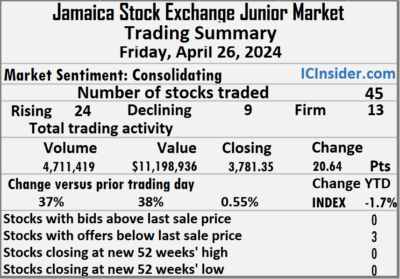

Stocks mostly rose on the Junior Market of the Jamaica Stock Exchange on Friday, after trading in 45 securities compared with 40 on Thursday and ending with prices of 24 rising, 9 declining and 12 closing unchanged following a 37 percent rise in the volume of stocks traded, with 38 percent greater value than Thursday.

At the close of trading, the Junior Market Index rallied 20.64 points to end the day at 3,781.35.

At the close of trading, the Junior Market Index rallied 20.64 points to end the day at 3,781.35.

Trading ended with 4,711,419 shares for $11,198,936 up from 3,441,451 units at $8,137,990 on Thursday.

Trading averaged 104,698 shares at $248,865, up from 86,036 units at $203,450 on Thursday with the month to date, averaging 189,955 units at $422,648 but slightly down from 194,892 stock units at $432,712 on the previous day and March ending with an average of 221,659 units at $464,382.

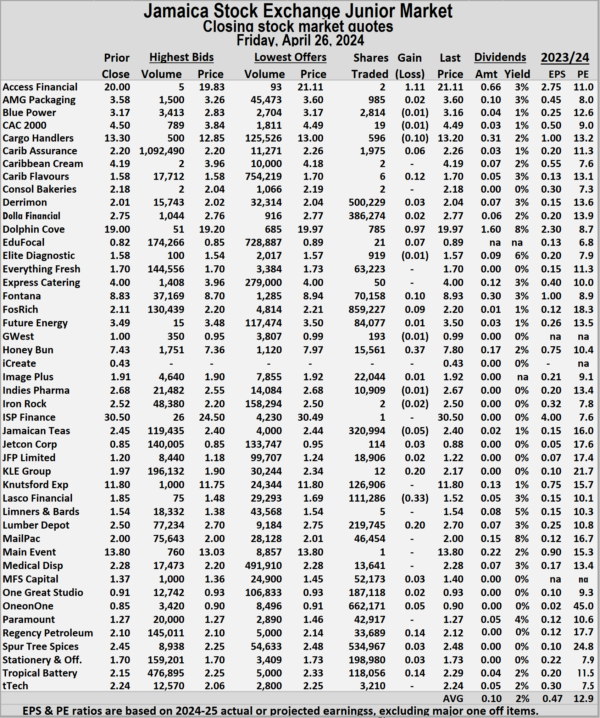

Fosrich led trading with 859,227 shares for 18.2 percent of total volume followed by ONE on ONE Educational with 662,171 units for 14.1 percent of the day’s trade and Spur Tree Spices with 534,967 units for 11.4 percent market share.

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.9, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

Investor’s Choice bid-offer indicator shows none ended with a bid higher than the last selling price and three with lower offers.

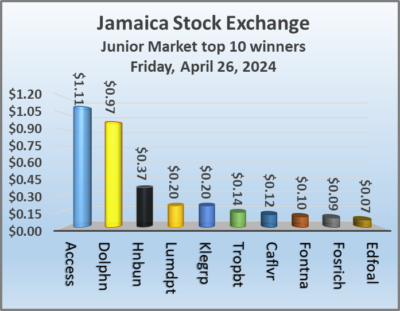

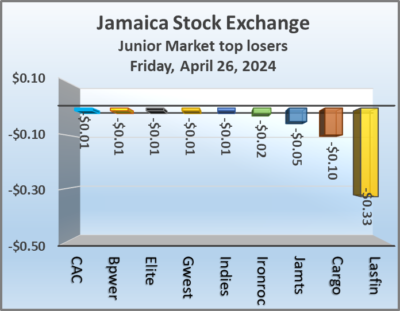

At the close, Access Financial gained $1.11 to end at $21.11, after just two stocks passed through the market, Cargo Handlers dipped 10 cents in closing at $13.20 with traders dealing in 596 units, Caribbean Assurance Brokers rose 6 cents to close at $2.26 with 1,975 shares clearing the market. Caribbean Flavours advanced 12 cents to end at $1.70 with investors swapping a mere 6 stock units, Dolphin Cove popped 97 cents to finish at $19.97 with an exchange of just 785 shares, EduFocal rallied 7 cents and ended at 89 cents, with 21 stocks crossing the market.  Fontana increased 10 cents to $8.93 in an exchange of 70,158 units, Fosrich climbed 9 cents in closing at $2.20 with investors dealing in 859,227 stock units, Honey Bun popped 37 cents to finish at $7.80 in an exchange of 15,561 shares. Jamaican Teas lost 5 cents and ended at $2.40 with investors trading 320,994 stock units, KLE Group increased 20 cents to close at $2.17 after an exchange of 12 stocks, Lasco Financial slipped 33 cents to end at $1.52 with 111,286 units passing through the market. Lumber Depot climbed 20 cents to $2.70 after a transfer of 219,745 shares, ONE on ONE Educational rose 5 cents to finish at 90 cents as investors exchanged 662,171 units and Tropical Battery rallied 14 cents and ended at $2.29 and closed with an exchange of 118,056 stocks.

Fontana increased 10 cents to $8.93 in an exchange of 70,158 units, Fosrich climbed 9 cents in closing at $2.20 with investors dealing in 859,227 stock units, Honey Bun popped 37 cents to finish at $7.80 in an exchange of 15,561 shares. Jamaican Teas lost 5 cents and ended at $2.40 with investors trading 320,994 stock units, KLE Group increased 20 cents to close at $2.17 after an exchange of 12 stocks, Lasco Financial slipped 33 cents to end at $1.52 with 111,286 units passing through the market. Lumber Depot climbed 20 cents to $2.70 after a transfer of 219,745 shares, ONE on ONE Educational rose 5 cents to finish at 90 cents as investors exchanged 662,171 units and Tropical Battery rallied 14 cents and ended at $2.29 and closed with an exchange of 118,056 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

The value of Pref shares vs ordinary ones

Investors drove up prices of several preference shares on the Jamaica Stock Exchange in 2023 to unrealistic levels that defile logic, while ordinary shares can enjoy unlimited rise driven by growth in profits the same is not the case for preference shares that have limited potential for growth.

Many of those listed on the JSE have limited life spans as they are primarily income generating instruments, with a finite life span. The JMMB preference shares are in this category. The old JPS preference shares that were issued at $2 each have declined in value due to a decline in interest rates but the supply of these are very limited. These seem to have no set date to be repaid.

Many of those listed on the JSE have limited life spans as they are primarily income generating instruments, with a finite life span. The JMMB preference shares are in this category. The old JPS preference shares that were issued at $2 each have declined in value due to a decline in interest rates but the supply of these are very limited. These seem to have no set date to be repaid.

Investors may be confused about the likely value of Transjamaican 8.5 percent preference shares. Some think the fair value should be closer to $4, but that is not so and will only be the case if market interest rates fall below 8.5 percent, even then the short term nature of these shares makes it unlikely that rational investors would push the price to that level. The Transjamaican preference shares have an 8 year timeline, with annual repayment of principal starting on the 6th anniversary.

The true value of the ordinary shares should be over $4. They currently provide a dividend yield close to where the preference shares trade currently, with expectations that there will be a greater level of dividend payment in the future.

Ordinary shares offer unlimited capital appreciation and the potential for an endless dividend stream depending on the level of profit generated. Preference shares have limited capital upside potential unless they have participative features, allowing them to share in profits over and above the coupon rate.

Ordinary shares offer unlimited capital appreciation and the potential for an endless dividend stream depending on the level of profit generated. Preference shares have limited capital upside potential unless they have participative features, allowing them to share in profits over and above the coupon rate.

None of the preference shares listed on the Jamaica Stock Exchange have participation features. Long ago the shares of Jasmaica Livestock that were listed on the local exchange had such a feature. With interest rates on the Bank of Jamaica certificate of deposits just under 11% currently, the prices of the preference shares on the market should have declined to better equate the yields with the CD rates and as these rates fall, the share prices should be rising to reflect the better returns from Preference shares that is possible.

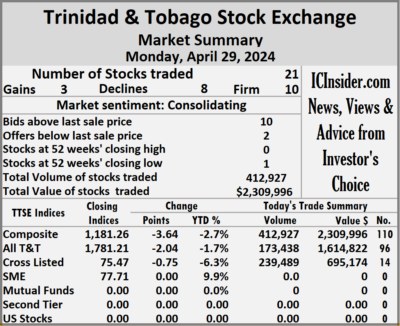

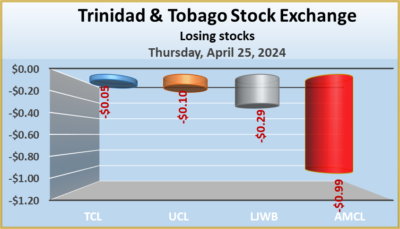

Losing Trinidad stocks bested winners

The Trinidad and Tobago Stock Exchange slipped on Monday, with declining stocks beating out those rising by nearly three to one, even as the volume of stocks traded jumped 235 percent with a 187 percent greater value than on Friday resulting in trading in 21 securities compared with 19 on Friday and ending with prices of three rising, eight declining and 10 remaining unchanged.

The market closed with an exchange of 412,927 shares for $2,309,996 up from 123,443 stock units at $805,947 on Friday.

The market closed with an exchange of 412,927 shares for $2,309,996 up from 123,443 stock units at $805,947 on Friday.

An average of 19,663 shares were traded at $110,000 compared to 6,497 units at $42,418 on Friday, with trading month to date averaging 17,895 shares at $176,513 compared with 17,789 units at $180,504 on the previous day and an average for March of 28,236 shares at $236,496.

The Composite Index lost 3.64 points to 1,181.26, the All T&T Index slipped 2.04 points to end at 1,781.21, the SME Index remained unchanged at 77.71 and the Cross-Listed Index dipped 0.75 points to settle at 75.47.

Investor’s Choice bid-offer indicator shows 10 stocks ended with bids higher than their last selling prices and two with lower offers.

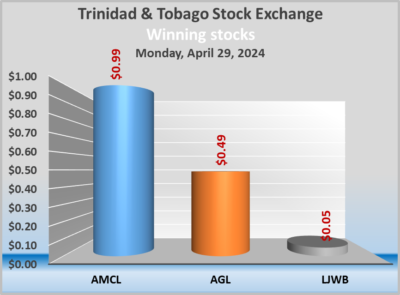

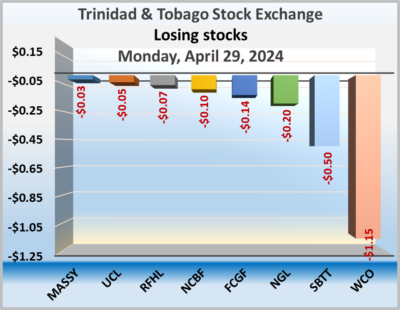

At the close, Agostini’s advanced 49 cents to $69.50, with 1,053 shares crossing the exchange, Angostura Holdings ended at $22.95 after a transfer of 100 units, Ansa McAl popped 99 cents to $56 with investors trading 2,565 stock.  First Citizens Group fell 14 cents to $48.16 with 1,829 stocks being traded, FirstCaribbean International Bank ended at $6.95 with investors dealing in 176 shares, Guardian Holdings remained at $18.05 in switching ownership of 2,700 units. JMMB Group ended at $1.40 with investors transferring 149 stocks, L.J. Williams B share increased 5 cents to end at $1.80 in an exchange of 5,000 units, Massy Holdings skidded 3 cents in closing at $4.32 with investors trading 6,400 shares. National Enterprises closed at $3.70 with an exchange of 39,544 units, National Flour Mills ended at $2.20 after 1,500 stocks passed through the market, NCB Financial sank 10 cents to close at $2.90 after an exchange of 239,164 stock units. One Caribbean Media remained at $3.70, with 804 shares crossing the market, Point Lisas ended at $3.90 with a transfer of a mere one stock unit, Prestige Holdings ended at $13 with investors swapping 3,862 units.

First Citizens Group fell 14 cents to $48.16 with 1,829 stocks being traded, FirstCaribbean International Bank ended at $6.95 with investors dealing in 176 shares, Guardian Holdings remained at $18.05 in switching ownership of 2,700 units. JMMB Group ended at $1.40 with investors transferring 149 stocks, L.J. Williams B share increased 5 cents to end at $1.80 in an exchange of 5,000 units, Massy Holdings skidded 3 cents in closing at $4.32 with investors trading 6,400 shares. National Enterprises closed at $3.70 with an exchange of 39,544 units, National Flour Mills ended at $2.20 after 1,500 stocks passed through the market, NCB Financial sank 10 cents to close at $2.90 after an exchange of 239,164 stock units. One Caribbean Media remained at $3.70, with 804 shares crossing the market, Point Lisas ended at $3.90 with a transfer of a mere one stock unit, Prestige Holdings ended at $13 with investors swapping 3,862 units.  Republic Financial slipped 7 cents and ended at $118.20 with 758 stocks clearing the market, Scotiabank lost 50 cents to close at $67 as investors traded 160 units, Trinidad & Tobago NGL declined 20 cents to finish at $8.30, with 5,308 shares passing through the market. Trinidad Cement ended at $2.55 with traders dealing in 20,596 stock units, Unilever Caribbean shed 5 cents to $11.15 in an exchange of 5,030 stocks and West Indian Tobacco dropped $1.15 in closing at $10, with 76,228 shares changing hands.

Republic Financial slipped 7 cents and ended at $118.20 with 758 stocks clearing the market, Scotiabank lost 50 cents to close at $67 as investors traded 160 units, Trinidad & Tobago NGL declined 20 cents to finish at $8.30, with 5,308 shares passing through the market. Trinidad Cement ended at $2.55 with traders dealing in 20,596 stock units, Unilever Caribbean shed 5 cents to $11.15 in an exchange of 5,030 stocks and West Indian Tobacco dropped $1.15 in closing at $10, with 76,228 shares changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Remittance inflows to Jamaica fall

Remittance inflows to Jamaica continue to decline at the start of 2024 following several months of decline last year, with inflows for January 2024 amounting to US$246 million, down a relatively small 1.1 percent compared with US$248.6 in January 2023.

The decline represents the eighth consecutive month of negative inflows since June last year for the country.

The decline represents the eighth consecutive month of negative inflows since June last year for the country.

Jamaica’s decline of 1.1 percent was in contrast to the growth of 3.8 percent in January last year. Total inflows last year declined by two percent to US$3.37 billion from US$3.44 billion in 2022. Inflows peaked at US$3.497 billion in 2021.

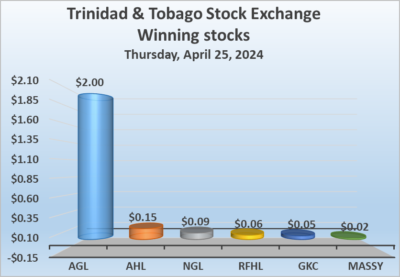

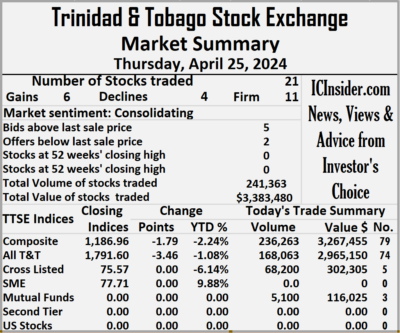

Rising stocks beat decliners on Trinidad Exchange

Trading ended on the Trinidad and Tobago Stock Exchange on Thursday, with the volume of stocks traded declining 83 percent, with the value 68 percent lower than on Wednesday, resulting in the trading of 21 securities compared with 22 on Wednesday and ending with prices of six stocks rising, four declining and 11 remaining unchanged.

Trading closed with an exchange of 241,363 shares for $3,383,480 versus 1,416,843 stocks at $10,593,318 on Wednesday.

Trading closed with an exchange of 241,363 shares for $3,383,480 versus 1,416,843 stocks at $10,593,318 on Wednesday.

An average of 11,493 shares were traded at $161,118 down from 64,402 stocks at $481,514 on Wednesday. Trading for the month to date averages 18,437 shares at $188,430 compared to 18,907 units at $190,281 on the previous day and March that ended with an average of 28,236 shares at $236,496.

The Composite Index dipped 1.79 points to 1,186.96, the All T&T Index dropped 3.46 points to 1,791.60, the SME Index remained unchanged at 77.71 and the Cross-Listed Index remained unchanged at 75.57.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s climbed $2 to close at $71 as investors exchanged 510 stock units, Angostura Holdings popped 15 cents to $22.95 after 130 shares passed through the market, Ansa McAl fell 99 cents to end at $55.01 after an exchange of 3,700 units.  Ansa Merchant Bank remained at $45.30 with investors swapping 5 stocks, Calypso Macro Investment Fund ended at $22.75 in swapping 5,100 shares, First Citizens Group remained at $48.30 after a transfer of 658 stocks. FirstCaribbean International Bank ended at $6.95 with 10,000 stock units being traded, GraceKennedy gained 5 cents in closing at $4.05 with investors trading 58,200 stocks, Guardian Holdings remained at $18.05 in an exchange of 25 shares. Guardian Media ended at $1.98 after trading of 5 stock units, L.J. Williams B share shed 29 cents and ended at $1.70 after an exchange of 700 stocks, Massy Holdings rose 2 cents to close at $4.35 with a transfer of 42,346 units. National Enterprises remained at $3.85 after 971 stocks changed hands,

Ansa Merchant Bank remained at $45.30 with investors swapping 5 stocks, Calypso Macro Investment Fund ended at $22.75 in swapping 5,100 shares, First Citizens Group remained at $48.30 after a transfer of 658 stocks. FirstCaribbean International Bank ended at $6.95 with 10,000 stock units being traded, GraceKennedy gained 5 cents in closing at $4.05 with investors trading 58,200 stocks, Guardian Holdings remained at $18.05 in an exchange of 25 shares. Guardian Media ended at $1.98 after trading of 5 stock units, L.J. Williams B share shed 29 cents and ended at $1.70 after an exchange of 700 stocks, Massy Holdings rose 2 cents to close at $4.35 with a transfer of 42,346 units. National Enterprises remained at $3.85 after 971 stocks changed hands,  National Flour Mills ended at $2.20 in an exchange of 12,307 units, Prestige Holdings remained at $13, with 262 shares crossing the market. Republic Financial gained 6 cents in closing at $118.27 with traders dealing in 12,219 stocks, Scotiabank ended at $67.50, after 1,997 shares changed hands, Trinidad & Tobago NGL advanced 9 cents to close at $8.59 with 2,244 units crossing the exchange. Trinidad Cement sank 5 cents to $2.70 with investors dealing in 16,000 stock units, Unilever Caribbean dropped 10 cents to close at $11.20 after 41,042 stock units crossed the market and West Indian Tobacco ended at $11.15 with an exchange of 32,942 shares.

National Flour Mills ended at $2.20 in an exchange of 12,307 units, Prestige Holdings remained at $13, with 262 shares crossing the market. Republic Financial gained 6 cents in closing at $118.27 with traders dealing in 12,219 stocks, Scotiabank ended at $67.50, after 1,997 shares changed hands, Trinidad & Tobago NGL advanced 9 cents to close at $8.59 with 2,244 units crossing the exchange. Trinidad Cement sank 5 cents to $2.70 with investors dealing in 16,000 stock units, Unilever Caribbean dropped 10 cents to close at $11.20 after 41,042 stock units crossed the market and West Indian Tobacco ended at $11.15 with an exchange of 32,942 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD Market drops

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with a 29 percent decline in the volume of stocks that changed hands following a 25 percent drop in value compared with market activity on Wednesday, resulting in trading in eight securities, compared to eight on Wednesday with prices of two rising, four declining and two ending unchanged.

The market closed with an exchange of 257,793 shares for US$17,324 down from 363,343 stock units at US$23,058 on Wednesday.

The market closed with an exchange of 257,793 shares for US$17,324 down from 363,343 stock units at US$23,058 on Wednesday.

Trading averaged 32,224 units at US$2,166 versus 45,418 shares at US$2,882 on Wednesday, with a month to date average of 38,643 shares at US$2,342 compared with 39,018 units at US$2,352 on the previous day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index skidded 1.80 points to cease trading at 237.54.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.6. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, AS Bryden ended at 22.49 US cents and closed after an exchange of 284 shares, Proven Investments declined 1.02 cents to 13.65 US cents after an exchange of 470 shares, Sterling Investments rose 0.1 of a cent to finish at 1.6 US cents with a transfer of 21,000 stocks.  Sygnus Credit Investments shed 0.01of a cent and ended at 8.79 US cents after an exchange of 2,990 units and Transjamaican Highway fell 0.01 of a cent to close at 2.03 US cents with 230,228 stocks clearing the market.

Sygnus Credit Investments shed 0.01of a cent and ended at 8.79 US cents after an exchange of 2,990 units and Transjamaican Highway fell 0.01 of a cent to close at 2.03 US cents with 230,228 stocks clearing the market.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.20 with an exchange of 1,900 units. Productive Business Solutions 9.25% preference share rallied 19 cents to US$11.21, with 164 shares crossing the market and Sygnus Credit Investments E8.5% skidded 40 cents to close at US$10.20 with investors transferring 757 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

BOJ engineers cut in CDs interest rates

Interest rates on Bank of Jamaica dropped to an average of 10.6 percent at the latest CD auction on Wednesday, April 24, following an offer of $34.5 billion to the public in a competitive price auction. The previous auction of $39 5 billion attracted only $37.8 billion in bids, resulting in an average rate of 11.032 percent.

Interest rates on Bank of Jamaica dropped to an average of 10.6 percent at the latest CD auction on Wednesday, April 24, following an offer of $34.5 billion to the public in a competitive price auction. The previous auction of $39 5 billion attracted only $37.8 billion in bids, resulting in an average rate of 11.032 percent.

In today’s auction bids amounting to just over $55 billion were received from 399 applications but only 257 were satisfied, with rates ranging from 9 to 11 percent. The latest offer brings the total amount of 30 days CDS to $125.7 billion which is down sharply from $155 billion on April 5, this year with the averaget rate then of 11.59 percent.

On April 22 the bank offered $14 billion in a 25 month CD that attracted $29 billion in bids and resulted in an average rate of 8.93 percent and put the total amounts in two year CDs to nearly $60 billion.

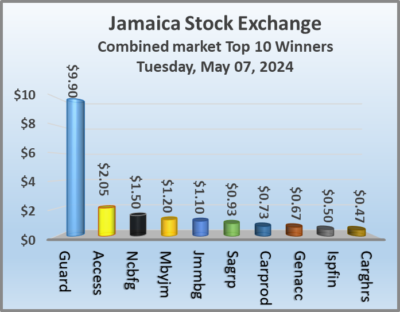

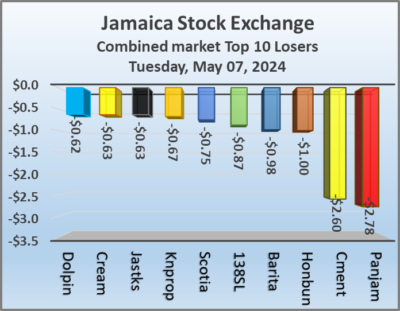

At the end of trading on Tuesday, the JSE Combined Market Index shed 1,210.14 points to 332,553.00, the All Jamaican Composite Index sank 1,855.81 points to 356,728.41. The JSE Main Index dropped 1,104.98 points to close trading at 319,557.13. The Junior Market Index fell 21.65 points to settle at 3,762.08 and the JSE USD Market Index skidded 0.58 points to 235.79.

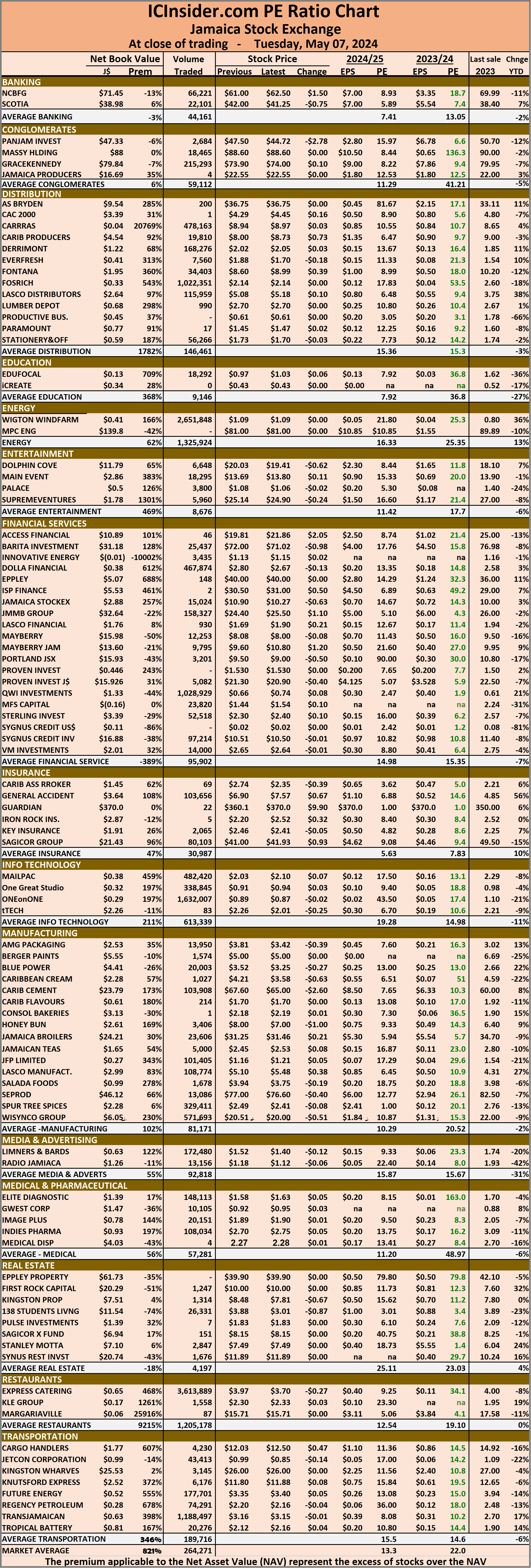

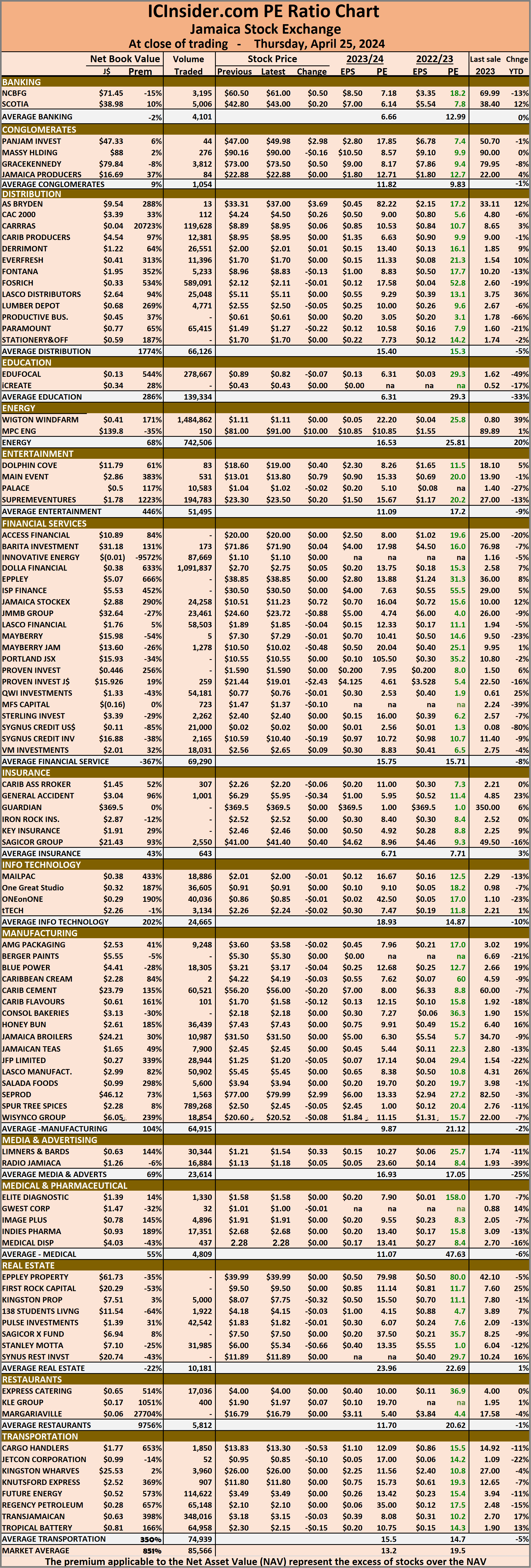

At the end of trading on Tuesday, the JSE Combined Market Index shed 1,210.14 points to 332,553.00, the All Jamaican Composite Index sank 1,855.81 points to 356,728.41. The JSE Main Index dropped 1,104.98 points to close trading at 319,557.13. The Junior Market Index fell 21.65 points to settle at 3,762.08 and the JSE USD Market Index skidded 0.58 points to 235.79. The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 22 on 2023-24 earnings and 13.3. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 22 on 2023-24 earnings and 13.3. times those for 2024-25 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

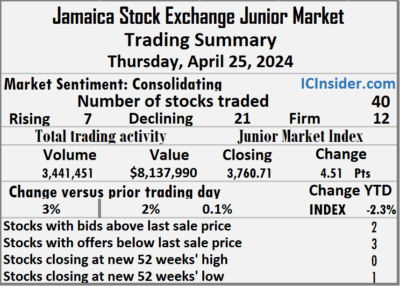

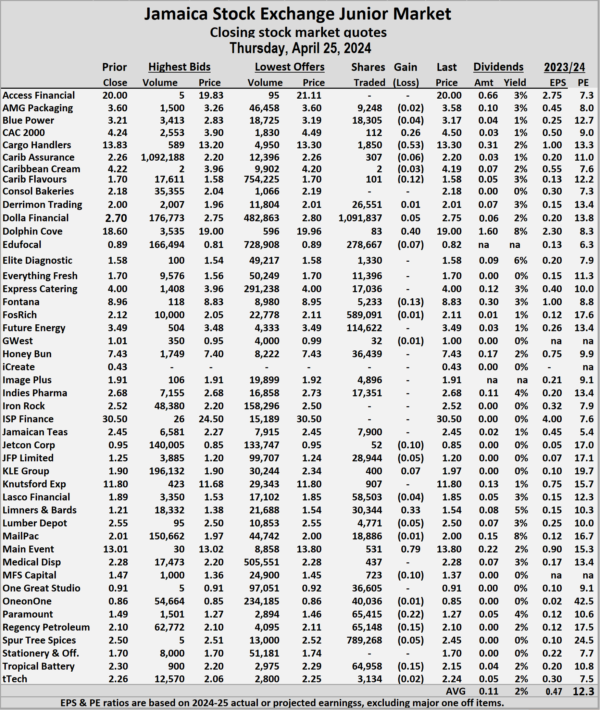

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed with trading of 3,441,451 shares for $8,137,990 up from 3,333,072 units at $7,971,094 on Wednesday.

The market closed with trading of 3,441,451 shares for $8,137,990 up from 3,333,072 units at $7,971,094 on Wednesday. Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and three with lower offers.

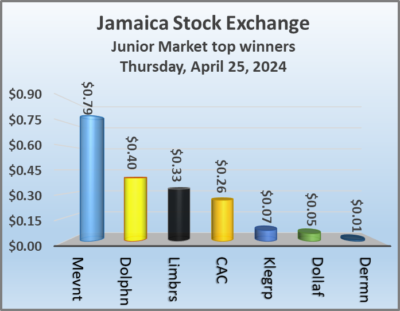

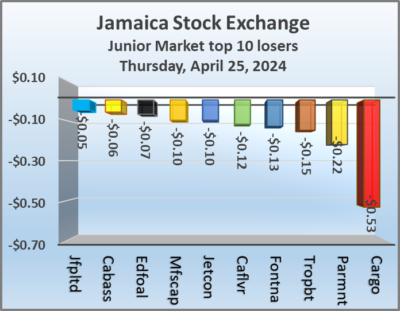

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and three with lower offers. JFP Ltd sank 5 cents to end at $1.20 with investors trading 28,944 stocks, KLE Group increased 7 cents and ended at $1.97 with an exchange of 400 units, Limners and Bards climbed 33 cents to finish at $1.54 with 30,344 stocks passing through the market. Lumber Depot slipped 5 cents to $2.50 and closed with an exchange of 4,771 shares, Main Event popped 79 cents in closing at $13.80 with traders dealing in 531 stock units, MFS Capital Partners dipped 10 cents and ended at $1.37 in switching ownership of 723 stocks. Paramount Trading sank 22 cents to finish at $1.27 with investors swapping 65,415 units, Spur Tree Spices skidded 5 cents to end at $2.45 in an exchange of 789,268 stocks and Tropical Battery lost 15 cents to close at $2.15 in trading 64,958 units.

JFP Ltd sank 5 cents to end at $1.20 with investors trading 28,944 stocks, KLE Group increased 7 cents and ended at $1.97 with an exchange of 400 units, Limners and Bards climbed 33 cents to finish at $1.54 with 30,344 stocks passing through the market. Lumber Depot slipped 5 cents to $2.50 and closed with an exchange of 4,771 shares, Main Event popped 79 cents in closing at $13.80 with traders dealing in 531 stock units, MFS Capital Partners dipped 10 cents and ended at $1.37 in switching ownership of 723 stocks. Paramount Trading sank 22 cents to finish at $1.27 with investors swapping 65,415 units, Spur Tree Spices skidded 5 cents to end at $2.45 in an exchange of 789,268 stocks and Tropical Battery lost 15 cents to close at $2.15 in trading 64,958 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index climbed by 2,382.17 points to 332,588.34, the All Jamaican Composite Index rallied 3,179.32 points to end at 356,115.39, the JSE Main Index jumped 2,452.20 points to end at 319,603.89. The Junior Market Index rose 4.51 points to settle at 3,760.71 and the JSE USD Market Index fell 3.34 points to cease trading at 237.54.

At the close of trading, the JSE Combined Market Index climbed by 2,382.17 points to 332,588.34, the All Jamaican Composite Index rallied 3,179.32 points to end at 356,115.39, the JSE Main Index jumped 2,452.20 points to end at 319,603.89. The Junior Market Index rose 4.51 points to settle at 3,760.71 and the JSE USD Market Index fell 3.34 points to cease trading at 237.54. While in Junior Market trading, Dolla Financial led trading with 1.09 million shares followed by Spur Tree Spices with 789,268 stocks and Fosrich with 589,091 units.

While in Junior Market trading, Dolla Financial led trading with 1.09 million shares followed by Spur Tree Spices with 789,268 stocks and Fosrich with 589,091 units. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.