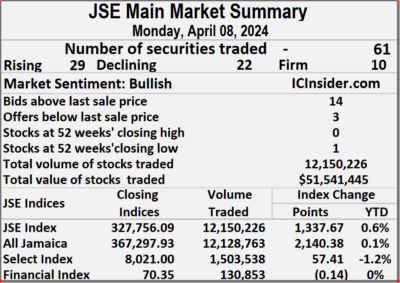

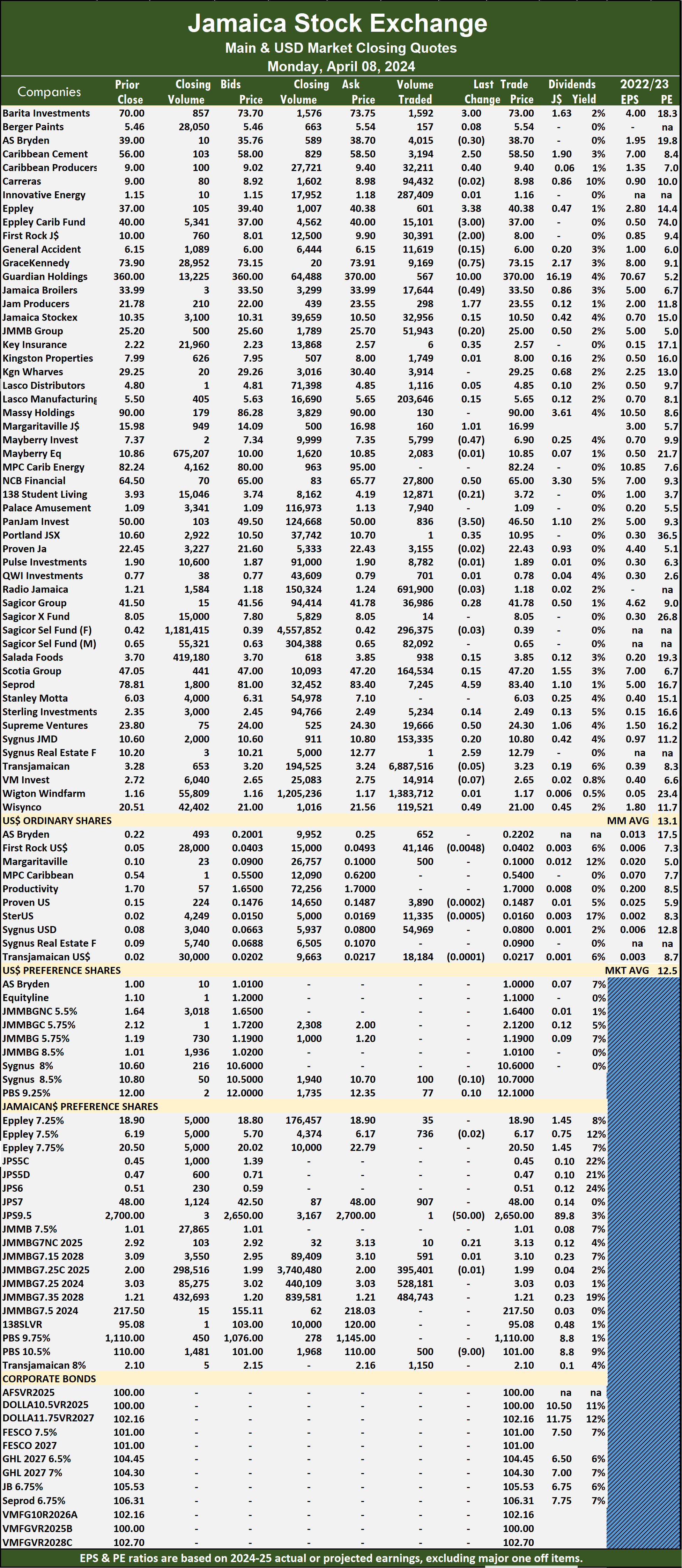

Trading dropped on the Jamaica Stock Exchange Main Market ended on Monday, with the volume of stocks changing hands declining 52 percent and the value 78 percent less than on Friday, with trading in 61 securities compared with 55 on Friday, with prices of 29 stocks rising, 22 declining and 10 ending unchanged.

The market closed with trading of 12,150,226 shares for $51,541,445 compared with 25,126,154 units at $233,060,092 on Friday.

The market closed with trading of 12,150,226 shares for $51,541,445 compared with 25,126,154 units at $233,060,092 on Friday.

Trading averaged 199,184 shares at $844,942 compared to 456,839 units at $4,237,456 on Friday and month to date, an average of 2,098,400 units at $7,747,771 down from 2,585,174 units at $9,516,984 on the previous day and March that closed with an average of 828,473 units at $2,341,254.

Transjamaican Highway led trading with 6.89 million shares for 56.7 percent of total volume followed by Wigton Windfarm with 1.38 million units for 11.4 percent of the day’s trade and Radio Jamaica with 691,900 units for 5.7 percent market share.

The All Jamaican Composite Index rallied 2,140.38 points to close at 367,297.93, the JSE Main Index gained 1,337.67 points to close at 327,756.09 and the JSE Financial Index declined 0.14 points to 70.35.

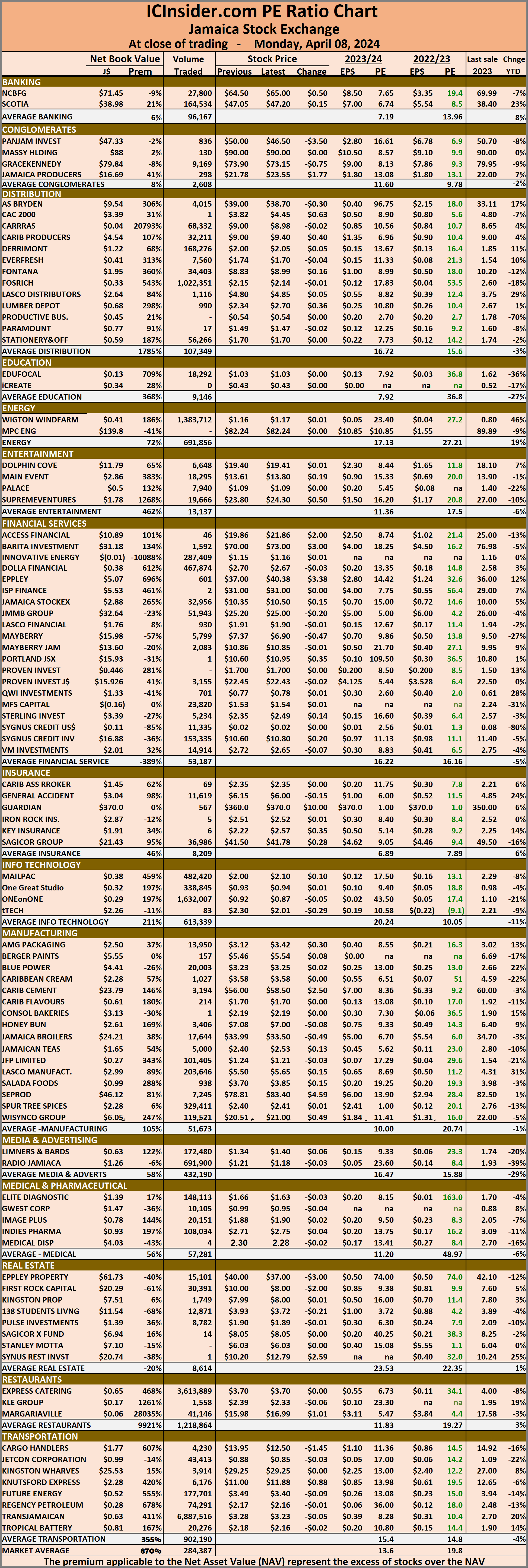

The Main Market ended trading with an average PE Ratio of 13.1 The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows 14 stocks ended with bids higher than their last selling prices and three with lower offers.

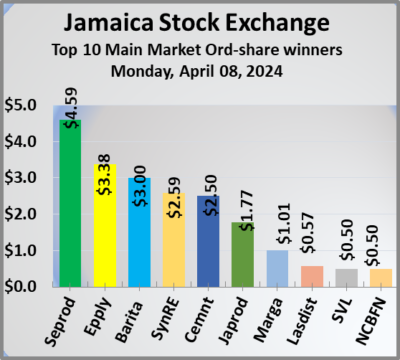

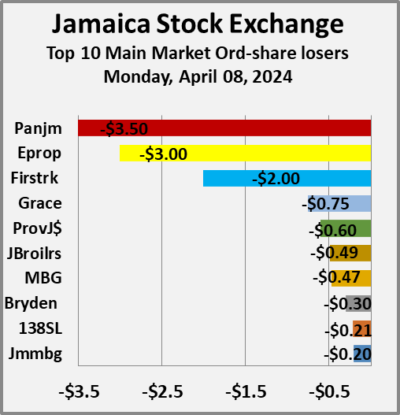

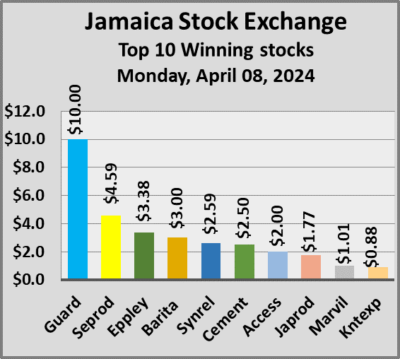

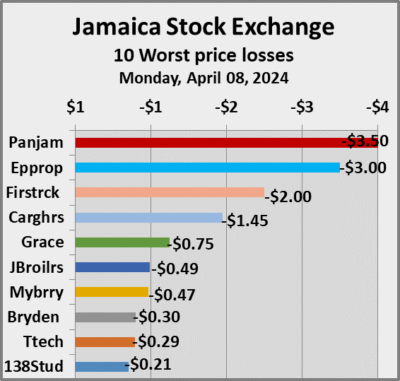

At the close, AS Bryden dropped 30 cents to end at $38.70, with 4,015 shares crossing the market, Barita Investments gained $3 to close at $73 with investors dealing in 1,592 stocks, Caribbean Cement rose $2.50 to finish at $58.50 with 3,194 shares clearing the market. Caribbean Producers advanced 40 cents and ended at $9.40 after and exchange of 32,211 stock units, Eppley popped $3.38 in closing at $40.38 in trading 601 shares, Eppley Caribbean Property Fund sank $3 to close at $37 after an exchange of 15,101 stock units. First Rock Real Estate slipped $2 to $8 after trading of 30,391 units, GraceKennedy fell 75 cents in closing at $73.15, with 9,169 stocks changing hands, Guardian Holdings increased by $10 to end at $370 in an exchange of 567 units. Jamaica Broilers declined 49 cents and ended at $33.50, with 17,644 shares crossing the market, Jamaica Producers climbed $1.77 to finish at $23.55 as investors exchanged 298 stock units, Key Insurance rallied 35 cents to close at $2.57 in switching ownership of just 6 stocks. Margaritaville popped $1.01 to $16.99 after exchanging 160 units, Mayberry Group lost 47 cents in closing at $6.90 with investors trading 5,799 stocks,  NCB Financial rallied 50 cents to close at $65, with 27,800 shares crossing the exchange. Pan Jamaica dipped $3.50 and ended at $46.50 with investors transferring 836 stock units, Portland JSX rose 35 cents to finish at $10.95 after one share passed through the market, Seprod climbed $4.59 to end at $83.40 with an exchange of 7,245 stock units. Supreme Ventures increased 50 cents to $24.30 in an exchange of 19,666 units, Sygnus Real Estate Finance advanced $2.59 and ended at $12.79 with investors swapping just one stock and Wisynco Group gained 49 cents in closing at $21 after a transfer of 119,521 shares.

NCB Financial rallied 50 cents to close at $65, with 27,800 shares crossing the exchange. Pan Jamaica dipped $3.50 and ended at $46.50 with investors transferring 836 stock units, Portland JSX rose 35 cents to finish at $10.95 after one share passed through the market, Seprod climbed $4.59 to end at $83.40 with an exchange of 7,245 stock units. Supreme Ventures increased 50 cents to $24.30 in an exchange of 19,666 units, Sygnus Real Estate Finance advanced $2.59 and ended at $12.79 with investors swapping just one stock and Wisynco Group gained 49 cents in closing at $21 after a transfer of 119,521 shares.

In the preference segment, Jamaica Public Service 9.5% shed $50 to end at a 52 weeks’ low of $2650 with traders dealing in one stock and Sygnus Credit Investments C10.5% skidded $9 to close at $101 with a transfer of 500 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE Main Market climbs on Monday

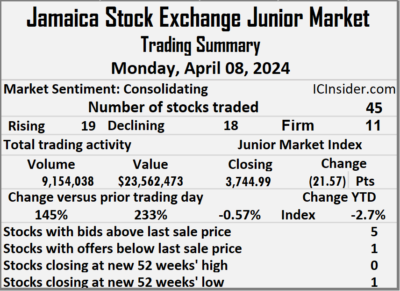

Third day of decline for Junior Market

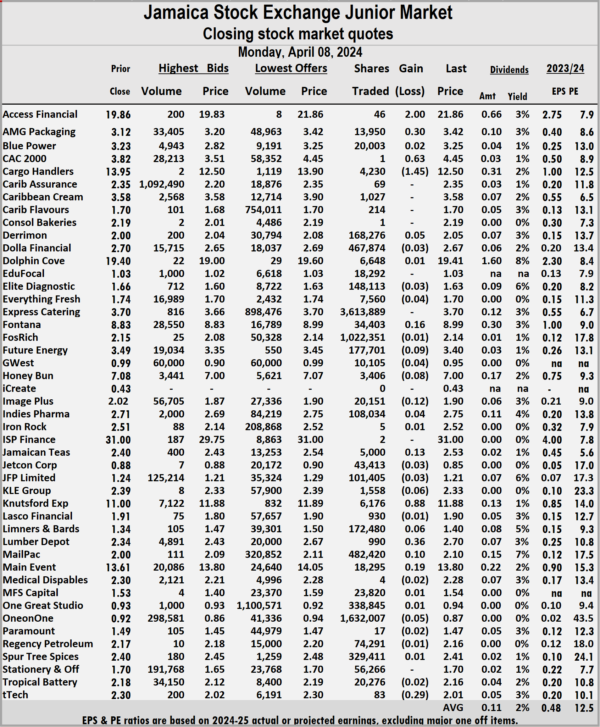

Trading closed on the Junior Market of the Jamaica Stock Exchange Monday, with a 145 percent jump in the volume of stocks traded, valued 233 percent more than Friday with trading in 45  securities compared with 40 on Friday and ending with prices of 19 rising, 18 declining and eight stocks closing unchanged and Medical Disposables ended at a 52 weeks’ low of $2.28 with the market Index falling for a third consecutive day.

securities compared with 40 on Friday and ending with prices of 19 rising, 18 declining and eight stocks closing unchanged and Medical Disposables ended at a 52 weeks’ low of $2.28 with the market Index falling for a third consecutive day.

The market closed with trading of 9,154,038 shares for $23,562,473 up from 3,732,698 units at $7,075,691 on Friday.

Trading averaged 203,423 shares at $523,611 compared with 93,317 units at $176,892 on Friday. Trading for the month to date, averaged 162,808 units at $369,487 compared to 151,929 stock units at $328,204 on the previous trading day and March with an average of 221,659 units at $464,382.

Express Catering led trading with 3.61 million shares for 39.5 percent of total volume followed by ONE on ONE Educational with 1.63 million units for 17.8 percent of the day’s trade and Fosrich with 1.02 million units for 11.2 percent of the day’s trade.

Express Catering led trading with 3.61 million shares for 39.5 percent of total volume followed by ONE on ONE Educational with 1.63 million units for 17.8 percent of the day’s trade and Fosrich with 1.02 million units for 11.2 percent of the day’s trade.

At the close of trading, the Junior Market Index fell 21.57 points to close at 3,744.99.

The Junior Market ended trading with an average PE Ratio of 12.5, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and one with a lower offer.

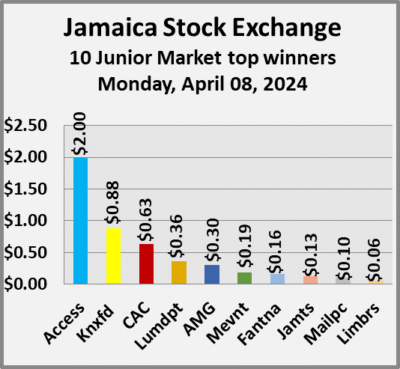

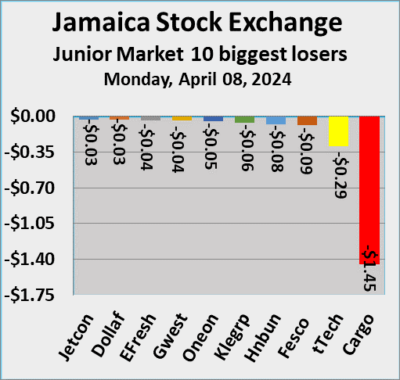

At the close, Access Financial rallied $2 to finish at $21.86 with traders dealing in 46 shares, AMG Packaging rose 30 cents to $3.42, with 13,950 stocks crossing the market, CAC 2000 gained 63 cents to close at $4.45 with a transfer of just one share. Cargo Handlers dropped $1.45 to end at $12.50 as investors exchanged 4,230 units, Fontana popped 16 cents in closing at $8.99 after investors ended trading 34,403 shares, Future Energy sank 9 cents and ended at $3.40 with investors trading 177,701 units. Honey Bun dipped 8 cents to $7 in an exchange of 3,406 stock units, Jamaican Teas climbed 13 cents to end at $2.53 after 5,000 stock units passed through the market, Knutsford Express increased 88 cents in closing at $11.88 with an exchange of 6,176 shares. Lumber Depot advanced 36 cents to close at $2.70, with 990 units changing hands, Mailpac Group rose 10 cents to finish at $2.10 after a transfer of 482,420 stocks, Main Event advanced 19 cents and ended at $13.80 with investors dealing in 18,295 stock units and tTech lost 29 cents to $2.01 in an exchange of 83 shares.

Cargo Handlers dropped $1.45 to end at $12.50 as investors exchanged 4,230 units, Fontana popped 16 cents in closing at $8.99 after investors ended trading 34,403 shares, Future Energy sank 9 cents and ended at $3.40 with investors trading 177,701 units. Honey Bun dipped 8 cents to $7 in an exchange of 3,406 stock units, Jamaican Teas climbed 13 cents to end at $2.53 after 5,000 stock units passed through the market, Knutsford Express increased 88 cents in closing at $11.88 with an exchange of 6,176 shares. Lumber Depot advanced 36 cents to close at $2.70, with 990 units changing hands, Mailpac Group rose 10 cents to finish at $2.10 after a transfer of 482,420 stocks, Main Event advanced 19 cents and ended at $13.80 with investors dealing in 18,295 stock units and tTech lost 29 cents to $2.01 in an exchange of 83 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

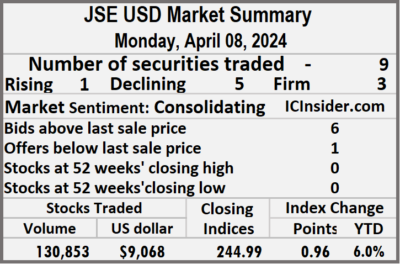

Falling prices dominates the JSE USD Market

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with a 38 percent drop in the volume of stocks being exchanged after a 68 percent fall in value from that of Friday, resulting in trading in nine securities, compared to eight on Friday with prices of one rising, five declining and three ending unchanged.

The market closed with an exchange of 130,853 shares for US$9,068 down from 209,773 units at US$28,768 on Friday.

The market closed with an exchange of 130,853 shares for US$9,068 down from 209,773 units at US$28,768 on Friday.

Trading averaged 14,539 units at US$1,008 versus 26,222 shares at US$3,596 on Friday, with a month to date average of 34,790 shares at US$2,925 compared with 40,669 units at US$3,482 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index increased 0.96 points to settle at 244.99.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.3. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden ended at 22.02 US cents in an exchange of 652 stocks, First Rock Real Estate USD share lost 0.48 of one cent to close at 4.02 US cents with investors dealing in 41,146 units, Margaritaville ending at 10 US cents in switching ownership of 500 shares. Proven Investments slipped 0.02 of a cent in closing at 14.87 US cents as investors exchanged 3,890 stock units, Sterling Investments sank 0.05 of a cent and ended at 1.6 US cents after trading 11,335 shares, Sygnus Credit Investments ended at 8 US cents with 54,969 stocks clearing the market and Transjamaican Highway dipped 0.01 of a cent to 2.17 US cents after an exchange of 18,184 units.

Proven Investments slipped 0.02 of a cent in closing at 14.87 US cents as investors exchanged 3,890 stock units, Sterling Investments sank 0.05 of a cent and ended at 1.6 US cents after trading 11,335 shares, Sygnus Credit Investments ended at 8 US cents with 54,969 stocks clearing the market and Transjamaican Highway dipped 0.01 of a cent to 2.17 US cents after an exchange of 18,184 units.

In the preference segment, Productive Business Solutions 9.25% preference share gained 10 cents in closing at US$12.10 with 77 stock units crossing the market and Sygnus Credit Investments E8.5% fell 10 cents to finish at US$10.70 in an exchange of 100 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Main Market rise Juniors fall

The JSE USD market inched higher at the close of the Jamaica Stock Exchange on Monday as the Main Market gained more than a thousand points but the Junior Market dropped for a third consecutive day, with fewer stocks changing hands, with the value traded falling sharply from that on the previous trading day, resulting in prices of 46 shares rising and 36 declining.

At the close of trading on Monday, the JSE Combined Market Index rallied 1,132.02 points to end at 340,293.63, the All Jamaican Composite Index rose 2,140.38 points to 367,297.93, the JSE Main Index rose 1,337.67 points to close at 327,756.09. The Junior Market Index sank 21.57 points to end the day at 3,744.99 and the JSE USD Market Index popped 0.96 points to settle at 244.99.

At the close of trading on Monday, the JSE Combined Market Index rallied 1,132.02 points to end at 340,293.63, the All Jamaican Composite Index rose 2,140.38 points to 367,297.93, the JSE Main Index rose 1,337.67 points to close at 327,756.09. The Junior Market Index sank 21.57 points to end the day at 3,744.99 and the JSE USD Market Index popped 0.96 points to settle at 244.99.

At the close of trading, 21,408,365 shares were exchanged in all three markets, down from 29,059,711 units on Friday, with the value of stocks traded on the Junior and Main markets with a value of $74.87 million, well off from $240.14, million on the previous trading day and the JSE USD market closed with an exchange of 130,853 shares for US$9,068 compared to 209,773 units at US$28,768 on Friday.

In Main Market activity, Transjamaican Highway led trading with 6.89 million shares followed by Wigton Windfarm with 1.38 million units and Radio Jamaica with 691,900 stocks.

In the Junior Market, Express Catering led trading with 3.61 million shares followed by ONE on ONE Educational with 1.63 million stock units and Fosrich with 1.02 million units.

In the preference segment Jamaica Public Service 9.5% dropped $50 to close at $2650 and Sygnus Credit Investments C10.5% declined $9 to finish at $101.

In the preference segment Jamaica Public Service 9.5% dropped $50 to close at $2650 and Sygnus Credit Investments C10.5% declined $9 to finish at $101.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 19.8 on 2023-24 earnings and 13.6 times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume of the highest bid and the lowest offer for each company.

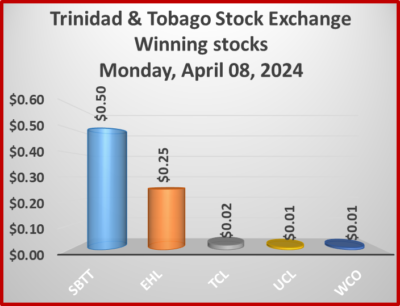

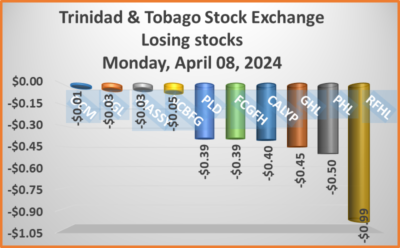

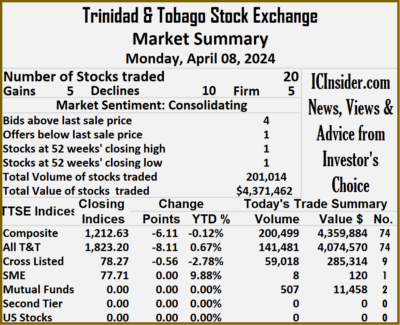

Falling prices dominate Trinidad stocks

Trading ended with 20 securities changing hands down from 23 on Friday, ending with prices of 10 stocks declining five rising and five ending unchanged on the Trinidad and Tobago Stock Exchange on Monday, following a 62 percent decline in the volume of stocks trading valued 53 percent less than on Friday.

The market closed trading of 201,014 shares for $4,371,462 compared with 533,983 stock units at $9,312,325 on Friday.

The market closed trading of 201,014 shares for $4,371,462 compared with 533,983 stock units at $9,312,325 on Friday.

An average of 10,051 shares were traded at $218,573 compared to 23,217 units at $404,884 on Friday. Trading for the month to date averages 18,679 shares at $196,215 compared with 20,783 units at $190,760 on the previous day and an average for March of 28,236 shares at $236,496.

The Composite Index shed 6.11 points to end at 1,212.63, the All T&T Index dipped 8.11 points to close at 1,823.20, the SME Index remained at 77.71 and the Cross-Listed Index dipped 0.56 points to close at 78.27.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close of the market, Calypso Macro Investment Fund fell 40 cents and ended at $22.60 with investors swapping 507 shares, Endeavour Holdings advanced 25 cents to a 52 weeks’ high of $15 after a transfer of 8 units, First Citizens Group sank 39 cents to $48.11 in trading 1,343 stocks.  FirstCaribbean International Bank ended at $7.04 after exchanging 16,870 units, GraceKennedy ended at $4.07 with 37,000 shares changing hands, Guardian Holdings dropped 45 cents to $18.05 with investors trading 28 stocks. L.J. Williams B share ended with an exchange of 5,000 stock units at $1.99, Massy Holdings slipped 3 cents to close at $4.37 with trading in 67,880 stocks, National Enterprises remained at $3.89 with, 18,813 shares changing hands. National Flour Mills ended at $2.20 with an exchange of 15 stocks, NCB Financial declined 5 cents in closing at $3.10, with 5,148 units crossing the market, One Caribbean Media shed 1 cent to finish at $3.82 with investors dealing in 3,030 stock units. Point Lisas skidded 39 cents and ended at $3.71 in an exchange of 3,000 shares, Prestige Holdings dipped 50 cents to $12.50 with 382 stocks clearing the market,

FirstCaribbean International Bank ended at $7.04 after exchanging 16,870 units, GraceKennedy ended at $4.07 with 37,000 shares changing hands, Guardian Holdings dropped 45 cents to $18.05 with investors trading 28 stocks. L.J. Williams B share ended with an exchange of 5,000 stock units at $1.99, Massy Holdings slipped 3 cents to close at $4.37 with trading in 67,880 stocks, National Enterprises remained at $3.89 with, 18,813 shares changing hands. National Flour Mills ended at $2.20 with an exchange of 15 stocks, NCB Financial declined 5 cents in closing at $3.10, with 5,148 units crossing the market, One Caribbean Media shed 1 cent to finish at $3.82 with investors dealing in 3,030 stock units. Point Lisas skidded 39 cents and ended at $3.71 in an exchange of 3,000 shares, Prestige Holdings dipped 50 cents to $12.50 with 382 stocks clearing the market,

Republic Financial slipped 99 cents to close at $119 as investors exchanged 28,448 units. Scotiabank popped 50 cents to finish at $70.50 in trading 176 stock units, Trinidad & Tobago NGL fell 3 cents to end at a 52 weeks’ low of $8.47, with 554 shares crossing the exchange, Trinidad Cement added 2 cents in closing at $2.62 after swapping 100 stocks. Unilever Caribbean popped 1 cent to $12.26 with traders dealing in 189 units and West Indian Tobacco rose 1 cent to $15.50 after 12,523 stock units passed through the market.

Republic Financial slipped 99 cents to close at $119 as investors exchanged 28,448 units. Scotiabank popped 50 cents to finish at $70.50 in trading 176 stock units, Trinidad & Tobago NGL fell 3 cents to end at a 52 weeks’ low of $8.47, with 554 shares crossing the exchange, Trinidad Cement added 2 cents in closing at $2.62 after swapping 100 stocks. Unilever Caribbean popped 1 cent to $12.26 with traders dealing in 189 units and West Indian Tobacco rose 1 cent to $15.50 after 12,523 stock units passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Profit jumps at the Lab as revenues fall

Revenues at Limners and Bards declined 11 percent in the January 2024 quarter to $219 million from $240 million in 2023 but a 16 percent decline in cost of sales resulted in gross profit falling by a mere 4 percent to $92 million from $96 million in 2023 and contributed in pretax profit jumping 216 percent to $20 million versus $6.4 million in 2023 before a recovery of $6 million in Impairment recovery on financial assets.

The net results after tax coming at a healthy $26 million sharp jump from just $6 million in 2023, a B 330 percent year over year increase with earnings per share coming in at 3 cents versus 1 cent in 2023. ICInsider.com forecast is for full year earnings of 15 cents per share, even as the advertising market is currently weighted down by soft demand that affects revenues for both production and media business segments.

The net results after tax coming at a healthy $26 million sharp jump from just $6 million in 2023, a B 330 percent year over year increase with earnings per share coming in at 3 cents versus 1 cent in 2023. ICInsider.com forecast is for full year earnings of 15 cents per share, even as the advertising market is currently weighted down by soft demand that affects revenues for both production and media business segments.

Helping to boost profit was a 21 percent decline in administrative costs to $62 million from $79 million in the prior year.

Depreciation charges increased marginally to just over $6 million from $6 million in the prior year and finance costs climbed to $2.6 million from $3.5 million in 2023.

The operations delivered gross cash flows of $32 million and ended with Net cash provided by operating activities of $126 million, with accounts receivable contributing $126 million.

Segment results show varying fortunes during the quarter compared to that of the previous year with production generating just $29 million in revenues versus 58 million in the previous year with a gross profit of $10 million down from $29 million in 2023 while the media segment delivered $118 million in revenue down from $135 million in the previous year with profit slipping marginally $17.7 million in 2024 from $18.4 million in the previous year while there was a significant climb 32 percent in the Agency segment to $71.6 million from $54 million in 2023 with gross profit of $61 million up Bly by 37 percent from $44 million in the previous year.

Current assets amounted to $732 million up from $624 million in 2023 with cash and cash equivalent amounting to $469 million up from $327 million in the previous year and current liabilities were $181 million in 2024 versus $140 million in the previous year and long term liabilities amounted to $104 million $102 million in the previous year.  Shareholders’ equity ended at $624 million up from 1748 billion in 2024.

Shareholders’ equity ended at $624 million up from 1748 billion in 2024.

In the directors’ report to shareholders, “the company remains fully focused on executing its strategy of diversifying its income, through engaging new clients and the introduction of new service lines. These strategic endeavours are aligned with our company’s expansion strategy into emerging markets, all aimed at fostering sustainable growth, increased revenues, enhanced profitability; while proactively anticipating the evolving needs of our valued clients and enhancing shareholders’ value.

In keeping with the above objective, we “have successfully completed the pilots for two TV/web series, “SEEN” and “Jenna In Law, additionally, pre-production for our first feature film, “Love Offside,” is currently underway, with production scheduled to commence in June 2024.”

The stock traded on the Junior Market of the Jamaica Stock Exchange at $1.34, on Friday, with a PE of 9 times projected earnings for 2024 which is below the market average of 12.5.

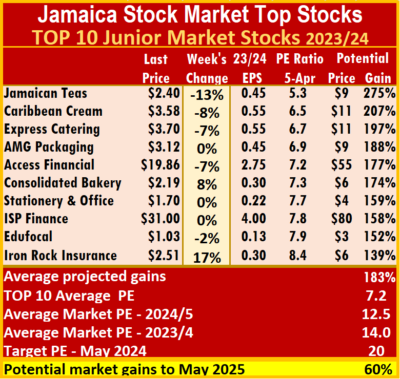

CPJ enters ICTOP10 Broilers out

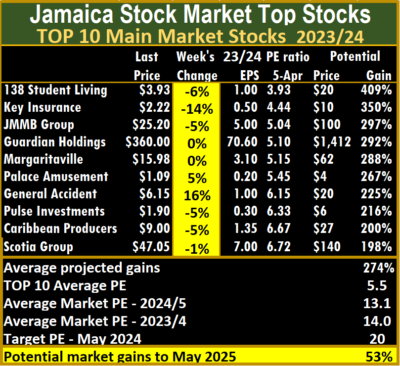

With what has become the norm, the markets pulled back to start April from the pump-up end of month prices in March, resulting in varied outcomes for the ICTOP10 and ending with Jamaica Broilers falling from the Main Market TOP10 and Caribbean Producers entering at the number 9 spot.

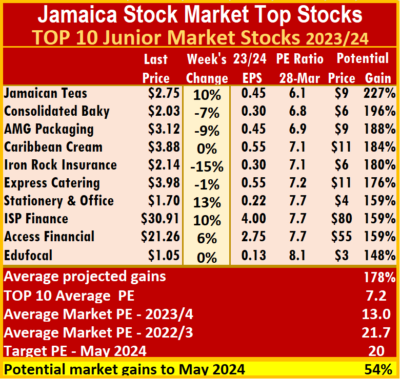

There were no changes to the list of companies in the Junior Market TOP10 this past week.

There were no changes to the list of companies in the Junior Market TOP10 this past week.

Caribbean Producers is the primary supplier of foods and beverages to the growing tourist industry on the north coast of Jamaica and St Lucia, the company is also expanding its meat processing arm as well as retail areas in both countries. ICInsider.com’s projected EPS is $1.35 for the fiscal year to June 2024. With plans for long term growth in the local tourism sector, the company has a B base for growth for many years to come.

Jamaica Broilers although out of the TOP10, is undervalued and possesses good long term growth prospects as they constantly spend resources to expand or modernise the operation.

In Main Market activity this past week, General Accident jumped 16 percent to $6.15, a 52 weeks’ high, with buying interest in recent weeks, being very high and active supply in the market low, a recipe for higher prices ahead and Key Insurance lost 14 percent to end at $2.22.

The Junior Market closed the week with a 17 percent jump for Iron Rock Insurance to $2.51 while Consolidated Bakeries gained 8 percent to $2.19 but Jamaican Teas dropped 13 percent to $2.40 and Caribbean Cream lost 8 percent to land at $3.58 while Express Catering and Access Financial fell by 7 percent to $3.70 and $19.86 respectively.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.1 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 12.5.

The average PE for the JSE Main Market ICTOP 10 stands at 5.5, well below the market average of 13.1 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 12.5.

The Main Market ICTOP10 is projected to gain an average of 274 percent by May 2025, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 183 percent over the same period.

In the Main Market ICTOP 10, a total of 17 of the most highly valued stocks representing 33 percent of the Main Market are priced at a PE of 15 to 106, with an average of 30 and 27 excluding the highest PE ratios, and a PE of 24 for the top half and 21 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 9 stocks, or 20 percent of the market, with PEs ranging from 15 to 50, averaging 22, well above the market’s average. The top half of the market has an average PE of 17, possibly the lowest fair value for stocks, currently.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2025 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

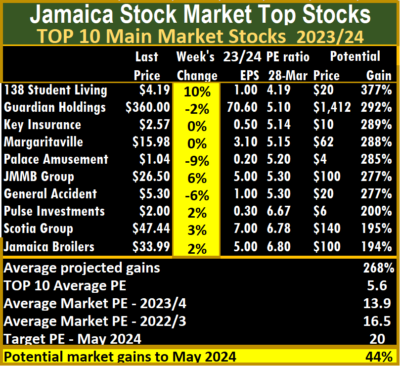

Lasco companies out of ICTOP10

Shake up took place in the ICTOP10 with Lasco Manufacturing that closed up by 10 percent to $6.08 at the end of last week and Lasco Distributors that fell 7 percent to $4.25 and dropping out of the TOP10 following migration from the Junior to the Main Market last week Wednesday.

With the 2024 financial year ending in March, the two companies will see a bump in earnings for 2025 and likely put them in the ICTOP10 again. Since the switch in listing, the number of stocks offered for sale has declined sharply and so have the bids to buy.

With the 2024 financial year ending in March, the two companies will see a bump in earnings for 2025 and likely put them in the ICTOP10 again. Since the switch in listing, the number of stocks offered for sale has declined sharply and so have the bids to buy.

Coming into the Junior Market listing are Consolidated Bakeries, while AMG Packaging returns after a weeks’ absence, with the price falling to $3.12 from $3.27, EPS for the Consolidated Bakeries is projected at 30 cents for 2024, pushing it into position 2. The company promised much with a good brand but has delivered inadequate returns since being listed in 2013, but the operations have been undergoing changes with more focus on higher margin products and less on the regular breads, that faces greater competition in the market. A review of the 2023 audited statements shows that cost jumped but this was mostly for big wage increases which should moderate in 2025. Investing in the company is not without risk but it should benefit from continued growth and improved employment in the local economy going forward that should result in revenues growing faster than cost.

There were no new listing in the Main Market, but 138 Student Living rose 10 percent to $4.19 and JMMB Group gained 6 percent to close trading last week at $26.50, while Palace Amusements shed 9 percent to $1.04 and General Accident fell 6 percent to $5.30.

The Junior Market closed last week in positive territory as Stationery & Office Supplies climbed 13 percent to $1.70 while, Jamaican Teas, ISP Finance and Lasco Manufacturing all gained 10 percent, Iron Rock Insurance dropped 15 percent to $2.14 and Lasco Distributors fell 7 percent to $4.25.

There were no changes to the list of companies in the Main Market TOP10 this past week.

The average PE for the JSE Main Market ICTOP 10 stands at 5.6, well below the market average of 13.4 and the Junior Market TOP10 sits at 7.2 over half of the market, with an average of 13.3.

The Main Market ICTOP10 is projected to gain an average of 270 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 178 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 270 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 178 percent over the same period.

In the Main Market ICTOP 10, a total of 16 of the most highly valued stocks representing 31 percent of the Main Market are priced at a PE of 15 to 106, with an average of 32 and 23 excluding the highest PE ratios, and a PE of 24 for the top half and 19 excluding the stocks with overweight values.

In the Junior Market IC TOP10 are 9 stocks, or 20 percent of the market, with PEs ranging from 15 to 50, averaging 23, well above the market’s average. The top half of the market has an average PE of 18, possibly the lowest fair value for stocks, currently.

Of great import is that the averages of both markets are now converging around a PE of 20 for close to a third of the market, as the year is coming to a close and with more information available on the full year’s earnings.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns on or around May 2024 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

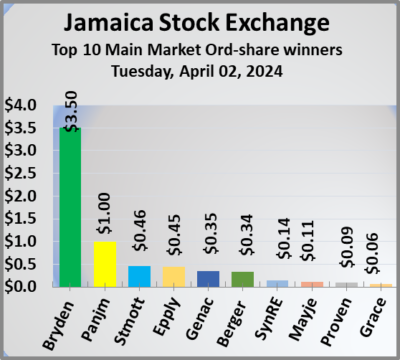

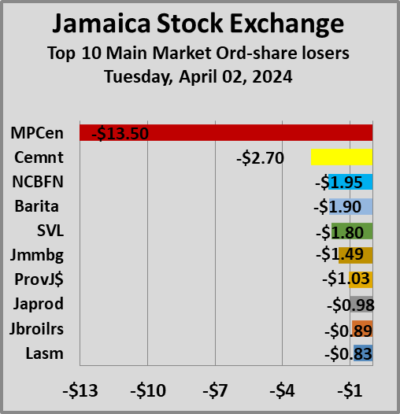

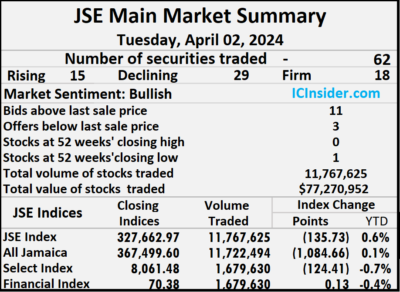

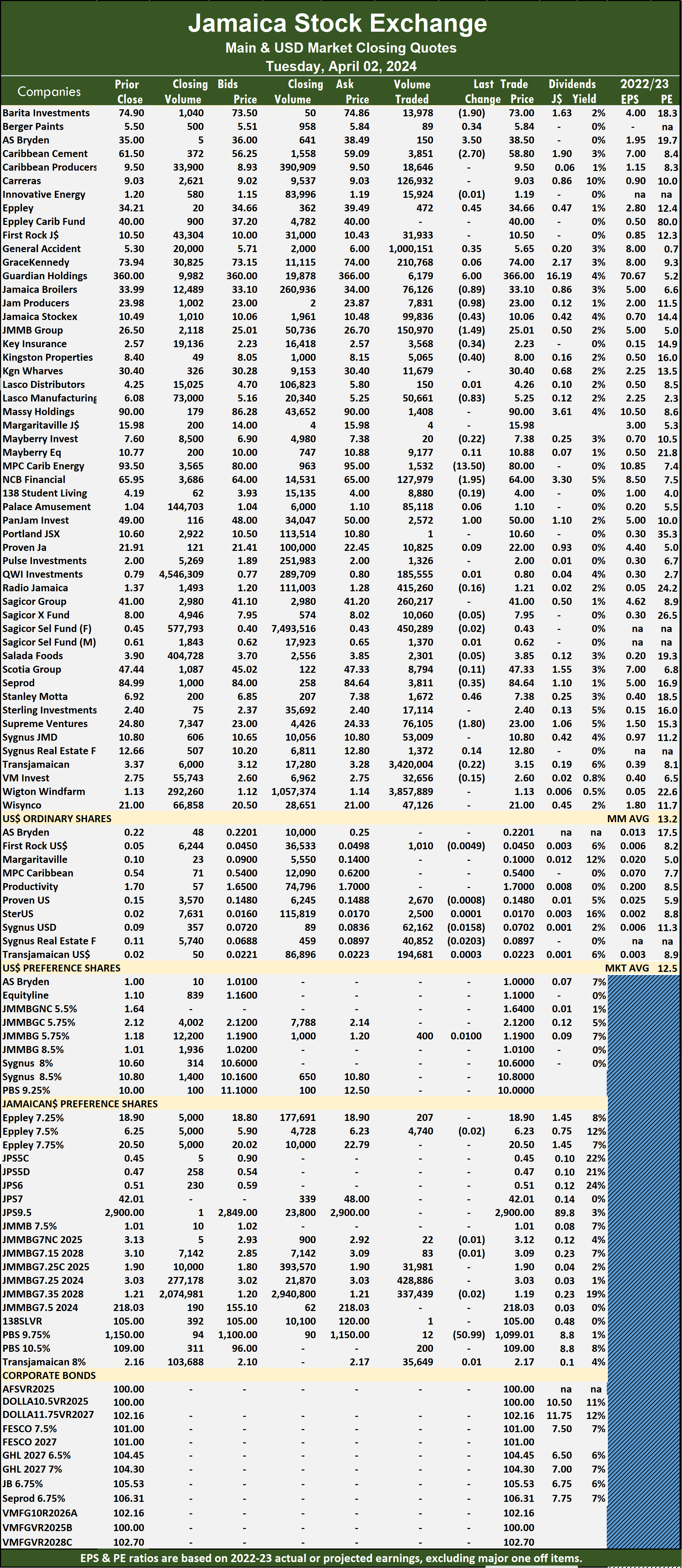

JSE Main Market slips into April

Following the closure of trading for the long Easter weekend, the Jamaica Stock Exchange Main Market ended on Tuesday, with declining stocks overpowering winning two to one following a 25 percent fall in the volume of stocks traded declining with a 54 percent drop in value compared to Thursday, with trading in 62 securities compared with 60 on Thursday, with prices of 15 stocks rising, 29 declining and 18 ending unchanged as Radio Jamaica closed at a 52 weeks’ low of $1.20.

The market closed with 11,767,625 shares being traded for $77,270,952 compared with 15,645,101 units at $167,372,295 on Thursday.

The market closed with 11,767,625 shares being traded for $77,270,952 compared with 15,645,101 units at $167,372,295 on Thursday.

Trading averaged 189,800 shares at $1,246,306 compared to 260,752 units at $2,789,538 on Thursday compared to March that closed with an average of 828,473 units at $2,341,254.

Wigton Windfarm led trading with 3.86 million shares for 32.8 percent of the overall volume followed by Transjamaican Highway with 3.42 million units for 29.1 percent of the day’s trade and General Accident with 1.0 million units for 8.5 percent of market share.

The All Jamaican Composite Index sank 1,084.66 points to close trading at 367,499.60, the JSE Main Index declined 135.73 points to settle at 327,662.97 and the JSE Financial Index rallied 0.13 points to 70.38.

The Main Market ended trading with an average PE Ratio of 13.2. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden jumped $3.50 and ended at $38.50 in an exchange of 150 stocks, Barita Investments lost $1.90 to close at $73 with investors swapping 13,978 units, Berger Paints popped 34 cents to end at $5.84 after 89 shares passed through the market. Caribbean Cement sank $2.70 in closing at $58.80 after an exchange of 3,851 stock units, Eppley rallied 45 cents to close at $34.66 in switching ownership of 472 shares, General Accident increased 35 cents to $5.65 after a transfer of 1,000,151 stock units. Guardian Holdings climbed $6 to close at $366, with 6,179 units changing hands, Jamaica Broilers declined 89 cents to $33.10 in an exchange of 76,126 units. Jamaica Producers fell 98 cents to end at $23 with investors dealing in 7,831 stocks, Jamaica Stock Exchange skidded 43 cents to $10.06, with 99,836 shares crossing the market, JMMB Group dropped $1.49 and ended at $25.01 in trading 150,970 stock units. Key Insurance shed 34 cents to close at $2.23 after an exchange of 3,568 shares, Kingston Properties dipped 40 cents in closing at $8 after 5,065 stock units passed through the market,  Lasco Manufacturing sank 83 cents to end at $5.25 as investors traded 50,661 stocks. MPC Caribbean Clean Energy dropped $13.50 to $80 with an exchange of 1,532 units, NCB Financial lost $1.95 to end at $64 with investors trading 127,979 shares, Pan Jamaica gained $1 in closing at $50, with 2,572 units crossing the exchange. Seprod skidded 35 cents to close at $84.64 with investors transferring 3,811 stocks, Stanley Motta rose 46 cents and ended at $7.38 with 1,672 stock units clearing the market and Supreme Ventures fell $1.80 to $23 while exchanging 76,105 shares.

Lasco Manufacturing sank 83 cents to end at $5.25 as investors traded 50,661 stocks. MPC Caribbean Clean Energy dropped $13.50 to $80 with an exchange of 1,532 units, NCB Financial lost $1.95 to end at $64 with investors trading 127,979 shares, Pan Jamaica gained $1 in closing at $50, with 2,572 units crossing the exchange. Seprod skidded 35 cents to close at $84.64 with investors transferring 3,811 stocks, Stanley Motta rose 46 cents and ended at $7.38 with 1,672 stock units clearing the market and Supreme Ventures fell $1.80 to $23 while exchanging 76,105 shares.

In the preference segment, Productive Business Solutions 10.5% preference share dropped $50.99 to end at $1,099.01 with a transfer of 12 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

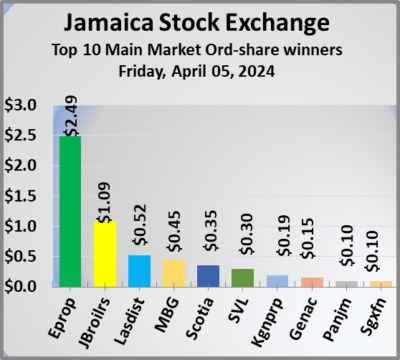

Trading drops & prices fall on Main Market

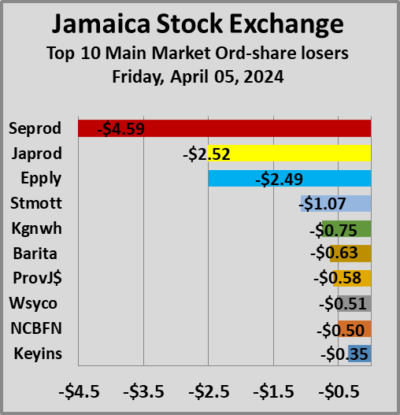

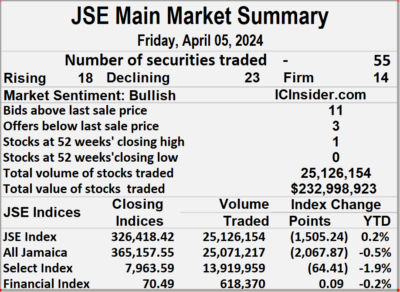

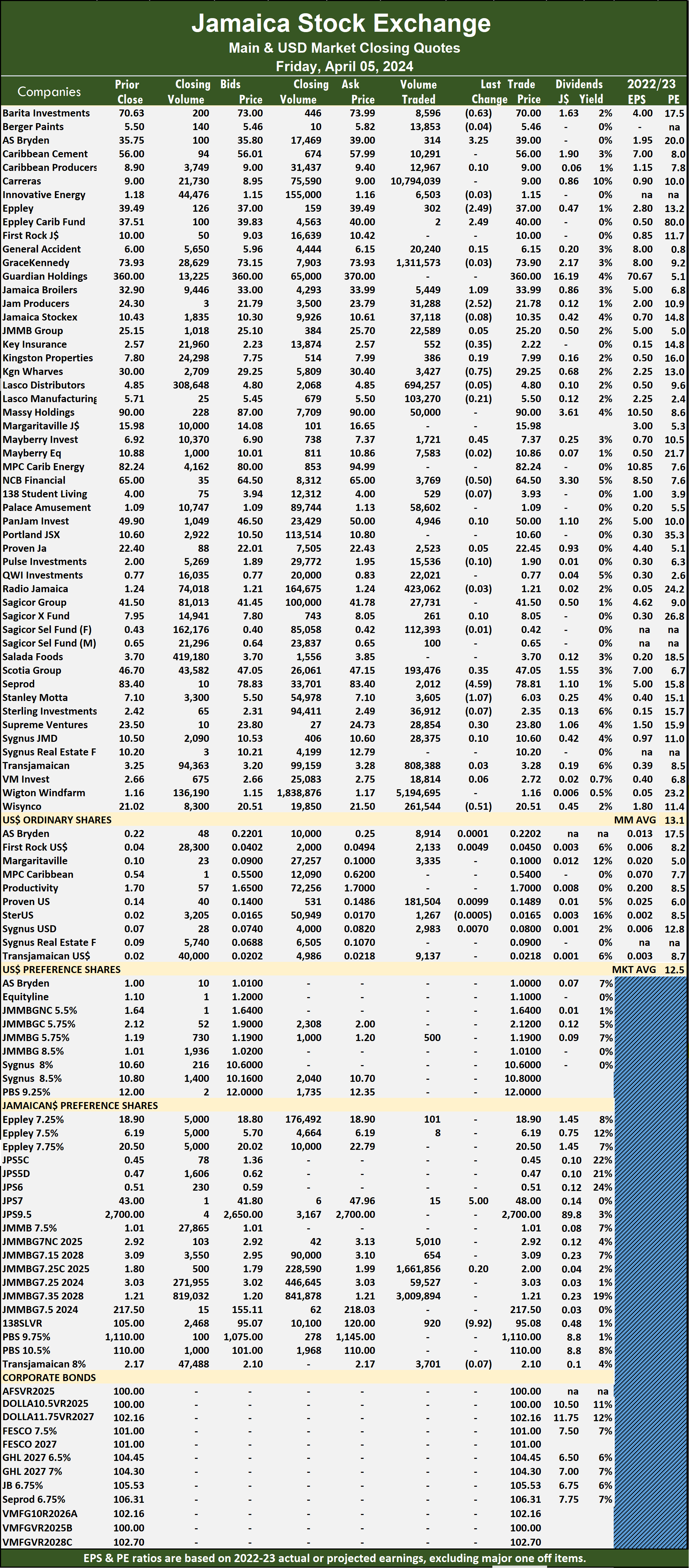

Trading slipped on the Jamaica Stock Exchange Main Market ended on Friday and pulled the Market indices with it after a 95 percent drop in the volume of stocks traded and an 87 percent fall in value compared with that on Thursday, with trading in 55 securities compared with 61 on Thursday and resulted in prices of 18 stocks rising, 23 declining and 14 ending unchanged.

The market closed with an exchange of 25,126,154 shares for $233,060,092, well down from 551,681,523 units at $1,798,734,217 on Thursday.

The market closed with an exchange of 25,126,154 shares for $233,060,092, well down from 551,681,523 units at $1,798,734,217 on Thursday.

Trading averaged 456,839 shares at $4,237,456 compared to 9,043,959 units at $29,487,446 on Thursday and month to date, an average of 2,585,174 units at $9,516,984 compared with 3,224,837 units at $11,103,727 on the previous day and March that closed with an average of 828,473 units at $2,341,254.

Carreras led trading with 10.79 million shares for 43 percent of total volume followed by Wigton Windfarm with 5.19 million units for 20.7 percent of the day’s trade, JMMB 9.5% preference share chipped in with 3.01 million units for 12 percent market share, as JMMB Group 7.25% preference share due 2024 ended with 1.66 million units for 6.6 percent total shares traded and GraceKennedy with 1.31 million units for 5.2 percent of the overall volume.

The All Jamaican Composite Index slipped 2,067.87 points to conclude trading at 365,157.55, the JSE Main Index skidded 1,505.24 points to wrap up trading at 326,418.42 and the JSE Financial Index rallied 0.09 points to 70.49.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.1. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 11 stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, AS Bryden gained $3.25 in closing at $39 with an exchange of 314 stock units, Barita Investments lost 63 cents to end at $70, with 8,596 shares crossing the market, Eppley shed $2.49 to end at $37 with a transfer of 302 units. Eppley Caribbean Property Fund rose $2.49 to close at $40 after investors ended trading just two stocks, Jamaica Broilers rallied $1.09 and ended at $33.99 in an exchange of 5,449 shares, Jamaica Producers fell $2.52 to finish at $21.78 with 31,288 stock units clearing the market. Key Insurance dipped 35 cents and ended at $2.22 in trading 552 stocks, Kingston Wharves sank 75 cents to $29.25, with 3,427 units crossing the market, Mayberry Group increased 45 cents to close at $7.37 in an exchange of 1,721 shares.  NCB Financial skidded 50 cents to end at $64.50 with investors transferring 3,769 units, Scotia Group climbed 35 cents in closing at $47.05 in switching ownership of 193,476 stocks, Seprod shed $4.59 to finish at $78.81 and closed with an exchange of 2,012 stock units. Stanley Motta declined $1.07 to $6.03 after 3,605 shares passed through the market, Supreme Ventures popped 30 cents to finish at $23.80 after an exchange of 28,854 stock units and Wisynco Group dropped 51 cents and ended at $20.51 with investors trading 261,544 stocks.

NCB Financial skidded 50 cents to end at $64.50 with investors transferring 3,769 units, Scotia Group climbed 35 cents in closing at $47.05 in switching ownership of 193,476 stocks, Seprod shed $4.59 to finish at $78.81 and closed with an exchange of 2,012 stock units. Stanley Motta declined $1.07 to $6.03 after 3,605 shares passed through the market, Supreme Ventures popped 30 cents to finish at $23.80 after an exchange of 28,854 stock units and Wisynco Group dropped 51 cents and ended at $20.51 with investors trading 261,544 stocks.

In the preference segment, Jamaica Public Service 7% advanced $5 to end at $48 with 15 units crossing the exchange and Productive Business Solutions 9.75% preference share fell $9.92 in closing at $95.08 with traders dealing in 920 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

- « Previous Page

- 1

- …

- 66

- 67

- 68

- 69

- 70

- …

- 1487

- Next Page »