Remittance inflows to Jamaica continue to decline at the start of 2024 following several months of decline last year, with inflows for January 2024 amounting to US$246 million, down a relatively small 1.1 percent compared with US$248.6 in January 2023.

The decline represents the eighth consecutive month of negative inflows since June last year for the country.

The decline represents the eighth consecutive month of negative inflows since June last year for the country.

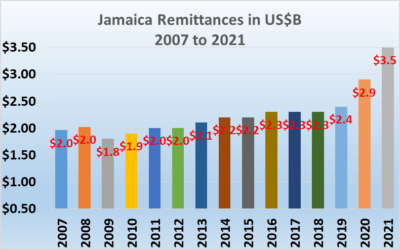

Jamaica’s decline of 1.1 percent was in contrast to the growth of 3.8 percent in January last year. Total inflows last year declined by two percent to US$3.37 billion from US$3.44 billion in 2022. Inflows peaked at US$3.497 billion in 2021.

Remittance inflows to Jamaica fall

Remittances to Jamaica slip

Jamaica’s Central Bank in downtown Kingston

Remittance inflows to Jamaica in July 2023 amount to US$303 million and represent a decline of 0.09 percent or US$2.7 million in comparison to July 2022 and is the 4th month of decline for the year to date, according to data released by the country’s Central Bank.

For the January to July 2023 period, remittance inflows to Jamaica amount to US$1,952 million, representing a decline of 0.4 percent compared to January to July 2022 when US$1,959 came into the country. Notwithstanding the decline for the year to date, the country is on track to match total inflows in 2022 of US$3.44 billion barring any major negative developments.

Treasury bill rates dip under 8%

Rates on Government of Jamaica Treasury bills hit their lowest level since November 2022 in this week’s auction for $2.2 billion in three tranches, due to mature in August and November this year and February 2024, resulting in rates on all three dipping under 8 percent.

The three months bill fell to 7.823 percent at this week’s auction, the lowest since November 2022, when the average rate came in at 7.96 percent. The six months instrument’s previous low of 7.96 percent in September last year came in at 7.975 percent at the recent auction and is also down from 8.32 percent in April this year. The nine months rate of 8.2 percent in July last year and 8.36 percent in April this year fell to 7.999 percent this week.

The three months bill fell to 7.823 percent at this week’s auction, the lowest since November 2022, when the average rate came in at 7.96 percent. The six months instrument’s previous low of 7.96 percent in September last year came in at 7.975 percent at the recent auction and is also down from 8.32 percent in April this year. The nine months rate of 8.2 percent in July last year and 8.36 percent in April this year fell to 7.999 percent this week.

The auction saw $8.9 billion going after the three issues on the same day that $27 billion, when after the CDs that Bank of Jamaica offered, resulted in CDs rate falling under 8 percent.

Jamaica’s remittances exceed $3 billion

Remittance inflows into Jamaica in 2022 exceeded the $3 billion mark second year with US$3.1 billion inflows for the first eleven months of the year and ended just below the $3.18 billion collected in the similar period for 2021.

For the full 2022 year, remittances seem set to exceed $3.4 billion, close to the full year intake of US$3.497 billion in 2021. In November, remittance inflows rose 0.7 percent to US$276.5 million, from US$274.5 million in 2021 and are just one of the four months that inflows increased during 2022.

For the full 2022 year, remittances seem set to exceed $3.4 billion, close to the full year intake of US$3.497 billion in 2021. In November, remittance inflows rose 0.7 percent to US$276.5 million, from US$274.5 million in 2021 and are just one of the four months that inflows increased during 2022.

Five countries account for the bulk of the flows, with the United States of America accounting for 70.2 percent of total flows, up from 70.1 percent recorded for November 2021. The United Kingdom contributed 10.2 percent, followed by Canada and the Cayman Islands at 9.7 percent and 6.2 percent, respectively.

Jamaica remittances fell in September

Remittance flows into Jamaica play a critical role for the country, it is the second largest inflow of foreign exchange after tourism. While tourism has now reached record levels for September and October, remittances fell US$16 million in September this year from the same period last year, with the country receiving U$288 million or 5.3 percent less than in 2021.

September is the fifth month for the year to register a decline and follows August with an increase of 12.7 percent.

September is the fifth month for the year to register a decline and follows August with an increase of 12.7 percent.

The decline brings the year to date fall to 1.9 percent with a total intake of US$2.55 billion, just under a billion dollars to match the total 2021 inflows of $3.5 billion. August registered a strong 12.7 percent increase to $307 million over the $273 million in 2021, but follows declines of May 8.1 percent, 4.7 percent in June and a fall of 5.6 percent in July.

Notwithstanding the decline this year, remittances are still well ahead of the pre-pandemic inflows of $2.4 billion in 2019.

Inflation in Jamaica now running under 5%

Inflation in Jamaica continues to decline and running well within the Bank of Jamaica target of 4 to 6 percent since the latter part of 2021, with inflation since October at 5.3 percent and 4.6 percent per annum since November last year.

In the next few months, inflation looks set to dip even more with commodity prices falling sharply with the price of fuel which is now under US$90 per barrel, set to send inflation locally down sharply.

In the next few months, inflation looks set to dip even more with commodity prices falling sharply with the price of fuel which is now under US$90 per barrel, set to send inflation locally down sharply.

As measured by the Consumer Price Index, Inflation increased by 0.7 percent for July 2022, the Statistical Institute of Jamaica (STATIN) reported this week, bringing inflation since July last year to 10.2 percent, the government agency stated. The July 2022 inflation comes in well under the 1.7 percent increase in July 2021 but in line with the Inflation for June last year of 0.7 percent.

This increase for July, Statin states, was due mainly to a 1.4 percent increase in the index for the heavily weighted ‘Food and Non-Alcoholic Beverages’ division, with ‘Vegetables, tubers, plantains, cooking bananas and pulses’ rising 3 percent, ‘Cereals and cereal products’ up 1.7 percent, ‘Meat and other parts of slaughtered land animals’ increasing 0.8 percent and ‘Fish and Seafood’ up 0.7 percent.

Inflation in July was impacted by one off increase in toll rates on the two toll roads.

Jamaica’s NIR jumps $104m in December

One signal of the health of a country’s international trade can be viewed from the performance of its net international reserves, based on this, the Jamaican economy could be in a pretty decent shape.

Jamaica has seen a bounce in remittances in the country climbing from just $2.4 billion in 2019 to $2.9 billion in 2020 and is expected to touch US$3.6 billion last year. In addition, tourism inflows have bounced back well in 2021, with preliminary data indicating that in December last year arrivals could be down 24 percent against that of 2019 before the disruptions in 2020 started, with all of 2021 down 45 percent on 2019. Bank of Jamaica reported that the country’s net international reserves rose US$104 million in December over November 2021 to close the year at $$4 billion and is up from US$3.1 billion at the end of 2020.

Jamaica has seen a bounce in remittances in the country climbing from just $2.4 billion in 2019 to $2.9 billion in 2020 and is expected to touch US$3.6 billion last year. In addition, tourism inflows have bounced back well in 2021, with preliminary data indicating that in December last year arrivals could be down 24 percent against that of 2019 before the disruptions in 2020 started, with all of 2021 down 45 percent on 2019. Bank of Jamaica reported that the country’s net international reserves rose US$104 million in December over November 2021 to close the year at $$4 billion and is up from US$3.1 billion at the end of 2020.

Have Interest rates peaked?

Jamaica’s Central Bank

Interest rates on Certificate of Deposit issued by Bank of Jamaica seem to be levelling off, with the rate at last week’s auction declining from the previous week’s outturn.

Last week’s offer of $7.5 billion in 30 days on Wednesday, 27 October, attracted 76 applications amounting to $13 billion and resulted in an average yield of 3.96 percent, down from 4.53 percent at the auction in the previous week. Bids were received as low as 2.5 percent covering $1.48 billion, with the highest rate bid being 7.34 percent for $20 million. A bid amounting to $550 million received full allocation at 4.79 percent. The total nominal outstanding amount for the 30-day CDs on the settlement date – 29 October, will be $41.5 billion, down from $46.5 billion in mid-October.

This was influenced mainly by the point-to-point inflation rate for the divisions: ‘Food and Non-Alcoholic Beverages’ (10.1%) and Restaurants and Accommodations Services’ (16.9%). These upward movements were, however, tempered by a 1.9 per cent decline in the index for the group ‘Housing, Water, Electricity, Gas and Other Fuels,“ Statin stated.

This was influenced mainly by the point-to-point inflation rate for the divisions: ‘Food and Non-Alcoholic Beverages’ (10.1%) and Restaurants and Accommodations Services’ (16.9%). These upward movements were, however, tempered by a 1.9 per cent decline in the index for the group ‘Housing, Water, Electricity, Gas and Other Fuels,“ Statin stated. The

The