Tropical Battery, the energy storage and power generation company is heading to the Jamaica Stock Exchange (JSE) Main Market by the end of this year, the company reported in a release to the JSE.

Tropical currently has operations in Jamaica, the Dominican Republic and the United States.

According to the company directors, “Since our listing on the Junior Market in September 2020, Tropical Battery has experienced substantial growth and is now surpassing the junior market’s $500 million capital requirement.  This strategic move to the Main Market reflects our commitment to continuing this trajectory of success and delivering enhanced value to our shareholders.” They go on to further state “Since our listing, revenue has grown more than threefold, from $1.8 billion to $5.7 billion forecasted for this fiscal year ending September 30, 2024.”

This strategic move to the Main Market reflects our commitment to continuing this trajectory of success and delivering enhanced value to our shareholders.” They go on to further state “Since our listing, revenue has grown more than threefold, from $1.8 billion to $5.7 billion forecasted for this fiscal year ending September 30, 2024.”

The company incurred a large amount of debt in funding recent acquisitions, with long term loans amounting to $2.9 billion and shareholders’ equity of only just $1.14 billion, in addition, the group has short term loans amounting to $1.8 billion. With gross cash flows from operations in 2023 amounting to $260 million and cash on hand of $429 million in March this year, funds on hand and to be generated over twelve months are not likely to be able to pay off the short term borrowings. Regardless, the heavy debt load is unhealthy and the company will need to bring the debt down to be in line with total equity. Accordingly, they will need the avenue of the Main Market to raise around $2 billion in equity to rebalance the financial position.

For the six months to March, the company reported revenues of $2.36 billion with $1.55 billion generated in the March quarter, with the operations producing $100 million in profit before minority interest and $164 million for the half year, excluding $77 million that was expensed relating to the acquisition of a subsidiary.

Tropical Battery to migrate

Lumber Depot buys 35% of Atlantic Hardware

Lumber Depot announced the acquisition of a 35 percent in Atlantic Hardware & Plumbing Company Limited, a 30 year old Jamaican company, engaged in the wholesaling and distribution of hardware, building materials, plumbing, electrical, tools, and supplies to hardware stores, contractors, and developers across Jamaica.

Lumber Depot acquisition announcement.

The business located on “Ashenheim Road in Kingston is led by Managing Director, Deanall Barnes, an experienced business leader in the trading and distribution of building materials”, the release from Lumber Depot states.

There will be no change to the business strategy of Atlantic. Accordingly, it will continue to operate as a dedicated hardware wholesaler and distributor. The acquisition’s purchase price is $210 million and was funded with internal funds.

The investment will account for from May 1, 2024 by Lumber Depot. The majority shareholder of Atlantic is Construct Group, a private investment company.

Lumber Depot did not disclose either revenues nor profitability of the company in which the shares were acquired. ICInsider.com projects the company to get a boost in profits as a result of the investment, that should exceed the returns they were getting on the liquid funds they held. The Lumber Depot netted a 25 percent per annum return on equity up to the February quarter as such, it is unlikely that they did not pay much more than 4 time earnings for the 35 percent acquired and that would boost profit for Lumber Depot around $70 million and earnings per share in the region of 36 cents for the current fiscal year. There are also prospects for economies of scale, particularly in the purchase and importation of goods for resale that could result in cost savings, in the future.

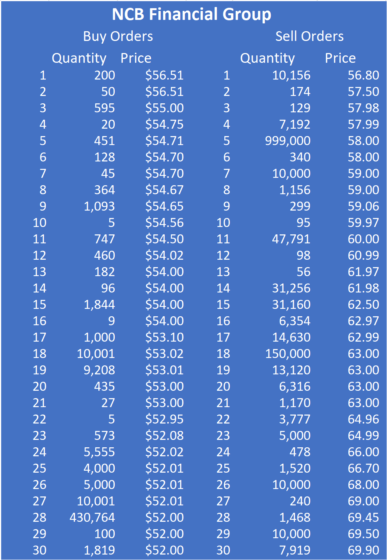

NCB Financial stock offer a long term investment

NCB Financial will be offering 78.5 million Ordinary Shares to the public to purchase at $65 per each of which 785,000 are Reserved Shares for staff at $58.

NCB Financial

The issue opens on May 6 at 9 AM and is slated to close on May 27, 2024 subject to the right of the Company to close it at any time after the opening date once the Invitation is fully subscribed.

The issue may be upsized to a maximum of 117.75 million shares. The issue is expected to raise between $5 billion if only the initial offer is subscribed to and up to $7.6 billion if the issue is upsized to the maximum.

The number of shares being initially offered will raise the issued share capital from 2.545 billion units to 2.624 billion and if the amount is upsized fully, to 2.663 billion.

The financial group states that they “intend to use the net proceeds from this Invitation to support a part of our deliberate plan to reallocate capital with a focus on reducing debt and bolstering the capital in the NCB Financial Group. This APO is one of multiple strategies that the NCB.”

Equity attributable to stockholders of the parent totalled $159.7 billion, an increase of $27.1 billion or 20 percent over the prior year. The growth in equity was mainly attributable to increased retained earnings and a reduction in unrealised fair value losses.

An APO brings an additional supply of shares to the market and will satisfy the demand for a large pool of investors for several months if not years, as such the issue is likely to keep the price of the stock subdued for some time unless there is a big jump in profitability to make them more attractive as an investment and thus encourage increased buying to move the stock price up appreciably.

An APO brings an additional supply of shares to the market and will satisfy the demand for a large pool of investors for several months if not years, as such the issue is likely to keep the price of the stock subdued for some time unless there is a big jump in profitability to make them more attractive as an investment and thus encourage increased buying to move the stock price up appreciably.

Recent issues of APO, except for those issued by Barita Investments send a cautionary note for investors looking for early capital gains. While the APO is priced at $65, the stock is trading closer to $63 on the Jamaica Stock Exchange.

NCBFG and its subsidiaries operate in 21 territories across the Caribbean, with the main operating territories being Jamaica, Trinidad & Tobago, Dutch Antilles, and Bermuda. The Group’s business, results of operations and financial condition are materially affected by the economic, social and political conditions of these countries.

Grace up stakes in Spur Tree Spices

The GraceKennedy a wholly owned subsidiary – GK Investments Limited, purchased 60,000,000 units of shares in Spur Tree Spices thereby increasing its ownership to 20.18 percent. this was the objective Grace had before the company went public.

The GraceKennedy a wholly owned subsidiary – GK Investments Limited, purchased 60,000,000 units of shares in Spur Tree Spices thereby increasing its ownership to 20.18 percent. this was the objective Grace had before the company went public.

On Wednesday Spur Tree reported that two directors sold 30 million units each, which seems to have met the demand from Grace, but it may not be the last of the big trades for the company whose products have strong appeal internationally.

The company has been struggling to grow its profit since listing on the Junior Market in 2022. Profit of $116 million fell to $88 million in 2023, with earnings per share of 5 cents last year and 7 cents in 2022.

Spur Three stock traded at $2.42, up 2 cents on the junior Market of the Jamaica Stock Exchange on Thursday.

Two Lasco companies head to JSE Main Market

Lasco Distributors and Lasco Manufacturing will be graduating to the main market of the Jamaica Stock Exchange, effective Wednesday, March 27, 2024.

The companies state in their report to investors and posted on the Jamaica Stock Exchange stated that the exchange approved to graduate to the Main Market.

The Lasco companies were some of the early listings on the Junior Market in 2010, with a listing on October 12, 2010.

In the first year of listing on the Junior Market, Lasco Manufacturing generated revenues of $2.97 billion and a profit of $401 million after tax and reported for the nine months to December last year, revenues of $9.24 billion and profit of $1.7 billion, with Shareholders’ equity climbing to $12.3 billion from $830 million at the end of March 2011.

Lasco Distributors reported revenues of $6.76 billion and a profit of $306 million after tax for the year to March 2011 and generated revenues of $21.86 billion for the nine months to December last year and profit of $1.2 billion, with Shareholders’ equity climbing to $9.25 billion from $727 million at the end of September 2010.

Supply is low for Scotia Group’s stock

The supply of Scotia Group stock is increasingly falling, with only 14 offers for sale of 144,000 shares posted at the close on Friday. The stock price jumped 14 percent this past week to a multi-year high of $46 and is up 20 percent since the start of 2024 and 32.5 percent since the publication of full year results on December 11.

The supply of Scotia Group stock is increasingly falling, with only 14 offers for sale of 144,000 shares posted at the close on Friday. The stock price jumped 14 percent this past week to a multi-year high of $46 and is up 20 percent since the start of 2024 and 32.5 percent since the publication of full year results on December 11.

Investors exchanged 135,109 shares on Friday up from 19,113 on Thursday and 80,990 on Wednesday. The number of stocks offered for sale and posted on the JSE site is very low with 144,000 units, supply is likely to increase as trading unfolds during the coming week.

Despite the price move since last year, the stock is attractively priced at a PE of 6 based on this year’s projected earnings of $7.50 and 8.30 based on reported the 2023 earnings of $5.54 per share. The valuation compares with an average of 13.7 for the Main Market based on projected 2023 earnings. At an average market PE, the stock would get to $76 based on earnings for 2023 and more, once investors start pricing in 2024 earnings into the price.

Despite the price move since last year, the stock is attractively priced at a PE of 6 based on this year’s projected earnings of $7.50 and 8.30 based on reported the 2023 earnings of $5.54 per share. The valuation compares with an average of 13.7 for the Main Market based on projected 2023 earnings. At an average market PE, the stock would get to $76 based on earnings for 2023 and more, once investors start pricing in 2024 earnings into the price.

The price broke through the top of a channel, formed in late November. This coming week may determine whether the price will move decidedly higher or stall for a while.

Scotia is not the only stock with shrinking supplies that investors should take note of. Not only is it a bullish signal but it foretells of a sharp rally ahead. Investors should also look at Transjamaican Highway, Stanley Motta, AS Bryden and Seprod.

Mayberry Group swapped for Mayberry Investments

Mayberry Investments ceased to be listed on the Jamaica Stock Exchange as of the 13th of December and is replaced by Mayberry Group, the new holding company for the group.

The change follows the court’s approval of the reorganization of the group and permission of the Jamaica Stock Exchange. Shareholders of Mayberry Investments (MIL) will get shares in the group company in exchange for their existing shareholdings in MIL.

Mayberry has shareholders’ equity of $24.5 billion and total assets of $58 billion as of September 2023. MIL last traded on the Jamaica Stock Exchange at $8.08, so far there is no trading in the new shares and no stocks are being offered for sale.

Investors buying into the public offer of NCB Financial Group stock at $65 each in May are hugging up an 18 percent loss on their investment since, with the stock hitting a 52 weeks’ low of $54.66 on Monday and ending at a closing low of $55 after more than 1.5 million shares were traded, following a sizable 3 million share trade on June 17, when the stock closed at $59.

Investors buying into the public offer of NCB Financial Group stock at $65 each in May are hugging up an 18 percent loss on their investment since, with the stock hitting a 52 weeks’ low of $54.66 on Monday and ending at a closing low of $55 after more than 1.5 million shares were traded, following a sizable 3 million share trade on June 17, when the stock closed at $59. NCB is a diversified financial group, providing services in general insurance, life insurance, banking and investments management. The group is also geographically diversified with operations in Trinidad, Bermuda and Jamaica. It has a solid base that it can use to produce increased revenues and profits in the future.

NCB is a diversified financial group, providing services in general insurance, life insurance, banking and investments management. The group is also geographically diversified with operations in Trinidad, Bermuda and Jamaica. It has a solid base that it can use to produce increased revenues and profits in the future.

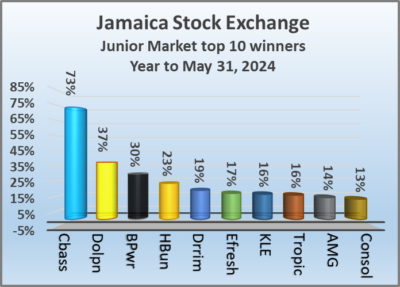

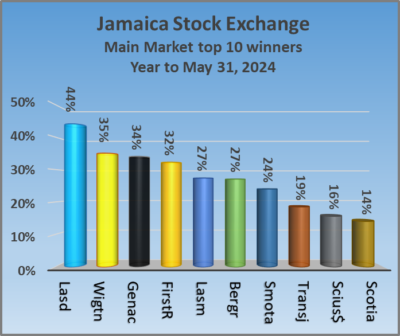

The Jamaica Stock Exchange Main and Junior Markets recorded mild declines for the year to the end of May, at the same time the Top 10 performing stocks all posted double digit gains with Caribbean Assurance Brokers landing a 73 percent increase to be the best performing stock in both markets.

The Jamaica Stock Exchange Main and Junior Markets recorded mild declines for the year to the end of May, at the same time the Top 10 performing stocks all posted double digit gains with Caribbean Assurance Brokers landing a 73 percent increase to be the best performing stock in both markets.  General Accident another former Junior Market stock that migrated last year, up 34 percent, with profit reported in the 2023 audited accounts beating expectations and followed by 30 percent rise in the 2024 first quarter profit before taxation. First Rock gained 32 percent and Lasco Manufacturing with improved full year results over 2023 posted gains of 27 percent.

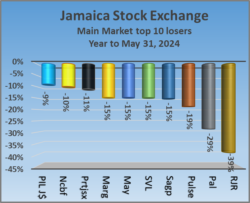

General Accident another former Junior Market stock that migrated last year, up 34 percent, with profit reported in the 2023 audited accounts beating expectations and followed by 30 percent rise in the 2024 first quarter profit before taxation. First Rock gained 32 percent and Lasco Manufacturing with improved full year results over 2023 posted gains of 27 percent. Pulse Investment lost 19 percent and the Sagicor Group 15 percent.

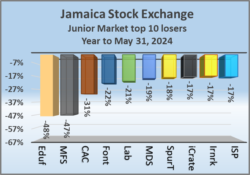

Pulse Investment lost 19 percent and the Sagicor Group 15 percent. Edufocal fell 48 percent to be the worst performing Junior Market stock followed by MFS Partners with a fall of 47 percent and CAC 2000 down 31 percent, following continued poor results. Also declining are Fontana down 22 percent and Limners and Bards had a fall of 21 percent

Edufocal fell 48 percent to be the worst performing Junior Market stock followed by MFS Partners with a fall of 47 percent and CAC 2000 down 31 percent, following continued poor results. Also declining are Fontana down 22 percent and Limners and Bards had a fall of 21 percent The position of Chief Executive Officer is a new one, in addition, the position of Head of Energy which was held by Miss Michelle Chin Lenn will be dispensed with and she will be appointed to the new position of Deputy Chief Executive Officer.

The position of Chief Executive Officer is a new one, in addition, the position of Head of Energy which was held by Miss Michelle Chin Lenn will be dispensed with and she will be appointed to the new position of Deputy Chief Executive Officer.