A series of third quarter company results were released during the past week, and most reported good numbers that augur well for the stock prices in the months ahead. Some of the results are companies in the ICTOP10. During the week the JSE Main Market rose but the Junior Market lost ground moderately for a second week.

Price movements in the market resulted in two new ICTOP10 listings for the Junior Market and one for the Main Market. In the Junior Market, Dolphin Cove rose 6 percent to $16.50 and AMG Packaging rose 4 percent to $2.44 after trading at a 52 weeks’ low of $1.95 during the week. Paramount Trading dropped 12 percent to $1.48, followed by Everything Fresh shedding 11 percent to $1.56, Iron Rock Insurance fell 9 percent to $2 and Caribbean Assurance Brokers declined 8 percent to end at $2.85.

Price movements in the market resulted in two new ICTOP10 listings for the Junior Market and one for the Main Market. In the Junior Market, Dolphin Cove rose 6 percent to $16.50 and AMG Packaging rose 4 percent to $2.44 after trading at a 52 weeks’ low of $1.95 during the week. Paramount Trading dropped 12 percent to $1.48, followed by Everything Fresh shedding 11 percent to $1.56, Iron Rock Insurance fell 9 percent to $2 and Caribbean Assurance Brokers declined 8 percent to end at $2.85.

The Main Market closed the week with Sygnus Credit Investments climbing 7 percent to $11.90, Margaritaville and Jamaica Broilers rising 6 percent to $17.58 and $34.97 respectively. General Insurance dropped 9 percent to end at $5.04.

Lasco Financial and Lasco Distributors released half year results but dropped out of the Junior Market ICTOP10 and Lasco Manufacturing also reported six months results but remained in the ICTOP 10. Following the release of the results, Lasco Distributors earnings were reduced from $1.65 to $1.60 for the full year and sits at number 12 in ICInsider.com rankings.  Importantly selling in the stock has been drastically reduced with just 19 offers up to $15.90 amounting to less than 200,000 shares and 19 bids above $4, with the highest bid amounting to more than the total stocks being offered. Earnings per share for Lasco Financial were reduced to 15 cents for the year and holds the 31st spot on the list.

Importantly selling in the stock has been drastically reduced with just 19 offers up to $15.90 amounting to less than 200,000 shares and 19 bids above $4, with the highest bid amounting to more than the total stocks being offered. Earnings per share for Lasco Financial were reduced to 15 cents for the year and holds the 31st spot on the list.

Jamaica Teas also released results for the year to September, showing an improvement over 2022 and disclosed expected improvements from major changes already undertaken, which should improve 2024 results added to that, stocks should do better in the coming year, resulting in exposure of projections for 2024 as such it along with Caribbean Cream are now in the ICTOP10.

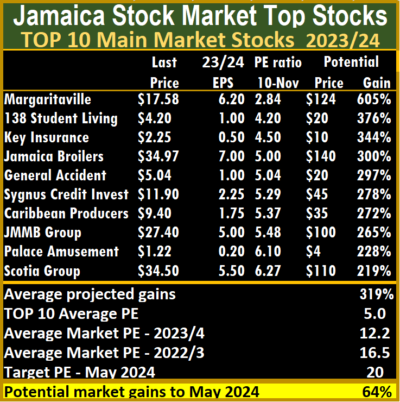

Returning to the Main Market TOP 10 is Palace Amusement Company replacing Caribbean Cement.

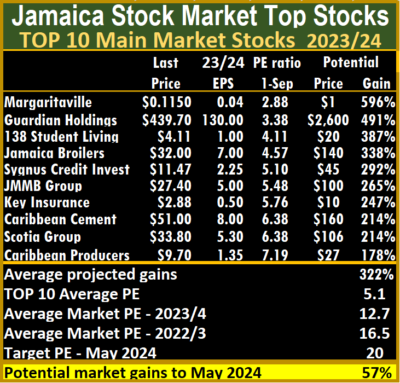

The average PE for the JSE Main Market ICTOP 10 stands at 5, well below the market average of 12.2. The Main Market ICTOP10 is projected to gain an average of 319 percent by May 2024, based on 2023 forecasted earnings.

An indication of where stock prices could be by May 2024 can be seen from stocks with the highest values in the Main and Junior Markets.

In the Main Market ICTOP 10, a total of 14 of the most highly valued stocks representing 29 percent of the Main Market are priced at a PE of 15 to 108, with an average of 30 and 20 excluding the highest PE ratios, and a PE of 23 for the top half and 16 excluding the stocks with overweight values.

The PE of the Junior Market TOP10 sits at 5.7, just over half of the market, with an average of 11.9. There are 11 stocks, or 23 percent of the market, with PEs from 15 to 48, averaging 21 that are well above the market’s average. The top half of the market has an average PE of 17, possibly the lowest fair value for Junior Market stocks currently, with the market projected to rise by 260 percent on or around May 2024.

The PE of the Junior Market TOP10 sits at 5.7, just over half of the market, with an average of 11.9. There are 11 stocks, or 23 percent of the market, with PEs from 15 to 48, averaging 21 that are well above the market’s average. The top half of the market has an average PE of 17, possibly the lowest fair value for Junior Market stocks currently, with the market projected to rise by 260 percent on or around May 2024.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Note that Margaritaville is listed on both the Main Market and the USD Market, with similar values.

Note that Margaritaville is listed on both the Main Market and the USD Market, with similar values. The markets are not in a bullish state, but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results, leading them to quietly nibble away at a number of stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.

The markets are not in a bullish state, but there continue to be cases of slow upward movements in some prices as investors respond to some recent attractive results, leading them to quietly nibble away at a number of stocks, gradually reducing the supply of a number of them that are attractively priced. The list includes stocks such as Access Financial, AMG Packaging, Everything Fresh, Dolphin Cove, Caribbean Cream, Caribbean Assurance Brokers, Lasco Distributors and Lasco Manufacturing, Main Event and Transjamaican Highway.