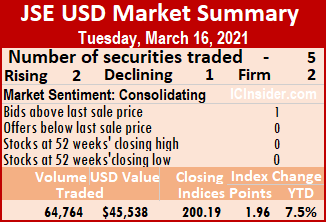

Trading on Tuesday ended with the market rising after trading 35 percent fewer shares than on Monday, at the close of the Jamaica Stock Exchange US dollar market.

at the close, five securities traded, similar to Monday, with two stocks rising, one declining and two remaining unchanged.

at the close, five securities traded, similar to Monday, with two stocks rising, one declining and two remaining unchanged.

The JSE USD Equity Index gained 1.96 points to end at 200.19. The average PE Ratio ends at 13.5 based on ICInsider.com’s forecast of 2020-21 earnings.

Overall, 64,764 shares traded for US$45,538 compared to 100,365 units at US$21,913 on Monday.

Trading averaged 12,953 units at US$9,108, in contrast to 20,073 shares at US$4,383 on Monday. Trading month to date averaged 58,883 units at US$12,573, versus 63,136 units at US$12,894 on Monday. February ended with an average of 69,547 units for US$9,223.

Investor’s Choice bid-offer indicator shows one stock ending with the bid higher than its last selling price and none with lower offers.

Investor’s Choice bid-offer indicator shows one stock ending with the bid higher than its last selling price and none with lower offers.

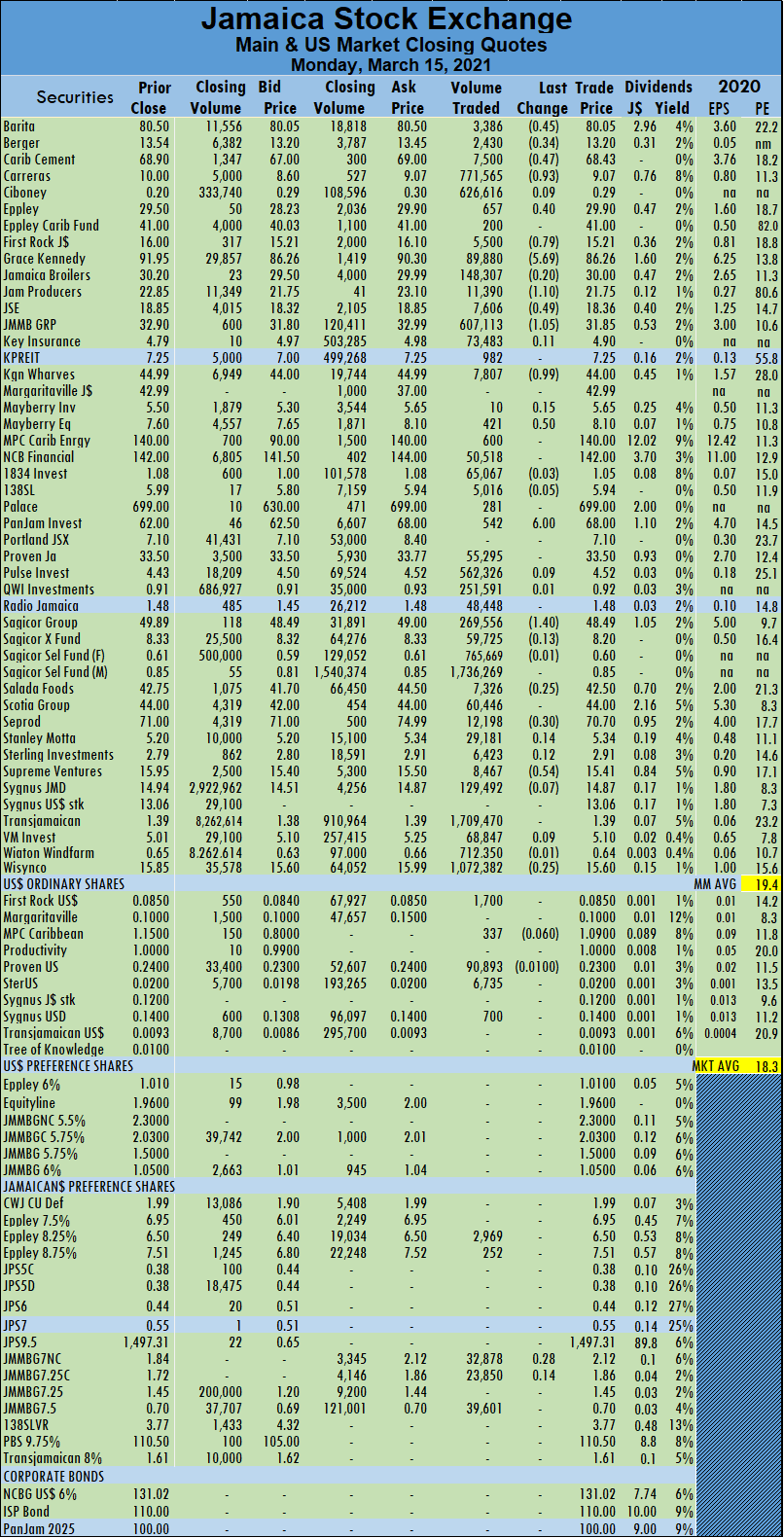

At the close, First Rock Capital ended at 8.5 US cents after trading 1,024 stocks, Proven Investments gained 1 cent to close at 24 US cents with 2,828 stocks changing hands, Sterling Investments remained at 2 US cents, with the trading of 21,418 stock units.

In the preference segment, JMMB Group 5.75% fell 3 cents to end at US$2 in an exchange of 1,000 units and JMMB Group 6% gained 5 cents to close at US$1.10, with 38,494 shares clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

The All Jamaican Composite Index climbed 2,301.07 points to 436,584.19, the JSE Main Index advanced 2,049.07 points to end at 398,010.00 and the JSE Financial Index rose 0.72 points to 99.95.

The All Jamaican Composite Index climbed 2,301.07 points to 436,584.19, the JSE Main Index advanced 2,049.07 points to end at 398,010.00 and the JSE Financial Index rose 0.72 points to 99.95. Trading averaged 175,488 units at $1,731,775, down from 211,498 shares at $1,978,267 on Monday. Month to date trading averaged 265,470 units at $2,355,997, versus 273,584 units at $2,412,290 on Monday. February closed with an average of 419,015 units at $2,509,660.

Trading averaged 175,488 units at $1,731,775, down from 211,498 shares at $1,978,267 on Monday. Month to date trading averaged 265,470 units at $2,355,997, versus 273,584 units at $2,412,290 on Monday. February closed with an average of 419,015 units at $2,509,660.  Sagicor Real Estate Fund fell 99 cents to $7.21, after clearing the market with 820 stocks, Salada Foods shed 80 cents to end at $41.70 with 23,847 stocks crossing the exchange, Scotia Group fell $1 to $43, transferring 293,556 shares. Seprod advanced $1.31 to $72.01 with investors switching ownership of 26,824 stock units and Supreme Ventures lost 41 cents to close at $15 after trading 127,248 stocks.

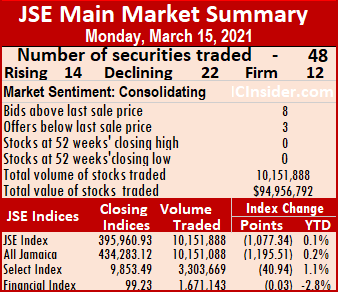

Sagicor Real Estate Fund fell 99 cents to $7.21, after clearing the market with 820 stocks, Salada Foods shed 80 cents to end at $41.70 with 23,847 stocks crossing the exchange, Scotia Group fell $1 to $43, transferring 293,556 shares. Seprod advanced $1.31 to $72.01 with investors switching ownership of 26,824 stock units and Supreme Ventures lost 41 cents to close at $15 after trading 127,248 stocks. The All Jamaican Composite Index dropped 1,195.51 points to 434,283.12, the Main Index declined 1,077.34 points to 395,960.93 and the JSE Financial Index slipped 0.03 points to 99.23.

The All Jamaican Composite Index dropped 1,195.51 points to 434,283.12, the Main Index declined 1,077.34 points to 395,960.93 and the JSE Financial Index slipped 0.03 points to 99.23. Investor’s Choice bid-offer indicator reading has eight stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator reading has eight stocks ending with bids higher than their last selling prices and three with lower offers.

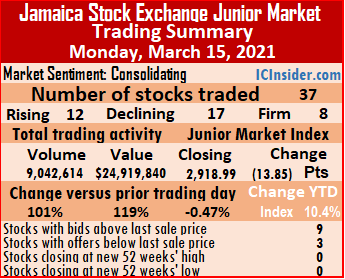

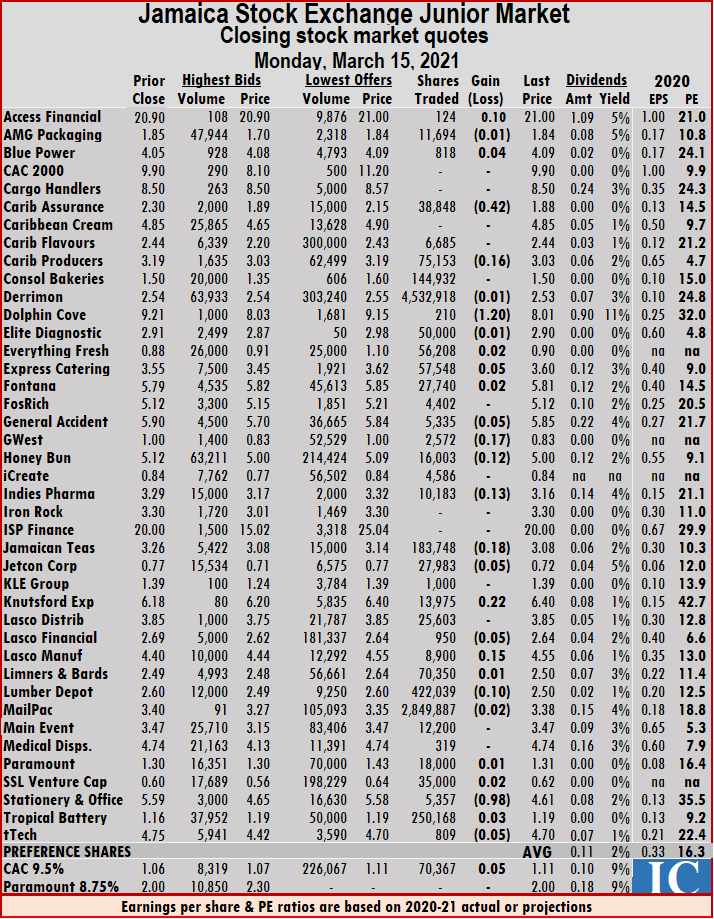

Trading ended with 12 stocks rising, 17 declining and eight remaining unchanged. The average PE Ratio ended at 16.3 based on ICInsider.com’s forecast of 2020-21 earnings.

Trading ended with 12 stocks rising, 17 declining and eight remaining unchanged. The average PE Ratio ended at 16.3 based on ICInsider.com’s forecast of 2020-21 earnings. Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and three with lower offers.

Investor’s Choice bid-offer indicator reading shows nine stocks ending with bids higher than their last selling prices and three with lower offers. Lasco Financial slipped 5 cents to $2.64 after transferring 950 stock units, Lasco Manufacturing gained 15 cents to close at $4.55, with 8,900 units changing hands. Lumber Depot shed 10 cents to $2.50 with investors switching ownership of 422,039 shares, Stationery and Office Supplies dropped 98 cents to $4.61, trading 5,357 stock units and tTech lost 5 cents to end at $4.70 after exchanging 809 shares.

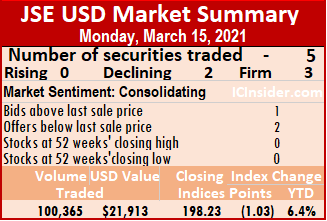

Lasco Financial slipped 5 cents to $2.64 after transferring 950 stock units, Lasco Manufacturing gained 15 cents to close at $4.55, with 8,900 units changing hands. Lumber Depot shed 10 cents to $2.50 with investors switching ownership of 422,039 shares, Stationery and Office Supplies dropped 98 cents to $4.61, trading 5,357 stock units and tTech lost 5 cents to end at $4.70 after exchanging 809 shares. The JSE USD Equity Index lost 1.03 points to end at 198.23. The average PE Ratio ends at 13.5 based on ICInsider.com’s forecast of 2020-21 earnings.

The JSE USD Equity Index lost 1.03 points to end at 198.23. The average PE Ratio ends at 13.5 based on ICInsider.com’s forecast of 2020-21 earnings. At the close, First Rock Capital traded 1,700 shares unchanged at 8.5 US cents, MPC Caribbean Clean Energy declined 6 cents to close at US$1.09, with 337 units crossing the exchange, Proven Investments fell 1 cent to 23 US cents, with 90,893 units changing hands. Sterling Investments ended at 2 US cents, with 6,735 stocks clearing the market and Sygnus Credit Investments settled at 14 US cents after finishing trading 700 stock units.

At the close, First Rock Capital traded 1,700 shares unchanged at 8.5 US cents, MPC Caribbean Clean Energy declined 6 cents to close at US$1.09, with 337 units crossing the exchange, Proven Investments fell 1 cent to 23 US cents, with 90,893 units changing hands. Sterling Investments ended at 2 US cents, with 6,735 stocks clearing the market and Sygnus Credit Investments settled at 14 US cents after finishing trading 700 stock units.

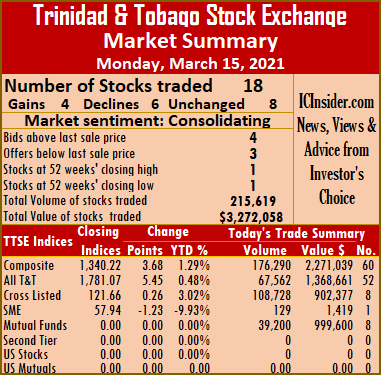

JMMB Group ended at $1.83 in a swap of 3,273 units, Massy Holdings ended at $63 trading 4,654 stock units, National Enterprises dropped 10 cents to close at $3 in an exchange of 19,500 shares. National Flour Mills ended at $2.20, with 5,693 stocks crossing the market, NCB Financial Group settled at $8.50 trading 105,430 stocks, One Caribbean Media lost 20 cents to close at $4.50 after exchanging 7,000 stocks. Scotiabank declined 30 cents to close at $55.50 while exchanging 6,632 units, Trinidad & Tobago NGL remained at $15 trading 12,594 stock units, Unilever Caribbean lost 2 cents in ending at $16.28 trading 90 shares and West Indian Tobacco increased 85 cents to $33 while exchanging 50 shares.

JMMB Group ended at $1.83 in a swap of 3,273 units, Massy Holdings ended at $63 trading 4,654 stock units, National Enterprises dropped 10 cents to close at $3 in an exchange of 19,500 shares. National Flour Mills ended at $2.20, with 5,693 stocks crossing the market, NCB Financial Group settled at $8.50 trading 105,430 stocks, One Caribbean Media lost 20 cents to close at $4.50 after exchanging 7,000 stocks. Scotiabank declined 30 cents to close at $55.50 while exchanging 6,632 units, Trinidad & Tobago NGL remained at $15 trading 12,594 stock units, Unilever Caribbean lost 2 cents in ending at $16.28 trading 90 shares and West Indian Tobacco increased 85 cents to $33 while exchanging 50 shares. Elsewhere, the 2021 TOP 15 listed Carreras that migrated from the 2021 ICTOP10 in February hit a new 52 weeks’ high during the week to sit at $10 for a rise of 45 percent for the year to date. The price could climb further, helped by improving profit and a high dividend yield. Future Energy Source (Fesco) hangs onto the Junior Market TOP10 list at the tenth position, with the prospectus still to be released to the public.

Elsewhere, the 2021 TOP 15 listed Carreras that migrated from the 2021 ICTOP10 in February hit a new 52 weeks’ high during the week to sit at $10 for a rise of 45 percent for the year to date. The price could climb further, helped by improving profit and a high dividend yield. Future Energy Source (Fesco) hangs onto the Junior Market TOP10 list at the tenth position, with the prospectus still to be released to the public.

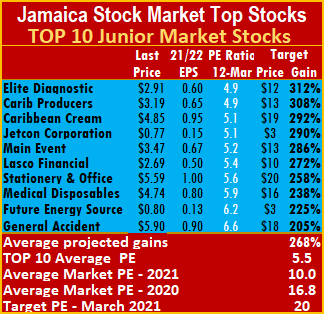

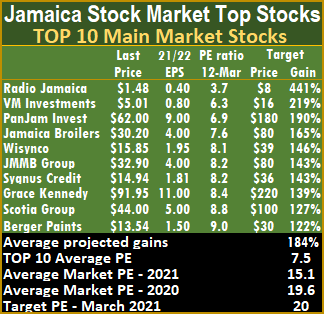

The Junior Market TOP10 contains companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some, with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. The Main Market has a number in the list that has put out record profits or shows strong earnings in 2021, with the stocks clearly undervalued. These include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside.

The Junior Market TOP10 contains companies that suffered a sharp reversal of revenues and profit in 2020, with recovery projected for them in 2021. Green shoots are showing for some, with sales picking up in recent quarters with improving bottom-line. Some of these companies may require another quarter or two of improving fortunes before there is meaningful buying into them. The Main Market has a number in the list that has put out record profits or shows strong earnings in 2021, with the stocks clearly undervalued. These include JMMB Group, Jamaica Broilers, Sygnus Credit Investments and Grace Kennedy that are currently in the TOP10 Main Market listing and Caribbean Cement that is just outside. The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Elite Diagnostic, followed by Caribbean Producers and Caribbean Cream. With expected gains of 190 to 441 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment.

The top three stocks in the Junior Market with the potential to gain between 292 to 312 percent are Elite Diagnostic, followed by Caribbean Producers and Caribbean Cream. With expected gains of 190 to 441 percent, the top three Main Market stocks are Radio Jamaica, followed by VM Investments and PanJam Investment. The Main Market TOP 10 stocks trade at a PE of 7.5 or 50 percent of that market’s PE.

The Main Market TOP 10 stocks trade at a PE of 7.5 or 50 percent of that market’s PE. Market activity ended with four securities changing hands, similar to Thursday and closed with two stocks rising, one declining and one remaining unchanged.

Market activity ended with four securities changing hands, similar to Thursday and closed with two stocks rising, one declining and one remaining unchanged. Investor’s Choice bid-offer indicator shows one stock ending with bids higher than their last selling prices and two with lower offers.

Investor’s Choice bid-offer indicator shows one stock ending with bids higher than their last selling prices and two with lower offers. Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and five with lower offers.

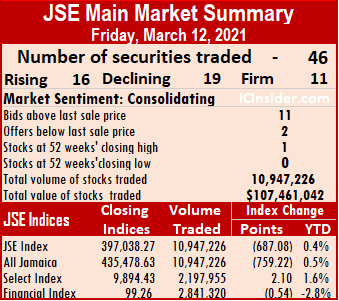

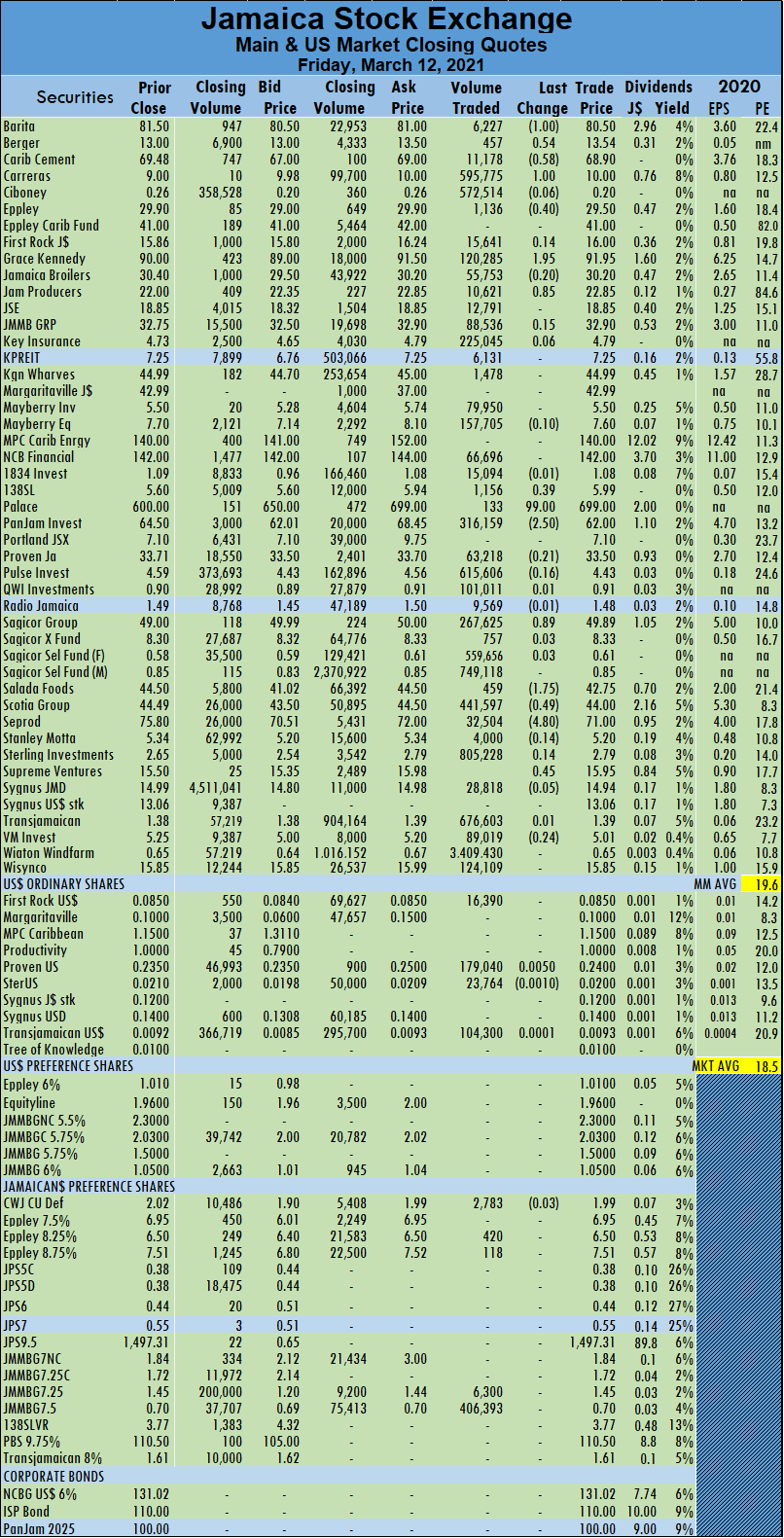

Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and five with lower offers. Sagicor Group rose 89 cents to $49.89 with the swapping of 267,625 shares, Salada Foods fell $1.75 to $42.75 after exchanging 459 stocks, Scotia Group shed 49 cents to close at $44 in switching ownership of 441,597 shares. Seprod declined $4.80 to end at $71 trading 32,504 units, Supreme Ventures gained 45 cents to end at $15.95 with 89,009 shares clearing the market and Victoria Mutual Investments shed 24 cents to close at $5.01 with 89,019 stocks crossing the market.

Sagicor Group rose 89 cents to $49.89 with the swapping of 267,625 shares, Salada Foods fell $1.75 to $42.75 after exchanging 459 stocks, Scotia Group shed 49 cents to close at $44 in switching ownership of 441,597 shares. Seprod declined $4.80 to end at $71 trading 32,504 units, Supreme Ventures gained 45 cents to end at $15.95 with 89,009 shares clearing the market and Victoria Mutual Investments shed 24 cents to close at $5.01 with 89,019 stocks crossing the market. Trading averaged 145,255 units at $366,311, from 153,162 at $547,055 on Thursday. The month to date averaged 227,879 units at $644,664, compared to 235,664 units at $670,892 on Thursday. February closed with an average of 365,365 units at $881,118.

Trading averaged 145,255 units at $366,311, from 153,162 at $547,055 on Thursday. The month to date averaged 227,879 units at $644,664, compared to 235,664 units at $670,892 on Thursday. February closed with an average of 365,365 units at $881,118. Honey Bun gained 6 cents to end at $5.12 in trading 27,055 stock units, Lasco Distributors gained 15 cents to close at $3.85 in an exchange of 110,217 units, Paramount Trading lost 15 cents in closing at $1.30 with 17,360 stock units clearing the market. SSL Venture lost 4 cents to close at 60 cents, with 54,312 stock units crossing the market and Stationery and Office Supplies advanced 99 cents to $5.59, trading 7,851 shares.

Honey Bun gained 6 cents to end at $5.12 in trading 27,055 stock units, Lasco Distributors gained 15 cents to close at $3.85 in an exchange of 110,217 units, Paramount Trading lost 15 cents in closing at $1.30 with 17,360 stock units clearing the market. SSL Venture lost 4 cents to close at 60 cents, with 54,312 stock units crossing the market and Stationery and Office Supplies advanced 99 cents to $5.59, trading 7,851 shares.