The Main Market of the Jamaica Stock Exchange slipped in trading on Friday and the Junior Market gained as the JSE USD market closed unchanged following a sharp reduction in the volume and value of stocks changing hands falling from the previous day andresulting in prices of 39 shares rose and 35, declined, with Scotia Group hitting new 52 weeks’ high in closing at $46 the largest Main Market rising stock.

At the close of trading on Friday, the JSE Combined Market Index climbed 418.12 points to close at 342,138.51, the All Jamaican Composite Index rallied 1,152.06 points to finish trading at 366,713.88, the JSE Main Index advanced 256.53 points to 329,340.57. The Junior Market Index rose 20.28 points to 3,798.77 and the JSE USD Market Index ended unchanged at 251.01.

At the close of trading on Friday, the JSE Combined Market Index climbed 418.12 points to close at 342,138.51, the All Jamaican Composite Index rallied 1,152.06 points to finish trading at 366,713.88, the JSE Main Index advanced 256.53 points to 329,340.57. The Junior Market Index rose 20.28 points to 3,798.77 and the JSE USD Market Index ended unchanged at 251.01.

At the close of trading, 17,913,688 shares were exchanged in all three markets, down from 24,848,411 units on Thursday, with the value of stocks traded on the Junior and Main markets amounts to $65.21 million, down from $94.99 million yesterday and the JSE USD market closed with an exchange of 1,000,615 shares for US$122,251 up from 393,307 units at US$18,728 on Thursday.

Main Market trading was led by JMMB 9.5% preference share with 4.66 million shares followed by Transjamaican Highway with 2.93 million units and Wigton Windfarm with 952,293 stock units.

In the Junior Market, One Great Studio led trading with 1.36 million shares followed by Lasco Distributors with 930,104 units and ONE on ONE Educational with 639,673 stock units.

At the close of the market, the major Main Market stocks that rose are Caribbean Cement popped 95 cents to $54.95, Guardian Holdings rose $2 to close at $369, Jamaica Producers rallied $2.29 in closing at $23.90, Massy Holdings climbed $1.80 to $94.85, Scotia Group popped $5 to $46 and Wisynco Group climbed $1.87 to $22.97.

At the close of the market, the major Main Market stocks that rose are Caribbean Cement popped 95 cents to $54.95, Guardian Holdings rose $2 to close at $369, Jamaica Producers rallied $2.29 in closing at $23.90, Massy Holdings climbed $1.80 to $94.85, Scotia Group popped $5 to $46 and Wisynco Group climbed $1.87 to $22.97.

The major declining Main Market stocks are Barita Investments dropped $1.10 in closing at $70.05, Eppley fell $4.10 to end at $34, Proven Investments dipped 99 cents to end at $22.01, Seprod sank $1.99 to end at $87 and Sygnus Real Estate Finance fell $1 to close at $10.

Stocks ending with major gains in the Junior Market are Dolphin Cove climbing 80 cents to $19 and ISP Finance gained $10.70 to close at $31, with the major losing stocks being Knutsford Express dropping $1.30 in closing at $11.10 and Main Event sinking 88 cents to close at $15.12.

In the preference segment, Jamaica Public Service 7% skidded $7.40 and ended at $41.90, 138 Student Living preference share increased $3.50 to close at $214.50 and Productive Business Solutions 9.75% preference share rallied $15.60 to end at $119.60.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21 on 2022-23 earnings and 14.3 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Big price changes for several JSE stocks

Solid gains for ICTOP10 stocks

The ICTOP10 stocks racked up some solid gains to close out the past week, even as the Jamaica Stock Exchange Junior and the Main Market that suffered losses last week declined further this past week.

The Main Market had just two stocks with notable price changes this past week, with Scotia Group jumping 13 percent to $34 and Key Insurance slipping 8 percent to close the week at $2.55. There were more changes of note in the Junior Market ICTOP10 that closed the week with a 15 percent rise in General Accident Insurance to $5.24, the price of Elite Diagnostic rose 11 percent to $1.79 and Iron Rock Insurance gained 5 percent to end at $2.20. Image Plus with a 4 percent loss to $2.02, was the only declining stock of note.

The Main Market had just two stocks with notable price changes this past week, with Scotia Group jumping 13 percent to $34 and Key Insurance slipping 8 percent to close the week at $2.55. There were more changes of note in the Junior Market ICTOP10 that closed the week with a 15 percent rise in General Accident Insurance to $5.24, the price of Elite Diagnostic rose 11 percent to $1.79 and Iron Rock Insurance gained 5 percent to end at $2.20. Image Plus with a 4 percent loss to $2.02, was the only declining stock of note.

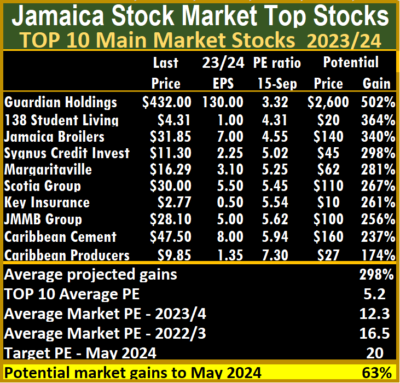

Earnings for Margaritaville was adjusted to $3.10 for the current fiscal year ending May 2024, placing the stock at number 5 on the list.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5, well below the market average of 12.2. The Main Market TOP10 is projected to gain an average of 298 percent, to May 2024, based on 2023 forecasted earnings.

A total of 11 of the most highly valued stocks representing 23 percent of the Main Market are priced with a PE of 16 to 84, with an average of 31 and 21 excluding the highest PE ratios, with a PE of 21 for the top half and 17 excluding the stocks with the over weighted valuations.

The PE of the Junior Market Top 10 sits at 5.2 just half of the market at 10.4. There are 10 stocks or 26 percent of the market, with PEs from 15 to 29, averaging 19 that are well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently, and projected to rise by 288 percent to May 2024.

The PE of the Junior Market Top 10 sits at 5.2 just half of the market at 10.4. There are 10 stocks or 26 percent of the market, with PEs from 15 to 29, averaging 19 that are well above the market’s average. The top half of the market has an average PE of 15, possibly the lowest fair value for Junior Market stocks currently, and projected to rise by 288 percent to May 2024.

The divergence between the average PE of the Main and Junior Markets and the overall market valuation are important indicators of the level of likely gains for ICTOP10 stocks.

The markets are not in a bullish state but there continue to be cases of slow upward movements in some prices as investors respond to some recent results leading them to quietly nibble away at the supplies of a number of stocks on offer and paving the way for price appreciation ahead. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors, Lasco Manufacturing and Transjamaican Highway.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 stocks are likely to deliver the best returns up to the end of May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly changes in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Junior Market Index drops for a second day

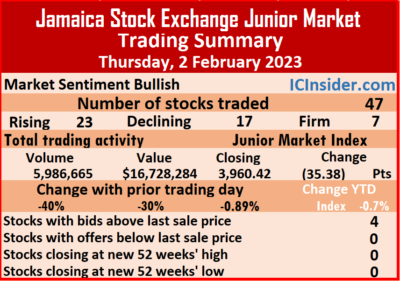

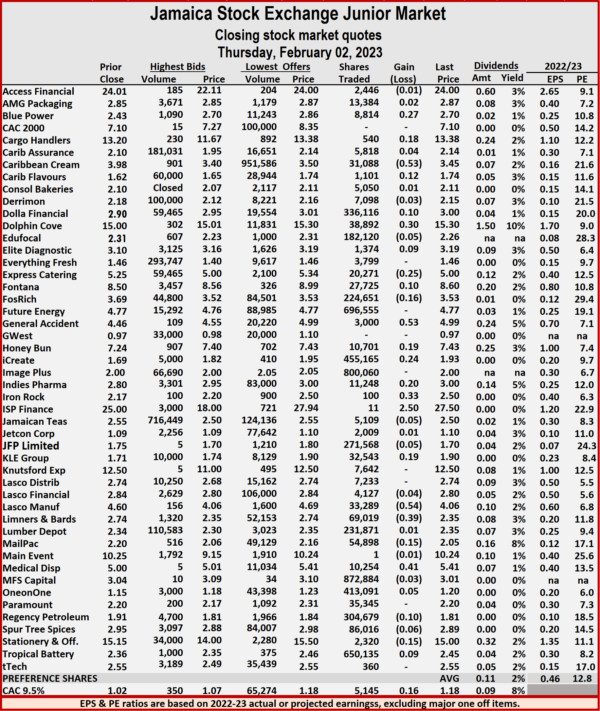

Investors were less active in Trading levels dropped the Junior Market of the Jamaica Stock Exchange on Thursday, resulting in a 40 percent fall in the volume of stocks traded, with the value slipping by 30 percent compared to trading on Wednesday, with trading in 47 securities compared with 45 on Wednesday and ending with 23 rising, 17 declining and seven unchanged.

A total of 5,986,665 shares were traded for $16,728,284 versus 10,060,543 units at $24,020,110 on Wednesday.

A total of 5,986,665 shares were traded for $16,728,284 versus 10,060,543 units at $24,020,110 on Wednesday.

Trading averaged 127,376 shares at $355,921 compared with 223,568 units at $533,780 on Wednesday, with the month to date averaging 174,426 stock units at $442,917. January closed with an average of 239,755 units at $646,375.

MFS Capital Partners led trading with 872,884 shares for 14.6 percent of total volume, followed by Image Plus Consultants with 800,060 units for 13.4 percent of the day’s trade and Future Energy Source with 696,555 units for 11.6 percent market share.

At the close, the Junior Market Index fell 35.38 points to settle at 3,960.42, giving back all of Tuesday’s substantial gains and a bit more.

The PE Ratio, a measure of computing appropriate stock values, averages 12.8. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for the financial years that end between November 2022 and August 2023.

The PE Ratio, a measure of computing appropriate stock values, averages 12.8. The PE ratios of Junior Market stocks incorporate ICInsider.com projected earnings for the financial years that end between November 2022 and August 2023.

Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and none with a lower offer.

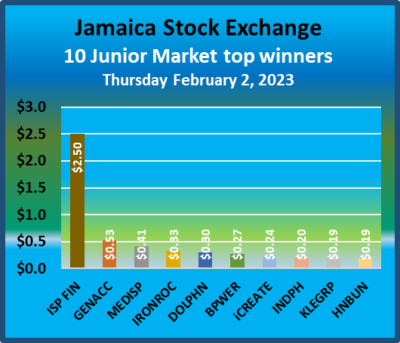

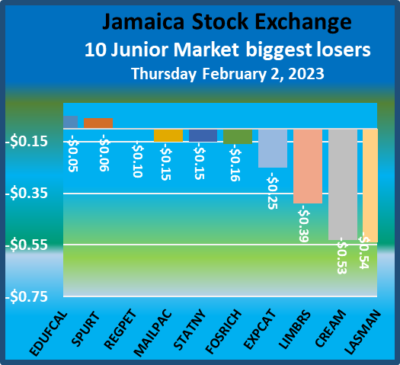

At the close, Blue Power rose 27 cents in closing at $2.70 after 8,814 shares were traded, Cargo Handlers rallied 18 cents ending at $13.38 with investors transferring 540 stocks, Caribbean Cream fell 53 cents to $3.45 after an exchange of 31,088 stock units. Caribbean Flavours gained 12 cents to end at $1.74 as investors switched ownership of 1,101 units, Dolla Financial popped 10 cents to close at $3 with a transfer of 336,116 shares, Dolphin Cove rose 30 cents in closing at $15.30, with 38,892 stocks crossing the market.  Elite Diagnostic popped 9 cents to close at $3.19 with 1,374 units changing hands, Express Catering lost 25 cents to end at $5 in switching ownership of 20,271 stock units, Fontana gained 10 cents to settle at $8.60 after swapping of 27,725 stocks. Fosrich dipped 16 cents to end at $3.53 in trading 224,651 shares, General Accident popped 53 cents to finish at $4.99 after 3,000 stock units cleared the market, Honey Bun advanced 19 cents to $7.43 after an exchange of 10,701 units, iCreate rallied 24 cents to $1.93 after trading 455,165 stocks, Indies Pharma gained 20 cents in ending at $3 with 11,248 units changing hands, Iron Rock Insurance rose 33 cents to close at $2.50 as investors exchanged 100 shares. ISP Finance climbed $2.50 in closing at $27.50 after a transfer of 11 stock units, KLE Group gained 19 cents to settle at $1.90 after an exchange of 32,543 units, Lasco Manufacturing declined 54 cents to end at $4.06 after 33,289 stock units passed through the market.

Elite Diagnostic popped 9 cents to close at $3.19 with 1,374 units changing hands, Express Catering lost 25 cents to end at $5 in switching ownership of 20,271 stock units, Fontana gained 10 cents to settle at $8.60 after swapping of 27,725 stocks. Fosrich dipped 16 cents to end at $3.53 in trading 224,651 shares, General Accident popped 53 cents to finish at $4.99 after 3,000 stock units cleared the market, Honey Bun advanced 19 cents to $7.43 after an exchange of 10,701 units, iCreate rallied 24 cents to $1.93 after trading 455,165 stocks, Indies Pharma gained 20 cents in ending at $3 with 11,248 units changing hands, Iron Rock Insurance rose 33 cents to close at $2.50 as investors exchanged 100 shares. ISP Finance climbed $2.50 in closing at $27.50 after a transfer of 11 stock units, KLE Group gained 19 cents to settle at $1.90 after an exchange of 32,543 units, Lasco Manufacturing declined 54 cents to end at $4.06 after 33,289 stock units passed through the market.  Limners and Bards dipped 39 cents to close at $2.35 in an exchange of 69,019 stocks, Mailpac Group shed 15 cents to $2.05 with a transfer of 54,898 shares, Medical Disposables rose 41 cents to $5.41 with the swapping of 10,254 stocks. Regency Petroleum lost 10 cents ending at $1.81, trading 304,679 shares, Stationery and Office Supplies shed 15 cents to close at $15 in exchanging 2,320 units and Tropical Battery gained 9 cents to end at $2.45 with the swapping of 650,135 stock units.

Limners and Bards dipped 39 cents to close at $2.35 in an exchange of 69,019 stocks, Mailpac Group shed 15 cents to $2.05 with a transfer of 54,898 shares, Medical Disposables rose 41 cents to $5.41 with the swapping of 10,254 stocks. Regency Petroleum lost 10 cents ending at $1.81, trading 304,679 shares, Stationery and Office Supplies shed 15 cents to close at $15 in exchanging 2,320 units and Tropical Battery gained 9 cents to end at $2.45 with the swapping of 650,135 stock units.

In the preference segment, CAC 2000 9.5% preference share gained 16 cents in closing at $1.18 in an exchange of 5,145 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Palace considering split stock

Palace Amusement Company is set to split the stock that last traded at $620 per share on Monday, with a range of 620 to $1,150 for 2022.

The company informed the Jamaica Stock Exchange that the Directors proposed to meet on Tuesday, December 20, 2022, and will be discussing the possibility of a stock split. A split is almost a certainty, with the company having borrowed over $700 million, the opportunity exists to raise fresh capital by way of an additional public issue of shares to pay down the debt. Splitting the stock to make them more attractive to retail investors would be a logical step.

The company informed the Jamaica Stock Exchange that the Directors proposed to meet on Tuesday, December 20, 2022, and will be discussing the possibility of a stock split. A split is almost a certainty, with the company having borrowed over $700 million, the opportunity exists to raise fresh capital by way of an additional public issue of shares to pay down the debt. Splitting the stock to make them more attractive to retail investors would be a logical step.

To achieve an attractive price and create wide-scale public interest would require a split in the order of 100 to 200 to one of the existing issued shares and would raise the issued number of shares to between 250 to 300 million units.

Other companies talking about stock splits that could come in 2023 are Medical Disposables that could come with a stock split and a rights issue of more shares to use to fund expansion.

Palace jumps $800 to a record $2,900.

Stationery and Office Supplies informed shareholders at the recently held Annual General Meeting that the directors have been looking but currently the liquidy of the stock does warrant one just yet.

Others that should give serious consideration to splitting their stocks are Access Financial Services, with the stock trading over $20, Dolphin Cove priced in double digits, Barita Investments, Cargo Handlers, Honey Bun, ISP Finance, Knutsford Express and Main Event.