The eleven best performing stocks on the Jamaica Stock Exchange for 2022 to the end of September, all came from the Junior Market with Fosrich, a company that expanded into manufacturing, put in an incredible run of 326 percent, the 2022 listed Spur Tree Spices was second with gains of 285 percent and Tropical Battery coming in at tenth position with gains of 99 percent.

Future Energy, distributors of gasoline, produced a rise of 96 percent to cap a spectacular two year run. 1834 Investments climbed 83 percent to be the best performing main market stock, after the company agreed to be acquired by Radio Jamaica, followed by Portland JSX, with 52 percent and Supreme Ventures the gaming company came next at 46 percent, in a period when the main market declined in value.

Future Energy, distributors of gasoline, produced a rise of 96 percent to cap a spectacular two year run. 1834 Investments climbed 83 percent to be the best performing main market stock, after the company agreed to be acquired by Radio Jamaica, followed by Portland JSX, with 52 percent and Supreme Ventures the gaming company came next at 46 percent, in a period when the main market declined in value.

Caribbean Producers was switched from the Junior Market in July this year to the Min Market with the price under $5 and ended the year as the best performing stock in the overall market with a towering gain of 364 percent with the price closing at $13. Had the switch not taken place the Junior Market would have recorded greater gains than it did. Ciboney rose 221 percent as investors speculated heavily on it and

Caribbean Producers was switched from the Junior Market in July this year to the Min Market with the price under $5 and ended the year as the best performing stock in the overall market with a towering gain of 364 percent with the price closing at $13. Had the switch not taken place the Junior Market would have recorded greater gains than it did. Ciboney rose 221 percent as investors speculated heavily on it and

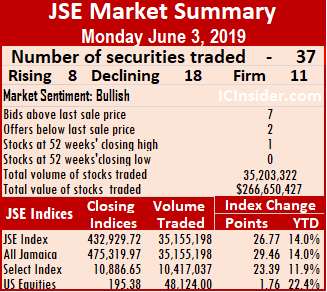

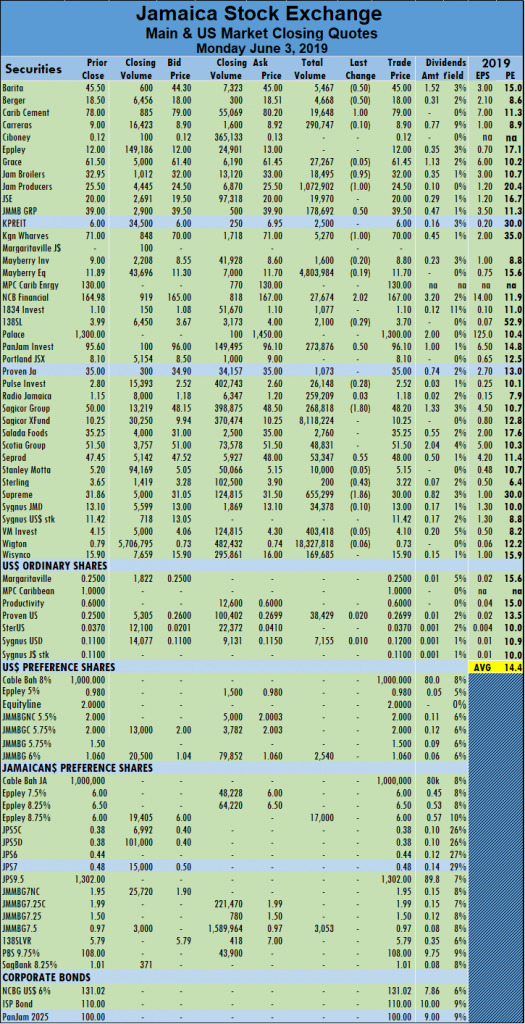

PanJam Investment concluded trading with 273,876 shares and rose 50 cents to end at $96.10, Sagicor Group traded 268,818 units and declined by $1.80 to close at $48.20, Seprod gained 55 cents to end at $48, in trading 53,347 shares. Sterling Investments lost 43 cents to close at $3.22, with 200 units crossing the exchange and Supreme Ventures dropped $1.86 and settled at $30, with 655,299 shares trading.

PanJam Investment concluded trading with 273,876 shares and rose 50 cents to end at $96.10, Sagicor Group traded 268,818 units and declined by $1.80 to close at $48.20, Seprod gained 55 cents to end at $48, in trading 53,347 shares. Sterling Investments lost 43 cents to close at $3.22, with 200 units crossing the exchange and Supreme Ventures dropped $1.86 and settled at $30, with 655,299 shares trading. Trading on the Jamaica Stock Exchange main market returned to more normal levels on Tuesday, than the heavy trading that took place on Monday.

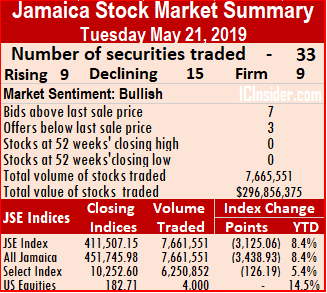

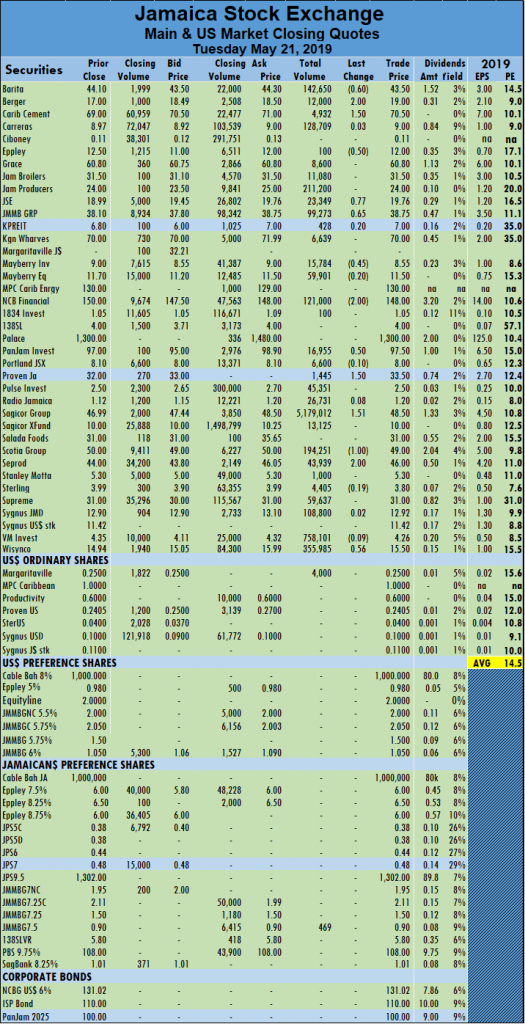

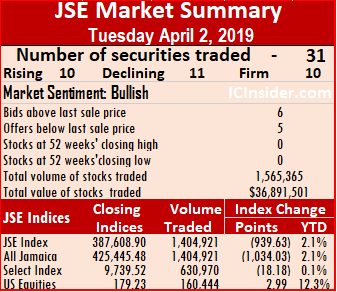

Trading on the Jamaica Stock Exchange main market returned to more normal levels on Tuesday, than the heavy trading that took place on Monday. The average volume and value for the month to date amounts to 265,920 units valued $11,582,843 and previously, 267,779 units valued $11,609,967. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded.

The average volume and value for the month to date amounts to 265,920 units valued $11,582,843 and previously, 267,779 units valued $11,609,967. Trading for April resulted in an average of 157,923 shares at $3,718,919, for each security traded. NCB Financial Group lost $2 trading 121,000 shares at $148. PanJam Investment added 50 cents with 16,955 shares changing hands, to close at $97.50, Proven Investments rose $1.50 to close trading of 1,445 units at $33.50, Sagicor Group jumped $1.51 to end at $48.50 in trading 5,179,012 stock units, Scotia Group declined $1 to $49, with 194,251 shares trading. Seprod gained $2 trading 43,939 shares to close at $46 and Wisynco Group rose 56 cents to close at a record high of $15.50, with 355,985 shares trading.

NCB Financial Group lost $2 trading 121,000 shares at $148. PanJam Investment added 50 cents with 16,955 shares changing hands, to close at $97.50, Proven Investments rose $1.50 to close trading of 1,445 units at $33.50, Sagicor Group jumped $1.51 to end at $48.50 in trading 5,179,012 stock units, Scotia Group declined $1 to $49, with 194,251 shares trading. Seprod gained $2 trading 43,939 shares to close at $46 and Wisynco Group rose 56 cents to close at a record high of $15.50, with 355,985 shares trading.

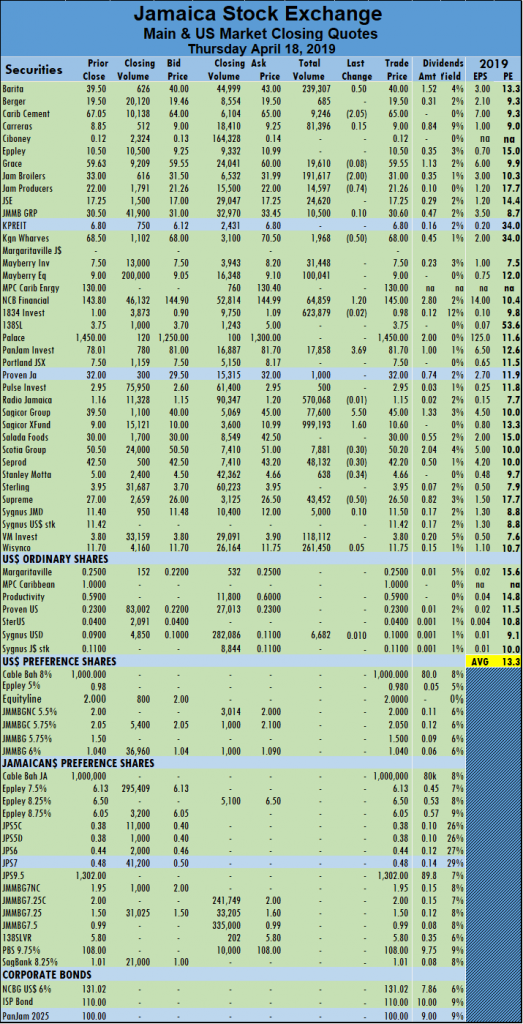

50 cents to settle at $68, with 1,968 units changing hands. NCB Financial Group recovered the $1.20 lost on Wednesday in trading 64,859 shares, to close at $145, PanJam Investment jumped $3.69 to close at $81.70 after trading 17,858 units, Sagicor Group jumped $5.50 to $45 in an exchange of 77,600 shares. Sagicor Real Estate Fund jumped $1.60 to $10.60, in trading 999,193 shares, Scotia Group fell 30 cents and finished trading 7,881 shares at $50.20, Seprod closed at $42.20 with a loss of 30 cents while trading 48,132 shares. Stanley Motta lost 34 cents and ended at $4.66, in trading 638 shares and Supreme Ventures lost 50 cents in finishing at $26.50, with 43,452 units changing hands.

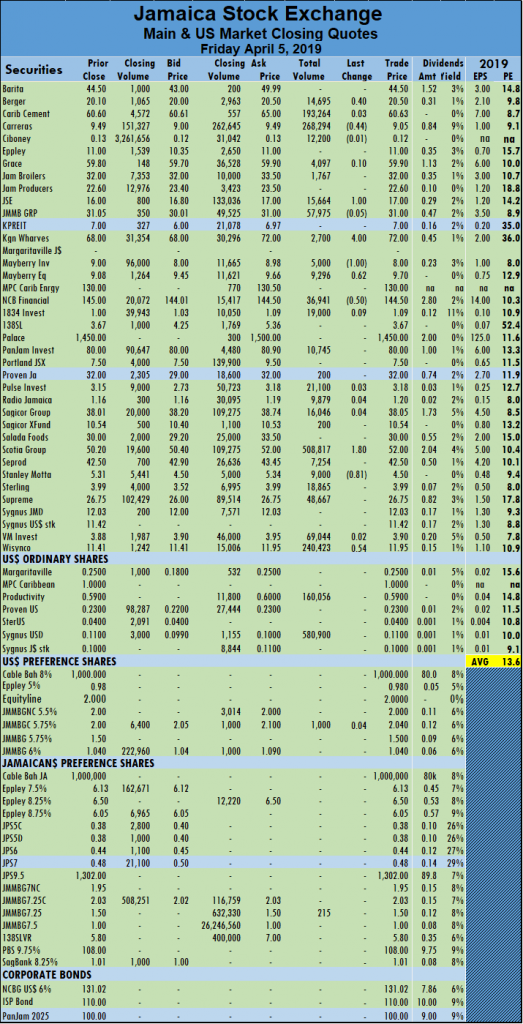

50 cents to settle at $68, with 1,968 units changing hands. NCB Financial Group recovered the $1.20 lost on Wednesday in trading 64,859 shares, to close at $145, PanJam Investment jumped $3.69 to close at $81.70 after trading 17,858 units, Sagicor Group jumped $5.50 to $45 in an exchange of 77,600 shares. Sagicor Real Estate Fund jumped $1.60 to $10.60, in trading 999,193 shares, Scotia Group fell 30 cents and finished trading 7,881 shares at $50.20, Seprod closed at $42.20 with a loss of 30 cents while trading 48,132 shares. Stanley Motta lost 34 cents and ended at $4.66, in trading 638 shares and Supreme Ventures lost 50 cents in finishing at $26.50, with 43,452 units changing hands. Trading on the main market of the Jamaica Stock Exchange ended on Friday with JSE All Jamaican Composite Index climbing 1,739.73 points to 424,572.25 and the JSE Index advancing by 1,580.91 points to 386,815.40.

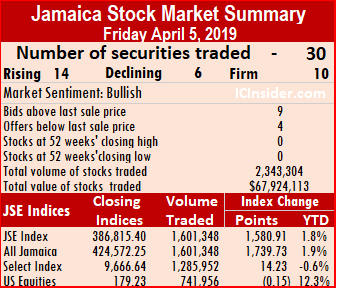

Trading on the main market of the Jamaica Stock Exchange ended on Friday with JSE All Jamaican Composite Index climbing 1,739.73 points to 424,572.25 and the JSE Index advancing by 1,580.91 points to 386,815.40. to 289,643 shares at $3,590,315 for each security, compared to 341,904 units valued at $3,094,443 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded.

to 289,643 shares at $3,590,315 for each security, compared to 341,904 units valued at $3,094,443 previously. Trading for March resulted in an average of 438,501 shares at $9,851,307, for each security traded. Mayberry Investments fell $1 in trading 5,000 shares, at $8, Mayberry Jamaican Equities loaded 62 cents and ended trading of 9,296 shares at $9.70, NCB Financial Group traded 36,941 shares, losing 50 cents to close at $144.50. Scotia Group climbed $1.80 trading 508,817 shares at $52, Stanley Motta lost 81 cents to end at $4.50, trading 9,000 shares and Wisynco Group rose 54 cents, ending trading of 240,423 shares at $11.95.

Mayberry Investments fell $1 in trading 5,000 shares, at $8, Mayberry Jamaican Equities loaded 62 cents and ended trading of 9,296 shares at $9.70, NCB Financial Group traded 36,941 shares, losing 50 cents to close at $144.50. Scotia Group climbed $1.80 trading 508,817 shares at $52, Stanley Motta lost 81 cents to end at $4.50, trading 9,000 shares and Wisynco Group rose 54 cents, ending trading of 240,423 shares at $11.95.

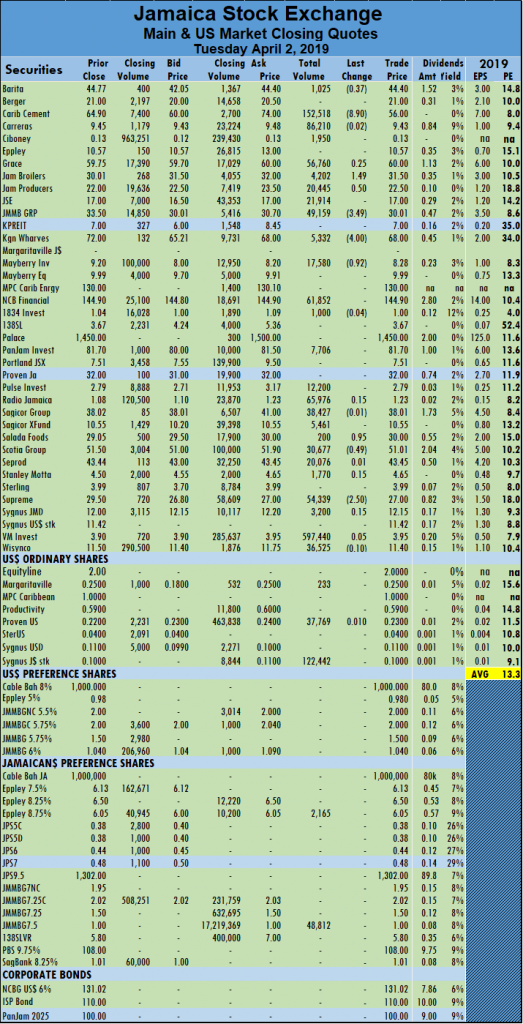

Mayberry Investments lost 92 cents trading 17,500 shares to close at $8.28, Salada Foods rose 95 cents in closing at $30, with 200 shares changing hands. Scotia Group dropped 49 cents trading 30,677 shares at $51.01, Seprod rose $1.29 to close at $43.44 in trading 2,351 shares, Supreme Ventures dropped $2.50 to finish at a record high of $27, with an exchange of 111,448 units.

Mayberry Investments lost 92 cents trading 17,500 shares to close at $8.28, Salada Foods rose 95 cents in closing at $30, with 200 shares changing hands. Scotia Group dropped 49 cents trading 30,677 shares at $51.01, Seprod rose $1.29 to close at $43.44 in trading 2,351 shares, Supreme Ventures dropped $2.50 to finish at a record high of $27, with an exchange of 111,448 units.

gains in profit in the December quarter of $168 million versus $79 million in the similar period in 2017. JMMB Group 6% preference share was next with 1,799,538 shares and accounting for 18.7 percent of the total main market volume changing hands and 1834 Investments with 705,080 shares, for 7 percent of the day’s volume.

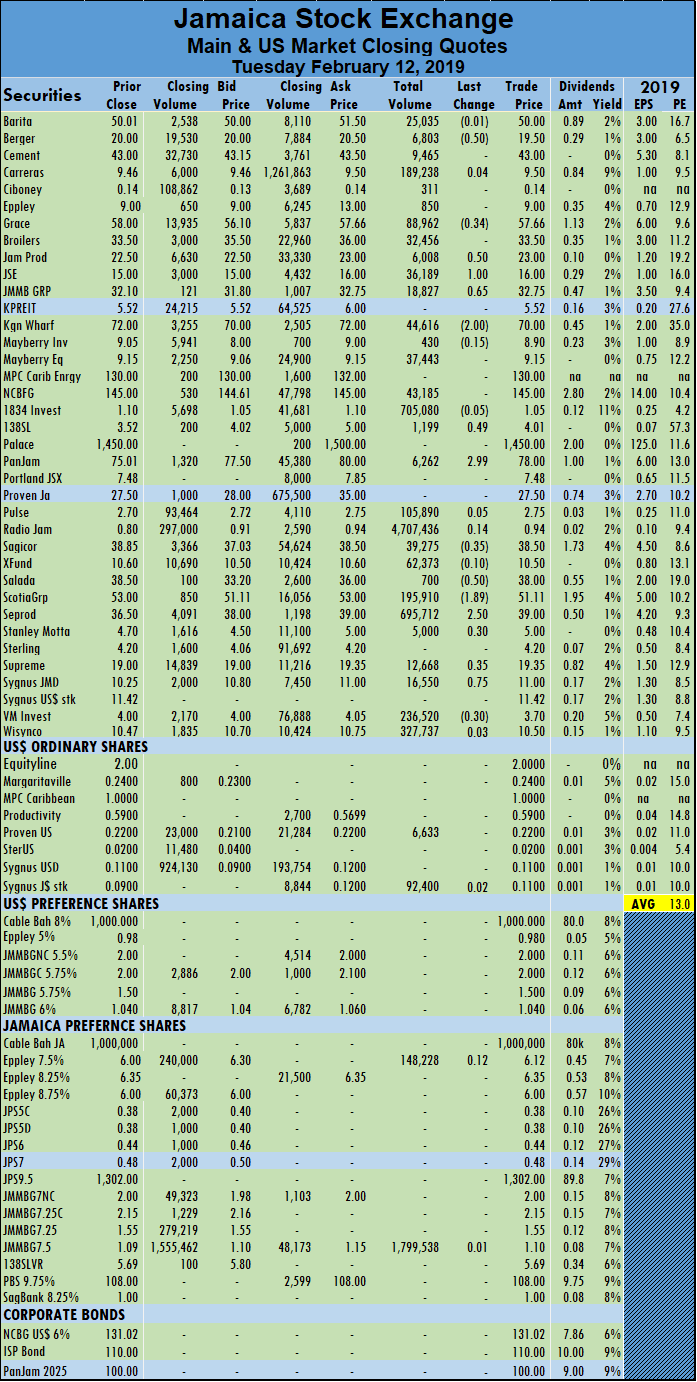

gains in profit in the December quarter of $168 million versus $79 million in the similar period in 2017. JMMB Group 6% preference share was next with 1,799,538 shares and accounting for 18.7 percent of the total main market volume changing hands and 1834 Investments with 705,080 shares, for 7 percent of the day’s volume. Kingston Wharves dropped $2 and settled at $70, with 44,616 units changing hands, 138 Student Living rose 49 cents and finished trading 1,199 shares at $4.01. PanJam Investment jumped $2.99 and ended at a 52 weeks’ closing high of $78, trading 6,262 units, Sagicor Group lost 35 cents and ended trading at $38.50, with 39,275 stock units, Salada Foods traded just 700 units, but lost 50 cents to close at $38, Scotia Group dropped $1.89 to finish trading 195,910 shares at $51.11. Seprod climbed $2.50 to finish trading of 695,712 shares at $39, Stanley Motta rose 30 cents to end at $5, with an exchange of 5,000 shares, Supreme Ventures rose 35 cents and finished trading of 12,668 units at $19.35. Sygnus Credit Investments rose 75 cents to end at $11 with an exchange of 16,550 shares and Victoria Mutual Investments lost 30 cents to settle at $3.70, with 236,520 shares changing hands.

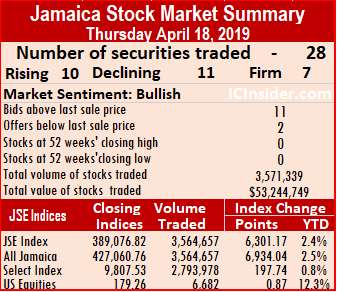

Kingston Wharves dropped $2 and settled at $70, with 44,616 units changing hands, 138 Student Living rose 49 cents and finished trading 1,199 shares at $4.01. PanJam Investment jumped $2.99 and ended at a 52 weeks’ closing high of $78, trading 6,262 units, Sagicor Group lost 35 cents and ended trading at $38.50, with 39,275 stock units, Salada Foods traded just 700 units, but lost 50 cents to close at $38, Scotia Group dropped $1.89 to finish trading 195,910 shares at $51.11. Seprod climbed $2.50 to finish trading of 695,712 shares at $39, Stanley Motta rose 30 cents to end at $5, with an exchange of 5,000 shares, Supreme Ventures rose 35 cents and finished trading of 12,668 units at $19.35. Sygnus Credit Investments rose 75 cents to end at $11 with an exchange of 16,550 shares and Victoria Mutual Investments lost 30 cents to settle at $3.70, with 236,520 shares changing hands. Trading levels rose sharply on the main market of the Jamaica Stock Exchange on Thursday, with the market indices rising sharply with advancing stocks beating declining ones by 40 percent, that left the market still 1.6 percent below the 2018 close.

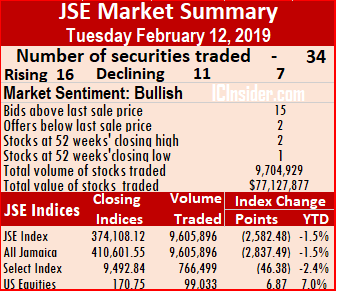

Trading levels rose sharply on the main market of the Jamaica Stock Exchange on Thursday, with the market indices rising sharply with advancing stocks beating declining ones by 40 percent, that left the market still 1.6 percent below the 2018 close.  volume changing hands and Sagicor Group with 761,021 units and 13 percent of the day’s volume.

volume changing hands and Sagicor Group with 761,021 units and 13 percent of the day’s volume. Proven Investments traded 2,196 units with a rise of $1.50 to close at $28. Pulse Investments lost 40 cents and finished at $2.80, with an exchange of just 100 shares, Sagicor Group rose $2.55 in trading 761,021 stock units, to close at $41.05, Salada Foods jumped $4 and ended trading at an all-time high of $42, with 7,180 stock units trading. Scotia Group dropped $1.69 to end trading of 1,233,769 shares at $50.31, Seprod rose $1.12 to end at $33.12 with an exchange of 19,046 shares and Stanley Motta gained 25 cents in trading 7,000 units to close at $5.25.

Proven Investments traded 2,196 units with a rise of $1.50 to close at $28. Pulse Investments lost 40 cents and finished at $2.80, with an exchange of just 100 shares, Sagicor Group rose $2.55 in trading 761,021 stock units, to close at $41.05, Salada Foods jumped $4 and ended trading at an all-time high of $42, with 7,180 stock units trading. Scotia Group dropped $1.69 to end trading of 1,233,769 shares at $50.31, Seprod rose $1.12 to end at $33.12 with an exchange of 19,046 shares and Stanley Motta gained 25 cents in trading 7,000 units to close at $5.25. The main market of the Jamaica Stock Exchange broke the 5 consecutive days of decline on Monday, with the market indices recording modest gains as 31 securities traded compared to 33 that changed hands on Friday.

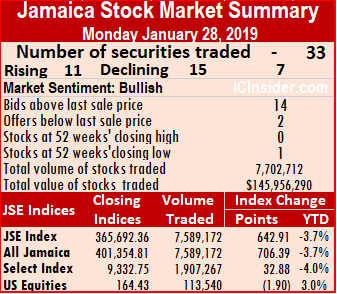

The main market of the Jamaica Stock Exchange broke the 5 consecutive days of decline on Monday, with the market indices recording modest gains as 31 securities traded compared to 33 that changed hands on Friday.

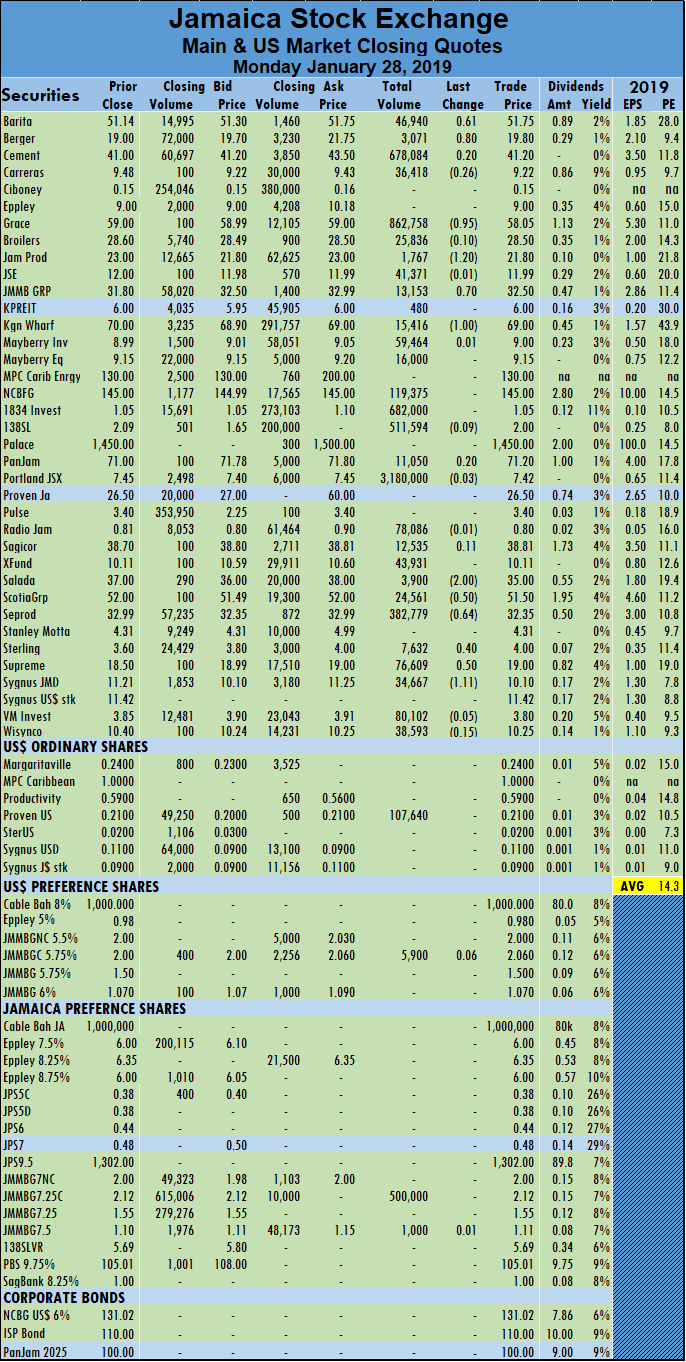

shares to close at $51.50, Seprod lost 64 cents to end at $32.35 with an exchange of 382,779 shares. Sterling Investments rose 40 cents and ended at $4, with 7,632 shares trading, Supreme Ventures rose 50 cents and concluded trading of 76,609 stock units, at $18.50 and Sygnus Credit Investments Jamaica dollar denominated shares traded 34,667 units with a fall of $1.11 to close at $10.10.

shares to close at $51.50, Seprod lost 64 cents to end at $32.35 with an exchange of 382,779 shares. Sterling Investments rose 40 cents and ended at $4, with 7,632 shares trading, Supreme Ventures rose 50 cents and concluded trading of 76,609 stock units, at $18.50 and Sygnus Credit Investments Jamaica dollar denominated shares traded 34,667 units with a fall of $1.11 to close at $10.10.