The Main Market index and the JSE USD market index of the Jamaica Stock Exchange eked out gains to start February but the Junior Market slipped at the close of trading on Thursday with market activity and ended with the number of shares and the value changing hands falling below the previous trading day’s levels and ended with 25 shares rising and 44 declining.

At the close of trading, the JSE Combined Market Index rose 258.54 points to close at 341,720.39, the All Jamaican Composite Index sank 266.16 points to 365,561.82, the JSE Main Index popped 608.95 points to conclude trading at 329,084.04. The Junior Market Index declined 35.69 points to 3,778.49 and the JSE USD Market Index popped 1.75 points to cease trading at 251.01.

At the close of trading, the JSE Combined Market Index rose 258.54 points to close at 341,720.39, the All Jamaican Composite Index sank 266.16 points to 365,561.82, the JSE Main Index popped 608.95 points to conclude trading at 329,084.04. The Junior Market Index declined 35.69 points to 3,778.49 and the JSE USD Market Index popped 1.75 points to cease trading at 251.01.

At the close of trading, 24,848,411 shares were exchanged in all three markets, down from 35,568,273 units on Wednesday, with the value of stocks traded on the Junior and Main markets amounted to $94.99 million, down from $134.96 million yesterday and the JSE USD market closed with an exchange of 393,307 shares for US$18,728 up from 15,298 units at US$860 on Wednesday.

Main Market trading was dominated by Wigton Windfarm led trading with 4.53 million shares followed by Transjamaican Highway with 2.04 million units and Sagicor Select Financial Fund with 1.17 million stocks.

In the Junior Market, Stationery and Office Supplies led trading with 2.92 million shares followed by EduFocal with 2.67 million units, MFS Capital Partners ended with 2.55 million stock units and Lasco Manufacturing with 2.20 million shares.

At the close of the market, the major Main Market stocks rising are Eppley Caribbean Property Fund rallied $2.01 to close at $40, Massy Holdings popped $3.05 and ended at $93.05.

At the close of the market, the major Main Market stocks rising are Eppley Caribbean Property Fund rallied $2.01 to close at $40, Massy Holdings popped $3.05 and ended at $93.05.

The major declining Main Market stocks include Caribbean Cement that fell $3 and ended at $54, Guardian Holdings declining $3 to end at $367, Jamaica Producers shedding $2.39 in closing at $21.61, JMMB Group losing $2.03 to end at $23.97 and Sagicor Group dropping $1 to end at $43.98. Scotia Group skidded $1.59 in closing at $41 and Wisynco Group dipped $1.40 to end at $21.10 with traders dealing in 80,737 shares.

Stocks ending with major gains in the Junior Market are AMG Packaging that popped 30 cents and ended at $2.92, Cargo Handlers advancing $1.92 to $14.92 and Main Event which rose 96 cents to end at $16, with major losing stocks being Dolphin Cove down 80 cents to close at $18.20, Fosrich dipping 37 cents in closing at $2.10, MFS Capital Partners skidding 38 cents to $2.32 and Spur Tree Spices that shed 38 cents to $2.50.

In the preference segment, Eppley 7.75% preference share skidded $3.45 in closing at $19.50, 138 Student Living preference share rose $18.72 and ended at $211 and Productive Business Solutions 10.5 % preference share shed $125 to close at $1,075.

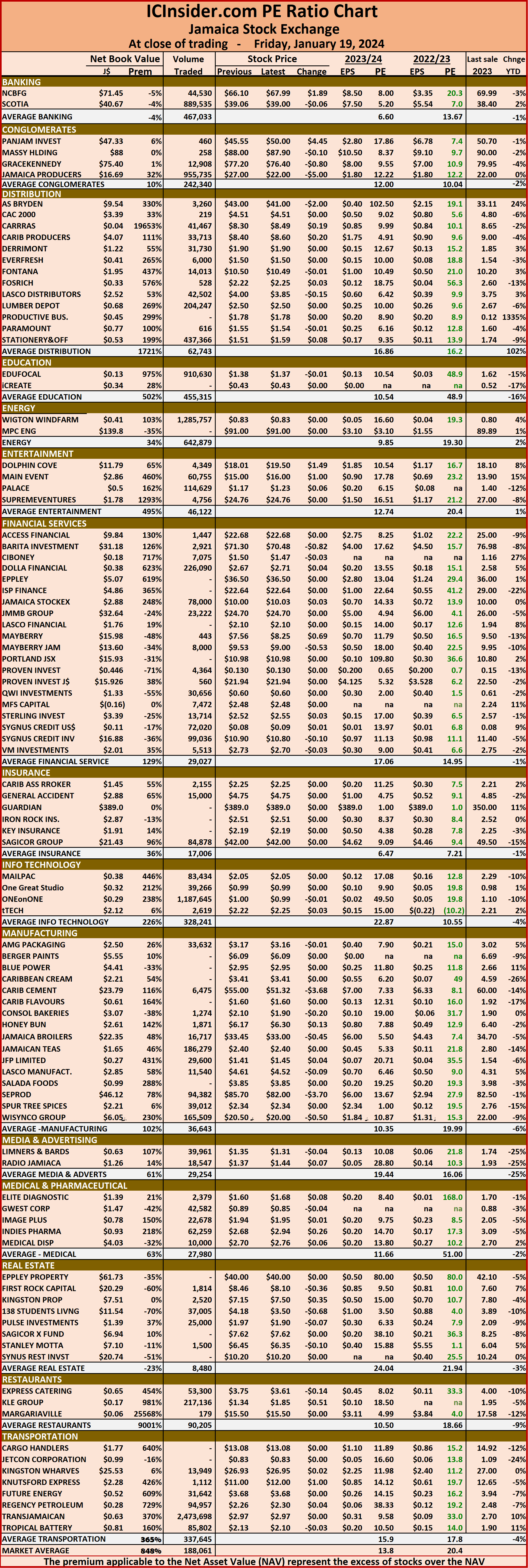

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 20.7 on 2022-23 earnings and 14.1 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

JSE markets fall in welcoming July

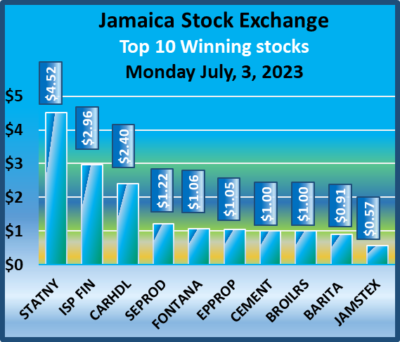

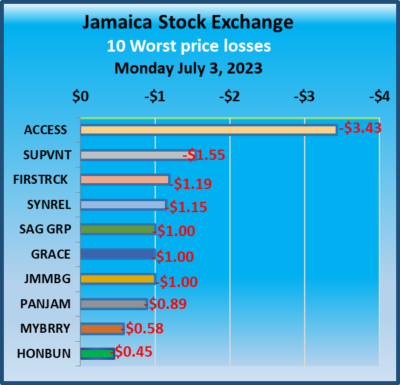

All three markets on Jamaica Stock Exchange closed lower on Monday, but the Junior Market made solid gains throughout the trading session after it opened down to just over 3,909 points within minutes of opening, thanks to a big jump in the prices of Fontana and Stationery and Office Supplies, the market index ended much higher at the close, but the Main and the USD Market suffered sharp reversal to Friday’s close.

At the close, the JSE Combined Market Index dropped 2,842.58 points to close at 343,439.95, the All Jamaican Composite Index dived 3,768.45 points to 366,805.48, the JSE Main Index declined 2,896.62 points to finish at 329,138.31. The Junior Market Index lost 15.27 points to close at 3,968.96. The JSE USD Market Index fell 7.39 points to close at 249.01.

At the close, the JSE Combined Market Index dropped 2,842.58 points to close at 343,439.95, the All Jamaican Composite Index dived 3,768.45 points to 366,805.48, the JSE Main Index declined 2,896.62 points to finish at 329,138.31. The Junior Market Index lost 15.27 points to close at 3,968.96. The JSE USD Market Index fell 7.39 points to close at 249.01.

Preference shares with notable price movements but not in the Main Market TOP10 graphs are Jamaica Public Service 7% shed $9.50 and ended at $57.50 and 138 Student Living preference share advanced $3 in closing at $88.

At the close, investors exchanged 24,673,817 shares, in all three markets, down sharply from 48,899,684 stocks on Friday. The value of stocks trading in the Junior and Main markets was $192.4 million, down from $307.37 million on Friday. Trading on the JSE USD market ended with investors exchanging 1,296,152 shares for US$10,636 down from 179,896 units at US$10,636 on Friday.

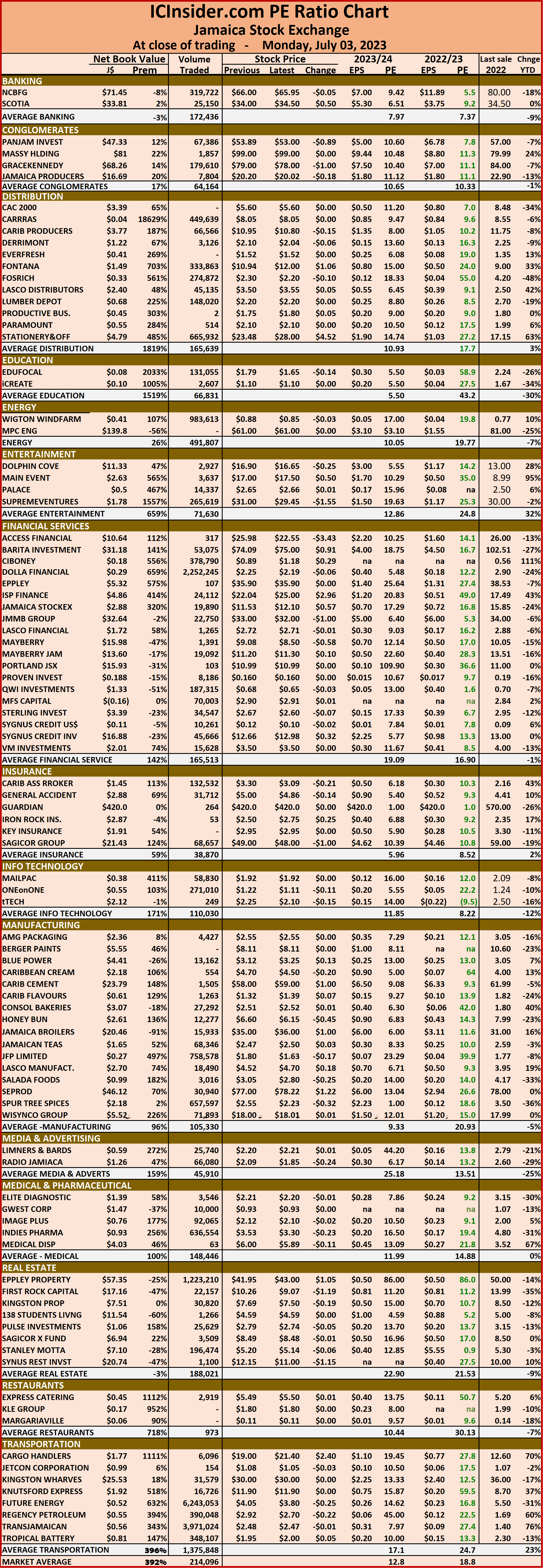

The market’s PE ratio ended at 18.8 on 2022-23 earnings and 12.8 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

The market’s PE ratio ended at 18.8 on 2022-23 earnings and 12.8 times those for 2023-24 at the close of trading. Investors need pertinent information to successfully navigate numerous investment options in the local stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and put in on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The ICInsider.com PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange and shows companies grouped per industry, allowing easy comparisons between the same sector companies and the overall market.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts along with the closing volume pertaining to the highest bid and the lowest offer for each company.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Stock split news lift SOS to a record $26

Investors in office supply Junior Market listed company Stationery and Office Supplies are having a grand time, with the company reporting two highly profitable years with 2023 starting off on a promising note for another year of record profits.

Stationery & Office Supplies hit a new high after the proposed stock split announcement.

Over the past year, shareholders will receive dividends amounting to 38 cents per share with the second payment in July. To add icing to the cake, the announcement on Monday that the board of directors will meet on Wednesday to consider a stock split has pushed the share price to a record high of $26 in early trading on Tuesday, with an increase of 52 percent for the year to date on top of 179 percent gain in 2022. Up to late May, the stock was trading in the $15 region, a level that it was at for weeks.

In premarket trading there were several bids amounting to over 306,000 units at $26, the maximum the stock will trade at initially, against 23,811 on offer up to $26. Trading in the stock is halted until 10:30 but currently, there are 21 bids at $26 to buy 282,981 shares. On the other hand, the lowest offer is at $30.50 with 23,000 units, followed by 575 shares at $34.96 and 28,774 units at $35.01 and then 42,277 stock units at $44.97.

SOS directors to consider splitting the stock

The board of directors of Stationary & Office Supplies informed the Jamaica Stock Exchange that they will meet on Wednesday, June 21st to discuss and consider whether or not to recommend a stock split to the company’s shareholders.

SOS is likely to split stock in 2023.

According to the release, “the market value of the company’s stock has been on a consistent growth trajectory and the liquidity of the stock is also a significant consideration.”

At the last annual general meeting the CEO, Allan McDaniel stated that they were reviewing the matter of a stock split on an ongoing basis but that trading in the stock was fairly liquid as such there was no need to make the adjustment then.

ICInsider.com gathers that the $20 was likely to be the trigger point for a split. Last week the stock traded at $24 but pulled back to $20 where it is now trading, but if history is anything to go by, the price is likely to climb in Tuesday’s trading. With profits for the current year likely to hit nearly $2 per share and around $3 in 2024, that could push the price between $30 and $40 this year and $50 to $60 next year, a split in the order of 10 could place the price closer to where Junior Market investors could find the stock reasonably priced and encourage greater trading in it.  A 10 to 1 split would lift the issued shares to just over 2.5 billion units which would be within a level that would facilitate a great deal of liquidity for a number of years, but the price could be back in the teens again in 2024. Even a 5 for 1 would result in an enhanced level of liquidity with just over 1.25 billion units in issue and push it to 16th Junior Market company in terms of the number of issued shares and 6th if a 10 to 1 split was to be approved. The prospects of profit jumping sharply in 2024, if achievable and seen by management as likely then a 10 to 1 split would seem to be the better option.

A 10 to 1 split would lift the issued shares to just over 2.5 billion units which would be within a level that would facilitate a great deal of liquidity for a number of years, but the price could be back in the teens again in 2024. Even a 5 for 1 would result in an enhanced level of liquidity with just over 1.25 billion units in issue and push it to 16th Junior Market company in terms of the number of issued shares and 6th if a 10 to 1 split was to be approved. The prospects of profit jumping sharply in 2024, if achievable and seen by management as likely then a 10 to 1 split would seem to be the better option.

The split if approved by the directors, would require ratification by shareholders at a general meeting and that is likely to be at the company’s upcoming general meeting.

The next stock split could well come for Cargo Handlers, with thin trading currently with the price now in excess of $20. Dolphin Cove seems to be shaping for a possible spilt as well but that would be more likely down the road.

Is SOS the next stock Split?

Business has been great for Stationery and Office Supplies (SOS) over the past two years, with sales rising 55 percent over 2021 last year and 16 percent over the covid-19 affected 2020 in 2021 and is up 22 percent for the first quarter to March this year.

The surge in sales drove pretax profit excluding one-time income, up 34 over last year on top of a 151 surge in 2022 over 2021. While the company has started 2023 positively, reports are that its first shipment of goods to Cayman Island, which is expected to be an ongoing trade, has been sent off and that, in addition to its connection with Trinidad and Tobago that started in the latter part of 2022 and reports indicate that arrangement is in place for regular shipments to a third Caribbean country.

The stock had nearly two million units on offer up to June 5 at just under $16, but investors aggressively bought 1.5 million on that day and the stock has since seen limited supply on offer. The $20 price level is believed to be the trigger point for the directors to seriously consider recommending splitting the stock to shareholders. The stock price hit a 52 weeks’ high on Monday when it traded a small quantity at $21 and closed there again on Tuesday after 10,230 shares were traded. The stock price is up 22 percent this year and trades at a PE of 11 times 2023 earnings, but has more room to grow, with a PE of 15 putting the price within reach of $30.

SOS executives

More than 91 percent of the issued share are in the hands of the top 10 shareholders, thus reducing the potential supply that can come to the market with only 250 million shares issued. At the close of Tuesday’s trade, stocks on offer below $25 amount to 7,200 units, with 80,000 on offer at $25. After that, the bids start at $35.

Stock splits are popular among investors in Jamaica, with each announcement accompanied by a hike in the price of the relevant stock.

The door is left open for a resolution to be put to the company’s upcoming AGM for a stock split, as the annual report filed with the JSE stated that the date of the AGM was to be determined.

ICTOP10 Image Plus price jump 9%

With interest rates softening, some life has entered the Jamaica stock market, with the Junior Market posting gains for a second consecutive week, but the Main Market suffered a mild retreat following notable increases in the last week of April as several ICTOP10 stocks posted solid gains, including Image Plus that posted impressive full year results at the end of the previous week.

Dr. Karlene McDonnough – Chairman of Image Consultants Ltd.

The week ended with several sizable winners in the ICTOP10 and one big loser. Lasco Distributors rose 13 percent to lead the winning stocks, followed by Everything Fresh with a strong 11 percent climb to $1.66, Consolidated Bakeries rose 10 percent to $2.39, Image Plus rallied 9 percent and iCreate rose by 5 percent to $1.47 and fell out of the ICTOP10 and is replaced by Jamaican Teas. Iron Rock Insurance fell 18 percent to close at $1.88 and General Accident slipped 6 percent to $5.08, being the only two losers of significance.

The price of Main Market listed Berger Paints rose 10 percent to $8.30, Caribbean Producers gained 8 percent in closing at $10.56, with the stocks seemingly poised to get back to the $12 region sooner than later as the supply of stocks being sold below $13 has virtually dried up. 138 Student Living popped 6 percent to $5.35, JMMB Group fell 6 percent to $29.60, and Jamaica Broilers slipped 4 percent to $35.70.

Stocks are being prepped to rally, with signals that interest rates will be declining across the board sooner. This stems from the continued slide of BOJ CDs rates since March, which saw the rate falling by 25 percent to 8 percent this past week. Lower interest rates are around the corner, which will be positive for stocks and the signs are already showing.

At the previous week’s close, Image Plus released solid full year results showing profit after tax that jumped 125.6 percent to $213 million or 21 cents per share. Based on those numbers, ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously. On Monday, the company reported revised results, with the profit being even higher at $252 million, with a reduction in the amount previously booked as professional fees. Based on the revision, projected earnings were raised by the publication to 40 cents per share for the current fiscal year. The stock sits at the number three spot in the ICTOP10. The revision raises some serious questions about how such matters escaped the directors, auditors and the financial controller before the audited financial statements were released.

At the previous week’s close, Image Plus released solid full year results showing profit after tax that jumped 125.6 percent to $213 million or 21 cents per share. Based on those numbers, ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously. On Monday, the company reported revised results, with the profit being even higher at $252 million, with a reduction in the amount previously booked as professional fees. Based on the revision, projected earnings were raised by the publication to 40 cents per share for the current fiscal year. The stock sits at the number three spot in the ICTOP10. The revision raises some serious questions about how such matters escaped the directors, auditors and the financial controller before the audited financial statements were released.

Dolla Financial fell out of the TOP10 at the end of the previous week and this past week released impressive first quarter results that excited investors who responded well to them by driving the price to close the week at $2.89, with the price hitting a high of $2.99 on Friday. The company seems poised to deliver ICInsider.com forecasted earnings of 40 cents, provided they obtain loans on a timely basis to on lend.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index in the previous week with more this past week, with the supply of some stocks continuing to fall sharply.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index in the previous week with more this past week, with the supply of some stocks continuing to fall sharply.

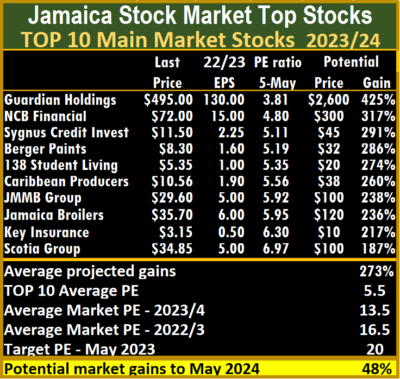

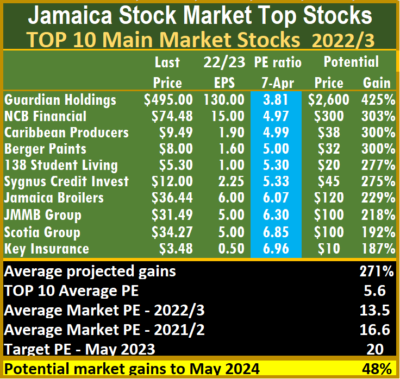

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.5, well below the market average of 13.5. The Main Market TOP10 is projected to have an average of 273 percent, to May 2024, based on 2023 forecasted earnings.

The 16 highest valued Main Market stocks are priced at a PE of 15 to 110, with an average of 28 and 19 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

The Junior Market Top 10 PE sits at 5.7 compared with the market at 11.5. There are 12 stocks, or 25 percent of the market, with PEs from 15 to 26, averaging 20, well above the market’s average. The top half of the market has an average PE of 16, suggesting that this may currently be the lowest fair value for Junior Market stocks. Junior Market is projected to rise by 258 percent to May 2024.

The differences between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

The differences between the average PE ratio of the Main and Junior Markets and the overall market valuation are important indicators of the likely gains for ICTOP10 stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

iCreate in ICTOP10 Image Plus EPS jumps

The markets are changing, with the Main Market up for three consecutive weeks but the Junior Market meandering for the last four weeks. Against this backdrop, there was one change to the TOP10, with iCreate coming in and Dolla Financial falling out, but Dolla and Honey Bun, that slipped out the previous week, sit immediately below the TOP10.

There were no significant winners for the past week in both markets’ TOP10 as losers dominated. The Junior market had Consolidated Bakeries falling 11 percent to $2.17 and general Accident down 10 percent to $5.40 and Lasco Distributors down 3 percent, with the stock selling at just 5.5 times 2023 estimated earnings and only 8.5 times the company’s nine month results. By any stretch, the stock is considerably undervalued and there are more profits to come in the current fiscal year.

There were no significant winners for the past week in both markets’ TOP10 as losers dominated. The Junior market had Consolidated Bakeries falling 11 percent to $2.17 and general Accident down 10 percent to $5.40 and Lasco Distributors down 3 percent, with the stock selling at just 5.5 times 2023 estimated earnings and only 8.5 times the company’s nine month results. By any stretch, the stock is considerably undervalued and there are more profits to come in the current fiscal year.

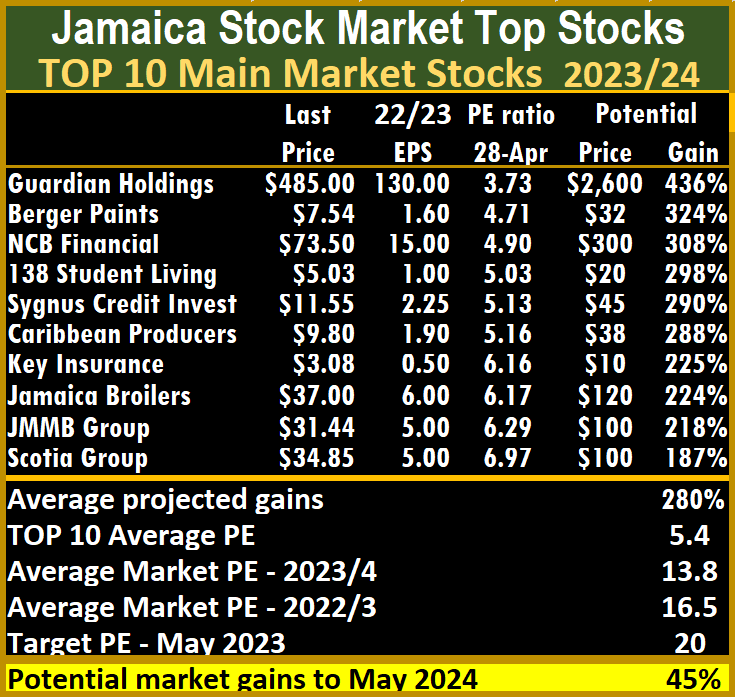

Main Market stocks had a 13 percent fall in Key Insurance after the price closed at $3.08, Berger Paints contracted by 9 percent to $7.54 and 138 Student Living slipped 5 percent to $5.03, while Jamaica Broilers rose just 3 percent to $37.

Stocks are being prepped to rally, with early signals that interest rates will be declining across the board sooner than later. This stems from the continued slide of rates on BOJ CDs since March, that saw the rate falling by 23 percent to 8.11 percent against a background where inflation since November last year is running at less than one percent per annum.

At the week’s close, Image Plus released full year results showing profit after tax jumping 125.6 percent to $213 million or 21 cents per share. ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously.

At the week’s close, Image Plus released full year results showing profit after tax jumping 125.6 percent to $213 million or 21 cents per share. ICInsider.com revised earnings for the current fiscal year to 35 cents from 30 cents previously.

The Junior Market’s long history of rising around a month before the release of quarterly results and declining shortly after results are released seems to be starting with a rise of 108 points in the market index this past week, with the supply of some stocks falling sharply.

At the end of the week, the average PE for the JSE Main Market TOP 10 is 5.4, well below the market average of 13.8, while the Junior Market Top 10 PE sits at 5.9 compared with the market at 11.6. The differences are important indicators of the level of likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 257 percent and the Main Market TOP10 by an average of 280 percent to May 2024, based on 2023 forecasted earnings.

The Junior Market has 11 stocks representing 23 percent of the market, with PEs from 15to 27, averaging 21, well above the market’s average. The top half of the market has an average PE of 17, suggesting that this may currently be the lowest fair value for Junior Market stocks.

The 18 highest valued Main Market stocks are priced at a PE of 15 to 115, with an average of 29 and 20 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

The 18 highest valued Main Market stocks are priced at a PE of 15 to 115, with an average of 29 and 20 excluding the highest PE stocks and 20 for the top half excluding the stocks with the highest valuation.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Transjamaican heads Stocks to Watch

Some positive signs are emerging in the local stock market, with a few stocks in the Main Market making new highs repeatedly. Elsewhere, inflation is down and the fall in BOJ CD rates since early March from 10.54 percent to this week’s 8.11 percent, a 23 percent fall, are signs that interest rates locally have softened and set to fall across the board before long.

The above are positive signals for stocks. Some stocks are worth holding or watching as they possess the assets and earnings potential to deliver above average returns in stock value for patient investors but are not likely to gain as much as those in the ICTOP10 lists.

The above are positive signals for stocks. Some stocks are worth holding or watching as they possess the assets and earnings potential to deliver above average returns in stock value for patient investors but are not likely to gain as much as those in the ICTOP10 lists.

These stocks are Transjamaican Highway, Access Financial, Dolphin Cove, Honey Bun, Lasco Financial, Lasco Manufacturing, Main Event, Stationery and Office Supplies and Wigton Windfarm.

In the stock market, there is a time to hold, a time to fold and be bold that is the case of investing in Transjamaican Highway. The stock that came to the market in 2020 at $1.41, which many touted as reasonably priced, lagged the IPO price until this year and is worth seriously considering.

Transjamaican Highway has moved away from the zone of the IPO price of $1.41 at the end of March and now sits at $1.77, with the stock trading in high volume. Why would a stock that the company reported a loss of US$7 million? First, acquiring the majority shares in Jamaica Infrastructure Operators resulted in a onetime loss of US$13.7 million, the only reason for the company to report a loss for the year. The transaction will result in future cost savings expected to significantly reduce Operating Expenses by more than 50 percent or US$12 million per annum and increase profitability in the future. ICInsider.com projects earnings per share of 0.016 US cents or J$0.24. A technical indicator is pointing to a short term price around $2.40.

Staff members of Main Event

Main Event has been on a tear following impressive first quarter results of $118 million or 39 cents per share. The stock gained 64 percent for 2023 to date and 227 since the start of 2021. ICInsider.com projects earnings per share of $1.70 for the current year and a stock price hitting $30 by the end of 2023. Interestingly, while revenues for the recent quarter were a record $626 million, marginally up on the $597 million generated in the 2019 first quarter, there is more room for growth as the economy returns to normal levels since the contraction over the past two years. it is noted that the company is involved in the staging of JMEA expo this year and that will bring in added revenues that were not there last year.

Honey Bun just dropped out of the ICInsider.com TOP10 but has room for more upside price movement, with revenues up 23 percent for the first quarter to December last year and profit surging 64 percent to 94 million before taxation. ICInsider.com projects a 25 percent rise in revenues for the current year, with earnings doubling to 90 cents per share over that of 2022. Those numbers should be enough to increase investors’ interest in the stock with an improved gross profit margin that slipped last year, helping boost profit.

With the first quarter results due out over the next three weeks for Access Financial, Dolphin Cove, Stationery and Office Supplies and full year results for Lasco Financial and Lasco Manufacturing, investors will see that these stocks are seriously undervalued.

With the first quarter results due out over the next three weeks for Access Financial, Dolphin Cove, Stationery and Office Supplies and full year results for Lasco Financial and Lasco Manufacturing, investors will see that these stocks are seriously undervalued.

Wigton Windfarm has been quietly hitting new 52 weeks highs. It could go higher as investors buy up what has become limited supply in recent weeks as the company venture into additional business activities. Technically the stock has broken out of a long consolidation phase and the trend indicates a higher price of around 90 cents before it is stopped.

Persons who compiled this report may have an interest in securities commented on.

Nice gains for ICTOP10 stocks, Purity returns

The Main and Junior Markets did not maintain the sharp bounce of the previous week, but most ICTOP10 Junior Market stocks ended with gains. In contrast, the Main Market ended with mostly modest losses, with 138 Student Living rising 5 percent to $5.30 and JMMB Group declining by 5 percent to $31.49, all other changes in the Main Market were two percent or less.

Dr Karlene McDonnough – Chairman of Image Consultants Ltd. The stock came in for increased demand during the week ahead of the release of full-year results.

The Junior Market had one change in its TOP10 list as Iron Rock Insurance and Image Plus climbed 13 percent to $2.27 and $2.03, respectively, while Main Event and Honey Bun rose 5 percent to $12.26 and $6.75, respectively, with the only sizable decline being a 9 percent fall for Tropical Battery to $1.90.

Image Plus never benefitted from any serious IPO bounce seems to be finally finding buying interest and closed the past week with 159,904 shares on the bid at $2.02, 160,746 at $2 and just over 800,000 between $1.90 and $1.95, with 25,987 stocks on offer at $2.03, 81,709 at $2.05 with one big offer of 1.72 million units at S2.50 with smaller offers before the this. There has been healthy trading in the stock recently, with trading of 824,526 units on Thursday. Trading on Wednesday saw 1,153,255 shares changing hands in the stock, with 910,000 units on Tuesday and 1.75 million shares on Monday, which seems to have cleared out a great deal of overhang in the market.

Update on interest rate developments. A number of developments taking place in the economy are worth watching. Following last week’s $35 billion Bank of Jamaica CD auction that saw the average rate coming in at 8.49 percent, this week’s auction saw an offer of $34 billion, with the average rate remaining the same as the previous week with fewer funds chasing the offered amount.  Another positive development is the average inflation rate running at 45 percent less than the same time last year and averaging 2.4 percent per annum since November last year. Foreign exchange inflows have been strong, with the NIR growing at $66 million in February and 220 million in March, putting it at a record end of month level as initial data suggest that tourism arrivals and foreign exchange generated by that industry exceed the similar period in 2019, the last year without the impact of covid-19 negatively affecting the sector. On top of those positive developments, corporate profits are expected to enjoy a good bounce for the majority of companies for the first quarter.

Another positive development is the average inflation rate running at 45 percent less than the same time last year and averaging 2.4 percent per annum since November last year. Foreign exchange inflows have been strong, with the NIR growing at $66 million in February and 220 million in March, putting it at a record end of month level as initial data suggest that tourism arrivals and foreign exchange generated by that industry exceed the similar period in 2019, the last year without the impact of covid-19 negatively affecting the sector. On top of those positive developments, corporate profits are expected to enjoy a good bounce for the majority of companies for the first quarter.

The Junior Market has a long term pattern, with the market starting to rise around a month before quarterly results are due and declining shortly after results are released. This is a pattern worth noting that can be built into investment decisions to improve returns.

Consolidated Bakeries Miss Birdie Easter bun. The stock is back in the ICTOP10

Dropping from the TOP10 Junior Market list this past week was Honey Bun, but investors should expect a big jump in revenues and profits for the first quarter, with the Easter coming at the beginning of April versus the 17th of April last year, as well as an improvement of gross profit margin that slipped up last year.

Returning to the TOP10 is Consolidated Bakeries in the number 3 spot. The company is projected to report a solid first quarter profit, with the Easter holidays coming at the start of April compared with April 17 last year and ensuring that mostly all Easter bun sales will be reported in the March quarter unlike 2022. The company reported a profit in 2022 a big improvement over a loss in the previous three years. ICInsider.com projects earnings of 40 cents for 2023 and 75 cents for 2024 with the company benefitting from a full recovery of the local economy and increase efficiency and reduction in borrowings. At the end of the week, the average PE for the JSE

Main Market TOP 10 is 5.6, well below the market average of 13.5, while the Junior Market Top 10 PE sits at 5.7 compared with the market at 11.1. The differences are important indicators of the likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 256 percent and the Main Market TOP10, an average of 271 percent, to May 2024, based on 2023 forecasted earnings.

Main Market TOP 10 is 5.6, well below the market average of 13.5, while the Junior Market Top 10 PE sits at 5.7 compared with the market at 11.1. The differences are important indicators of the likely gains for ICTOP10 stocks. The Junior Market is projected to rise by 256 percent and the Main Market TOP10, an average of 271 percent, to May 2024, based on 2023 forecasted earnings.

The Junior Market has 10 stocks representing 21 percent of the market, with PEs from 15 to 29, averaging 19, well above the market’s average. The top half of the market has an average PE of 15, suggesting this may be a logical value for junior market stocks.

The 16 stocks with the highest value in the Main Market stocks are priced at a PE of 15 to 115, with an average of 30 and 19 excluding the highest PE stocks and 19 for the top half excluding the stocks with the highest valuation.

The above average shows the extent of potential gains for the TOP 10 stocks.

The above average shows the extent of potential gains for the TOP 10 stocks.

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but not always. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

IC TOP10 stocks will likely deliver the best returns up to the end of May 2023 and are ranked in order of potential gains, computed using projected earnings for the current fiscal year. Expected values will change as stock prices fluctuate, resulting in weekly movements in and out of the lists. Revisions to earnings are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

At the close of the market on Friday, the Composite Index shed 465.78 points to end at 356,593.80. The JSE Main Index lost 723.40 points to conclude trading at 321,375.67. The Junior Market Index slipped 2.31 points to 3,729.58 and the JSE USD Market Index sank 3.74 points to lock up trading at 237.32.

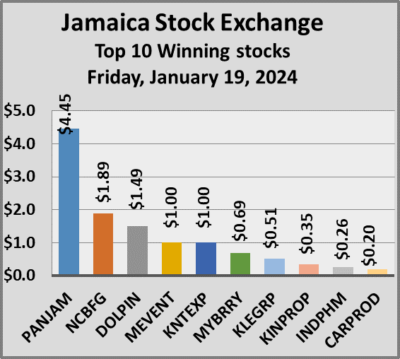

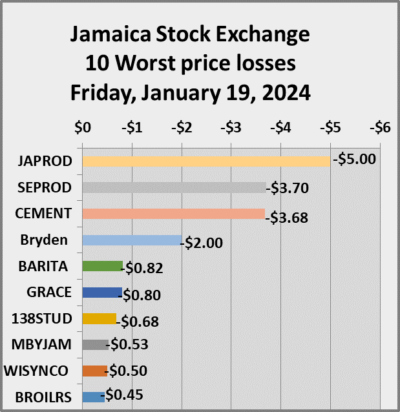

At the close of the market on Friday, the Composite Index shed 465.78 points to end at 356,593.80. The JSE Main Index lost 723.40 points to conclude trading at 321,375.67. The Junior Market Index slipped 2.31 points to 3,729.58 and the JSE USD Market Index sank 3.74 points to lock up trading at 237.32. At the close of the market, some of the major Main Market stocks that rose are NCB Financial rose $1.89 to $67.99, Pan Jamaica gained $4.45 in closing at $50.

At the close of the market, some of the major Main Market stocks that rose are NCB Financial rose $1.89 to $67.99, Pan Jamaica gained $4.45 in closing at $50. Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.