After a robust start to stopover arrivals in the early months of the year, data on passenger traffic passing through Jamaica’s two major international airports declined in May, with passenger traffic passing through the Sangster International Airport slipping from 402,000 in May last year to 401,500, down 0.3 percent.

The airport traffic although not telling the full picture of stopover arrivals, is a good barometer of likely outcomes showing that Sangster International Airport which accounts for around 85 percent of visitor arrivals is up just 3.9 percent to 2,294,800 for the year to date.

The airport traffic although not telling the full picture of stopover arrivals, is a good barometer of likely outcomes showing that Sangster International Airport which accounts for around 85 percent of visitor arrivals is up just 3.9 percent to 2,294,800 for the year to date.

This is the second month of decline for Montego Bay that had a 4.2 percent reduction to 435,500 in April from 454,500 for the same period last year, bringing the year to date increase then to 4.8 percent to 1.8928 million.

Traffic through Kingston’s Norman Manley continues the decline since the start of the year, with a fall of 1.1 percent to 139,900 compared to 141,500, with traffic for the first five months of this year, declining by 2.2 percent to 667,300 from 682,300.

The data is taken from a report on airport traffic during May published by Grupo Aeroportuario Del Pacifico operators of Jamaica’s two major airports.

Remittance inflows to Jamaica slip

After a modest increase in total remittance inflows into Jamaica in February, remittances for March slipped from the same period last by 1.3 percent to US$297.5 million but was higher than the US$295 million in March 2022, data released by the country’s central bank show.

Remittance inflows which are major source of foreign for the country and remains fairly stable, slipped moderately for the three months to March this year, with total inflows down a mere 0.4 percent to US$797 million compared with US$801 million to March 2023. The decline in March albeit small, is a continuation of several months of decline since May 2023.

Remittance inflows which are major source of foreign for the country and remains fairly stable, slipped moderately for the three months to March this year, with total inflows down a mere 0.4 percent to US$797 million compared with US$801 million to March 2023. The decline in March albeit small, is a continuation of several months of decline since May 2023.

The United States of America continues to be Jamaica’s largest source of remittance flows in March 2024, accounting for 69.8 percent of total flows, down from 71.7 percent in March 2023. Other countries which contributed a notable share of remittances for the month were the United Kingdom, with 10.6 percent followed by Canada at 8.7 percent and the Cayman Islands with 6.7 percent, the report from Bank of Jamaica states.

Jamaica’s NIR drops

Jamaica’s Net International Reserves declined by US$35 million in April moving from US$5.137 billion at the end of March this year to US$5.102 billion at the end of April 2024, data recently released by Bank of Jamaica show.

Jamaica’s Net International Reserves declined by US$35 million in April moving from US$5.137 billion at the end of March this year to US$5.102 billion at the end of April 2024, data recently released by Bank of Jamaica show.

The balance at the end of April which exceeds the balance of US$4.76 billion at the end of December last year represents 25.78 weeks of Goods & Services Imports and 37.51 weeks of imports of goods, the Bank of Jamaica report stated.

Remittance inflows to Jamaica recover

Total remittance inflows into Jamaica, a major source of foreign exchange earnings for the country, rose 1.3 percent to US$254 million for February 2024, up from $250 million in February 2023, reversing months of decline since May 2023, data released by the country’s central bank show.

The moderately improved inflows pushed the year to date performance above 2023 with a marginal increase to $499.6 million from $499 million.

The moderately improved inflows pushed the year to date performance above 2023 with a marginal increase to $499.6 million from $499 million.

For February, the United States of America accounted for the bulk of the inflows at 69.6 percent, down from 71.7 percent in January. The UK followed with 10.8 percent, Canada with 8.5 percent and Cayman Island with 6.8 percent.

Remittance inflows to Jamaica fall

Remittance inflows to Jamaica continue to decline at the start of 2024 following several months of decline last year, with inflows for January 2024 amounting to US$246 million, down a relatively small 1.1 percent compared with US$248.6 in January 2023.

The decline represents the eighth consecutive month of negative inflows since June last year for the country.

The decline represents the eighth consecutive month of negative inflows since June last year for the country.

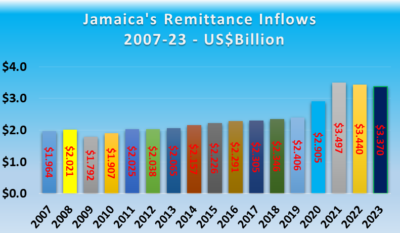

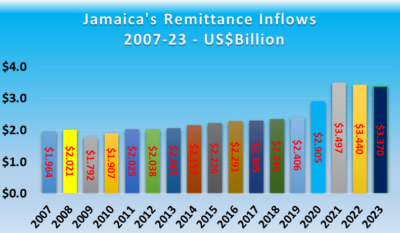

Jamaica’s decline of 1.1 percent was in contrast to the growth of 3.8 percent in January last year. Total inflows last year declined by two percent to US$3.37 billion from US$3.44 billion in 2022. Inflows peaked at US$3.497 billion in 2021.

Jamaica’s NIR at record US$5.14 billion

Jamaica’s Net Internal Reserves surged to a record US$5.14 billion at the end of March buoyed by a hefty US$438 million inflows in March, moving the reserves from US$4.7 billion at the end of February this year. The surge follows a US$770 million build in the reserves in 2023 that saw the total rising to $4.76 billion at the end of 2023.

Jamaica’s Net Internal Reserves surged to a record US$5.14 billion at the end of March buoyed by a hefty US$438 million inflows in March, moving the reserves from US$4.7 billion at the end of February this year. The surge follows a US$770 million build in the reserves in 2023 that saw the total rising to $4.76 billion at the end of 2023.

An examination of the financial statement of Jamaica’ central bank the inflows came from funds received mainly by the government of Jamaica.

ICInsider.com gather that the government was in the process of selling forward 20 years rental income for the two main international airports as such the inflows could well be related to this. The Minister of Finance in his budget presentation alluded to this.

BOJ pumps life into J$ with high interest rates

Jamaica’s Central Bank is pumping a great deal of life into the Jamaican dollar, lifting the value from just under J$158 to one United States dollar in February this year, to under $155 currently and driving rates on CDS up by almost 26 percent from a year ago, as the bank moves aggressively to bend year over year inflation within the mandated 4-6 percent, from 6.20 percent to February.

Liquidity in the financial has been drained with BOJ pulling out all available liquidity. At the most recent auction of Certificate of Deposits, the bank offered $42.5 billion to the public and attracted bids amounting to $43.16 billion, resulting in an average yield for successful bids of 11.12 percent, with the rate of 13.29 percent being partial satisfied.

Liquidity in the financial has been drained with BOJ pulling out all available liquidity. At the most recent auction of Certificate of Deposits, the bank offered $42.5 billion to the public and attracted bids amounting to $43.16 billion, resulting in an average yield for successful bids of 11.12 percent, with the rate of 13.29 percent being partial satisfied.

The total outstanding 30-day CDs now amount to $157.5 billion, in contrast, a year ago the total outstanding 30-day CDs was $81.85 billion with the average yield at that auction being 8.85 percent.

Revaluation of the Jamaican dollar is critically important in curbing inflation as it cuts the cost of imported items and, most importantly, the cost of fuel that feeds into a wide array of goods and services. These include petrol for vehicles, electricity for households and businesses and powering the water supply. Of course, it affects other imported items such as foods clothing to name just two.

Jamaica pulled US$3.37B in remittances in 2023

Remittance inflows to Jamaica, ended in 2023 at US$3.37 billion, down two percent compared to total inflows of US$3.44 billion in 2022, and representing the third consecutive year that remittances exceed $3 billion and the fourth since it has come close to $3 billion, in 2020 in hitting a then record high of US$2.9 billion, well above the previous high of US$2.4 billion in 2019.

Remittance inflows to Jamaica, ended in 2023 at US$3.37 billion, down two percent compared to total inflows of US$3.44 billion in 2022, and representing the third consecutive year that remittances exceed $3 billion and the fourth since it has come close to $3 billion, in 2020 in hitting a then record high of US$2.9 billion, well above the previous high of US$2.4 billion in 2019.

Remittance inflows for December 2023 declined by 3.6 percent to US$314 million, compared with US$326 million in December 2022. The data was compiled from data released by Bank of Jamaica

Jamaica’s NIR jumps another $100m

Jamaica’s Net International Reserves (NIR) rose approximately US$113 in the first 10 days of 2024 data published by the country’s central bank, the Bank of Jamaica shows. The latest increase to the total of US$770 million that was added in 2023 to over US$870 million since the beginning of 2023.

The January inflows push the total at the close last year of US$4.76 billion to US$4.87 billion and just short of the US$5 billion mark. The build-up of the NIR comes against the background of the tight monetary policy pursued by the country’s central bank that has sucked local money from the financial market, by use of certificates of deposit (CDs). Over the past year, the Bank of Jamaica’s open market instruments mainly CDs have moved up by J$74 billion to $247 billion. Apart from funds being bought from the market, the NIR would also have grown by interest earned on the funds being held as reserves which could be around US$200 million per year based on current interest rates internationally.

The January inflows push the total at the close last year of US$4.76 billion to US$4.87 billion and just short of the US$5 billion mark. The build-up of the NIR comes against the background of the tight monetary policy pursued by the country’s central bank that has sucked local money from the financial market, by use of certificates of deposit (CDs). Over the past year, the Bank of Jamaica’s open market instruments mainly CDs have moved up by J$74 billion to $247 billion. Apart from funds being bought from the market, the NIR would also have grown by interest earned on the funds being held as reserves which could be around US$200 million per year based on current interest rates internationally.