Trading dropped back on the Jamaica Stock Exchange gained on Monday, with the number of stocks exchanged rising to but with a lower value than on Friday, with the Main Market sliding and the Junior Market dropping sharply as the JSE USD market rose moderately, to start the week.

At the close of trading, the JSE Combined Market Index fell 1,296.25 points to 333,903.28, the All Jamaican Composite Index sank 2,854.05 points to end trading at 356,985.14, the JSE Main Index dropped 873.63 points to conclude trading at 321,365.17. The Junior Market Index lost 54.46 to end at 3,712.49 and the JSE USD Market Index fell 0.30 points to finish at 237.76.

At the close of trading, the JSE Combined Market Index fell 1,296.25 points to 333,903.28, the All Jamaican Composite Index sank 2,854.05 points to end trading at 356,985.14, the JSE Main Index dropped 873.63 points to conclude trading at 321,365.17. The Junior Market Index lost 54.46 to end at 3,712.49 and the JSE USD Market Index fell 0.30 points to finish at 237.76.

At the close of trading, 25,106,007 shares were exchanged in all three markets, up from 23,346,054 units on Friday, with the value of stocks traded on the Junior and Main markets amounted to $52.28 million, down from $389.49 million on Friday and the JSE USD market closed with an exchange of 501,713 shares for US$12,814 compared to 30,414 units at US$3,460 on Friday.

Main Market trading was dominated by Wigton Windfarm led trading with 8.92 million shares followed by Transjamaican Highway with 2.37 million units, Sagicor Select Financial Fund closed with 1.70 million units and Ciboney Group with 1.35 million units.

In the Junior Market, One Great Studio led trading with 2.19 million shares followed by Fosrich with 1.25 million units and iCreate with 904,279 stock units.

At the close of the market, some of the major Main Market stocks that rose are First Rock Real Estate gained 99 cents to close at $7, MPC Caribbean Clean Energy rose $1 to end at $91, NCB Financial rallied $1.95 to $67.40 Seprod climbed $1.95 and ended at $85.95.

At the close of the market, some of the major Main Market stocks that rose are First Rock Real Estate gained 99 cents to close at $7, MPC Caribbean Clean Energy rose $1 to end at $91, NCB Financial rallied $1.95 to $67.40 Seprod climbed $1.95 and ended at $85.95.

The major declining Main Market stocks include Caribbean Cement shed $1.40 in closing at $55.50, GraceKennedy skidded $1 to close at $78 while exchanging 104,553 units and Guardian Holdings dropped $9.49 in closing at $350.51.

On a day of limited price movement in the Junior Market, there were no stocks with a major higher, with the major losing stocks being ISP Finance down $3.41, Main Event with a loss of 60 cents and Caribbean Cream and Knutsford Express with a decline of 40 cents each.

In the preference segment, no stock traded with a notable price change.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21.2 on 2022-23 earnings and 13.8 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Kremi ekes out small profit

Caribbean Cream reported revenues of $646 million for the August quarter this year versus $645 million in 2022, with the year to date revenues slipping to $1.25 billion from $1.257 billion in the previous year. Profit fell to $3.6 million in the August quarter from $7 million in 2022 and rose to $10 million for the six months from $8.5 million in 2022.

Caribbean Cream Kingston outlet

Improvement in production cost pushed gross profit up 10 percent to $390 million for the half year versus $354 million in 2022 and $205 million for the quarter to August this year, up 8.5 percent from $189 million in 2022. Cost savings were only realised in some areas as administrative expenses and finance costs climbed over 2022. Administrative expenses increased 6 percent to $158 million from $149 million, with finance costs climbing 60 percent to $24 million, from $15 million in the August 2022 quarter. For the half year, administrative costs rose 7 percent to $306 million from $286 million the previous year, while finance costs jumped 56 percent from $27 million to $42 million for the half year.

Finance cost associated with the expansion of the warehouse and building out of the cogeneration energy plant is being written off directly as a current expense rather than capitalising it, with the equipment as such, the reported profit over the past three years appears understated as a result of the treatment of this item. Accordingly, the 2023 full year’s profit should be closer to $70 to $80 million than the above figure, and the 2023 half year’s figure should be around $37 million.

Operations generated Gross cash flow of $77 million, growth in working capital and $206 million spent in addition to fixed assets offset by loan inflows net of outflows of $238 million, resulting in funds growing by $78 million during the six months.

Considerable sums have been spent on plant and machinery to improve efficiency and, by extension, increase profit. Accordingly, $439 million was expended over the past year, bringing the gross amount in fixed assets to $2.7 billion from $1.7 billion at the end of February 2022. Most of the new expenditure went into equipping a new cold storage plant that has expanded freezing and cold storage capacity, with some spent on the cogeneration energy plant, which is intended to cut energy costs.

Considerable sums have been spent on plant and machinery to improve efficiency and, by extension, increase profit. Accordingly, $439 million was expended over the past year, bringing the gross amount in fixed assets to $2.7 billion from $1.7 billion at the end of February 2022. Most of the new expenditure went into equipping a new cold storage plant that has expanded freezing and cold storage capacity, with some spent on the cogeneration energy plant, which is intended to cut energy costs.

The company remains financially healthy, with current assets of $539 million, including trade and other receivables of $114 million, cash and bank balances of $145 million and inventories of $248 million, up from $183 million in August 2022. Current liabilities ended at $225 million and net current assets at $314 million.

At the end of August, shareholders’ equity amounts to $836 million, a rise from $807 million at the end of August 2022, with long term borrowings at $1.2 billion and short term loans at $43 million.

Earnings per share for the quarter was one cent and 3 cents for the year to date. IC Insider.com computation projects earnings of 55 cents per share for the fiscal year ending February 2024, with a PE of 7 times current year’s earnings based on the price of $3.95 the stock traded at on the Jamaica Stock Exchange Junior Market on Friday. The PE ratio compared with a market average of 10.7. Net asset value ended the period at $2.21, with the stock selling at just under two times book value.

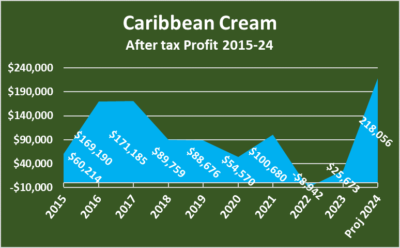

The company has a checkered profit history, as shown by the attached chart of profits, since 2015 and has struggled with increased costs since the disruption caused by COVID-19. The situation is worsened by the treatment of interest incurred to finance the new warehouse.

Disappointing early Q3 results

Profits are the primary driver of stock prices. The early release of third quarter results for 2023 for some listed companies has been less than inspiring, with the majority reporting lower revenues and profits for the third quarter and, in some cases, reduced revenues and profits for the year to date. That is not the results the market needs to lift a sagging market weighted down by some poor profit results for the year and tight monetary policy being pursued by Jamaica’s Central Bank.

Margaritaville, located in the Turks & Caicos Islands

So far, Companies reporting include AMG Packaging, Caribbean Cream with it trading brand Kremi, Express Catering, Image Plus Consultants, Knutsford Express, Margaritaville, Mayberry Investments, Paramount Trading and Portland JSX Fund.

AMG Packaging reported a slight drop in full year earnings to August of $94 million. The 2023 performance is better than that of 2022, with the current year’s figures including a one-off charge and vastly increased taxation than in the previous year.

Profit after tax is down from $105 million in the previous year, but this is after taxation that climbed from $18 million to $39 million in the current year. Revenues in the current year come out at $1 billion, up from $996 million in the prior year. For the quarter, revenues fell to $230 million from $257 million, with profits after tax of $19 million, down from $25 million in the previous year. The 2023 result was dragged down by a one off charge relating to payroll tax credits that were not allowed in prior years, amounting to $11 million, had this not been the case, profits would have been higher than for the previous year. Additionally, the taxation charge for the year was $11 million versus just $5 million in the prior year’s fourth quarter.

Caribbean Cream reported revenues of $646 million for the 2023 August quarter versus $645 million in 2022, with the year to date revenues slipping into $1.25 billion from $1.257 billion in 2022. Profit fell to $3.6 million in the August quarter, down from $7 million in 2022, but is up to $10 million for the six months from $8.5 million in 2022.

Caribbean Cream reported revenues of $646 million for the 2023 August quarter versus $645 million in 2022, with the year to date revenues slipping into $1.25 billion from $1.257 billion in 2022. Profit fell to $3.6 million in the August quarter, down from $7 million in 2022, but is up to $10 million for the six months from $8.5 million in 2022.

Revenues and profits rebounded strongly at Express Catering in the first quarter to August 2023 versus 2022. Net profit for the quarter ended at US$843,114 for EPS of 0.051 US cents, up 29 percent from a profit of US$652,841, with EPS of 0.040 US cents in the similar period in 2022 as revenues climbed 30 percent to US$5.4 million from US$4.9 million in 2022 aided by a strong rebound in tourism traffic passing through the Sangster International Airport in Montego Bay, as well as the opening of new restaurants in the airport.

Image Plus reported sharply lower second quarter results, a 40 percent drop in earnings from $64 million before tax in 2022 to just $39 million for the second quarter as revenues declined by 7 percent to $254 million from $274 million in 2022 but remained flat for the half year at $554 million, resulting in pretax profit falling 33 percent from $153 million down to $103 million. The company indicated that revenues decreased due to machine breakdown.

Revenues at Knutsford Express jumped 18.5 percent for the first quarter ending August to $492 million from $415 million in the 2022 first quarter. The revenue improvement translated to slight growth in profit as cost rose nearly 26 percent to $380 million from $303 million. The company stated that it increased its workforce to manage growth. Before tax, profit increased marginally to $86 million from $84 million in the prior year.

Margaritaville was one company delivering improved revenues and profit for the 2023 first quarter, primarily reflecting improvement in tourism traffic in the Caribbean region. The company generated revenues of US$1.8 million in the August 2023 quarter, up solidly from US$1.42 million in the prior year and delivered gross profit of $1.33 billion this year versus US$1.03 million. Net profit surged to US$230,000 for the year to date against just US$94,000 in 2022.

Mayberry Investments released nine months’ results with a $985 million loss for the third quarter and $693 million loss for the nine months after reporting significant investment losses of around $2 billion in both periods, but shareholders’ equity remains strong at $15.75 billion.

Paramount

Paramount Trading reported lower revenues and profits in the first quarter ending August, following what the company states is the conclusion of the best major six month contract to supply admixture to the construction sector. Revenues declined by 28 percent to $426 million from $595 million the year before and profits fell by 32 percent to $65 million from $97 million the previous year.

Portland JSX Fund reported a worsened loss of US$1,457,327 for the quarter to August this year, up from US$416,643 in the similar quarter in 2022 and a loss of US$8.71 million versus a profit of US$376,681 profit for the six months to August 2022.

The results reflect net fair value losses on investments of US$1.3 million in the quarter and US$8.3 million for the half year.

Profit returns for Caribbean Cream

Following a torrid 2022 fiscal year, with a loss before taxation of $13.7 million, Caribbean Cream delivered a much better performance in the fiscal year to February this year, with pretax profit of $41.8 million and $27 million after accounting for $14.7 million for taxes, up from a $9 million loss in 2022 in a year that finance cost almost doubled to $66 million from $34 million in 2022, from increased borrowings.

Sale revenues for the just completed year rose 20 percent to $2.5 billion from $2.1 billion in 2022. In the final quarter, revenues climbed 22.5 percent to $674 million from $553 million in 2022 and increased 17 percent over the $576 million in the November 2022 quarter. In contrast, revenues for the 2022 February quarter were 10 percent more than the $501 million generated in the November 2021 quarter. All in all, the 2023 fiscal year performance was well ahead of the year to February 2022, even as the year started with just $1.3 million in profit with cost of sales at 73.2 percent with the second quarter being slightly better with cost of sales down to 70.7 percent and profit improving to $7.2 million as both volume improvement and price adjustment to the output chipped in to help improve the bottom line.

Sale revenues for the just completed year rose 20 percent to $2.5 billion from $2.1 billion in 2022. In the final quarter, revenues climbed 22.5 percent to $674 million from $553 million in 2022 and increased 17 percent over the $576 million in the November 2022 quarter. In contrast, revenues for the 2022 February quarter were 10 percent more than the $501 million generated in the November 2021 quarter. All in all, the 2023 fiscal year performance was well ahead of the year to February 2022, even as the year started with just $1.3 million in profit with cost of sales at 73.2 percent with the second quarter being slightly better with cost of sales down to 70.7 percent and profit improving to $7.2 million as both volume improvement and price adjustment to the output chipped in to help improve the bottom line.

Kremi, as the company is known, has had a checkered history with Profit meandering from 2015 to 2023. (See Chart)

Since 2020 the company has faced increased input costs that squeezed profit margin. In the latest fiscal year, cost of sales dropped to 64 percent in the final quarter compared to 69 percent for the year and 71 percent for the nine months to November. The jump in revenues in the fourth quarter over the November quarter would have helped to improve the margin, but it appears that raw material costs fell compared with the earlier months of the fiscal year. In 2022 cost of sales was 71.6 percent and 66.6 percent in 2021.

Cost of sales rose 16 percent, slower than sales in 2023, to $1.73 billion from $1.49 billion in 2022, with gross profit rising faster than revenues, a positive development with an increase of 31 percent to $593 million from $775 million in 2022. The cost of raw materials used in sales rose 16 percent to $1.17 billion, compared with a 33 percent rise in fiscal year 2022 over 2021. Milk solids, one of the primary raw materials, about 70 percent that is used in producing ice cream moved from an average of US$3,355 per ton in 2018 to US$5,067 in 2022 and is now $4,676 in 2023, down 9 percent. In 2022 the cost rose by 29 percent, these movements, coupled with exchange rate changes for the Jamaican dollar, would have pushed up the company’s production cost; also affecting cost would be a 7 percent movement in the exchange rate between the Jamaica dollar and the US dollar. If continued, falling commodity prices in 2023 will lower the cost for them and help improve profits. Also of note is that the price of crude oil is now 38 percent less than it was in 2023 at the start of June and that feeds directly into utility cost incurred in production, which was $166 million, 16 percent higher than 2022 and 19 percent more in Administration with $99 million versus $83 million in 2022.

Cost of sales rose 16 percent, slower than sales in 2023, to $1.73 billion from $1.49 billion in 2022, with gross profit rising faster than revenues, a positive development with an increase of 31 percent to $593 million from $775 million in 2022. The cost of raw materials used in sales rose 16 percent to $1.17 billion, compared with a 33 percent rise in fiscal year 2022 over 2021. Milk solids, one of the primary raw materials, about 70 percent that is used in producing ice cream moved from an average of US$3,355 per ton in 2018 to US$5,067 in 2022 and is now $4,676 in 2023, down 9 percent. In 2022 the cost rose by 29 percent, these movements, coupled with exchange rate changes for the Jamaican dollar, would have pushed up the company’s production cost; also affecting cost would be a 7 percent movement in the exchange rate between the Jamaica dollar and the US dollar. If continued, falling commodity prices in 2023 will lower the cost for them and help improve profits. Also of note is that the price of crude oil is now 38 percent less than it was in 2023 at the start of June and that feeds directly into utility cost incurred in production, which was $166 million, 16 percent higher than 2022 and 19 percent more in Administration with $99 million versus $83 million in 2022.

Administrative expenses rose 17 percent to $598 million from $512 the previous year. Marketing and sales expenses increased by 18 percent to $72 million from $61 million in 2022 and depreciation came in at $100 million, marginally down from $102 million in 2022. Some $930 million is tied up in construction in progress at the end of the fiscal year and will result in the charge rising appreciably in the 2024 fiscal year when those assets are transferred to fixed assets but will reduce the actual taxation payable as capital allowances in the first year, will reduce the actual tax liability that will be payable. Finance cost jumped 91 percent to $66 million from $34.5 million in 2022, but a significant portion of the loans have interest rates capped and will not result in increases in the current period.

Gross cash flow generated $195 million from operating activities, up from just $53 million in 2022. Funds internally generated were augmented by loan inflows of $353 million and funds at the start of the year amounting to $145 million, which helped to fund additions to fixed assets of $541 million.

Gross cash flow generated $195 million from operating activities, up from just $53 million in 2022. Funds internally generated were augmented by loan inflows of $353 million and funds at the start of the year amounting to $145 million, which helped to fund additions to fixed assets of $541 million.

The total Current assets ended the year at $535 million inclusive of trade and other receivables of $157 million, cash and bank balances of $67 million, down from $146 million in 2022. Current liabilities ended at $389 million, up from $313 million and net current assets ended the period at $167 million, down from $212 million in 2022.

At the end of December, shareholders’ equity stood at $826 million, with long term borrowings at $920 million, up from $603 million in 2022 and short term at $107 million against $67 million in 2022. The increased borrowing helped to fund additions to fixed assets amounting to $542 million during the year, of which $490 million is construction in progress.

Earnings per share came out at just 7 cents for the year, with a steep PE of 45.7, but earnings for the current year are expected to jump well over that for 2023. IC Insider.com forecasts a considerable increase of 90 cents per share for the fiscal year ending February 2024, with a PE of 3.6 times the current year’s earnings based on the price of $3.20 the stock traded at on the Jamaica Stock Exchange Junior Market and a net asset of $2.18.

The company did not pay a dividend in 2022 but 6.94 cents in 2021.

The company may have faltered over the last two years, but it has shown in the past that it can recover. Additionally, it is not going away anytime soon. It will recover lost ground as they invest in its manufacturing operations to generate cost reductions, greater efficiency, and improved profit. The first quarter results due by July should show the first signs of this robustness as the company reports a significant profit improvement over the 2022 first quarter and a better than the 2023 February quarter.

What should investors do? Investors should buy the stock that is selling well below potential as investors reacted negatively to poor results reported in 2022 before the release of the 2023 results.

Former ICTOP10 stock jumps 130%

The star performer for the week was iCreate, up 132 percent and Supreme Ventures, with a 30 percent price movement in the market during the week, but several ICTOP10 stocks had some noted moves as well.

iCreate hits a low of 80 cents on Thursday.

iCreate, more than doubled, surging from the previous week’s $1.36 close to $3.16. The move coincides primarily with two acquisition announcements with little or no information given as to the cost and funding, leading to wild speculation in the stock. Supreme Ventures (SVL) stock jumped to a 52 weeks’ high of $33.41 from $24.49 at the end of the previous week. The SVL was more solidly based as the company reported solid increased profits for the March quarter as investors pushed the price sharply higher in response.

There are two changes to this week’s ICTOP10 listing. Lasco Distributors returns to the Junior Market TOP10 as Stationery and Office Supplies slipped out. The latter rose 15 percent to close the week at $9.11. The expectations are that the company will have blowout first quarter results, helped by school opening and following a strong 2021 fourth quarter. The Main Market welcomed back Jamaica Stock Exchange share that will benefit from an upsurge in trading activity in the first quarter as Scotia Group fell out, still looking attractively priced at $35.20, with Bank of Jamaica increasing interest rates is positively impacting the results.

The Junior Market ended with three stocks rising from 8 to 15 percent. Caribbean Assurance Brokers climbed 10 percent for the week while Jetcon Corporation rose 8 percent to close at $1.40. Declining were Lasco Financial, down 8 percent and Access Financial and AMG Packaging, down 5 percent, as buying eased markedly following improved results released at the close of the market ahead of the Easter weekend. Investors seem not to be factoring in cost savings and increased efficiency that the newly installed machine brings to the business following the close of the recent quarter. With a 5 percent rise, Guardian Holdings was the biggest mover in the Main Market.

The Junior Market ended with three stocks rising from 8 to 15 percent. Caribbean Assurance Brokers climbed 10 percent for the week while Jetcon Corporation rose 8 percent to close at $1.40. Declining were Lasco Financial, down 8 percent and Access Financial and AMG Packaging, down 5 percent, as buying eased markedly following improved results released at the close of the market ahead of the Easter weekend. Investors seem not to be factoring in cost savings and increased efficiency that the newly installed machine brings to the business following the close of the recent quarter. With a 5 percent rise, Guardian Holdings was the biggest mover in the Main Market.

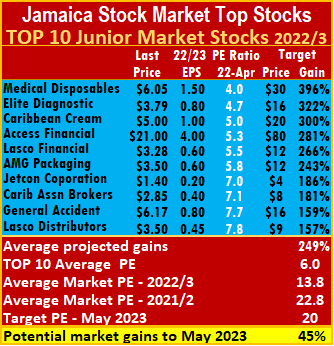

The average PE for the JSE Main Market TOP 10 ends the week at 6.2, well below the market average of 14.8, while the Junior Market PE for the Top 10 sits at 6 versus the market at 13.8. The Junior Market TOP10 is projected to gain an average of 249 percent by May 2023 and the Main Market 200 percent.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners; accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023. They are ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Profit melts in the third quarter at Kremi

The 2022 fiscal year started with a blast for the first quarter to May with profit at $54 million after tax, doubling the $27 million in 2020, but a lot of that melted away in the third quarter to November at Caribbean Cream, which trades as Kremi, with the company reporting a loss in that quarter of $25 million down from a profit of $11 million in 2020. The loss brought profit for the nine months to $36 million compared to $85 million in the similar 2020 period.

Caribbean Cream closed at 52 weeks’ low of $3.80

Caribbean Cream did not have a good second quarter with sales rising 5.4 percent and profit falling 85 percent from $47 million to just $7 million due to what the company stated was the introduction of no movement days during the quarter that curtailed sales.

Sales revenues rose 14 percent for the third quarter to $500 million from $441 million but climbed 15 percent for the year to date, to $1.54 billion from $1.33 billion in 2020. The poor performance in the third quarter management attributes to “equipment and infrastructure challenges which we have addressed as we begin the final quarter.” In spelling out the issues Management, stated “at the beginning of the quarter the company faced unforeseen challenges in production resulting in the plant’s efficiency and capacity being impacted negatively. Since then, changes have been made in procedures, equipment and personnel to rectify the problem.”

While the company has been making headways with increased revenues, profit performance has not been consistent for some time, with the exception of the years 2014 to 2017 that enjoyed an annual increase in profits. The turbulence in profits since 2017 and the major problems in the 2021 third quarter reveal a major weakness in management that needs addressing. Such inconsistencies destroy investors’ interest in the company as well as the stock price.

Gross profit fell 13 percent in the quarter to $125 million from $143 million but rose 7 percent for the year to date, to $486 million from $453 billion in 2020.

Gross profit margin in the first nine months of the year, declined in the November quarter to 32 percent from 34 percent in the 2020 and for the quarter it dropped sharply to just 24 percent compared to 32 percent for the 2020 and that was a major contributor to the loss in the period.

Gross profit margin in the first nine months of the year, declined in the November quarter to 32 percent from 34 percent in the 2020 and for the quarter it dropped sharply to just 24 percent compared to 32 percent for the 2020 and that was a major contributor to the loss in the period.

Administrative expenses rose 15.5 percent to $129 million in the quarter and increased 26 percent in the nine months period to $378 million. Sales and distribution expenses increased by 8 percent in the quarter and the nine months to $16 million from $15 million in 2020 and from $43 million to $47 million, respectively. Depreciation rose from $88 million in 2020 to $95 million and is likely to rise further with the completion of the power generating plant being installed and is expected to make a major impact on the cost of utilities in the new fiscal year. Finance cost more than doubled in the quarter to $8 million from $4 million in 2020 and jumped 52 percent from $13 million to $20 million for the nine months.

Gross cash flow brought in $130 million down from $185 million in 2020. There was a release of $30 million from working capital but additions to fixed assets consumed $263 million funded by net loan inflows of $328 million. Payment of dividends consumed $26 million, more than twice the $11 million in 2020.

At the end of the period, shareholders’ equity stood at $844 million. Long term loans amounted to $654 million and short term at $11 million. Current assets ended the period at $553 million, including trade and other receivables of $82 million, inventories of $244 million and cash and bank balances of $227 million. Current liabilities ended at $140 million and net current assets at $413 million.

Earnings per share for the quarter was negative 7 cents and a profit of 10 cents for the year to date. IC Insider.com forecasts 27 cents per share for the fiscal year and $1 for 2023.

The stock traded at $5.40 on the Junior Market of the Jamaica Stock Exchange with a PE ratio of 20 times 2022 earnings and a PE of 5.4 times fiscal 2023 earnings. Net asset value is $2.33 with the stock selling at 2.4 times book value.

Caribbean Cream stock for the main course in 2022

Sale revenues rose 16 percent for the half year, to August 2021 $1.03 billion from $891 million but rose a mere 5.4 percent for the August quarter, to $486 million from $461 million in 2020 at ice cream maker Caribbean Cream. Management attributed the poorer second quarter performance to the several no movement days imposed by the government during the quarter.

Sale revenues rose 16 percent for the half year, to August 2021 $1.03 billion from $891 million but rose a mere 5.4 percent for the August quarter, to $486 million from $461 million in 2020 at ice cream maker Caribbean Cream. Management attributed the poorer second quarter performance to the several no movement days imposed by the government during the quarter.

Profit melted in the quarter by 85 percent to just $7 million from $47 million in 2020 and fell 17 percent for the six months to August, to $61 million from $74 million in 2020.

The company has not had a consistent and predictable profit outcome for some years, still, the trajectory has generally been up. In 2019 the company posted $89 million after tax that fell to $55 million in 2020 and $101 in 2021. The 2022 fiscal year profit is poised to beat that of 2021, notwithstanding the setback in the second quarter.

Caribbean Cream posted significant gains in profit in Q1.

Improvement in profit margin in the first half of the year was consistent at 41 percent, with the prior year’s six months but has increased over the 37 percent achieved for the fiscal year to February 2021. But it fell from 50 percent in the 2020 august quarter to 44 percent in 2021. The effect, operating profit fell 6 percent in the quarter to $215 million from $230 million but increased 15 percent for the year to date, to $423 million from $369 million in 2020.

Administrative expenses excluding depreciation rose 25.4 percent to $134 million in the quarter and increased 32 percent in the six months to $249 million, from $188 million in 2020. Sales and distribution expenses increased 8 percent to $30.5 million from $28 million in 2020 for the half year and were virtually flat at $15.5 million for the second quarter. Depreciation charge rose from $59 million in 2020 to $62 million in 2021 for the six months. Finance cost rose in the quarter to $6.7 million from $6 million in 2020 and $9 million to $12 million for the six months.

Gross cash flow brought in $151 million versus $160 million in 2020. Working capital growth used up all but $13 million in 2021 versus $81 million used up in 2020. Additions to fixed assets consumed $83 million for the 2021 half year versus $62 million in 2020. Loan repayment and paying $26 million dividends resulted in outflows of $114 million. At the end of December, shareholders’ equity stood at $869 million, with long term borrowings at $303 million and short term loans at $13 million. Current assets ended the period at $408 million, including trade and other receivables of $65 million, cash and bank balances of $103 million. Current liabilities ended the period at $173 million. Net current assets ended the period at $235 million.

The results in the past few years being inconsistent does not mean that the future will continue in that vein. One focus is on taking a more significant share of the market for ice cream and related products while finding avenues to cut costs. The company announced earlier this year that in collaboration with Power Factor Technologies, a power engineering services company, they embarked on a major project to install a 630 kilowatt capacity Combined Heat & Power plant fueled by LNG at the company’s premises. This project is scheduled to come on stream at the start of 2022 and is expected to generate considerable cost savings and should have a positive impact on results for 2022 onwards.

The stock closed 2021 at $5.70 with a PE ratio of 9 much lower than the average for the market around 15 and below many Junior Market stocks trading around 20 times earnings.

Big savings from Kremi’s power plant

In collaboration with Power Factor Technologies, a power engineering services company, Caribbean Cream has embarked on a major project to install a 630 kilowatt capacity Combined Heat & Power plant fueled by LNG at the company’s premises.

Caribbean Cream post big gains in profit in Q1.

The cost of the project is estimated to be just under US$2 million. The company expects to complete installation and commissioning of the power plant before the end of 2021. “While the company will remain connected to JPS, as to ensure sufficient power supply in the event of higher energy demand, we anticipate greater efficiency and increased market reach,’ a release from the company stated.

The company incurred utility costs of $204 million in the last financial year and is set to grow with more production and expanded cold storage space. Historical data indicates that water is approximately 10 percent of the utility bill; based on this, the electricity cost is currently around $180 million.

“One electricity unit for running machines and the use of heat from electrical generation to be used to heat water and oil to do pasteurization is the maximization of energy efficiency of the plan” an engineer who ICInsider.com spoke to states, the cost savings will be significant, with the estimated savings he stated could be in the region of two thirds which ICInsider.com puts at over $120 million per annum.

The company reported a profit of $101 million for the financial year to February this year, with the first quarter to May coming out at $54 million twice the 2020 first quarter profit.

Profit doubles at Caribbean Cream for Q1

Caribbean Cream released first quarter results with revenues up a solid 28 percent to $549 million and profit doubled to $54 million after taxation of nearly $8 from $27 million after tax of $4 million with earnings of 14 cents per share.

Caribbean Cream’s Kremi product

Cost of sales rose 17 percent to $341 million from $292 million in 2020. Selling and distribution costs rose 21 percent to $15 million while administrative costs rose 41 percent to $126 million, finance costs came in at $5 million. Taxation rose to $7.7 million from $4 million in 2020.

Commenting on the results for the year in a joint statement Christopher Clarke, Chairman and Carol Clarke Webster director, operating expenses rose 35 percent or 38 million due to a number of factors, higher transport cost for an increased number of deliveries of product. “Internal reclassification of electricity from production to distribution to more fairly reflect energy usage by business segments’ salary increases and other staff related costs and the full annualized cost for the Ocho Rios depot. The directors stated that they are currently carrying out capital works at the properties for operations that will lead to reduced cost of utilities.

Cash inflows for the quarter were $98 million versus $64 million in 2020, but after working capital changes, inflows rose to $117 million, $62 million was expended on the acquisition of property and resulted in cash on hand of $264 million. Current assets stood at $453 million and current liabilities at $210 million, resulting in net current assets of $243 million. Shareholders’ equity grew to $888 million from $771 million as of May 2020 and loans amounted to $324 million, of which $29 million is due to be repaid in the next twelve months.

IC Insider.com projects a profit of $320 million or 85 cents per share for the 2022 fiscal year and $1.50 per share for 2023. The stocks last traded at $6.90, after releasing the results, on the Junior Market of the Jamaica Stock Exchange, a 52 weeks’ high and the highest since October 2018. At Friday’s last traded price, the stock ended the week at a PE ratio of 8.3, well below the average of 13 currently for the Junior Market.

The Main Market ICTOP10 ended with, General Accident declined 11 percent to $4.50. Buying interest picked up during the week for Scotia Group pushing the stock to several 52 weeks’ highs and a rose of 7 percent for the week to a 52 weeks’ closing high of $38.40. This stock has much more juice left that should take it into the $40 range by early 2024. Caribbean Producers rallied 6 percent to $9, while Margaritaville also rose 6 percent and closed at $17 and Pulse Investments rose 5 percent to $2.09 and Key Insurance slipped 4 percent to $2.40.

The Main Market ICTOP10 ended with, General Accident declined 11 percent to $4.50. Buying interest picked up during the week for Scotia Group pushing the stock to several 52 weeks’ highs and a rose of 7 percent for the week to a 52 weeks’ closing high of $38.40. This stock has much more juice left that should take it into the $40 range by early 2024. Caribbean Producers rallied 6 percent to $9, while Margaritaville also rose 6 percent and closed at $17 and Pulse Investments rose 5 percent to $2.09 and Key Insurance slipped 4 percent to $2.40. The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 13.1. The Main Market ICTOP10 is projected to gain an average of 288 percent by May 2024, based on 2023 forecasted earnings and now provides better values than the Junior Market with the potential to gain 195 percent over the same time frame.

The average PE for the JSE Main Market ICTOP 10 stands at 5.3, well below the market average of 13.1. The Main Market ICTOP10 is projected to gain an average of 288 percent by May 2024, based on 2023 forecasted earnings and now provides better values than the Junior Market with the potential to gain 195 percent over the same time frame. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.