exchange declined $1.06 to $10.01 with a transfer of 101,193 stock units, JMMB Group increased 40 cents in closing at $23.70 with investors dealing in 3,757 shares. Kingston Wharves rallied 99 cents to finish at $26.99 in switching ownership of 238 units, Massy Holdings increased $1.95 to close at $80 as investors exchanged 615 stocks,  MPC Caribbean Clean Energy climbed 95 cents to end at $107.95 in trading 298 stock units. NCB Financial popped 85 cents in closing at $51.85, with 13,264 shares crossing the exchange, Pan Jamaica shed 99 cents to $48.01 with investors swapping 120 units, Scotia Group gained $2.13 to finish at $45.20, with 44,969 stocks crossing the market. Seprod rose 50 cents and ended at $79 with an exchange of 510 stock units, Sygnus Real Estate Finance advanced 50 cents to close at $11 after 501 shares passed through the market and Wisynco Group rallied 32 cents to end at $20.20 after a transfer of 20,657 stocks.

MPC Caribbean Clean Energy climbed 95 cents to end at $107.95 in trading 298 stock units. NCB Financial popped 85 cents in closing at $51.85, with 13,264 shares crossing the exchange, Pan Jamaica shed 99 cents to $48.01 with investors swapping 120 units, Scotia Group gained $2.13 to finish at $45.20, with 44,969 stocks crossing the market. Seprod rose 50 cents and ended at $79 with an exchange of 510 stock units, Sygnus Real Estate Finance advanced 50 cents to close at $11 after 501 shares passed through the market and Wisynco Group rallied 32 cents to end at $20.20 after a transfer of 20,657 stocks.

In the preference segment, Jamaica Public Service 7% increased 92 cents to $47.34 with 170 units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

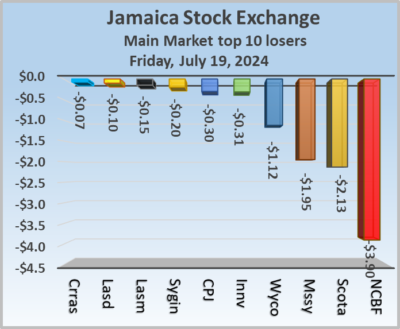

Trading dives on Main Market

Trading values plunged on the Jamaica Stock Exchange Main Market ended on Friday, with the volume of stocks traded moderately more with the value diving 86 percent lower than on Thursday, following trading in 53 securities compared with 57 on Thursday, with prices of 22 stocks rising, with only 12 declining and 19 ending firm.

Massy Holdings and NCB Financial sank to close at 52 weeks’ lows.

Massy Holdings and NCB Financial sank to close at 52 weeks’ lows.

The market closed with an exchange of 7,561,920 shares for $37,357,214 compared with 7,104,872 units at $275,255,774 on Thursday.

Trading averaged 142,678 shares at $704,853 compared to 124,647 stock units for $4,829,049 on Thursday and month to date, an average of 821,037 units at $7,965,321 down from 871,110 units at $8,501,261 on the prior day and June with an average of 246,425 units at $1,945,941.

Transjamaican Highway led trading with 3.24 million shares for 42.9 percent of total volume followed by Wigton Windfarm with 1.70 million units for 22.5 percent of the day’s trade and Sagicor Select Financial Fund with 1.0 million units for 13.2 percent of the day’s trade.

The All Jamaican Composite Index dropped 943.02 points to end the day at 351,920.60, the JSE Main Index shed 1,235.69 points to conclude trading at 311,517.67 and the JSE Financial Index slipped 0.08 points to cease trading at 65.57.

The Main Market ended trading with an average PE Ratio of 14. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 14. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden gained 73 cents in closing at $36.75 in switching ownership of 103 stocks, Caribbean Producers shed 30 cents to $9.90 with investors dealing in 11,306 units, General Accident rose 30 cents to close at $6.30 after an exchange of 1,000 shares. GraceKennedy rallied $1 and ended at $73, with 1,324 stock units changing hands, Jamaica Broilers increased 64 cents to finish at $34 in an exchange of 19,217 shares, Jamaica Stock Exchange climbed 93 cents to end at $11.07 with 1,678 stocks clearing the market. JMMB Group popped $1.30 to $23.30 as investors exchanged 60,112 units, Massy Holdings lost $1.95 to close at a 52 weeks’ low of $78.05 after 158 stock units passed through the market, NCB Financial sank $3.90 and ended at a 52 weeks’ low of $51 with investors trading 81,951 shares. Pan Jamaica advanced $1.01 in closing at $49 with an exchange of 78 units, Sagicor Group popped 37 cents to finish at $40.38 after trading in 38,918 stocks, Scotia Group dropped $2.13 to end at $43.07, with 179,695 stock units crossing the exchange. Seprod climbed 50 cents in closing at $78.50 after a transfer of 5,036 shares and Wisynco Group sank $1.12 to $19.88 with investors swapping 95,466 stocks.

NCB Financial sank $3.90 and ended at a 52 weeks’ low of $51 with investors trading 81,951 shares. Pan Jamaica advanced $1.01 in closing at $49 with an exchange of 78 units, Sagicor Group popped 37 cents to finish at $40.38 after trading in 38,918 stocks, Scotia Group dropped $2.13 to end at $43.07, with 179,695 stock units crossing the exchange. Seprod climbed 50 cents in closing at $78.50 after a transfer of 5,036 shares and Wisynco Group sank $1.12 to $19.88 with investors swapping 95,466 stocks.

In the preference segment, Jamaica Public Service 7% rose $4.42 to end at $46.42 with a transfer of 2 units. 138 Student Living preference share advanced 74 cents to finish at $128.10, with 100 stock units crossing the market and Sygnus Credit Investments C10.5% increased $5 and ended at $107 with traders dealing in 550 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

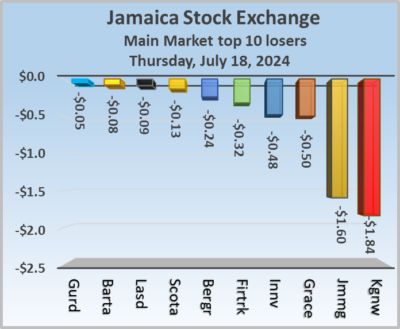

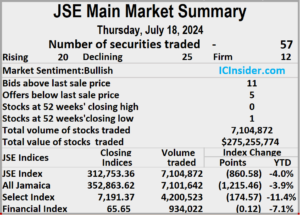

Grace dominated the JSE Main Market

GraceKennedy dominated trading on Thursday being the lead trade with 3.45 million shares valued at $249 million at the close of the Jamaica Stock Exchange Main Market that ended with the volume of stocks traded declining by 73 percent with the value surging 63 percent above trading on Wednesday, ending with activity in 57 securities up from 54 on Wednesday, ending with prices of 20 stocks rising, 25 declining and 12 ending unchanged.

Trading closed with an exchange of 7,104,872 shares for $275,255,774 compared with 26,580,065 units at $169,019,186 on Wednesday.

Trading closed with an exchange of 7,104,872 shares for $275,255,774 compared with 26,580,065 units at $169,019,186 on Wednesday.

Trading averaged 124,647 shares at $4,829,049 compared to 492,223 units at $3,129,985 on Wednesday and month to date, an average of 871,110 stock units at $8,501,261 compared with 935,480 stock units at $8,817,927 on the previous day and June with an average of 246,425 units at $1,945,941.

GraceKennedy the leading traded stock in the entire stock exchange accounted for 48.5 percent of total Main Market volume followed by Wigton Windfarm with 1.10 million shares for 15.5 percent of the day’s trade and Transjamaican Highway with 990,119 units for 13.9 percent market share.

The All Jamaican Composite Index dropped 1,215.46 points to end the day at 352,863.62, the JSE Main Index fell 860.58 points to close at 312,753.36 and the JSE Financial Index slipped 0.12 points to settle at 65.65.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.8. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, Eppley rallied $1.90 and ended at $37.90 in switching ownership of 100 stocks, Eppley Caribbean Property Fund popped $3.38 to $40.98 with investors trading 165 units, First Rock Real Estate declined 32 cents to finish at $10.20, with 7,881 stocks crossing the market. GraceKennedy sank 50 cents to close at $72, with 3,445,766 shares crossing the market, JMMB Group dropped $1.60 to finish at a 52 weeks’ closing low of $22 with investors swapping 90,678 stock units, Jamaica Broilers increased 36 cents to close at $33.36 in an exchange of 32,774 stocks.  Kingston Wharves fell $1.84 in closing at $25.99 after a mere 2,089 shares passed through the market, Mayberry Jamaican Equities climbed 64 cents to end at $9.52 as investors exchanged 4,698 units and Proven Investments rose 65 cents to $19.75, with 36,876 stocks crossing the market.

Kingston Wharves fell $1.84 in closing at $25.99 after a mere 2,089 shares passed through the market, Mayberry Jamaican Equities climbed 64 cents to end at $9.52 as investors exchanged 4,698 units and Proven Investments rose 65 cents to $19.75, with 36,876 stocks crossing the market.

In the preference segment, Eppley 7.25% preference share gained $2.79 and ended at $19.80 in an exchange of a mere 10 stock units, Jamaica Public Service 7% sank $5.34 in closing at $42 with investors trading 325 shares and 138 Student Living preference share lost $12.64 to end at $127.36 after an exchange of 100 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Surge in trading on JSE Main Market

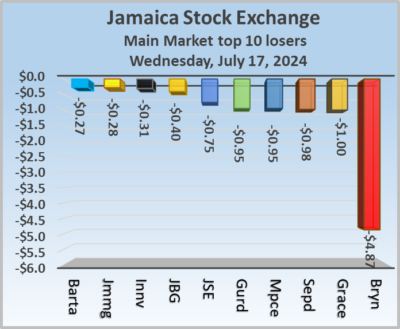

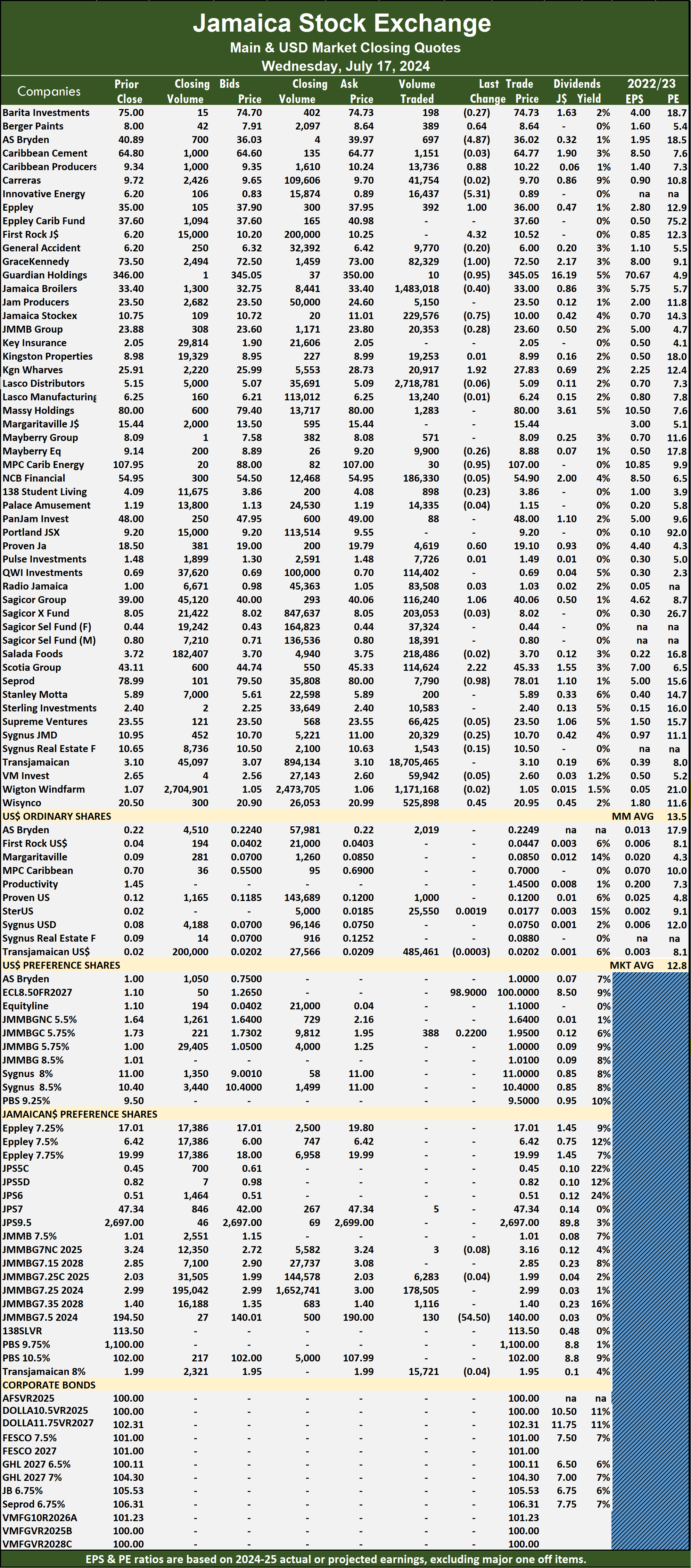

A surge in the volume of stock trading on the Jamaica Stock Exchange Main Market ended on Wednesday, with a 355 percent increase in the volume of stocks traded with a value of 554 percent more than on Tuesday, with trading in 54 securities compared with 55 on Tuesday, with prices of 12 rising, 29 declining and 13 ending unchanged.

The market closed with 26,580,065 shares being traded for $169,019,186 up from 5,847,947 units at $25,826,887 on Tuesday.

The market closed with 26,580,065 shares being traded for $169,019,186 up from 5,847,947 units at $25,826,887 on Tuesday.

Trading averaged 492,223 shares at $3,129,985 compared to 106,326 units at $469,580 on Tuesday and month to date, an average of 935,480 units at $8,817,927 compared with 974,913 units at $9,323,938 on the previous day and June with an average of 246,425 units at $1,945,941.

Transjamaican Highway led trading with 18.71 million shares for 70.4 percent of total volume followed by Lasco Distributors with 2.72 million units for 10.2 percent of the day’s trade, Jamaica Broilers ended with 1.48 million stocks for 5.6 percent market share and Wigton Windfarm with 1.17 million units for 4.4 percent of total volume.

The All Jamaican Composite Index rose 1,371.83 points to close at 354,079.08, the JSE Main Index increased 497.17 points to 313,613.94 and the JSE Financial Index popped 0.11 points to finish at 65.77.

The Main Market ended trading with an average PE Ratio of 14.5. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 14.5. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden skidded $4.87 to $36.02 with investors trading 697 stocks, Berger Paints climbed 64 cents to end at $8.64 after closing after an exchange of 389 units, Caribbean Producers rose 88 cents in closing at $10.22 after 13,736 shares passed through the market. Eppley rallied $1 and ended at $36, with investors trading 392 stock units, GraceKennedy fell $1 to finish at $72.50 with 82,329 shares clearing the market, Guardian Holdings slipped 95 cents to close at $345.05 with investors swapping 10 stocks. Jamaica Broilers lost 40 cents in ending at $33 in switching ownership of 1,483,018 units, Jamaica Stock Exchange declined 75 cents and ended at $10 after an exchange of 229,576 stock units, Kingston Wharves popped $1.92 to finish at $27.83 in trading 20,917 shares.  MPC Caribbean Clean Energy shed 95 cents to end at $107, with 30 stocks crossing the exchange, Proven Investments increased 60 cents in closing at $19.10 after a transfer of 4,619 units, Sagicor Group gained $1.06 to close at $40.06, with 116,240 stock units changing hands. Scotia Group advanced $2.22 to $45.33 in an exchange of 114,624 shares, Seprod dropped 98 cents to end at $78.01 with investors dealing in 7,790 units and Wisynco Group rose 45 cents in closing at $20.95 after an exchange of 525,898 stocks.

MPC Caribbean Clean Energy shed 95 cents to end at $107, with 30 stocks crossing the exchange, Proven Investments increased 60 cents in closing at $19.10 after a transfer of 4,619 units, Sagicor Group gained $1.06 to close at $40.06, with 116,240 stock units changing hands. Scotia Group advanced $2.22 to $45.33 in an exchange of 114,624 shares, Seprod dropped 98 cents to end at $78.01 with investors dealing in 7,790 units and Wisynco Group rose 45 cents in closing at $20.95 after an exchange of 525,898 stocks.

In the preference segment, 138 Student Living preference share sank $54.50 to finish at $140 with a transfer of 130 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

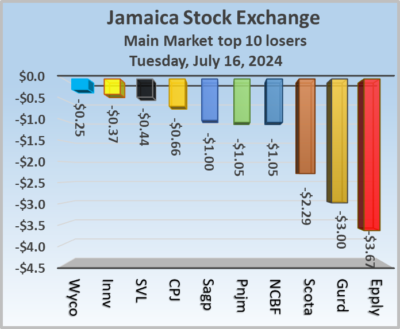

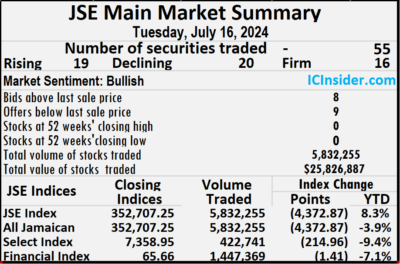

Stocks plunged on the JSE Main Market Tuesday

Stocks prices plunged at the close of trading on Jamaica Stock Exchange Main Market on Tuesday, following trading in 55 securities compared with 59 on Monday, with prices of 19 stocks rising, 20 declining and 16 ending unchanged at the close, with the volume of stocks traded rising by 86 percent with a 15 percent lower value than Monday.

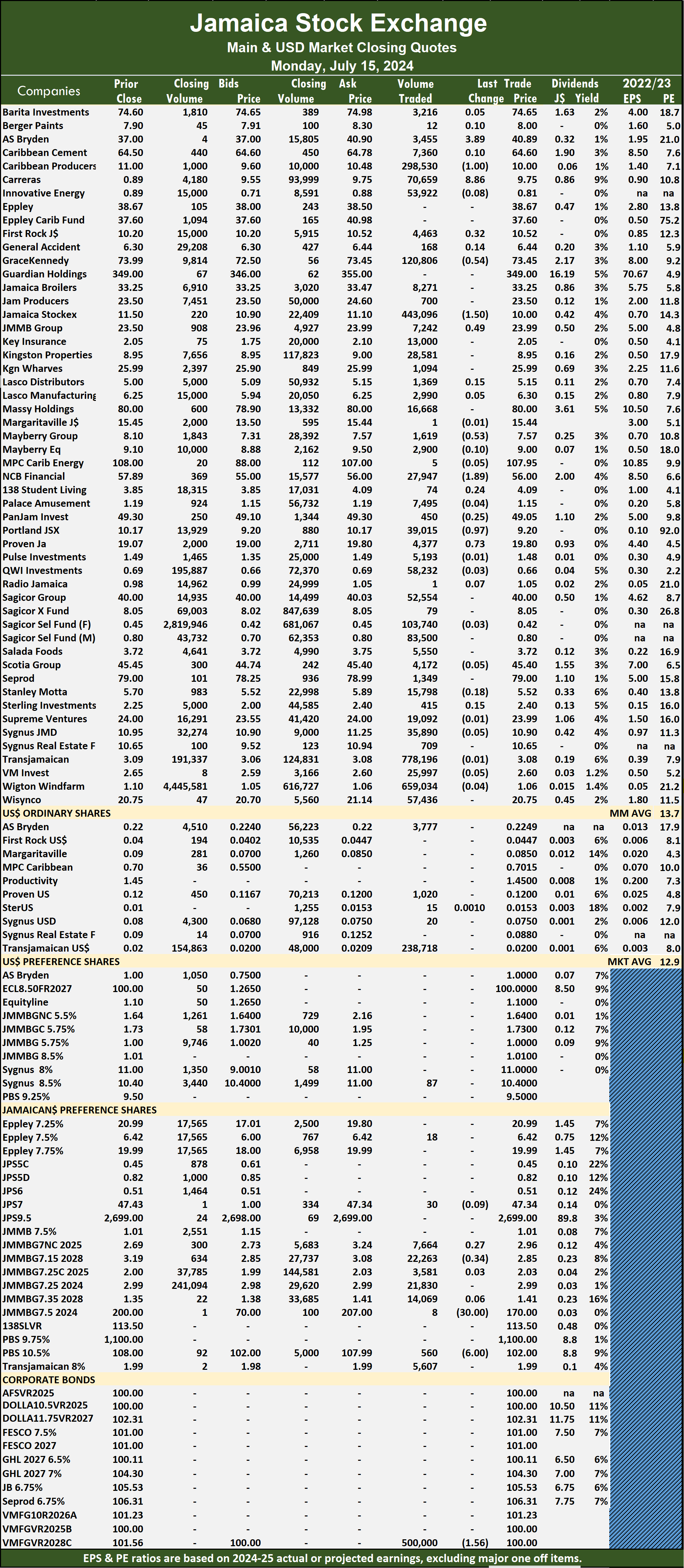

The market closed with 5,847,947 shares trading for a mere $25,826,887 compared with 3,152,052 units at $30,466,322 on Monday.

The market closed with 5,847,947 shares trading for a mere $25,826,887 compared with 3,152,052 units at $30,466,322 on Monday.

Trading averaged 106,326 shares at $469,580 compared to 53,425 units at $516,378 on Monday and month to date, an average of 974,913 units at $9,323,938 compared with 1,061,457 units at $10,206,166 on the previous day and June with an average of 246,425 units at $1,945,941.

Transjamaican Highway led trading with 1.93 million shares for 32.9 percent of total volume followed by Wigton Windfarm with 1.56 million stocks for 26.6 percent of the day’s trade and Sagicor Select Financial Fund with 1.06 million units for 18.1 percent of market share.

The All Jamaican Composite Index dived 4,372.87 points to close at 352,707.25, the JSE Main Index dropped 3,334.60 points to end at 313,116.77 and the JSE Financial Index fell 1.41 points to finish at 65.66.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and nine with lower offers.

At the close, Caribbean Producers lost 66 cents to finish at $9.34 after 20,238 stocks changed hands, Eppley dropped $3.67 and ended at $35, with 965 units crossing the exchange, Guardian Holdings sank $3 to $346 in switching ownership of 58 shares. Jamaica Stock Exchange increased 75 cents in closing at $10.75, with 6,345 stock units crossing the market, Mayberry Group popped 52 cents to close at $8.09 with investors swapping 28,774 shares, NCB Financial shed $1.05 to end at $54.95, with 34,412 units crossing the market. Pan Jamaica declined $1.05 in closing at $48 after an exchange of 57,445 stocks,  Proven Investments fell $1.30 to $18.50, with 10,189 stock units passed through the market, Sagicor Group skidded $1 to finish at $39 in an exchange of 68,737 shares. Scotia Group sank $2.29 and ended at $43.11 with 47,852 units clearing the market and Supreme Ventures slipped 44 cents to close at $23.55 as investors exchanged 18,496 stocks.

Proven Investments fell $1.30 to $18.50, with 10,189 stock units passed through the market, Sagicor Group skidded $1 to finish at $39 in an exchange of 68,737 shares. Scotia Group sank $2.29 and ended at $43.11 with 47,852 units clearing the market and Supreme Ventures slipped 44 cents to close at $23.55 as investors exchanged 18,496 stocks.

In the preference segment, Eppley 7.25% preference share dipped $3.98 to end at $17.01 after a transfer of 288 stock units. Jamaica Public Service 9.5% fell $2 in closing at $2,697 with investors dealing in 30 shares and 138 Student Living preference share gained $24.50 to close at $194.50 in an exchange of 131 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

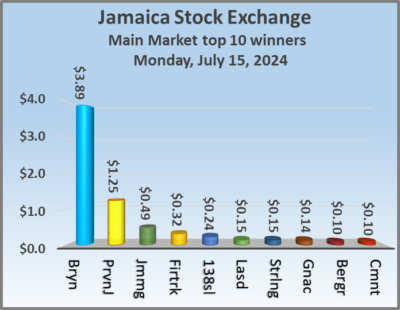

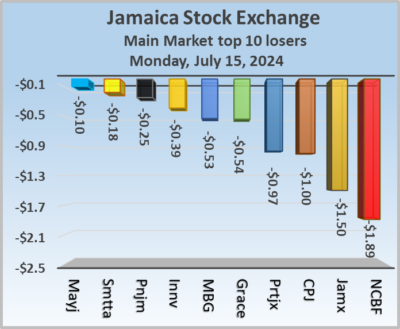

Plunging trades on JSE Main Market

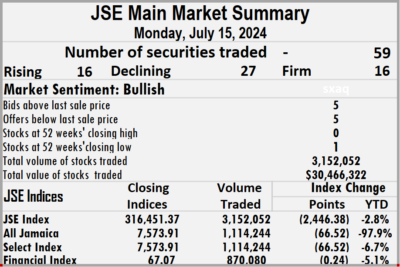

Trading plunged on the Jamaica Stock Exchange Main Market ended on Monday, with an 88 percent drop in the volume of stocks traded with a 48 percent lower value than on Friday, with trading in 59 securities compared with 57 on Friday, with prices of 16 rising, 27 declining and 16 ending unchanged. Innovative Energy closed at a 52 weeks’ low of 81 cents after hitting a low of 65 cents, before rebounding.

Trading ended with an exchange of 3,152,052 shares for $30,466,322 compared with 26,181,772 units at $59,057,741 on Friday.

Trading ended with an exchange of 3,152,052 shares for $30,466,322 compared with 26,181,772 units at $59,057,741 on Friday.

Trading averaged 53,425 shares at $516,378 compared to 459,329 units at $1,036,101 on Friday and month to date, an average of 1,061,457 units at $10,206,166 compared with 1,182,094 units at $11,365,796 on the previous day and June with an average of 246,425 units at $1,945,941.

Transjamaican Highway led trading with 778,196 shares for 24.7 percent of total volume followed by Wigton Windfarm with 659,034 stocks for 20.9 percent of the day’s trade and Jamaica Stock Exchange with 443,096 units for 14.1 percent market share.

The All Jamaican Composite Index skidded 610.00 points to end trading at 357,080.12, the JSE Main Index dropped 2,446.38 points to lock up trading at 316,451.37 and the JSE Financial Index slipped 0.24 points to 67.07.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, AS Bryden rose $3.89 to end at $40.89 with a transfer of 3,455 stock units, Caribbean Producers shed $1 to close at $10, with 298,530 shares crossing the exchange, as the impact of acquisition of the largest shareholding seems to have waned for awhile, GraceKennedy fell 54 cents and ended at $73.45, with 120,806 stocks changing hands.  Jamaica Stock Exchange dropped $1.50 in closing at $10 with an exchange of 443,096 units, JMMB Group advanced 49 cents to finish at $23.99 after 7,242 shares passed through the market, Mayberry Group sank 53 cents to close at $7.57 after an exchange of 1,619 units. NCB Financial dipped $1.89 to $56 with investors trading 27,947 stocks, Portland JSX lost 97 cents to finish at $9.20 in an exchange of 39,015 stock units and Proven Investments popped 73 cents and ended at $19.80 with investors swapping 4,377 shares.

Jamaica Stock Exchange dropped $1.50 in closing at $10 with an exchange of 443,096 units, JMMB Group advanced 49 cents to finish at $23.99 after 7,242 shares passed through the market, Mayberry Group sank 53 cents to close at $7.57 after an exchange of 1,619 units. NCB Financial dipped $1.89 to $56 with investors trading 27,947 stocks, Portland JSX lost 97 cents to finish at $9.20 in an exchange of 39,015 stock units and Proven Investments popped 73 cents and ended at $19.80 with investors swapping 4,377 shares.

In the preference segment, 138 Student Living preference share dropped $30 in closing at $170 in an exchange of 8 units and Sygnus Credit Investments C10.5% sank $6 to end at $102 with traders dealing in 560 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- 1

- 2

- 3

- …

- 337

- Next Page »