Investors drove up prices of several preference shares on the Jamaica Stock Exchange in 2023 to unrealistic levels that defile logic, while ordinary shares can enjoy unlimited rise driven by growth in profits the same is not the case for preference shares that have limited potential for growth.

Many of those listed on the JSE have limited life spans as they are primarily income generating instruments, with a finite life span. The JMMB preference shares are in this category. The old JPS preference shares that were issued at $2 each have declined in value due to a decline in interest rates but the supply of these are very limited. These seem to have no set date to be repaid.

Many of those listed on the JSE have limited life spans as they are primarily income generating instruments, with a finite life span. The JMMB preference shares are in this category. The old JPS preference shares that were issued at $2 each have declined in value due to a decline in interest rates but the supply of these are very limited. These seem to have no set date to be repaid.

Investors may be confused about the likely value of Transjamaican 8.5 percent preference shares. Some think the fair value should be closer to $4, but that is not so and will only be the case if market interest rates fall below 8.5 percent, even then the short term nature of these shares makes it unlikely that rational investors would push the price to that level. The Transjamaican preference shares have an 8 year timeline, with annual repayment of principal starting on the 6th anniversary.

The true value of the ordinary shares should be over $4. They currently provide a dividend yield close to where the preference shares trade currently, with expectations that there will be a greater level of dividend payment in the future.

Ordinary shares offer unlimited capital appreciation and the potential for an endless dividend stream depending on the level of profit generated. Preference shares have limited capital upside potential unless they have participative features, allowing them to share in profits over and above the coupon rate.

Ordinary shares offer unlimited capital appreciation and the potential for an endless dividend stream depending on the level of profit generated. Preference shares have limited capital upside potential unless they have participative features, allowing them to share in profits over and above the coupon rate.

None of the preference shares listed on the Jamaica Stock Exchange have participation features. Long ago the shares of Jasmaica Livestock that were listed on the local exchange had such a feature. With interest rates on the Bank of Jamaica certificate of deposits just under 11% currently, the prices of the preference shares on the market should have declined to better equate the yields with the CD rates and as these rates fall, the share prices should be rising to reflect the better returns from Preference shares that is possible.

The value of Pref shares vs ordinary ones

Gambling with stocks

What is happening with 138 Student Living preference share trading at a record high of $50 on Tuesday and hitting a new high of $51.74 after trading a mere four shares? There is just no rational explanation for this.

The stock pays interest at 3 percent above the 180 days Treasury bill rates, currently, the rate payable is just over 10 percent before tax. At the current price, the annual yield is a mere 2 percent. So why are investors buying the stock at such an elevated price and why are there more sellers?

The stock pays interest at 3 percent above the 180 days Treasury bill rates, currently, the rate payable is just over 10 percent before tax. At the current price, the annual yield is a mere 2 percent. So why are investors buying the stock at such an elevated price and why are there more sellers?

A better perspective is gleaned from the stock price last year at just $5.43 resulting in an increase of 853 percent. Last year investors pushed Salada Foods to an unrealistic $10, with several investors lapping up large numbers of the shares. Now the stock is in the $4 range, the same thing is happening at Fesco where investors where the price was pushed to $8.49 and is now at $5.50 as it slowly adjusts to reality, but seems set to fall some more.

Investing in stocks is far easier than some think. Buy low and sell high is a recipe for making money. Momentum trading where investors buy into those stocks that are rising can make money for investors but many end up guessing when to sell before a correction starts.

Newer investors will save themselves much headache if they buy low PE stocks of companies whose profits are growing and sell ones with extended PE ratios well over the market average.

Get the most from credit cards

The Christmas season is here and persons will be spending above the normal levels in the earlier part of the year. The use of Credit cards will rise sharply and many will feel the pain of their spending when they face credit card payment in the first two months of 2022, yet there are ways to have your cake and eat it when it comes to the use of credit cards if some simple rules are followed.

Credit cards are extremely useful if managed properly, but the number of Jamaicans with credit cards is relatively small, with just under four hundred thousand according to data from the Bank of Jamaica. The same data shows debit cards numbering 4.34 million. Many persons seem to fear using credit cards that carry extremely high interest rates and penalties for missed payments. A number of persons have gotten into financial difficulties because of how they misuse them or just fail to manage them well.

How many persons know how to use these instruments to their advantage, with the possibility of nearly two months interest free credit.

Individuals should get to know all the terms of each card they hold. These include interest rates applicable, the date that interest will start to accrue if the amounts incurred are not paid within the time frame the statement indicates. Know the dates when statements are cut off as this can allow one to max out on the credit received without incurring charges. Both dates are shown on monthly statements but may vary from one statement to another. While the payment date will vary by a few days from month to month the date statements are printed are usually fixed. This latter date is most important if cardholders are to get the most out of their cards.

NCB Financial Montego Bay branch

Credit cards should be used to avoid paying the prohibited high interest rates. Rule one, do not use the cards unless the user knows where money will come from when the payment is due so it can be paid in full and on time thus avoiding the heavy interest cost.

Do not be lulled into paying just 10 percent per month that the banks entice cardholders to do, if you don’t pay in full when due there will be unnecessary expensive interest charges to bear. Get a regular bank loan instead. Remember that banks loan cost about 80 percent less than credit card interest.

The dates for the statement is of focal point for when the card is to be used. A few days before the cutoff date and the credit received is cut sharply to a few days compared to using them the day after the statements are printed. Where there is more than one card, alternate them to use the one that has the longest time to go before the cut off for printing statements, with the other to be used after the next cut off time. This way users will max out on the credit terms and save cash.

A card cut off for printing is say the 20th of the month, if the card is used on the following day a payment would not be due until the middle of the second month following the use of the card. Say the bank cuts off transactions and prints the statement on December 20 and the cardholder effects a charge on the 21st, payment will not due until mid-February resulting in almost two months of interest free credit. If the cardholder incurred the charge on the 20th, that amount would appear on the next statement normally due for payment by January next year, one full month ahead of a charge that was incurred just one day later.

If persons have the option to put off paying a bill before the statement date or a few days after the statement date such action will afford them one more month of interest free debt.

An indispensable tool for all investors

The PE ratio is one of the most popular and valuable tools used by investors to assess the value of a stock, allowing them to make appropriate investment decisions. Every investor should understand this simple measure. If they do, they will make better investment decisions, but not all PE ratios are equal and the differences should be noted when using them to make investment decisions.

“The PE Ratio is a measure used in computing appropriate stock values, averages 16 based on ICInsider.com’s forecast of 2021-22 earnings.” Readers of ICInsider.com’s daily Jamaican stock market reports will be familiar with the above quote.

“The PE Ratio is a measure used in computing appropriate stock values, averages 16 based on ICInsider.com’s forecast of 2021-22 earnings.” Readers of ICInsider.com’s daily Jamaican stock market reports will be familiar with the above quote.

What is the reason to quote this daily? PEs help investors determine if they value stocks appropriately by comparing the value of one stock against another and the overall market value.

The PE ratio is the number of years it takes for investors to get back their money based on the profit made by a company, ignoring growth in profits. At the close of trading on Wednesday, Main Market stocks were trading at an average of around 15.8, which is equal to the amount of money invested in each stock that would be repaid within 15.8 years based on this year’s profit and assuming the profit would be constant for the next 15.8 years.

On the surface, stocks with high PE ratios take longer to deliver returns than those with lower PEs, all things being equal. Globally, stocks with high PEs have high growth rates, resulting in a higher level of an annual increase in profit than stocks with lower PEs. The rationale is that if profits are going fast, the accumulated gains will reduce the payback period.

Investors can find the PE ratio for each stock on the daily report of Jamaica Stock Exchange stocks quotation charts included in the markets’ reports. The charts carry projected earnings for each company and the PE ratio for each stock, based on ICInsider.com computations. From these charts, investors can easily see the stocks that are expensive and those that are not. A company with profits growing at 10 percent per annum will have profit doubling in 7.2 years. A company that has profits growing at 20 percent per annum will double its earnings in 3.6 years, which should carry a higher PE ratio than the former.

Don’t follow the crowd. Pay attention to facts, not fads. The general rule; buy stocks with low PEs and stay away from those with high PEs and monitor them regularly to see if there are significant changes that may warrant changes in an investment.

The general rule; buy stocks with low PEs and stay away from those with high PEs and monitor them regularly to see if there are significant changes that may warrant changes in an investment.

While many investors get attracted to cheaper priced stocks believing they can double easier than high priced ones, they often ignore the main feature that determines cheapness and, therefore, the ability to make more profitable trades.

A significant and most crucial issue is the makeup of the profits used in computing the PEs, are they based on earnings from continuing operations or not? Not all PEs are equal and investors need to find out periods used to calculate the PE ratio and the quality of earnings used in the composition. PEs may be based on historical profits, trailing four quarters, current year’s or based on future earnings. Why is this important? Many companies have onetime income or expenses that are not likely to repeat consistently in the future. In such cases, it is vital to strip earnings of the onetime items to determine earnings from continuing operations. If reported profits are not adjusted for these items, the stock may be considered undervalued or overvalued and lead investors and lead to wrong investment decisions.

The usual procedure is to buy when PE are low and sell when high. Patience is required as stocks tend to take time to fully valuation, especially when they have fallen out of favour.

Virtues & pitfalls of OPAs & stock splits

A reader of IC Insider.com asks the following question. In general, based on what l have read, listed companies can raise capital faster than getting a loan. I think there is a risk for the company that the Additional Public Offer (APO) can be undersubscribed. What are other ways APOs may hurt the company?

An APO is just like an IPO but it is usually better as the former is already listed and has followers and a wide number of shareholders who are familiar with the company’s history of management and financial wellbeing.

An APO is just like an IPO but it is usually better as the former is already listed and has followers and a wide number of shareholders who are familiar with the company’s history of management and financial wellbeing.

Shares issued to the public can be undersubscribed if the pricing is out of line with investors’ expectations or if market conditions change adversely after the issue opens. Bear in mind that the management and their Broker would get a sense from the market whether the issue will be taken up or not. Brokers will usually do roadshows to pitch an issue or get feedback from their clients before pricing and going to market with the issue. At least with an APO, the market has already determined the value investors place on the company so pricing is easier than for an IPO that has to be priced off the indicative market valuation.

One more question? if there’s a stock split after an APO ( thinking of PanJam), might it be better to buy shares after the APO as they could buy more shares for less money, is my understanding correct?

Stock splits tend to cause the stock price to rise because the news of the split and the lower share price stimulate short-term interest and if investors wait until after the split they are likely to pay more for the stock in real terms. In the case of PanJam buying in the APO could be the best bet. It, however, depends on the timing of the split as well as that of the APO. The odds are that the split would take place before the APO and if history is anything to go by the stock price will rise and result in a higher APO price than the price before the split. Buying the stock now before the announced stock split may be the better move.

The big Junior Market rally ahead

Investors can trade shares either by using fundamental analysis, the more common method, or technical analysis. Both have their place, but technical analysis informs investors ahead of significant market moves and thus reduces the time one has to buy or sell a stock.

The triangular formation is shown by the black and golden lines.

The Junior Market suffered a sizable fall from its peak of 3,436 points in September last year to Mid-March and bounced sharply in the first two weeks in April, then retreated until-Mid May from which it started a rebound.

The market was recently in a triangular formation and is breaking higher as the formation suggests. Ascending triangle patterns are bullish, meaning that they indicate that a security’s price is likely to climb higher as the pattern completes itself. Two trendlines form the pattern, the first is flat along the top of the triangle and acts as a resistance point which—after price successfully breaks above it—signals the resumption or beginning of an uptrend. The second the bottom trendline of the triangle that shows price support—is a line of ascension formed by a series of higher lows. It is this configuration, formed by higher lows that forms the triangle and gives it a bullish characterization as each time sellers attempt to push prices lower, they are increasingly less successful.

The Junior Market has broken to the upside of the triangle, an indication of the rising market ahead. A critical factor behind this is the low PE ratio for Junior Market stocks at 9.3 versus Main market stocks of 15 as well as the fact that the average PE of Junior Market stocks had reached 15 times 2019 earnings.

Wigton price dreamers

Wigton stock price could top out soon.

“Buy now, Ride the $3 wave”. That’s a stunning advice by an online stock market investor to another, regarding the likely performance of the Wigton Windfarm stock after trading, on the first day of listing.

Wigton shares closed trading on the Jamaica Stock Exchange on Friday at 83 cents, with a PE of 14, placing the value in the upper half of the most valued main market stocks. The premium over net asset value, another measure of valuation, is 291 percent above the net asset value. Few stocks in the main market are selling at such a premium. At $3, the stock would trade at a stunningly high PE ratio of 50 times 2019 and 2020 earnings. The only main market stock close to that valuation is Kingston Wharves (KW) at 35 times 2019 earnings and that is coming down from more than 50 times 2018 earnings in 2018, when investors traded it at $85, now it’s trading around $70 even as profit for 2019 is up in the first quarter of this year.

Unlike KW, that has less than 10 percent of the shareholding amounting to a few million units, that trade, Wigton has billion of shares that will trade. The high liquidity of Wigton shares almost ensures that the stock will not become overvalued and if so, will not remain that way for a prolonged period.

The bulk of investors who would be buying the vast quantity are more professional than not and are versed on the valuation levels of stocks. Accordingly, they are unlikely to be buying a stock that has doubtful expansion credentials at an inflated value. The most popular valuation tool, the PE ratio does not support a price much higher than $1.20, with EPS of 6 cents per share. A price of $1.20 equates to a relatively high PE ratio of 20. Only a few stocks are valued close to this multiple and many of them have prospects for profits to grow. Wigton has no immediate prospects for growth in earnings, pricing it at 20 times EPS would, therefore, be unwise. The market will speak but the heavy selling on Friday is more in line with the thinking that the top is not far off. Investors who buy shares above the accepted market norm will likely get crushed unless they have a long term investment horizon on their minds. PE ratios are there to give a sense of appropriate values. When investors try to break away from where the bulk of investments funds place the value of a stock at, they usually end up regretting the move.

The bulk of investors who would be buying the vast quantity are more professional than not and are versed on the valuation levels of stocks. Accordingly, they are unlikely to be buying a stock that has doubtful expansion credentials at an inflated value. The most popular valuation tool, the PE ratio does not support a price much higher than $1.20, with EPS of 6 cents per share. A price of $1.20 equates to a relatively high PE ratio of 20. Only a few stocks are valued close to this multiple and many of them have prospects for profits to grow. Wigton has no immediate prospects for growth in earnings, pricing it at 20 times EPS would, therefore, be unwise. The market will speak but the heavy selling on Friday is more in line with the thinking that the top is not far off. Investors who buy shares above the accepted market norm will likely get crushed unless they have a long term investment horizon on their minds. PE ratios are there to give a sense of appropriate values. When investors try to break away from where the bulk of investments funds place the value of a stock at, they usually end up regretting the move.

In the investment world staying close to the crowd with pricing is a prudent investment practice that tends to be less costly than trying to predict lofty heights for a stock to reach.

How do I invest in stocks?

Persons interested in investing in stocks should open an account at a brokerage company so they can start investing when they decide to take the plunge.

Persons interested in investing in stocks should open an account at a brokerage company so they can start investing when they decide to take the plunge.

Stocks are not like fixed interest securities where the returns are usually known, up front. Put another way, there are no guarantees about the returns on stock market investments, that is a negative. History shows it to be a huge positive with no limit to possible gains. The basic principle is to find companies that are likely to increase profit going forward. This is most important, as profit are the main reasons why investors buy a stock, as it increases the value of a company.

Buy stocks with low price earnings (PE) ratio relative to the rest of the market. What does this mean? Listed companies are required to report profit and show the amount of profit earned per share (EPS). EPS is the profit for each issued share. In simple terms, the EPS is arrived at by dividing the profit by the total issued shares. This figure by itself does not mean much, but it allows for the computation of one of the most important and used investment tools, the PE ratio. PE is the price of the stock on the stock exchange divided by EPS.

Do not buy stocks because the price is low in monetary terms. Instead, have laser like focus on stocks with lower PE ratios. Sometimes when persons buy shares, also called stocks, they may see quick gains, as may happen with the Wigton Windfarm initial public offer (IPO) issue that is now on the Market. More often, investors will not see any gains for months but then may do so with the passage of several months, if the company reports increased profit. Effectively, if one buys stocks of good quality companies they will usually grow in value.

Do not buy stocks because the price is low in monetary terms. Instead, have laser like focus on stocks with lower PE ratios. Sometimes when persons buy shares, also called stocks, they may see quick gains, as may happen with the Wigton Windfarm initial public offer (IPO) issue that is now on the Market. More often, investors will not see any gains for months but then may do so with the passage of several months, if the company reports increased profit. Effectively, if one buys stocks of good quality companies they will usually grow in value.

A good quality company is one that has consistent growth in earnings over a number of years, with few if any decline. There is more to it than the above, but these are a few basics. New investors are well advised to start small until they get a better feel of the market. Yes, you can start with $10,000, but $25,000 may be better.

Investors can find the earnings per share EPS and PE ratios for each local stock, on the stock market trading chart shown daily and included in the Junior and Main market reports. The key to using them is to find those stocks with the lowest PE ratios and get more information on them. This website analyses the companies on an ongoing basis to provide relevant investment information for investors.

When investing try to have about five different companies. Some companies to consider investing in now are: Wisynco, NCB, Fontana, General Accident and Wigton

Bank of Jamaica (BOJ) raised interest rates in 2021 with the overnight rate landing at 7 percent in November 2022 and has remained there since, with BOJ keeping a tight lid on market rates by the use of Certificate of Deposits with rates mostly around 10 percent on average, to tame inflation that peaked close to 12 percent in early 2023.

Bank of Jamaica (BOJ) raised interest rates in 2021 with the overnight rate landing at 7 percent in November 2022 and has remained there since, with BOJ keeping a tight lid on market rates by the use of Certificate of Deposits with rates mostly around 10 percent on average, to tame inflation that peaked close to 12 percent in early 2023.

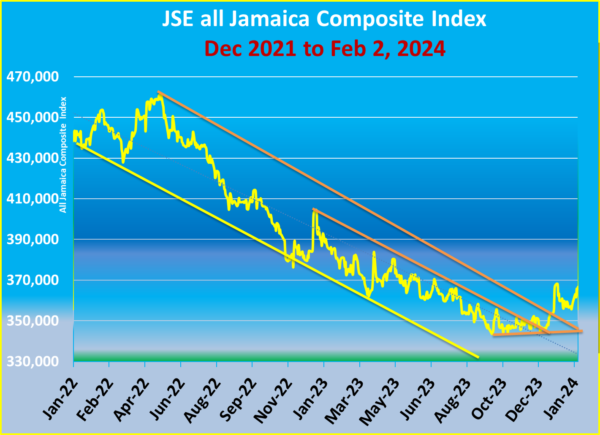

Part of the decline in the Junior Market in 2023 is due to an overall level of over-exuberance by investors in 2022, pushing the prices of a limited number of Junior Market stocks to unrealistic levels, with sharp correction for some of these in 2023 and helping to drag the market. The situation in the Main Market was somewhat different with a lack of interest from institutional investors until the final quarter of the year which is reflected in a continuous slide in the Main Market Index throughout the year until the end of September, indeed from a two-year high of 461,783 points on the All Jamaica Composite Index in May 2022 until it bottomed at the end of September 2023 at 344,153 points and put on almost 23,000 points to the end of the year. While the Main Market declined for two consecutive years, the Junior Market was experiencing its first yearly decline since 2020.

Part of the decline in the Junior Market in 2023 is due to an overall level of over-exuberance by investors in 2022, pushing the prices of a limited number of Junior Market stocks to unrealistic levels, with sharp correction for some of these in 2023 and helping to drag the market. The situation in the Main Market was somewhat different with a lack of interest from institutional investors until the final quarter of the year which is reflected in a continuous slide in the Main Market Index throughout the year until the end of September, indeed from a two-year high of 461,783 points on the All Jamaica Composite Index in May 2022 until it bottomed at the end of September 2023 at 344,153 points and put on almost 23,000 points to the end of the year. While the Main Market declined for two consecutive years, the Junior Market was experiencing its first yearly decline since 2020. Barring increased interest rates, the Jamaican economy should grow just around two percent in 20224 and that ought to be sufficient to help generate increased demand for goods and services and assist many listed companies to increase profits from existing operations. Expanding companies will see above average performances.

Barring increased interest rates, the Jamaican economy should grow just around two percent in 20224 and that ought to be sufficient to help generate increased demand for goods and services and assist many listed companies to increase profits from existing operations. Expanding companies will see above average performances.