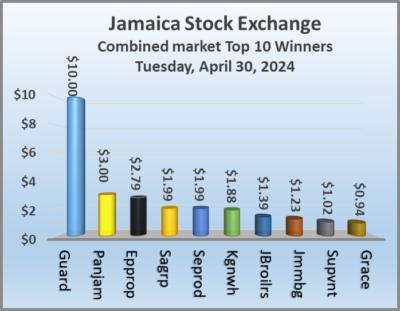

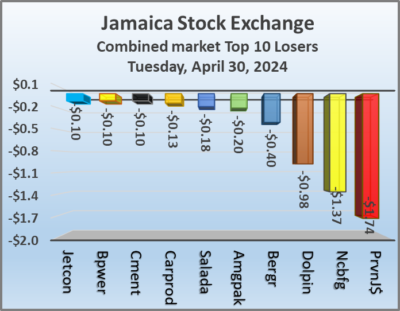

All three markets of the Jamaica Stock Exchange rose in trading on Tuesday to close out April on a positive note, with trading ending with the number of stocks changing hands jumping with a higher value compared with the previous day and resulting in prices of 41 shares rising and 32 declining.

At the close of the market, the JSE Combined Market Index climbed by 1,789.14 points to 335,481.81, the All Jamaican Composite Index jumped 2,671.92 points to close trading at 360,156.55, while the JSE Main Index popped 1,606.70 points to 322,033.61. The Junior Market Index rallied by 35.72 points to wrap up trading at 3,841.69 and the JSE USD Market Index rose 3.25 points to close at 240.86.

At the close of the market, the JSE Combined Market Index climbed by 1,789.14 points to 335,481.81, the All Jamaican Composite Index jumped 2,671.92 points to close trading at 360,156.55, while the JSE Main Index popped 1,606.70 points to 322,033.61. The Junior Market Index rallied by 35.72 points to wrap up trading at 3,841.69 and the JSE USD Market Index rose 3.25 points to close at 240.86.

At the close of trading, 38,032,128 shares were exchanged in all three markets, up from 22,815,192 shares on Monday, with the value of stocks traded on the Junior and Main markets amounting to $150.17 million, well over the $98.86 million on the previous trading day and the JSE USD market closed with an exchange of 82,573 shares for US$14,855 compared to 113,936 units at US$36,355 on Monday.

In Main Market activity, Wigton Windfarm led trading with 7.73 million shares followed by Sagicor Select Financial Fund with 2.44 million stock units, Supreme Ventures with 1.41 million stocks, Lasco Distributors chipped in with 1.19 million units and Transjamaican Highway with 1.01 million shares.

In Junior Market trading, One Great Studio led trading with 7.89 million shares followed by ONE on ONE Educational with 1.69 million units, Future Energy closed with 1.48 million stocks, Spur Tree Spices ended with 1.46 million units, JFP Ltd chipped in with 1.23 million stock units and Fosrich with 1.07 million shares.

In Junior Market trading, One Great Studio led trading with 7.89 million shares followed by ONE on ONE Educational with 1.69 million units, Future Energy closed with 1.48 million stocks, Spur Tree Spices ended with 1.46 million units, JFP Ltd chipped in with 1.23 million stock units and Fosrich with 1.07 million shares.

In the preference segment, 138 Student Living preference share gained $4.70 to close at $190.

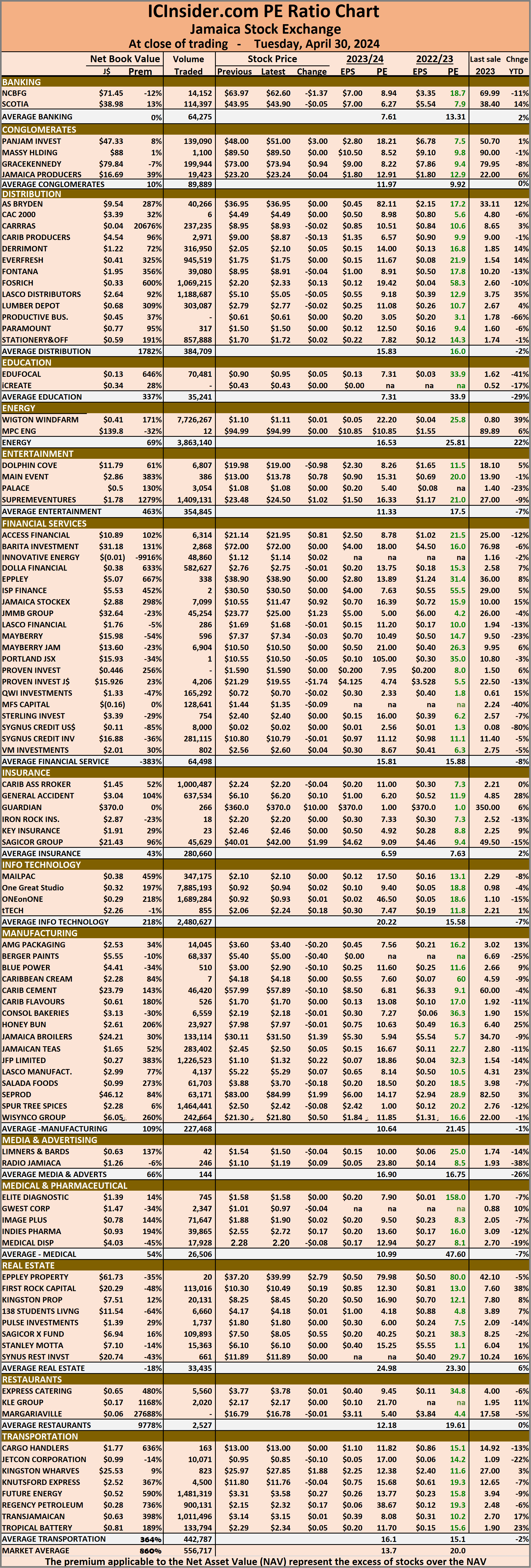

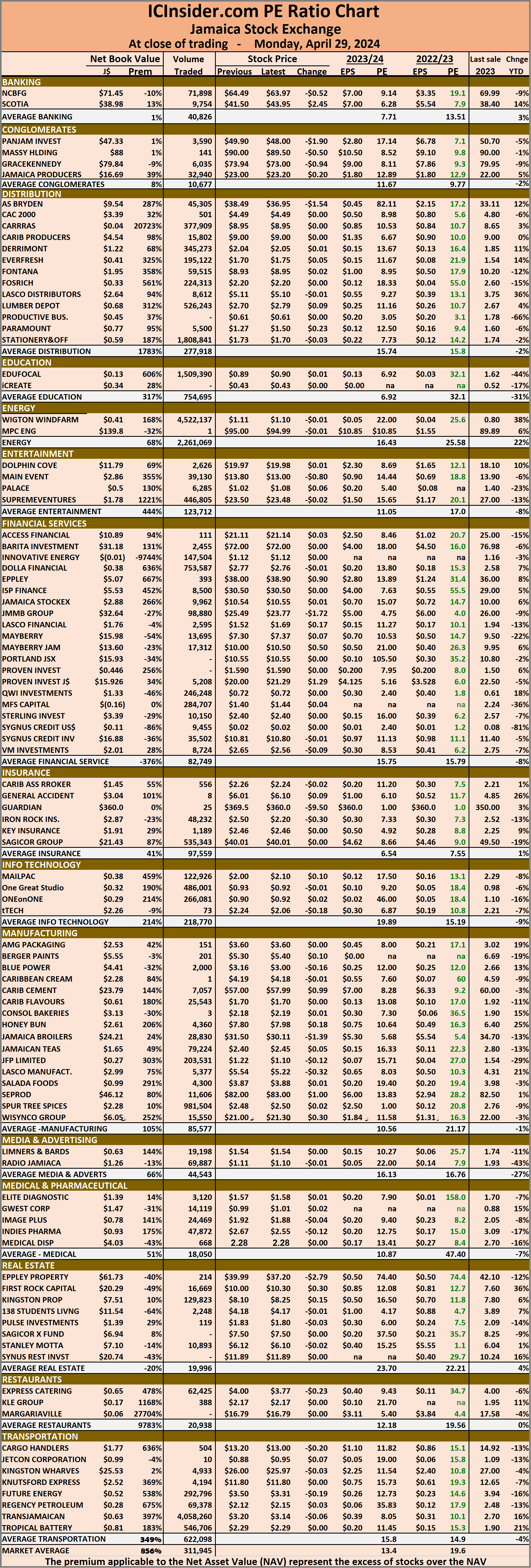

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20 on 2023-24 earnings and 13.7. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

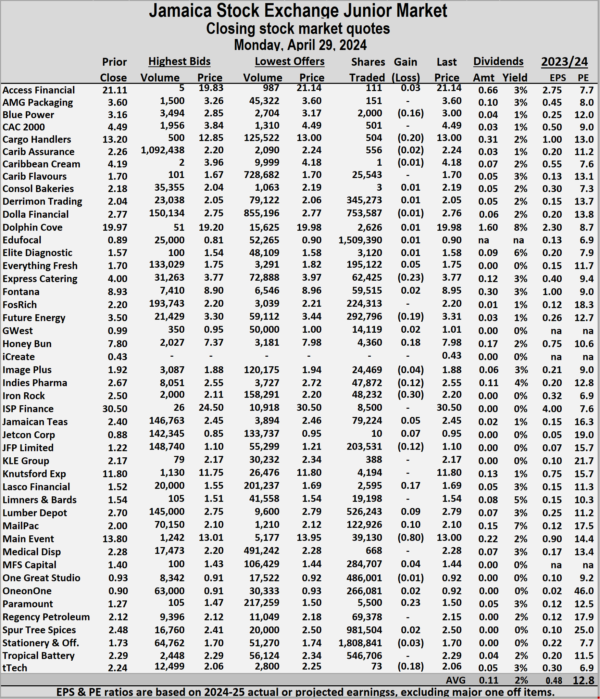

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

ALL JSE markets climb to end month

Caribbean Cement blockbuster Q1 profits

Caribbean Cement reported blockbuster profits in the first quarter to March this year from an increase of nearly 12 percent in revenues of $7.6 billion versus $6.8 billion in 2023 with profits jumping by 546 percent to $1.9 billion compared to just $289 million in last year first quarter.

Helping with the surge in profits was a sharp drop in the cost of sales from $5.5 billion to just $4 billion in the current quarter as the cost of raw materials fell sharply in the first quarter from $1.3 billion to $505 million.

Helping with the surge in profits was a sharp drop in the cost of sales from $5.5 billion to just $4 billion in the current quarter as the cost of raw materials fell sharply in the first quarter from $1.3 billion to $505 million.

Total operating expenses remained fairly stable at $673 million in 2024 versus $670 million last year with other operating expenses coming out at $311 million compared with $319 million in the previous year. Taxation jumped to $701 million versus a tax credit of $133 million last year.

Earnings per share ended at $2.27 for the quarter, up sharply from just 34 cents in the 2023 first quarter with full year’s earnings likely to exceed $8 per share.

The company generated $2.2 billion in cash inflows, bringing first quarter balance to $6.3 billion.

The company generated $2.2 billion in cash inflows, bringing first quarter balance to $6.3 billion.

Shareholders’ equity climbed to $26 billion from $20 billion at the end of March 2023 and there is just a small amount of long term debt on the books.

Caribbean Cement stock is trading currently around $58 at a PE of just over 7 times this year’s earnings compared with an average of 13 for the Main Market. The company reported that the 30 percent expansion is expected to be completed in 2025. That will allowed for increased sales on the local and the overseas markets and making the stock an attractive investment for the immediate future and longer term.

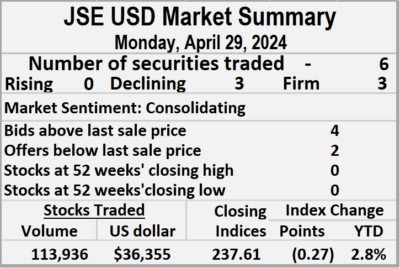

No gains for JSE USD stocks

Stocks fell in trading on Monday with none rising and resulted in slippage in the Jamaican Stock Exchange US dollar market, with the volume of stocks exchanged dropping 23 percent after 70 percent more US dollars changed hands compared with Friday, resulting in trading in six securities, compared to eight on Friday with prices of none rising, three declining and three ending unchanged.

The market closed with an exchange of 113,936 shares for US$36,355 compared to 147,586 units at US$21,362 on Friday.

The market closed with an exchange of 113,936 shares for US$36,355 compared to 147,586 units at US$21,362 on Friday.

Trading averaged 18,989 units at US$6,059 versus 18,448 shares at US$2,670 on Friday, with a month to date average of 36,886 shares at US$2,499 compared with 37,587 units at US$2,359 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index lost 0.27 points to close trading at 237.61.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, AS Bryden ended at 22.49 US cents after exchanging 20,486 stock units, Sterling Investments dipped 0.1 of a cent to 1.5 US cents with 9,455 shares clearing the market,  Sygnus Credit Investments lost 1.29 cents to end at 7.5 US cents with an exchange of 76,267 units. Sygnus Real Estate Finance USD share dropped 0.2 of a cent in closing at 8.8 US cents, with 224 stocks crossing the market and Transjamaican Highway ended at 2.03 US cents in an exchange of 5,050 units.

Sygnus Credit Investments lost 1.29 cents to end at 7.5 US cents with an exchange of 76,267 units. Sygnus Real Estate Finance USD share dropped 0.2 of a cent in closing at 8.8 US cents, with 224 stocks crossing the market and Transjamaican Highway ended at 2.03 US cents in an exchange of 5,050 units.

In the preference segment, Sygnus Credit Investments E8.5% remained at US$10.20 with investors trading 2,454 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

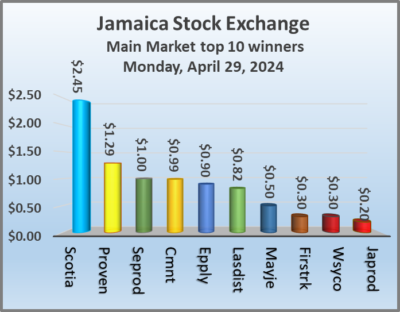

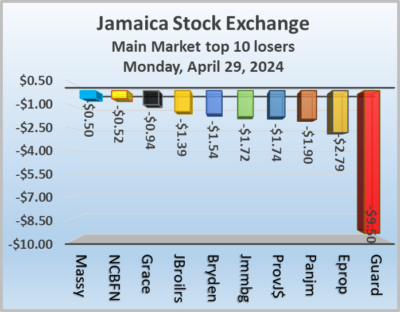

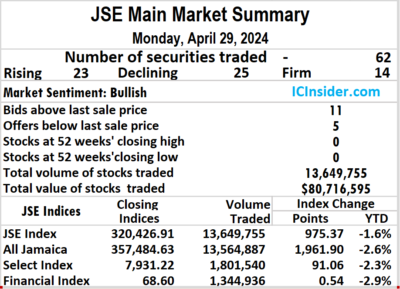

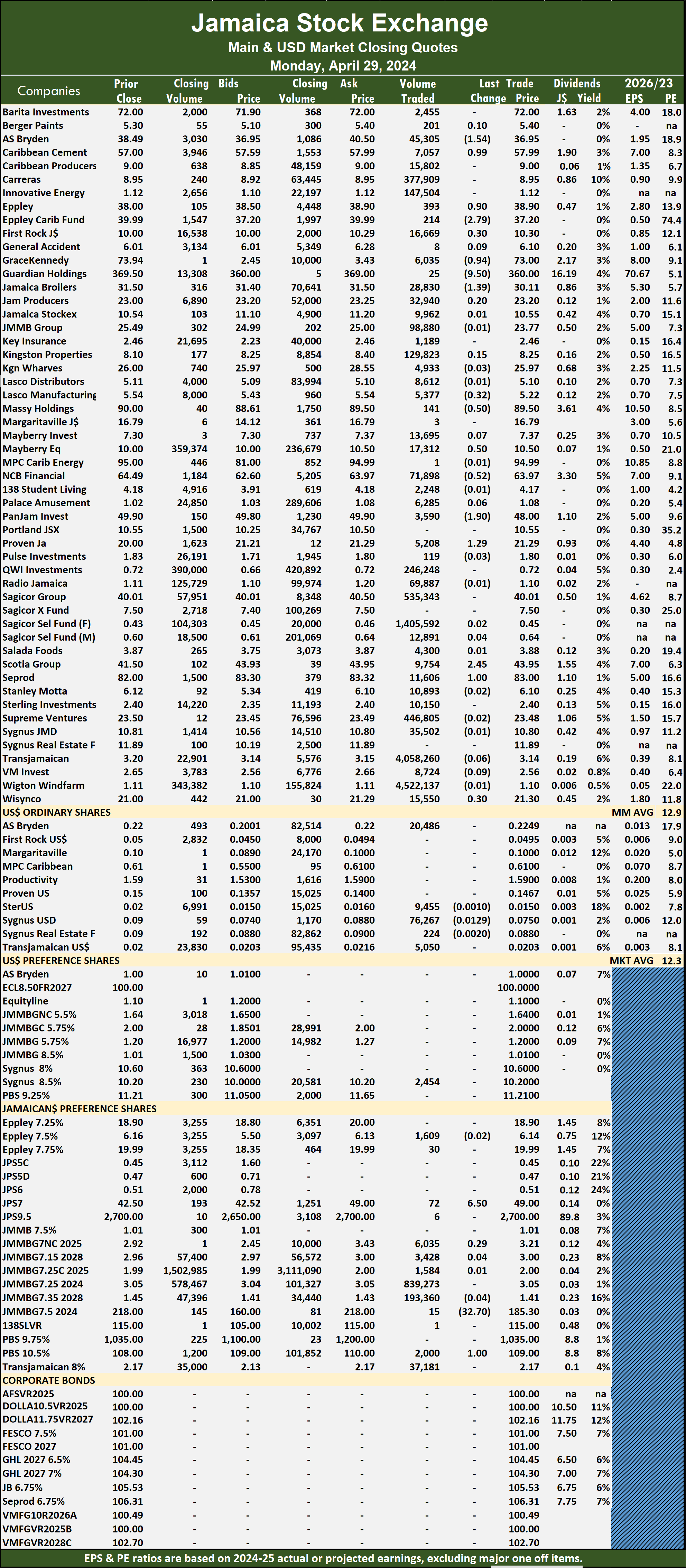

Main Market rallying into month-end

Rising stocks drove the Jamaica Stock Exchange Main Market higher on Monday, after trading took place in 62 securities, the same as Friday, with prices of 23 rising, 25 declining and 14 ending unchanged, following a 72 percent fall in the volume of stocks traded with 51 percent lower value than on Friday.

Trading ended with an exchange of 13,649,755 shares for $80,716,595 compared with 49,321,891 units at $163,817,114 on Friday.

Trading ended with an exchange of 13,649,755 shares for $80,716,595 compared with 49,321,891 units at $163,817,114 on Friday.

Trading averaged 220,157 shares at $1,301,881 compared to 795,514 units at $2,642,212 on Friday and month to date, an average of 703,378 units at $3,719,556, in comparison with 729,589 units at $3,850,699 on the previous day and March that closed with an average of 828,473 units at $2,341,254.

Wigton Windfarm led trading with 4.52 million shares for 33.1 percent of total volume followed by Transjamaican Highway with 4.06 million units for 29.7 percent of the day’s trade and Sagicor Select Financial Fund with 1.41 million units for 10.3 percent of the day’s trade.

The All Jamaican Composite Index climbed 1,961.90 points to 357,484.63, the JSE Main Index rose 975.37 points to conclude trading at 320,426.91 and the JSE Financial Index added 0.54 points to wrap up trading at 68.60.

The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and five with lower offers.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and five with lower offers.

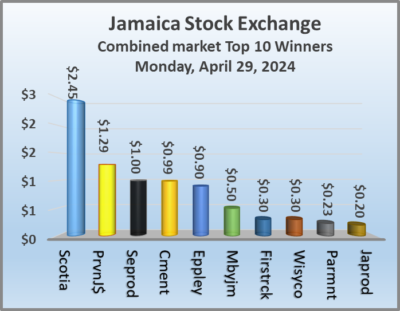

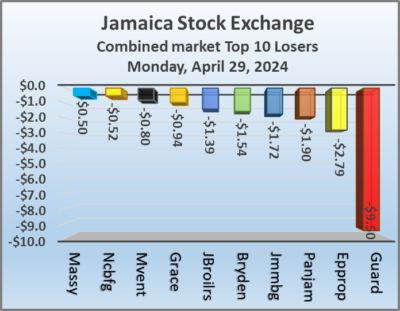

At the close, AS Bryden dipped $1.54 to finish at $36.95 with investors trading 45,305 units, Caribbean Cement climbed 99 cents to $57.99 with an exchange of 7,057 stocks, Eppley rose 90 cents to end at $38.90 after an exchange of 393 shares. Eppley Caribbean Property Fund sank $2.79 in closing at $37.20 with investors trading 214 stock units, First Rock Real Estate advanced 30 cents to close at $10.30 after an exchange of 16,669 shares, GraceKennedy dropped 94 cents and ended at $73 with 106,931 units clearing the market. Guardian Holdings fell $9.50 to $360 after an exchange of 25 stocks, Jamaica Broilers declined $1.39 in closing at $30.11 after 28,830 stock units passed through the market, JMMB Group shed $1.72 to end at $23.77, with 98,880 shares crossing the exchange.  Lasco Manufacturing lost 32 cents to close at $5.22 in switching ownership of 5,377 stocks, Massy Holdings slipped 50 cents and ended at $89.50 after 141 stock units passed through the market, Mayberry Jamaican Equities rose 50 cents to finish at $10.50 in trading 17,312 stock units. NCB Financial skidded 52 cents to $63.97 after a transfer of 71,898 shares, Pan Jamaica fell $1.90 in closing at $48 while trading 3,590 units, Proven Investments rallied $1.29 to end at $21.29 in an exchange of 5,208 stocks. Scotia Group increased $2.45 and ended at $43.95, with 9,754 stock units crossing the market, Seprod gained $1 to finish at $83 in an exchange of 11,606 shares and Wisynco Group popped 30 cents to close at $21.30 with traders dealing in 15,550 stocks.

Lasco Manufacturing lost 32 cents to close at $5.22 in switching ownership of 5,377 stocks, Massy Holdings slipped 50 cents and ended at $89.50 after 141 stock units passed through the market, Mayberry Jamaican Equities rose 50 cents to finish at $10.50 in trading 17,312 stock units. NCB Financial skidded 52 cents to $63.97 after a transfer of 71,898 shares, Pan Jamaica fell $1.90 in closing at $48 while trading 3,590 units, Proven Investments rallied $1.29 to end at $21.29 in an exchange of 5,208 stocks. Scotia Group increased $2.45 and ended at $43.95, with 9,754 stock units crossing the market, Seprod gained $1 to finish at $83 in an exchange of 11,606 shares and Wisynco Group popped 30 cents to close at $21.30 with traders dealing in 15,550 stocks.

In the preference segment, Jamaica Public Service 7% climbed $6.50 to $49, with 72 units changing hands, 138 Student Living preference share skidded $32.70 to end at $185.30 with a transfer of 15 stock units and Sygnus Credit Investments C10.5% rose $1 in closing at $109 with investors dealing in 2,000 shares.

In the preference segment, Jamaica Public Service 7% climbed $6.50 to $49, with 72 units changing hands, 138 Student Living preference share skidded $32.70 to end at $185.30 with a transfer of 15 stock units and Sygnus Credit Investments C10.5% rose $1 in closing at $109 with investors dealing in 2,000 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

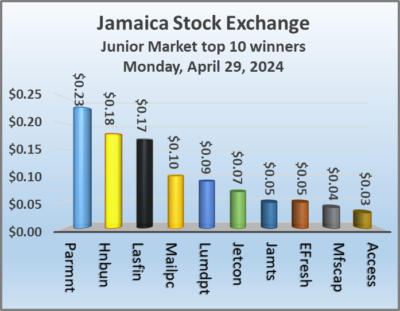

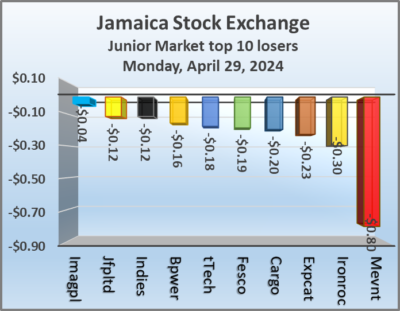

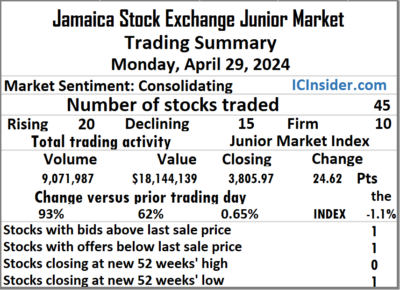

Junior Market rallies ahead of month end

Rising stocks dominated trading on the Junior Market of the Jamaica Stock Exchange on Monday, with trading in 45 securities similar to Friday and ended with prices of 20 rising, 15 declining and 10 finishing unchanged following a 93 percent rise in the volume of stocks traded, after 62 percent more funds passed through the market than on Friday.

The market closed with trading of 9,071,987 shares for $18,144,139 up from 4,711,419 units at $11,198,936 on Friday.

The market closed with trading of 9,071,987 shares for $18,144,139 up from 4,711,419 units at $11,198,936 on Friday.

Trading averaged 201,600 shares at $403,203, up from 104,698 units at $248,865 on Friday with trading for the month to date, averaging 190,559 units at $421,638 compared with 189,955 stock units at $422,648 on the previous trading day and March with an average of 221,659 units at $464,382.

Stationery and Office Supplies led trading with 1.81 million shares for 19.9 percent of total volume followed by EduFocal with 1.51 million units for 16.6 percent of the day’s trade and Spur Tree Spices with 981,504 units for 10.8 percent market share.

At the close of trading, the Junior Market Index increased 24.62 points to conclude trading at 3,805.97.

The Junior Market ended trading with an average PE Ratio of 12.8, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and one with a lower offer.

Investor’s Choice bid-offer indicator shows one stock ended with a bid higher than the last selling price and one with a lower offer.

At the close, Blue Power declined 16 cents to close at $3, with 2,000 shares crossing the market, Cargo Handlers fell 20 cents to end at $13 after 504 stock units were traded, Everything Fresh rallied 5 cents to end at $1.75, with 195,122 stock units crossing the market. Express Catering dropped 23 cents in closing at $3.77 in an exchange of 62,425 stock units, Future Energy fell 19 cents and ended at $3.31 with investors trading 292,796 shares, Honey Bun popped 18 cents to close at $7.98 with 4,360 stocks passing through the market. Indies Pharma slipped 12 cents and ended at $2.55 as investors exchanged 47,872 units, Iron Rock Insurance lost 30 cents to end at $2.20 after 48,232 stock units passed through the market, Jamaican Teas advanced 5 cents to finish at $2.45 with investors swapping 79,224 shares.

Jetcon Corporation rose 7 cents to 95 cents after 10 units passed through the exchange, JFP Ltd sank 12 cents to close at a 52 weeks’ low of $1.10 in swapping ownership of 203,531 stocks, Lasco Financial climbed 17 cents to end at $1.69 after a transfer of 2,595 stock units. Lumber Depot increased by 9 cents to $2.79 with investors dealing in 526,243 shares, Mailpac Group rallied 10 cents and closed at $2.10 after an exchange of 122,926 stocks, Main Event skidded 80 cents to close at $13 after trading 39,130 units. Paramount Trading rose 23 cents to end at $1.50 after exchanging 5,500 stock units and tTech dipped 18 cents and ended at $2.06 with investors trading 73 shares.

Jetcon Corporation rose 7 cents to 95 cents after 10 units passed through the exchange, JFP Ltd sank 12 cents to close at a 52 weeks’ low of $1.10 in swapping ownership of 203,531 stocks, Lasco Financial climbed 17 cents to end at $1.69 after a transfer of 2,595 stock units. Lumber Depot increased by 9 cents to $2.79 with investors dealing in 526,243 shares, Mailpac Group rallied 10 cents and closed at $2.10 after an exchange of 122,926 stocks, Main Event skidded 80 cents to close at $13 after trading 39,130 units. Paramount Trading rose 23 cents to end at $1.50 after exchanging 5,500 stock units and tTech dipped 18 cents and ended at $2.06 with investors trading 73 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Pre month end rally for the JSE Market

As the end of the month approaches the Main and the Junior Markets posted gains ahead of the final day of the month on Tuesday as the Market JSE USD market closed moderately lower at the close of trading the Jamaica Stock Exchange on Monday with trading ended with the number and the value of stocks changing hands falling, below the levels of the previous trading day, resulting in prices of 37 shares rising and 38 declining.

At the close of trading, the JSE Combined Market Index popped 1,106.58 points to 333,692.67,the All Jamaican Composite Index climbed 1,961.90 points to cease trading at 357,484.63, the JSE Main Index rose 975.37 points to 320,426.91. The Junior Market Index rallied 24.62 points to end at 3,805.97 and the JSE USD Market Index fell 0.27 points to cease trading at 237.61.

At the close of trading, the JSE Combined Market Index popped 1,106.58 points to 333,692.67,the All Jamaican Composite Index climbed 1,961.90 points to cease trading at 357,484.63, the JSE Main Index rose 975.37 points to 320,426.91. The Junior Market Index rallied 24.62 points to end at 3,805.97 and the JSE USD Market Index fell 0.27 points to cease trading at 237.61.

At the close of trading, 22,815,192 shares were exchanged in all three markets, down from 54,180,896 shares on Friday, with the value of stocks traded on the Junior and Main markets amounted to $98.86 million, well below the $175 million on the previous trading day and the JSE USD market closed with an exchange of 113,936 shares for US$36,355 compared to 147,586 units at US$21,362 on Friday.

In Main Market activity, Wigton Windfarm led trading with 4.52 million shares followed by Transjamaican Highway with 4.06 million units and Sagicor Select Financial Fund with 1.41 million stocks.

While in Junior Market trading, Stationery and Office Supplies led trading with 1.81 million shares followed by EduFocal with 1.51 million units and Spur Tree Spices with 981,504 stocks.

In the preference segment, Jamaica Public Service 7% climbed $6.50 to $4, 138 Student Living preference share skidded $32.70 to end at $185.30 and Sygnus Credit Investments C10.5% rose $1 in closing at $109.

In the preference segment, Jamaica Public Service 7% climbed $6.50 to $4, 138 Student Living preference share skidded $32.70 to end at $185.30 and Sygnus Credit Investments C10.5% rose $1 in closing at $109.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.6 on 2023-24 earnings and 13.4. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons within a sector and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Pertinent information is required to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The chart should be used in making rational decisions when investing in stocks close to the average for the sector, not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

Two additions to ICTOP10

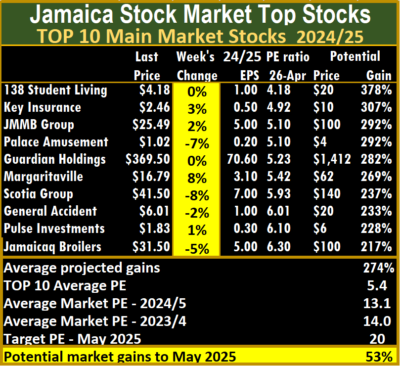

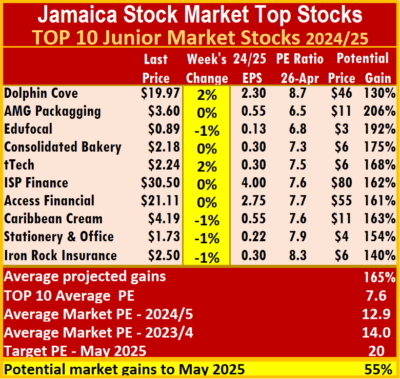

The Main and the Junior Markets slipped from the previous week’s close, for a second week, with minimal price changes in the Junior Market ICTOP10, but there were three stocks with notable price changes in the Main Market TOP10 price.

In market activity during the week, the Junior Market ICTOP10 had no stock with a price movement of note, with the highest movement being 4 percent, as Jamaican Teas fell 4 percent to close at $2.40. The Main Market, Margaritaville rose 8 percent to $16.79. Scotia Group dropped 8 percent to $41.50 and Palace Amusement lost 7 percent to close at $1.02.

In market activity during the week, the Junior Market ICTOP10 had no stock with a price movement of note, with the highest movement being 4 percent, as Jamaican Teas fell 4 percent to close at $2.40. The Main Market, Margaritaville rose 8 percent to $16.79. Scotia Group dropped 8 percent to $41.50 and Palace Amusement lost 7 percent to close at $1.02.

Jamaican Teas dropped out of the TOP10, following the release of second quarter results that showed improvements but not enough to support the previously projected earnings and Caribbean Producers fell out of the Main Market TOP10, with Jamaica Broilers returning, while Dolphin Cove returns to the Junior Market TOP10 after a long absence.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.2 and the Junior Market TOP10 sits at 7.4 over half of the market, with an average of 12.6.

The Main Market ICTOP10 is projected to gain an average of 274 percent by May 2025, based on 2024 forecasted earnings, providing better values than the Junior Market with the potential to gain 165 percent over the same period.

In the Main Market ICTOP 10, a total of 16 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 106, with an average of 31 and 22 excluding the highest PE ratios, and a PE of 24 for the top half and 18 excluding the stocks with overweight values.

In the Main Market ICTOP 10, a total of 16 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 106, with an average of 31 and 22 excluding the highest PE ratios, and a PE of 24 for the top half and 18 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 11 stocks, or 24 percent of the market, with PEs ranging from 15 to 45, averaging 21, well above the market’s average. The top half of the market currently has an average PE of 17, possibly the lowest fair value for stocks.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so.  ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Share buy back & dividend at Kingston Properties

Kingston Properties (KPREIT) plans to repurchase up to one half of one percent or 4.42 million shares in issue for up to two years to commence in the later part of May this year.

According to the release, “the Board of Directors sees this use of capital as an opportunity to enhance shareholder value through the purchase, from time to time, of undervalued shares”.

According to the release, “the Board of Directors sees this use of capital as an opportunity to enhance shareholder value through the purchase, from time to time, of undervalued shares”.

The repurchase of the shares will be done using the Company’s cash flows and will be conducted on the open market through the Company’s stockbrokers. A fixed price for the repurchase will not be set but will be the market price at the time of the repurchase. In keeping with the requirements of the Companies Act of Jamaica, within 30 days of the dates of the repurchase of shares, Kingston Properties will advise its shareholders of the details of the shares purchased.

The company has 884 million issued shares that were last traded at $8.10 on the Main Market of the Jamaica Stock Exchange with a PE of 10 times last year’s earnings and a book value of $8.40.

A total of 7.5 million shares were traded over the past twelve months for a daily average of 30,000 units.

The company has also declared a dividend of 0.0566 US cents per share, payable on June 5 to shareholders on record at May 17 with the ex-dividend date of May 16, 2024.

The company reported a profit of US$4.65 million in 2023 an increase over 2022 with US$3.8 million from operating revenues of US$4 million in 2023 and US$3.5 million in 2022. Profit was boosted by gains from revaluation and gain on sale of properties of US$3 million in 2023 and US$2.4 million in 2022.

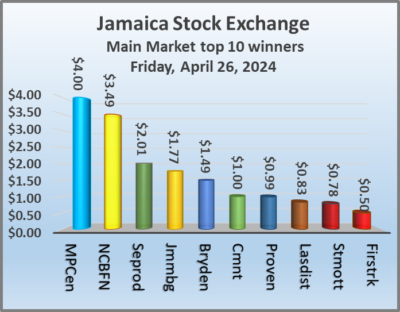

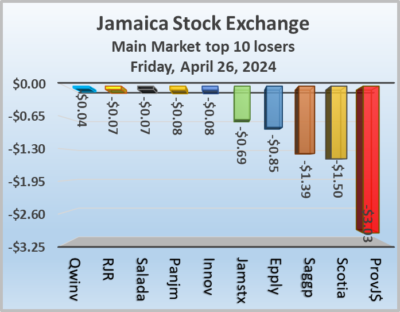

Transjamaican dominated Main Market trading

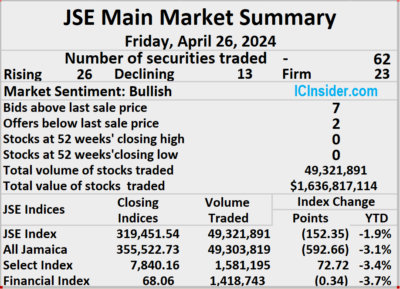

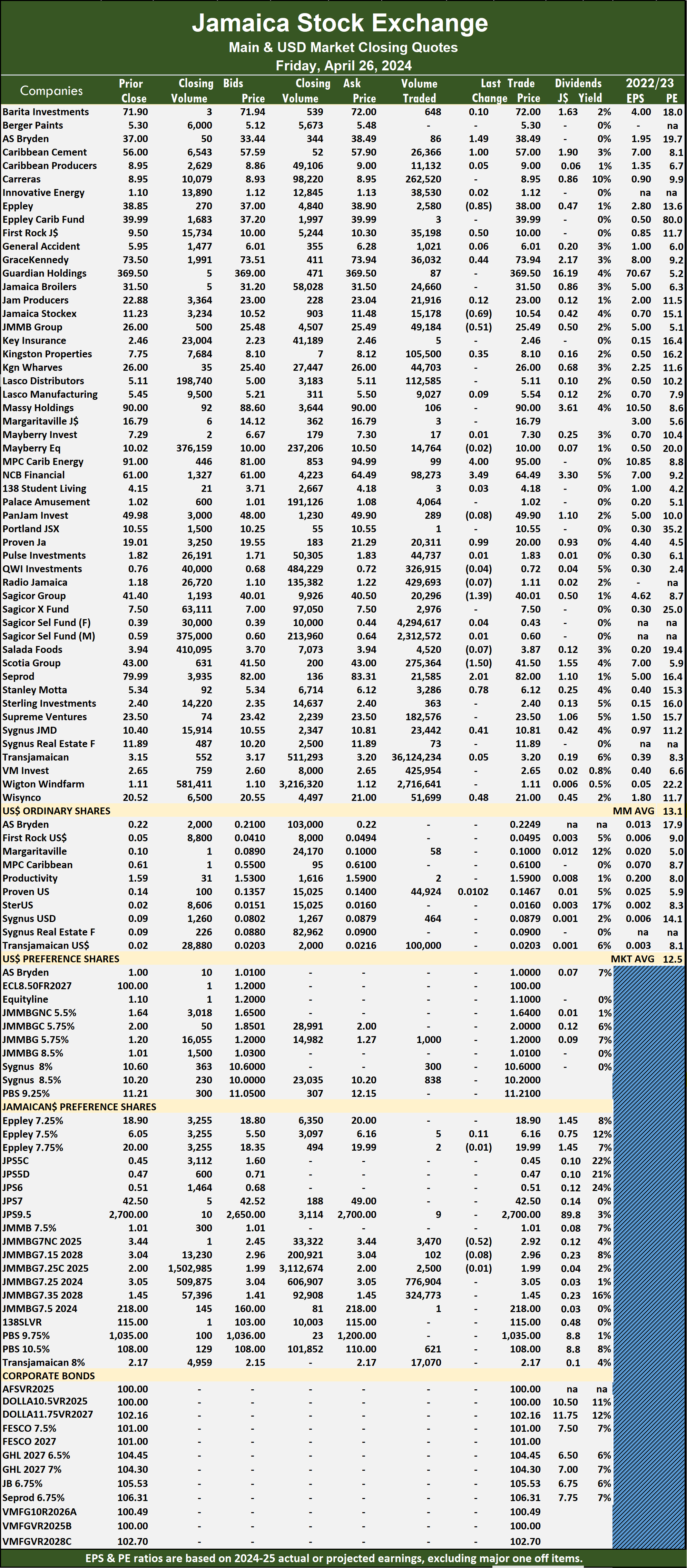

Trading surged on the Jamaica Stock Exchange Main Market on Friday, with a 240 percent surge in the volume of stocks traded following a 417 percent and a jump in value over Thursday, as Transjamaican Highway traded more than 36 million shares with a value of $114 million as the market closed with 62 securities trading compared with 54 on Thursday and resulted in prices of 26stocks rising, 13 declining and 23 ending unchanged.

Trading closed with 49,321,891 shares for $163,817,114 up from 14,522,075 units at just $31,656,097 on Thursday.

Trading closed with 49,321,891 shares for $163,817,114 up from 14,522,075 units at just $31,656,097 on Thursday.

Trading averaged 795,514 shares at $2,642,212 compared to 268,927 units at $586,224 on Thursday and month to date, an average of 729,589 units at $3,850,69 compared to 725,808 units at $3,920,010 on the previous day and March with an average of 828,473 units at $2,341,254.

Transjamaican Highway led trading with 36.12 million shares for 73.2 percent of total volume followed by Sagicor Select Financial Fund with 4.29 million units for 8.7 percent of the day’s trade, Wigton Windfarm with 2.72 million units for 5.5 percent market share and Sagicor Select Manufacturing & Distribution Fund with 2.31 million units for 4.7 percent of total volume.

The All Jamaican Composite Index lost 592.66 points to lock up trading at 355,522.73, the JSE Main Index declined 152.35 points to 319,451.54 and the JSE Financial Index sank 0.34 points to lock up trading at 68.06.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year, ending around August 2025.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with financial year, ending around August 2025.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, AS Bryden rose $1.49 and ended at $38.49, with 86 shares crossing the market, Caribbean Cement climbed $1 to $57 with an exchange of 26,366 stocks, Eppley fell 85 cents in closing at $38 and closed after an exchange of 2,580 shares. First Rock Real Estate rallied 50 cents to finish at $10 with traders dealing in 35,198 stock units, GraceKennedy popped 44 cents to close at $73.94 in switching ownership of 36,032 shares, Jamaica Stock Exchange sank 69 cents to end at $10.54, with 15,178 stock units changing hands. JMMB Group rallied $1.77 to $25.49 in an exchange of 49,184 units, Kingston Properties advanced 35 cents to finish at $8.10 after 105,500 stocks passed through the market, MPC Caribbean Clean Energy gained $4 and ended at $95 with a transfer of 99 units.  NCB Financial rose $3.49 in closing at $64.49, with 98,273 stocks crossing the exchange, Proven Investments gained 99 cents to end at $20 in trading 20,311 shares, Sagicor Group declined $1.39 to close at $40.01 after a transfer of 20,296 units. Scotia Group shed $1.50 to $41.50 with investors exchanging 275,364 shares, Seprod popped $2.01 to end at $82 in an exchange of 21,585 stocks, Stanley Motta gained 78 cents to close at $6.12 with investors trading 3,286 units. Sygnus Credit Investments climbed 41 cents to close at $10.81 after an exchange of 23,442 stock units and Wisynco Group advanced 48 cents and ended at $21 with investors dealing in 51,699 shares.

NCB Financial rose $3.49 in closing at $64.49, with 98,273 stocks crossing the exchange, Proven Investments gained 99 cents to end at $20 in trading 20,311 shares, Sagicor Group declined $1.39 to close at $40.01 after a transfer of 20,296 units. Scotia Group shed $1.50 to $41.50 with investors exchanging 275,364 shares, Seprod popped $2.01 to end at $82 in an exchange of 21,585 stocks, Stanley Motta gained 78 cents to close at $6.12 with investors trading 3,286 units. Sygnus Credit Investments climbed 41 cents to close at $10.81 after an exchange of 23,442 stock units and Wisynco Group advanced 48 cents and ended at $21 with investors dealing in 51,699 shares.

In the preference segment, JMMB Group 7% preference share dropped 52 cents to finish at $2.92 after an exchange of 3,470 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

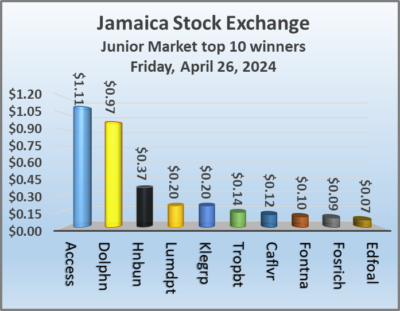

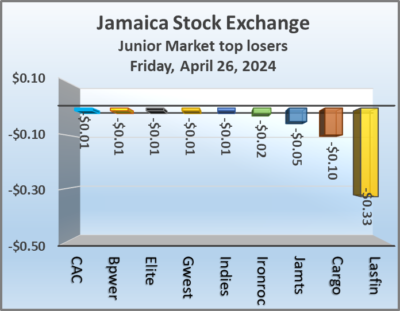

Junior Market gains

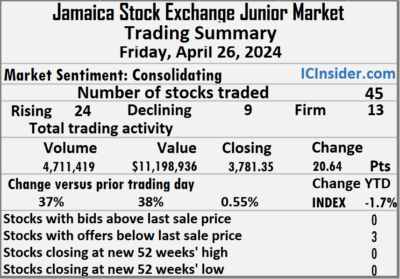

Stocks mostly rose on the Junior Market of the Jamaica Stock Exchange on Friday, after trading in 45 securities compared with 40 on Thursday and ending with prices of 24 rising, 9 declining and 12 closing unchanged following a 37 percent rise in the volume of stocks traded, with 38 percent greater value than Thursday.

At the close of trading, the Junior Market Index rallied 20.64 points to end the day at 3,781.35.

At the close of trading, the Junior Market Index rallied 20.64 points to end the day at 3,781.35.

Trading ended with 4,711,419 shares for $11,198,936 up from 3,441,451 units at $8,137,990 on Thursday.

Trading averaged 104,698 shares at $248,865, up from 86,036 units at $203,450 on Thursday with the month to date, averaging 189,955 units at $422,648 but slightly down from 194,892 stock units at $432,712 on the previous day and March ending with an average of 221,659 units at $464,382.

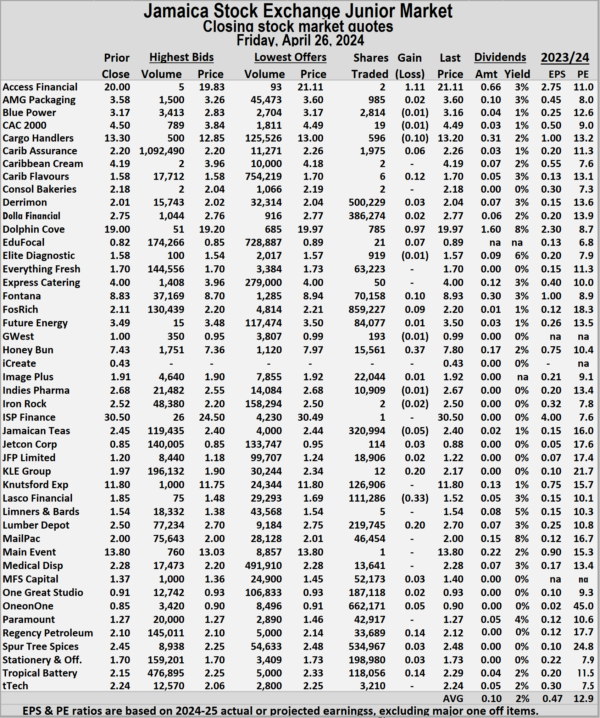

Fosrich led trading with 859,227 shares for 18.2 percent of total volume followed by ONE on ONE Educational with 662,171 units for 14.1 percent of the day’s trade and Spur Tree Spices with 534,967 units for 11.4 percent market share.

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and three with lower offers.

At the close, Access Financial gained $1.11 to end at $21.11, after just two stocks passed through the market, Cargo Handlers dipped 10 cents in closing at $13.20 with traders dealing in 596 units, Caribbean Assurance Brokers rose 6 cents to close at $2.26 with 1,975 shares clearing the market. Caribbean Flavours advanced 12 cents to end at $1.70 with investors swapping a mere 6 stock units, Dolphin Cove popped 97 cents to finish at $19.97 with an exchange of just 785 shares, EduFocal rallied 7 cents and ended at 89 cents, with 21 stocks crossing the market.  Fontana increased 10 cents to $8.93 in an exchange of 70,158 units, Fosrich climbed 9 cents in closing at $2.20 with investors dealing in 859,227 stock units, Honey Bun popped 37 cents to finish at $7.80 in an exchange of 15,561 shares. Jamaican Teas lost 5 cents and ended at $2.40 with investors trading 320,994 stock units, KLE Group increased 20 cents to close at $2.17 after an exchange of 12 stocks, Lasco Financial slipped 33 cents to end at $1.52 with 111,286 units passing through the market. Lumber Depot climbed 20 cents to $2.70 after a transfer of 219,745 shares, ONE on ONE Educational rose 5 cents to finish at 90 cents as investors exchanged 662,171 units and Tropical Battery rallied 14 cents and ended at $2.29 and closed with an exchange of 118,056 stocks.

Fontana increased 10 cents to $8.93 in an exchange of 70,158 units, Fosrich climbed 9 cents in closing at $2.20 with investors dealing in 859,227 stock units, Honey Bun popped 37 cents to finish at $7.80 in an exchange of 15,561 shares. Jamaican Teas lost 5 cents and ended at $2.40 with investors trading 320,994 stock units, KLE Group increased 20 cents to close at $2.17 after an exchange of 12 stocks, Lasco Financial slipped 33 cents to end at $1.52 with 111,286 units passing through the market. Lumber Depot climbed 20 cents to $2.70 after a transfer of 219,745 shares, ONE on ONE Educational rose 5 cents to finish at 90 cents as investors exchanged 662,171 units and Tropical Battery rallied 14 cents and ended at $2.29 and closed with an exchange of 118,056 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.