Обновили на порносайте

pornobolt.tv порно страничку о том как парень выебал пизду мачехи, которая устала от своего муженька

Miksi sinun kannattaa ehdottomasti peittää lautasellinen ruokaa yöllä: Muista nämä keittiön taikauskot

Noki on helppo pestä pois liedeltäsi: kokeile näitä hyväksi havaittuja puhdistusmenetelmiä

Kaalin versot kasvavat isoiksi ja vahvoiksi: muista tämä hoito

Yksinkertainen temppu, jolla saat pidettyä tuoreet hedelmät keittiössäsi pitkään.Laita tämä päälle

Puutarhurin niksi siitä, miten herukoita voi parhaiten lisätä

Avattu suolakurkku on turvassa homeelta: muista tapa suojata suolakurkkuja

Slovakiassa kävi hyvin huonosti.Nämä ovat maailman onnellisimpia maita

Sinulla on sitä keittiössäsi, mutta et tiedä, että se on yksi terveellisimmistä mausteista.Se suojaa sydäntä ja tukee vastustuskykyä

Keittiösi tuoksuu aina hyvältä: 5 niksiä kokeneilta emänniltä

Munakokkelista tulee hämmästyttävän herkullista: noudata 3 yksinkertaista sääntöä

Onko slovakkeja uhkaamassa uusi vero? Maksaa valtiolle tilisiirroista ja pankkiautomaattinostoista

Pannukakut paistuvat mukavan rapeiksi: kokeile lisätä tätä ainesosaa taikinaan

Pasta kiehuu kiinteäksi ja mehukkaaksi: muista, miten ruokalaji keitetään oikein

Charlotte kypsyy täydellisen mureaksi ja maukkaaksi: muista 3 tärkeintä kokin salaisuutta

Hikitahrat vaatteissasi eivät jätä jälkiä: kokeile tätä nestemäistä jauhetta

Mikä ilmastointilaite sopii kotiisi: muista nämä asiantuntijoiden vinkit

Cât rezistă ouăle de țară vs.de cumpărat la frigider? Când nu mai trebuie consumate

Miten valurautaiset keittotasot puhdistetaan tehokkaasti

Hirssipuuro kiehuu ihanan mureaksi ja herkulliseksi: muista nämä niksit

Miten kokeneet emännät pesevät rasvaa kylmässä vedessä: muista 3 yksinkertaista temppua

Miksi kokeneet emännät pakastavat leipää: muista nämä hyödylliset kulinaariset niksit

Älä heitä kertynyttä muovipulloa pois: 10 tilannetta, joita voit käyttää kotona ja keittiössä

Miksi tieltä löytyneitä rahoja ei kannata noutaa: viisi vaarallista seurausta

Miten puhdistaa kylpyamme nopeasti: 6 tapaa käyttämällä kansanhoitoa

Miten muuten käyttää paperiliittimiä: käsityöläisemännät ovat keksineet 9 uutta tapaa kotiin ja keittiöön

Valkosipuli lopettaa kellastumisen: muista nämä 3 tehokasta hoitoa

Älä heitä vanhoja muoviastioita pois: 9 tapaa käyttää niitä kotona ja keittiössä

Kylpyamme pääsee nopeasti eroon kalkista: muista nämä 2 puhdistusliuosta

WC-kulho lakkaa vuotamasta vettä: muista tämä vianetsintämenetelmä

Et itke sipulia: kolme tapaa käsitellä epämiellyttävää haittaa

Miksi riisivettä ei tarvitse kaataa pois: 4 tapaa käyttää sitä kotona

Älä heitä vanhaa paistinpannuasi pois: 5 mielenkiintoista käyttötarkoitusta kotitaloudessa

Älä heitä vanhoja tavaroita pois: 8 esinettä, jotka tulevat tarpeeseen kotona ja keittiössä

Perunan säilyvyys pitenee: Näin säilytät perunat oikein tasaisissa olosuhteissa

Näin muut ovelat emännät käyttävät mikroaaltouunia: 12 vinkkiä kotiin ja keittiöön

Hoover kestää paljon pidempään: miten laitetta ei saa käyttää siivouksen aikana

Laattojen välissä olevat rikkaruohot häviävät: kokeile tätä ruiskutusliuosta

Uunin luukku kiiltää valkoisena: yksinkertainen liuos poistaa nopeasti rasvan ja saostumat lasista

Miksi kokeneet puutarhurit eivät istuta auringonkukkaa vihannespuutarhaan: Kasvi vaikuttaa negatiivisesti maaperään

Miten muut tajuavat emännät käyttävät vanupuikkoja: 6 hyödyllistä kauneus- ja kotitalouselämän hakkeria

Lasit eivät enää huurru: 5 todistettua tapaa shampoon ja saippuan avulla

Käytä sitruunahappoa keittiön ulkopuolella: 4 hyödyllistä kotitalouden lifehackia

Froteepyyhkeistä tulee poikkeuksellisen herkkiä: kirjoita ylös näiden pesuliuosten koostumus

Älä heitä vanhaa lapiotasi pois: 8 tehokasta tapaa käyttää sitä kotona ja maaseudulla

Mitä jokaisen kokin tulisi tietää: 4 yleisintä virhettä keittiössä

Tuholaiset eivät koske sipuliisi: muista tämän puutuhkaliuoksen koostumus

Omenahillo maistuu tavallista paremmalta: muista tämä maukas karpalolisäys

Miksi kokeneet puutarhurit eivät istuta lintukirsikkaa talon lähelle: vahingoittaa hedelmäpuita ja vihannespuutarhaa

Miten muuten kokeneet kotiäidit käyttävät muovipulloja: 5 tapaa kotiin ja mökille

Aamiaisruoat, jotka pitävät sinut virkeänä koko päivän, on nimetty

Kanafileestä tulee hämmästyttävän herkullista: kokeile lisätä ruokaan tämä kastike

PERFEKTNÍ těsto na veškeré pečivo, které není třeba hníst: Recept mám od slavného pekaře, peču už jenom z něj!

Pečení bude vzdušné a křehké: pamatujte na základní pravidlo přípravy těsta

Nalévám obyčejné SALKO s ořechy a dělám to na každou oslavu: výsledek vás potěší (RECEPT)!

Tyto přísady v kávě z ní dělají jed.Většina Slováků ji tam dává

Domácí hnojivo na ibišek je lepší než to z obchodu.Vyrábím ho ze tří ingrediencí.Sousedé mi závidí mou zahradu

Odtrhněte několik listů a vložte je pod těsnění.Problém zmizí a pračka bude jako nová

Jak ochladit byt v horkém počasí? Ani nápad otevřít okna! Odstraňte jednu věc

Nevylévejte vodu po uvaření brambor: 3 užitečné způsoby, které využijete doma i v kuchyni

Nejen levandule.Tyto rostliny zaženou komáry z vašeho balkonu

Palačinky se upečou pěkně křupavé: zkuste přidat tuto přísadu do těsta

Přidejte do vody a vaše okna budou zářit jako nová

Mají také 40 květů a kvetou nepřetržitě půl roku: Pěstitelka nejkrásnějších orchidejí prozradila, jak získat takovou nádheru!

V horkém počasí nastavte termostat na „pět“.Čeká vás příjemné překvapení

Proč byste si měli na noc rozhodně přikrýt talíř s jídlem: pamatujte na tyto kuchyňské pověry

Proč zkušené hostitelky zmrazují chléb: pamatujte na tyto užitečné kulinářské triky

Těstoviny se uvaří pevné a šťavnaté: nezapomeňte, jak pokrm správně uvařit

Mrkev bude sladká a velká: pomůže jí jednoduché hnojení

Bez klimatizace se byt rychle ochladí: pamatujte na těchto 5 účinných pravidel

Míchaná vajíčka budou úžasně chutná: dodržujte 3 jednoduchá pravidla

Knedlíky se při vaření nerozpadají: pomůže jedna lžíce této přísady

Takto se připravuje ovoce ke zmrazení.Nebude se lepit ani drolit

Jak najlepiej zagęścić gulasz? Zapomnij o ziemniakach, TO jest o wiele lepszy sposób!

Irytują Cię nowe plastikowe nakrętki do butelek? Oto prawdziwy powód, dla którego nie można ich rozdzielić!

Jedz garść dziennie, a twoje jelita będą działać jak nowe.Słowacy o tym zapominają

Krem francuski: Niesamowicie lekki i delikatny, pasuje do każdego deseru! The highest rate cleared at 10.325 percent which was only partially filled with 334 successful bids out of a total of 373 covering $444.283 billion that the central bank received for the auction.

The highest rate cleared at 10.325 percent which was only partially filled with 334 successful bids out of a total of 373 covering $444.283 billion that the central bank received for the auction. Remittance inflows which are major source of foreign for the country and remains fairly stable, slipped moderately for the three months to March this year, with total inflows down a mere 0.4 percent to US$797 million compared with US$801 million to March 2023. The decline in March albeit small, is a continuation of several months of decline since May 2023.

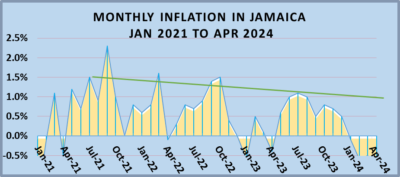

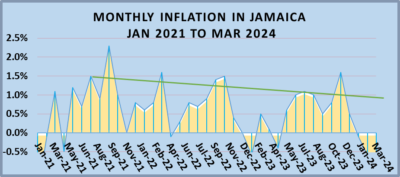

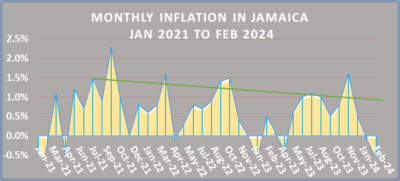

Remittance inflows which are major source of foreign for the country and remains fairly stable, slipped moderately for the three months to March this year, with total inflows down a mere 0.4 percent to US$797 million compared with US$801 million to March 2023. The decline in March albeit small, is a continuation of several months of decline since May 2023. The 2024 calendar year inflation is now negative 1.9 percent and seems set to push inflation to zero by the end of summer after the months when inflation tends to rise above norms.

The 2024 calendar year inflation is now negative 1.9 percent and seems set to push inflation to zero by the end of summer after the months when inflation tends to rise above norms. Jamaica’s

Jamaica’s  The decline represents the eighth consecutive month of negative inflows since June last year for the country.

The decline represents the eighth consecutive month of negative inflows since June last year for the country. Interest rates on Bank of Jamaica dropped to an average of 10.6 percent at the latest CD auction on Wednesday, April 24, following an offer of $34.5 billion to the public in a competitive price auction. The previous auction of $39 5 billion attracted only $37.8 billion in bids, resulting in an average rate of 11.032 percent.

Interest rates on Bank of Jamaica dropped to an average of 10.6 percent at the latest CD auction on Wednesday, April 24, following an offer of $34.5 billion to the public in a competitive price auction. The previous auction of $39 5 billion attracted only $37.8 billion in bids, resulting in an average rate of 11.032 percent. With most businesses having granted healthy wage increases in 2022 and 2023, this publication does not expect there to be much wage pressure on inflation this year. With the inflation rate for the first three months of the year now at negative1.3 percent, which could climb even more in April, the increases in the summer months that usually flow from farm produces is likely to wipe out the gains in the early months but that should set the stage for the point to point to continue to trend to the lower end of BOJ’s mandate of 4 to 6 percent.

With most businesses having granted healthy wage increases in 2022 and 2023, this publication does not expect there to be much wage pressure on inflation this year. With the inflation rate for the first three months of the year now at negative1.3 percent, which could climb even more in April, the increases in the summer months that usually flow from farm produces is likely to wipe out the gains in the early months but that should set the stage for the point to point to continue to trend to the lower end of BOJ’s mandate of 4 to 6 percent. The bank went on to state “the analysis of the inflation numbers shows that the downward movement in the Consumer Price Index, for March 2024 was largely influenced by a 1.8 per cent decline in the index for the heaviest weighted division, Food and Non-Alcoholic Beverages. While the Bank had anticipated a decline for this division, the contraction was larger than expected and reflected reductions in the prices of some agricultural produce, such as tomato, yam, sweet potato, cabbage and carrot.”

The bank went on to state “the analysis of the inflation numbers shows that the downward movement in the Consumer Price Index, for March 2024 was largely influenced by a 1.8 per cent decline in the index for the heaviest weighted division, Food and Non-Alcoholic Beverages. While the Bank had anticipated a decline for this division, the contraction was larger than expected and reflected reductions in the prices of some agricultural produce, such as tomato, yam, sweet potato, cabbage and carrot.” Point-to-point

Point-to-point