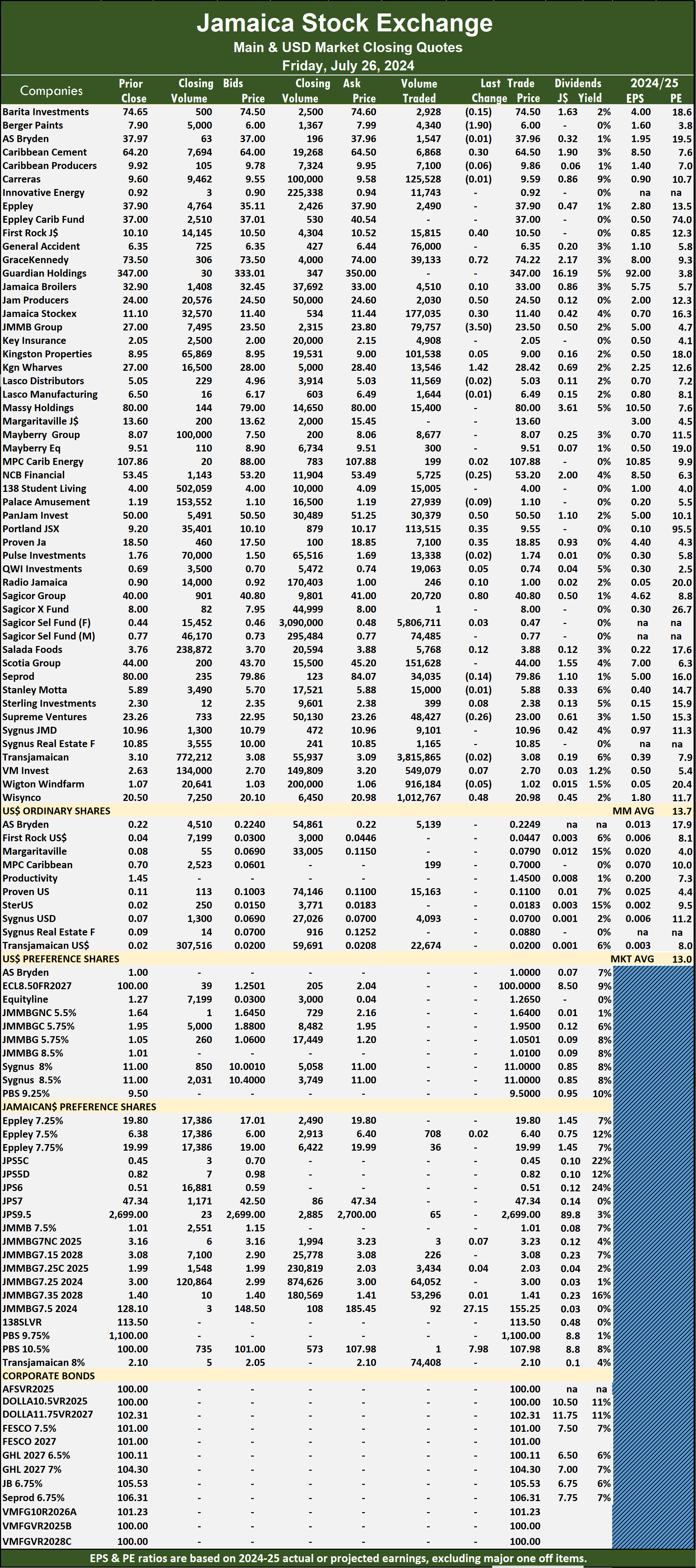

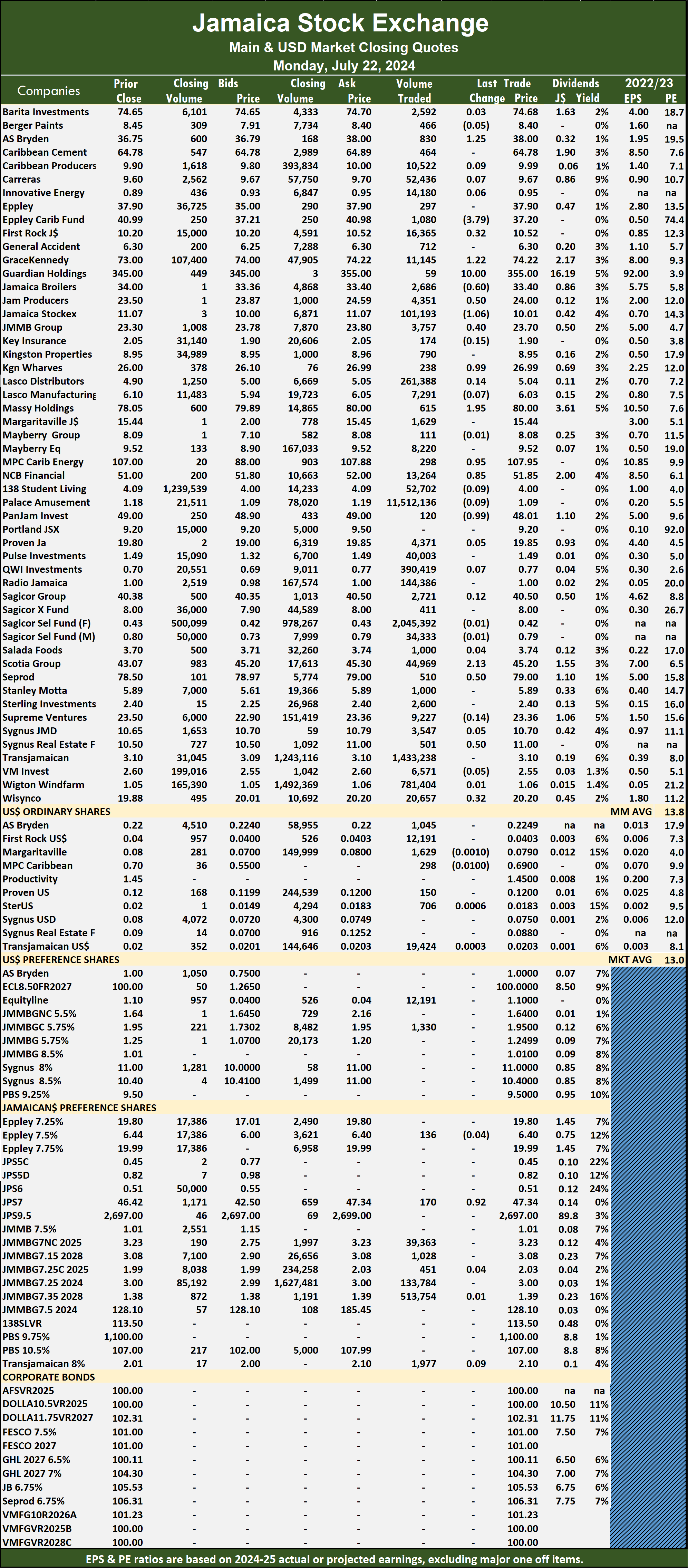

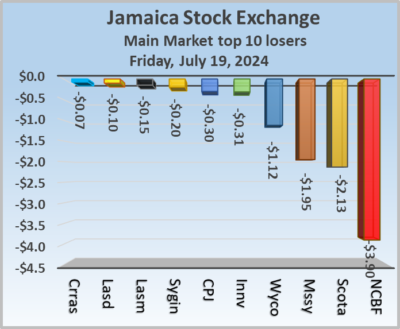

The Main Market of the Jamaica Stock Exchange rose on Friday, for the 4th time this week and ended with rising stocks outpacing those declining by almost 2 to 1 after the volume and value of stocks traded were marginally different than market activity on Thursday and ended with trading in 60 securities compared with 55 on Thursday, with prices of 26 stocks rising, 15 declining and 19 ending unchanged.

The market closed with 13,604,571 shares being traded for $65,580,443 compared with 12,877,172 units at $69,293,990 on Thursday.

The market closed with 13,604,571 shares being traded for $65,580,443 compared with 12,877,172 units at $69,293,990 on Thursday.

Trading averaged 226,743 shares at $1,093,007 compared to 234,130 units at $1,259,891 on Thursday and month to date, an average of 659,733 stocks at $6,104,693 compared with 685,922 units at $6,407,819 on the previous day and June with an average of 246,425 shares at $1,945,941.

Sagicor Select Financial Fund led trading with 5.81 million shares for 42.7 percent of total volume followed by Transjamaican Highway with 3.82 million units for 28 percent of the day’s trade and Wisynco Group with 1.01 million stocks for 7.4 percent of the day’s trade.

The All Jamaican Composite Index rose 1,682.41 points to 356,592.46, the JSE Main Index rallied 1,044.59 points to settle at 314,466.93 and the JSE Financial Index increased 0.42 points to end trading at 66.26.

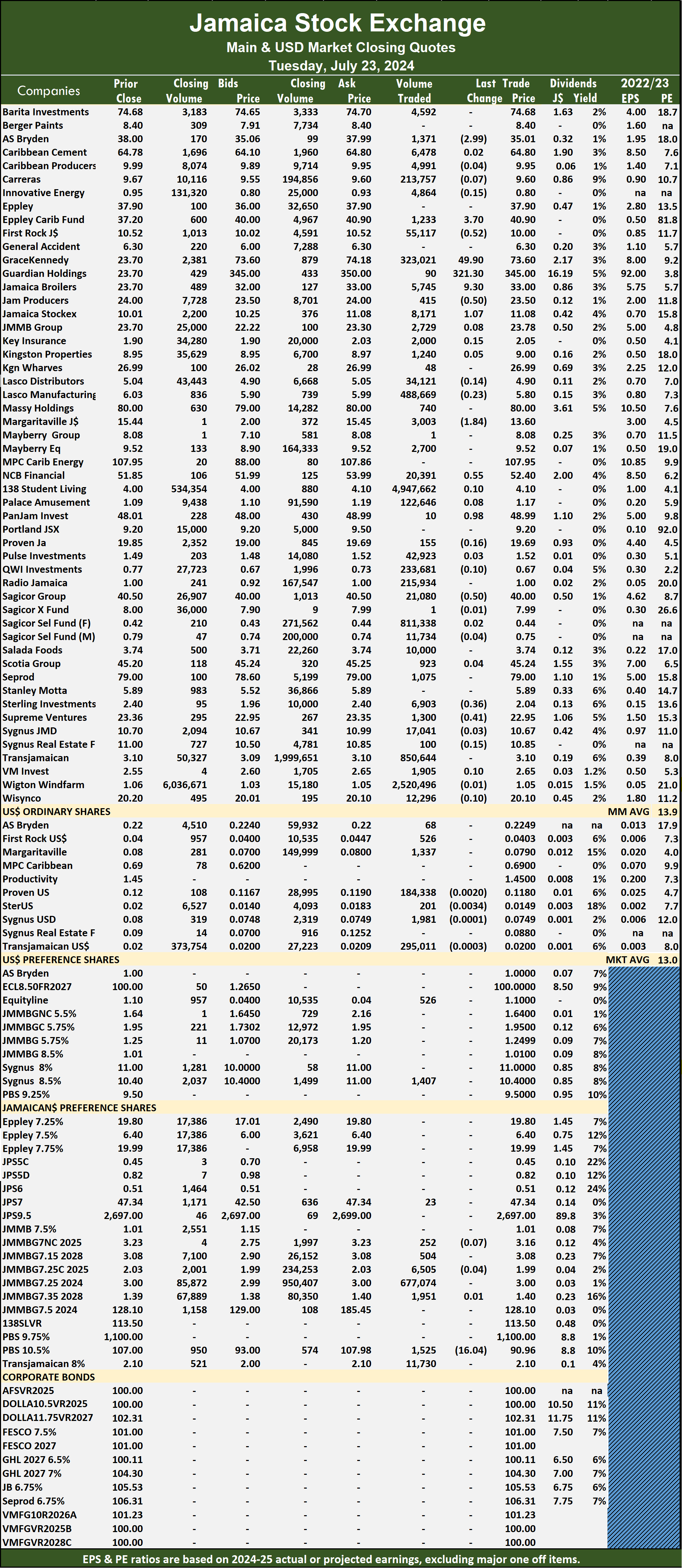

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and five with lower offers.

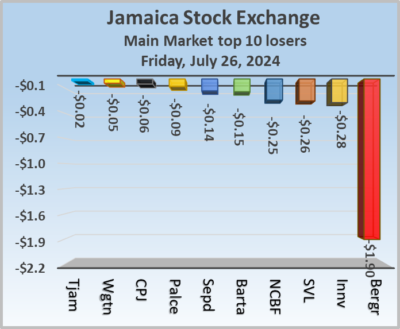

At the close of the market, Berger Paints shed $1.90 to end at $6 with investors trading 4,340 stock units, Caribbean Cement rose 30 cents in closing at $64.50 after an exchange of 6,868 shares, First Rock Real Estate climbed 40 cents to $10.50 after closing with an exchange of 15,815 stocks. GraceKennedy popped 72 cents to close at $74.22 in an exchange of 39,133 units, Jamaica Producers gained 50 cents and ended at $24.50, with 2,030 stocks crossing the market, Jamaica Stock Exchange advanced 30 cents to finish at $11.40 in an exchange of 177,035 units.  Kingston Wharves increased $1.42 and ended at $28.42 with traders dealing in 13,546 shares, Pan Jamaica rallied 50 cents to $50.50 after a transfer of 30,379 stock units, Portland JSX rose 35 cents to close at $9.55 in switching ownership of 113,515 shares. Proven Investments rallied 35 cents in closing at $18.85, with 7,100 stocks crossing the exchange, Sagicor Group popped 80 cents to finish at $40.80 with a transfer of 20,720 units and Wisynco Group advanced 48 cents to end at $20.98 with 1,012,767 stock units clearing the market.

Kingston Wharves increased $1.42 and ended at $28.42 with traders dealing in 13,546 shares, Pan Jamaica rallied 50 cents to $50.50 after a transfer of 30,379 stock units, Portland JSX rose 35 cents to close at $9.55 in switching ownership of 113,515 shares. Proven Investments rallied 35 cents in closing at $18.85, with 7,100 stocks crossing the exchange, Sagicor Group popped 80 cents to finish at $40.80 with a transfer of 20,720 units and Wisynco Group advanced 48 cents to end at $20.98 with 1,012,767 stock units clearing the market.

In the preference segment, 138 Student Living preference share climbed $27.15 in closing at $155.25 with an exchange of 92 shares and Sygnus Credit Investments C10.5% increased $7.98 to $107.98, with jsut 1 unit crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading broadens on the JSE USD Market

Trading climbed on the Jamaica Stock Exchange US dollar market on Thursday, with a 696 percent jump in the volume of stocks exchanged along with a 565 percent climb in value trading on Wednesday, resulting from trading in nine securities, compared to six on Wednesday with prices of four rising, three declining and two ending unchanged.

The market closed with an exchange of 200,309 shares for US$13,942 well above the 25,171 units that traded at US$2,096 on Wednesday.

The market closed with an exchange of 200,309 shares for US$13,942 well above the 25,171 units that traded at US$2,096 on Wednesday.

Trading averaged 22,257 stock units at US$1,549 versus 4,195 shares at US$349 on Wednesday, with a month to date average of 34,001 shares at US$2,482 compared with 35,114 units at US$2,571 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index dipped 3.15 points to conclude trading at 224.87.

The PE Ratio, a most used measure for computing stock values, averages 8.1. The PE ratio is calculated based on last traded prices divided by ICInsider.com’s projected earnings for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last prices and one with a lower offer.

At the close of trading, AS Bryden ended at 22.49 US cents with investors trading 2,448 units, First Rock Real Estate USD share rallied 0.44 of one cent to 4.47 US cents and closed with an exchange of 7,469 stocks, MPC Caribbean Clean Energy popped 1 cent to finish at 70 US cents as investors exchanged a mere one share. Proven Investments lost 0.9 of one cent and ended at a 52 weeks’ low of 11 US cents after the trading of 84,198 stock units, Sterling Investments advanced 0.34 of a cent in closing at 1.83 US cents in an exchange of 322 shares, Sygnus Credit Investments remained at 7 US cents with investors trading 10,199 units and Transjamaican Highway declined 0.08 of a cent to 2 US cents with an exchange of 95,546 stocks.

Proven Investments lost 0.9 of one cent and ended at a 52 weeks’ low of 11 US cents after the trading of 84,198 stock units, Sterling Investments advanced 0.34 of a cent in closing at 1.83 US cents in an exchange of 322 shares, Sygnus Credit Investments remained at 7 US cents with investors trading 10,199 units and Transjamaican Highway declined 0.08 of a cent to 2 US cents with an exchange of 95,546 stocks.

In the preference segment, JMMB Group US8.5% preference share shed 14.99 cents to close at US$1.0501, with 30 stock units crossing the market and Sygnus Credit Investments E8.5% rose by 60 cents in closing at US$11 after an exchange of 96 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading plunges for JSE USD Market

Trading plunged on the Jamaica Stock Exchange US dollar market on Wednesday, with a 95 percent in the volume and value of stocks passing through compared with Tuesday, resulting from trading in six securities, compared to eight on Tuesday with prices of three stocks rising, two declining and one ending unchanged.

The market closed with an exchange of 25,171 shares for US$2,096 compared to 484,869 units at US$42,958 on Tuesday.

The market closed with an exchange of 25,171 shares for US$2,096 compared to 484,869 units at US$42,958 on Tuesday.

Trading averaged 4,195 stock units at US$349 down sharply from 60,609 shares at US$5,370 on Tuesday, with a month to date average of 35,114 shares at US$2,571 compared with 37,198 units at US$2,721 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index gained 1.67 points to end at 228.02.

The PE Ratio, a most used measure for computing appropriate stock values, averages 7.9. The PE ratio is computed based on last traded prices divided by projected earnings done by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share ended at 4.03 US cents after investors traded 182 stocks, Proven Investments popped 0.1 of a cent to end at 11.9 US cents in trading 1,171 shares, Sygnus Credit Investments shed 0.49 of one cent in closing at 7 US cents after a transfer of 21,798 units and Transjamaican Highway increased 0.08 of a cent to finish at 2.08 US cents with investors trading 1,759 stocks.

At the close, First Rock Real Estate USD share ended at 4.03 US cents after investors traded 182 stocks, Proven Investments popped 0.1 of a cent to end at 11.9 US cents in trading 1,171 shares, Sygnus Credit Investments shed 0.49 of one cent in closing at 7 US cents after a transfer of 21,798 units and Transjamaican Highway increased 0.08 of a cent to finish at 2.08 US cents with investors trading 1,759 stocks.

In the preference segment, JMMB Group US8.5% preference share fell 4.99 cents and ended at US$1.20 with 6 units crossing the market and Equityline Mortgage Investment preference share popped 16.5 cents to close at US$1.265 as investors exchanged 255 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Elevated trading on JSE USD Market

Trading picked up on the Jamaica Stock Exchange US dollar market over the past two days, with the volume of stocks exchanged surging 1,219 percent on Tuesday after a 954 percent jump in the value over Monday, resulting in trading in eight securities, compared to eight on Monday with prices of four declining and four ending unchanged.

The market closed with an exchange of 484,869 shares for US$42,958 compared to 36,773 units at US$4,077 on Monday, as trading averaged 60,609 stock units at US$5,370 versus 4,597 shares at US$510 on Monday, with a month to date average of 37,198 shares at US$2,721 compared with 34,886 units at US$2,459 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The market closed with an exchange of 484,869 shares for US$42,958 compared to 36,773 units at US$4,077 on Monday, as trading averaged 60,609 stock units at US$5,370 versus 4,597 shares at US$510 on Monday, with a month to date average of 37,198 shares at US$2,721 compared with 34,886 units at US$2,459 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index slipped 0.44 points to end trading at 226.35.

The PE Ratio, a most used measure for computing appropriate stock values, averages 7.9. The PE ratio is calculated based on last traded prices divided by projected earnings computed by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close of the market, AS Bryden ended at 22.49 US cents after a transfer of 68 stocks, First Rock Real Estate USD share had trading of 526 units at 4.03 US cents, Margaritaville remained at 7.9 US cents with traders dealing in 1,337 shares. Proven Investments dipped 0.2 of a cent to 11.8 US cents after an exchange of 184,338 stock units,  Sterling Investments sank 0.34 of a cent to close at 1.49 US cents after 201 shares passed through the market, Sygnus Credit Investments dipped 0.01 of a cent to7.49 US cents with investors dealing in 1,981 stocks and Transjamaican Highway fell 0.03 of a cent to 2 US cents closed at 295,011 units.

Sterling Investments sank 0.34 of a cent to close at 1.49 US cents after 201 shares passed through the market, Sygnus Credit Investments dipped 0.01 of a cent to7.49 US cents with investors dealing in 1,981 stocks and Transjamaican Highway fell 0.03 of a cent to 2 US cents closed at 295,011 units.

In the preference segment, Sygnus Credit Investments E8.5% ended at US$10.40 with a transfer of 1,407 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

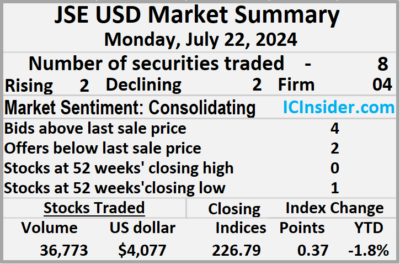

Depressed trading on JSE USD Market

Trading remained depressed on the Jamaica Stock Exchange US dollar market on Monday, with the volume of stocks exchanged declining 32 percent after 214 percent more money changed hands than on Friday, resulting from trading in eight securities, up from six on Friday with prices of two rising, two declining and four ending unchanged, with Margaritaville trading at a 52 weeks’ low.

The market closed on Monday with an exchange of 36,773 shares for US$4,077 compared to 54,388 units at US$1,299 on Friday.

The market closed on Monday with an exchange of 36,773 shares for US$4,077 compared to 54,388 units at US$1,299 on Friday.

Trading averaged 4,597 stock units at US$510 versus 9,065 shares at US$216 on Friday, with the month to date ending with an average of 34,886 shares at US$2,459 compared to 38,205 units at US$2,673 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index gained 0.37 points to cease trading at 226.79.

The PE Ratio, a most used measure for computing appropriate stock values, averages 8.1. The PE ratio is computed based on last traded prices divided by projected earnings computed by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close of trading on Monday, AS Bryden ended at 22.49 US cents with traders dealing in 1,045 shares, First Rock Real Estate USD share remained at 4.03 US cents after an exchange of 12,191 stock units, Margaritaville dipped 0.1 of a cent to close trading at a 52 weeks’ low of 7.9 US cents with an exchange of 1,629 shares.  MPC Caribbean Clean Energy fell 1 cent to 69 US cents after 298 stocks changed hands, Proven Investments ended at 12 US cents, with 150 shares crossing the market, Sterling Investments rose 0.06 of a cent to end at 1.83 US cents with investors trading 706 stock units and Transjamaican Highway rallied 0.03 of a cent to 2.03 US cents with investors dealing in 19,424 stocks.

MPC Caribbean Clean Energy fell 1 cent to 69 US cents after 298 stocks changed hands, Proven Investments ended at 12 US cents, with 150 shares crossing the market, Sterling Investments rose 0.06 of a cent to end at 1.83 US cents with investors trading 706 stock units and Transjamaican Highway rallied 0.03 of a cent to 2.03 US cents with investors dealing in 19,424 stocks.

In the preference segment, JMMB Group 5.75% ended at US$1.95 in switching ownership of 1,330 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

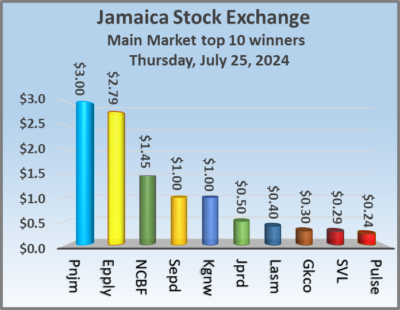

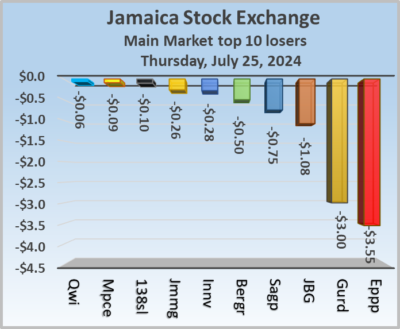

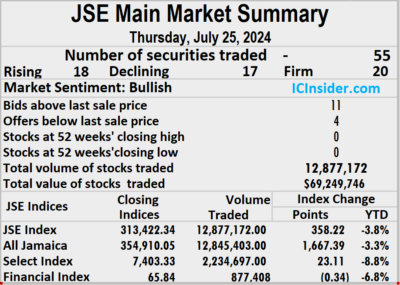

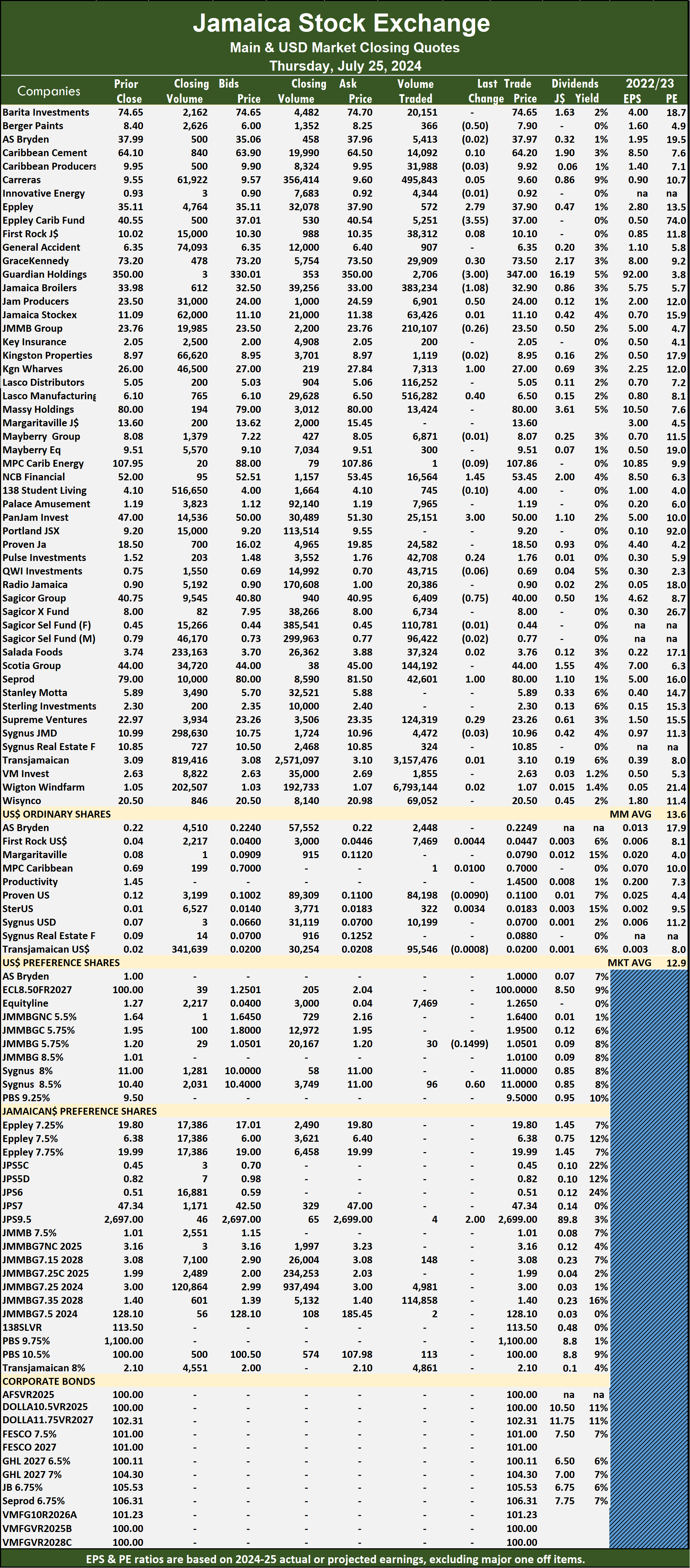

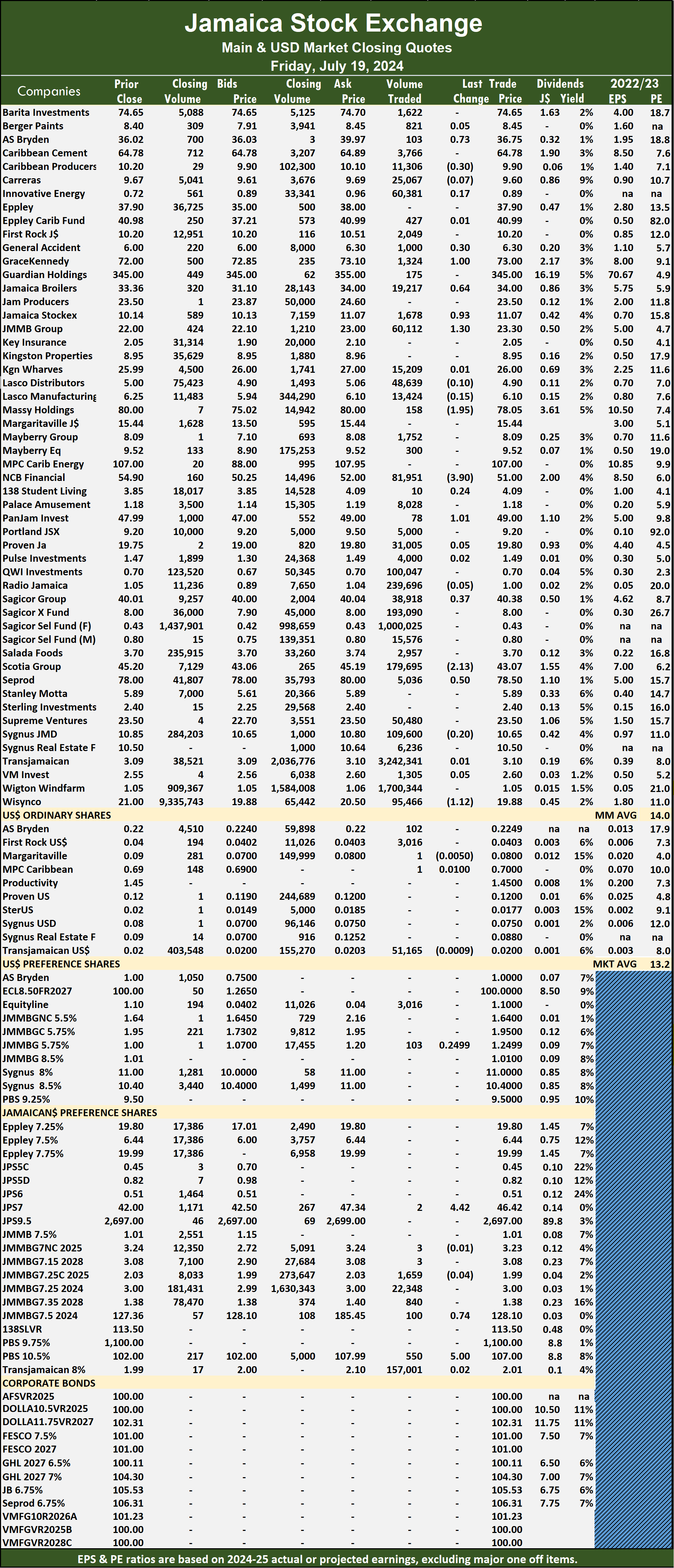

Some 12,877,172 shares were traded for $69,293,990 up from 5,083,717 units at $55,164,698 on Wednesday.

Some 12,877,172 shares were traded for $69,293,990 up from 5,083,717 units at $55,164,698 on Wednesday. The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Jamaica Producers gained 50 cents to close at $24 after a transfer of 6,901 shares, Kingston Wharves rose $1 to finish at $27 after 7,313 stock units passed through the market, Lasco Manufacturing climbed 40 cents and ended at $6.50 after an exchange of 516,282 shares. NCB Financial increased $1.45 in closing at $53.45 with an exchange of 16,564 units, Pan Jamaica advanced $3 to close at $50 with investors trading 25,151 stocks, Sagicor Group dropped 75 cents to end at $40 with an exchange of 6,409 stock units and Seprod popped $1 in closing at $80 with 42,601 shares clearing the market.

Jamaica Producers gained 50 cents to close at $24 after a transfer of 6,901 shares, Kingston Wharves rose $1 to finish at $27 after 7,313 stock units passed through the market, Lasco Manufacturing climbed 40 cents and ended at $6.50 after an exchange of 516,282 shares. NCB Financial increased $1.45 in closing at $53.45 with an exchange of 16,564 units, Pan Jamaica advanced $3 to close at $50 with investors trading 25,151 stocks, Sagicor Group dropped 75 cents to end at $40 with an exchange of 6,409 stock units and Seprod popped $1 in closing at $80 with 42,601 shares clearing the market. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading closed with an exchange of 5,083,717 shares for a total sum of $55,164,698 compared to 11,714,898 units at $61,785,252 on Tuesday.

Trading closed with an exchange of 5,083,717 shares for a total sum of $55,164,698 compared to 11,714,898 units at $61,785,252 on Tuesday. The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

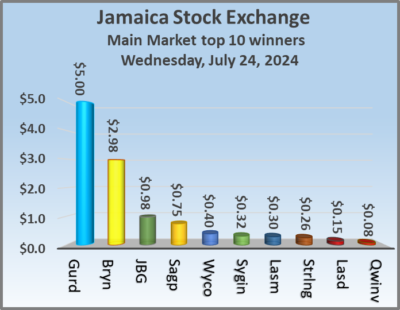

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. NCB Financial slipped 40 cents in closing at $52 after closing with an exchange of 6,993 stocks, Pan Jamaica fell $1.99 to $47, with 3,282 shares crossing the exchange, Proven Investments declined $1.19 and ended at $18.50 with investors trading 4,057 stock units. Sagicor Group climbed 75 cents to $40.75 after a transfer of 6,473 shares, Scotia Group skidded $1.24 to end at $44 with traders dealing in 23,673 units, Sygnus Credit Investments rose 32 cents and ended at $10.99 in an exchange of 226 stocks and Wisynco Group advanced 40 cents to close at $20.50 with investors trading 2,210,502 stock units.

NCB Financial slipped 40 cents in closing at $52 after closing with an exchange of 6,993 stocks, Pan Jamaica fell $1.99 to $47, with 3,282 shares crossing the exchange, Proven Investments declined $1.19 and ended at $18.50 with investors trading 4,057 stock units. Sagicor Group climbed 75 cents to $40.75 after a transfer of 6,473 shares, Scotia Group skidded $1.24 to end at $44 with traders dealing in 23,673 units, Sygnus Credit Investments rose 32 cents and ended at $10.99 in an exchange of 226 stocks and Wisynco Group advanced 40 cents to close at $20.50 with investors trading 2,210,502 stock units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

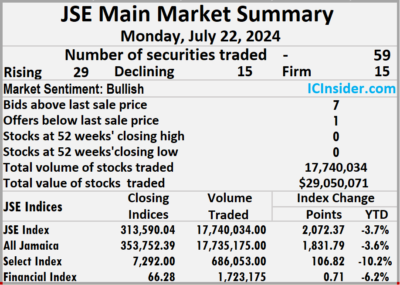

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with 11,714,898 shares being traded for $61,785,252 compared with 17,740,034 units at $29,050,071 on Monday.

The market closed with 11,714,898 shares being traded for $61,785,252 compared with 17,740,034 units at $29,050,071 on Monday. The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

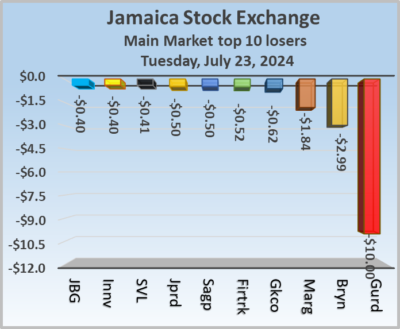

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Margaritaville sank $1.84 and ended at $13.60 with investors trading 3,003 stocks. NCB Financial popped 55 cents to finish at $52.40 after an exchange of 20,391 shares, Pan Jamaica climbed 98 cents to close at $48.99 with investors trading 10 stock units, Sagicor Group dropped 50 cents to end at $40 with 21,080 units crossing the exchange. Sterling Investments shed 36 cents to $2.04 with investors swapping 6,903 shares and Supreme Ventures skidded 41 cents to finish at $22.95 in an exchange of 1,300 stock units.

Margaritaville sank $1.84 and ended at $13.60 with investors trading 3,003 stocks. NCB Financial popped 55 cents to finish at $52.40 after an exchange of 20,391 shares, Pan Jamaica climbed 98 cents to close at $48.99 with investors trading 10 stock units, Sagicor Group dropped 50 cents to end at $40 with 21,080 units crossing the exchange. Sterling Investments shed 36 cents to $2.04 with investors swapping 6,903 shares and Supreme Ventures skidded 41 cents to finish at $22.95 in an exchange of 1,300 stock units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed on Monday with 17,740,034 shares being traded for $29,050,071 compared with 7,561,920 units at $37,357,214 on Friday.

The market closed on Monday with 17,740,034 shares being traded for $29,050,071 compared with 7,561,920 units at $37,357,214 on Friday. Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

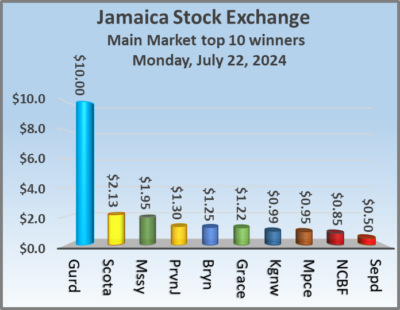

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer. MPC Caribbean Clean Energy climbed 95 cents to end at $107.95 in trading 298 stock units. NCB Financial popped 85 cents in closing at $51.85, with 13,264 shares crossing the exchange, Pan Jamaica shed 99 cents to $48.01 with investors swapping 120 units, Scotia Group gained $2.13 to finish at $45.20, with 44,969 stocks crossing the market. Seprod rose 50 cents and ended at $79 with an exchange of 510 stock units, Sygnus Real Estate Finance advanced 50 cents to close at $11 after 501 shares passed through the market and Wisynco Group rallied 32 cents to end at $20.20 after a transfer of 20,657 stocks.

MPC Caribbean Clean Energy climbed 95 cents to end at $107.95 in trading 298 stock units. NCB Financial popped 85 cents in closing at $51.85, with 13,264 shares crossing the exchange, Pan Jamaica shed 99 cents to $48.01 with investors swapping 120 units, Scotia Group gained $2.13 to finish at $45.20, with 44,969 stocks crossing the market. Seprod rose 50 cents and ended at $79 with an exchange of 510 stock units, Sygnus Real Estate Finance advanced 50 cents to close at $11 after 501 shares passed through the market and Wisynco Group rallied 32 cents to end at $20.20 after a transfer of 20,657 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Massy Holdings and

Massy Holdings and  The Main Market ended trading with an average PE Ratio of 14. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 14. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasted by ICInsider.com for companies with the financial year ending around August 2025.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.