Trading dropped on the Jamaica Stock Exchange US dollar market on Tuesday, with the volume and value of stocks exchanged declining 49 percent compared to Monday, resulting in the exchanging of six securities, similar to that on Monday with prices of two rising, one declining and three ending unchanged.

The market closed with an exchange of 123,275 shares for US$3,408 down from 243,637 units at US$6,654 on Monday.

The market closed with an exchange of 123,275 shares for US$3,408 down from 243,637 units at US$6,654 on Monday.

Trading averaged 20,546 shares at US$568 versus 40,606 stock units at US$1,109 on Monday, with a month to date average of 34,087 shares at US$2,992 compared with 35,649 units at US$3,271 on the previous day and June with an average of 53,325 units for US$3,682.

The US Denominated Equities Index increased 0.85 points to end the day at 227.22.

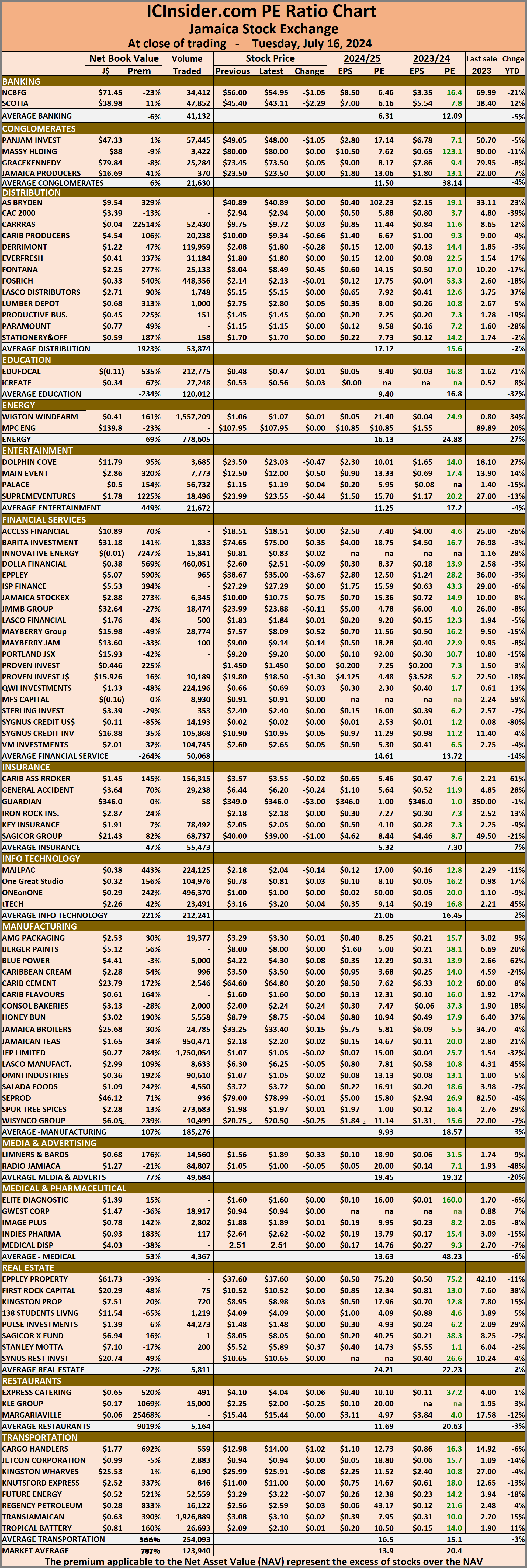

The PE Ratio, a most used measure for computing appropriate stock values, averages 8.2. The PE ratio is based on last traded prices and projected earnings computed by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, AS Bryden ended at 22.49 US cents after 295 shares crossed the exchange,  MPC Caribbean Clean Energy declined 0.15 of a cent to 70 US cents with a transfer of 151 stocks, Proven Investments remained at 12 US cents after an exchange of 7,654 units. Sterling Investments gained 0.05 of a cent to end at 1.58 US cents with investors swapping 14,193 stock units, Sygnus Credit Investments ended at 7.5 US cents after an exchange of 982 shares and Transjamaican Highway popped 0.05 of a cent and ended at 2.05 US cents with investors trading 100,000 stock units.

MPC Caribbean Clean Energy declined 0.15 of a cent to 70 US cents with a transfer of 151 stocks, Proven Investments remained at 12 US cents after an exchange of 7,654 units. Sterling Investments gained 0.05 of a cent to end at 1.58 US cents with investors swapping 14,193 stock units, Sygnus Credit Investments ended at 7.5 US cents after an exchange of 982 shares and Transjamaican Highway popped 0.05 of a cent and ended at 2.05 US cents with investors trading 100,000 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops for JSE USD Market

More decline for Trinidad stocks

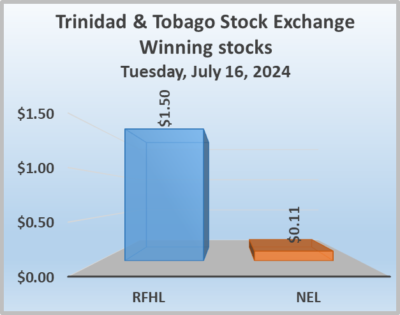

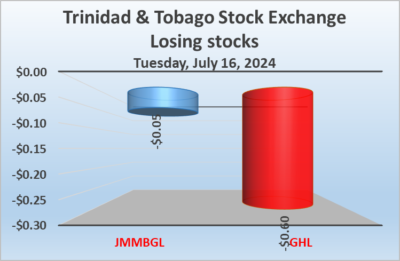

Rising stocks shared the honours in trading on Tuesday with those declining on the Trinidad and Tobago Stock Exchange, resulting from an exchange of 13 securities down from 17 on Monday and ending with prices of two stocks rising, two declining and nine ending firm, with the market suffering another body blow with the main indices declining after the volume of stocks traded rose 5 percent and valued 81 percent less than on Monday.

The market ended trading of 236,530 shares at $1,357,640 versus 225,863 stock units at $7,248,630 on Monday.

The market ended trading of 236,530 shares at $1,357,640 versus 225,863 stock units at $7,248,630 on Monday.

An average of 18,195 shares were traded for $104,434 compared with 13,286 units at $426,390 on Monday, with trading month to date averaging 9,863 shares at $182,820 compared to 9,322 units at $187,914 on the previous day and an average for June of 9,110 shares at $119,497.

The Composite Index dipped 4.45 points to lock up trading at 1,122.06, the All T&T Index sank 6.62 points to 1,685.50, the SME Index remained unchanged at 87.78 and the Cross-Listed Index lost 0.30 points to culminate at 72.67.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and six with lower offers.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, Calypso Macro Investment Fund ended at $24 with investors dealing in 66 shares, First Citizens Group ended with an exchange of 205 stock units at $44, FirstCaribbean International Bank ended at $6.90 with investors exchanging 464 units. GraceKennedy closed at $3.89 after 166,221 stocks crossed the exchange, Guardian Holdings shed 60 cents to close at $15 in switching ownership of 11,164 shares, JMMB Group dipped 5 cents to finish at a 52 weeks’ low of $1.15 with 2,500 units clearing the market.

Massy Holdings ended at $3.80 with an exchange of 41,119 stocks, National Enterprises advanced 11 cents in closing at $3.21, with 355 stock units crossing the market, National Flour Mills remained at $2.12 after an exchange of 45 shares. Republic Financial popped $1.50 to end at $115.50 with a transfer of 2,371 stock units, Scotiabank ended at $64, with 23 units changing hands, Unilever Caribbean closed at $11 with an exchange of 140 stocks and West Indian Tobacco ended at $8.50 after 11,857 units passed through the market.

Massy Holdings ended at $3.80 with an exchange of 41,119 stocks, National Enterprises advanced 11 cents in closing at $3.21, with 355 stock units crossing the market, National Flour Mills remained at $2.12 after an exchange of 45 shares. Republic Financial popped $1.50 to end at $115.50 with a transfer of 2,371 stock units, Scotiabank ended at $64, with 23 units changing hands, Unilever Caribbean closed at $11 with an exchange of 140 stocks and West Indian Tobacco ended at $8.50 after 11,857 units passed through the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Profit surged 144% at the Lab

Net Profit for the half year was $49.4 million, up a b 144 percent above the $20 million generated in 2023, at Limners and Bards for the quarter profit rose 71 percent to $23 million from $13.6 million for the same period in 2023.

The improved profit flowed from reduced costs and better margins as revenues fell sharply in the Media segment, with a $100 million reduction to $206 million. Segment profit fell from $43.5 million to $31.9 million. Media was not the only area of contraction, production had a minor drop in revenues to $127 million from $130 in 2023 but delivered a $13 million fall in profit contribution to $50.6 million from $63 million in 2023. The agency segment saw profit contribution jumping $98 million from $86 million in 2023 with revenues rising from $102 million to $113 million.

The improved profit flowed from reduced costs and better margins as revenues fell sharply in the Media segment, with a $100 million reduction to $206 million. Segment profit fell from $43.5 million to $31.9 million. Media was not the only area of contraction, production had a minor drop in revenues to $127 million from $130 in 2023 but delivered a $13 million fall in profit contribution to $50.6 million from $63 million in 2023. The agency segment saw profit contribution jumping $98 million from $86 million in 2023 with revenues rising from $102 million to $113 million.

For the second quarter, total revenues for the company fell 23 percent from $291 million to $226 million and declined 17 percent to $446 million from $539 million in 2023 for the half year.

Although gross profit fell in both periods, to $91.4 in the latest quarter from $100 million in 2023, down 8.6 percent and declined by 6 percent from $193 million for the six months to $180 million. Gross margin grew, with direct costs declining faster than revenues for half of the year, down 23.5 percent to $265 million from $347 million and by 29.4 in the quarter to $135 million from $191 million.

Administrative expenses fell 17 percent to $69 million in the quarter from $84 million in 2023 and declined 18 percent to $138 million in the half year from $169 million in 2023.

Selling and distribution cost expenses declined in the half year and second quarter by 36 percent to $966,245 in the half million from $1.5 million and by xxx percent in the quarter to $484,477 from $810,997 in 2023. Finance cost declined in the quarter, to $2.6 million from $3.5 million in 2023 and from $6.9 million to $5.2 million for the six months. Finance Income rose from $922,872 to $5.33 million in the quarter and for the six months, it moved from $4.5 million to $8.4 million.

Selling and distribution cost expenses declined in the half year and second quarter by 36 percent to $966,245 in the half million from $1.5 million and by xxx percent in the quarter to $484,477 from $810,997 in 2023. Finance cost declined in the quarter, to $2.6 million from $3.5 million in 2023 and from $6.9 million to $5.2 million for the six months. Finance Income rose from $922,872 to $5.33 million in the quarter and for the six months, it moved from $4.5 million to $8.4 million.

Current assets ended the period at $864 million and Current liabilities at of $298 million. The company has cash and bank balances of $559 million, up from $438 million in 2023.

At the end of April, shareholders’ equity amounts to $647 million with loans payable at $106 million.

Earnings per share for the quarter was two cents and 5 cents for the year to date. IC Insider.com computation projects earnings of 10 cents per share for the fiscal year ending August 2024, with a PE of 16 times the current year’s earnings based on the price of $1.56 the stock traded at on the Jamaica Stock Exchange Junior Market. Net asset value ended the period at $0.68 with the stock selling at 3 times book value.

The company in its quarterly report to shareholders, indicates that they have ventured into the risky business of film production. The first production ‘Jenna In Law’, was officially selected to screen at the 2024 Essence Film Festival this summer in New Orleans, Louisiana.

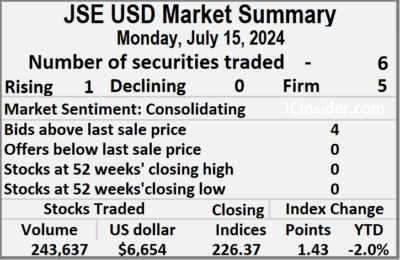

No losses just gains for JSE USD Market

The Jamaica Stock Exchange US dollar market ended on Monday, with the volume of stocks traded declining by 10 percent with an 81 percent lower value than on Friday, resulting in activity in six securities, compared to seven on Friday with prices of one rising and five ending unchanged.

The market closed with an exchange of 243,637 shares for US$6,654 compared to 269,334 units at US$34,981 on Friday.

The market closed with an exchange of 243,637 shares for US$6,654 compared to 269,334 units at US$34,981 on Friday.

Trading averaged 40,606 stock units at US$1,109 versus 38,476 shares at US$4,997 on Friday, with a month to date average of 35,649 shares at US$3,271 compared with 35,003 units at US$3,553 on the previous day and June that ended with an average of 53,325 units for US$3,682.

The US Denominated Equities Index increased 1.43 points to end the day at 226.37.

The PE Ratio, a most used measure for computing appropriate stock values, averages 8.1. The PE ratio is computed based on last traded prices divided by projected earnings done by ICInsider.com for companies with financial year ending and or around August 2025.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and none with a lower offer.

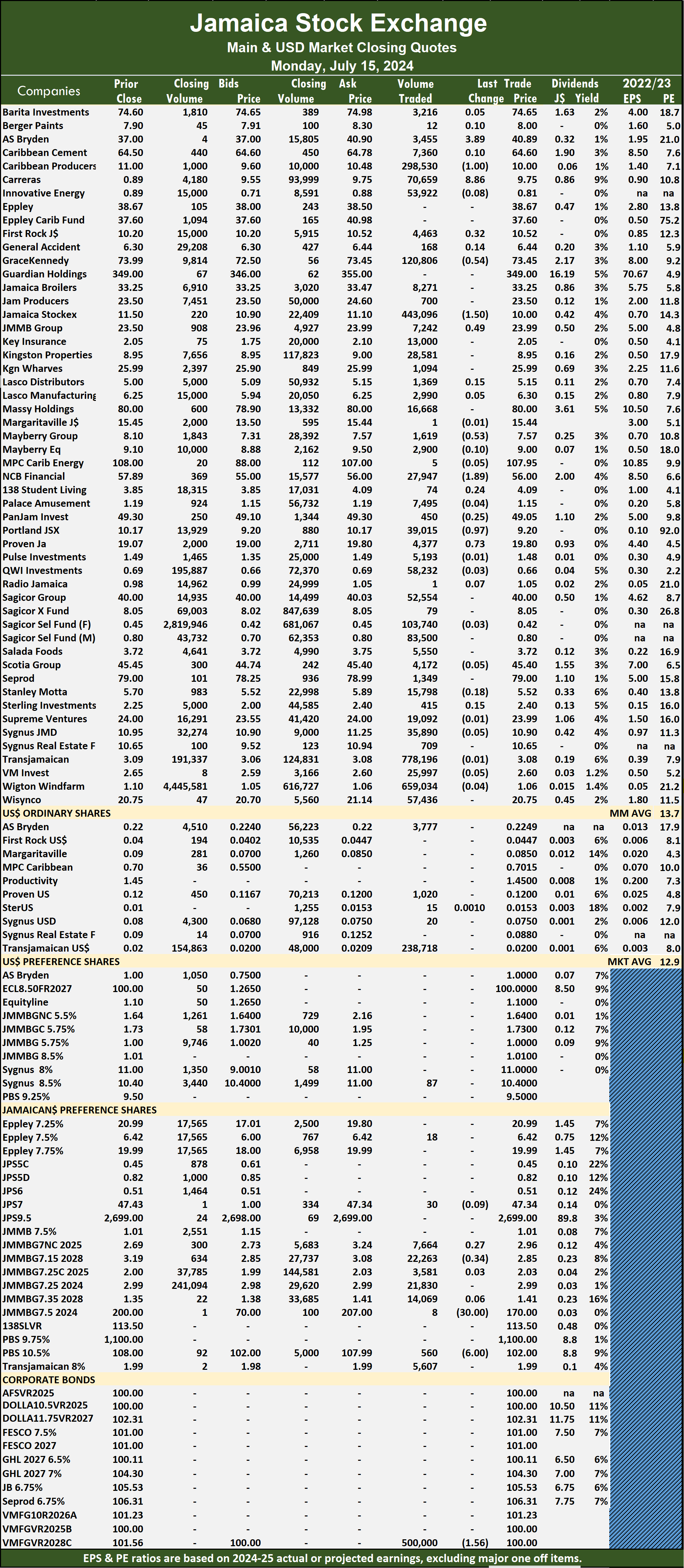

At the market’s close, AS Bryden remained at 22.49 US cents with a transfer of 3,777 units, Proven Investments ended at 12 US cents after an exchange of 1,020 stocks,  Sterling Investments rose 0.1 of a cent and ended at 1.53 US cents with 15 shares clearing the market. Sygnus Credit Investments ended at 7.5 US cents in switching ownership of just 20 stock units and Transjamaican Highway remained at 2 US cents with investors trading 238,718 shares.

Sterling Investments rose 0.1 of a cent and ended at 1.53 US cents with 15 shares clearing the market. Sygnus Credit Investments ended at 7.5 US cents in switching ownership of just 20 stock units and Transjamaican Highway remained at 2 US cents with investors trading 238,718 shares.

In the preference segment, Sygnus Credit Investments E8.5% ended at US$10.40 after a transfer of 87 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

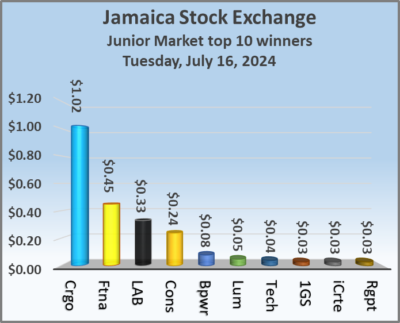

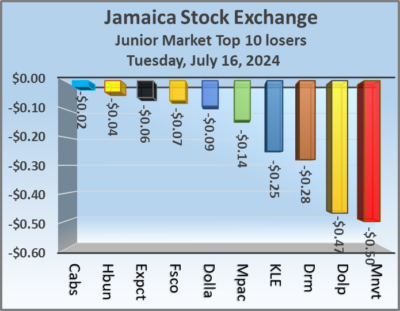

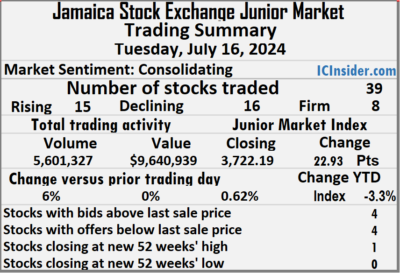

Trading averaged 143,624 shares at $247,204 compared with 120,435 units at $218,644 on Monday with the month to date, averaging 304,747 units at $554,463 compared to 320,942 stock units at $585,348 on the previous day and June with an average of 318,732 units at $696,979.

Trading averaged 143,624 shares at $247,204 compared with 120,435 units at $218,644 on Monday with the month to date, averaging 304,747 units at $554,463 compared to 320,942 stock units at $585,348 on the previous day and June with an average of 318,732 units at $696,979.

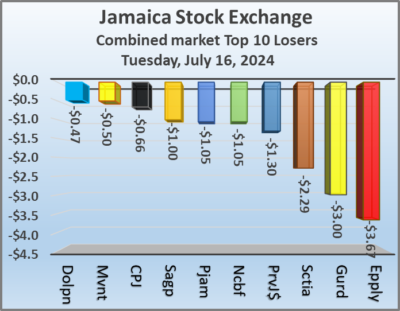

Express Catering sank 6 cents to $4.04 with investors dealing in 491 stocks, Fontana increased 45 cents to close at $8.49 after an exchange of 25,133 units, Future Energy skidded 7 cents to end at $3.22 with investors trading 52,559 stocks. KLE Group lost 25 cents in closing at $2 after 15,000 shares crossed the market, Limners and Bards popped 33 cents to finish at $1.89 with a transfer of 14,560 units, Lumber Depot gained 5 cents and ended at $2.80 after an exchange of 1,000 stock units. Mailpac Group dipped 14 cents to $2.04 and closed after 224,125 shares changed hands and Main Event fell 50 cents and ended at $12 with traders dealing in 7,773 units of its shares.

Express Catering sank 6 cents to $4.04 with investors dealing in 491 stocks, Fontana increased 45 cents to close at $8.49 after an exchange of 25,133 units, Future Energy skidded 7 cents to end at $3.22 with investors trading 52,559 stocks. KLE Group lost 25 cents in closing at $2 after 15,000 shares crossed the market, Limners and Bards popped 33 cents to finish at $1.89 with a transfer of 14,560 units, Lumber Depot gained 5 cents and ended at $2.80 after an exchange of 1,000 stock units. Mailpac Group dipped 14 cents to $2.04 and closed after 224,125 shares changed hands and Main Event fell 50 cents and ended at $12 with traders dealing in 7,773 units of its shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

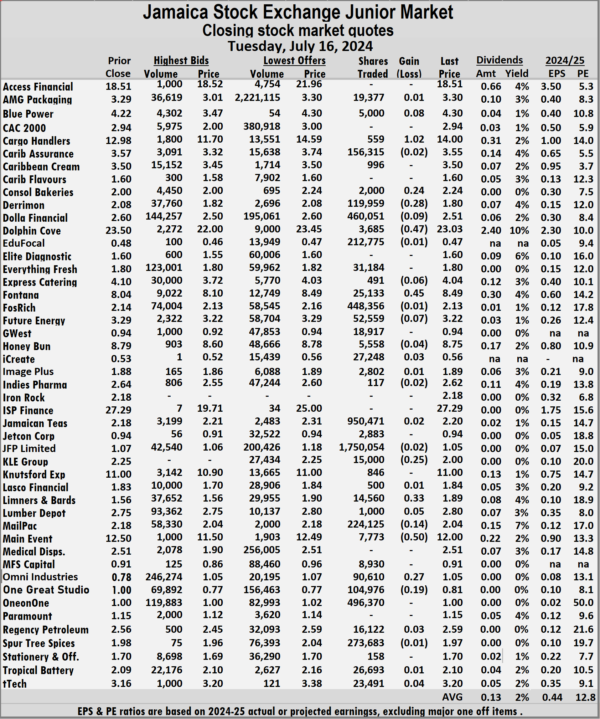

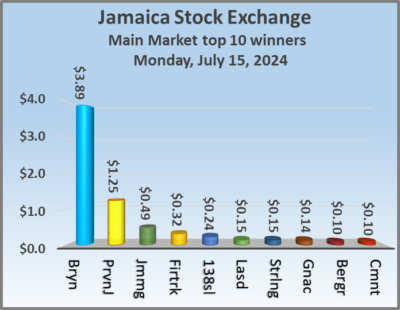

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index dropped 3,029.58 points to 326,113.36, the All Jamaican Composite Index dived 4,372.87 points to end at 352,707.25, the JSE Main Index sank 3,334.60 points to close trading at 313,116.77. The Junior Market Index climbed 22.93 points to 3,722.19 and the JSE USD Market Index rallied 0.85 points to 227.22.

At the close of trading, the JSE Combined Market Index dropped 3,029.58 points to 326,113.36, the All Jamaican Composite Index dived 4,372.87 points to end at 352,707.25, the JSE Main Index sank 3,334.60 points to close trading at 313,116.77. The Junior Market Index climbed 22.93 points to 3,722.19 and the JSE USD Market Index rallied 0.85 points to 227.22. In the preference segment, Eppley 7.25% preference share dropped $3.98 to end at $17.01, Jamaica Public Service 9.5% fell $2 in closing at $2,697 and 138 Student Living preference share gained $24.50 to close at $194.50.

In the preference segment, Eppley 7.25% preference share dropped $3.98 to end at $17.01, Jamaica Public Service 9.5% fell $2 in closing at $2,697 and 138 Student Living preference share gained $24.50 to close at $194.50. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. In Junior Market ICTOP10, Consolidated Barkeries rose 14 percent to close at $3.85, Caribbean Cream gained 13 percent to $3.75 and tTech rose 5 percent to $2.50 following a switch in ownership of the company. Access Financial fell 9 percent to $19.95 followed by One Great Studio, down 7 percent to 77 cents.

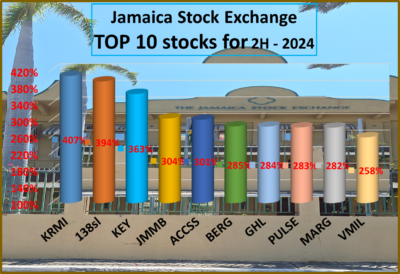

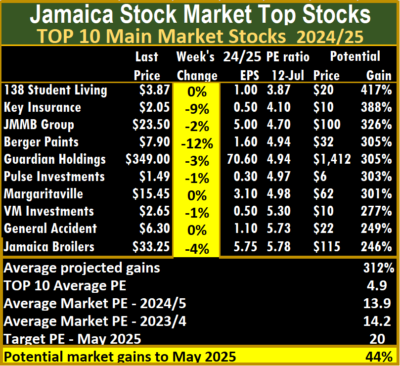

In Junior Market ICTOP10, Consolidated Barkeries rose 14 percent to close at $3.85, Caribbean Cream gained 13 percent to $3.75 and tTech rose 5 percent to $2.50 following a switch in ownership of the company. Access Financial fell 9 percent to $19.95 followed by One Great Studio, down 7 percent to 77 cents. The Main Market ICTOP10 is projected to gain an average of 312 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period.

The Main Market ICTOP10 is projected to gain an average of 312 percent by May 2025, based on 2024 forecasted earnings and providing better values than the Junior Market with the potential to achieve 207 percent over the same period. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

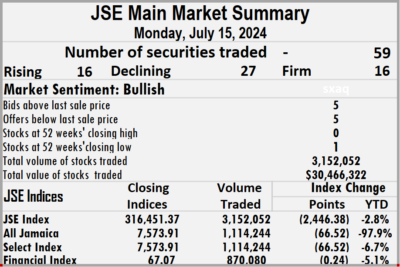

ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. Trading ended with an exchange of 3,152,052 shares for $30,466,322 compared with 26,181,772 units at $59,057,741 on Friday.

Trading ended with an exchange of 3,152,052 shares for $30,466,322 compared with 26,181,772 units at $59,057,741 on Friday. The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

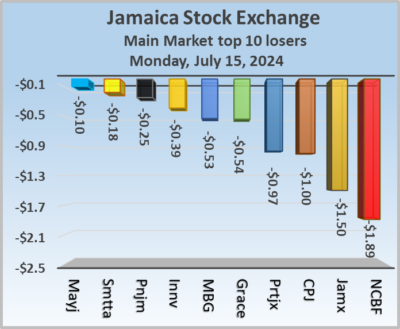

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Jamaica Stock Exchange dropped $1.50 in closing at $10 with an exchange of 443,096 units, JMMB Group advanced 49 cents to finish at $23.99 after 7,242 shares passed through the market, Mayberry Group sank 53 cents to close at $7.57 after an exchange of 1,619 units. NCB Financial dipped $1.89 to $56 with investors trading 27,947 stocks, Portland JSX lost 97 cents to finish at $9.20 in an exchange of 39,015 stock units and Proven Investments popped 73 cents and ended at $19.80 with investors swapping 4,377 shares.

Jamaica Stock Exchange dropped $1.50 in closing at $10 with an exchange of 443,096 units, JMMB Group advanced 49 cents to finish at $23.99 after 7,242 shares passed through the market, Mayberry Group sank 53 cents to close at $7.57 after an exchange of 1,619 units. NCB Financial dipped $1.89 to $56 with investors trading 27,947 stocks, Portland JSX lost 97 cents to finish at $9.20 in an exchange of 39,015 stock units and Proven Investments popped 73 cents and ended at $19.80 with investors swapping 4,377 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

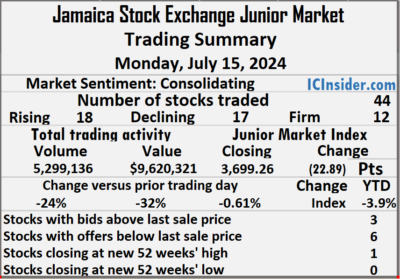

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The Junior Market of the Jamaica Stock Exchange closed on Monday, with a 24 percent decline in the volume of stocks traded and a 32 percent lower value than Friday resulting in trading of 44 securities up sharply from just 33 on Friday and ending with prices of 18 rising, 17 declining and nine closing unchanged.

The Junior Market of the Jamaica Stock Exchange closed on Monday, with a 24 percent decline in the volume of stocks traded and a 32 percent lower value than Friday resulting in trading of 44 securities up sharply from just 33 on Friday and ending with prices of 18 rising, 17 declining and nine closing unchanged. The Junior Market ended trading with an average PE Ratio of 12.8, based on last traded prices and earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.8, based on last traded prices and earnings projected by ICInsider.com for the financial years ending around August 2025. Honey Bun climbed 10 cents to finish at $8.79 with a transfer of 3,510 stock units, Jamaican Teas shed 17 cents and ended at $2.18, with investors trading 314,434 units, Knutsford Express rallied 10 cents to close at $11 after an exchange of 1,150 stocks. Lasco Financial gained 13 cents to close at $1.83 with investors trading 2,319 shares, Mailpac Group rallied 12 cents to end at $2.18 after a transfer of 72,793 stocks, Main Event increased 95 cents in closing at $12.50 with an exchange of 5,099 units. MFS Capital Partners dropped 5 cents to close at 91 cents in an exchange of 83,559 stock units, Regency Petroleum popped 24 cents to finish at $2.56 with traders dealing in 50,895 shares, Stationery and Office Supplies advanced 5 cents and ended at $1.70 in an exchange of 69,395 stocks. Tropical Battery fell 9 cents to $2.09 after 54,548 units passed through the market and tTech rose 66 cents and ended at a 52 weeks’ high of $3.16 with investors dealing in 214,359 stock units.

Honey Bun climbed 10 cents to finish at $8.79 with a transfer of 3,510 stock units, Jamaican Teas shed 17 cents and ended at $2.18, with investors trading 314,434 units, Knutsford Express rallied 10 cents to close at $11 after an exchange of 1,150 stocks. Lasco Financial gained 13 cents to close at $1.83 with investors trading 2,319 shares, Mailpac Group rallied 12 cents to end at $2.18 after a transfer of 72,793 stocks, Main Event increased 95 cents in closing at $12.50 with an exchange of 5,099 units. MFS Capital Partners dropped 5 cents to close at 91 cents in an exchange of 83,559 stock units, Regency Petroleum popped 24 cents to finish at $2.56 with traders dealing in 50,895 shares, Stationery and Office Supplies advanced 5 cents and ended at $1.70 in an exchange of 69,395 stocks. Tropical Battery fell 9 cents to $2.09 after 54,548 units passed through the market and tTech rose 66 cents and ended at a 52 weeks’ high of $3.16 with investors dealing in 214,359 stock units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. tTech gains did little to ease the pain of the Junior Market as a drop in the average price of the heavily weighted Derrimon Trading and a near $2 drop in Access Financial helped to pull the market down.

tTech gains did little to ease the pain of the Junior Market as a drop in the average price of the heavily weighted Derrimon Trading and a near $2 drop in Access Financial helped to pull the market down.  In Main Market activity, on a day of low trading, Transjamaican Highway was the lead trade with 778,196 shares followed by Wigton Windfarm with 659,034 stocks and Jamaica Stock Exchange with 443,096 units.

In Main Market activity, on a day of low trading, Transjamaican Highway was the lead trade with 778,196 shares followed by Wigton Windfarm with 659,034 stocks and Jamaica Stock Exchange with 443,096 units. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.