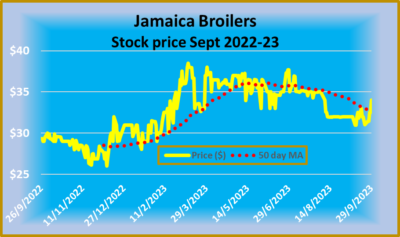

Scotia Group recently reported record profits for the year to October, surging 67 percent to $17.23 billion with earnings of $5.54 per share, from revenues that jumped 29 percent to $59.64 billion but based on the reaction of investors the results seem to hardly matter with the stock valued a mere 6.5 times historical earnings compared with a market average of 13, nevertheless, the price hit a yearly high of $36.69 this past Friday as selling has eased considerably, with a few open offers to sell.

The group declared a dividend payable in January of 40 cents for a second consecutive quarter putting it at $1.60 annualised, for a 4.6 percent yield based on the current price. Traditionally the group was committed to paying 40 to 50 percent of profits, this seems to have temporarily changed with the fallout from the Covid-19 pandemic but could return in the near future.

The group declared a dividend payable in January of 40 cents for a second consecutive quarter putting it at $1.60 annualised, for a 4.6 percent yield based on the current price. Traditionally the group was committed to paying 40 to 50 percent of profits, this seems to have temporarily changed with the fallout from the Covid-19 pandemic but could return in the near future.

The October quarter saw profit popping a robust 49 percent to $4.4 billion from $2.98 billion in 2022 with revenues rising 24 percent to $15.79 billion from 12.8 billion.

The good news does not end there. ICinsider.com is forecasting earnings of $7.50 for the 2024 fiscal year, with the PE ratio at just 4.8 times earnings making it a stunning buy at the current price of $36, the stock closed at on Friday. The group has many of the qualities for an excellent investment, good management, quality products and services that are in demand, a growing business and increasing profitability and best of all the stock price is well below the market average, with the potential for a major rise in the near term.

While the 2023 performance looks dramatic compared with the pre-Covid period it is more one of recovery as opposed to rapid growth as the increase over 2019 is just 31 percent, representing a 6 percent increase per annum as loans grew 31 percent as well since the end of 2019.

Highlights of the good performance came from interest income, with the quarter jumping 22 percent to $11.6 billion from $9.5 billion in 2022 and by 31 percent for the full year to $40.8 billion with loans disbursed growing a robust 15 percent to $269 billion from $234.7 billion in 2022, after loan loss provisions. Non-accrual loans stood at $4.5 billion compared to $4 billion at the end of October 2022 and represent 1.6 percent of gross loans compared to October 2022 at 1.7 percent.

Highlights of the good performance came from interest income, with the quarter jumping 22 percent to $11.6 billion from $9.5 billion in 2022 and by 31 percent for the full year to $40.8 billion with loans disbursed growing a robust 15 percent to $269 billion from $234.7 billion in 2022, after loan loss provisions. Non-accrual loans stood at $4.5 billion compared to $4 billion at the end of October 2022 and represent 1.6 percent of gross loans compared to October 2022 at 1.7 percent.

Also contributing to the growth in interest income was an increase in funds held in cash resources and investments of $343 billion up from $316 billion in 2022.

Insurance revenues fell 5 percent from $1 billion to $961 million in the quarter and surged 49 percent from $1.87 billion to $2.79 billion for the year.

Audrey Tugwell Henry Scotia group’s CEO

Deposits grew 12.7 percent from $399 billion to $449 billion, but the cost of funds grew 138 percent from $580 million in 2022 to $1.38 billion and 207 percent from $152 million in the final quarter to $466 million as interest rates rose sharply following Bank of Jamaica’s increase in the overnight rate in during late 2021 into 2022 and the maintenance of tight liquidity in the system by the country’s central bank.

Amounts set aside for expected credit losses fell 16 percent to $741 million in the quarter from the 2022 quarter’s $880 million and from $3.06 billion for the year in 2022 to $2.4 billion in 2023.

Other Income delivered $3.23 billion in the final quarter of the year versus $2.26 billion in 2022 and for the 2023 year ending October an increase of 22 percent to $16 billion from $13 billion in 2022, with foreign exchange trading and fees and commission dominating.

Operating expenses rose 6 percent in the final quarter to $6.8 billion from $6.39 billion in 2022 and for the twelve months to $27.6 billion up 11.7 percent from $24.7 billion.

The group’s Shareholders’ equity ended the fiscal year at $126.5 billion, increasing by $20 billion, compared to the previous fiscal year, due primarily to re-measurement of defined benefit pension plan assets,  lower fair value losses on the investment portfolio, recognition of the insurance finance reserve on the adoption of IFRS 17 and profit generated for the year, partially offset by dividends paid. Total assets grew by $70 billion to $665 billion at October 2023.

lower fair value losses on the investment portfolio, recognition of the insurance finance reserve on the adoption of IFRS 17 and profit generated for the year, partially offset by dividends paid. Total assets grew by $70 billion to $665 billion at October 2023.

ICInsider.com rates the stock a strong buy, with the potential to deliver attractive dividend yields going forward and a huge increase in the stock price in the months ahead. The future appears bright with continued growth in the local economy that sets the stage for more lending. 2024 could well deliver some negatives as the Bank of Jamaica holds interest rates at excessively high levels and ushers in a recession. Additionally, interest rates could start to decline and negatively affect net interest income. Regardless the stock is priced so low currently that most bad news to come if any is more than taken into consideration by the current pricing.

Administrative costs declined marginally from $2.98 billion to $2.92 billion in the current period, distribution costs rose four percent from $690 million to $720 million, finance costs almost doubled, moving from $320 million to $633 million, taxation moved up from $332 million to $393 million during the 2023 quarter.

Administrative costs declined marginally from $2.98 billion to $2.92 billion in the current period, distribution costs rose four percent from $690 million to $720 million, finance costs almost doubled, moving from $320 million to $633 million, taxation moved up from $332 million to $393 million during the 2023 quarter. Cash inflows before working capital requirements for $3.4 billion and is up from $2.6 billion in the previous year after working capital funding rose, the group ended up with a negative cash flow of $2 billion that is up from $1 billion in the previous year.

Cash inflows before working capital requirements for $3.4 billion and is up from $2.6 billion in the previous year after working capital funding rose, the group ended up with a negative cash flow of $2 billion that is up from $1 billion in the previous year. Trades by directors and connected parties in listed companies may speak volumes about what is currently occurring in their operations and can be a short term signal to follow. Not all trades have immediate significance, as they may be for reasons unrelated to the company’s performance, like the need for cash or reallocation of investments; regardless, investors would be well advised to take a keen interest in such actions.

Trades by directors and connected parties in listed companies may speak volumes about what is currently occurring in their operations and can be a short term signal to follow. Not all trades have immediate significance, as they may be for reasons unrelated to the company’s performance, like the need for cash or reallocation of investments; regardless, investors would be well advised to take a keen interest in such actions.

Earnings per share amounted to $2.67 for the September quarter and $4.55 for the nine months to September, that should end the year around $7 per share, with a PE of 3.5 times current year’s earnings and a stock price at J$530.

Earnings per share amounted to $2.67 for the September quarter and $4.55 for the nine months to September, that should end the year around $7 per share, with a PE of 3.5 times current year’s earnings and a stock price at J$530.

We projected revenues of $1.465 billion and they delivered $1.449 billion in the quarter. Our forecast for TV revenues was $626.344 million, they reported $639.377. Radio revenues came in at $199.605, somewhat higher than ICInsider.com’s projection of $184.05 and the print division delivered $610,217 million versus ICI’s forecast of $635,697. Other income amounts to $29 million versus IC forecast of $19 million.

We projected revenues of $1.465 billion and they delivered $1.449 billion in the quarter. Our forecast for TV revenues was $626.344 million, they reported $639.377. Radio revenues came in at $199.605, somewhat higher than ICInsider.com’s projection of $184.05 and the print division delivered $610,217 million versus ICI’s forecast of $635,697. Other income amounts to $29 million versus IC forecast of $19 million.

The company enjoys a ten-year tax profit break and will be subject to zero taxation until mid-2022 and 50 percent thereafter for five years.

The company enjoys a ten-year tax profit break and will be subject to zero taxation until mid-2022 and 50 percent thereafter for five years. Cash funds and investments amount to $121 million after the company generated cash funds of $69 million before working capital and capital financing needs. ICInsider.com projects earnings of $1 for the financial year to December 2021 and $1.60 for 2022.

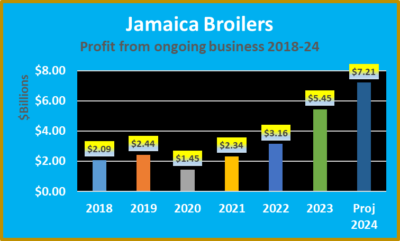

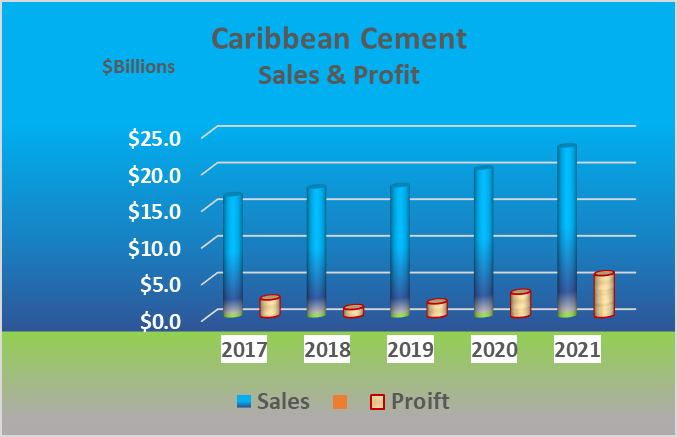

Cash funds and investments amount to $121 million after the company generated cash funds of $69 million before working capital and capital financing needs. ICInsider.com projects earnings of $1 for the financial year to December 2021 and $1.60 for 2022. For the year, profit after tax surged 70 percent to $3.2 billion after tax provision of $1.2 billion. The tax charge includes deferred tax amounting to $414 million, down from $664 million in 2019. The results would have been far better but for a billion loss in foreign exchange movement, but interest cost fell from $939 million to $812 million, partially cushioning some exchange losses. Interest cost will fall further in 2021 as the debt load recedes with the strong cash flows allowing for the rapid repayment of the $4.4 billion of long term loans.

For the year, profit after tax surged 70 percent to $3.2 billion after tax provision of $1.2 billion. The tax charge includes deferred tax amounting to $414 million, down from $664 million in 2019. The results would have been far better but for a billion loss in foreign exchange movement, but interest cost fell from $939 million to $812 million, partially cushioning some exchange losses. Interest cost will fall further in 2021 as the debt load recedes with the strong cash flows allowing for the rapid repayment of the $4.4 billion of long term loans. At the end of the year, shareholders’ equity moved to $11.5 billion from $8.3 billion at the end of 2019. The stock is one of the original

At the end of the year, shareholders’ equity moved to $11.5 billion from $8.3 billion at the end of 2019. The stock is one of the original

The group earned 6.26 per share for the year versus $4.51 in 2019 and the stock price closed on Friday with a last traded price of $84.50 for a PE ratio of 13, well below the market average of 20. ICInsider.com projects 2021 earnings of $11 per share and see the stock heading close to $200 for the year and receives the coveted

The group earned 6.26 per share for the year versus $4.51 in 2019 and the stock price closed on Friday with a last traded price of $84.50 for a PE ratio of 13, well below the market average of 20. ICInsider.com projects 2021 earnings of $11 per share and see the stock heading close to $200 for the year and receives the coveted