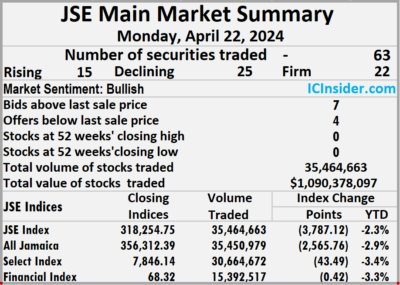

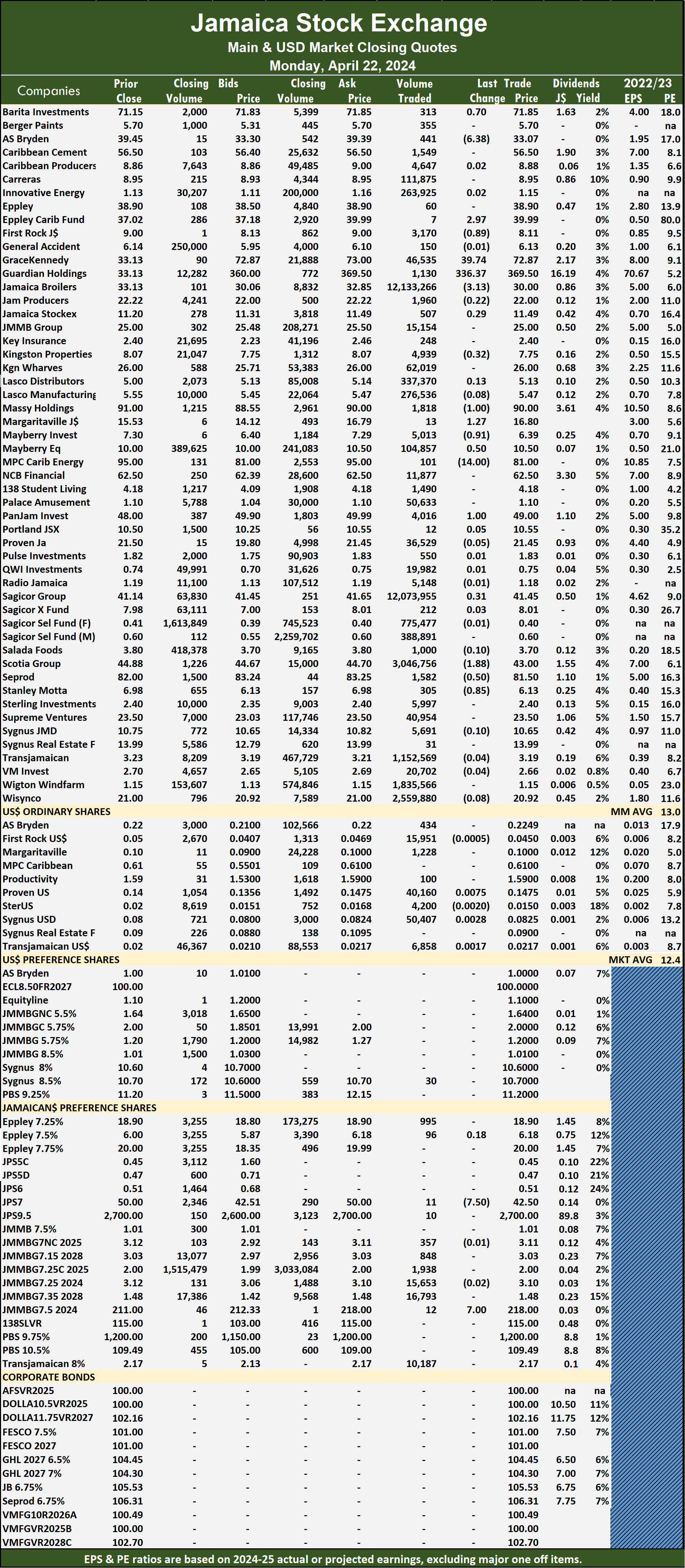

Sagicor Group ended with trading of 12.07 million shares with a value of $500 million and Jamaica Broilers with 12.1 million shares for $388 million and lifted trading to over $1.1 billion on the Main Market of the Jamaica Stock Exchange on Monday, with the volume of stocks traded rising 663 percent and the value 1,272 percent more than on Friday. As was the case on Friday trading ended with activity in 63 securities, with prices of 16 stocks rising, 25 declining and 22 ending unchanged.

The market closed on Monday with 35,464,663 shares being traded for $1,090,378,097 in comparison to just 4,649,405 units at $79,455,741 on Friday.

The market closed on Monday with 35,464,663 shares being traded for $1,090,378,097 in comparison to just 4,649,405 units at $79,455,741 on Friday.

Trading averaged 562,931 shares at $17,307,589 up sharply from 73,800 units at $1,261,202 on Friday and month to date, an average of 812,889 stock units at $4,488,294, compared with 831,372 units at $3,540,388 on the prior trading day and March that ended with an average of 828,473 units at $2,341,254.

Jamaica Broilers led trading with 12.13 million shares for 34.2 percent of total volume followed by Sagicor Group with 12.07 million units for 34 percent of the day’s trade, Scotia Group chipped in with 3.05 million stocks for 8.6 percent market share, Wisynco Group ended with 2.56 million units for 7.2 percent share of the stocks traded, Wigton Windfarm closed with 1.84 million stock units for 5.2 percent of the trading and Transjamaican Highway with 1.15 million shares for 3.2 percent of total volume.

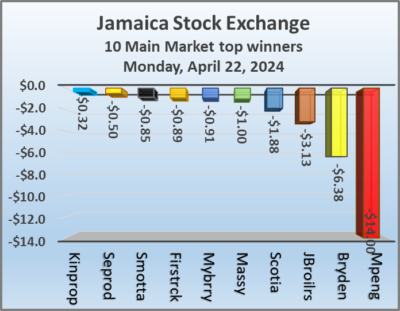

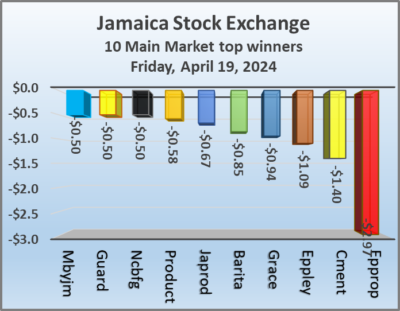

The All Jamaican Composite Index sank by 2,565.76 points to end trading at 356,312.39, the JSE Main Index dropped 3,787.12 points to 318,254.75 and the JSE Financial Index slipped by 0.42 points to end at 68.32.

The All Jamaican Composite Index sank by 2,565.76 points to end trading at 356,312.39, the JSE Main Index dropped 3,787.12 points to 318,254.75 and the JSE Financial Index slipped by 0.42 points to end at 68.32.

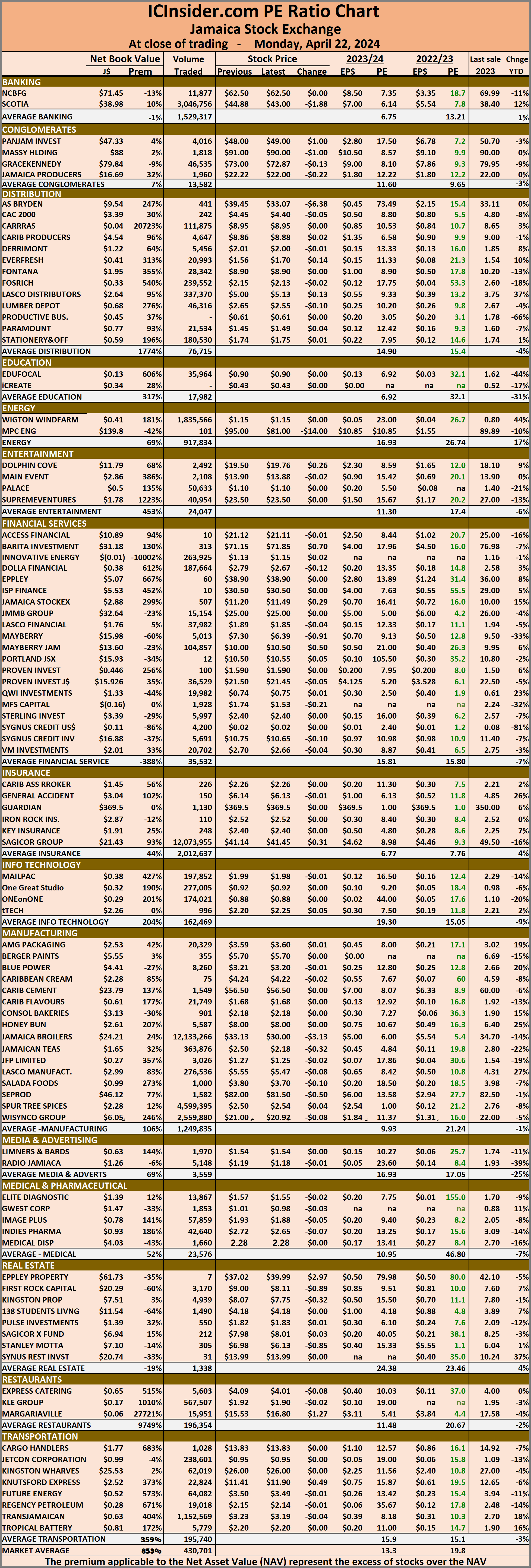

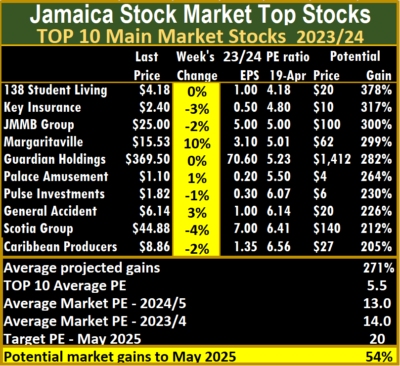

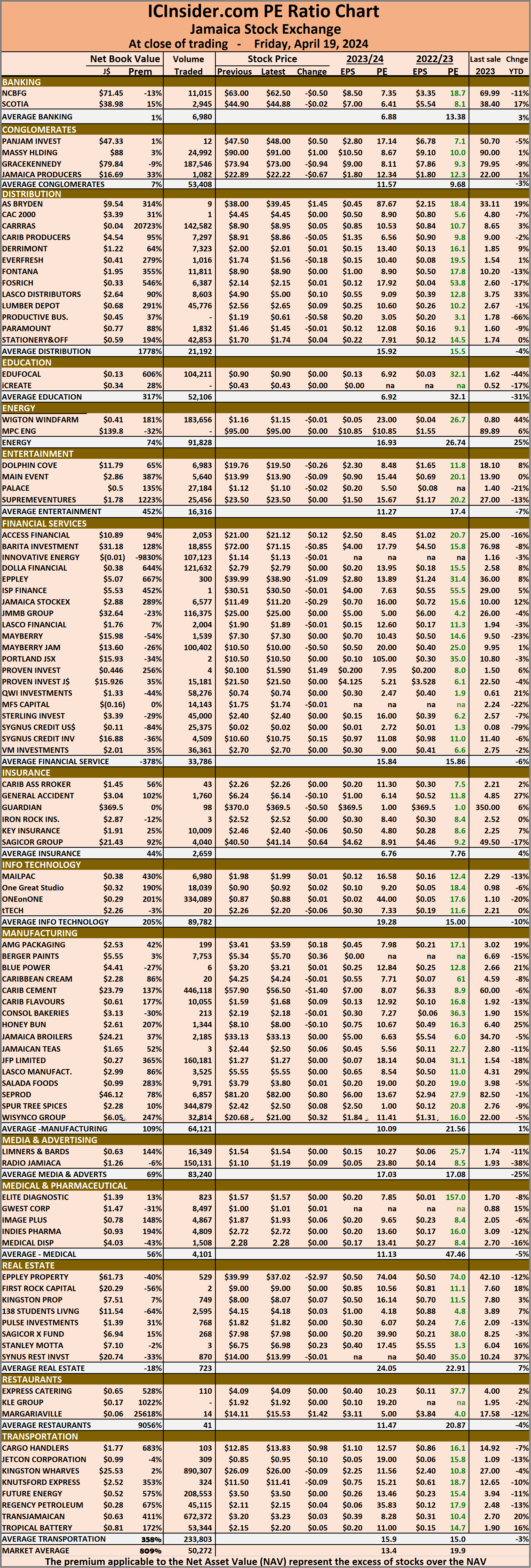

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts done by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and four with lower offers.

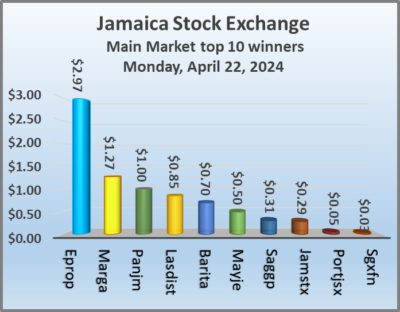

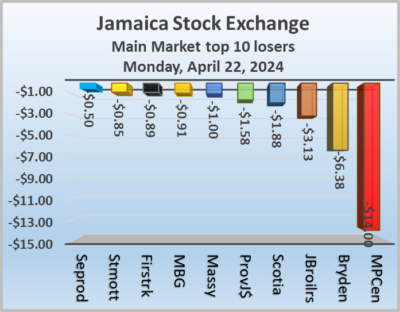

At the close, AS Bryden fell $6.38 to finish at $33.07 after trading of 441 stocks, Barita Investments rallied 70 cents to $71.85 in switching ownership of 313 units, Eppley Caribbean Property Fund rose $2.97 in closing at $39.99 after investors cleared the market of 7 shares. First Rock Real Estate dropped 89 cents to close at $8.11 with a transfer of 3,170 stock units, Jamaica Broilers sank $3.13 and ended at $30 with an exchange of 12,133,266 shares,  Kingston Properties dropped 32 cents to $7.75, with 4,939 stocks changing hands. Margaritaville rallied $1.27 in closing at $16.80 as investors exchanged 13 units, Massy Holdings shed $1 to end at $90 after 1,818 stock units crossed the market, Mayberry Group declined 91 cents to finish at $6.39 in an exchange of 5,013 shares. Mayberry Jamaican Equities popped 50 cents and ended at $10.50 with investors trading 104,857 units, MPC Caribbean Clean Energy lost $14 to close at $81 with an exchange of 101 stocks, Pan Jamaica popped $1 to end at $49 after 4,016 stock units passed through the market. Sagicor Group increased 31 cents to $41.45 after a transfer of 12,073,955 shares, Scotia Group skidded $1.88 to end at $43 with investors dealing in 3,046,756 units, Seprod dipped 50 cents in closing at $81.50 after an exchange of 1,582 stocks and Stanley Motta sank 85 cents and ended at $6.13 closed at 305 stock units.

Kingston Properties dropped 32 cents to $7.75, with 4,939 stocks changing hands. Margaritaville rallied $1.27 in closing at $16.80 as investors exchanged 13 units, Massy Holdings shed $1 to end at $90 after 1,818 stock units crossed the market, Mayberry Group declined 91 cents to finish at $6.39 in an exchange of 5,013 shares. Mayberry Jamaican Equities popped 50 cents and ended at $10.50 with investors trading 104,857 units, MPC Caribbean Clean Energy lost $14 to close at $81 with an exchange of 101 stocks, Pan Jamaica popped $1 to end at $49 after 4,016 stock units passed through the market. Sagicor Group increased 31 cents to $41.45 after a transfer of 12,073,955 shares, Scotia Group skidded $1.88 to end at $43 with investors dealing in 3,046,756 units, Seprod dipped 50 cents in closing at $81.50 after an exchange of 1,582 stocks and Stanley Motta sank 85 cents and ended at $6.13 closed at 305 stock units.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 after exchanging 11 shares and 138 Student Living preference share advanced $7 to close at $218 with investors transferring 12 units.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 after exchanging 11 shares and 138 Student Living preference share advanced $7 to close at $218 with investors transferring 12 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices tumble on Trinidad Exchange on Monday

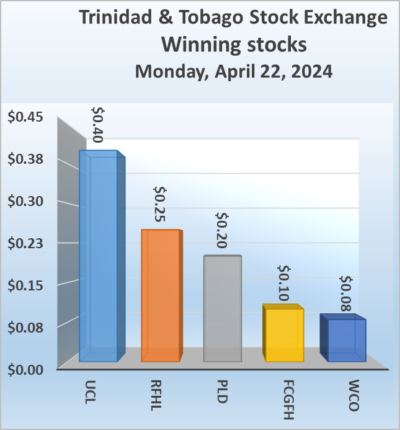

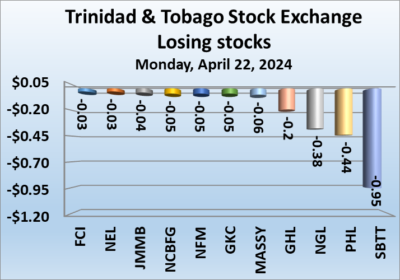

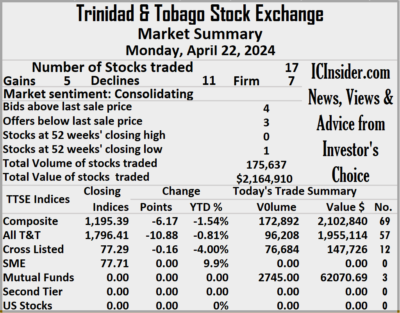

Falling stocks clobbered those rising at the end of trading on the Trinidad and Tobago Stock Exchange on Monday, with the volume of stocks traded declining 80 percent valued 70 percent less than on Friday and similar to Friday a total of 17 securities were traded and ending with prices of five stocks rising, 11 declining and one remaining unchanged.

The market closed with an exchange of 175,637 shares at $2,164,910 down from 888,399 stock units at $7,274,583 on Friday.

The market closed with an exchange of 175,637 shares at $2,164,910 down from 888,399 stock units at $7,274,583 on Friday.

An average of 10,332 shares were traded at $127,348 compared to 52,259 units at $427,917 on Friday, with trading month to date averaging 15,430 shares at $166,342 compared to 15,774 units at $168,973 on the previous day and an average for March of 28,236 shares at $236,496.

The Composite Index sank 6.17 points to finish at 1,195.39, the All T&T Index fell 10.88 points to close at 1,796.41, the SME Index ended unchanged at 77.71 and the Cross-Listed Index skidded 0.16 points to close at 77.29.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Calypso Macro Investment Fund ended at $22.60 with 2,745 shares crossing the market, First Citizens Group increased 10 cents to $48.25 as investors exchanged 2,230 units, FirstCaribbean International Bank shed 3 cents to finish at $7.01 after 799 stocks passed through the market. GraceKennedy fell 5 cents in closing at $3.90 after an exchange of 13,000 stock units, Guardian Holdings lost 20 cents to end at $18.50 with investors trading 200 shares, JMMB Group declined 4 cents to close at $1.45, with 62,385 stocks crossing the market. Massy Holdings sank 6 cents to $4.30 with an exchange of 39,050 units, National Enterprises slipped 3 cents to finish at $3.82 and closed with an exchange of 2,790 stock units, National Flour Mills dropped 5 cents and ended at $2.20 with traders dealing in 1,500 shares. NCB Financial skidded 5 cents to close at $3.10 in switching ownership of 500 stocks, Point Lisas popped 20 cents to end at $3.70 with investors dealing in 237 units, Prestige Holdings dipped 44 cents in closing at $13.55 with a transfer of 30,238 stock units.

GraceKennedy fell 5 cents in closing at $3.90 after an exchange of 13,000 stock units, Guardian Holdings lost 20 cents to end at $18.50 with investors trading 200 shares, JMMB Group declined 4 cents to close at $1.45, with 62,385 stocks crossing the market. Massy Holdings sank 6 cents to $4.30 with an exchange of 39,050 units, National Enterprises slipped 3 cents to finish at $3.82 and closed with an exchange of 2,790 stock units, National Flour Mills dropped 5 cents and ended at $2.20 with traders dealing in 1,500 shares. NCB Financial skidded 5 cents to close at $3.10 in switching ownership of 500 stocks, Point Lisas popped 20 cents to end at $3.70 with investors dealing in 237 units, Prestige Holdings dipped 44 cents in closing at $13.55 with a transfer of 30,238 stock units.  Republic Financial advanced 25 cents to $118.50 after trading 681 shares, Scotiabank fell 95 cents to end at $69, with 17,051 stocks crossing the exchange, Trinidad & Tobago NGL slipped 38 cents in closing at a 52 weeks’ low of $8.60, with 1,600 stock units changing hands. Unilever Caribbean rose 40 cents and ended at $11.56 in trading 250 stocks and West Indian Tobacco gained 8 cents to close at $11.15 with 381 units clearing the market.

Republic Financial advanced 25 cents to $118.50 after trading 681 shares, Scotiabank fell 95 cents to end at $69, with 17,051 stocks crossing the exchange, Trinidad & Tobago NGL slipped 38 cents in closing at a 52 weeks’ low of $8.60, with 1,600 stock units changing hands. Unilever Caribbean rose 40 cents and ended at $11.56 in trading 250 stocks and West Indian Tobacco gained 8 cents to close at $11.15 with 381 units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Profits continue to send mixed signals

Early profit results for the first 2024 quarter show some positives, with the Montego Bay-based Knutsford Express reporting b revenue growth and profit for the quarter and the nine months to February, followed by positive results for AMG Packaging and Express Catering, but there were also some disappointing ones.

Knutsford Express

The directors of Knutsford Express stated that “strong and steady demand for our courier services complemented our passenger services have combined in delivering year to date profit of $268 million, up 27.1 percent from $211 million at the end of February 2023. We, therefore, recorded a 20.9 percent growth in our total revenue in this quarter moving to $565 million from $468 million in the comparative period in 2023. Similarly, our nine-month year-to-date revenue has increased by 19.5 percent from $1,281 million in 2023 to $1,530 million in 2024.”

Innovative Energy, formerly Ciboney reported no revenues in the February quarter and a loss of $4.4 million with the year to date, ending with $500,000 in income and a loss of $7.8 million.

AMG Packaging grew profit by 79 percent to $32 million from $18 million in 2023, better than the 72 percent rise in the first quarter. For the six months to February, profit was up by 79 percent to $84 million from $47 million in 2023.

Revenues climbed from US$6 million to US$7 million at Express Catering, up 17.6 percent in the quarter and increased by 23 percent from US$15 million to US$18.7 million, delivering a profit of US$2 million for the year to date and US$1 million for the latest quarter, compared with US$1.9 million for the nine months in 2023 and $1.15 million in the February 2023 quarter. Ian Dear, the company’s CEO confirmed that added cost in the third quarter would have been associated with new restaurants opened close to the quarter as such, some of the cost would not be fully covered by revenues.

The revenue at Margaritaville (Turks) rose just 5 percent to US$5.25 million for the current year, compared to US$4.98 million for the same period last year, with a net profit of US$521,909, earnings per share of 0.773 US cents compared with the similar period of 2023, with a net profit of US$1.18 million which includes non-recurring gains of US$658,000 for EPS of 1.749 US cents.

The revenue at Margaritaville (Turks) rose just 5 percent to US$5.25 million for the current year, compared to US$4.98 million for the same period last year, with a net profit of US$521,909, earnings per share of 0.773 US cents compared with the similar period of 2023, with a net profit of US$1.18 million which includes non-recurring gains of US$658,000 for EPS of 1.749 US cents.

For the third quarter, revenues fell to US$1.9 million from US$2.2 million in 2023, delivering a profit of US$222,174 versus US$725,000 in 2023 including one time income of US$340,000.

Sygnus Real Estate Finance fell by 43 percent in the February quarter from $67 million in 2023 to $44 million in 2024. For six months revenues reached $88 million down 38 percent from $142 million in the prior year. The company incurred a loss of $187 million in the 2024 second quarter 45 percent worse than the $129 million and for the six months, a loss of $320 million was incurred marginally more than $302 million in 2023.

Paramount Trading is expanding into Chlorine and bleach processing.

Paramount Trading reported reduced revenues and profit for the third quarter and the nine months. Revenues in the February quarter declined 8.5 percent from $438 million in 2023 to $401 million in 2024. For the nine months, revenues fell 23 percent from $1.63 billion down to $1.266 billion with profits coming in at 40 percent lower at $18 million for the quarter from $30 million in 2023 and 44 percent to $100 million for the nine months of February this year from $179 million in the previous year.

One On One Educational Services reported revenues of $57 million in the February quarter down 12 percent from $73 million in 2023 and fell 27 percent to $111 million for the six months to February from $153 million in 2023.

A loss of $20 million million was incurred in the February quarter down from a profit of $6 million in 2023 and a loss of $41 million for the six months, down from a profit of $17 million in 2023 for the 6 months.

Big trading jump on the JSE USD Market

Trading jumped sharply on the Jamaica Stock Exchange US dollar market ended on Friday, with a huge 1,233 percent rise in the volume of stocks exchanged, with 794 percent greater value than on Thursday, resulting in trading in eight securities, down from 11 on Thursday with prices of four rising, two declining and two ending unchanged.

The market closed with an exchange of 880,808 shares for US$49,826 up sharply from 66,053 stock units at US$5,573 on Thursday.

The market closed with an exchange of 880,808 shares for US$49,826 up sharply from 66,053 stock units at US$5,573 on Thursday.

Trading averaged 110,101 units at US$6,228 versus 6,005 shares at US$507 on Thursday, with a month to date average of 38,941 shares at US$2,417 compared with 33,620 units at US$2,132 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index declined 3.05 points to wrap-up trading at 237.70.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share rose 0.52 of one cent in closing at 4.55 US cents as investors exchanged 14 stocks, Productive Business Solutions ended at US$1.59 and closed with an exchange of 4 units, Proven Investments ended at 14 US cents as investors traded 113,267 shares.  Sterling Investments climbed 0.19 of a cent and ended at 1.7 US cents after 25,375 stock units passed through the market, Sygnus Credit Investments declined 0.02 of a cent to end at 7.97 US cents after a transfer of 4,488 shares and Transjamaican Highway lost 0.18 of a cent to close at 2 US cents, with 726,047 stocks crossing the market.

Sterling Investments climbed 0.19 of a cent and ended at 1.7 US cents after 25,375 stock units passed through the market, Sygnus Credit Investments declined 0.02 of a cent to end at 7.97 US cents after a transfer of 4,488 shares and Transjamaican Highway lost 0.18 of a cent to close at 2 US cents, with 726,047 stocks crossing the market.

In the preference segment, JMMB Group US8.5% preference share popped 1 cent to US$1.20 with a transfer of 11,224 units and Productive Business Solutions 9.25% preference share gained 20 cents and ended at US$11.20, with 389 stock units crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

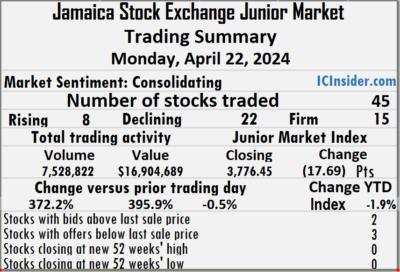

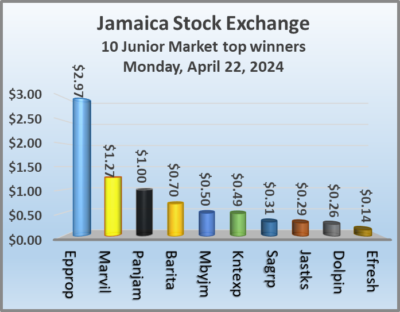

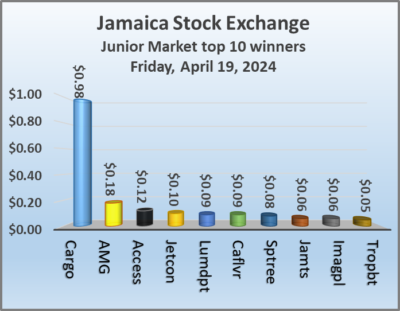

The market closed with an exchange of 7,528,822 shares for $16,904,689, up from 1,594,451 units at $3,409,014 on Friday.

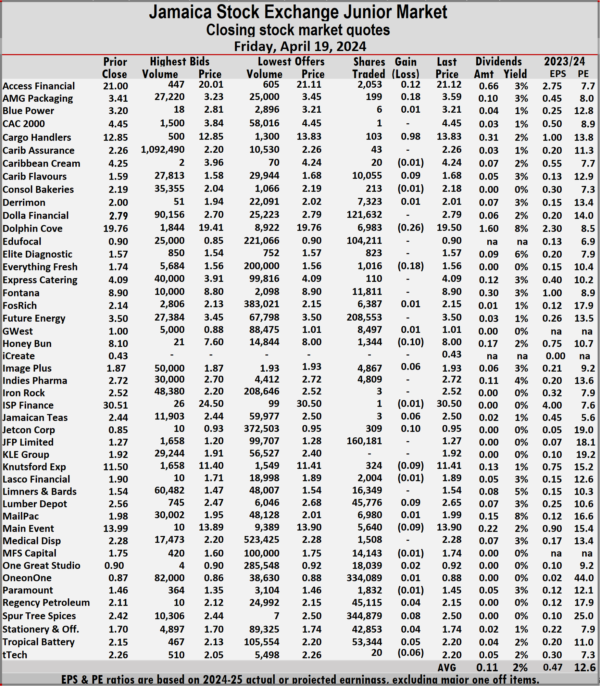

The market closed with an exchange of 7,528,822 shares for $16,904,689, up from 1,594,451 units at $3,409,014 on Friday. The Junior Market ended trading with an average PE Ratio of 12.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

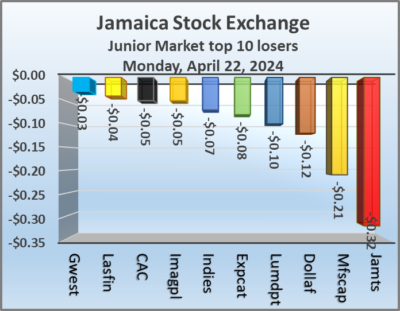

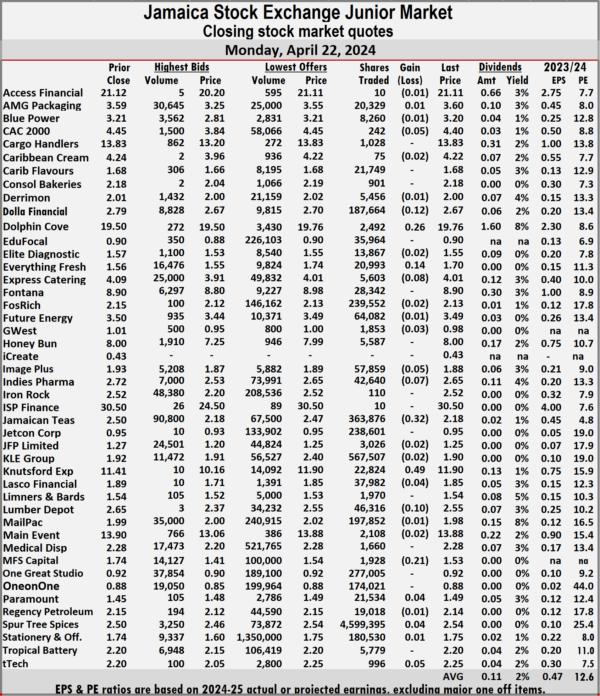

The Junior Market ended trading with an average PE Ratio of 12.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025. Indies Pharma dipped 7 cents and ended at $2.65, with 42,640 stocks crossing the market, Jamaican Teas sank 32 cents to $2.18 with an exchange of 363,876 stock units, Knutsford Express gained 49 cents to end at $11.90 after 22,824 shares passed through the market. Lumber Depot dipped 10 cents in closing at $2.55 with investors dealing in 46,316 stock units, MFS Capital Partners slipped 21 cents to close at $1.53 with a transfer of 1,928 stocks and tTech rose 5 cents to finish at $2.25 and closed with an exchange of 996 units.

Indies Pharma dipped 7 cents and ended at $2.65, with 42,640 stocks crossing the market, Jamaican Teas sank 32 cents to $2.18 with an exchange of 363,876 stock units, Knutsford Express gained 49 cents to end at $11.90 after 22,824 shares passed through the market. Lumber Depot dipped 10 cents in closing at $2.55 with investors dealing in 46,316 stock units, MFS Capital Partners slipped 21 cents to close at $1.53 with a transfer of 1,928 stocks and tTech rose 5 cents to finish at $2.25 and closed with an exchange of 996 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of the market, the JSE Combined Market Index dropped 3,753.71 points to 331,404.71, the All Jamaican Composite Index declined 2,565.76 points to end at 356,312.39, the JSE Main Index shed 3,787.12 points to finish at 318,254.75. The Junior Market Index dipped 17.69 points to finish at 3,776.45 and the JSE USD Market Index gained 4.33 points to finish at 242.03.

At the close of the market, the JSE Combined Market Index dropped 3,753.71 points to 331,404.71, the All Jamaican Composite Index declined 2,565.76 points to end at 356,312.39, the JSE Main Index shed 3,787.12 points to finish at 318,254.75. The Junior Market Index dipped 17.69 points to finish at 3,776.45 and the JSE USD Market Index gained 4.33 points to finish at 242.03. In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 and 138 Student Living preference share advanced $7 to close at $218.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 and 138 Student Living preference share advanced $7 to close at $218. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

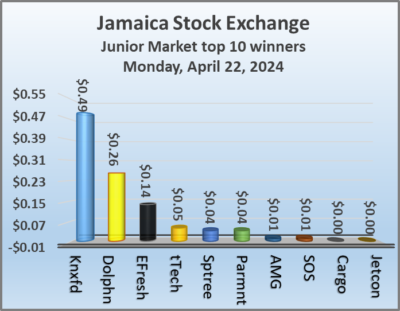

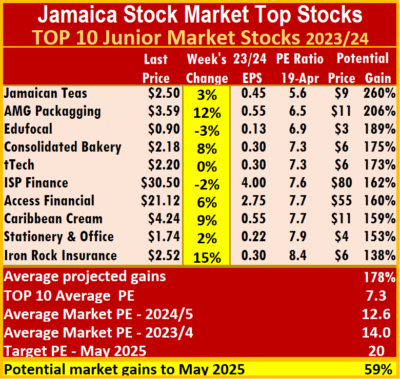

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. In market activity during the week, the only price movement of note in the Main Market is Margaritaville, up 10 percent to $15.53. On the other hand, the Junior Market ICTOP10 has 5 stocks with price changes of note. Iron Rock Insurance topped the list with a gain of 15 percent to $2.52 followed by AMG Packaging up 12 percent to $3.59. Caribbean Cream climbed 9 percent to $4.24, while Consolidated Bakeries popped 8 percent to $2.18 and Access Financial gained 6 percent to $21.12. Two declining Junior Market stocks suffered losses of 3 and 2 percent.

In market activity during the week, the only price movement of note in the Main Market is Margaritaville, up 10 percent to $15.53. On the other hand, the Junior Market ICTOP10 has 5 stocks with price changes of note. Iron Rock Insurance topped the list with a gain of 15 percent to $2.52 followed by AMG Packaging up 12 percent to $3.59. Caribbean Cream climbed 9 percent to $4.24, while Consolidated Bakeries popped 8 percent to $2.18 and Access Financial gained 6 percent to $21.12. Two declining Junior Market stocks suffered losses of 3 and 2 percent. The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.2 and the Junior Market TOP10 sits at 7.4 over half of the market, with an average of 12.6.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.2 and the Junior Market TOP10 sits at 7.4 over half of the market, with an average of 12.6. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. The market closed with 4,649,405 shares trading for $79,455,741 down from 8,718,855 units at $132,519,420 on Thursday.

The market closed with 4,649,405 shares trading for $79,455,741 down from 8,718,855 units at $132,519,420 on Thursday. The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Margaritaville increased $1.42 in closing at $15.53 in an exchange of 4 stocks, Massy Holdings climbed $1 to finish at $91 with investors swapping 24,992 stock units, Mayberry Jamaican Equities declined 50 cents to close at $10 in an exchange of 100,402 stock units. NCB Financial skidded 50 cents to $62.50 after investors traded 11,015 shares, Pan Jamaica rose 50 cents to close at $48 with an exchange of 12 stocks, Sagicor Group gained 64 cents in closing at $41.14 with 4,040 units clearing the market. Seprod advanced 80 cents to end at $82 and closed with 6,857 stock units changing hands and Wisynco Group rose 32 cents and ended at $21 with an exchange of 32,814 shares.

Margaritaville increased $1.42 in closing at $15.53 in an exchange of 4 stocks, Massy Holdings climbed $1 to finish at $91 with investors swapping 24,992 stock units, Mayberry Jamaican Equities declined 50 cents to close at $10 in an exchange of 100,402 stock units. NCB Financial skidded 50 cents to $62.50 after investors traded 11,015 shares, Pan Jamaica rose 50 cents to close at $48 with an exchange of 12 stocks, Sagicor Group gained 64 cents in closing at $41.14 with 4,040 units clearing the market. Seprod advanced 80 cents to end at $82 and closed with 6,857 stock units changing hands and Wisynco Group rose 32 cents and ended at $21 with an exchange of 32,814 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading closed with an exchange of 1,594,451 shares for $3,409,014 down sharply from 8,355,224 stock units at $15,074,942 on Thursday.

Trading closed with an exchange of 1,594,451 shares for $3,409,014 down sharply from 8,355,224 stock units at $15,074,942 on Thursday. Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and two with lower offers.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and two with lower offers. Jetcon Corporation increased 10 cents to end at 95 cents and closed after an exchange of 309 stocks, Knutsford Express sank 9 cents in closing at $11.41 after an exchange of 324 units. Lumber Depot popped 9 cents higher and ended at $2.65 with investors trading 45,776 stocks, Main Event dipped 9 cents to finish at $13.90 after an exchange of 5,640 shares. Spur Tree Spices advanced 8 cents to close at $2.50 in trading 344,879 stock units, Tropical Battery increased 5 cents to end at $2.20 with investors transferring 53,344 stocks and tTech shed 6 cents to close at $2.20 after trading 20 units.

Jetcon Corporation increased 10 cents to end at 95 cents and closed after an exchange of 309 stocks, Knutsford Express sank 9 cents in closing at $11.41 after an exchange of 324 units. Lumber Depot popped 9 cents higher and ended at $2.65 with investors trading 45,776 stocks, Main Event dipped 9 cents to finish at $13.90 after an exchange of 5,640 shares. Spur Tree Spices advanced 8 cents to close at $2.50 in trading 344,879 stock units, Tropical Battery increased 5 cents to end at $2.20 with investors transferring 53,344 stocks and tTech shed 6 cents to close at $2.20 after trading 20 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading on the overall market ended as the number and value of stocks changing hands dropped, from the previous trading day, resulting in prices of 37 shares rising and 31 declining.

Trading on the overall market ended as the number and value of stocks changing hands dropped, from the previous trading day, resulting in prices of 37 shares rising and 31 declining. In the preference segment, Productive Business Solutions 9.75% preference share gained $4.99 to finish at $115.

In the preference segment, Productive Business Solutions 9.75% preference share gained $4.99 to finish at $115. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.