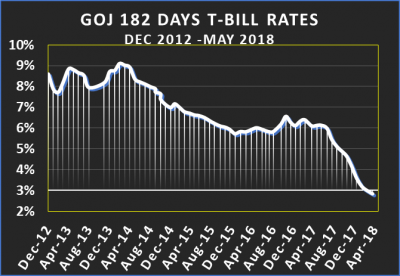

On Friday, July 5 investors in the Bank of Jamaica’s 28 days $37 billion CDs auction received an average interest rate of 9.91 percent with the highest successful rate at 10.249 percent, resulting in $141.5 billion being siphoned out of the financial market, with 299 successful bids out of a total 377 bids.

On July 12, Bank of Jamaica offered just $9 billion in CDs were offered, reducing the outstanding CDS to $139.5 billion, after attracting 278 bids covering $24.9 billion with just 74 successful bids from a high of 9.65 percent to a low of 8.50, with an average of 9.40 percent.

On July 12, Bank of Jamaica offered just $9 billion in CDs were offered, reducing the outstanding CDS to $139.5 billion, after attracting 278 bids covering $24.9 billion with just 74 successful bids from a high of 9.65 percent to a low of 8.50, with an average of 9.40 percent.

In the past week, Bank of Jamaica offered $36 billion and obtained 472 bids amounting to $52.68 billion with 392 succeeding with an average rate of 9.47 percent. The highest successful rate came out at 9.85 percent, the total amount of the 28 days CDS stood at $135 billion.

The average of the above rates is well below 11.90 percent on April 17 when the total amount of 28 days CDS was $155 billion.

The latest offering of $50 billion today is lower than the $53 billion that expires on Friday and is in line with BOJ’s commitment to ease liquidity within the financial market.

Falling interest rates

The Lagoon townhouses Cayman

The Lagoons in Georgetown, Cayman Islands.

The Lagoon townhouse complex in the Cayman Islands, a joint venture development between Proven REIT Limited and Infinity Capital Partners, is slated for completion and delivery of units in early 2023, a spoke person for Infinity Capital Partners advised ICIsider.com.

The complex comprises 13 residential units comprising nine two-bedroom and four three bedrooms townhouses in Georgetown, the capital of the country are all sold.

The units were priced at CI$520,000 for the two-bedroom units and $675,000 for the three-bedroom units. That amounts to US$624,000 and US$810,000. Converted to Jamaica dollar, put prices at JS$960,000 and J$1.247 million. The unit sizes range up to around 1,600 square feet for the three-bedroom units and slightly less for the two-bedroom units.

Cement production surges with big Q1 profit

Three months after Caribbean Cement Company announced its 2020 record cement production of 940,000 metric tons results, approximately 78,000 per month, the company recently reports the production of more than 100,000 metric tonnes of cement in a month in March. It marks the highest monthly production in recent history, the company reported.

Three months after Caribbean Cement Company announced its 2020 record cement production of 940,000 metric tons results, approximately 78,000 per month, the company recently reports the production of more than 100,000 metric tonnes of cement in a month in March. It marks the highest monthly production in recent history, the company reported.

“The trend for this quarter is of a higher average than that of the past ten years and is in response to domestic market demand”, a release from the company stated.

In 2020, the company had sales of $20 billion, up 13 percent from $17.8 billion in 2019, with a profit of $3.2 billion, up from $1.9 billion. In the first quarter of 2020, revenues grew by two percent to $4.5 billion, but profit fell to $453 million from $1.1 billion in 2019. In the 2020 first quarter, there was a loss on foreign exchange of $282 million. The company reduced most of its foreign currency exposure. As such there should be minimal exchange losses in the 2021 first quarter.

The company reported sales of $5.77 billion in the September quarter sales were approximately 270,000 tons and in December 2020, quarter sales was around 310,000 resulting in revenues of $6.6 billion.

ICInsider.com estimate revenues to be slightly ahead of the December quarter and has upgraded projections of revenues to $26 billion for 2021 with a net profit of $7.2 billion for EPS of $8.50, up from $6.70 previously.

Cement production is one of many bright spots in the Jamaican economy in 2020 and the current year. The companies shares are listed on the Jamaica Stock Exchange and last traded at $73 with a PE of 8.6 times 2021 earnings and a projected stock price of $160 by early 2022.

Banks love Turks & Caicos most

Turks & Caicos Islands is the destination by far, that banks and non-banks are most bullish about, according to data disclosed by the KPMG Carib Tourism 2018 survey.

Turks & Caicos Islands is the destination by far, that banks and non-banks are most bullish about, according to data disclosed by the KPMG Carib Tourism 2018 survey.

Following Turks & Caicos, the financiers were bullish on Cayman Islands, then Jamaica, Antigua and Barbuda with Bermuda in fifth spot.

“When we looked at which destination in the Caribbean financiers are most bullish about there were 16 different destinations put forward of which only 7 were nominated by both bank and non-banks,” KPMG said. KPMG went on to state,”this further corroborates the position seen in recent years that the financing landscape has changed and that the new landscape involves financiers favoring a small number of jurisdictions for whatever reason rather than financing projects across the entire region”

The survey stated that airlift was the number one factor that considered important followed by ability to recover for hurricanes speedily.

“For banks the second most important issues were the ability to recover from hurricanes (88 percent) and outdated infrastructure (88 percent). Non-banks were unanimous (100 percent) in terms of the importance of crime and the ability to recover from hurricanes.”

According to the release, “the Board of Directors sees this use of capital as an opportunity to enhance shareholder value through the purchase, from time to time, of undervalued shares”.

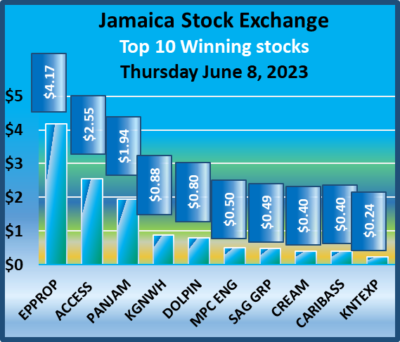

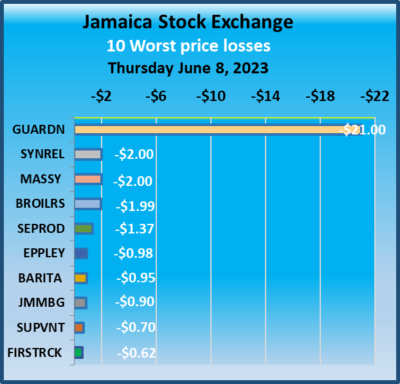

According to the release, “the Board of Directors sees this use of capital as an opportunity to enhance shareholder value through the purchase, from time to time, of undervalued shares”. At the close of trading, the JSE Combined Market Index dropped 3,572.73 points to 342,592.8, the All Jamaican Composite Index dived 4,628.88 points to 363,894.60, the JSE Main Index plunged 3,811.14 points to 329,820.27, the Junior Market Index dipped 1.81 points to settle at 3,806.88 and the JSE USD Market Index rose 9.27 points to close at 238,86.

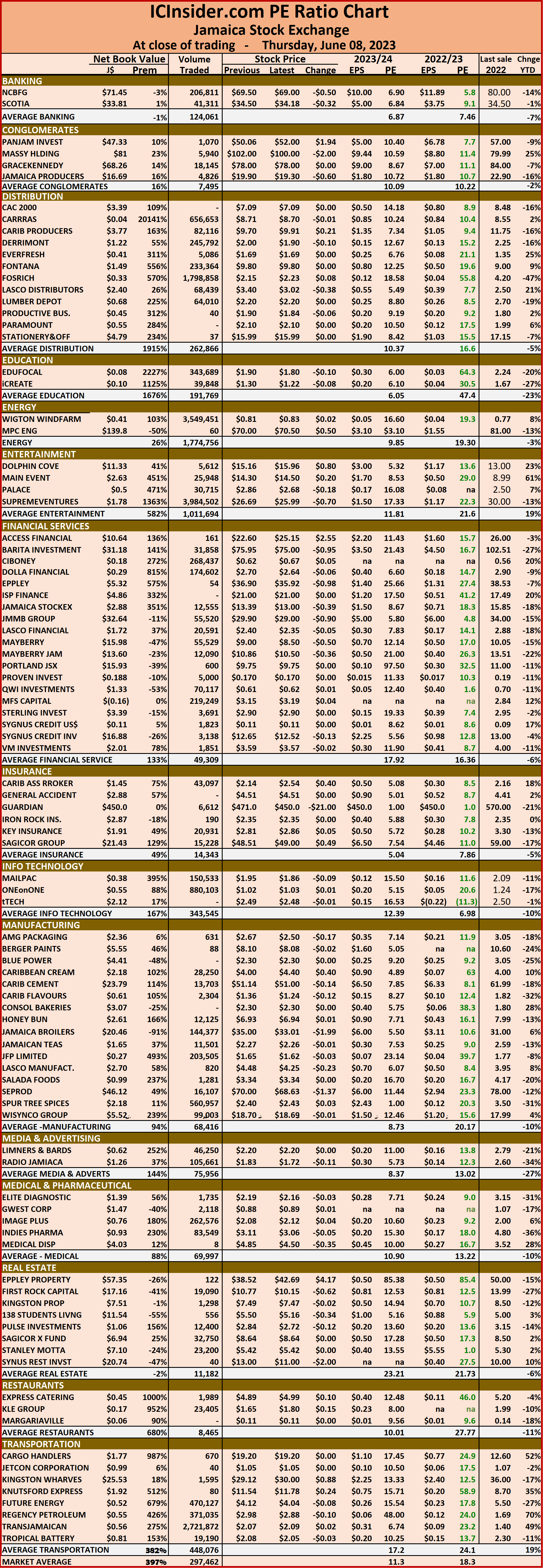

At the close of trading, the JSE Combined Market Index dropped 3,572.73 points to 342,592.8, the All Jamaican Composite Index dived 4,628.88 points to 363,894.60, the JSE Main Index plunged 3,811.14 points to 329,820.27, the Junior Market Index dipped 1.81 points to settle at 3,806.88 and the JSE USD Market Index rose 9.27 points to close at 238,86. The market’s PE ratio ended at 18.3 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading.

The market’s PE ratio ended at 18.3 on 2022-23 earnings and 11.3 times those for 2023-24 at the close of trading. Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Bank of Jamaica slashed their overnight policy interest rate by a hefty

Bank of Jamaica slashed their overnight policy interest rate by a hefty  According to Bank of Jamaica, the decision is intended to stimulate an even faster expansion in private sector credit which should lead to higher economic activity, consistent with the inflation target. The move also comes at the same time that the bank announced the lowering of the cash reserves that commercial banks need to keep with the central.

According to Bank of Jamaica, the decision is intended to stimulate an even faster expansion in private sector credit which should lead to higher economic activity, consistent with the inflation target. The move also comes at the same time that the bank announced the lowering of the cash reserves that commercial banks need to keep with the central.

Effective April will government will reduce transfer tax from 5 percent to 2 percent, the Minister of Finance Dr. Nigel Clarke told Parliament, in his maiden budget presentation.

Effective April will government will reduce transfer tax from 5 percent to 2 percent, the Minister of Finance Dr. Nigel Clarke told Parliament, in his maiden budget presentation.