It was not a great year for Jamaican stocks in 2023, with all three Jamaica Stock Exchange markets declining, with the Main Market dropping 9 percent, marginally below the 10.2 percent fall in the JSE Index in 2022. The Junior Market slipped 2.5 percent for the year compared to a 16.3 percent gain in 2022 while the USD market fell 1.2 percent compared with a 14 percent rise in 2022. Main market stocks were helped considerably by the market recovering 6.5 percent since early December with the market closing with a bullish tone.

Main market stocks were helped considerably by the market recovering 6.5 percent since early December with the market closing with a bullish tone.

Ciboney was the Jamaica Stock Exchange best performing stock for 2023 in the Main Market with gains of 107 percent, followed by Transjamaican Highway, with an outstanding performance, ending the year up 93 percent and paid a dividend of 18.7 cents for an overall return to investors from the start of the year of 106 percent. The next best performing stock was AS Bryden, the Trinidad based, majority Jamaican ownership, up by 47 percent from the listed price of $22.50 in November. Buoyed by improved results for the fiscal year 2023 and the first quarter profit results to September, Wisynco Group  gained 22 percent and Stanley Motta 14 percent followed by the Trinidad based Massy Holdings up 13 percent, in a year when only 13 stocks posted gains in the main market.

gained 22 percent and Stanley Motta 14 percent followed by the Trinidad based Massy Holdings up 13 percent, in a year when only 13 stocks posted gains in the main market.

Losing stocks were plentiful during the year, with 38 or 78 percent decline in the Main Market.

The worst performing stock was the real estate development company, First Rock Real Estate Investments with a 46 percent decline, followed by Palace Amusement down 44 percent, Guardian Holdings sinking 39 percent, Jamaica Stock Exchange and Berger Paints both losing 37 percent, followed by Pulse Investments down 34 percent and Key Insurance with a fall of 32 percent.

Ciboney gains 107% & Transjamaican 93% for 2023

Ciboney & Transjamaican JSE hottest stocks

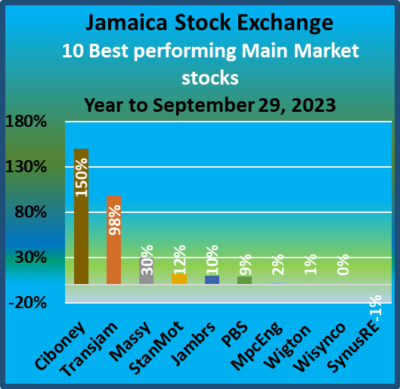

Ciboney and Transjamaican Highway stocks recorded gains of 150 percent and 98 percent to September respectively in a period of poor performance for the Main Market of the Jamaica Stock Exchange that fell 8 percent over the same period. The Trinidad and Tobago based Massey Holdings was next with a 30 percent rise.

The above two leading stocks were not only dominant Main Market, they were the best performing ones in the overall market of the exchange bettering the next best, the Junior Market, ISP Finance with a gain of 94 percent.

The above two leading stocks were not only dominant Main Market, they were the best performing ones in the overall market of the exchange bettering the next best, the Junior Market, ISP Finance with a gain of 94 percent.

The Main Market had only eight companies recording gains for the first nine months of 2023 as tight monetary policy pursued by Bank of Jamaica and poor profit results of several companies weighed down on stock prices.

Ciboney rise follows the acquisition of the majority shares from Finsac by the new majority owners IEC Energy Company. Transjamaican Highway the next performer was pushed by an outstanding jump in profits for the six months to June over the similar period last year, with earnings of 14 Jamaican cents per share versus just 3 cents for the same period last year. The stock’s performance was also helped by the declaration of a substantial increase in dividend of 18.66 cents up from 8.55 cents last year.

The commercial rental property company Stanley Motta, delivered a 12 percent increase, Jamaica Broilers chipped in with 10 percent and Productivity Business Solutions 9 percent.

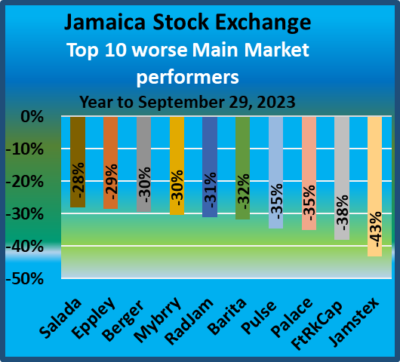

Most of the Main Market worst performing stocks reported disappointing results compared to the previous year. Palace Amusement Company was the only listing of the worst performing stocks that recorded improved profit compared to 2022. Mayberry Investments suffered a sharp reversal in profit during 2023 compared to the previous year, Berger Paints profit fell sharply with the company reporting a loss during the period, Radio Jamaica reported a loss during the last two quarters compared to the previous year. Barita Investments profits are down sharply with the third quarter to June down from $1.5 billion in 2022 to just $504 million in the current year.

Mayberry Investments suffered a sharp reversal in profit during 2023 compared to the previous year, Berger Paints profit fell sharply with the company reporting a loss during the period, Radio Jamaica reported a loss during the last two quarters compared to the previous year. Barita Investments profits are down sharply with the third quarter to June down from $1.5 billion in 2022 to just $504 million in the current year.

Jamaica Stock Exchange led the declining stocks with a 43 percent drop, First Rock Capital was next with a fall of 38 percent followed by Palace and Pulse down 35 percent each. Barita Investments dropped 32 percent and Radio Jamaica ended with a fall of 31 percent, Salada Foods ended up with the lowest decline of the TOP10 worst performing stocks with a loss of 20 percent.

Junior Market stocks dominate half year

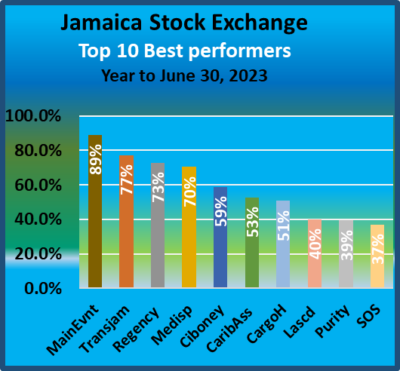

At the midway point in the year, the Jamaica Stock Exchange Main Market is down 7 percent, with the Financial Index down a much larger 15 percent, but the Junior Market is flat, as the JSE delivered 35 price gains for the ordinary shares and 59 losses as Junior Market stocks dominated the top positions for the first half of 2023.

Expectations are that the Junior Market will continue its upward movement in the second half of the year with technical indicators pointing to a big upward push in the market. The market gained 75 percent the last time these indicators flashed a buy signal.

Expectations are that the Junior Market will continue its upward movement in the second half of the year with technical indicators pointing to a big upward push in the market. The market gained 75 percent the last time these indicators flashed a buy signal.

The Main Market remains under some selling pressure and is not signalling a sustained rally in the short term. But June is never the month of recovery for that market following sell in May and go away. July is the month that is historically the period in the past the Main Market usually starts to rally and sometimes as late as August fueled by mid year results that will mostly be in by the middle of August.

There are only two Main Market stocks in the TOP10 with Transjamaican heads Stocks to Watch coming on top for that market with a 77 percent gain, year to date, with it being the second highest performer for the overall market for the year so far. Ciboney is up 59 percent and the fifth highest performer, and the second best Main market stock, thanks partially to a change in the majority ownership to IEC Energy Company Ltd, with the new directors being Nigel Davy, Jennifer Davy, Klyle Davy, Wycliffe Cameron Conley Salmon Donald Patterson and Wayne Wray.

The top performing stock is Main Event with a rise of 89 percent, with more gains expected with the PE ratio of just 10 times this year’s earnings, while Stationery and Office Supplies doubled after an announcement to consider a stock split at a directors meeting on June 21 ended with a gain of 37 percent for the half year as the price pulled back after the directors announced a recommendation for a 9 for 1 split to be voted on at the company’s AGM on July 25.

The top performing stock is Main Event with a rise of 89 percent, with more gains expected with the PE ratio of just 10 times this year’s earnings, while Stationery and Office Supplies doubled after an announcement to consider a stock split at a directors meeting on June 21 ended with a gain of 37 percent for the half year as the price pulled back after the directors announced a recommendation for a 9 for 1 split to be voted on at the company’s AGM on July 25.

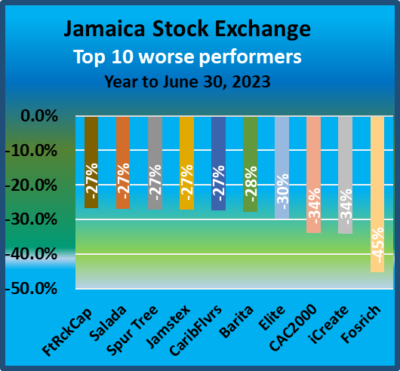

The Junior Market has the majority of stocks, six, in the worst performer grouping, with Fosrich being the worst with a loss of 45 percent as the price corrected sharply from an overbought position last year, followed by iCreate down 34 percent from excessive speculation from a number of announcements the company made last year.

Junior Market jumps 47% since March 2020

The Junior Market climbed 47 percent in just over a year since the market collapsed by just over 39 percent in March last year from the close of 2019 when the market hit a multi-year low of 2,031.79 on March 18 last year.

At the same time, the JSE Main Market, while trading above the March 2001 low, is nowhere near the 2020 high and closed out the first quarter marginally down on the 2020 closing.

At the same time, the JSE Main Market, while trading above the March 2001 low, is nowhere near the 2020 high and closed out the first quarter marginally down on the 2020 closing.

The Junior Market is up 13 percent for 2021 to the end of March, clawing back most of 21 percent of the fall in 2020 and is now just 11 percent from the close of 3,348.97 at the end of December 2019.

In 2020, the Junior and Main Markets declined, with the Junior Market just edging out the Main Market index with a lower decline of 21 percent versus 22.6 percent for the year.

One year ago, to the end of March, the Junior Market Index dropped 29 percent to 2304.14 but was down a much steeper 47 percent to March 18, at 2031.79 points on the market index. The March 2020 low was the lowest point for the Junior Market since it closed at 2,032.77 points on July 1, 2016.

The market made some recovery last year from the year’s low when it moved higher on April 14, to 2,686.90 points but drifted down after some attempts to break over 2,600 points on a sustained level and closed out 2020 at 2,643.38.

In the meantime, the JSE Main Market failed to move higher in 2021, ending the first quarter 0.20 percent lower than the December close. It is still a bit lower than the 442,905.76 reached on the All Jamaica Composite Index after the early rebound from the 2020 low of 375,091.09 reached on March 25 last year, or the 438,045.18 reached subsequently on November 30.

In the meantime, the JSE Main Market failed to move higher in 2021, ending the first quarter 0.20 percent lower than the December close. It is still a bit lower than the 442,905.76 reached on the All Jamaica Composite Index after the early rebound from the 2020 low of 375,091.09 reached on March 25 last year, or the 438,045.18 reached subsequently on November 30.

The gains of eighteen stocks in the first quarter, this year, exceed that of the average of the market and just three performed worse, including CAC 2000 with a fall of 24 percent 19 percent decline for Dolphin Cove and 16 percent in the case of Knutsford Express. Five stocks contributing to the 2021 rebound for the Junior Market are Jamaican Teas up 60 percent, Indies Pharma 48 percent, Lumber Depot 47 percent, Blue Power 35 percent, Caribbean Flavours 35 percent and Fosrich 28 percent.

The Main Market recorded gains in 16 stocks that beat the market’s average move in 2021, with 26 falling below. Main market stocks with healthy gains are Ciboney with a stunning 142 percent rise, followed by Salada Foods with 125 percent gain aided by a 10 to one stock split, Grace Kennedy 37 percent, First Rock 31 percent and proven Investments 27 percent. Palace Amusement Company that the Covid-19 dislocation has badly hurt is the worst-performing stock with a 51 percent decline, followed by Portland JSX with a loss of 25 percent and Radio Jamaica with 22 percent. Wisynco lost 14 percent and Wigton Windfarm 13 percent.

The Main Market recorded gains in 16 stocks that beat the market’s average move in 2021, with 26 falling below. Main market stocks with healthy gains are Ciboney with a stunning 142 percent rise, followed by Salada Foods with 125 percent gain aided by a 10 to one stock split, Grace Kennedy 37 percent, First Rock 31 percent and proven Investments 27 percent. Palace Amusement Company that the Covid-19 dislocation has badly hurt is the worst-performing stock with a 51 percent decline, followed by Portland JSX with a loss of 25 percent and Radio Jamaica with 22 percent. Wisynco lost 14 percent and Wigton Windfarm 13 percent.

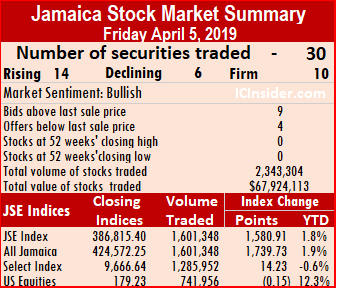

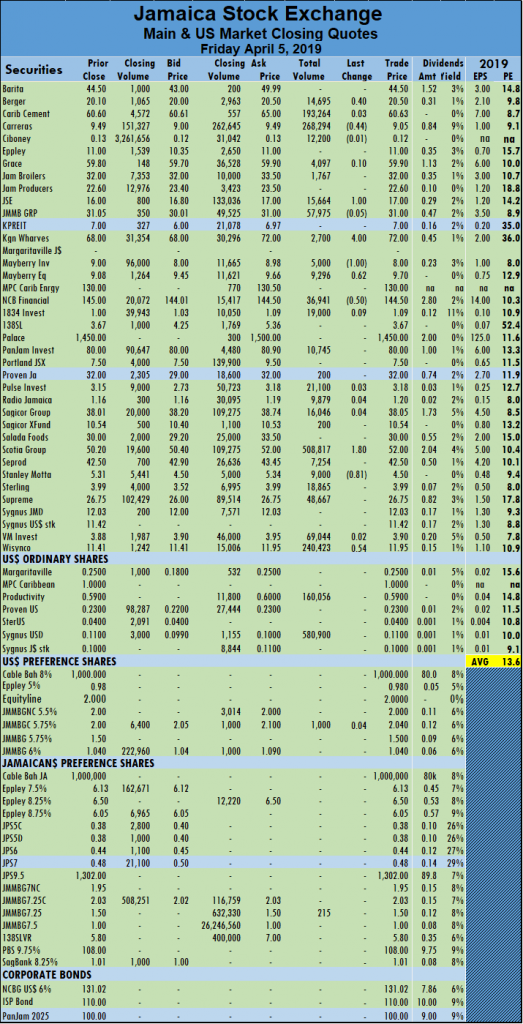

Main market closes higher – Friday

Trading on the main market of the Jamaica Stock Exchange ended on Friday with JSE All Jamaican Composite Index climbing 1,739.73 points to 424,572.25 and the JSE Index advancing by 1,580.91 points to 386,815.40.

Trading on the main market of the Jamaica Stock Exchange ended on Friday with JSE All Jamaican Composite Index climbing 1,739.73 points to 424,572.25 and the JSE Index advancing by 1,580.91 points to 386,815.40.

At the close of the main and US markets, 30 securities traded, compared to 33 on Thursday and leading to 14 advancing, 6 declining and 10 closing unchanged.

Trading ended with 1,601,348 units valued $55,418,482 crossing the exchange, compared to 12,017,340 units valued $109,444,077 changing hands on Thursday.

Scotia Group led trading with 508,817 shares, comprising 31.8 percent of total main market volume, followed by Carreras with 268,294 stock units or 16.75 percent of the day’s trades and Wisynco Group with 240,423 units or 15 percent.

Market activity ended with an average of 59,309 units valued at over $2,052,536, in contrast to 375,542 shares valued at $3,420,127 on Thursday. The average volume and value for the month to date amounts  to 289,643 shares at $3,590,315 for each security, compared to 341,904 units valued at $3,094,443 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

to 289,643 shares at $3,590,315 for each security, compared to 341,904 units valued at $3,094,443 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 9 stocks ending with bids higher than their last selling prices and 4 closing with lower offers.

In main market activity, Berger Paints gained 40 cents and ended at $20.50, with 14,695 stock units changing hands, Carreras concluded trading with 268,294 units but lost 44 cents to close at $9.05, Jamaica Stock Exchange gained $1 to end at $17, with an exchange of 15,664 shares. Kingston Wharves recovered the $4 it lost on Thursday, to settle at $72, trading 2,700 units, Mayberry Investments fell $1 in trading 5,000 shares, at $8, Mayberry Jamaican Equities loaded 62 cents and ended trading of 9,296 shares at $9.70, NCB Financial Group traded 36,941 shares, losing 50 cents to close at $144.50. Scotia Group climbed $1.80 trading 508,817 shares at $52, Stanley Motta lost 81 cents to end at $4.50, trading 9,000 shares and Wisynco Group rose 54 cents, ending trading of 240,423 shares at $11.95.

Mayberry Investments fell $1 in trading 5,000 shares, at $8, Mayberry Jamaican Equities loaded 62 cents and ended trading of 9,296 shares at $9.70, NCB Financial Group traded 36,941 shares, losing 50 cents to close at $144.50. Scotia Group climbed $1.80 trading 508,817 shares at $52, Stanley Motta lost 81 cents to end at $4.50, trading 9,000 shares and Wisynco Group rose 54 cents, ending trading of 240,423 shares at $11.95.

Trading in the US dollar market ended with 741,956 units valued at over US$96,943. JMMB Group 5.75% preference share traded 1,000 units with a 4 US cents gain to close at US$2.04Proven Investments ended with 160,056 units trading at 23 US cents and Sygnus Credit Investments traded 580,900 units to end at 10 US cents. The JSE USD Equities Index declined 0.15 points to close at 179.23.

Gains for JSE main market – Friday

The market indices of the main market of the Jamaica Stock Exchange rose at the end of trading on Friday, with JSE All Jamaican Composite Index increased by 805.06 points to 423,994.88 and the JSE Index advanced 731.56 points to 386,288.84.

The market indices of the main market of the Jamaica Stock Exchange rose at the end of trading on Friday, with JSE All Jamaican Composite Index increased by 805.06 points to 423,994.88 and the JSE Index advanced 731.56 points to 386,288.84.

At the close of market, the main and US markets traded 34 securities, compared to 31 trading on Thursday as 11 advanced, 18 declined and 5 traded without prices changing.

Main market activity ended with 12,313,288 units valued $192,392,395 trading, compared to 4,358,596 units valued $135,130,896 changing hands, on Thursday.

Wisynco Group led trading with 6.38 million shares for 51.8 percent of the day’s volume, followed by Ciboney ending with 1.67 million units, for 13.6 percent of the total main market volume changing hands and Jamaica Broilers ended with 1.63 million units, for 12.5 percent of the day’s volume.

Market activity ended with an average of 373,130 units valued $5,830,073 for each security trading, in contrast to 155,664 shares valued at $4,826,103 on Thursday. The average volume and value for the month to date, amounts to 405,757 shares at $6,032,403 for each security traded, in contrast to 409,081 shares at $6,055,347 on the prior trading day. Trading for February resulted in an average of 281,016 shares with a value of $11,715,160, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 7 stocks ending with bids higher than their last selling prices and 3 closing with lower offers.

In main market activity, Berger Paints gained 50 cents and ended at $20, trading 7,650 stock units, Caribbean Cement fell 50 cents to finish at $51.50, with 81,125 shares changing hands, Eppley dropped 35 cents to close at $10, trading 913 stock units, Jamaica Broilers lost $1.12 in trading 1,532,550 units at $31.88. Jamaica Producers rose 55 cents to close at $22.55, with 51,269 shares changing hands, Mayberry Jamaican Equities added 41 cents to settle at $10, with an exchange of 38,103 units, NCB Financial Group lost 50 cents trading 67,660 shares to close at $144.50. PanJam Investment lost $1.70 to end at $80, in trading 3,810 units, Sagicor Group gained 45 cents in  trading 18,701 shares, to close at $39. Salada Foods lost 95 cents trading 1,808 units to close at $29.05, Scotia Group fell 39 cents to end trading at $51.01, with 150,247 units, Seprod lost 50 cents to close at $44, with 31,309 shares changing hands, Supreme Ventures concluded trading at $24.40, with 237,378 stock units, Sygnus Credit Investments added 35 cents to close at $13.65 trading 17,212 shares and Wisynco Group fell 50 cents settled at $11.50, with an exchange of 6,381,077 shares.

trading 18,701 shares, to close at $39. Salada Foods lost 95 cents trading 1,808 units to close at $29.05, Scotia Group fell 39 cents to end trading at $51.01, with 150,247 units, Seprod lost 50 cents to close at $44, with 31,309 shares changing hands, Supreme Ventures concluded trading at $24.40, with 237,378 stock units, Sygnus Credit Investments added 35 cents to close at $13.65 trading 17,212 shares and Wisynco Group fell 50 cents settled at $11.50, with an exchange of 6,381,077 shares.

Trading in the US dollar market resulted in 67,189 units valued at $18,750 changing hands. JMMB Group 6% preference share concluded trading of 147 units with a rise of 4 cents to end at US$1.04, JMMB Group 5.75% closed at $2 with 5,500 shares changing hands, Margaritaville ended trading of 2,828 share at 23 US cents after falling 1 cent. Proven Investments traded 8,214 units at 24 US cents after rising by 1 cent and Sygnus Credit Investments Jamaican dollar ordinary share traded 50,500 to close at 10 US cents The JSE USD Equities Index rose 0.11 points to close at 178.87.

JSE majors pulls back – Thursday

Carib Cement traded at a record high of $60.

At the close market activity, the main and US markets traded 38 securities, compared to 35 securities trading on Wednesday as 17 advanced, 9 declined and 12 traded without changes in prices. Caribbean Cement traded at an at a 52 weeks’ high of $60 before retreating to close at $54, Eppley 7.5% preference share traded a at a 52 weeks’ high of $6.13 and the Jamaica Stock Exchange traded at a record high of $18.

Main market activity ended with 6,800,119 units valued at $107,742,633 compared to 2,447,527 units valued $48,782,718, changing hands, on Wednesday.

Ciboney led trading with 2,217,789 shares for 32.6 percent of the day’s volume, JMMB Group 7.25% Preference share was next with 1,001,753 units, accounting for 14.7 percent of the total main market volume changing hands and Wisynco Group ended with 948,463 shares, for 14 percent of the day’s volume.

Market activity ended with an average 206,064 units, valued at $3,264,928 for each securities traded, compared with an average of 78,952 units valued at $1,573,636, on Wednesday. The average volume and value for the month to date, amounts to 281,016 shares with a value of $11,715,160 and previously, 285,064 shares with a value of $12,195,949. Trading for January resulted in an average of 101,980 units, valued at $3,042,494, for each security traded.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 8 stocks ending with bids higher than their last selling prices and 2 closing with lower offers.

In main market activity, Berger Paints rose 48 cents and ended at $20, with 6,734 stock units, Jamaica Broilers finished trading 62,676 shares after climbing $1.40, to close at $34.40, Jamaica Producers lost 50 cents trading 21,935 units, to close at $23. Jamaica Stock Exchange climbed 50 cents and ended at a 52 weeks’ high of

$18, with 22,755 shares changing hands, Kingston Wharves dropped $2 and settled at $75, with an exchange of 7,729 units, PanJam Investment gained 45 cents to end at $79.45, trading 2,503 units. Sagicor Group shed $1.94 trading 83,879 shares to close at $40.05, Salada Foods shed $2.50 trading 25,900 units to close at $31.50, Scotia Group gained 90 cents trading 8,275 stock units at $53.40 and Sygnus Credit Investments rose 28 cents trading 182,345 shares to close at $14.

$18, with 22,755 shares changing hands, Kingston Wharves dropped $2 and settled at $75, with an exchange of 7,729 units, PanJam Investment gained 45 cents to end at $79.45, trading 2,503 units. Sagicor Group shed $1.94 trading 83,879 shares to close at $40.05, Salada Foods shed $2.50 trading 25,900 units to close at $31.50, Scotia Group gained 90 cents trading 8,275 stock units at $53.40 and Sygnus Credit Investments rose 28 cents trading 182,345 shares to close at $14.Trading in the US dollar market resulted in 141,624 units valued at over $91,276 changing hands. JMMB Group 5.75% preference share closed at $2 trading 2,600 shares, JMMB Group 6% USD preference share traded 13,000 units at US$1.04, Proven Investments rose 0.98 cent in trading 25,455 units, to close at 21.98 US cents and Sygnus Credit Investments exchanged of 40,800 shares at 11 US cents after falling 1 cent. The JSE USD Equities Index rose 0.86 points to close at 173.96.

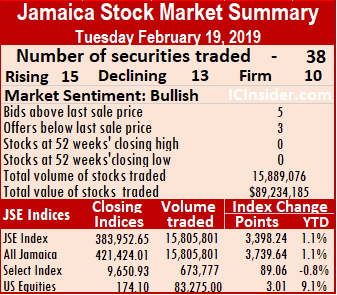

Seprod jumps $7 to $46 – Tuesday

Seprod jumped $7.01 to close at $46.

Seprod an IC Insider.com Stock to Watch, for the week, jumped a sharp $7.01 to close at $46 after hitting $47 during the trading session, in trading 69,936 shares, in response to the company reporting a big jump in profit for 2018.

Profit after tax moved from $735 million in 2017 to $1.276 billion from an increase in revenues of 48 percent to $24.4 billion with profit rising over 2,000 percent to $304 million in the December quarter, from a doubling in revenues.

Trading on the main market of the Jamaica Stock Exchange ended as JSE All Jamaican Composite Index increased by 3,739.64 points to 421,424.01 and the JSE Index advanced 3,398.24 points to 383,952.65.

At the close market activity, the main and US markets traded 38 securities, compared to 34 securities trading on Monday, with 15 advanced, 13 declined and 10 traded with prices unchanged.

Main market activity ended with, 15,805,801 units valued at $87,341,139 compared to 4,631,898 units valued $132,673,939 changing hands, on Monday.

An average of 451,594 units valued at an average of $2,495,461 for each security traded. In contrast to 149,416 units for an average of $4,279,804 on Monday. The average volume and value for the month to date, amounts to 325,058 shares with a value of $13,668,348 and previously, 313,874 shares with a value of $14,739,721. Trading for January resulted in an average of 101,980 units, valued at $3,042,494, for each security traded.

JMMB Group 7.25% preference share led trading with 11,919,446 shares for 75.4 percent of the day’s volume, Pulse Investments was next with 901,239 shares, accounting for 5.7 percent of the total main market volume changing hands and Ciboney ended with 607,166 shares, for 3.8 percent of the day’s volume.

IC bid-offer Indicator|The Investor’s Choice bid-offer indicator ended with the reading showing 4 stocks ending with bids higher than their last selling prices and 3 stocks closed with lower offers.

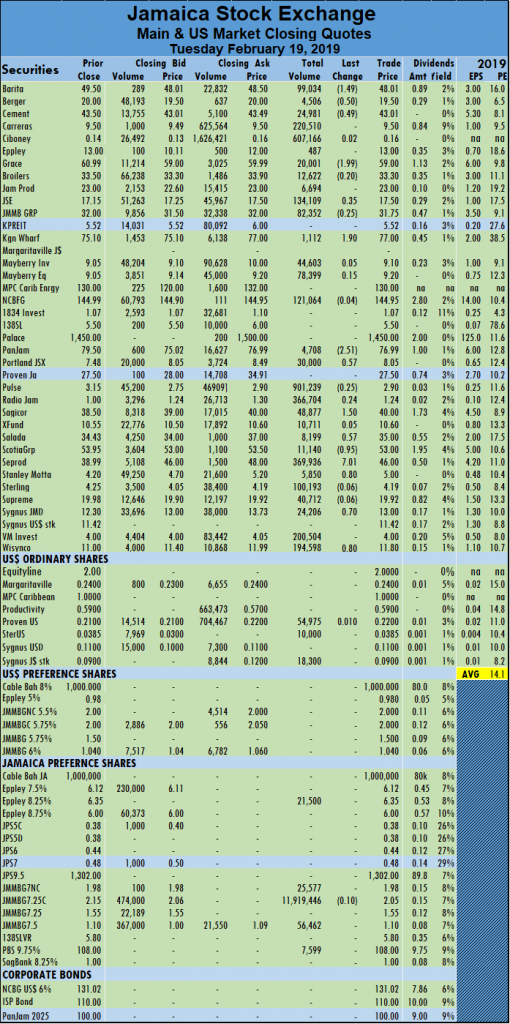

In main market activity, Barita Investments declined by $1.49 trading 99,034 shares, to close at $48.01, Berger Paints fell 50 cents to end at $19.50, with an exchange of 4,506 stock units, Caribbean Cement exchanged 24,981 shares but fell 49 cents, to end at $43.01, Grace Kennedy traded 20,001 stock units with a fall of $1.99 to end at $59. Jamaica Stock Exchange rose 35 cents to close at $17.50, with 134,109 shares trading. JMMB Group lost 25 cents trading of 82,352 shares at $31.75, Kingston Wharves jumped $1.90 to close at $77, with 1,112 units changing hands, Pulse Investments lost 25 cents to close at $2.90, with an exchange of 901,239 shares. Radio Jamaica rose 24 cents and  settled at $1.24, with 366,704 shares, Sagicor Group climbed $1.50 and ended trading of 48,877 stock units at $40, Salada Foods jumped 57 cents trading 8,199 shares at $35, Stanley Motta rose 80 cents to end at $5, with an exchange of 5,850 shares. Sygnus Credit Investments gained 70 cents to end at $13 with an exchange of 24,206 shares and another Stock to Watch, Wisynco Group gained 80 cents and ended trading of 194,598 shares at $11.80.

settled at $1.24, with 366,704 shares, Sagicor Group climbed $1.50 and ended trading of 48,877 stock units at $40, Salada Foods jumped 57 cents trading 8,199 shares at $35, Stanley Motta rose 80 cents to end at $5, with an exchange of 5,850 shares. Sygnus Credit Investments gained 70 cents to end at $13 with an exchange of 24,206 shares and another Stock to Watch, Wisynco Group gained 80 cents and ended trading of 194,598 shares at $11.80.

Trading in the US dollar market resulted in 83,275 units valued at US$14,233 units changing hands. Proven Investments gained 1 cent in trading 54,975 units, with the price closing at 22 US cents, Sterling Investments traded 10,000 units at 0.0385 US cents and Sygnus Credit Investments ended with 18,300 units trading unchanged at 9 US cents. The JSE USD Equities Index advanced by 3.01 points to close at 174.10.

JSE starts November with a big fall

Having risen strongly on the last trading day for October, the Jamaica Stock Exchange slipped back to normal on Thursday with stocks giving back most of the gains of the previous day, in keeping with patterns seen at month ends and openings, going back several years.

Having risen strongly on the last trading day for October, the Jamaica Stock Exchange slipped back to normal on Thursday with stocks giving back most of the gains of the previous day, in keeping with patterns seen at month ends and openings, going back several years.

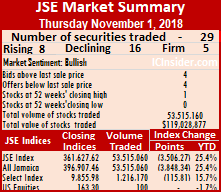

Trading closed with 29 active securities in the main and US dollar markets, on Thursday compared to 33 on Wednesday. Prices of 8 securities rose, 16 declined, while 5 remained unchanged. At the end of market activity, the All Jamaica Composite Index dropped 3,848.34 points to close at 396,907.46 and the JSE Index dived 3,506.27 points to end at 361,627.62.

Trading closed with 53,515,060 units valued $119,025,805 compared with 36 6,766,220 units valued at $113,213,380 changing hands, on Wednesday.

Main market trading closed with 1834 Investments leading with 50,001,500 units trading, or 93.4 percent of the day’s volume, Mayberry Jamaican Equities with 1,029,435 units and 1.9 percent of volume traded and Ciboney with 764,000 units with 1.4 percent of the day’s volume.

IC bid-offer Indicator|At the end of trading, the Choice bid-offer indicator reading shows 4 stocks ending with bids higher than the last selling prices and 4 closing with lower offers.

Trading resulted in an average of 1,911,252 units valued at over $4,250,922, in contrast to 225,541 shares valued at $3,773,779 on Wednesday. October closed, with an average of 290,851 shares, valued $5,213,901, for each security traded.

In the main market activity, Barita Investments gained $1 to close at $20, with 6,375 shares changing hands, Caribbean Cement gave up $2.79 trading 7,157 shares to close at $41.21, Grace Kennedy lost $1 and ended trading with 45,770 shares at $55, Jamaica Broilers traded 28,064 stock units, at $30 after falling $1, Jamaica Producers dropped $2.99 and finished trading 26,432 units, at $24.51, Jamaica Stock Exchange jumped $1.50 to close at a 52 weeks’ high of $11.50, exchanging 73,099 shares, JMMB Group fell $1.78 and ended at $32.02, trading 127,582 shares, Kingston Wharves gained 95 cents and finished at $75.95 with 24,474 stock units trading, NCB Financial Group added 80 cents and ended trading 160,771 shares to close at $126.80, PanJam Investment closed with a loss of $2.01 to end at $61.99, trading 14,135 stock units, Sagicor Group settled at $45 after falling $1.85, with 7,156 shares traded, Sagicor Real Estate Fund lost 57 cents to settle at $11.43, exchanging 239,704 shares, Salada Foods ended trading just 258 stock units and dropped $3.70 to end at $21.10, Scotia Group fell $1.97 to $51.03, trading 122,623 units and Supreme Ventures dropped $2.26 to close at $17.54 with 197,166 shares changing hands.

Kingston Wharves gained 95 cents and finished at $75.95 with 24,474 stock units trading, NCB Financial Group added 80 cents and ended trading 160,771 shares to close at $126.80, PanJam Investment closed with a loss of $2.01 to end at $61.99, trading 14,135 stock units, Sagicor Group settled at $45 after falling $1.85, with 7,156 shares traded, Sagicor Real Estate Fund lost 57 cents to settle at $11.43, exchanging 239,704 shares, Salada Foods ended trading just 258 stock units and dropped $3.70 to end at $21.10, Scotia Group fell $1.97 to $51.03, trading 122,623 units and Supreme Ventures dropped $2.26 to close at $17.54 with 197,166 shares changing hands.

Trading in the US dollar market ended with Margaritaville being the only stock trading to end with a mere 100 units changing hands at 24 US cents. The JSE USD Equities Index remained unchanged at 163.30.

More stocks less volume trade on JSE – Tuesday

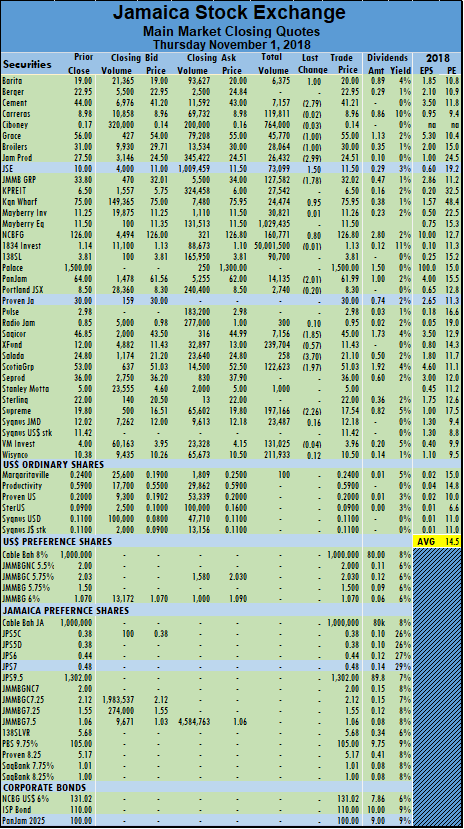

The number of securities trading rose on Tuesday on the Jamaica Stock Exchange main and US markets to 36 up from 32 on Monday but with less volume of 2,431,671 units valued at $40,003,992 compared with 5,670,913 units valued at $98,003,071 changing hands, on Monday.

The number of securities trading rose on Tuesday on the Jamaica Stock Exchange main and US markets to 36 up from 32 on Monday but with less volume of 2,431,671 units valued at $40,003,992 compared with 5,670,913 units valued at $98,003,071 changing hands, on Monday.

Trading closed with Ciboney leading with 1,039,900 units and 42.7 percent of the day’s volume, followed by Scotia Group trading 255,885 shares or 10.5 percent of the day’s volume and Carreras with 166,800 units and 7 percent of volume traded.

The market ended with the prices of 13 securities rising, 9 declining while 14 remained unchanged leading to the All Jamaica Composite Index in slipping 44.99 points to 399,117.95 and the JSE Index falling by 40.99 points to close at 363,641.63. During the morning session the market was up more than 6,000 points with NCB Financial trading up to $128.25.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading shows 5 stocks ending with bids higher than the last selling prices and 5 closing with lower offers, an indication that falling prices are likely to be dominant on Wednesday.

Trading resulted in an average of 78,441 units valued at over $1,290,451, in contrast to 189,030 shares valued at $3,266,769 on Monday. The average volume and value for the month to date amounts to 321,423 shares, valued $5,766,429 and previously 337,978 shares, valued $6,091,383. September closed, with an average of 1,022,243 shares valued $15,752,876, for each security traded.

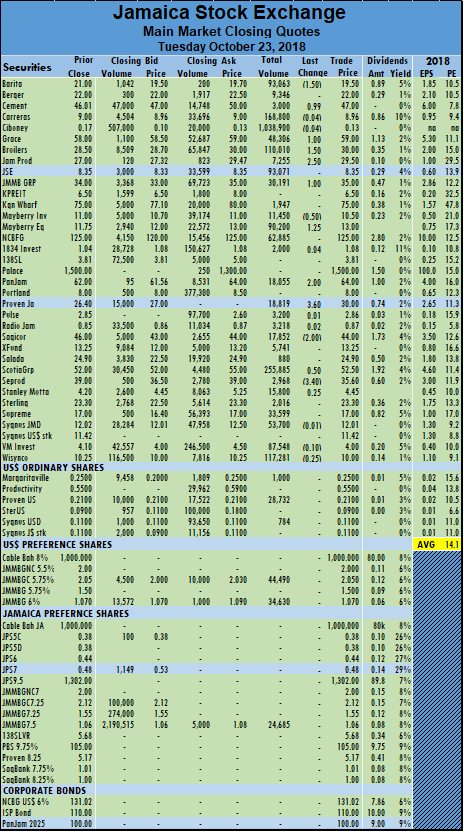

In the main market activity, Barita Investments lost $1.50 to close at $19.50, in exchanging 93,063 shares, Caribbean Cement rose 99 cents to finish at $47, trading 3,000 shares, Grace Kennedy rose $1 trading of 48,306 shares at $59, Jamaica Broilers climbed $1.50 in trading 110,010 stock units to close at $30, Jamaica Producers added $2.50 to close of $29.50 with 7,255 units changing hands, JMMB Group jumped $1 to $35 trading 30,191 shares, Mayberry Investments fell 50 cents to settle at $10.50, exchanging 11,450 units, Mayberry Jamaican Equities climbed $1.25 to $13 with 90,200 units trading, PanJam Investment gained $2 to end at $64, trading  18,055 shares, Proven Investments ended trading 18,819 shares in the Jamaican dollar based market to close at a record $30 after rising $3.60, Sagicor Group fell by $2 cent to $44, trading 17,852 shares, Scotia Group gained 50 cents in trading 255,885 units to close at $52.50, Seprod finished trading 2,968 shares, with a fall of $3.40 to close at $35.60, Stanley Motta added 25 cents, trading 15,800 units to close at $4.45 and Wisynco Group finished 25 cents down to $10, with 117,281 units trading.

18,055 shares, Proven Investments ended trading 18,819 shares in the Jamaican dollar based market to close at a record $30 after rising $3.60, Sagicor Group fell by $2 cent to $44, trading 17,852 shares, Scotia Group gained 50 cents in trading 255,885 units to close at $52.50, Seprod finished trading 2,968 shares, with a fall of $3.40 to close at $35.60, Stanley Motta added 25 cents, trading 15,800 units to close at $4.45 and Wisynco Group finished 25 cents down to $10, with 117,281 units trading.

Trading in the US dollar market closed with 109,636 units valued at $134,951 changing hands as JMMB Group 5.75% preference share traded 44,490 units in closing at US$2.05, JMMB Group 6% preference share traded 44,490 units in closing at US$2.05, Margaritaville traded 1,000 shares at 25 US cents,Proven Investments ended trading 28,732 to close at 21 US cents and Sygnus Credit Investments US dollar ordinary share traded 784 units to end at 11 US cents. The JSE USD Equities Index closed unchanged at 164.66.

- 1

- 2

- 3

- …

- 21

- Next Page »