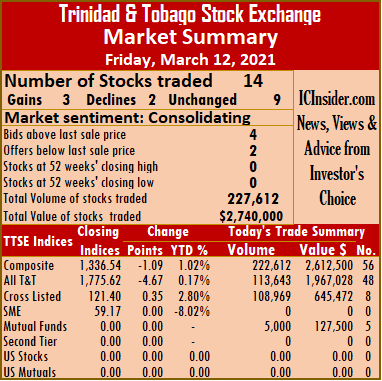

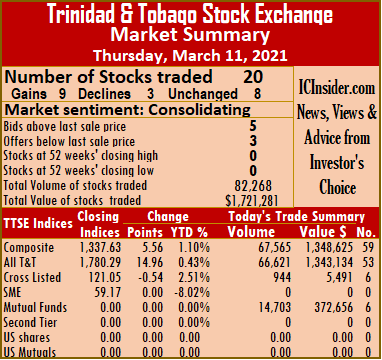

Market activity on Friday ended with a third fewer securities trading than on Thursday but with a jump of 177 percent in volume of stocks changing hands, carrying a value that is 59 percent higher at the close of the Trinidad and Tobago Stock Exchange for the week.

Trading ended with 14 active securities compared to 20 on Thursday, with three stocks rising, two declining and nine ending unchanged. The Composite Index fell 1.09 points to 1,336.54, the All T&T Index fell 4.67 points to close at 1,775.62 and the Cross Listed Index added 0.35 points to 121.40.

Trading ended with 14 active securities compared to 20 on Thursday, with three stocks rising, two declining and nine ending unchanged. The Composite Index fell 1.09 points to 1,336.54, the All T&T Index fell 4.67 points to close at 1,775.62 and the Cross Listed Index added 0.35 points to 121.40.

The market closed on Friday with 227,612 shares trading for $2,740,000 up from 82,268 units at $1,721,281 on Thursday.

Trading ended with an average of 16,258 units at $195,714, down from 4,113 at $86,064 on Thursday. An average of 13,292 units traded at $414,295 for the month to date, versus 13,033 units at $433,421. The average trade for February amounted to 15,920 units for $307,754.

The Investor’s Choice bid-offer indicator shows four stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Clico Investment Fund remained at $25.50 trading 5,000 units, First Citizens Bank advanced 50 cents to $47 with the swapping of 1,996 stocks, FirstCaribbean International Bank climbed 3 cents to $6.99 in an exchange of 600 units, Guardian Holdings ended at $23.39 in switching ownership of 23,483 shares.  JMMB Group remained at $1.83 while exchanging 41,500 shares, Massy Holdings closed at $63, with 1,660 stocks crossing the exchange, National Flour Mills ended at $2.20 after exchanging 53,382 stocks. NCB Financial Group advanced 10 cents to $8.50 after an exchange of 66,869 units, One Caribbean Media ended at $4.70 trading 2,000 stock units, Republic Financial Holdings dropped $2.06 to $132.50 trading 3,852 stocks. Scotiabank closed at $55.80, with 3,526 units crossing the market, Trinidad & Tobago NGL ended at $15 after exchanging 21,231 units, Unilever Caribbean ended at $16.30, with 429 stock units changing hands and West Indian Tobacco shed $1.09 to end at $32.15 crossing the market 2,084 stock units.

JMMB Group remained at $1.83 while exchanging 41,500 shares, Massy Holdings closed at $63, with 1,660 stocks crossing the exchange, National Flour Mills ended at $2.20 after exchanging 53,382 stocks. NCB Financial Group advanced 10 cents to $8.50 after an exchange of 66,869 units, One Caribbean Media ended at $4.70 trading 2,000 stock units, Republic Financial Holdings dropped $2.06 to $132.50 trading 3,852 stocks. Scotiabank closed at $55.80, with 3,526 units crossing the market, Trinidad & Tobago NGL ended at $15 after exchanging 21,231 units, Unilever Caribbean ended at $16.30, with 429 stock units changing hands and West Indian Tobacco shed $1.09 to end at $32.15 crossing the market 2,084 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

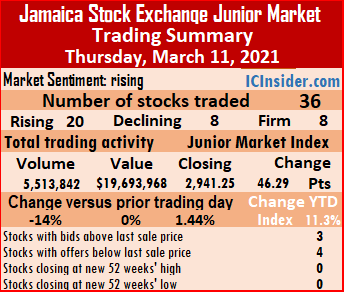

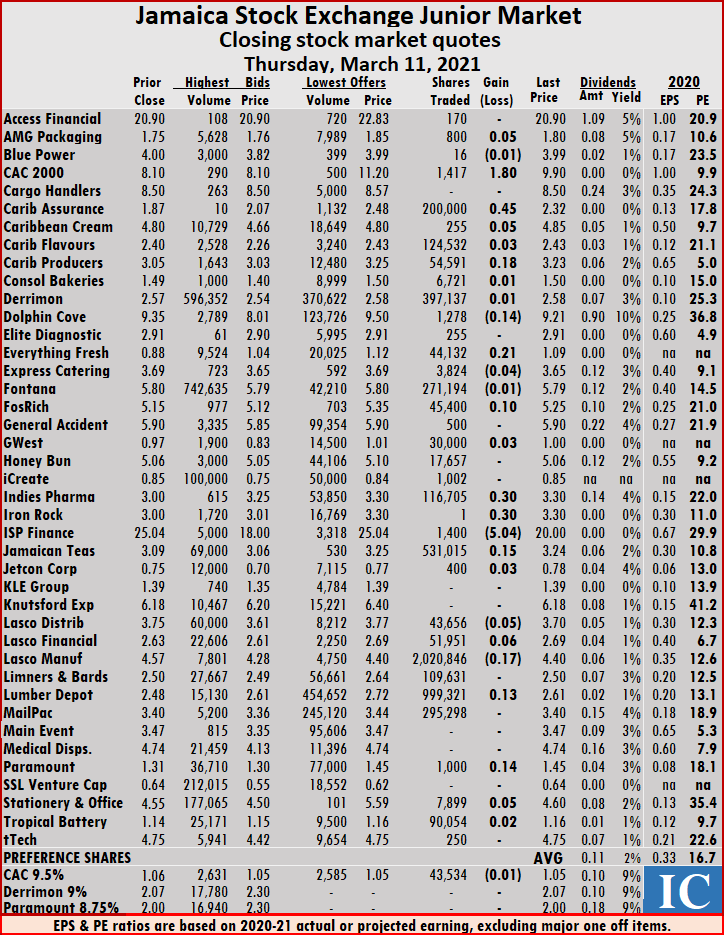

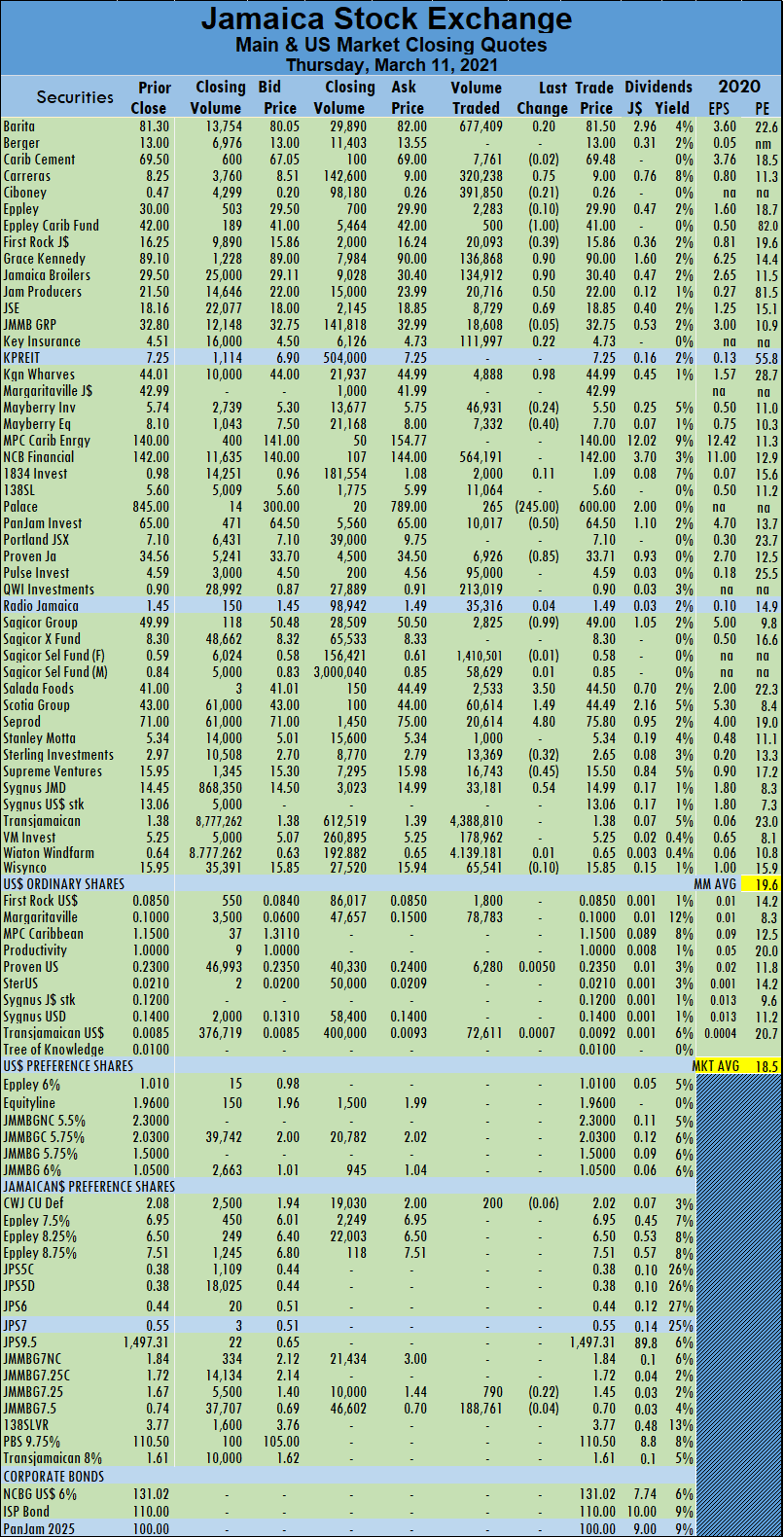

A total of 36 securities traded against 35 on Wednesday and ended with 20 rising, eight declining and eight remaining unchanged. The average PE Ratio ended at 16.7 based on ICInsider.com’s forecast of 2020-21 earnings.

A total of 36 securities traded against 35 on Wednesday and ended with 20 rising, eight declining and eight remaining unchanged. The average PE Ratio ended at 16.7 based on ICInsider.com’s forecast of 2020-21 earnings. Investor’s Choice bid-offer indicator shows three stock ended with bids higher than their last selling price and four with lower offers.

Investor’s Choice bid-offer indicator shows three stock ended with bids higher than their last selling price and four with lower offers. Lasco Distributors slipped 5 cents to $3.70 with 43,656 units passing through the market, Lasco Financial rose 6 cents to $2.69 with 51,951 shares traded, Lasco Manufacturing climbed 17 cents to $4.40 with a transfer of 2,020,846 stock units. Lumber Depot advanced 13 cents to $2.61 with 999,321 units changing hands, Paramount Trading rose 14 cents to $1.45 with 1,000 stock units traded and Stationery and Office Supplies gained 5 cents to close at $4.60 with 7,899 shares crossing the exchange.

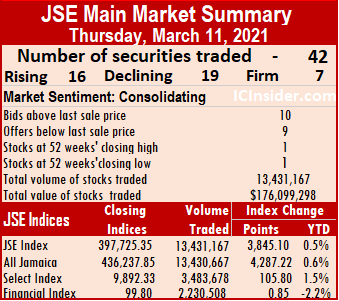

Lasco Distributors slipped 5 cents to $3.70 with 43,656 units passing through the market, Lasco Financial rose 6 cents to $2.69 with 51,951 shares traded, Lasco Manufacturing climbed 17 cents to $4.40 with a transfer of 2,020,846 stock units. Lumber Depot advanced 13 cents to $2.61 with 999,321 units changing hands, Paramount Trading rose 14 cents to $1.45 with 1,000 stock units traded and Stationery and Office Supplies gained 5 cents to close at $4.60 with 7,899 shares crossing the exchange. The All Jamaican Composite Index climbed 4,287.22 points to 436,237.85, the Main Index advanced by 3,845.10 points to 397,725.35 and the JSE Financial Index gained 0.85 points to close at 99.80.

The All Jamaican Composite Index climbed 4,287.22 points to 436,237.85, the Main Index advanced by 3,845.10 points to 397,725.35 and the JSE Financial Index gained 0.85 points to close at 99.80. Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and nine with lower offers.

Investor’s Choice bid-offer indicator reading has ten stocks ending with bids higher than their last selling prices and nine with lower offers. Sagicor Group fell 99 cents to $49, with 2,825 shares crossing the market, Salada Foods climbed $3.50 to $44.50 with the swapping of 2,533 stock units, Scotia Group advanced $1.49 to $44.49, with 60,614 shares clearing the market. Seprod climbed $4.80 to close at $75.80 trading 20,614 stocks, Sterling Investments lost 32 cents in settle at $2.65 in switching ownership of 13,369 units, Supreme Ventures shed 45 cents to end at $15.50 trading 16,743 stock units and Sygnus Credit Investments advanced 54 cents to $14.99, with 33,181 shares crossing the market.

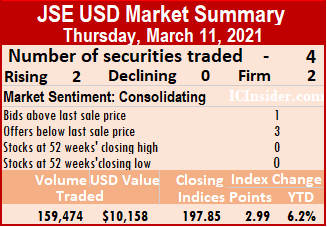

Sagicor Group fell 99 cents to $49, with 2,825 shares crossing the market, Salada Foods climbed $3.50 to $44.50 with the swapping of 2,533 stock units, Scotia Group advanced $1.49 to $44.49, with 60,614 shares clearing the market. Seprod climbed $4.80 to close at $75.80 trading 20,614 stocks, Sterling Investments lost 32 cents in settle at $2.65 in switching ownership of 13,369 units, Supreme Ventures shed 45 cents to end at $15.50 trading 16,743 stock units and Sygnus Credit Investments advanced 54 cents to $14.99, with 33,181 shares crossing the market. Trading ended with four active securities, compared to five on Wednesday and closed with the prices of two rising and two remaining unchanged.

Trading ended with four active securities, compared to five on Wednesday and closed with the prices of two rising and two remaining unchanged. At the close, First Rock Capital settled at 8.5 US cents trading 1,800 shares, Margaritaville closed at 10 US cents with 78,783 units crossing the market, Proven Investments gained half a cent in closing at 23.5 US cents in an exchange of 6,280 shares and Transjamaican Highway gained 0.07 of one cent in ending at 0.92 of a US cent, with a transfer of 72,611 stocks.

At the close, First Rock Capital settled at 8.5 US cents trading 1,800 shares, Margaritaville closed at 10 US cents with 78,783 units crossing the market, Proven Investments gained half a cent in closing at 23.5 US cents in an exchange of 6,280 shares and Transjamaican Highway gained 0.07 of one cent in ending at 0.92 of a US cent, with a transfer of 72,611 stocks. Trading accounted for 20 active securities compared to 21 on Wednesday, with prices of nine rising, three declining and eight remaining unchanged. The Composite Index advanced 5.56 points to 1,337.63, the All T&T Index climbed 14.96 points to 1,780.29, and the Cross Listed Index rose 0.54 points to end at 121.05.

Trading accounted for 20 active securities compared to 21 on Wednesday, with prices of nine rising, three declining and eight remaining unchanged. The Composite Index advanced 5.56 points to 1,337.63, the All T&T Index climbed 14.96 points to 1,780.29, and the Cross Listed Index rose 0.54 points to end at 121.05. Massy Holdings climbed $1 to $63 after 2,701 shares crossed the market, National Enterprises closed at $3.10, with 30 shares clearing the market, National Flour Mills ended at $2.20 in exchanging 30,934 shares. NCB Financial Group rose 20 cents to $8.40 with an exchange of 500 stock units, Republic Financial Holdings shed 44 cents to $134.56, with 2,786 stocks crossing the exchange, Scotiabank increased 31 cents to $55.80 after trading 1,510 stock units. Trinidad & Tobago NGL closed at $15 with 1,894 shares clearing the market, Trinidad Cement carved out a gain of 26 cents to $3.25 with an exchange of 615 units and West Indian Tobacco rose 24 cents to $33.24, with 1,533 units changing hands.

Massy Holdings climbed $1 to $63 after 2,701 shares crossed the market, National Enterprises closed at $3.10, with 30 shares clearing the market, National Flour Mills ended at $2.20 in exchanging 30,934 shares. NCB Financial Group rose 20 cents to $8.40 with an exchange of 500 stock units, Republic Financial Holdings shed 44 cents to $134.56, with 2,786 stocks crossing the exchange, Scotiabank increased 31 cents to $55.80 after trading 1,510 stock units. Trinidad & Tobago NGL closed at $15 with 1,894 shares clearing the market, Trinidad Cement carved out a gain of 26 cents to $3.25 with an exchange of 615 units and West Indian Tobacco rose 24 cents to $33.24, with 1,533 units changing hands. Trading ended with 35 securities compared to 39 on Tuesday and ended with just eight stocks rising, while 22 declined and five remained unchanged.

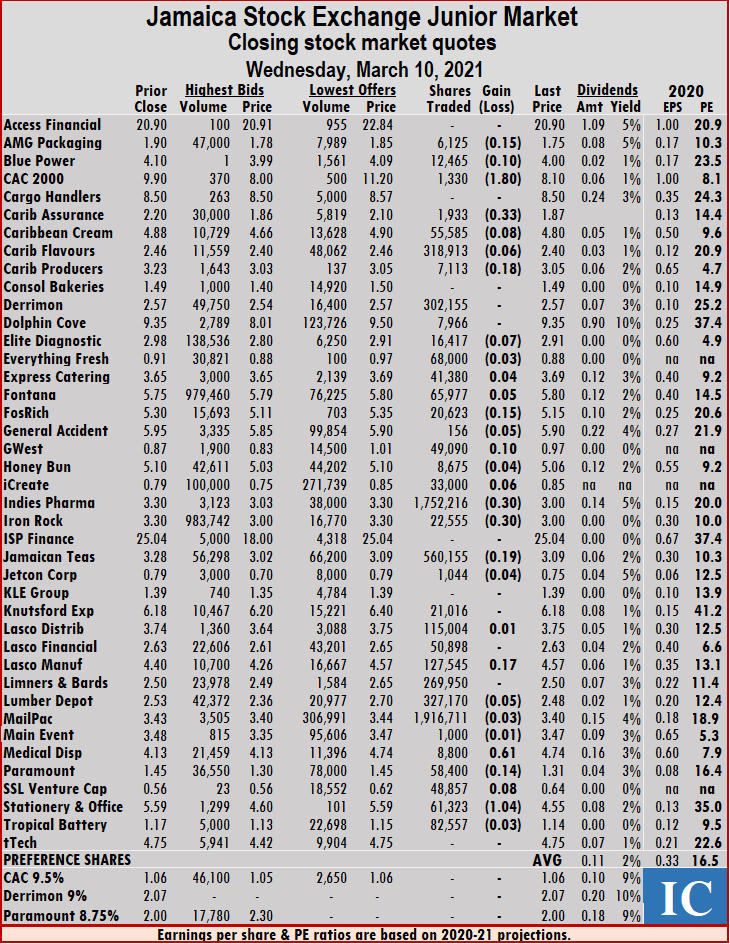

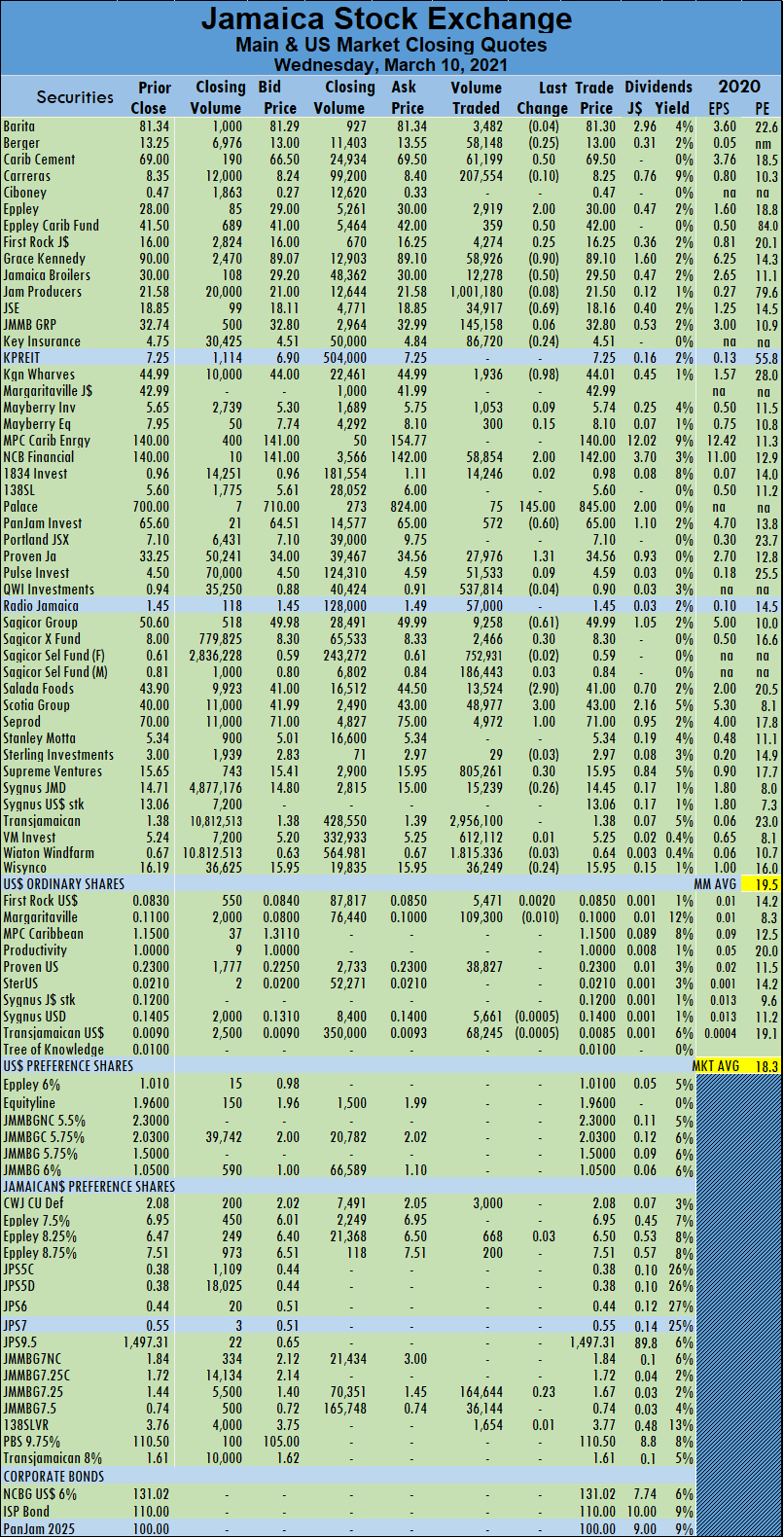

Trading ended with 35 securities compared to 39 on Tuesday and ended with just eight stocks rising, while 22 declined and five remained unchanged. At the close, AMG Packaging dropped 15 cents to $1.75 with 6,125 shares traded, Blue Power fell 10 cents to $4 after trading 12,465 stock units, CAC 2000 shed $1.80 to $8.10 with 1,330 units changing hands. Caribbean Assurance Brokers declined 33 cents to $1.87 with an exchange of 1,933 shares, Caribbean Cream dipped 8 cents to $4.80 with 55,585 stocks crossing the market, Caribbean Flavours slid 6 cents to $2.40 with 318,913 units traded. Caribbean Producers fell 18 cents to $3.05 trading 7,113 stock units, Elite Diagnostic lost 7 cents to end at $2.91 with 16,417 shares changing hands, Fontana rose 5 cents to $5.80 with 65,977 stocks trading. Fosrich declined 15 cents to close at $5.15 with 20,623 units passing through the market, General Accident slipped 5 cents to $5.90 with 156 stock units traded, GWest Corporation rose 10 cents to 97 cents with a transfer of 49,090 units. iCreate rose 6 cents to 85 cents with a transfer of 33,000 shares, Indies Pharma dropped 30 cents to $3 with a transfer of 1,752,216 units, Iron Rock Insurance shed 30 cents to close at $3 with 22,555 stock units changing hands. Jamaican Teas fell 19 cents to $3.09, trading 560,155 shares, Lasco Manufacturing advanced 17 cents to $4.57 with 127,545 stock units passing through the market, Lumber Depot declined 5 by cents to $2.48 with 327,170 units traded.

At the close, AMG Packaging dropped 15 cents to $1.75 with 6,125 shares traded, Blue Power fell 10 cents to $4 after trading 12,465 stock units, CAC 2000 shed $1.80 to $8.10 with 1,330 units changing hands. Caribbean Assurance Brokers declined 33 cents to $1.87 with an exchange of 1,933 shares, Caribbean Cream dipped 8 cents to $4.80 with 55,585 stocks crossing the market, Caribbean Flavours slid 6 cents to $2.40 with 318,913 units traded. Caribbean Producers fell 18 cents to $3.05 trading 7,113 stock units, Elite Diagnostic lost 7 cents to end at $2.91 with 16,417 shares changing hands, Fontana rose 5 cents to $5.80 with 65,977 stocks trading. Fosrich declined 15 cents to close at $5.15 with 20,623 units passing through the market, General Accident slipped 5 cents to $5.90 with 156 stock units traded, GWest Corporation rose 10 cents to 97 cents with a transfer of 49,090 units. iCreate rose 6 cents to 85 cents with a transfer of 33,000 shares, Indies Pharma dropped 30 cents to $3 with a transfer of 1,752,216 units, Iron Rock Insurance shed 30 cents to close at $3 with 22,555 stock units changing hands. Jamaican Teas fell 19 cents to $3.09, trading 560,155 shares, Lasco Manufacturing advanced 17 cents to $4.57 with 127,545 stock units passing through the market, Lumber Depot declined 5 by cents to $2.48 with 327,170 units traded.  Medical Disposables climbed 61 cents to $4.74 with a transfer of 8,800 shares, Paramount Trading fell 14 cents to $1.31 with 58,400 stocks switching hands, SSL Venture gained 8 cents to close at 64 cents with investors switching ownership of 48,857 units and Stationery and Office Supplies shed $1.04 to finish at $4.55 with 61,323 shares crossing the exchange.

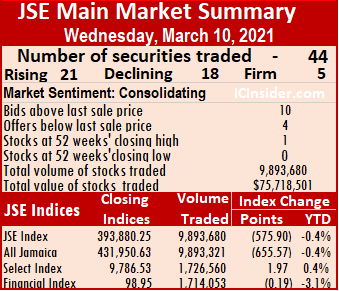

Medical Disposables climbed 61 cents to $4.74 with a transfer of 8,800 shares, Paramount Trading fell 14 cents to $1.31 with 58,400 stocks switching hands, SSL Venture gained 8 cents to close at 64 cents with investors switching ownership of 48,857 units and Stationery and Office Supplies shed $1.04 to finish at $4.55 with 61,323 shares crossing the exchange. The All Jamaican Composite Index fell 655.57 points to 431,950.63, the Main Index shed 575.90 points to 393,880.25, while the JSE Financial Index slipped 0.19 points to settle at 98.95.

The All Jamaican Composite Index fell 655.57 points to 431,950.63, the Main Index shed 575.90 points to 393,880.25, while the JSE Financial Index slipped 0.19 points to settle at 98.95. Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and five with lower offers.

Investor’s Choice bid-offer indicator shows nine stocks ending with bids higher than their last selling prices and five with lower offers. Sagicor Group shed 61 cents in ending at $49.99 in switching ownership of 9,258 stocks, Sagicor Real Estate Fund gained 30 cents to $8.30 in a transfer of 2,466 shares, Salada Foods declined $2.90 to $41 trading 13,524 units. Scotia Group climbed $3 to $43 with 48,977 stock units crossing the market, Seprod rose $1 to $71, with 4,972 stocks changing hands, Supreme Ventures gained 30 cents in ending at $15.95 with 805,261 units crossing the exchange. Sygnus Credit Investments fell 26 cents to $14.45, trading 15,239 stocks and Wisynco Group shed 24 cents to close at $15.95 with the swapping of 36,249 stock units.

Sagicor Group shed 61 cents in ending at $49.99 in switching ownership of 9,258 stocks, Sagicor Real Estate Fund gained 30 cents to $8.30 in a transfer of 2,466 shares, Salada Foods declined $2.90 to $41 trading 13,524 units. Scotia Group climbed $3 to $43 with 48,977 stock units crossing the market, Seprod rose $1 to $71, with 4,972 stocks changing hands, Supreme Ventures gained 30 cents in ending at $15.95 with 805,261 units crossing the exchange. Sygnus Credit Investments fell 26 cents to $14.45, trading 15,239 stocks and Wisynco Group shed 24 cents to close at $15.95 with the swapping of 36,249 stock units. Similar to Tuesday, five securities traded, with one stock rising, three declining and one remaining unchanged.

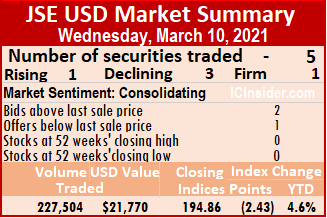

Similar to Tuesday, five securities traded, with one stock rising, three declining and one remaining unchanged. At the close, First Rock Capital advanced 0.2 of a cent to close at 8.5 US cents trading 5,471 shares, Margaritaville fell 1 cent to 10 US cents after exchanging 109,300 stocks, Proven Investments ended at 23 US cents, with 38,827 stock units crossing the exchange. Sygnus Credit Investments shed 0.05 of a cent to close at 14 US cents with an exchange of 5,661 units and Transjamaican Highway declined 0.05 of a cent in closing at 0.85 US cents with 68,245 stock units changing hands.

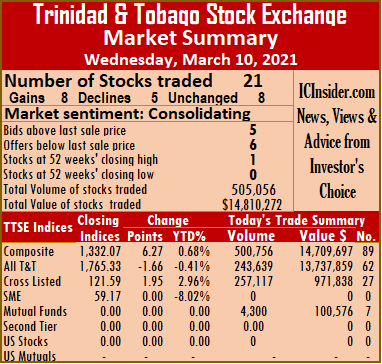

At the close, First Rock Capital advanced 0.2 of a cent to close at 8.5 US cents trading 5,471 shares, Margaritaville fell 1 cent to 10 US cents after exchanging 109,300 stocks, Proven Investments ended at 23 US cents, with 38,827 stock units crossing the exchange. Sygnus Credit Investments shed 0.05 of a cent to close at 14 US cents with an exchange of 5,661 units and Transjamaican Highway declined 0.05 of a cent in closing at 0.85 US cents with 68,245 stock units changing hands. The market closed with prices of eight stocks rising, five declining and eight remaining unchanged. The Composite Index gained 6.27 points to close at 1,332.07, the All T&T Index declined 1.66 points to 1,765.33 and the Cross Listed Index rose 1.95 to 121.59.

The market closed with prices of eight stocks rising, five declining and eight remaining unchanged. The Composite Index gained 6.27 points to close at 1,332.07, the All T&T Index declined 1.66 points to 1,765.33 and the Cross Listed Index rose 1.95 to 121.59. JMMB Group rose 2 cents to $1.84 after an exchange of 131,000 shares, L.J Williams B share close at $1.40 with an exchange of 5,000 stock units, Massy Holdings rose 12 cents to $62 trading 200,013 units. National Enterprises ended at $3.10 in trading 1,020 stocks, National Flour Mills stayed at $2.20 with the swapping of 250 stock units, NCB Financial Group settled at $8.20, with 40,430 stock units changing hands. One Caribbean Media lost 5 cents to close at $4.70, with 2,450 units clearing the market, Prestige Holdings shed 20 cents to end at $7.50, with the trading of 566 stocks, Republic Financial Holdings rose 45 cents to $135 while trading 2,188 stock units. Scotiabank fell 1 cent to $55.49 with the swapping of 1,713 shares, Trinidad & Tobago NGL dropped 1 cent to end at $15, with 7,680 stock units clearing the market, Trinidad Cement declined 1 cent to $2.99 with 150 stocks trading and West Indian Tobacco remained at $33, with 1,753 units changing hands.

JMMB Group rose 2 cents to $1.84 after an exchange of 131,000 shares, L.J Williams B share close at $1.40 with an exchange of 5,000 stock units, Massy Holdings rose 12 cents to $62 trading 200,013 units. National Enterprises ended at $3.10 in trading 1,020 stocks, National Flour Mills stayed at $2.20 with the swapping of 250 stock units, NCB Financial Group settled at $8.20, with 40,430 stock units changing hands. One Caribbean Media lost 5 cents to close at $4.70, with 2,450 units clearing the market, Prestige Holdings shed 20 cents to end at $7.50, with the trading of 566 stocks, Republic Financial Holdings rose 45 cents to $135 while trading 2,188 stock units. Scotiabank fell 1 cent to $55.49 with the swapping of 1,713 shares, Trinidad & Tobago NGL dropped 1 cent to end at $15, with 7,680 stock units clearing the market, Trinidad Cement declined 1 cent to $2.99 with 150 stocks trading and West Indian Tobacco remained at $33, with 1,753 units changing hands. Trading closed with 39 active securities up from 37 on Monday with prices of 21 stocks rising, nine declining and nine remaining unchanged.

Trading closed with 39 active securities up from 37 on Monday with prices of 21 stocks rising, nine declining and nine remaining unchanged. Investor’s Choice bid-offer indicator reading shows one stock ending with the bid higher than the last selling price and three with lower offers.

Investor’s Choice bid-offer indicator reading shows one stock ending with the bid higher than the last selling price and three with lower offers. Lasco Manufacturing rose 5 cents to $4.40 in an exchange of 38,079 shares, Limners and Bards lost 10 cents in ending at $2.50 with the swapping of 365,960 units, Lumber Depot shed 17 cents to close at $2.53 in a switch of ownership of 1,715,865 stock units. Main Event rose 13 cents to $3.48 trading 1,000 units, Medical Disposables shed 36 cents to end at $4.13 with the swapping of 20,000 stock units. Paramount Trading gained 13 cents in closing at $1.45 in trading 52,175 shares, Stationery and Office Supplies advanced 97 cents to $5.59 with an exchange of 22,030 stock units and tTech rose 33 cents to end at $4.75 with 1,500 shares changing hands.

Lasco Manufacturing rose 5 cents to $4.40 in an exchange of 38,079 shares, Limners and Bards lost 10 cents in ending at $2.50 with the swapping of 365,960 units, Lumber Depot shed 17 cents to close at $2.53 in a switch of ownership of 1,715,865 stock units. Main Event rose 13 cents to $3.48 trading 1,000 units, Medical Disposables shed 36 cents to end at $4.13 with the swapping of 20,000 stock units. Paramount Trading gained 13 cents in closing at $1.45 in trading 52,175 shares, Stationery and Office Supplies advanced 97 cents to $5.59 with an exchange of 22,030 stock units and tTech rose 33 cents to end at $4.75 with 1,500 shares changing hands.