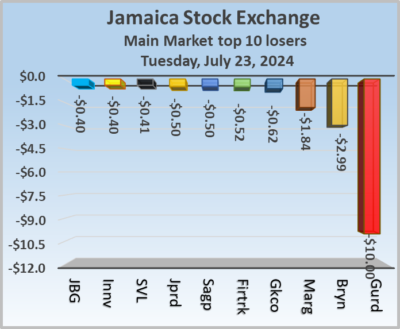

Trading on the Jamaica Stock Exchange Main Market ended on Tuesday, with the volume of stocks traded declining 34 percent and the value jumping by 113 percent than on Monday, with activity in 54 securities down from 59 on Monday, with prices of 15 stocks rising, 26 declining and 13 ending unchanged.

The market closed with 11,714,898 shares being traded for $61,785,252 compared with 17,740,034 units at $29,050,071 on Monday.

The market closed with 11,714,898 shares being traded for $61,785,252 compared with 17,740,034 units at $29,050,071 on Monday.

Trading averaged 216,943 shares at $1,144,171 compared with 300,679 units at $492,374 on Monday and month to date, an average of 749,405 units at $7,049,885 compared with 784,047 units at $7,434,112 on the previous day and June that ended with an average of 246,425 units at $1,945,941.

138 Student Living led trading with 4.95 million shares for 42.2 percent of total volume followed by Wigton Windfarm with 2.52 million units for 21.5 percent of the day’s trade and Transjamaican Highway with 850,644 units for 7.3 percent market share.

The All Jamaican Composite Index rose 1,008.75 points to end trading at 354,761.14, the JSE Main Index increased 338.01 points to settle at 313,928.05 and the JSE Financial Index increased by just 0.28 points to 66.56.

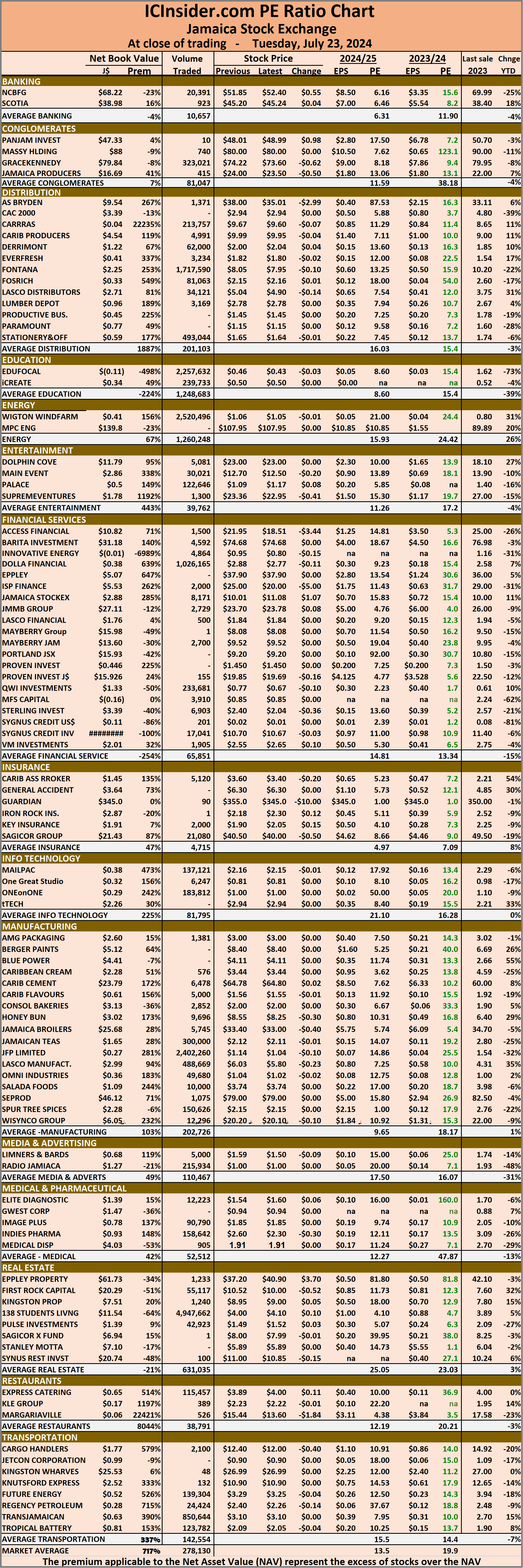

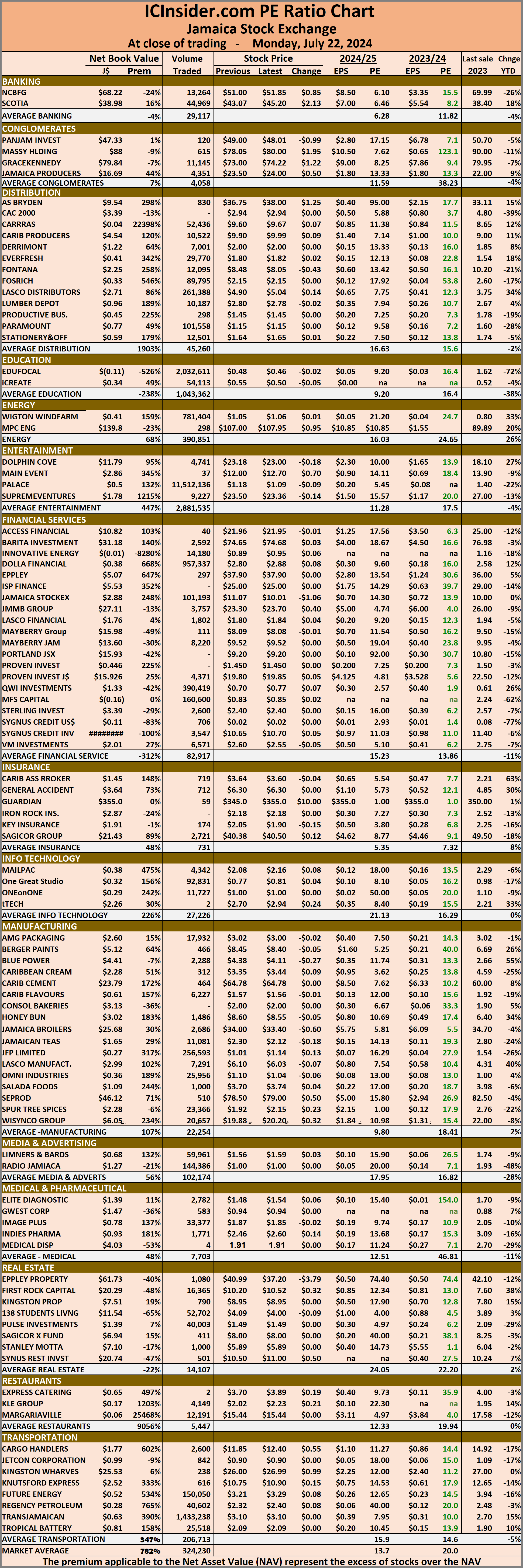

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and five with lower offers.

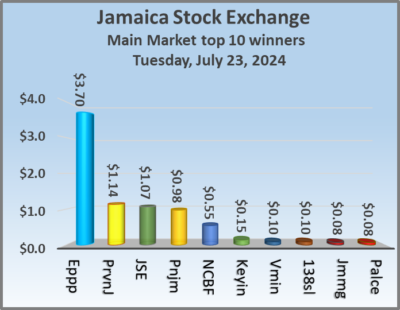

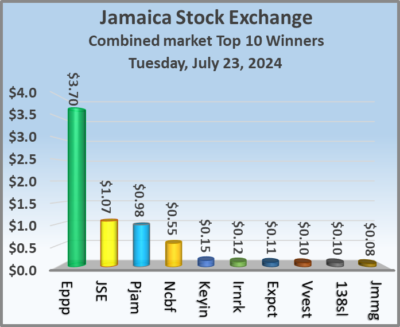

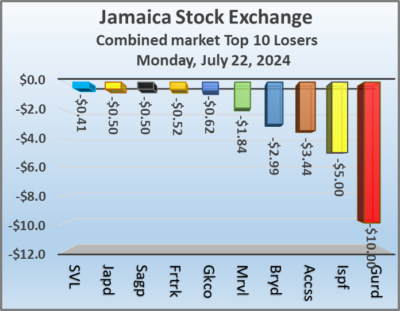

At the close, AS Bryden fell $2.99 to close at $35.01 in an exchange of 1,371 units, Eppley Caribbean Property Fund rose $3.70 to $40.90 with traders dealing in 1,233 stocks, First Rock Real Estate dipped 52 cents and ended at $10 after a transfer of 55,117 shares. GraceKennedy lost 62 cents to finish at $73.60 as investors exchanged 323,021 stock units, Guardian Holdings declined $10 in closing at $345 with a transfer of 90 shares, Jamaica Broilers sank 40 cents to end at $33, with 5,745 stock units crossing the market. Jamaica Producers slipped 50 cents in closing at $23.50 with an exchange of 415 stocks, Jamaica Stock Exchange advanced $1.07 to $11.08, with 8,171 units changing hands,  Margaritaville sank $1.84 and ended at $13.60 with investors trading 3,003 stocks. NCB Financial popped 55 cents to finish at $52.40 after an exchange of 20,391 shares, Pan Jamaica climbed 98 cents to close at $48.99 with investors trading 10 stock units, Sagicor Group dropped 50 cents to end at $40 with 21,080 units crossing the exchange. Sterling Investments shed 36 cents to $2.04 with investors swapping 6,903 shares and Supreme Ventures skidded 41 cents to finish at $22.95 in an exchange of 1,300 stock units.

Margaritaville sank $1.84 and ended at $13.60 with investors trading 3,003 stocks. NCB Financial popped 55 cents to finish at $52.40 after an exchange of 20,391 shares, Pan Jamaica climbed 98 cents to close at $48.99 with investors trading 10 stock units, Sagicor Group dropped 50 cents to end at $40 with 21,080 units crossing the exchange. Sterling Investments shed 36 cents to $2.04 with investors swapping 6,903 shares and Supreme Ventures skidded 41 cents to finish at $22.95 in an exchange of 1,300 stock units.

In the preference segment, Sygnus Credit Investments C10.5% sank $16.04 and ended at $90.96 with investors dealing in 1,525 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Elevated trading on JSE USD Market

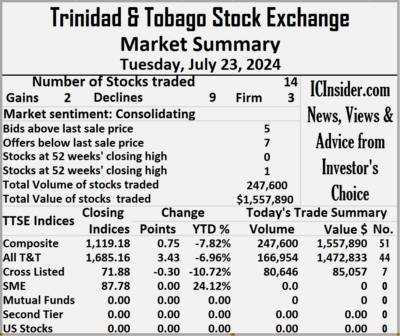

Trading picked up on the Jamaica Stock Exchange US dollar market over the past two days, with the volume of stocks exchanged surging 1,219 percent on Tuesday after a 954 percent jump in the value over Monday, resulting in trading in eight securities, compared to eight on Monday with prices of four declining and four ending unchanged.

The market closed with an exchange of 484,869 shares for US$42,958 compared to 36,773 units at US$4,077 on Monday, as trading averaged 60,609 stock units at US$5,370 versus 4,597 shares at US$510 on Monday, with a month to date average of 37,198 shares at US$2,721 compared with 34,886 units at US$2,459 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The market closed with an exchange of 484,869 shares for US$42,958 compared to 36,773 units at US$4,077 on Monday, as trading averaged 60,609 stock units at US$5,370 versus 4,597 shares at US$510 on Monday, with a month to date average of 37,198 shares at US$2,721 compared with 34,886 units at US$2,459 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index slipped 0.44 points to end trading at 226.35.

The PE Ratio, a most used measure for computing appropriate stock values, averages 7.9. The PE ratio is calculated based on last traded prices divided by projected earnings computed by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close of the market, AS Bryden ended at 22.49 US cents after a transfer of 68 stocks, First Rock Real Estate USD share had trading of 526 units at 4.03 US cents, Margaritaville remained at 7.9 US cents with traders dealing in 1,337 shares. Proven Investments dipped 0.2 of a cent to 11.8 US cents after an exchange of 184,338 stock units,  Sterling Investments sank 0.34 of a cent to close at 1.49 US cents after 201 shares passed through the market, Sygnus Credit Investments dipped 0.01 of a cent to7.49 US cents with investors dealing in 1,981 stocks and Transjamaican Highway fell 0.03 of a cent to 2 US cents closed at 295,011 units.

Sterling Investments sank 0.34 of a cent to close at 1.49 US cents after 201 shares passed through the market, Sygnus Credit Investments dipped 0.01 of a cent to7.49 US cents with investors dealing in 1,981 stocks and Transjamaican Highway fell 0.03 of a cent to 2 US cents closed at 295,011 units.

In the preference segment, Sygnus Credit Investments E8.5% ended at US$10.40 with a transfer of 1,407 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

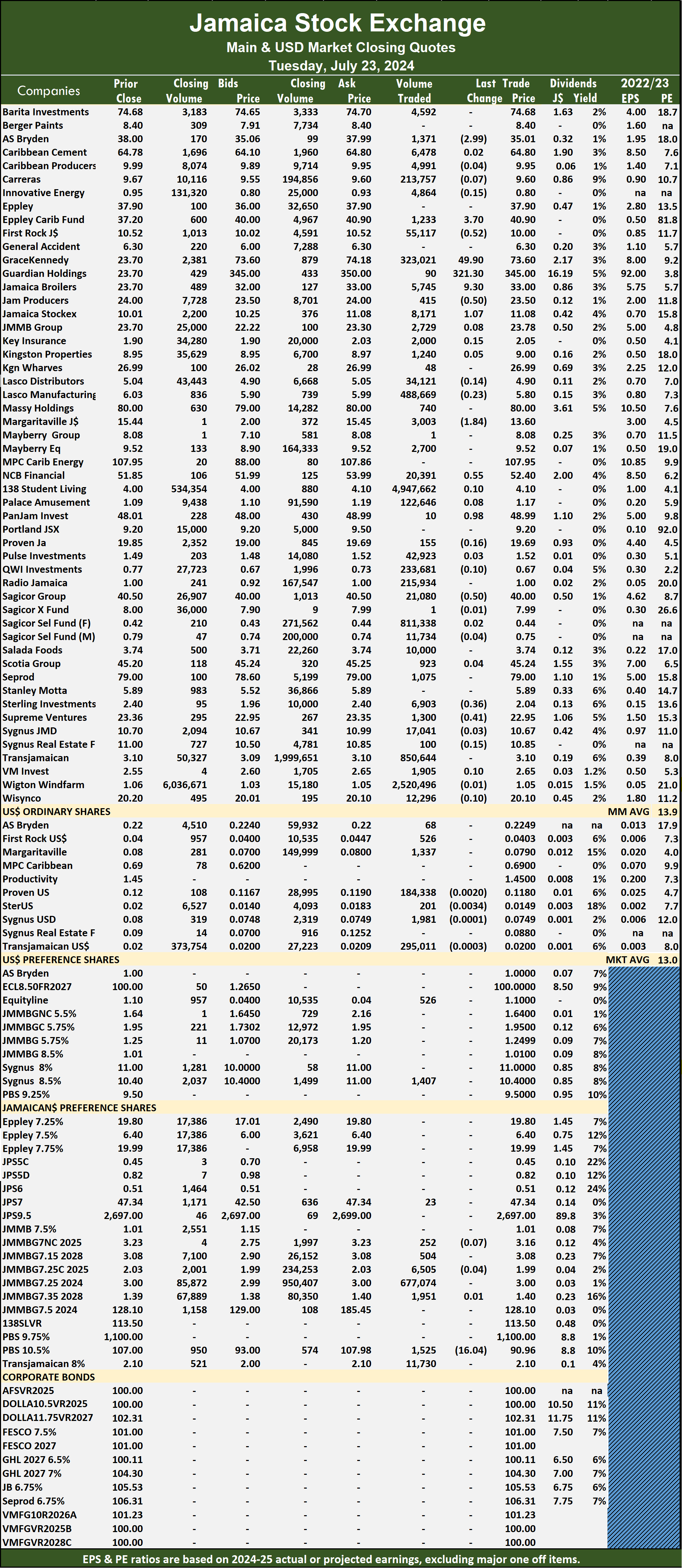

Ansa $4.48 jump pushes Trinidad market up

Ansa McAl jumped $4.48 at the close of trading on the Trinidad and Tobago Stock Exchange on Tuesday and was the main factor in a modest rise in the major market indices, following a 599 percent surge in the volume of stocks traded with the value climbing 238 percent over trading on Monday, resulting in 14 securities trading as was the case previously and ending with prices of two stocks rising, nine declining and three ended firm.

The market closed with 247,600 shares changing hands for $1,557,890 up from 35,422 stocks at $461,124 on Monday.

The market closed with 247,600 shares changing hands for $1,557,890 up from 35,422 stocks at $461,124 on Monday.

An average of 17,686 shares were traded at $111,278 up from 2,530 units at $32,937 on Monday, with trading month to date averaging 9,446 shares at $150,075 compared with 9,030 units at $152,034 on the previous day and an average for June of 9,110 shares at $119,497.

The Composite Index rose 0.75 points to 1,119.18, the All T&T Index gained 3.43 points to finish at 1,685.16, the SME Index remained unchanged at 87.78 and the Cross-Listed Index slipped 0.30 points to conclude trading at 71.88.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and seven with lower offers.

At the close of the market, Agostini’s lost 72 cents to close at $68.78 after trading of 50 stock units, Ansa McAl rose $4.48 to $63 as investors exchanged 14 shares, Ansa Merchant Bank ended at $42.50 with an exchange of 375 stock units. First Citizens Group dipped 1 cent to close at $44.05 after 8,599 stocks changed hands, FirstCaribbean International ended at $6.86 in trading 70 shares, JMMB Group fell 7 cents to finish at a 52 weeks’ low of $1.03, with 80,576 stocks crossing the market. Massy Holdings skidded 5 cents to $3.65 with an exchange of 139,153 stock units, National Enterprises dipped 1 cent in closing at $3.20 after 612 stocks passed through the market, National Flour Mills shed 5 cents and ended at $2.05 with investors dealing in 3,117 stock units.

At the close of the market, Agostini’s lost 72 cents to close at $68.78 after trading of 50 stock units, Ansa McAl rose $4.48 to $63 as investors exchanged 14 shares, Ansa Merchant Bank ended at $42.50 with an exchange of 375 stock units. First Citizens Group dipped 1 cent to close at $44.05 after 8,599 stocks changed hands, FirstCaribbean International ended at $6.86 in trading 70 shares, JMMB Group fell 7 cents to finish at a 52 weeks’ low of $1.03, with 80,576 stocks crossing the market. Massy Holdings skidded 5 cents to $3.65 with an exchange of 139,153 stock units, National Enterprises dipped 1 cent in closing at $3.20 after 612 stocks passed through the market, National Flour Mills shed 5 cents and ended at $2.05 with investors dealing in 3,117 stock units.  Prestige Holdings dropped 10 cents to close at $11.90 following a 52 weeks’ closing high on Monday, with an exchange of 5,000 stocks on Tuesday, Republic Financial gained 10 cents to finish at $115.10 with investors trading 3,867 shares, Scotiabank fell 1 cent to close trading at $63.99, with 25 stocks crossing the exchange. Trinidad Cement slipped 4 cents to close at $2.56 with a transfer of 1,122 shares and West Indian Tobacco remained at $8.50 with investors swapping 5,020 units.

Prestige Holdings dropped 10 cents to close at $11.90 following a 52 weeks’ closing high on Monday, with an exchange of 5,000 stocks on Tuesday, Republic Financial gained 10 cents to finish at $115.10 with investors trading 3,867 shares, Scotiabank fell 1 cent to close trading at $63.99, with 25 stocks crossing the exchange. Trinidad Cement slipped 4 cents to close at $2.56 with a transfer of 1,122 shares and West Indian Tobacco remained at $8.50 with investors swapping 5,020 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

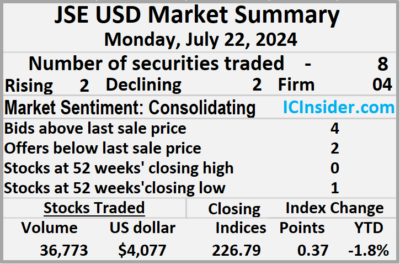

Depressed trading on JSE USD Market

Trading remained depressed on the Jamaica Stock Exchange US dollar market on Monday, with the volume of stocks exchanged declining 32 percent after 214 percent more money changed hands than on Friday, resulting from trading in eight securities, up from six on Friday with prices of two rising, two declining and four ending unchanged, with Margaritaville trading at a 52 weeks’ low.

The market closed on Monday with an exchange of 36,773 shares for US$4,077 compared to 54,388 units at US$1,299 on Friday.

The market closed on Monday with an exchange of 36,773 shares for US$4,077 compared to 54,388 units at US$1,299 on Friday.

Trading averaged 4,597 stock units at US$510 versus 9,065 shares at US$216 on Friday, with the month to date ending with an average of 34,886 shares at US$2,459 compared to 38,205 units at US$2,673 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index gained 0.37 points to cease trading at 226.79.

The PE Ratio, a most used measure for computing appropriate stock values, averages 8.1. The PE ratio is computed based on last traded prices divided by projected earnings computed by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close of trading on Monday, AS Bryden ended at 22.49 US cents with traders dealing in 1,045 shares, First Rock Real Estate USD share remained at 4.03 US cents after an exchange of 12,191 stock units, Margaritaville dipped 0.1 of a cent to close trading at a 52 weeks’ low of 7.9 US cents with an exchange of 1,629 shares.  MPC Caribbean Clean Energy fell 1 cent to 69 US cents after 298 stocks changed hands, Proven Investments ended at 12 US cents, with 150 shares crossing the market, Sterling Investments rose 0.06 of a cent to end at 1.83 US cents with investors trading 706 stock units and Transjamaican Highway rallied 0.03 of a cent to 2.03 US cents with investors dealing in 19,424 stocks.

MPC Caribbean Clean Energy fell 1 cent to 69 US cents after 298 stocks changed hands, Proven Investments ended at 12 US cents, with 150 shares crossing the market, Sterling Investments rose 0.06 of a cent to end at 1.83 US cents with investors trading 706 stock units and Transjamaican Highway rallied 0.03 of a cent to 2.03 US cents with investors dealing in 19,424 stocks.

In the preference segment, JMMB Group 5.75% ended at US$1.95 in switching ownership of 1,330 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

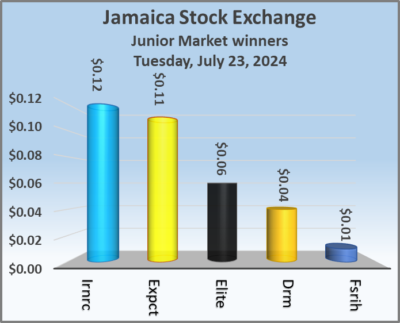

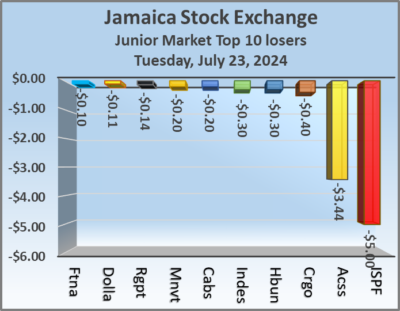

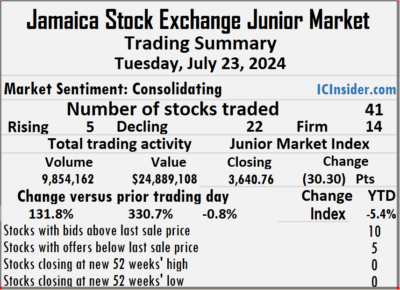

The market closed on Tuesday with trading of 9,854,162 stock units for $24,889,108 compared to 4,251,907 shares at $5,779,055 on Monday.

The market closed on Tuesday with trading of 9,854,162 stock units for $24,889,108 compared to 4,251,907 shares at $5,779,055 on Monday. The Junior Market ended trading with an average PE Ratio of 12.4, based on last traded prices in conjunction with earnings projected by ICInsider.com for financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.4, based on last traded prices in conjunction with earnings projected by ICInsider.com for financial years ending around August 2025. Honey Bun fell 30 cents to $8.25 in trading 9,696 units, Indies Pharma skidded 30 cents to close at $2.30, with 158,642 stock units crossing the exchange, following the lifting of the suspension of trading, Iron Rock Insurance increased 12 cents to finish at $2.30 with traders dealing in just one stock with the company posting big gains in profit for the 2023 fiscal year and the first quarter to March. ISP Finance lost $5 and ended at $20, with 2,000 stocks clearing the market, JFP Ltd declined 10 cents in closing at $1.04 with an exchange of 2,402,260 units, Limners and Bards dipped 9 cents to end at $1.50 after investors ended trading 5,000 stock units. Main Event fell 20 cents in closing at $12.50 with a transfer of 30,021 shares and Regency Petroleum dropped 14 cents to $2.26, with 24,424 stocks changing hands.

Honey Bun fell 30 cents to $8.25 in trading 9,696 units, Indies Pharma skidded 30 cents to close at $2.30, with 158,642 stock units crossing the exchange, following the lifting of the suspension of trading, Iron Rock Insurance increased 12 cents to finish at $2.30 with traders dealing in just one stock with the company posting big gains in profit for the 2023 fiscal year and the first quarter to March. ISP Finance lost $5 and ended at $20, with 2,000 stocks clearing the market, JFP Ltd declined 10 cents in closing at $1.04 with an exchange of 2,402,260 units, Limners and Bards dipped 9 cents to end at $1.50 after investors ended trading 5,000 stock units. Main Event fell 20 cents in closing at $12.50 with a transfer of 30,021 shares and Regency Petroleum dropped 14 cents to $2.26, with 24,424 stocks changing hands. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index climbed 108.87 points to 326,312.91, the All Jamaican Composite Index rallied 1,008.75 points to 354,761.14, the JSE Main Index popped 338.01 points to close at 313,928.05. The Junior Market Index sank 30.30 points to close trading at 3,640.76 and the JSE USD Market Index slipped 0.44 points to 226.35.

At the close of trading, the JSE Combined Market Index climbed 108.87 points to 326,312.91, the All Jamaican Composite Index rallied 1,008.75 points to 354,761.14, the JSE Main Index popped 338.01 points to close at 313,928.05. The Junior Market Index sank 30.30 points to close trading at 3,640.76 and the JSE USD Market Index slipped 0.44 points to 226.35. In the preference segment, Sygnus Credit Investments C10.5% sank $16.04 and ended at $90.96.

In the preference segment, Sygnus Credit Investments C10.5% sank $16.04 and ended at $90.96. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

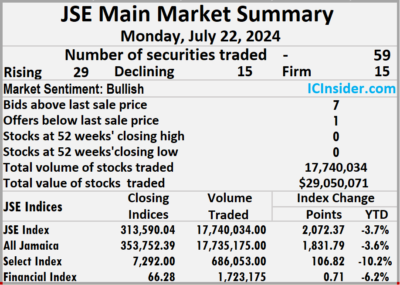

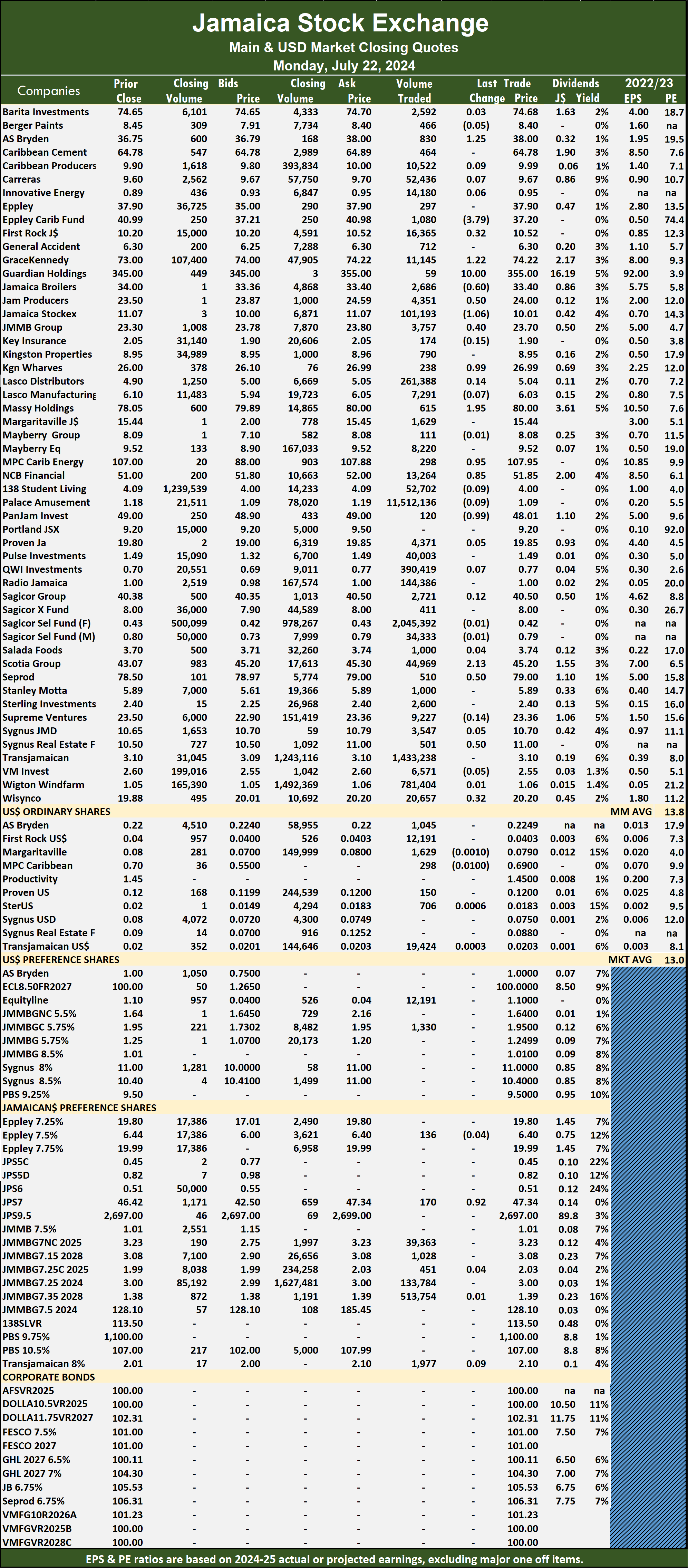

The market closed on Monday with 17,740,034 shares being traded for $29,050,071 compared with 7,561,920 units at $37,357,214 on Friday.

The market closed on Monday with 17,740,034 shares being traded for $29,050,071 compared with 7,561,920 units at $37,357,214 on Friday. Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

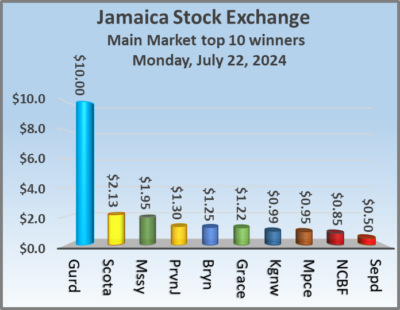

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer. MPC Caribbean Clean Energy climbed 95 cents to end at $107.95 in trading 298 stock units. NCB Financial popped 85 cents in closing at $51.85, with 13,264 shares crossing the exchange, Pan Jamaica shed 99 cents to $48.01 with investors swapping 120 units, Scotia Group gained $2.13 to finish at $45.20, with 44,969 stocks crossing the market. Seprod rose 50 cents and ended at $79 with an exchange of 510 stock units, Sygnus Real Estate Finance advanced 50 cents to close at $11 after 501 shares passed through the market and Wisynco Group rallied 32 cents to end at $20.20 after a transfer of 20,657 stocks.

MPC Caribbean Clean Energy climbed 95 cents to end at $107.95 in trading 298 stock units. NCB Financial popped 85 cents in closing at $51.85, with 13,264 shares crossing the exchange, Pan Jamaica shed 99 cents to $48.01 with investors swapping 120 units, Scotia Group gained $2.13 to finish at $45.20, with 44,969 stocks crossing the market. Seprod rose 50 cents and ended at $79 with an exchange of 510 stock units, Sygnus Real Estate Finance advanced 50 cents to close at $11 after 501 shares passed through the market and Wisynco Group rallied 32 cents to end at $20.20 after a transfer of 20,657 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

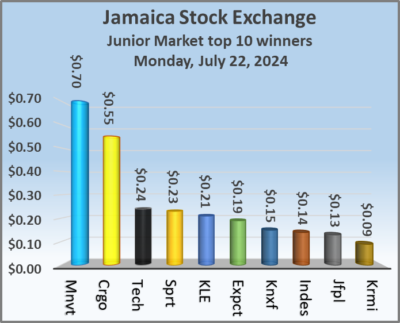

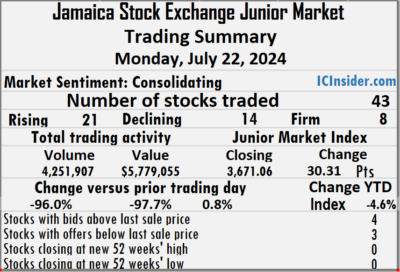

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed on Monday with the trading of 4,251,907 shares for $5,779,055 down from 106,310,225 units at $249,915,230 on Friday.

The market closed on Monday with the trading of 4,251,907 shares for $5,779,055 down from 106,310,225 units at $249,915,230 on Friday. At the close, Blue Power fell 27 cents and ended at $4.11 after the trading of 2,288 shares, Cargo Handlers rallied 55 cents to close at $12.40 after an exchange of 2,600 stock units, Caribbean Cream increased 9 to end at $3.44 with investors dealing in 312 stocks, Dolla Financial climbed 8 cents in closing at $2.88 with a transfer of 957,337 units, Dolphin Cove declined 18 cents to finish at $23 as investors exchanged 4,741 shares, Elite Diagnostic rose 6 cents to close at $1.54 after a transfer of 2,782 units. Express Catering advanced 19 cents to $3.89, with just 2 stock units changing hands, Fontana sank 43 cents and ended at $8.05 in trading 12,095 stock units, Future Energy popped 8 cents in closing at $3.29 with 150,050 shares clearing the market. Honey Bun slipped 5 cents to finish at $8.55 with an exchange of 1,486 units, iCreate sank 5 cents to end at 50 cents, with 54,113 stocks crossing the market, Indies Pharma gained 14 cents to close at $2.60 with investors trading 1,771 stock units. Jamaican Teas shed 18 cents to end at $2.12 in an exchange of 11,081 shares,

At the close, Blue Power fell 27 cents and ended at $4.11 after the trading of 2,288 shares, Cargo Handlers rallied 55 cents to close at $12.40 after an exchange of 2,600 stock units, Caribbean Cream increased 9 to end at $3.44 with investors dealing in 312 stocks, Dolla Financial climbed 8 cents in closing at $2.88 with a transfer of 957,337 units, Dolphin Cove declined 18 cents to finish at $23 as investors exchanged 4,741 shares, Elite Diagnostic rose 6 cents to close at $1.54 after a transfer of 2,782 units. Express Catering advanced 19 cents to $3.89, with just 2 stock units changing hands, Fontana sank 43 cents and ended at $8.05 in trading 12,095 stock units, Future Energy popped 8 cents in closing at $3.29 with 150,050 shares clearing the market. Honey Bun slipped 5 cents to finish at $8.55 with an exchange of 1,486 units, iCreate sank 5 cents to end at 50 cents, with 54,113 stocks crossing the market, Indies Pharma gained 14 cents to close at $2.60 with investors trading 1,771 stock units. Jamaican Teas shed 18 cents to end at $2.12 in an exchange of 11,081 shares, JFP Ltd popped 13 cents to end at $1.14 with traders dealing in 256,593 stock units, KLE Group climbed 21 cents in closing at $2.23 with an exchange of 4,149 units. Knutsford Express increased 15 cents to finish at $10.90 with investors swapping 616 stocks, Mailpac Group rallied 8 cents and ended at $2.16 in switching ownership of 4,342 shares, Main Event rose 70 cents to close at $12.70, with an exchange of 37 stock units. Omni Industries lost 6 cents to close at $1.04 with investors trading 25,956 stocks, Regency Petroleum gained 8 cents and ended at $2.40 after 40,602 units passed through the market, Spur Tree Spices advanced 23 cents to end at $2.15 after an exchange of 23,366 shares and tTech popped 24 cents in closing at $2.94, with just 2 stock units crossing the market.

JFP Ltd popped 13 cents to end at $1.14 with traders dealing in 256,593 stock units, KLE Group climbed 21 cents in closing at $2.23 with an exchange of 4,149 units. Knutsford Express increased 15 cents to finish at $10.90 with investors swapping 616 stocks, Mailpac Group rallied 8 cents and ended at $2.16 in switching ownership of 4,342 shares, Main Event rose 70 cents to close at $12.70, with an exchange of 37 stock units. Omni Industries lost 6 cents to close at $1.04 with investors trading 25,956 stocks, Regency Petroleum gained 8 cents and ended at $2.40 after 40,602 units passed through the market, Spur Tree Spices advanced 23 cents to end at $2.15 after an exchange of 23,366 shares and tTech popped 24 cents in closing at $2.94, with just 2 stock units crossing the market. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

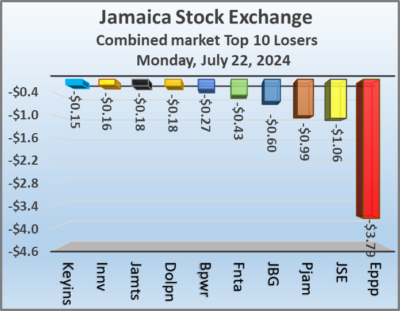

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading on Monday, the JSE Combined Market Index climbed 2,198.61 points to end at 326,204.04, the All Jamaican Composite Index rallied 1,831.79 points to 353,752.39, the JSE Main Index climbed 2,072.37 points to close at 313,590.04. The Junior Market Index bounced 30.31 points to end trading at 3,671.06 and the JSE USD Market Index rose 0.37 points to close at 226.79.

At the close of trading on Monday, the JSE Combined Market Index climbed 2,198.61 points to end at 326,204.04, the All Jamaican Composite Index rallied 1,831.79 points to 353,752.39, the JSE Main Index climbed 2,072.37 points to close at 313,590.04. The Junior Market Index bounced 30.31 points to end trading at 3,671.06 and the JSE USD Market Index rose 0.37 points to close at 226.79. In the preference segment, Jamaica Public Service 7% increased 92 cents to $47.34.

In the preference segment, Jamaica Public Service 7% increased 92 cents to $47.34. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.