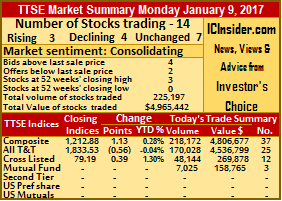

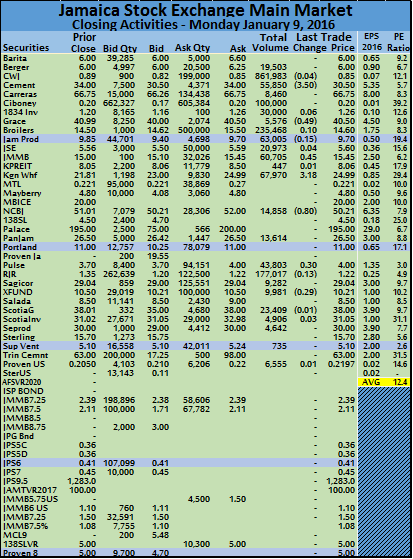

Market activity on the Trinidad & Tobago stock market on Monday ended with 14 securities changing hands compared to 11 on Friday. The market closed as 3 stocks advanced, 4 declined and 7 were unchanged with 225,197 units being traded at a value of $4,965,442 compared to Friday’s 222,518 shares valued at $4,418,139.

Market activity on the Trinidad & Tobago stock market on Monday ended with 14 securities changing hands compared to 11 on Friday. The market closed as 3 stocks advanced, 4 declined and 7 were unchanged with 225,197 units being traded at a value of $4,965,442 compared to Friday’s 222,518 shares valued at $4,418,139.

The Composite Index advanced 1.13 points to 1,212.88 points, the All T&T Index lost of 0.56 points to close at 1,833.53 points and the Cross Listed Index gained 0.39 points to 79.19 points.

IC bid-offer Indicator |The Investor’s Choice bid-offer ended with 4 stocks with bids higher than last selling prices and 2 with lower offers.

Gains| National Commercial Bank exchanged 8,087 shares advancing 5 cents to close at a 52 weeks’ high of $3.10, Scotia Investments rose 5 cents, with 11,041 units trading, and closed at a 52 weeks’ high of $2.10 and Trinidad Cement added 22 cents to close at a 52 weeks’ high of $4.67 while exchanging of 121,560 shares, valued at $551,785.

< Strong> Losses| Angostura Holdings closed at $14.70, falling 5 cents with 2,221 shares changing owners, Ansa McAL lost 25 cents, closing trading at $66.25 with only 150 units traded,. Scotiabank was down 3 cents to $58.77 with 26,839 shares changing ownership, valued at $1,577,378 and Unilever Caribbean closed at $59.80, with a loss of 3 cents and a mere 40 units trading.

Firm Trades| Clico Investments closed trading at $22.60 with 7,025 units being exchanged, First Caribbean International traded 25,716 shares and closed at $8.50, Guardian Media traded 408 units, to close at $19, JMMB Group was unchanged at 92 cents with an exchange of 3,300 shares. National Enterprises with 200 shares traded, closed at $10.68, Trinidad & Tobago NGL ended the day at $20.50 with an exchange of 100 units and West Indian Tobacco with 18,510 shares valued at $2,350,770 changing ownership, closed at $127.

Firm Trades| Clico Investments closed trading at $22.60 with 7,025 units being exchanged, First Caribbean International traded 25,716 shares and closed at $8.50, Guardian Media traded 408 units, to close at $19, JMMB Group was unchanged at 92 cents with an exchange of 3,300 shares. National Enterprises with 200 shares traded, closed at $10.68, Trinidad & Tobago NGL ended the day at $20.50 with an exchange of 100 units and West Indian Tobacco with 18,510 shares valued at $2,350,770 changing ownership, closed at $127.

More securities actively traded Monday

Jamaican stocks up in early trading – Monday

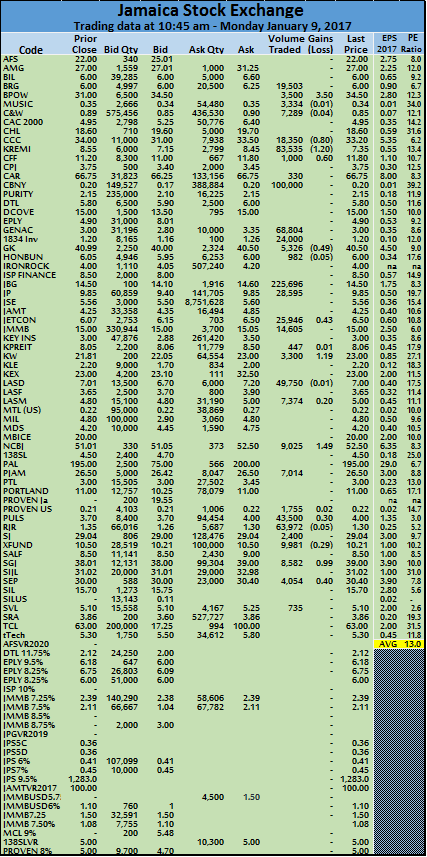

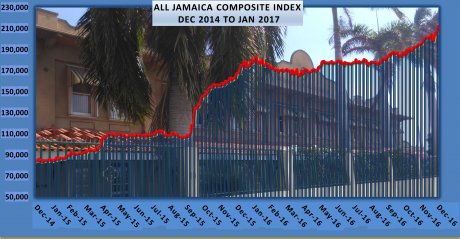

Stocks on the Jamaica Stock Exchange surged forward first thing Monday morning, with the All Jamaica composite index rising by 1,109.47 at 1 minute after trading opened to trade at a new high and the combined index moved up by 919.92 points.

Market activity resulted in 31 securities traded at 10:45 am, compared to 26 on Friday at 10:45 am. A total of 11 securities advanced and 9 declined, resulting in a volume of 842,68 shares changing hands, carrying a value of $7,961,875, compared of 984,204 shares changing hands, carrying a value of $4,620,010 on Friday. The average number of shares traded, amount to 27,183 units versus 37,854 units on Friday.

Market activity was helped by National Commercial Bank rising to $52.50, with 7,180 shares up from a last trade on Friday of $51.01, Scotia Group trading 8,582 units at $39, representing a rise of 99 cents from Friday’s close. In the junior market, Blue Power jumped $3.50 to a new all-time high of $34.50 with 3,500 units changing hands, Caribbean Cream fell back from Friday’s close of $8.55 to trade at $7.35 with 83,535 units and Jetcon Corporation with 25,946 units traded at a new high of $6.50. Caribbean Cement dropped $3.50 with 9,350 shares to $30.50 but recovered partially to traded 18,350 units up to $33.20.

Market activity was helped by National Commercial Bank rising to $52.50, with 7,180 shares up from a last trade on Friday of $51.01, Scotia Group trading 8,582 units at $39, representing a rise of 99 cents from Friday’s close. In the junior market, Blue Power jumped $3.50 to a new all-time high of $34.50 with 3,500 units changing hands, Caribbean Cream fell back from Friday’s close of $8.55 to trade at $7.35 with 83,535 units and Jetcon Corporation with 25,946 units traded at a new high of $6.50. Caribbean Cement dropped $3.50 with 9,350 shares to $30.50 but recovered partially to traded 18,350 units up to $33.20.

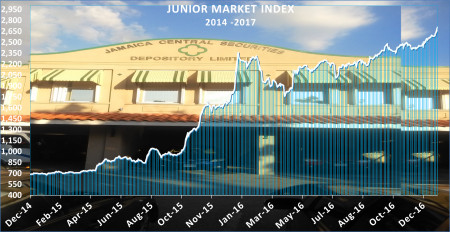

The all Jamaica Composite Index gained 645.01 points to 214,293.58, the Jamaica Stock Exchange Market Index grew 576.75 points 195,991.13 the Jamaica Stock Exchange combined index gained 662.77 points to 208,847.13 and the junior market index rose 12.45 points to 2,636.77.

Jamaican$ ended mixed on Friday

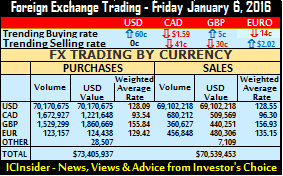

On Friday the central bank reported net inflows US$2.9 million with the buying and selling rates for the main currencies for the Jamaican dollar being mixed.

On Friday the central bank reported net inflows US$2.9 million with the buying and selling rates for the main currencies for the Jamaican dollar being mixed.

At the close of the market, dealers bought the equivalent of US$73,405,937 of all currencies and sold US$70,539,453, compared to US$36,967,257 purchased and US$39,708,349 sold on Thursday.

In US dollar trading, dealers bought US$70,170,675 compared to US$30,748,354 on Thursday. The buying rate for the US dollar rose 60 cents to close at $128.09. A total of US$69,102,218 was sold versus US$35,784,226 on Thursday, with the selling rate remaining unchanged at $128.55. The Canadian dollar buying rate fell $1.59 to $93.54, with dealers buying C$1,672,927 and selling C$680,212 at an average rate that slipped 41 cents to end at $96.30. The average rate for buying the British Pound climbed just 5 cents to $155.84 for the purchase of £1,529,299 while £360,627 was sold with a decline of 30 cents to end at $156.93.

The Canadian dollar buying rate fell $1.59 to $93.54, with dealers buying C$1,672,927 and selling C$680,212 at an average rate that slipped 41 cents to end at $96.30. The average rate for buying the British Pound climbed just 5 cents to $155.84 for the purchase of £1,529,299 while £360,627 was sold with a decline of 30 cents to end at $156.93.

At the end of trading on Friday, dealers sold €456,848 with the selling rate for the Euro, closing with a rise of $2.02 to $135.15, according to data from Bank of Jamaica. Dealers purchased €123,157 of the European common currency at $129.42 after falling 14 cents. The US dollar equivalent of other currencies traded, amounts to US$28,507 being bought and selling of US$7,109.

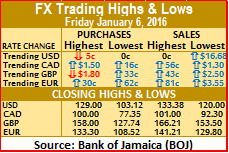

Highs & Lows| Notable changes to the highest and lowest rates for the regularly traded foreign currencies on Friday, include a rise in the lowest selling rate of the US dollar by $16.68 to $120. A rise of $1.50 in the highest buying rate for the Canadian dollar to end at $100 while the lowest selling rate grew $1.30 to $92.30. The highest buying rate for the British Pound dropped $1.80 to $158 and the lowest selling rate rose $2.50 to $153.50, while the lowest selling rate for the Euro put on $3.55 to close at $129.80.

Highs & Lows| Notable changes to the highest and lowest rates for the regularly traded foreign currencies on Friday, include a rise in the lowest selling rate of the US dollar by $16.68 to $120. A rise of $1.50 in the highest buying rate for the Canadian dollar to end at $100 while the lowest selling rate grew $1.30 to $92.30. The highest buying rate for the British Pound dropped $1.80 to $158 and the lowest selling rate rose $2.50 to $153.50, while the lowest selling rate for the Euro put on $3.55 to close at $129.80.

3 TTSE stocks rise 3 fall

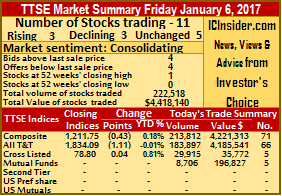

The Trinidad stock market closed Friday with the two main indices falling with advancing stocks equalling each other. Trading ended with 222,518 units changing hands, valued at $4,418,139 compared to Thursday’s 326,391 units valued at $3,531,245.

The Trinidad stock market closed Friday with the two main indices falling with advancing stocks equalling each other. Trading ended with 222,518 units changing hands, valued at $4,418,139 compared to Thursday’s 326,391 units valued at $3,531,245.

Trading closed on with 11 securities changing hands, the same as Thursday with 3 stocks advancing, 3 declining and 5 remaining unchanged.

The Composite Index fell 0.43 points to 1,211.75 points, the All T&T Index dropped 1.11 points to 1,834.09 and the Cross Listed Index gained 0.04 points to close at 78.80 points.

IC bid-offer Indicator|The Investor’s Choice bid-offer ended with 4 stocks with bids higher than last selling prices and 4 with lower offers.

Gains| Guardian Media gained 1 cent and closed at $19 with 2,000 units traded, Scotia Investments closed at 52 weeks’ high of $2.05, adding 4 cents with 6,000 units trading and Scotiabank gained 3 cents to close at $58.80 with 130 shares changing hands.

Losses| Clico Investments suffered a loss of 19 cents, closing at $22.60 with 8,706 shares trading, Republic Financial Holdings closed at $108.43, a loss of 1 cent with trades of 15,472 shares valued at $1,677,630 and Trinidad & Tobago NGL fell 49 cents to $20.50 after trading 107,200 units valued at $2,197,600.

Losses| Clico Investments suffered a loss of 19 cents, closing at $22.60 with 8,706 shares trading, Republic Financial Holdings closed at $108.43, a loss of 1 cent with trades of 15,472 shares valued at $1,677,630 and Trinidad & Tobago NGL fell 49 cents to $20.50 after trading 107,200 units valued at $2,197,600.

Firm Trades| Grace Kennedy closed trading at $2.67 trading 840 units, Guardian Holdings held firm at $13 with an exchange of 2,700 shares. JMMB Group was unchanged at 92 cents trading 23,075 units, Massy Holdings closed at $52 with 1,900 units changing owners and National Flour Mills traded 54,495 shares closing at $2.40.

Jamaica’s

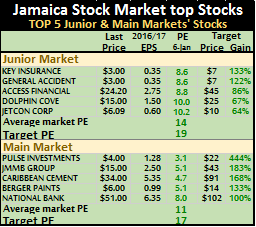

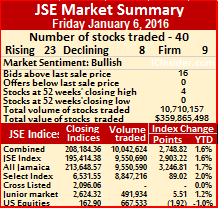

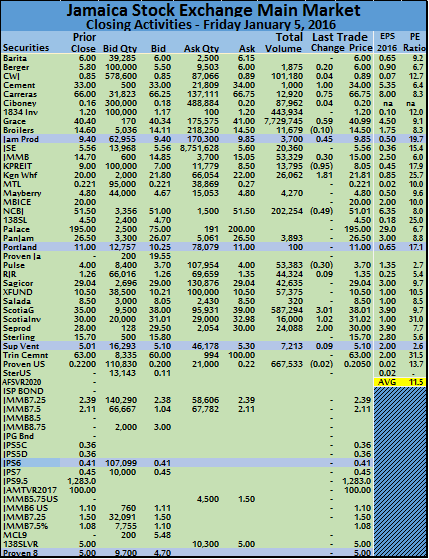

Jamaica’s  The main market of the Jamaica Stock Exchange, surged 3,247 points on Friday, cooled its heels on Monday as it failed to hang to decent gains at the start of trading of more than 1,000 points.

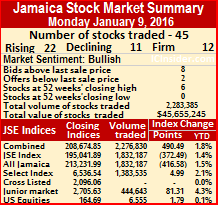

The main market of the Jamaica Stock Exchange, surged 3,247 points on Friday, cooled its heels on Monday as it failed to hang to decent gains at the start of trading of more than 1,000 points.  In market activity, Berger Paints ended trading 19,503 shares to close at $6, Cable & Wireless fell 4 cents to close at 85 cents with 861,983 units trading, Caribbean Cement ended with a fall of $3.50 while trading just 55,850 shares to close at $30.50. Carreras closed at $66.75 with 8,460 shares changing hands, Ciboney traded 100,000 units to end at 20 cents, Investors traded 30,000 shares of 1834 Investments to close at $1.26 after rising 6 cents. Grace Kennedy had just 5,576 units trading with the price falling 49 cents to close at $40.50. Jamaica Broilers gained 10 cents and closed at $14.60 with 235,468 shares changing hands, Jamaica Producers lost 15 cents to end trading at $9.70 with 63,005 units changing hands, Jamaica Stock Exchange gained 4 cents in trading 20,973 shares, to end at $5.60. JMMB Group traded 60,705 units and added 45 cents to end at $15.45, Kingston Wharves jumped by $3.18 in trading 67,970 shares at a 52 closing high of $24.99, National Commercial Bank traded 14,858 shares with a fall of 80 cents to close at $50.21.

In market activity, Berger Paints ended trading 19,503 shares to close at $6, Cable & Wireless fell 4 cents to close at 85 cents with 861,983 units trading, Caribbean Cement ended with a fall of $3.50 while trading just 55,850 shares to close at $30.50. Carreras closed at $66.75 with 8,460 shares changing hands, Ciboney traded 100,000 units to end at 20 cents, Investors traded 30,000 shares of 1834 Investments to close at $1.26 after rising 6 cents. Grace Kennedy had just 5,576 units trading with the price falling 49 cents to close at $40.50. Jamaica Broilers gained 10 cents and closed at $14.60 with 235,468 shares changing hands, Jamaica Producers lost 15 cents to end trading at $9.70 with 63,005 units changing hands, Jamaica Stock Exchange gained 4 cents in trading 20,973 shares, to end at $5.60. JMMB Group traded 60,705 units and added 45 cents to end at $15.45, Kingston Wharves jumped by $3.18 in trading 67,970 shares at a 52 closing high of $24.99, National Commercial Bank traded 14,858 shares with a fall of 80 cents to close at $50.21.  Pan Jam Investment traded 13,614 shares at $26.50, Pulse Investments gained 30 cents in trading 43,803 shares at $4, Radio Jamaica fell 13 cents to close at $1.22 after 177,017 shares changed hands, Sagicor Group closed with 9,282 shares changing hands at $29.04. Sagicor X Fund ended with 9,981 units trading at $10.21 lost 29 cents, Scotia Group with 23,409 shares changing hands and closed with a fall of 1 cent at $38, Scotia Investments gained 3 cents with 4,906 units trading, to end at $31.05. Seprod closed at $30 with 4,642 units changing hands and Proven Investments ordinary share traded 6,555 units at 21.97 US cents.

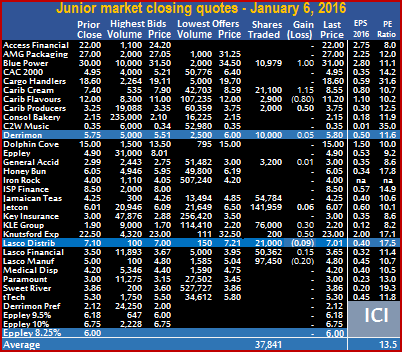

Pan Jam Investment traded 13,614 shares at $26.50, Pulse Investments gained 30 cents in trading 43,803 shares at $4, Radio Jamaica fell 13 cents to close at $1.22 after 177,017 shares changed hands, Sagicor Group closed with 9,282 shares changing hands at $29.04. Sagicor X Fund ended with 9,981 units trading at $10.21 lost 29 cents, Scotia Group with 23,409 shares changing hands and closed with a fall of 1 cent at $38, Scotia Investments gained 3 cents with 4,906 units trading, to end at $31.05. Seprod closed at $30 with 4,642 units changing hands and Proven Investments ordinary share traded 6,555 units at 21.97 US cents. The junior market surged 81.31 points, pushing the market index over the 2,700 mark for the first time, to end at a record 2,705.63 points at the close on Monday, with 5 securities trading at the close, at new all-time highs.

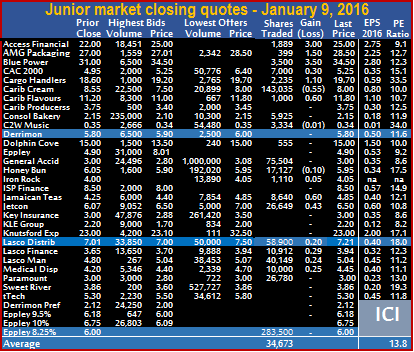

The junior market surged 81.31 points, pushing the market index over the 2,700 mark for the first time, to end at a record 2,705.63 points at the close on Monday, with 5 securities trading at the close, at new all-time highs. Securities that had bids above their last selling prices numbered just 4 on Monday and one ended with a lower offer. Since the start of last week there were a number of securities closing with large gaps between bids and last sale prices, with the exception of Eppley that has a bid of $8.01, compared to a last sale of $4.90, they have all traded higher to wipe out the major differences.

Securities that had bids above their last selling prices numbered just 4 on Monday and one ended with a lower offer. Since the start of last week there were a number of securities closing with large gaps between bids and last sale prices, with the exception of Eppley that has a bid of $8.01, compared to a last sale of $4.90, they have all traded higher to wipe out the major differences. Jetcon Corporation rose 43 cents, to close at a new all-time high of $6.50, with 26,649 shares being exchanged by investors, Lasco Distributors ended with 58,900 units trading with a gain of 20 cents to close at $7.21, Lasco Financial rose 29 cents and closed with 10,912 shares changing hands at $3.94. Lasco Manufacturing rose 24 cents to end at $5.04, with 40,149 units trading, Medical Disposables traded 10,000, shares with a rise of 25 cents to close at $4.45, Paramount Trading ended with 26,700 shares changing hands at $3 and Eppley 8.25% preference share, ended with 283,500 units changing hands at $6.

Jetcon Corporation rose 43 cents, to close at a new all-time high of $6.50, with 26,649 shares being exchanged by investors, Lasco Distributors ended with 58,900 units trading with a gain of 20 cents to close at $7.21, Lasco Financial rose 29 cents and closed with 10,912 shares changing hands at $3.94. Lasco Manufacturing rose 24 cents to end at $5.04, with 40,149 units trading, Medical Disposables traded 10,000, shares with a rise of 25 cents to close at $4.45, Paramount Trading ended with 26,700 shares changing hands at $3 and Eppley 8.25% preference share, ended with 283,500 units changing hands at $6.

There were not much movement in the main market stocks during the week.

There were not much movement in the main market stocks during the week.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator reading shows 13 stocks with bids higher than their last selling prices and none with a lower offer.

IC bid-offer Indicator| At the end of trading in the main and junior markets, the Investor’s Choice bid-offer indicator reading shows 13 stocks with bids higher than their last selling prices and none with a lower offer. Pan Jam Investment traded 3,893 shares at $26.50. Pulse Investments lost 30 cents in trading 53,383 shares at $3.70, Radio Jamaica rose 9 cents to close at $1.35 after 44,324 shares changed hands, Sagicor Group closed with 42,635 shares changing hands at $29.04. Sagicor X Fund ended with 57,375 units trading at $10.50. Scotia Group with 587,294 shares changing hands and closed with a rise of $3.01 at $38.01, Scotia Investments gained $1.02 with 16,000 units trading, to end at $31.02, Seprod rose $2 to $30 with 24,088 units changing hands, after trading at an intraday high, of $30.50, Supreme Ventures had just 7,213 shares trading and gained 9 cents to end at $5.10 and Proven Investments ordinary share traded 667,533 units at 20.5 US cents.

Pan Jam Investment traded 3,893 shares at $26.50. Pulse Investments lost 30 cents in trading 53,383 shares at $3.70, Radio Jamaica rose 9 cents to close at $1.35 after 44,324 shares changed hands, Sagicor Group closed with 42,635 shares changing hands at $29.04. Sagicor X Fund ended with 57,375 units trading at $10.50. Scotia Group with 587,294 shares changing hands and closed with a rise of $3.01 at $38.01, Scotia Investments gained $1.02 with 16,000 units trading, to end at $31.02, Seprod rose $2 to $30 with 24,088 units changing hands, after trading at an intraday high, of $30.50, Supreme Ventures had just 7,213 shares trading and gained 9 cents to end at $5.10 and Proven Investments ordinary share traded 667,533 units at 20.5 US cents.

The prices of 9 stocks rose, 3 declined with 13 securities trading, compared to 16 trading on Thursday. Volume of stocks traded fell 37 percent, from Thursday’s low level, ending with just 491.934 units changing hands, valued at $2,672,851, down by 32 percent from $3,954,032 on Thursday.

The prices of 9 stocks rose, 3 declined with 13 securities trading, compared to 16 trading on Thursday. Volume of stocks traded fell 37 percent, from Thursday’s low level, ending with just 491.934 units changing hands, valued at $2,672,851, down by 32 percent from $3,954,032 on Thursday. Jamaican Teas ended at $4.25 with 54,784 shares being exchanged.

Jamaican Teas ended at $4.25 with 54,784 shares being exchanged.