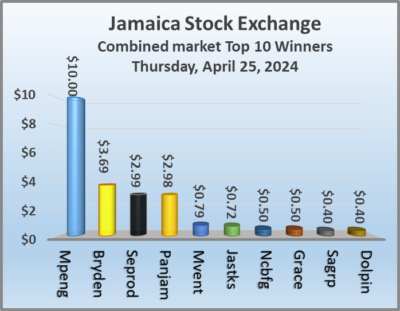

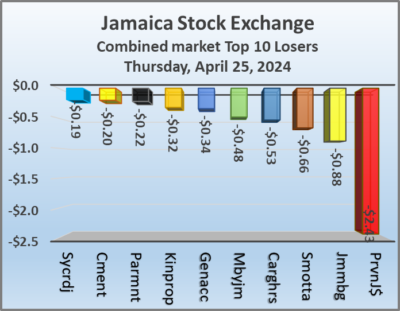

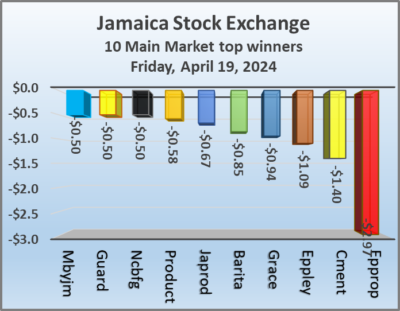

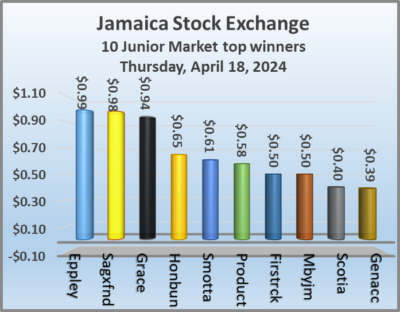

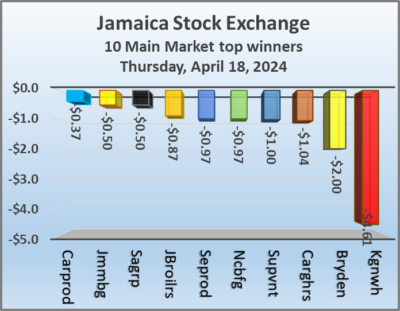

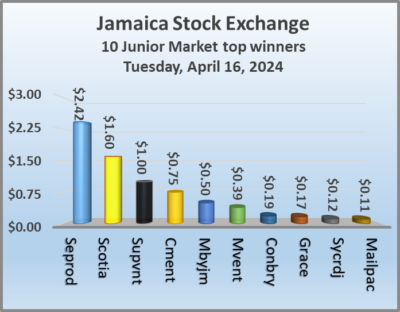

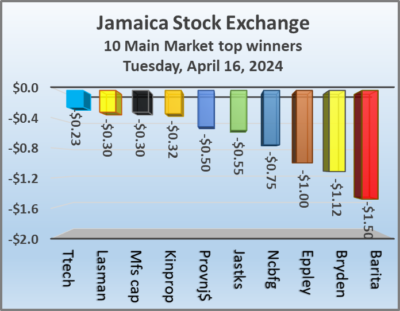

The Main Market of the Jamaica Stock Exchange climbed at the end of trading on Thursday as the Junior Market inched higher and JSE USD market closed lower as trading ended with the number of stocks changing hands rising, with the value dropping sharply from the previous trading day, resulting in prices of 21 shares rising and 39 declining.

At the close of trading, the JSE Combined Market Index climbed by 2,382.17 points to 332,588.34, the All Jamaican Composite Index rallied 3,179.32 points to end at 356,115.39, the JSE Main Index jumped 2,452.20 points to end at 319,603.89. The Junior Market Index rose 4.51 points to settle at 3,760.71 and the JSE USD Market Index fell 3.34 points to cease trading at 237.54.

At the close of trading, the JSE Combined Market Index climbed by 2,382.17 points to 332,588.34, the All Jamaican Composite Index rallied 3,179.32 points to end at 356,115.39, the JSE Main Index jumped 2,452.20 points to end at 319,603.89. The Junior Market Index rose 4.51 points to settle at 3,760.71 and the JSE USD Market Index fell 3.34 points to cease trading at 237.54.

At the close of trading, 18,221,035 shares were exchanged in all three markets, up from 16,963,120 units on Wednesday, with the value of stocks traded on the Junior and Main markets amounted to $39.79 million, which below the $53.75, million on the previous trading day and the JSE USD market closed with an exchange of 257,793 shares for US$17,324 compared to 363,343 units at US$23,058 on Wednesday.

In Main Market activity, JMMB 9.5% preference share led trading with 9.03 million shares followed by Sagicor Select Financial Fund with 2.27 million stock units and Wigton Windfarm with 1.48 million units.

While in Junior Market trading, Dolla Financial led trading with 1.09 million shares followed by Spur Tree Spices with 789,268 stocks and Fosrich with 589,091 units.

While in Junior Market trading, Dolla Financial led trading with 1.09 million shares followed by Spur Tree Spices with 789,268 stocks and Fosrich with 589,091 units.

In the preference segment, Productive Business Solutions 10.5% preference share declined $165 and ended at $1,035 and Sygnus Credit Investments C10.5% advanced $4 in closing at $108.

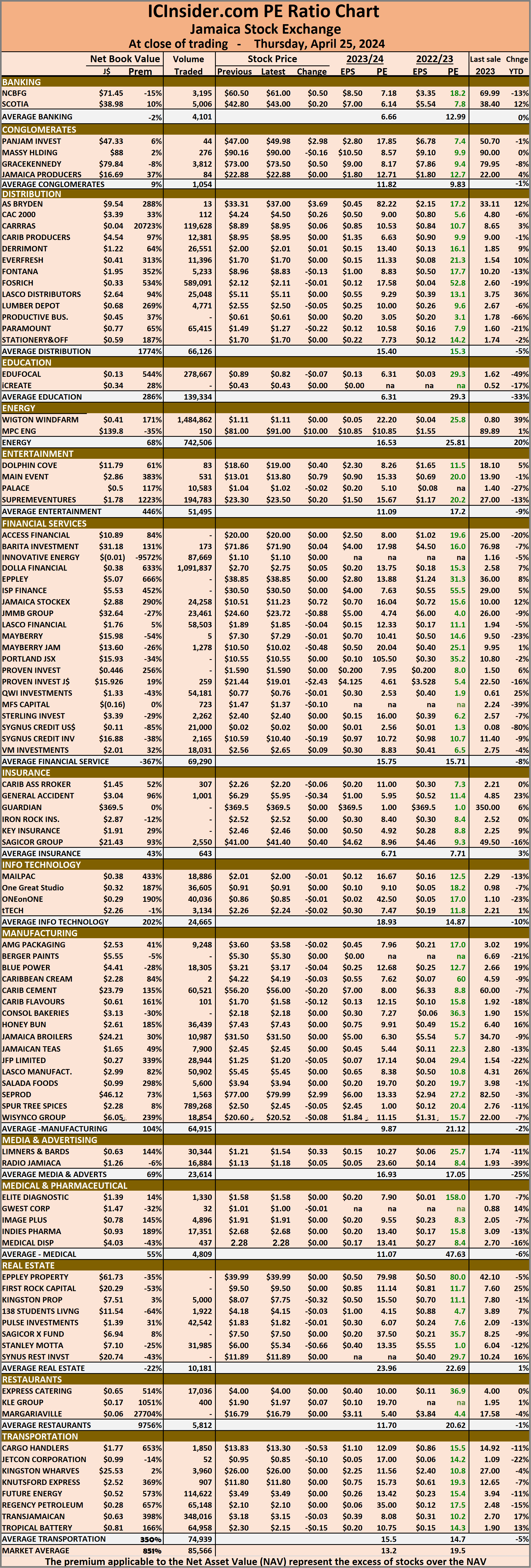

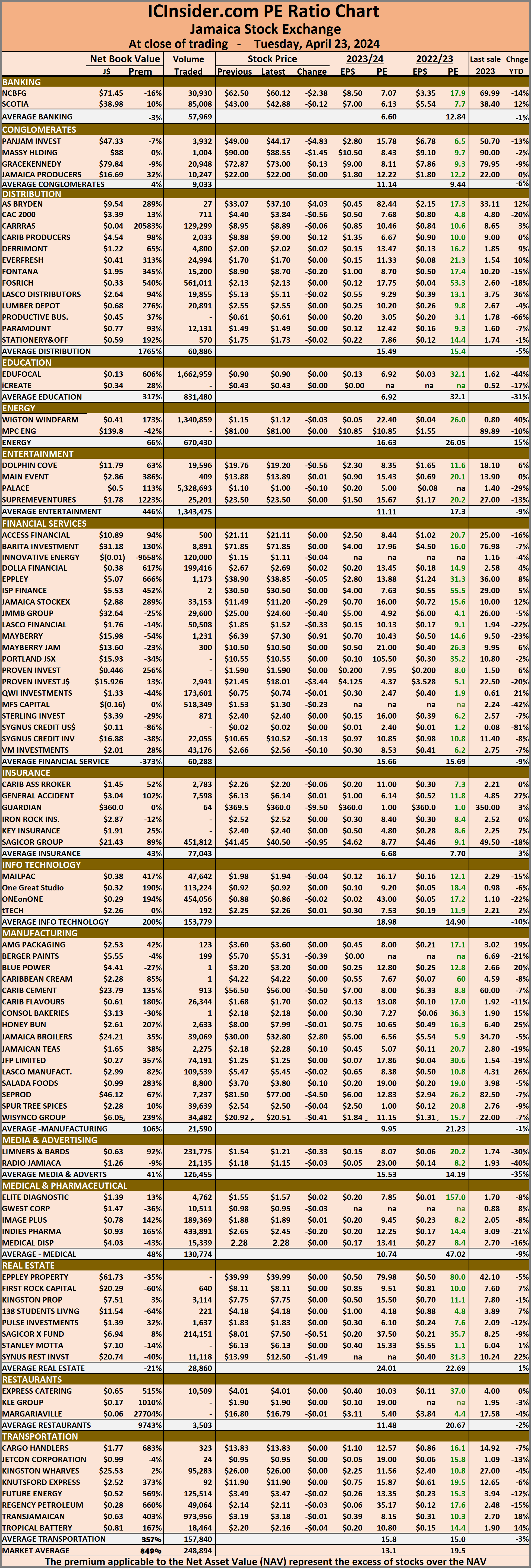

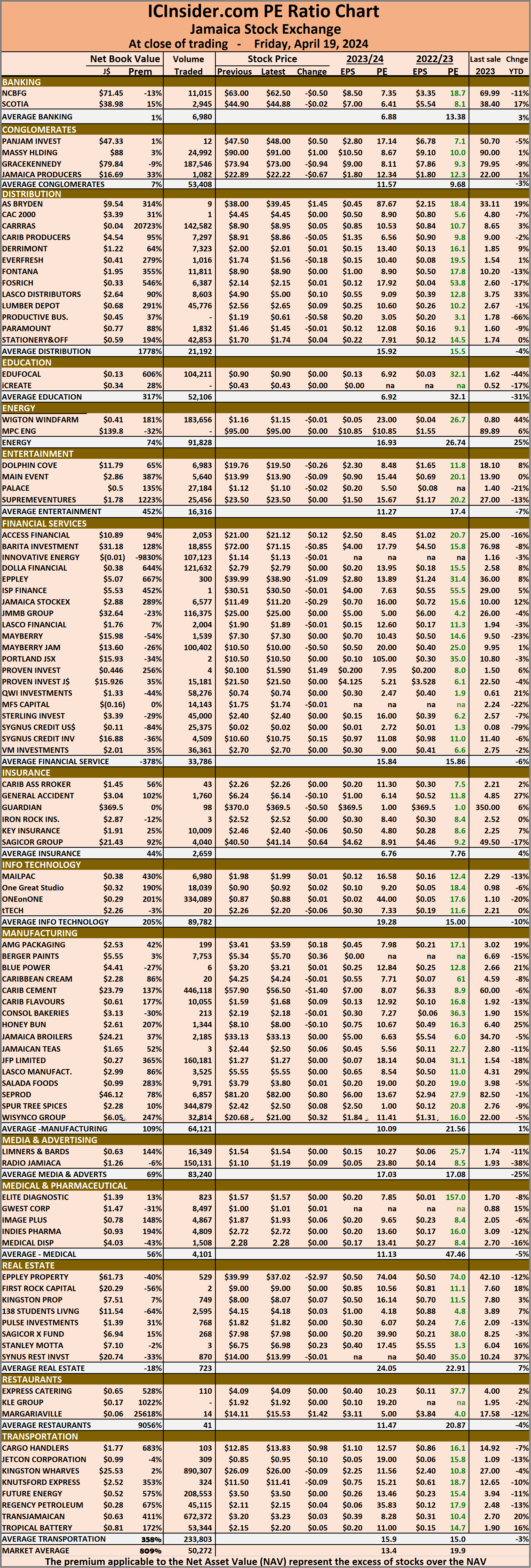

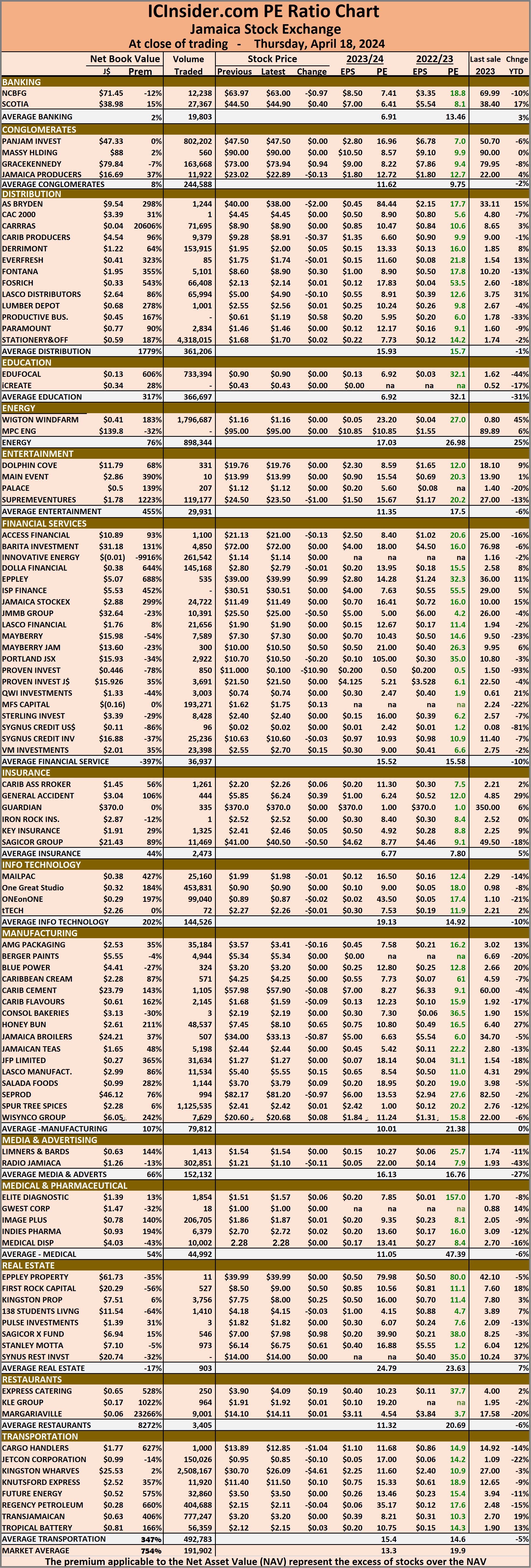

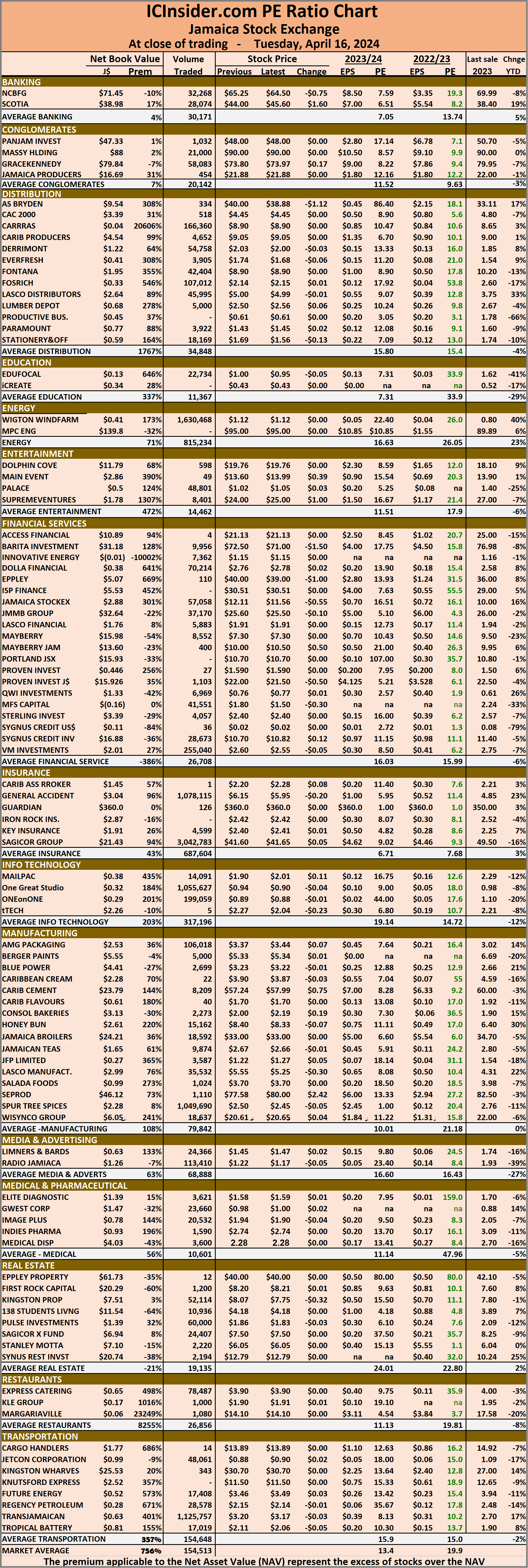

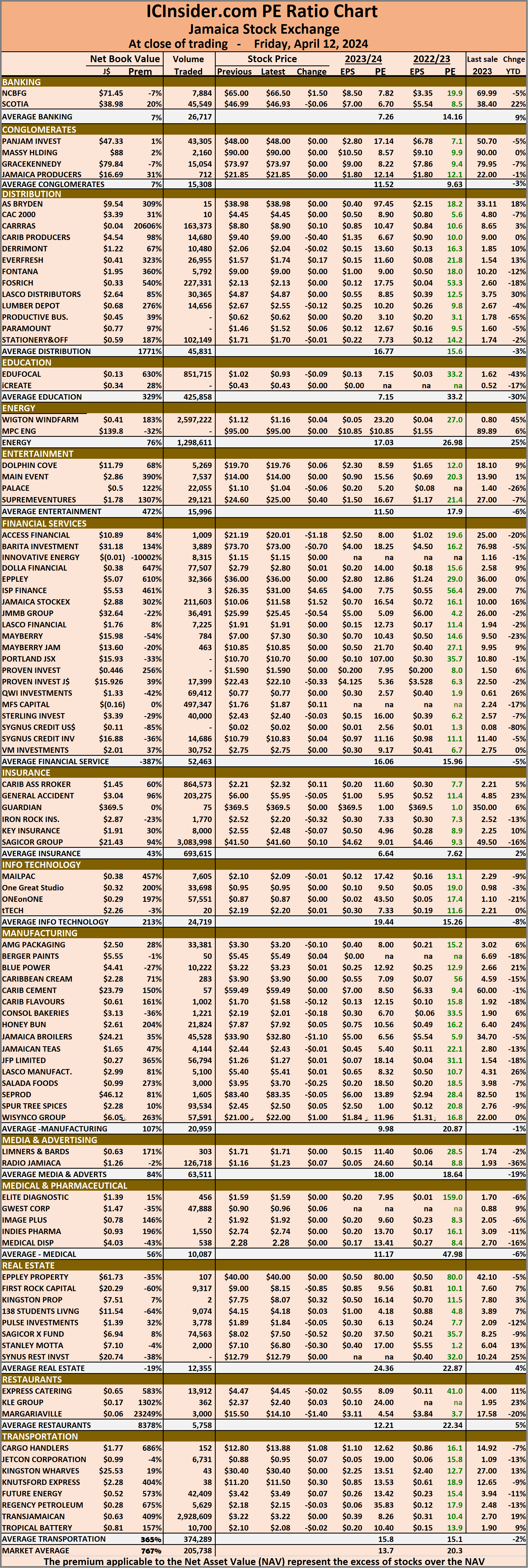

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20 on 2023-24 earnings and 13.4. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so.  This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Main Market jumps Junior market limps higher

Dull trading on the JSE Markets

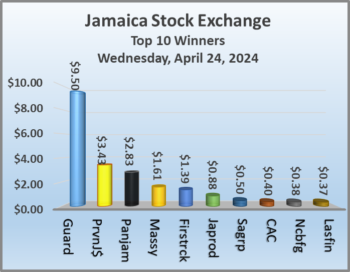

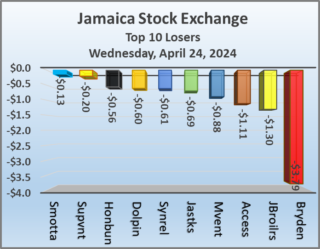

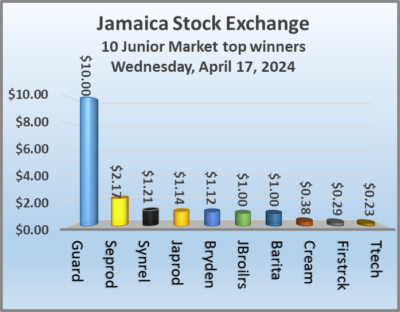

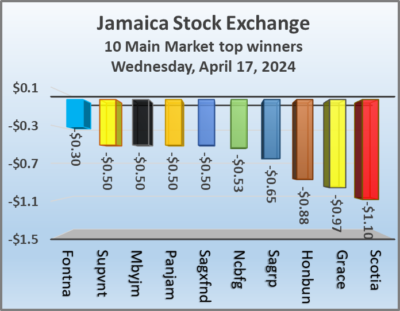

Junior Market stocks posted gains at the close of the Jamaica Stock Exchange on Wednesday reversing two consecutive days of decline but still leaving the market below Tuesday’s opening, while the Main Market and the JSE USD slipped marginally lower than the close on Tuesday, with the number of shares and their value changing hands falling below that those on the previous trading day, resulting in prices of 33 shares rising and 25 declining.

At the close of trading, the JSE Combined Market Index slipped 4.61 points to close at 330,206.17, the All Jamaican Composite Index dipped 967.20 points to 352,936.07, the JSE Main Index slipped 87.43 points to end trading at 317,151.69. The Junior Market Index advanced 11.36 points to 3,756.20 and the JSE USD Market Index fell 0.46 points to conclude trading at 240.88.

At the close of trading, the JSE Combined Market Index slipped 4.61 points to close at 330,206.17, the All Jamaican Composite Index dipped 967.20 points to 352,936.07, the JSE Main Index slipped 87.43 points to end trading at 317,151.69. The Junior Market Index advanced 11.36 points to 3,756.20 and the JSE USD Market Index fell 0.46 points to conclude trading at 240.88.

At the close of trading, 16,963,120 shares were exchanged in all three markets, from 18,324,325 units on Tuesday, with the value of stocks traded on the Junior and Main markets amounted to $53.75 million, below the $60.94 million on the previous trading day and the JSE USD market closed with an exchange of 363,343 shares for US$23,058 compared to 384,592 units at US$9,594 on Tuesday.

In Main Market activity, JMMB Group 7.35% – 2028 led trading with 5.56 million shares followed by Wigton Windfarm with 2.37 million units, Sagicor Select Financial Fund with 2.05 million stock units and Transjamaican Highway with 1.48 million shares.

While in Junior Market trading, Dolla Financial led trading with 1.40 million shares followed by MFS Capital Partners with 605,087 units and Tropical Battery with 449,373 stocks.

In the preference segment, no stock traded with a noted price change.

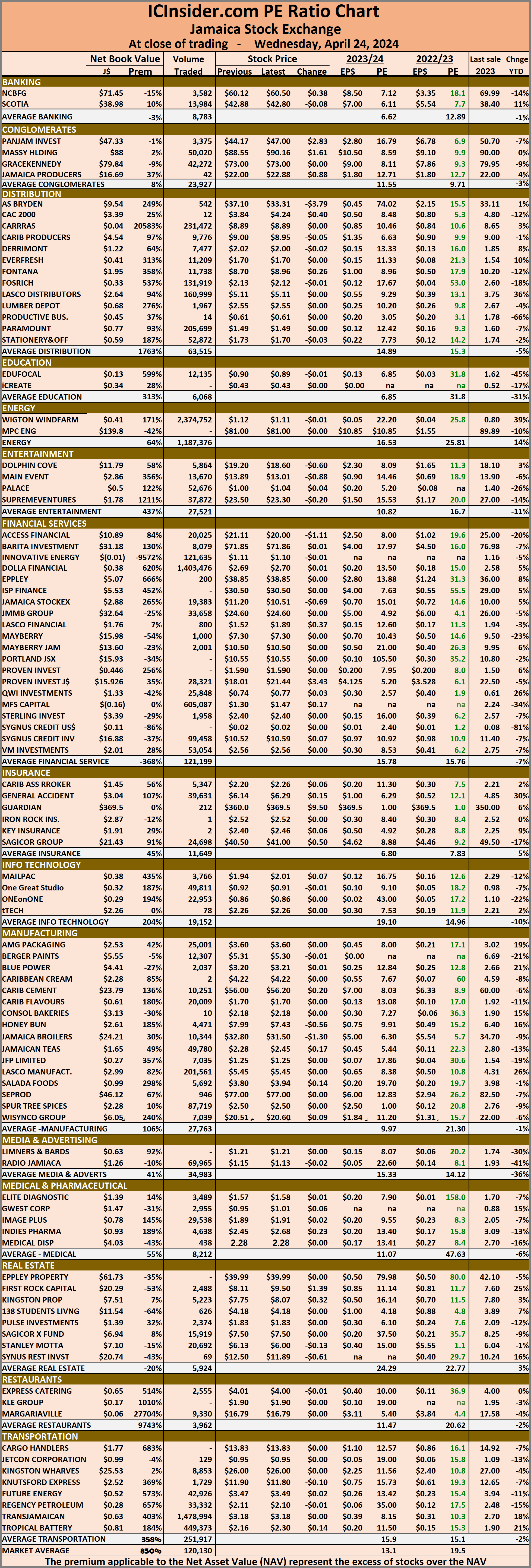

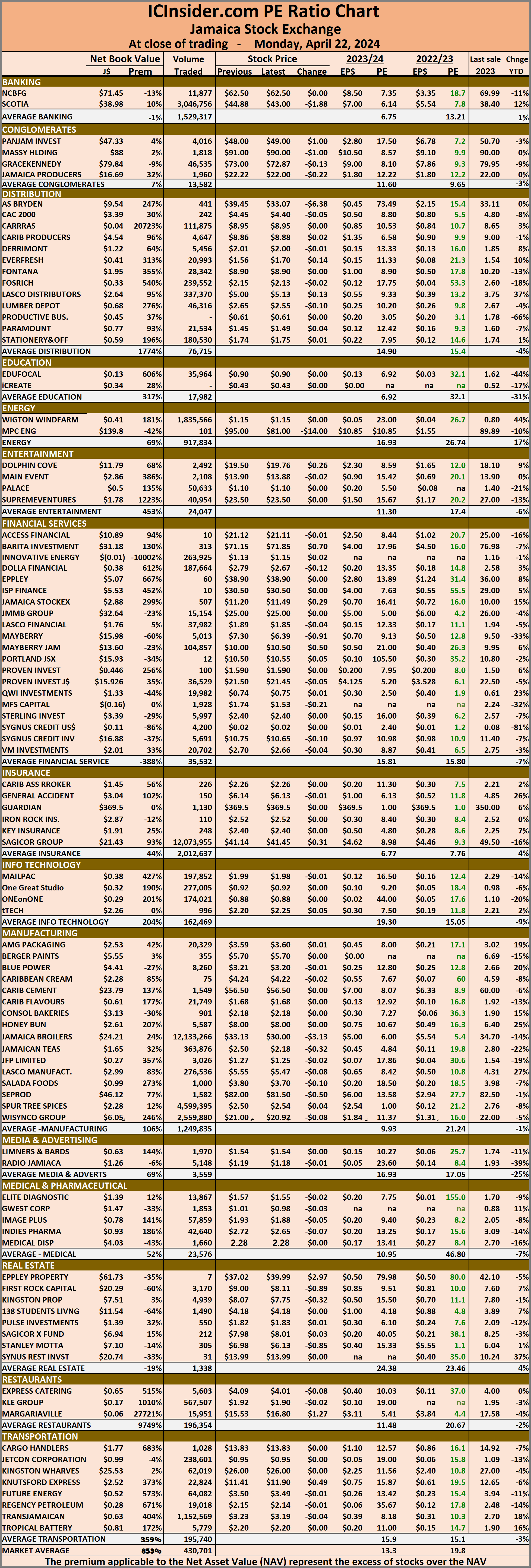

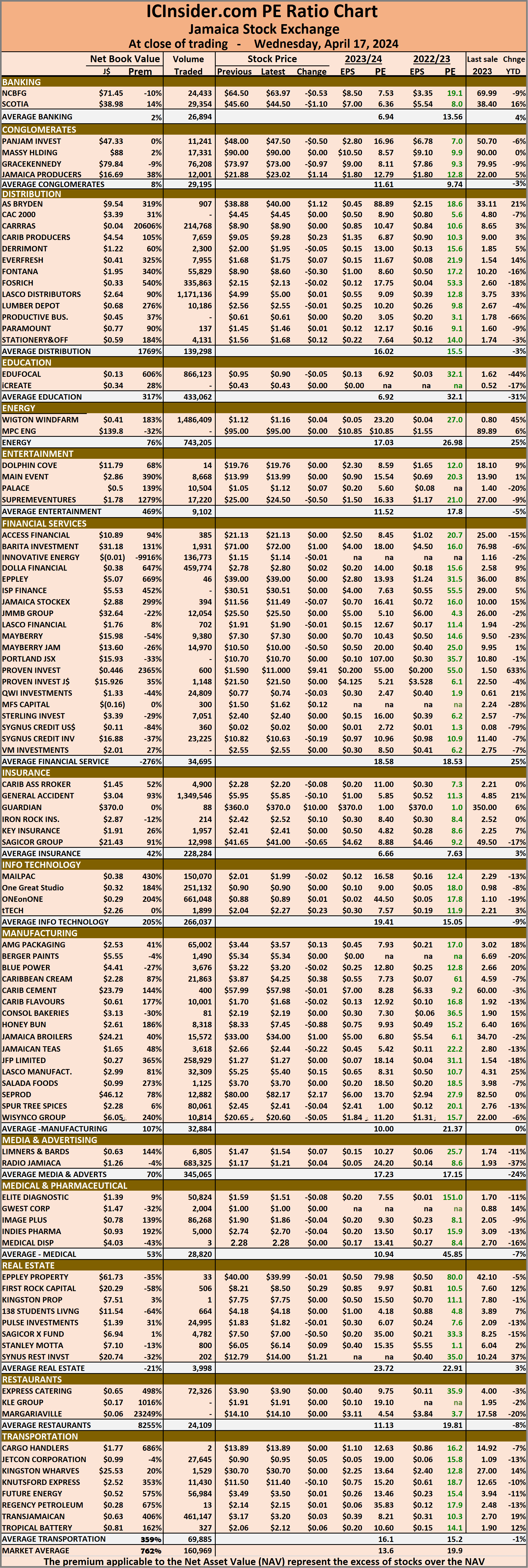

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.5 on 2023-24 earnings and 13.1. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.5 on 2023-24 earnings and 13.1. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

All JSE markets fall on Tuesday

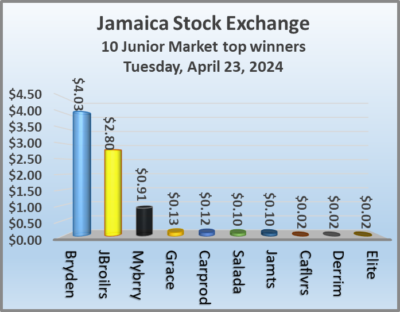

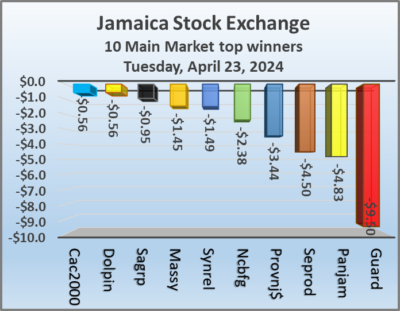

Investors chopped several points off the Jamaica Stock Exchange market indices in trading on Tuesday as trading dropped well below Tuesday’s elevated levels that were pushed by trading in Jamaica broilers and Sagicor Group shares and resulted in prices of only 15 shares rising and 45 declining.

At the close of trading, the JSE Combined Market Index fell 1,193.93 points to close at 330,210.8, the All Jamaican Composite Index skidded 2,409.12 points to 353,903.27, the JSE Main Index declined by 1,015.63 points to close at 317,239.12. The Junior Market Index declined 31.61 points to lock up trading at 3,744.84 and the JSE USD Market Index sank 0.69 points to end at 241.34.

At the close of trading, the JSE Combined Market Index fell 1,193.93 points to close at 330,210.8, the All Jamaican Composite Index skidded 2,409.12 points to 353,903.27, the JSE Main Index declined by 1,015.63 points to close at 317,239.12. The Junior Market Index declined 31.61 points to lock up trading at 3,744.84 and the JSE USD Market Index sank 0.69 points to end at 241.34.

At the close of trading, 18,324,325 shares were exchanged in all three markets, down from 43,112,419 units on Monday, with the value of stocks traded on the Junior and Main markets amounted to $60.94 million, well below the $1.1 billion on the previous trading day and the JSE USD market closed with an exchange of 384,592 shares for US$9,594 compared to 119,368 units at US$11,630 on Monday.

In Main Market activity, Palace Amusement led trading with 5.33 million shares followed by JMMB 9.5% preference share with 2.27 million units and Wigton Windfarm with 1.34 million socks. While in Junior Market trading, EduFocal led trading with 1.66 million shares followed by Fosrich with 561,011 units and MFS Capital Partners with 518,349 stocks.

In the preference segment, Sygnus Credit Investments C10.5% sank $5.49 to close at $104.

In the preference segment, Sygnus Credit Investments C10.5% sank $5.49 to close at $104.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended the day at 19.5 on 2023-24 earnings and 13.1. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

JSE trading surges with big Broilers & Sagicor trades

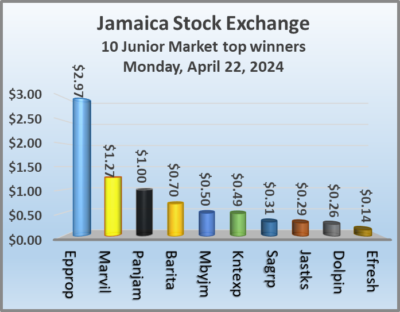

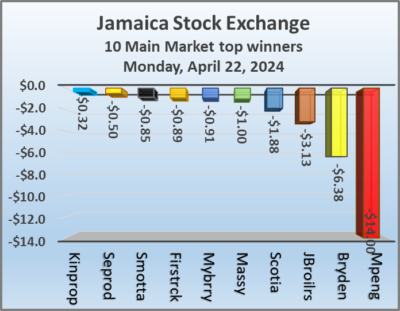

Trading jumped sharply on the Jamaica Stock Exchange on Monday with trading in 12.13 million shares in Jamaica Broilers followed by Sagicor Group with 12.07 million units, valued at $388 million and $500 million respectively and pushed the overall value of stock trading to $1.1 billion with volume well above that on Friday as the Main Market and the Junior Market declined at the close of the market but the JSE USD market closed moderately higher as trading ended with the prices of 22 shares rising and 44 declining.

At the close of the market, the JSE Combined Market Index dropped 3,753.71 points to 331,404.71, the All Jamaican Composite Index declined 2,565.76 points to end at 356,312.39, the JSE Main Index shed 3,787.12 points to finish at 318,254.75. The Junior Market Index dipped 17.69 points to finish at 3,776.45 and the JSE USD Market Index gained 4.33 points to finish at 242.03.

At the close of the market, the JSE Combined Market Index dropped 3,753.71 points to 331,404.71, the All Jamaican Composite Index declined 2,565.76 points to end at 356,312.39, the JSE Main Index shed 3,787.12 points to finish at 318,254.75. The Junior Market Index dipped 17.69 points to finish at 3,776.45 and the JSE USD Market Index gained 4.33 points to finish at 242.03.

At the end of trading, 43,112,419 shares were exchanged in all three markets, up from 7,124,664 units on Friday, with the value of stocks traded on the Junior and Main markets amounted to $1.1 billion, well over the $82.86 million on the previous trading day and the JSE USD market closed with an exchange of 119,368 shares for US$11,630 compared to 880,808 units at US$49,826 on Friday.

In Main Market activity, Jamaica Broilers led trading with 12.13 million shares followed by Sagicor Group with 12.07 million units, Scotia Group with 3.05 million units, Wisynco Group with 2.56 million shares, Wigton Windfarm with 1.84 million stock units and Transjamaican Highway with 1.15 million stocks.

In Junior Market trading, Spur Tree Spices led trading with 4.60 million shares followed by KLE Group with 567,507 stock units and Jamaican Teas with 363,876 units.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 and 138 Student Living preference share advanced $7 to close at $218.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 and 138 Student Living preference share advanced $7 to close at $218.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.8 on 2023-24 earnings and 13.3. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

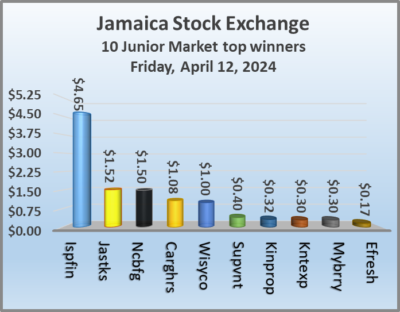

Junior Market rallies Main Market drops

The Junior Market of the Jamaica Stock Exchange jumped right out at the open to hit the day’s high point at 3,824.08 and drifted down just below the 3,800 points level at the close but the Main Market and the JSE USD market declined to close out the week on Friday on a negative note with both market ending the week lower than the start.  Trading on the overall market ended as the number and value of stocks changing hands dropped, from the previous trading day, resulting in prices of 37 shares rising and 31 declining.

Trading on the overall market ended as the number and value of stocks changing hands dropped, from the previous trading day, resulting in prices of 37 shares rising and 31 declining.

The market closed, with the JSE Combined Market Index shedding 1,804.41 points to 335,158.42, the All Jamaican Composite Index plunged 3,372.85 points to 358,878.15, the JSE Main Index dropped 2,142.25 points to finish at 322,041.87. The Junior Market Index jumped 35.75 points to end at 3,794.14 and the JSE USD Market Index declined by 3.05 points to end at 237.70.

At the close of trading, 7,124,664 shares were exchanged in all three markets, down sharply from 17,138,332 units on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $82.86 million, well below the $147.59 million on the previous trading day and the JSE USD market closed with an exchange of 880,808 shares for US$49,826 up from 66,053 units at US$5,573 on Thursday.

In Main Market activity, Kingston Wharves led trading with 890,307 shares followed by JMMB 9.5% preference share with 810,423 stock units and Transjamaican Highway with 672,372 units while in Junior Market activity, Spur Tree Spices led trading with 344,879 shares followed by ONE on ONE Educational with 334,089 units and Future Energy with 208,553 stocks.

In the preference segment, Productive Business Solutions 9.75% preference share gained $4.99 to finish at $115.

In the preference segment, Productive Business Solutions 9.75% preference share gained $4.99 to finish at $115.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.4. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and a more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all Jamaica Stock Exchange ordinary shares, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends are paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Gains for JSE as trading jumps

Kingston Wharves and Pan Jamaica dominated trading with the stocks having the highest traded value on the Jamaica Stock Exchange in Thursday trading session and driving the volume and value well over Wednesday’s activities, with the market closing with Main Market indices and JSE USD market closing higher while the Junior Market just manage to eked out a gain in the last few dying moments of the market to close moderately higher, resulting in prices of 33 shares rising and 28 declining.

At the close of trading, the JSE Combined Market Index climbed 1,198.94 points to 336,962.83, the All Jamaican Composite Index jumped 2,030.08 points to 362,251.00, the JSE Main Index rose 1,240.26 points to conclude trading at 324,184.12. The Junior Market Index squeezed out a gain of 1.44 points to close trading at 3,758.39 and the JSE USD Market Index rose 1.69 points to settle at 240.75.

At the close of trading, the JSE Combined Market Index climbed 1,198.94 points to 336,962.83, the All Jamaican Composite Index jumped 2,030.08 points to 362,251.00, the JSE Main Index rose 1,240.26 points to conclude trading at 324,184.12. The Junior Market Index squeezed out a gain of 1.44 points to close trading at 3,758.39 and the JSE USD Market Index rose 1.69 points to settle at 240.75.

At the close of trading, 17,138,332 shares were exchanged in all three markets, up from 11,705,524 units on Wednesday, with the value of stocks traded on the Junior and Main markets amounted to $147.59 million, well over the $43.87 million on the previous trading day and the JSE USD market closed with an exchange of 66,053 shares for US$5,573 compared to 1,005,394 units at US$50,711 on Wednesday.

In Main Market activity, Kingston Wharves led trading with 2.51 million shares followed by Wigton Windfarm with 1.80 million stock units and Pan Jamaica with 802,202 units, while in Junior Market trading, Stationery and Office Supplies led with 4.32 million shares followed by Spur Tree Spices with 1.13 million stocks and EduFocal with 733,394 units.

In the preference segment, 138 Student Living preference share rallied $1 to end at $211 and Productive Business Solutions 9.75% preference share sank $4.99 to $110.01.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.3 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.3 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all the Jamaica Stock Exchange ordinary shares grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Fall for all JSE markets

All three markets of the Jamaica Stock Exchange declined in trading on Wednesday and ended with a sharp rise in trading on the USD market, with trading in the rest of the market enjoying a modest increase in the volume of stocks changing hands but with a fall in the value traded compared with the previous day and resulting in prices of 32 shares rising and 33 declining.

At the close of trading on Wednesday, the JSE Combined Market Index shed 1,130.34 points to end trading at 335,763.89, while the All Jamaican Composite Index dropped 1,794.74 points to close at 360,220.92, while the JSE Main Index lost 1,004.10 points to close at 322,943.86. The Junior Market Index fell 24.08 points to lock up trading at 3,756.95 and the JSE USD Market Index declined 3.55 points to end at 239.06.

At the close of trading on Wednesday, the JSE Combined Market Index shed 1,130.34 points to end trading at 335,763.89, while the All Jamaican Composite Index dropped 1,794.74 points to close at 360,220.92, while the JSE Main Index lost 1,004.10 points to close at 322,943.86. The Junior Market Index fell 24.08 points to lock up trading at 3,756.95 and the JSE USD Market Index declined 3.55 points to end at 239.06.

At the close of trading, 11,705,524 shares were exchanged in all three markets compared to 11,538,316 units on Tuesday, with the value of stocks traded on the Junior and Main markets amount to $43.87 million, well below the $162.75 million on the previous trading day and the JSE USD market closed with an exchange of 1,005,394 shares for US$50,711 compared to 86,667 units at US$14,748 on Tuesday.

In Main Market activity, Wigton Windfarm led trading with 1.49 million shares followed by General Accident with 1.35 million units and Lasco Distributors with 1.17 million stock units.

In Junior Market trading, EduFocal led trading with 866,123 shares followed by ONE on ONE Educational with 661,048 stock units and Dolla Financial with 459,774 units.

In the preference segment, 138 Student Living preference share skidded $5 in closing at $210 and Productive Business Solutions 10.5% preference share rose $50 to end at $1,200.

In the preference segment, 138 Student Living preference share skidded $5 in closing at $210 and Productive Business Solutions 10.5% preference share rose $50 to end at $1,200.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.9 on 2023-24 earnings and 13.6 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so.  This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Fall for Main & Junior Markets but USD rises

The Main Market of the Jamaica Stock Exchange declined in trading on Tuesday as the Junior Market JSE USD market closed moderately higher as trading ended with the number of stocks changing hands rising moderately over that on Monday, with a much higher the value, resulting in prices of 31 shares rising and 32 declining.

At the close of trading, the JSE Combined Market Index fell 2,956.19 points to close at 336,894.23, the All Jamaican Composite Index declined 4,420.59 points to 362,015.66, the JSE Main Index dropped 3,062.56 points to end the day at 323,947.96. The Junior Market Index dipped 2.92 points to end at 3,781.03 and the JSE USD Market Index popped 1.19 points to settle at 242.61.

At the close of trading, the JSE Combined Market Index fell 2,956.19 points to close at 336,894.23, the All Jamaican Composite Index declined 4,420.59 points to 362,015.66, the JSE Main Index dropped 3,062.56 points to end the day at 323,947.96. The Junior Market Index dipped 2.92 points to end at 3,781.03 and the JSE USD Market Index popped 1.19 points to settle at 242.61.

At the close of trading, 11,538,316 shares were exchanged in all three markets, marginally up from 11,094,504 units on Monday, with the value of stocks traded on the Junior and Main markets amounted to $162.75 million, well over the $40.23 million on the previous trading day and the JSE USD market closed with an exchange of 86,667 shares for US$14,748 compared to 152,339 units at US$5,545 on Monday.

In Main Market activity, Sagicor Group led trading with 3.04 million shares followed by Wigton Windfarm with 1.63 million stock units, Transjamaican Highway with 1.13 million stocks and General Accident with 1.08 million shares.

In Junior Market trading, One Great Studio led trading with 1.06 million shares followed by Spur Tree Spices with 1.05 million units and ONE on ONE Educational with 199,059 units for 6.4 percent market share.

In the preference segment, Jamaica Public Service 7% advanced $3.01 to end at $50, 138 Student Living preference share climbed $5 in closing at $215, Productive Business Solutions 9.75% preference share skidded $3.45 and ended at $115 and Sygnus Credit Investments C10.5% popped $5.49 to finish at $109.49.

In the preference segment, Jamaica Public Service 7% advanced $3.01 to end at $50, 138 Student Living preference share climbed $5 in closing at $215, Productive Business Solutions 9.75% preference share skidded $3.45 and ended at $115 and Sygnus Credit Investments C10.5% popped $5.49 to finish at $109.49.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20 on 2023-24 earnings and 13.4. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Subdued Jamaica stock market trading

Investors shunned trading activity on the Jamaica Stock Exchange on Monday resulting in just $40 million being exchanged in the Main and Junior Markets as trading in the JSE USD market climbed sharply above Friday’s extremely low level and helped push prices of 28 stocks higher and 43 lower, at the close of trading.

At the end of trading, the JSE Combined Market Index gained 104.84 points to close at 339,850.42, the All Jamaican Composite Index skidded 64.70 points to 366,436.25, but the JSE Main Index gained 255.28 points to end at 327,010.52. The Junior Market Index skidded 20.07 points to conclude trading at 3,783.95 and the JSE USD Market Index sank 0.73 points to 241.42.

At the end of trading, the JSE Combined Market Index gained 104.84 points to close at 339,850.42, the All Jamaican Composite Index skidded 64.70 points to 366,436.25, but the JSE Main Index gained 255.28 points to end at 327,010.52. The Junior Market Index skidded 20.07 points to conclude trading at 3,783.95 and the JSE USD Market Index sank 0.73 points to 241.42.

At the close of trading, 11,094,504 shares were exchanged in all three markets, down from 14,089,380 units on Friday, with the value of stocks traded on the Junior and Main markets amounted to a mere $40.23 million, well below the $166.13 million on the previous trading day and the JSE USD market closed with an exchange of 152,339 shares for US$5,545 compared to 9,705 units at US$1,717 on Friday.

In Main Market activity, Transjamaican Highway led trading with 2.33 million shares followed by Wigton Windfarm with 1.53 million stocks and Sagicor Select Manufacturing & Distribution Fund with 541,191 units

At the close of the Junior Market, Spur Tree Spices led trading with 1.47 million shares followed by EduFocal with 536,957 units and Stationery and Office Supplies with 517,761 units.

In the preference segment, Jamaica Public Service 7% slipped $1.01 and ended at $46.99, 138 Student Living preference share lost $3 to end at $210, Productive Business Solutions 9.75% preference share popped $23.37 in closing at $118.45 and Sygnus Credit Investments C10.5% dipped $6 to close at $104.

In the preference segment, Jamaica Public Service 7% slipped $1.01 and ended at $46.99, 138 Student Living preference share lost $3 to end at $210, Productive Business Solutions 9.75% preference share popped $23.37 in closing at $118.45 and Sygnus Credit Investments C10.5% dipped $6 to close at $104.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20 on 2023-24 earnings and 13.4. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so.  This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Volume plunges on JSE combined market

The Junior Market cleared the 3,800 barrier at the close of the Jamaica Stock Exchange on Friday but the Main Market JSE USD market closed with losses as trading ended with the number of stocks changing hands falling and the value jumping sharply over the previous trading day, as the Junior and Main markets switched roles for the level of stocks traded compared with Thursday, with the value of stocks traded in the Main Market jumping 390 percent even as the volume dropped by 32 percent, with the Junior Market trading dropping over 95 percent compared with Thursday as trading resulted in prices of 33 shares rising and 32 declining in the markets.

At the close of trading on Friday, the JSE Combined Market Index shed 1,284.91 points to end at 339,745.60, the All Jamaican Composite Index skidded 1,102.99 points to close at 366,500.95, the JSE Main Index fell 1,547.35 points to 326,755.24. The Junior Market Index popped 28.47 points to end trading at 3,804.02 and the JSE USD Market Index slipped 0.26 points to settle at 242.15.

At the close of trading on Friday, the JSE Combined Market Index shed 1,284.91 points to end at 339,745.60, the All Jamaican Composite Index skidded 1,102.99 points to close at 366,500.95, the JSE Main Index fell 1,547.35 points to 326,755.24. The Junior Market Index popped 28.47 points to end trading at 3,804.02 and the JSE USD Market Index slipped 0.26 points to settle at 242.15.

At the close of trading, 14,089,380 shares were exchanged in all three markets, down on the 83,531,081 units on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $166.13 million, moderately below the $188.25 million on the previous trading day and the JSE USD market closed with an exchange of 9,705 shares for US$1,717 compared to 326,941 units at US$17,135 on Thursday.

In Main Market activity, Sagicor Group led trading with 3.08 million shares followed by Transjamaican Highway with 2.93 million units and Wigton Windfarm with 2.60 million stocks, while in the Junior Market trading, Caribbean Assurance Brokers led trading with 864,573 shares followed by EduFocal with 851,715 units and MFS Capital Partners with 497,347 stock units.

In the preference segment, 138 Student Living preference share fell $3 to end at $213 and Sygnus Credit Investments C10.5% gained $4 in closing at $110.

In the preference segment, 138 Student Living preference share fell $3 to end at $213 and Sygnus Credit Investments C10.5% gained $4 in closing at $110.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.37 on 2023-24 earnings and 13.7 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

- 1

- 2

- 3

- …

- 55

- Next Page »