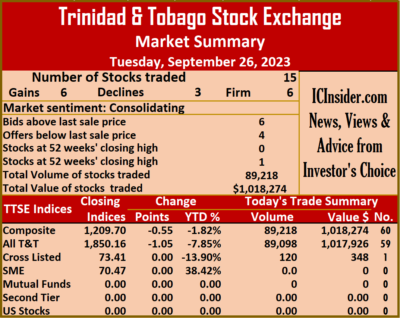

Fresh from closer of trading on the Trinidad and Tobago Stock Exchange on Monday due to a public holiday, the market reopened on Tuesday, with a sharp 84 percent fall in the volume of stocks traded, with the value diving 82 percent lower than on Friday and from trading in 15 securities, down from 19 on Friday, with six stocks rising, three declining and six remaining unchanged.

Investors exchanged 89,218 shares for $1,018,274 down from 559,401 stock units at $5,612,843 on Friday.

Investors exchanged 89,218 shares for $1,018,274 down from 559,401 stock units at $5,612,843 on Friday.

An average of 5,948 units were traded at $67,885 compared to 29,442 shares at $295,413 on Friday, with trading month to date averaging 17,139 shares at $185,866 compared with 17,702 units at $191,805 on the previous trading day and an average of 14,526 shares at $195,195 in August.

The Composite Index dipped 0.55 points to end at 1,209.70, the All T&T Index dipped 1.05 points to conclude trading at 1,850.16, the SME Index remained unchanged at 70.47 and the Cross-Listed Index remained unchanged at 73.41.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and four with lower offers.

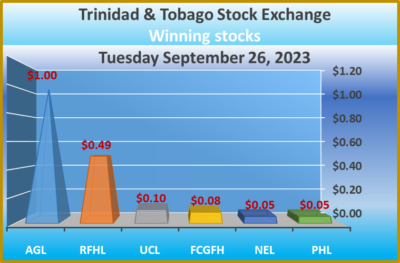

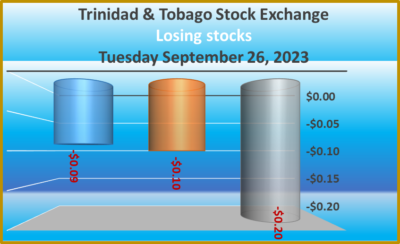

At close, Agostini’s popped $1 to close at $68 with 72 shares clearing the market, Angostura Holdings ended at $22.98 after investors traded of 1,000 units, First Citizens Group gained 8 cents to close at $49.19 in switching ownership of 2,794 stocks. Guardian Holdings remained at $19.10 with traders dealing in just two stocks, Guardian Media lost 20 cents and ended at $2 with stakeholders exchanging 490 stock units, Massy Holdings shed 10 cents to end at $4.85 as investors exchanged 11,902 shares. National Enterprises rallied 5 cents to close at $3.60 after an exchange of 56,607 units, NCB Financial ended at $2.90, with 120 stocks crossing the market, Prestige Holdings climbed 5 cents and ended at $8 after a transfer of 6,000 shares.

At close, Agostini’s popped $1 to close at $68 with 72 shares clearing the market, Angostura Holdings ended at $22.98 after investors traded of 1,000 units, First Citizens Group gained 8 cents to close at $49.19 in switching ownership of 2,794 stocks. Guardian Holdings remained at $19.10 with traders dealing in just two stocks, Guardian Media lost 20 cents and ended at $2 with stakeholders exchanging 490 stock units, Massy Holdings shed 10 cents to end at $4.85 as investors exchanged 11,902 shares. National Enterprises rallied 5 cents to close at $3.60 after an exchange of 56,607 units, NCB Financial ended at $2.90, with 120 stocks crossing the market, Prestige Holdings climbed 5 cents and ended at $8 after a transfer of 6,000 shares.  Republic Financial rose 49 cents to end at $121.99 after 99 stock units passed through the market, Scotiabank remained at $72.50 with a transfer of 6,807 units, Trinidad & Tobago NGL dipped 9 cents and ended at a 52 weeks’ low of $12.81 with an exchange of 927 stocks. Trinidad Cement remained at $3.14 with investors transferring a mere two stock units, Unilever Caribbean popped 10 cents to end at $11.80, with 908 stocks crossing the market and West Indian Tobacco ended at $10.20 in an exchange of 1,488 units.

Republic Financial rose 49 cents to end at $121.99 after 99 stock units passed through the market, Scotiabank remained at $72.50 with a transfer of 6,807 units, Trinidad & Tobago NGL dipped 9 cents and ended at a 52 weeks’ low of $12.81 with an exchange of 927 stocks. Trinidad Cement remained at $3.14 with investors transferring a mere two stock units, Unilever Caribbean popped 10 cents to end at $11.80, with 908 stocks crossing the market and West Indian Tobacco ended at $10.20 in an exchange of 1,488 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading plunges on the Trinidad Exchange

JSE USD Market rallies on Monday

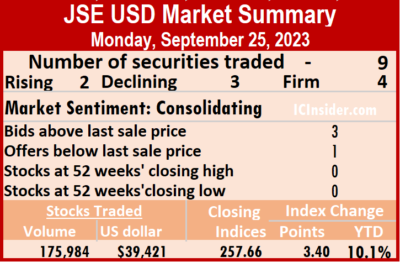

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with a 70 percent decline in the volume of stocks changing hands but valued 287 percent more than on Friday, resulting in trading in nine securities, compared to eight on Friday with two rising, three declining and four ending unchanged.

, 175,984 shares were traded, for US$39,421 compared to 580,017 units at US$10,197 on Friday.

, 175,984 shares were traded, for US$39,421 compared to 580,017 units at US$10,197 on Friday.

Trading averaged 19,554 units at US$4,380 versus 72,502 shares at US$1,275 on Friday, with a month to date average of 48,101 shares at US$3,900 compared with 50,278 units at US$3,863 on the previous day, fairly close to August with an average of 57,291 units for US$4,251.

The US Denominated Equities Index rose 3.40 points to close at 257.66.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.2. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share increased 0.89 of one cent to 6 US cents and closing after 1,974 shares changed hands, Margaritaville remained at 11 US cents with traders dealing in 113 units,  Proven Investments dipped 1 cent to 13.5 US cents in trading 160,775 stocks Sterling Investments shed 0.02 of a cent in closing at 1.9 US cents after investors traded 1,729 stock units, Sygnus Credit Investments ended at 9.07 US cents, with 1,276 units crossing the exchange, Sygnus Real Estate Finance USD share ended at 10 US cents with an exchange of 974 stock units and Transjamaican Highway remained at 1.69 US cents with shareholders swapping 937 stocks.

Proven Investments dipped 1 cent to 13.5 US cents in trading 160,775 stocks Sterling Investments shed 0.02 of a cent in closing at 1.9 US cents after investors traded 1,729 stock units, Sygnus Credit Investments ended at 9.07 US cents, with 1,276 units crossing the exchange, Sygnus Real Estate Finance USD share ended at 10 US cents with an exchange of 974 stock units and Transjamaican Highway remained at 1.69 US cents with shareholders swapping 937 stocks.

In the preference segment, JMMB Group 5.75% dropped 38 cents to close at US$1.87, with 8,198 shares clearing the market and JMMB Group 6% rallied 8.24 cents to US$1.0727 with investors dealing in 8 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on JSE USD Market

Trading picked on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks changing hands rising 688 percent valued 309 percent more than on Thursday, resulting in the trading of eight securities, up from six on Thursday with prices of three rising, four declining and one ending unchanged.

Overall, 580,017 shares were traded, for US$10,197 up from 73,572 units at US$2,495 on Thursday.

Overall, 580,017 shares were traded, for US$10,197 up from 73,572 units at US$2,495 on Thursday.

Trading averaged 72,502 units at US$1,275 versus 12,262 shares at US$416 on Thursday, with a month to date average of 50,278 shares at US$3,863 compared with 48,662 units at US$4,051 on the previous day. August ended with an average of 57,291 units for US$4,251.

The US Denominated Equities Index shed 1.12 points to end at 254.26.

The USD Market ended with a PE Ratio, of 9, the PE is the most commonly used measure in determining stock values and is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with financial year ending between November 2023 and August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share popped 0.01 of a cent to 5.11 US cents after an exchange of 360 shares, Margaritaville declined 1 cent to end at 11 US cents as investors traded 43 stock units, MPC Caribbean Clean Energy remained at 55 US cents with shareholders swapping 94 stocks.  Proven Investments fell 0.25 of one cent in closing at 14.5 US cents with stakeholders exchanging 4,029 units, Sterling Investments lost 0.03 of a cent and ended at 1.92 US cents with a transfer of 21,145 stocks. Sygnus Credit Investments dropped 0.03 of a cent to close at 9.07 US cents with an exchange of 558 units, Sygnus Real Estate Finance USD share rallied 1.5 cents to 10 US cents with investors dealing in 106 stocks and Transjamaican Highway popped 0.06 of a cent in closing at 1.69 US cents in switching ownership of 553,682 shares.

Proven Investments fell 0.25 of one cent in closing at 14.5 US cents with stakeholders exchanging 4,029 units, Sterling Investments lost 0.03 of a cent and ended at 1.92 US cents with a transfer of 21,145 stocks. Sygnus Credit Investments dropped 0.03 of a cent to close at 9.07 US cents with an exchange of 558 units, Sygnus Real Estate Finance USD share rallied 1.5 cents to 10 US cents with investors dealing in 106 stocks and Transjamaican Highway popped 0.06 of a cent in closing at 1.69 US cents in switching ownership of 553,682 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices drop on Trinidad Exchange

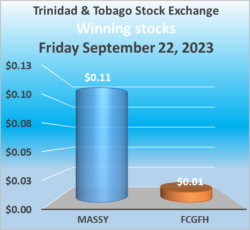

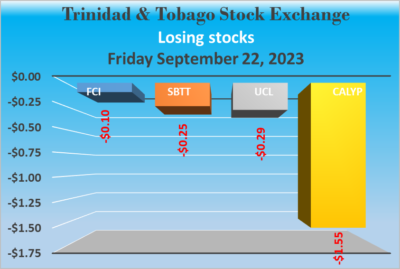

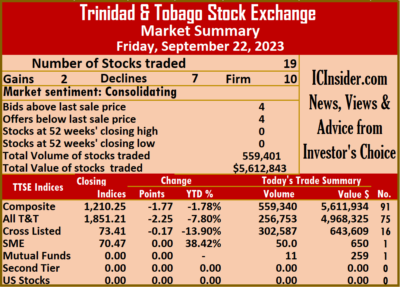

Falling stocks battered those rising at the close of trading on the Trinidad and Tobago Stock Exchange on Friday, with the volume of stocks traded rising 127 percent with a value 205 percent more than on Thursday, resulting from trading in 19 securities up sharply from just 10 on Thursday, with prices of two rising, seven declining and 10 remaining unchanged.

Investors exchanged 559,401 shares for $5,612,843 up from 246,775 stock units at $1,839,912 on Thursday.

Investors exchanged 559,401 shares for $5,612,843 up from 246,775 stock units at $1,839,912 on Thursday.

An average of 29,442 units were traded at $295,413 compared to 24,678 shares at $183,991 on Thursday, with trading month to date averaging 17,702 shares at $191,805 compared with 16,903 units at $184,750 on the previous day. The average trade for August amounts to 14,526 shares at $195,195.

The Composite Index fell 1.77 points to finish at 1,210.25, the All T&T Index skidded 2.25 points to conclude trading at 1,851.21, the SME Index remained at 70.47 and the Cross-Listed Index skidded 0.17 points to close at 73.41.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Agostini’s ended at $67 with an exchange of 1,656 shares, Angostura Holdings dipped 1 cent in closing at $22.98 after 5,070 stocks passed through the market, Ansa McAl remained at $57 with 5,000 units crossing the exchange, Calypso Macro Investment Fund skidded $1.55 to end at $23.50 with investors transferring 11 stock units. Endeavour Holdings ended at $13 in trading 50 units, First Citizens Group advanced 1 cent to $49.11 in switching ownership of 3,249 shares, FirstCaribbean International Bank shed 10 cents and ended at $6.90, with 3,634 stock units crossing the exchange, GraceKennedy dipped 1 cent to $3.28 with investors dealing in 106,160 stocks. Guardian Holdings remained at $19.10 after a transfer of 70 stock units, JMMB Group ended at $1.40 after an exchange of 192,693 units, Massy Holdings popped 11 cents to end at $4.95 in trading 57,734 stocks,  National Enterprises remained at $3.55 after exchanging 124,154 shares. NCB Financial ended at $2.90 with a transfer of 100 stocks, Prestige Holdings remained at $7.95 with traders dealing in 2,071 units, Republic Financial ended at $121.50 while exchanging 15,854 shares, Scotiabank fell 25 cents to end at $72.50 after 18,280 stock units passed through the market. Trinidad & Tobago NGL lost 5 cents in closing at $12.90 with shareholders swapping 20,237 stock units, Unilever Caribbean declined 29 cents to $11.70 as investors exchanged 778 shares and West Indian Tobacco remained at $10.20 in an exchange of 2,600 units.

National Enterprises remained at $3.55 after exchanging 124,154 shares. NCB Financial ended at $2.90 with a transfer of 100 stocks, Prestige Holdings remained at $7.95 with traders dealing in 2,071 units, Republic Financial ended at $121.50 while exchanging 15,854 shares, Scotiabank fell 25 cents to end at $72.50 after 18,280 stock units passed through the market. Trinidad & Tobago NGL lost 5 cents in closing at $12.90 with shareholders swapping 20,237 stock units, Unilever Caribbean declined 29 cents to $11.70 as investors exchanged 778 shares and West Indian Tobacco remained at $10.20 in an exchange of 2,600 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

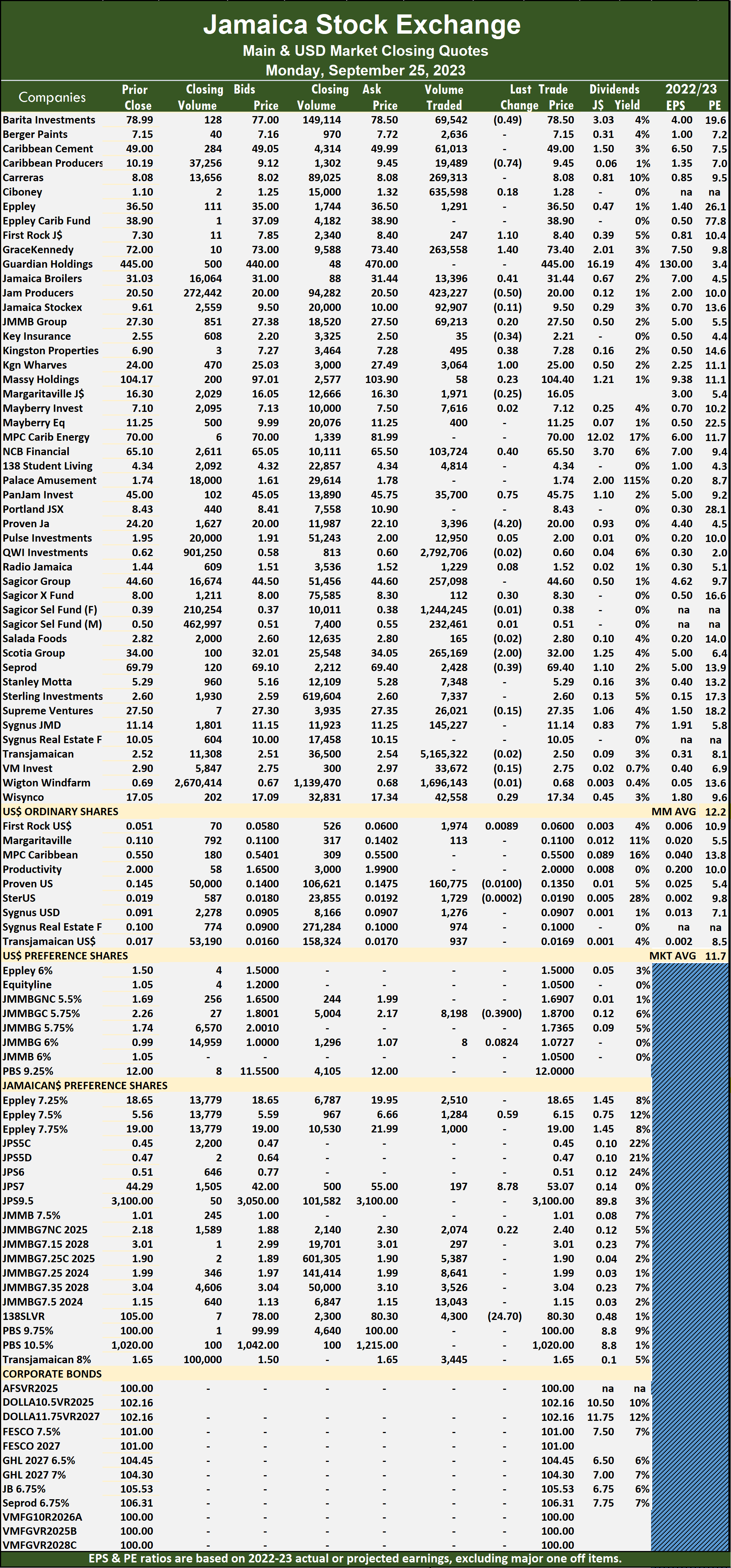

A total of 14,060,598 shares were traded for $91,699,748 compared to 3,872,550 units at $72,059,401 on Friday.

A total of 14,060,598 shares were traded for $91,699,748 compared to 3,872,550 units at $72,059,401 on Friday. The Main Market ended trading with an average PE Ratio of 12.2, the JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024.

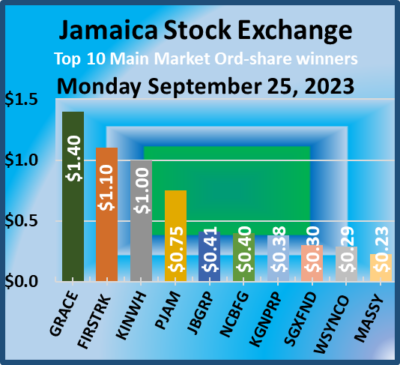

The Main Market ended trading with an average PE Ratio of 12.2, the JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending up to August 2024. NCB Financial advanced 40 cents to end at $65.50 with investors transferring 103,724 stocks, Pan Jamaica rallied 75 cents in closing at $45.75, with 35,700 units clearing the market, Proven Investments skidded $4.20 to $20 after a transfer of 3,396 stock units. Sagicor Real Estate Fund gained 30 cents and ended at $8.30 in an exchange of 112 stock units, Scotia Group declined $2 to close at $32 with traders dealing in 265,169 stocks and Seprod dipped 39 cents to end at $69.40 after 2,428 units passed through the market.

NCB Financial advanced 40 cents to end at $65.50 with investors transferring 103,724 stocks, Pan Jamaica rallied 75 cents in closing at $45.75, with 35,700 units clearing the market, Proven Investments skidded $4.20 to $20 after a transfer of 3,396 stock units. Sagicor Real Estate Fund gained 30 cents and ended at $8.30 in an exchange of 112 stock units, Scotia Group declined $2 to close at $32 with traders dealing in 265,169 stocks and Seprod dipped 39 cents to end at $69.40 after 2,428 units passed through the market. Jamaica Public Service 7% climbed $8.78 and ended at $53.07 after trading 197 units and 138 Student Living preference share lost $24.70 to close at $80.30, with 4,300 shares crossing the market.

Jamaica Public Service 7% climbed $8.78 and ended at $53.07 after trading 197 units and 138 Student Living preference share lost $24.70 to close at $80.30, with 4,300 shares crossing the market. Investors traded 7,109,987 shares for $15,074,419 compared with 6,672,237 units at $13,058,494 on Friday.

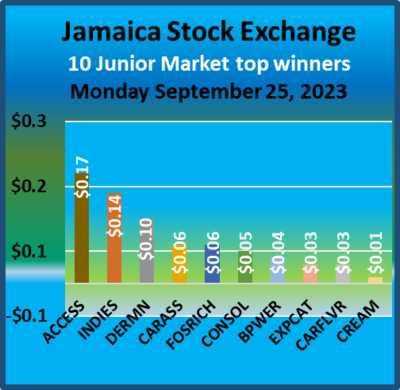

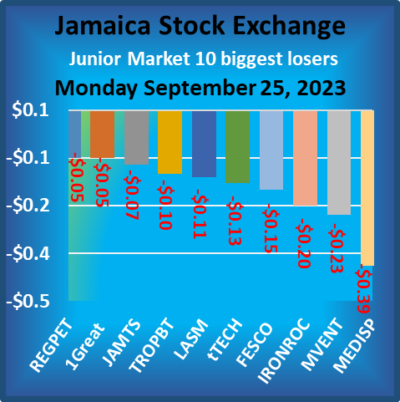

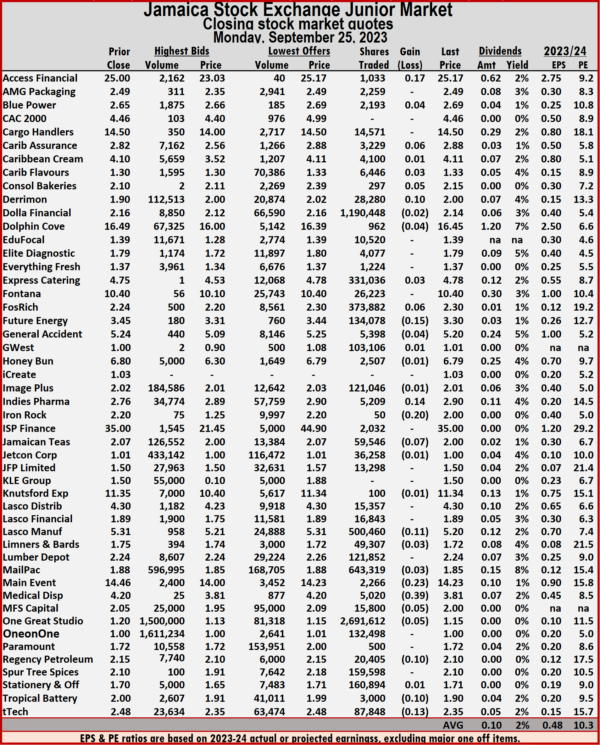

Investors traded 7,109,987 shares for $15,074,419 compared with 6,672,237 units at $13,058,494 on Friday. At the close, the Junior Market Index fell 20.18 points to conclude trading at 3,789.41.

At the close, the Junior Market Index fell 20.18 points to conclude trading at 3,789.41. Future Energy Source fell 15 cents to end at $3.30 with investors dealing in 134,078 units. Indies Pharma advanced 14 cents to $2.90 in an exchange of 5,209 stock units, Iron Rock Insurance dropped 20 cents to close trading at $2 with investors swapping 50 stocks, Jamaican Teas lost 7 cents to close at $2 with an exchange of 59,546 stock units. Lasco Manufacturing dipped 11 cents in closing at $5.20 as investors exchanged 500,460 units, Main Event declined 23 cents to $14.23 after 2,266 shares crossed the market, Medical Disposables shed 39 cents and ended at at a 52 weeks’ low of $3.81, with 5,020 shares crossing the exchange.

Future Energy Source fell 15 cents to end at $3.30 with investors dealing in 134,078 units. Indies Pharma advanced 14 cents to $2.90 in an exchange of 5,209 stock units, Iron Rock Insurance dropped 20 cents to close trading at $2 with investors swapping 50 stocks, Jamaican Teas lost 7 cents to close at $2 with an exchange of 59,546 stock units. Lasco Manufacturing dipped 11 cents in closing at $5.20 as investors exchanged 500,460 units, Main Event declined 23 cents to $14.23 after 2,266 shares crossed the market, Medical Disposables shed 39 cents and ended at at a 52 weeks’ low of $3.81, with 5,020 shares crossing the exchange. Tropical Battery skidded 10 cents to end at $1.90, with 3,000 stock units changing hands and tTech declined 13 cents to close at $2.35 after a transfer of 87,848 units.

Tropical Battery skidded 10 cents to end at $1.90, with 3,000 stock units changing hands and tTech declined 13 cents to close at $2.35 after a transfer of 87,848 units. The Main Market had just two stocks with notable price changes this past week, with

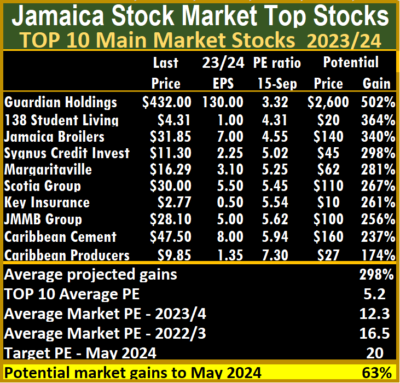

The Main Market had just two stocks with notable price changes this past week, with  The PE of the Junior Market Top 10 sits at 5.2 just half of the market at 10.4. There are 10 stocks or 26 percent of the market, with PEs from 15 to 29, averaging 19 that are well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently, and projected to rise by 288 percent to May 2024.

The PE of the Junior Market Top 10 sits at 5.2 just half of the market at 10.4. There are 10 stocks or 26 percent of the market, with PEs from 15 to 29, averaging 19 that are well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently, and projected to rise by 288 percent to May 2024. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. Overall, 3,872,550 shares were traded for $72,059,401 up from 6,606,269 units at $40,160,944 on Thursday.

Overall, 3,872,550 shares were traded for $72,059,401 up from 6,606,269 units at $40,160,944 on Thursday. Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and four with lower offers.

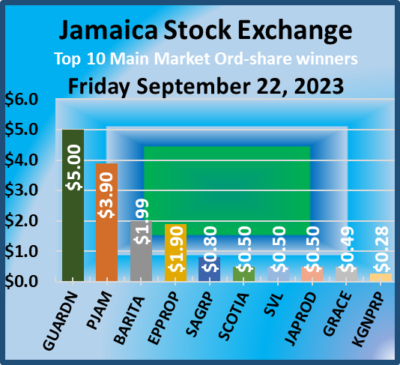

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and four with lower offers. Kingston Wharves skidded $3.72 to close at a multiyear low of $24 with stakeholders exchanging 45,945 stocks. Massy Holdings dipped 23 cents to end at $104.17 with traders dealing in 178 shares, Mayberry Investments shed 81 cents to $7.10 after a transfer of 18,129 stocks, Pan Jamaica increased $3.90 in closing at $45 with 230,694 stock units crossing the market, Sagicor Group climbed 80 cents in closing at $44.60 with investors transferring 15,345 units. Sagicor Real Estate Fund dipped 34 cents to close at $8, with 20,000 shares changing hands, Scotia Group popped 50 cents and ended at $34 in trading 92,228 stocks and Supreme Ventures gained 50 cents to end at $27.50 after exchanging 19,296 units.

Kingston Wharves skidded $3.72 to close at a multiyear low of $24 with stakeholders exchanging 45,945 stocks. Massy Holdings dipped 23 cents to end at $104.17 with traders dealing in 178 shares, Mayberry Investments shed 81 cents to $7.10 after a transfer of 18,129 stocks, Pan Jamaica increased $3.90 in closing at $45 with 230,694 stock units crossing the market, Sagicor Group climbed 80 cents in closing at $44.60 with investors transferring 15,345 units. Sagicor Real Estate Fund dipped 34 cents to close at $8, with 20,000 shares changing hands, Scotia Group popped 50 cents and ended at $34 in trading 92,228 stocks and Supreme Ventures gained 50 cents to end at $27.50 after exchanging 19,296 units. In the preference segment, JMMB Group 7.25% preference share advanced 23 cents to $1.90 after an exchange of 544 stock units and 138 Student Living preference share jumped $11.52 and ended at $105 as investors exchanged 114 units.

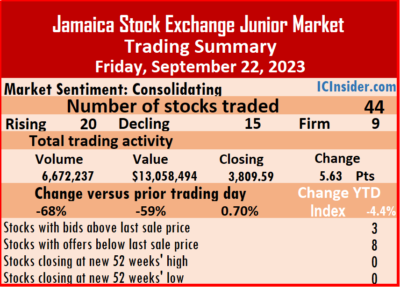

In the preference segment, JMMB Group 7.25% preference share advanced 23 cents to $1.90 after an exchange of 544 stock units and 138 Student Living preference share jumped $11.52 and ended at $105 as investors exchanged 114 units. A total of 44 securities were traded compared to 45 on Thursday with market activity ending with prices of 20 rising, 15 declining and nine closing unchanged.

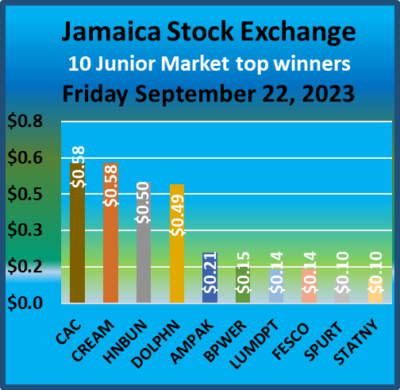

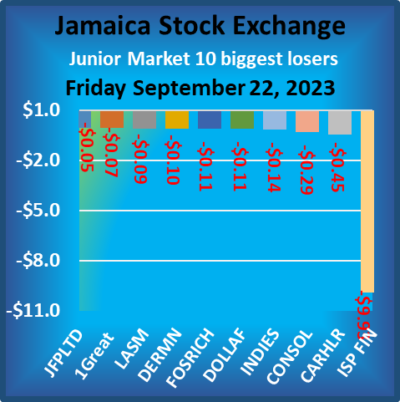

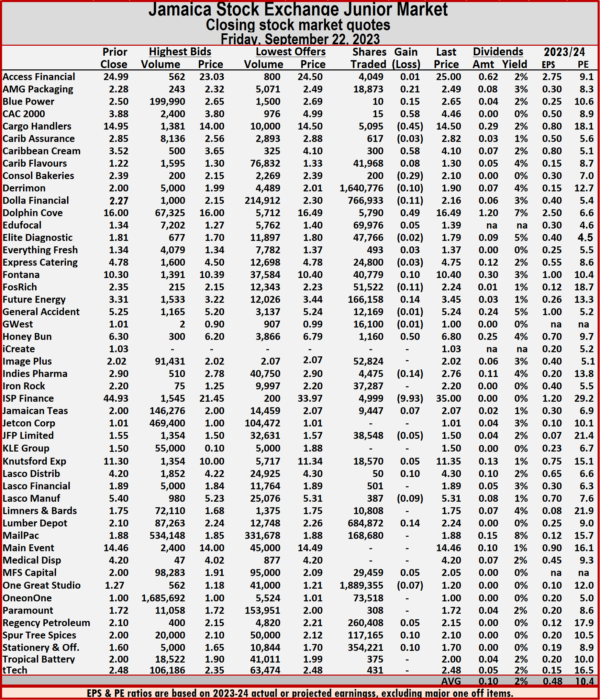

A total of 44 securities were traded compared to 45 on Thursday with market activity ending with prices of 20 rising, 15 declining and nine closing unchanged. At the close, AMG Packaging rallied 21 cents to $2.49 after 18,873 shares passed through the market, Blue Power advanced 15 cents to $2.65 in switching ownership of 10 units, CAC 2000 climbed 58 cents to end at $4.46 after an exchange of 15 stocks, Cargo Handlers lost 45 cents to close at $14.50, with 5,095 stock units crossing the market. Caribbean Cream climbed 58 cents to $4.10 in trading 300 stocks, Caribbean Flavours popped 8 cents to end at $1.30 with investors transferring 41,968 units, Consolidated Bakeries shed 29 cents to close at $2.10 after a transfer of 200 shares, Derrimon Trading dropped 10 cents and ended at $1.90 in an exchange of 1,640,776 stocks. Dolla Financial dipped 11 cents in closing at $2.16 in trading of 766,933 stocks, Dolphin Cove rose 49 cents to $16.49, with 5,790 shares crossing the exchange, EduFocal gained 5 cents to end at $1.39 with shareholders swapping 69,976 units, Fontana rose 10 cents to close at $10.40 after exchanging 40,779 stock units. Fosrich skidded 11 cents in closing at $2.24 after trading 51,522 stock units, Future Energy Source gained 14 cents to $3.45 with investors dealing in 166,158 shares,

At the close, AMG Packaging rallied 21 cents to $2.49 after 18,873 shares passed through the market, Blue Power advanced 15 cents to $2.65 in switching ownership of 10 units, CAC 2000 climbed 58 cents to end at $4.46 after an exchange of 15 stocks, Cargo Handlers lost 45 cents to close at $14.50, with 5,095 stock units crossing the market. Caribbean Cream climbed 58 cents to $4.10 in trading 300 stocks, Caribbean Flavours popped 8 cents to end at $1.30 with investors transferring 41,968 units, Consolidated Bakeries shed 29 cents to close at $2.10 after a transfer of 200 shares, Derrimon Trading dropped 10 cents and ended at $1.90 in an exchange of 1,640,776 stocks. Dolla Financial dipped 11 cents in closing at $2.16 in trading of 766,933 stocks, Dolphin Cove rose 49 cents to $16.49, with 5,790 shares crossing the exchange, EduFocal gained 5 cents to end at $1.39 with shareholders swapping 69,976 units, Fontana rose 10 cents to close at $10.40 after exchanging 40,779 stock units. Fosrich skidded 11 cents in closing at $2.24 after trading 51,522 stock units, Future Energy Source gained 14 cents to $3.45 with investors dealing in 166,158 shares,  Honey Bun popped 50 cents and ended at $6.80 as investors exchanged 1,160 stocks, Indies Pharma fell 14 cents to end at $2.76, with 4,475 units crossing the market. ISP Finance dropped $9.93 to close at $35 with 4,999 shares changing hands, Jamaican Teas advanced 7 cents and ended at $2.07 while exchanging 9,447 stock units, JFP Ltd dipped 5 cents to close at $1.50 after investors traded 38,548 units, Knutsford Express rose 5 cents in closing at $11.35 with a transfer of 18,570 stocks. Lasco Distributors rallied 10 cents and ended at $4.30 with traders dealing in 50 stocks, Lasco Manufacturing skidded 9 cents in closing at $5.31 with stakeholders exchanging 387 shares, Lumber Depot increased 14 cents to close at $2.24 with 684,872 stock units clearing the market, MFS Capital Partners rose 5 cents to $2.05 with an exchange of 29,459 units.

Honey Bun popped 50 cents and ended at $6.80 as investors exchanged 1,160 stocks, Indies Pharma fell 14 cents to end at $2.76, with 4,475 units crossing the market. ISP Finance dropped $9.93 to close at $35 with 4,999 shares changing hands, Jamaican Teas advanced 7 cents and ended at $2.07 while exchanging 9,447 stock units, JFP Ltd dipped 5 cents to close at $1.50 after investors traded 38,548 units, Knutsford Express rose 5 cents in closing at $11.35 with a transfer of 18,570 stocks. Lasco Distributors rallied 10 cents and ended at $4.30 with traders dealing in 50 stocks, Lasco Manufacturing skidded 9 cents in closing at $5.31 with stakeholders exchanging 387 shares, Lumber Depot increased 14 cents to close at $2.24 with 684,872 stock units clearing the market, MFS Capital Partners rose 5 cents to $2.05 with an exchange of 29,459 units.  One Great Studio shed 7 cents to end at $1.20 with investors transferring 1,889,355 units, Regency Petroleum increased 5 cents in closing at $2.15 after an exchange of 260,408 shares, Spur Tree Spices advanced 10 cents and ended at $2.10 with a transfer of 117,165 stocks and Stationery and Office Supplies popped 10 cents to end at $1.70 while exchanging 354,221 stock units.

One Great Studio shed 7 cents to end at $1.20 with investors transferring 1,889,355 units, Regency Petroleum increased 5 cents in closing at $2.15 after an exchange of 260,408 shares, Spur Tree Spices advanced 10 cents and ended at $2.10 with a transfer of 117,165 stocks and Stationery and Office Supplies popped 10 cents to end at $1.70 while exchanging 354,221 stock units.