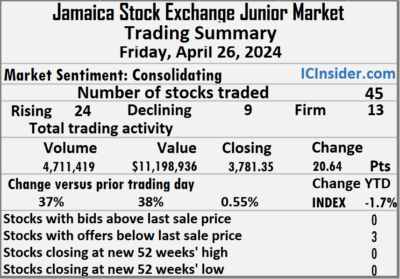

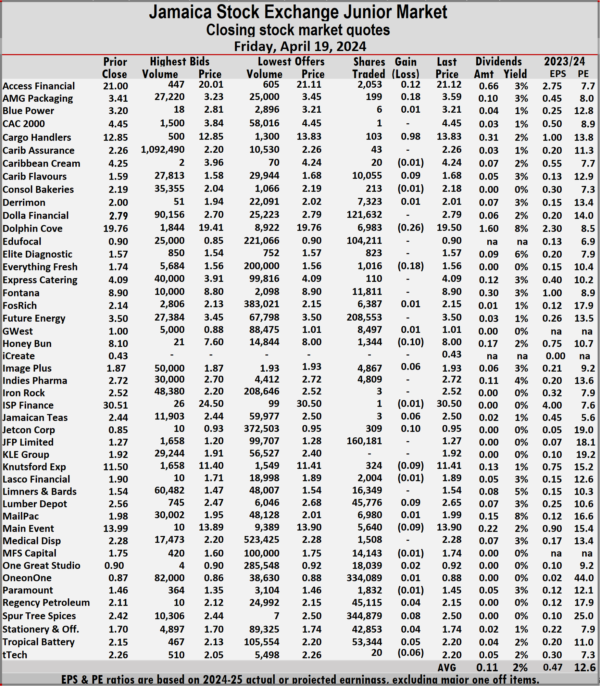

Stocks mostly rose on the Junior Market of the Jamaica Stock Exchange on Friday, after trading in 45 securities compared with 40 on Thursday and ending with prices of 24 rising, 9 declining and 12 closing unchanged following a 37 percent rise in the volume of stocks traded, with 38 percent greater value than Thursday.

At the close of trading, the Junior Market Index rallied 20.64 points to end the day at 3,781.35.

At the close of trading, the Junior Market Index rallied 20.64 points to end the day at 3,781.35.

Trading ended with 4,711,419 shares for $11,198,936 up from 3,441,451 units at $8,137,990 on Thursday.

Trading averaged 104,698 shares at $248,865, up from 86,036 units at $203,450 on Thursday with the month to date, averaging 189,955 units at $422,648 but slightly down from 194,892 stock units at $432,712 on the previous day and March ending with an average of 221,659 units at $464,382.

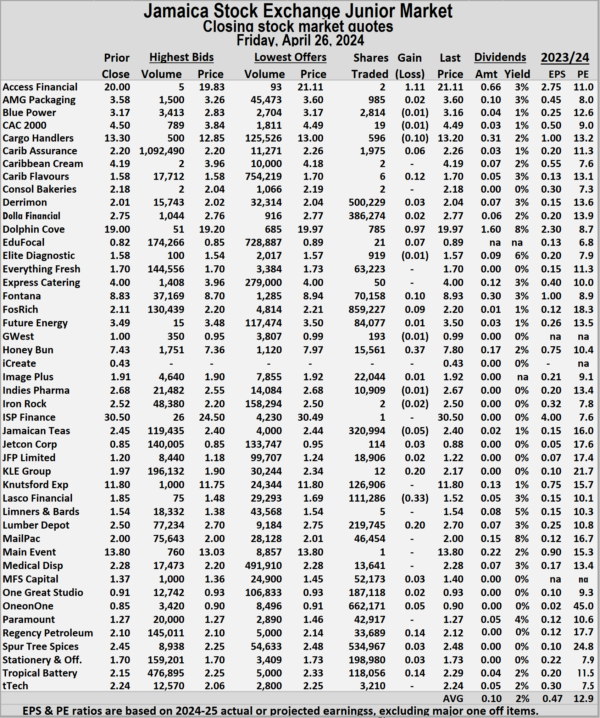

Fosrich led trading with 859,227 shares for 18.2 percent of total volume followed by ONE on ONE Educational with 662,171 units for 14.1 percent of the day’s trade and Spur Tree Spices with 534,967 units for 11.4 percent market share.

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and three with lower offers.

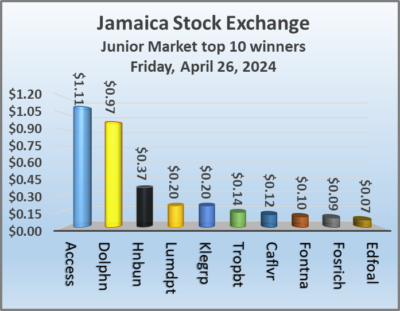

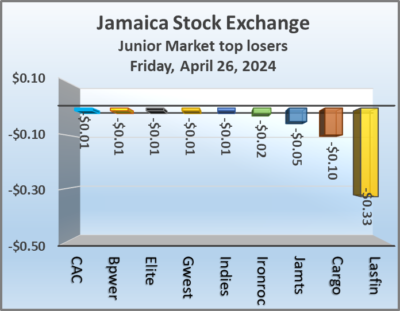

At the close, Access Financial gained $1.11 to end at $21.11, after just two stocks passed through the market, Cargo Handlers dipped 10 cents in closing at $13.20 with traders dealing in 596 units, Caribbean Assurance Brokers rose 6 cents to close at $2.26 with 1,975 shares clearing the market. Caribbean Flavours advanced 12 cents to end at $1.70 with investors swapping a mere 6 stock units, Dolphin Cove popped 97 cents to finish at $19.97 with an exchange of just 785 shares, EduFocal rallied 7 cents and ended at 89 cents, with 21 stocks crossing the market.  Fontana increased 10 cents to $8.93 in an exchange of 70,158 units, Fosrich climbed 9 cents in closing at $2.20 with investors dealing in 859,227 stock units, Honey Bun popped 37 cents to finish at $7.80 in an exchange of 15,561 shares. Jamaican Teas lost 5 cents and ended at $2.40 with investors trading 320,994 stock units, KLE Group increased 20 cents to close at $2.17 after an exchange of 12 stocks, Lasco Financial slipped 33 cents to end at $1.52 with 111,286 units passing through the market. Lumber Depot climbed 20 cents to $2.70 after a transfer of 219,745 shares, ONE on ONE Educational rose 5 cents to finish at 90 cents as investors exchanged 662,171 units and Tropical Battery rallied 14 cents and ended at $2.29 and closed with an exchange of 118,056 stocks.

Fontana increased 10 cents to $8.93 in an exchange of 70,158 units, Fosrich climbed 9 cents in closing at $2.20 with investors dealing in 859,227 stock units, Honey Bun popped 37 cents to finish at $7.80 in an exchange of 15,561 shares. Jamaican Teas lost 5 cents and ended at $2.40 with investors trading 320,994 stock units, KLE Group increased 20 cents to close at $2.17 after an exchange of 12 stocks, Lasco Financial slipped 33 cents to end at $1.52 with 111,286 units passing through the market. Lumber Depot climbed 20 cents to $2.70 after a transfer of 219,745 shares, ONE on ONE Educational rose 5 cents to finish at 90 cents as investors exchanged 662,171 units and Tropical Battery rallied 14 cents and ended at $2.29 and closed with an exchange of 118,056 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Junior Market gains

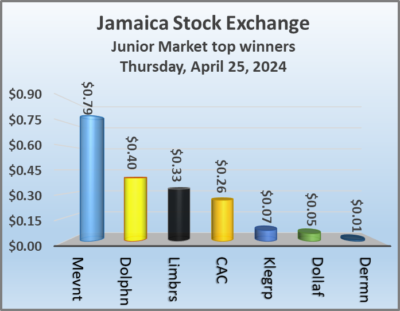

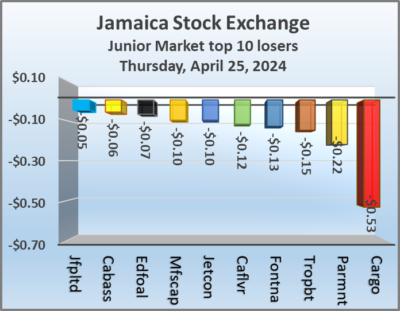

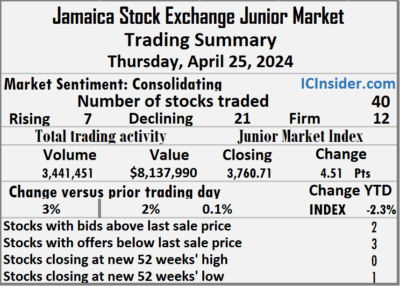

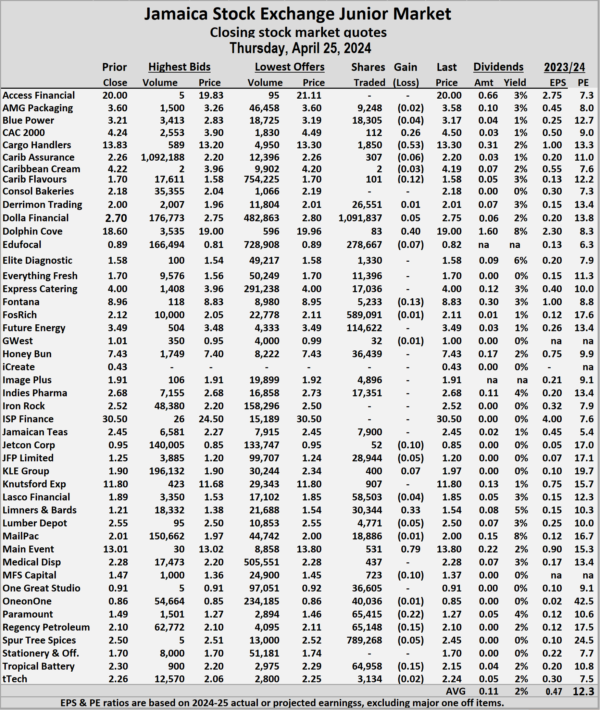

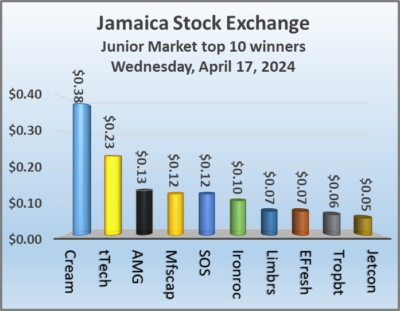

Few Junior Market winners

Winning stocks were hard to come by as trading closed on the Junior Market of the Jamaica Stock Exchange on Thursday, with trading in 40 securities down from 41 on Wednesday and ending with prices of just seven rising, 21 declining and 12 closing unchanged following a moderate rise in the volume and value of stocks that were exchanged on Wednesday.

The market closed with trading of 3,441,451 shares for $8,137,990 up from 3,333,072 units at $7,971,094 on Wednesday.

The market closed with trading of 3,441,451 shares for $8,137,990 up from 3,333,072 units at $7,971,094 on Wednesday.

Trading averaged 86,036 shares at $203,450 compared to 81,294 units at $194,417 on Wednesday, with a month to date average of 194,892 units at $432,712 down from 200,800 stocks at $445,155 on the previous day and March with an average of 221,659 units at $464,382.

Dolla Financial led trading with 1.09 million shares for 31.7 percent of total volume followed by Spur Tree Spices with 789,268 stock units for 22.9 percent of the day’s trade and Fosrich with 589,091 units for 17.1 percent market share.

At the close of trading, the Junior Market Index increased 4.51 points to settle at 3,760.71.

The Junior Market ended trading with an average PE Ratio of 12.3, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, CAC 2000 added 26 cents to finish at $4.50 after 112 shares were traded, Cargo Handlers dropped by 53 cents to $13.30 with investors trading 1,850 stocks, Caribbean Assurance Brokers fell 6 cents to close at $2.20 after investors ended the trading of 307 stock units. Caribbean Flavours fell 12 cents and ended at $1.58 with a transfer of 101 stocks, Dolla Financial rose 5 cents in closing at $2.75 after trading of 1,091,837 shares, Dolphin Cove rallied 40 cents to end at $19 after 83 stocks passed through the market. EduFocal shed 7 cents in closing at a 52 weeks’ low of 82 cents with investors dealing in 278,667 units, Fontana lost 13 cents to end at $8.83 after an exchange of 5,233 stock units, Jetcon Corporation skidded 10 cents to close at 85 cents with just 52 shares crossing the market.  JFP Ltd sank 5 cents to end at $1.20 with investors trading 28,944 stocks, KLE Group increased 7 cents and ended at $1.97 with an exchange of 400 units, Limners and Bards climbed 33 cents to finish at $1.54 with 30,344 stocks passing through the market. Lumber Depot slipped 5 cents to $2.50 and closed with an exchange of 4,771 shares, Main Event popped 79 cents in closing at $13.80 with traders dealing in 531 stock units, MFS Capital Partners dipped 10 cents and ended at $1.37 in switching ownership of 723 stocks. Paramount Trading sank 22 cents to finish at $1.27 with investors swapping 65,415 units, Spur Tree Spices skidded 5 cents to end at $2.45 in an exchange of 789,268 stocks and Tropical Battery lost 15 cents to close at $2.15 in trading 64,958 units.

JFP Ltd sank 5 cents to end at $1.20 with investors trading 28,944 stocks, KLE Group increased 7 cents and ended at $1.97 with an exchange of 400 units, Limners and Bards climbed 33 cents to finish at $1.54 with 30,344 stocks passing through the market. Lumber Depot slipped 5 cents to $2.50 and closed with an exchange of 4,771 shares, Main Event popped 79 cents in closing at $13.80 with traders dealing in 531 stock units, MFS Capital Partners dipped 10 cents and ended at $1.37 in switching ownership of 723 stocks. Paramount Trading sank 22 cents to finish at $1.27 with investors swapping 65,415 units, Spur Tree Spices skidded 5 cents to end at $2.45 in an exchange of 789,268 stocks and Tropical Battery lost 15 cents to close at $2.15 in trading 64,958 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

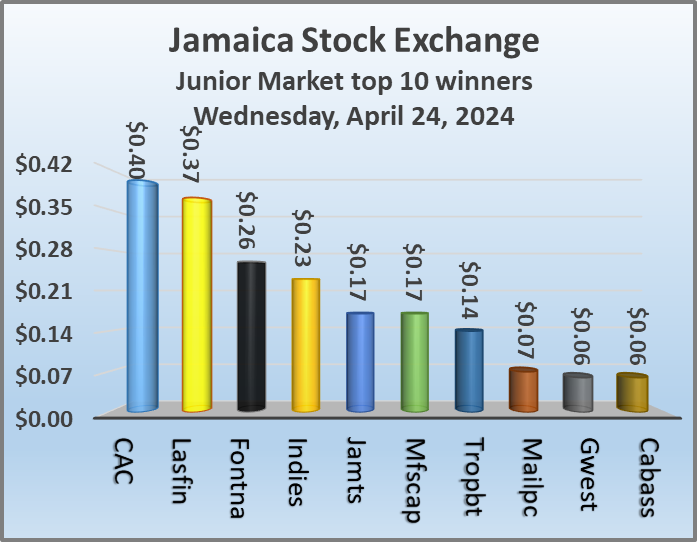

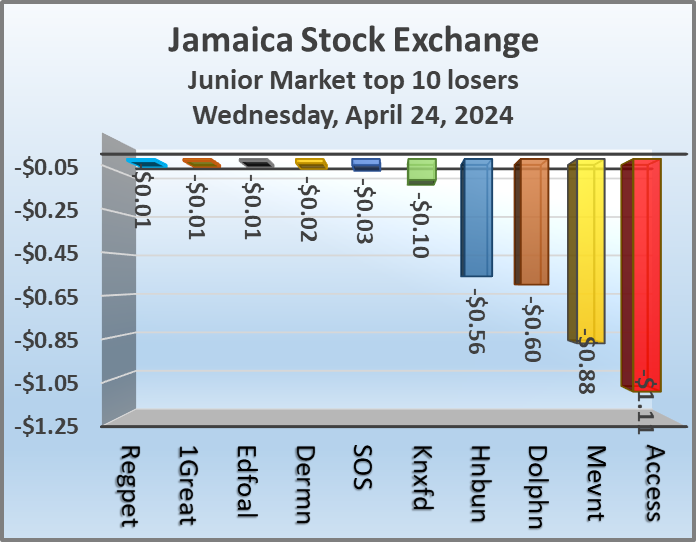

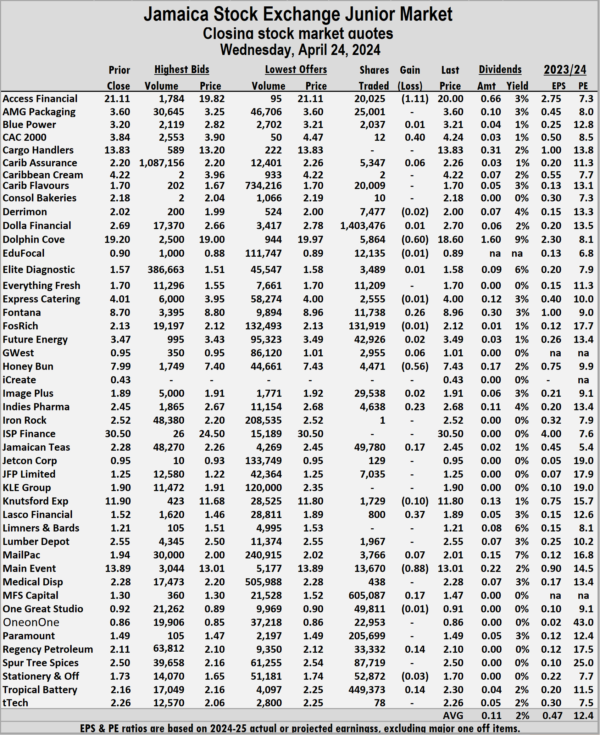

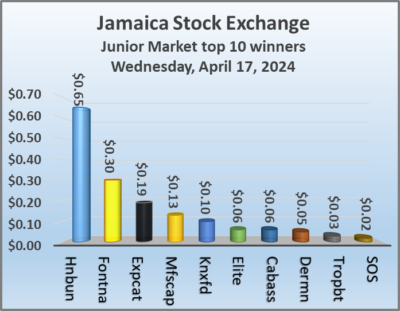

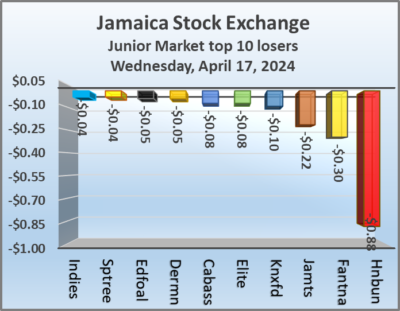

Rising Junior Market stocks beat losers

Rising Junior Market stock edged out those declining at the close of trading on the Jamaica Stock Exchange on Wednesday, with trading in 41 securities compared with 43 on Tuesday and ending with prices of 15 rising, 12 declining and 14 closing unchanged after a 33 percent decline in the volume of stocks traded, with a modest rise in value over that on Tuesday.

The market closed with trading of 3,333,072 shares with a value of $7,971,094 compared with 4,944,789 units at $7,691,275 on Tuesday.

The market closed with trading of 3,333,072 shares with a value of $7,971,094 compared with 4,944,789 units at $7,691,275 on Tuesday.

Trading averaged 81,294 shares at $194,417 compared to 114,995 units at $178,867 on Tuesday with a month to date average of 200,800 units at $445,155 compared to 207,840 stock units at $459,926 on the previous day and March averaging 221,659 units at $464,382.

Dolla Financial led trading with 1.40 million shares for 42.1 percent of total volume followed by MFS Capital Partners with 605,087 units for 18.2 percent of the day’s trade and Tropical Battery with 449,373 units for 13.5 percent market share.

The Junior Market Index increased 11.36 points to end at 3,756.20 at the close of trading.

The Junior Market ended trading with an average PE Ratio of 12.4, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.4, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Access Financial fell $1.11 to finish at $20 after a transfer of 20,025 shares, CAC 2000 popped 40 cents to $4.24 in switching ownership of 12 stocks, Caribbean Assurance Brokers increased 6 cents in closing at $2.26 with investors dealing in 5,347 shares. Dolphin Cove declined 60 cents to close at $18.60 after an exchange of 5,864 stock units, Fontana climbed 26 cents and ended at $8.96 with an exchange of 11,738 shares, GWest Corporation rose 6 cents to end at $1.01 with investors transferring 2,955 units. Honey Bun shed 56 cents in closing at $7.43 with 4,471 stocks passing through the market, Indies Pharma advanced 23 cents to $2.68 after exchanging 4,638 stock units,  Jamaican Teas gained 17 cents to close at $2.45 with 49,780 shares clearing the market. Knutsford Express sank 10 cents to end at $11.80 after investors ended trading 1,729 stock units, Lasco Financial rallied 37 cents to finish at $1.89, with just 800 units changing hands, Mailpac Group rose 7 cents and ended at $2.01 after an exchange of 3,766 stock units. Main Event dropped 88 cents to $13.01, with 13,670 units crossing the market, MFS Capital Partners advanced 17 cents after hitting an intraday 52 weeks’ low of $1.10 but ended at $1.47 with a transfer of 605,087 stocks and Tropical Battery popped 14 cents to close at $2.30 as investors exchanged 449,373 shares.

Jamaican Teas gained 17 cents to close at $2.45 with 49,780 shares clearing the market. Knutsford Express sank 10 cents to end at $11.80 after investors ended trading 1,729 stock units, Lasco Financial rallied 37 cents to finish at $1.89, with just 800 units changing hands, Mailpac Group rose 7 cents and ended at $2.01 after an exchange of 3,766 stock units. Main Event dropped 88 cents to $13.01, with 13,670 units crossing the market, MFS Capital Partners advanced 17 cents after hitting an intraday 52 weeks’ low of $1.10 but ended at $1.47 with a transfer of 605,087 stocks and Tropical Battery popped 14 cents to close at $2.30 as investors exchanged 449,373 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

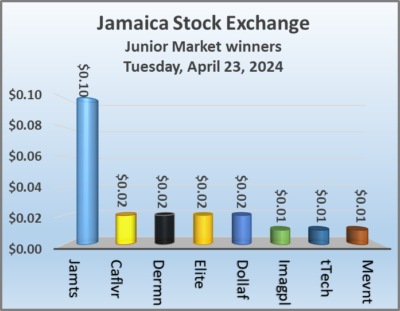

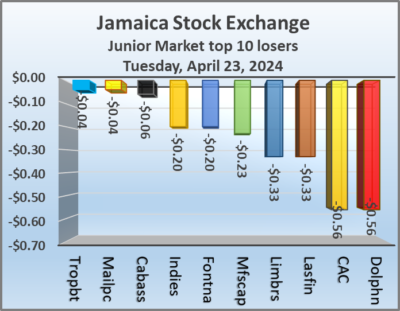

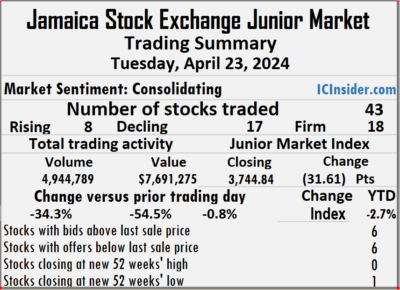

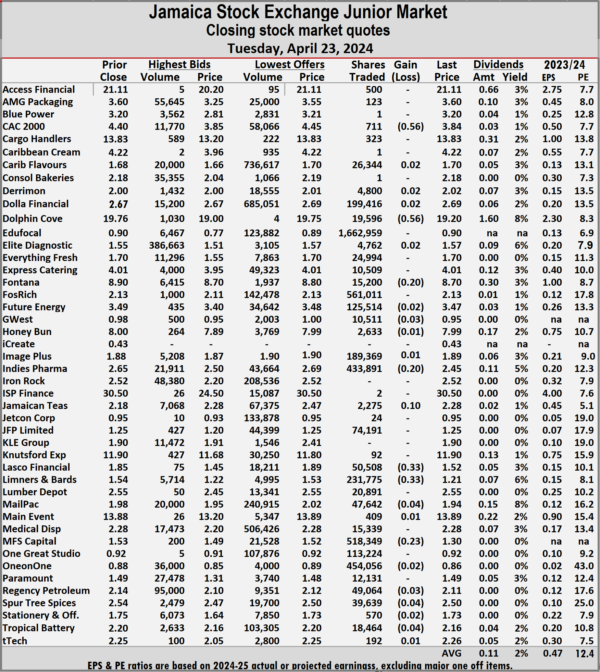

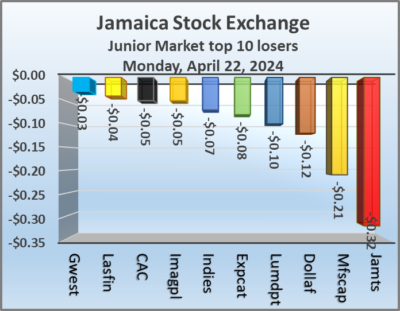

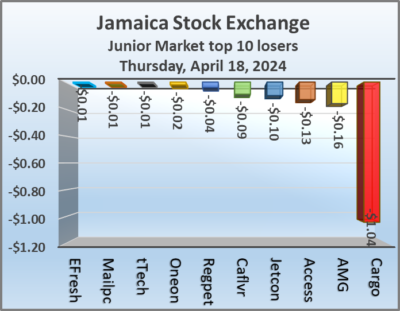

Falling stocks hit Junior Market

Falling stocks overwhelmed those rising at the end of trading on the Junior Market of the Jamaica Stock Exchange Tuesday, with trading in 43 securities compared with 45 on Monday and ending with prices of eight rising with modest gains, 17 declining and 18 closing unchanged, with the market closing with a 34 percent decline in the volume of stocks traded, after a 55 percent fall value than in trading on Monday.

The market closed trading of 4,944,789 shares for $7,691,275 compared with 7,528,822 stock units at $16,904,689 on Monday.

The market closed trading of 4,944,789 shares for $7,691,275 compared with 7,528,822 stock units at $16,904,689 on Monday.

Trading averaged 114,995 shares at $178,867 compared with 167,307 units at $375,660 on Monday with the month to date, averaging 207,840 units at $459,926 compared with 213,954 stock units at $478,434 on the previous day and March with an average of 221,659 units at $464,382.

EduFocal led trading with 1.66 million shares for 33.6 percent of total volume, but the stocks traded at an intraday 52 weeks’ low of 78 cents before closing at 90 cents and was followed by Fosrich with 561,011 units for 11.3 percent of the day’s trade and MFS Capital Partners with 518,349 units for 10.5 percent market share after trading at a 52 weeks’ low.

At the close of trading, the Junior Market Index declined 31.61 points to cease trading at 3,744.84.

At the close of trading, the Junior Market Index declined 31.61 points to cease trading at 3,744.84.

The Junior Market ended trading with an average PE Ratio of 12.4, based on the last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, CAC 2000 lost 56 cents and ended at $3.84 with investors transferring 711 stock units, Caribbean Assurance Brokers shed 6 cents to close at $2.20, with 2,783 shares crossing the market, Dolphin Cove declined 56 cents to close at $19.20 with a transfer of 19,596 units. Fontana fell 20 cents to end at $8.70 after an exchange of 15,200 stocks, Indies Pharma skidded 20 cents in closing at $2.45 with investors trading 433,891 units,  Jamaican Teas rallied 10 cents to finish at $2.28 after a transfer of 2,275 stocks. Lasco Financial sank 33 cents and ended at $1.52 with 50,508 shares clearing the market, Limners and Bards dropped 33 cents to $1.21 with an exchange of 231,775 stock units. Mailpac Group skidded 4 cents to close at $1.94 after a transfer of 47,642 shares, MFS Capital Partners dipped 23 cents to finish at a 52 weeks’ low of $1.30 after 518,349 shares crossed the market, Spur Tree Spices fell 4 cents to end at $2.50 and closed after 39,639 stocks changed hands and Tropical Battery dipped 4 cents in closing at $2.16 in an exchange of 18,464 units.

Jamaican Teas rallied 10 cents to finish at $2.28 after a transfer of 2,275 stocks. Lasco Financial sank 33 cents and ended at $1.52 with 50,508 shares clearing the market, Limners and Bards dropped 33 cents to $1.21 with an exchange of 231,775 stock units. Mailpac Group skidded 4 cents to close at $1.94 after a transfer of 47,642 shares, MFS Capital Partners dipped 23 cents to finish at a 52 weeks’ low of $1.30 after 518,349 shares crossed the market, Spur Tree Spices fell 4 cents to end at $2.50 and closed after 39,639 stocks changed hands and Tropical Battery dipped 4 cents in closing at $2.16 in an exchange of 18,464 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

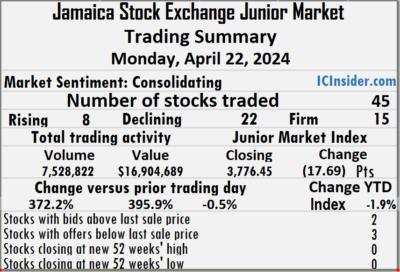

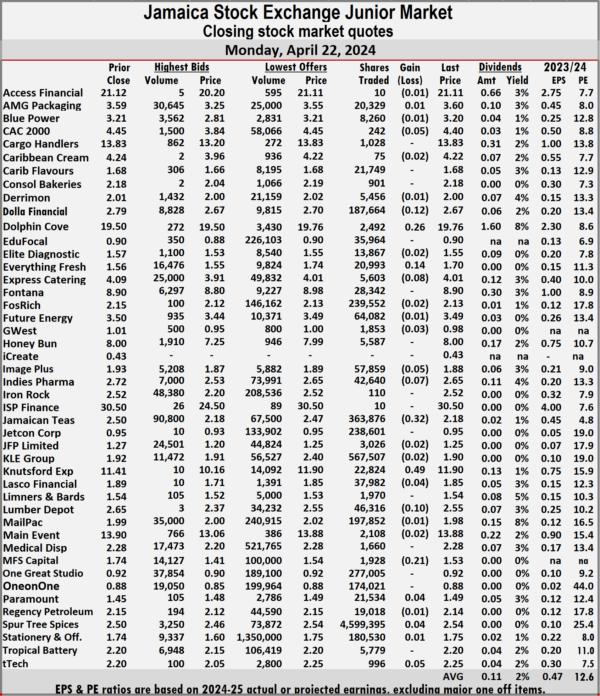

Trading jumps on Junior Market

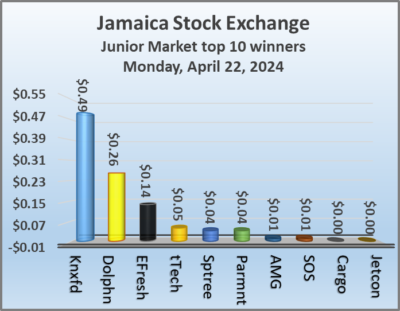

Trading jumped on the Junior Market of the Jamaica Stock Exchange Monday, with rising a 372 percent rise in the volume of stocks traded, with 396 percent more value than Friday following trading in 45 securities compared with 44 on Friday and ending with prices of only eight stocks rising, 22 declining and 15 closing unchanged.

The market closed with an exchange of 7,528,822 shares for $16,904,689, up from 1,594,451 units at $3,409,014 on Friday.

The market closed with an exchange of 7,528,822 shares for $16,904,689, up from 1,594,451 units at $3,409,014 on Friday.

Trading averaged 167,307 shares at $375,660, compared with 36,238 units at $77,478 on Friday with a month to date, average of 213,954 units at $478,434 compared to 217,407 stock units at $486,040 on the previous day and March with an average of 221,659 units at $464,382.

Spur Tree Spices led trading with 4.60 million shares for 61.1 percent of total volume followed by KLE Group with 567,507 units for 7.5 percent of the day’s trade and Jamaican Teas with 363,876 units for 4.8 percent market share.

At the close of trading, the Junior Market Index sank 17.69 points to 3,776.45.

The Junior Market ended trading with an average PE Ratio of 12.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, CAC 2000 fell 5 cents to end at $4.40 after a transfer of 242 units, Dolla Financial lost 12 cents in closing at $2.67, with 187,664 stocks crossing the market, Dolphin Cove rallied 26 cents to $19.76 after investors exchanged 2,492 shares. Everything Fresh popped 14 cents and ended at $1.70 after trading 20,993 stock units, Express Catering declined 8 cents to close at $4.01, with 5,603 shares crossing the exchange, Image Plus shed 5 cents to finish at $1.88 with investors swapping 57,859 units. Indies Pharma dipped 7 cents and ended at $2.65, with 42,640 stocks crossing the market, Jamaican Teas sank 32 cents to $2.18 with an exchange of 363,876 stock units, Knutsford Express gained 49 cents to end at $11.90 after 22,824 shares passed through the market. Lumber Depot dipped 10 cents in closing at $2.55 with investors dealing in 46,316 stock units, MFS Capital Partners slipped 21 cents to close at $1.53 with a transfer of 1,928 stocks and tTech rose 5 cents to finish at $2.25 and closed with an exchange of 996 units.

Indies Pharma dipped 7 cents and ended at $2.65, with 42,640 stocks crossing the market, Jamaican Teas sank 32 cents to $2.18 with an exchange of 363,876 stock units, Knutsford Express gained 49 cents to end at $11.90 after 22,824 shares passed through the market. Lumber Depot dipped 10 cents in closing at $2.55 with investors dealing in 46,316 stock units, MFS Capital Partners slipped 21 cents to close at $1.53 with a transfer of 1,928 stocks and tTech rose 5 cents to finish at $2.25 and closed with an exchange of 996 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

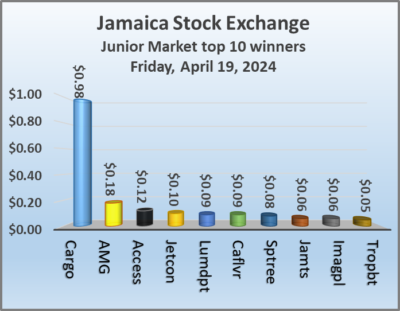

Trading plunged as the Junior Market index jumps

Trading plunged on the Junior Market of the Jamaica Stock Exchange on Friday, with an 81 percent drop in the volume of stocks traded, with a 77 percent lower value than Thursday following trading in 44 securities as was the case on Thursday, with prices of 19 rising, 12 declining and 13 closing unchanged.

Trading closed with an exchange of 1,594,451 shares for $3,409,014 down sharply from 8,355,224 stock units at $15,074,942 on Thursday.

Trading closed with an exchange of 1,594,451 shares for $3,409,014 down sharply from 8,355,224 stock units at $15,074,942 on Thursday.

Trading averaged 36,238 shares at $77,478, compared with 189,891 units at $342,612 on Thursday with the month to date, averaging 217,407 units at $486,040 compared to 231,540 stock units at $517,914 on the previous day and March with an average of 221,659 units at $464,382.

Spur Tree Spices led trading with 344,879 shares for 21.6 percent of total volume followed by ONE on ONE Educational with 334,089 units for 21 percent of the day’s trade and Future Energy with 208,553 units for 13.1 percent market share.

At the close of trading, the Junior Market Index jumped 35.75 points, ending at 3,794.14.

The Junior Market ended trading with an average PE Ratio of 12.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and two with lower offers.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and two with lower offers.

At the close, Access Financial popped 12 cents to end at $21.12 after a transfer of 2,053 shares, AMG Packaging gained 18 cents to close at $3.59 with 199 units crossing the market, Cargo Handlers rose 98 cents in closing at $13.83 in an exchange of 103 stocks. Caribbean Flavours rallied 9 cents and ended at $1.68 with investors swapping 10,055 stock units, Dolphin Cove dropped 26 cents to close at $19.50 with a transfer of 6,983 shares, Everything Fresh fell 18 cents to finish at $1.56 with investors trading 1,016 stock units. Honey Bun shed 10 cents to end at $8 after an exchange of 1,344 units, Image Plus popped 6 cents to end at $1.93 with 4,867 stock units clearing the market, Jamaican Teas rose 6 cents to $2.50 in trading 3 shares.  Jetcon Corporation increased 10 cents to end at 95 cents and closed after an exchange of 309 stocks, Knutsford Express sank 9 cents in closing at $11.41 after an exchange of 324 units. Lumber Depot popped 9 cents higher and ended at $2.65 with investors trading 45,776 stocks, Main Event dipped 9 cents to finish at $13.90 after an exchange of 5,640 shares. Spur Tree Spices advanced 8 cents to close at $2.50 in trading 344,879 stock units, Tropical Battery increased 5 cents to end at $2.20 with investors transferring 53,344 stocks and tTech shed 6 cents to close at $2.20 after trading 20 units.

Jetcon Corporation increased 10 cents to end at 95 cents and closed after an exchange of 309 stocks, Knutsford Express sank 9 cents in closing at $11.41 after an exchange of 324 units. Lumber Depot popped 9 cents higher and ended at $2.65 with investors trading 45,776 stocks, Main Event dipped 9 cents to finish at $13.90 after an exchange of 5,640 shares. Spur Tree Spices advanced 8 cents to close at $2.50 in trading 344,879 stock units, Tropical Battery increased 5 cents to end at $2.20 with investors transferring 53,344 stocks and tTech shed 6 cents to close at $2.20 after trading 20 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

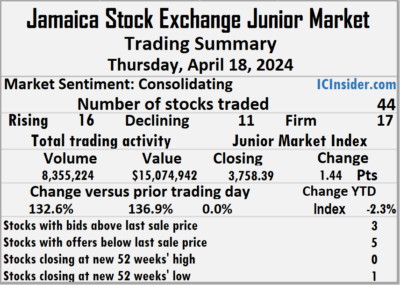

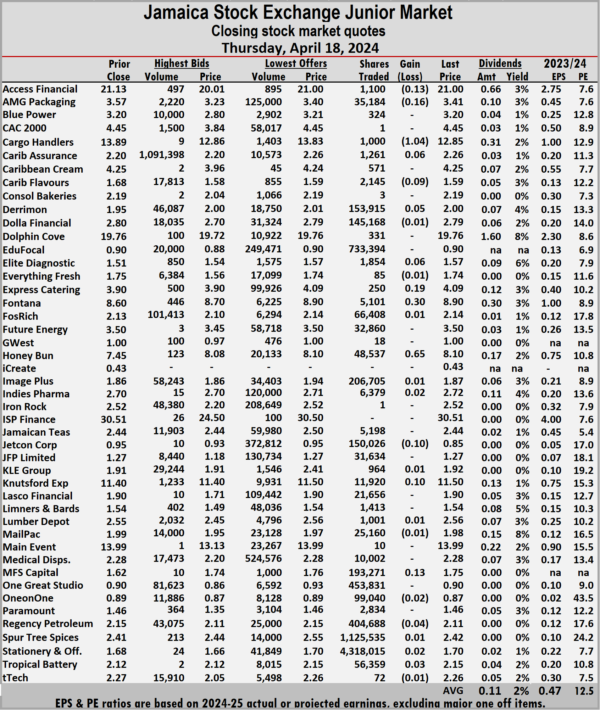

Winning stocks barely moved Junior Market

Trading climbed on the Junior Market of the Jamaica Stock Exchange on Thursday, with a 133 percent rise in the volume of stocks traded, and a 137 percent rise in value over Wednesday with trading in 44 securities compared with 42 on Wednesday and ending with prices of 16 rising, 11 declining and 17 closing unchanged.

The market closed with trading of 8,355,224 shares for $15,074,942 up from just 3,592,810 units at $6,363,318 on Wednesday.

The market closed with trading of 8,355,224 shares for $15,074,942 up from just 3,592,810 units at $6,363,318 on Wednesday.

Trading averaged 189,891 shares at $342,612, compared with 85,543 units at $151,508 on Wednesday with the month to date, averaging 231,540 units at $517,914 compared with 235,064 stock units at $532,747 on the previous day and March with an average of 221,659 units at $464,382.

Stationery and Office Supplies led trading with 4.32 million shares for 51.7 percent of total volume followed by Spur Tree Spices with 1.13 million stocks for 13.5 percent of the day’s trade and EduFocal with 733,394 units for 8.8 percent market share as the stock traded at a 52 weeks’ intraday low of 85 cents and a closing low of 90 cents.

At the close of trading, the Junior Market Index popped 1.44 points to 3,758.39.

At the close of trading, the Junior Market Index popped 1.44 points to 3,758.39.

The Junior Market ended trading with an average PE Ratio of 12.5, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and five with lower offers.

At the close, Access Financial dipped 13 cents to close at $21 after an exchange of 1,100 stock units, AMG Packaging lost 16 cents to end at $3.41, with 35,184 shares crossing the market, Cargo Handlers dropped $1.04 to finish at $12.85 with investors swapping 1,000 units. Caribbean Flavours sank 9 cents and ended at $1.59 after 2,145 stocks crossed the market,  Express Catering rose 19 cents to end at $4.09 with investors transferring 250 units, Fontana climbed 30 cents in closing at $8.90 in an exchange of 5,101 shares. Honey Bun popped 65 cents to $8.10 with investors trading 48,537 stocks, Jetcon Corporation declined 10 cents to end at 85 cents in switching ownership of 150,026 stock units, Knutsford Express advanced 10 cents in closing at $11.50 after 11,920 shares passed through the exchange and MFS Capital Partners rallied 13 cents to close at $1.75 in trading 193,271 stocks.

Express Catering rose 19 cents to end at $4.09 with investors transferring 250 units, Fontana climbed 30 cents in closing at $8.90 in an exchange of 5,101 shares. Honey Bun popped 65 cents to $8.10 with investors trading 48,537 stocks, Jetcon Corporation declined 10 cents to end at 85 cents in switching ownership of 150,026 stock units, Knutsford Express advanced 10 cents in closing at $11.50 after 11,920 shares passed through the exchange and MFS Capital Partners rallied 13 cents to close at $1.75 in trading 193,271 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Grace up stakes in Spur Tree Spices

The GraceKennedy a wholly owned subsidiary – GK Investments Limited, purchased 60,000,000 units of shares in Spur Tree Spices thereby increasing its ownership to 20.18 percent. this was the objective Grace had before the company went public.

The GraceKennedy a wholly owned subsidiary – GK Investments Limited, purchased 60,000,000 units of shares in Spur Tree Spices thereby increasing its ownership to 20.18 percent. this was the objective Grace had before the company went public.

On Wednesday Spur Tree reported that two directors sold 30 million units each, which seems to have met the demand from Grace, but it may not be the last of the big trades for the company whose products have strong appeal internationally.

The company has been struggling to grow its profit since listing on the Junior Market in 2022. Profit of $116 million fell to $88 million in 2023, with earnings per share of 5 cents last year and 7 cents in 2022.

Spur Three stock traded at $2.42, up 2 cents on the junior Market of the Jamaica Stock Exchange on Thursday.

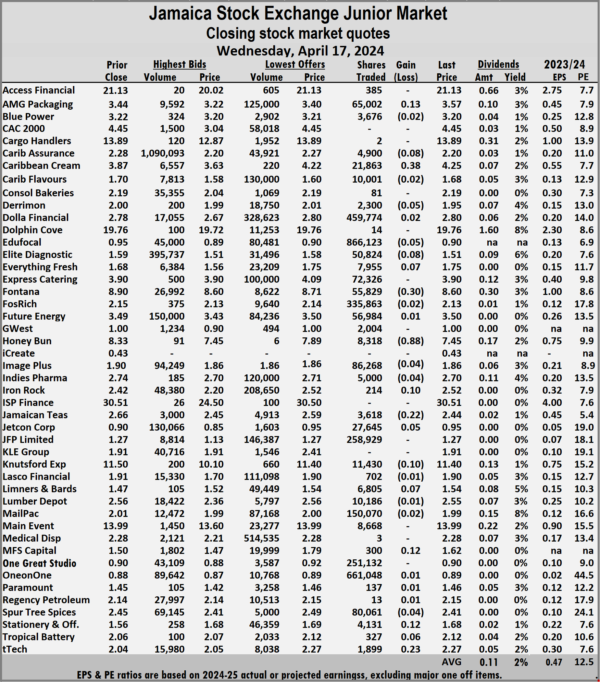

Junior stocks drift lower

Stocks drifted lower in trading on the Junior Market of the Jamaica Stock Exchange on Wednesday, following a 16 percent rise in the volume of stocks traded, with an 8 percent higher value than Tuesday with trading in 42 securities the same as on Tuesday and ending with prices of 15 rising, 17 declining and 10 closing unchanged.

Trading netted 3,592,810 shares for $6,363,318 compared with 3,102,805 units at $5,901,970 on Tuesday.

Trading netted 3,592,810 shares for $6,363,318 compared with 3,102,805 units at $5,901,970 on Tuesday.

Trading averaged 85,543 shares at $151,508 compared with 73,876 units at $140,523 on Tuesday. Trading for the month to date averages 235,064 units at $532,747 compared to 248,202 stock units at $566,245 on the previous day and March with an average of 221,659 units at $464,382.

On a day of low trading volume, EduFocal led with 866,123 shares for 24.1 percent of total volume followed by ONE on ONE Educational with 661,048 units for 18.4 percent of the day’s trade and Dolla Financial with 459,774 units for 12.8 percent market share.

At the close of trading, the Junior Market Index declined 24.08 points to close at 3,756.95.

The Junior Market ended trading with an average PE Ratio of 12.5, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and four with lower offers.

At the close of the market, AMG Packaging popped 13 cents to finish at $3.57 as 65,002 stock units passed through the market, Caribbean Assurance Brokers shed 8 cents in closing at $2.20 with investors exchanging 4,900 shares, Caribbean Cream increased 38 cents to end at $4.25 with 21,863 stocks clearing the market. Derrimon Trading lost 5 cents in closing at $1.95 in an exchange of 2,300 units, EduFocal dropped 5 cents to close at 90 cents with investors swapping 866,123 stocks, Elite Diagnostic sank 8 cents and ended at $1.51 with an exchange of 50,824 units. Everything Fresh climbed 7 cents to $1.75 with 7,955 shares crossing the market, Fontana skidded 30 cents to end at $8.60 as investors exchanged 55,829 stock units, Honey Bun fell 88 cents in closing at $7.45 with a transfer of 8,318 shares.  Iron Rock Insurance rose 10 cents to close at $2.52 with 214 units passing through the exchange, Jamaican Teas slipped 22 cents to finish at $2.44 in trading 3,618 stocks, Jetcon Corporation rallied 5 cents and ended at 95 cents, with 27,645 stock units changing hands. Knutsford Express declined 10 cents to $11.40 with investors transferring 11,430 shares, Limners and Bards advanced 7 cents to close at $1.54 after 6,805 units were traded, MFS Capital Partners gained 12 cents and ended at $1.62 in switching ownership of 300 stocks. Stationery and Office Supplies popped 12 cents in closing at $1.68 with trading in 4,131 stock units, Tropical Battery advanced 6 cents to finish at $2.12 with investors dealing in 327 shares and tTech rose 23 cents to end at $2.27 with 1,899 stocks crossing the market.

Iron Rock Insurance rose 10 cents to close at $2.52 with 214 units passing through the exchange, Jamaican Teas slipped 22 cents to finish at $2.44 in trading 3,618 stocks, Jetcon Corporation rallied 5 cents and ended at 95 cents, with 27,645 stock units changing hands. Knutsford Express declined 10 cents to $11.40 with investors transferring 11,430 shares, Limners and Bards advanced 7 cents to close at $1.54 after 6,805 units were traded, MFS Capital Partners gained 12 cents and ended at $1.62 in switching ownership of 300 stocks. Stationery and Office Supplies popped 12 cents in closing at $1.68 with trading in 4,131 stock units, Tropical Battery advanced 6 cents to finish at $2.12 with investors dealing in 327 shares and tTech rose 23 cents to end at $2.27 with 1,899 stocks crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading slips on the Junior Market

Trading closed on the Junior Market of the Jamaica Stock Exchange Tuesday, with a 35 percent decline in the volume of stocks traded with 44 percent lower value than on Monday and ended with trading in 42 securities down from 45 on Monday and closing with prices of 16 rising, 16 declining and 10 closing unchanged.

The market closed with trading in 3,102,805 shares for $5,901,970 down from 4,798,812 units at $10,594,590 on Monday.

The market closed with trading in 3,102,805 shares for $5,901,970 down from 4,798,812 units at $10,594,590 on Monday.

Trading averaged 73,876 shares at $140,523 compared to 106,640 units at $235,435 on Monday with a month to date, average of 248,202 units at $566,245 compared to 264,995 stock units at $607,255 on the previous day and March with an average of 221,659 units at $464,382.

One Great Studio led trading with 1.06 million shares for 34 percent of total volume followed by Spur Tree Spices with 1.05 million units for 33.8 percent of the day’s trade and ONE on ONE Educational with 199,059 units for 6.4 percent market share.

At the close of trading, the Junior Market Index slipped 2.92 points to finish at 3,781.03.

The Junior Market ended trading with an average PE Ratio of 12.7, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.7, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AMG Packaging advanced 7 cents to $3.44 in switching ownership of 106,018 shares, Caribbean Assurance Brokers popped 8 cents to finish at $2.28 with investors swapping just one share, Consolidated Bakeries increased 19 cents and ended at $2.19, with 2,273 shares crossing the market. EduFocal declined 5 cents to close at 95 cents with traders dealing in 22,734 stock units, Everything Fresh shed 6 cents to end at $1.68 with 3,905 shares clearing the market, Honey Bun fell 7 cents in closing at $8.33 with a transfer of 15,162 stock units.  JFP Ltd popped 5 cents to $1.27 with investors dealing in 3,587 units, Lumber Depot rose 6 cents to end at $2.56 in an exchange of 5,000 stocks, Mailpac Group rallied 11 cents in closing at $2.01 as 14,091 units passed through the market. Main Event gained 39 cents and ended at $13.99 with an exchange of 49 shares, MFS Capital Partners slipped 30 cents to finish at $1.50, with 41,551 stocks crossing the market, Spur Tree Spices lost 5 cents to close at $2.45 after a transfer of 1,049,690 stock units. Stationery and Office Supplies skidded 13 cents to $1.56 as investors exchanged 18,169 shares, Tropical Battery sank 5 cents in closing at $2.06, with 17,019 stocks changing hands and tTech dipped 23 cents to finish at $2.04 in an exchange of 5 units.

JFP Ltd popped 5 cents to $1.27 with investors dealing in 3,587 units, Lumber Depot rose 6 cents to end at $2.56 in an exchange of 5,000 stocks, Mailpac Group rallied 11 cents in closing at $2.01 as 14,091 units passed through the market. Main Event gained 39 cents and ended at $13.99 with an exchange of 49 shares, MFS Capital Partners slipped 30 cents to finish at $1.50, with 41,551 stocks crossing the market, Spur Tree Spices lost 5 cents to close at $2.45 after a transfer of 1,049,690 stock units. Stationery and Office Supplies skidded 13 cents to $1.56 as investors exchanged 18,169 shares, Tropical Battery sank 5 cents in closing at $2.06, with 17,019 stocks changing hands and tTech dipped 23 cents to finish at $2.04 in an exchange of 5 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- 1

- 2

- 3

- …

- 46

- Next Page »