Trading ended on Monday, with the volume of shares changing hands falling 33 percent after the value fell 37 percent below Friday’s trades, on the Jamaica Stock Exchange US dollar market, resulting in an even number of stocks rising and falling and the market index slipping 4.4 percent for the year to date.

Trading ended with five securities changing hands, compared to seven on Friday with prices of two stocks rising, two declining and one remaining unchanged.

Trading ended with five securities changing hands, compared to seven on Friday with prices of two stocks rising, two declining and one remaining unchanged.

The US Denominated Equities Index lost 4.85 points to end at 178.19. The PE Ratio, a measure that computes appropriate stock values, averages 11.3 based on ICInsider.com’s forecast of 2021-22 earnings.

Overall, 329,386 shares traded for US$32,977 compared to 490,246 units at US$52,340 on Friday. Trading averaged 65,877 units at US$6,595 compared to 70,035 shares at US$7,477 on Friday, with the month to date averaging 30,966 shares at US$7,093 versus 26,999 units at US$7,149 on Friday. August ended with an average of 210,413 units for US$12,959.

Investor’s Choice bid-offer indicator shows no stock ending with the bid higher than the last selling price and one stock with a lower offer.

At the close, First Rock Capital rallied 0.2 of a cent to 7 US cents after trading 566 shares, Proven Investments lost 1.86 cents to end at 22.14 US cents, with 113,357 stocks clearing the market, Sygnus Credit Investments US$ share remained at 12.5 US cents after 20,804 units crossed the market and Transjamaican Highway declined 0.07 of a cent to 0.81 US cents with the swapping of 190,966 stock units.

At the close, First Rock Capital rallied 0.2 of a cent to 7 US cents after trading 566 shares, Proven Investments lost 1.86 cents to end at 22.14 US cents, with 113,357 stocks clearing the market, Sygnus Credit Investments US$ share remained at 12.5 US cents after 20,804 units crossed the market and Transjamaican Highway declined 0.07 of a cent to 0.81 US cents with the swapping of 190,966 stock units.

In the preference segment JMMB Group 6% climbed 1 cent to US$1.01, with 3,693 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

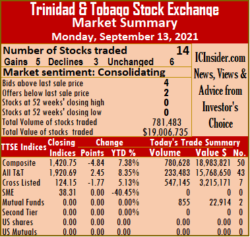

At the close, 14 securities traded compared to 16 on Friday, with five stocks rising, three declining and six remaining unchanged.

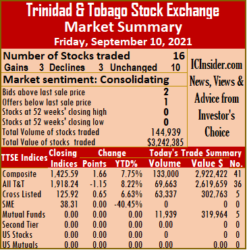

At the close, 14 securities traded compared to 16 on Friday, with five stocks rising, three declining and six remaining unchanged. First Citizens Bank popped 1 cent to $50.31 in an exchange of 854 units, GraceKennedy edged 1 cent higher to $6.26, with 491,867 units crossing the market, JMMB Group remained at $2.22 after 52,650 stock units crossed the market. Massy Holdings lost 8 cents to end at $82.02 after clearing the market of 100,375 shares, NCB Financial Group declined 24 cents to $8.01, with 2,628 stocks changing hands, Republic Financial Holdings popped 1 cent to $135.46 in exchanging 195 shares. Scotiabank fell 2 cents to $59 with the swapping of 123,818 units, Trinidad & Tobago NGL increased 4 cents to $16.49 in trading 4,591 stocks, Trinidad Cement remained at $3.91 trading 2,700 stock units. Unilever Caribbean had a switch in ownership of 148 units at $16.40 and West Indian Tobacco remained at $31 while exchanging 88 shares.

First Citizens Bank popped 1 cent to $50.31 in an exchange of 854 units, GraceKennedy edged 1 cent higher to $6.26, with 491,867 units crossing the market, JMMB Group remained at $2.22 after 52,650 stock units crossed the market. Massy Holdings lost 8 cents to end at $82.02 after clearing the market of 100,375 shares, NCB Financial Group declined 24 cents to $8.01, with 2,628 stocks changing hands, Republic Financial Holdings popped 1 cent to $135.46 in exchanging 195 shares. Scotiabank fell 2 cents to $59 with the swapping of 123,818 units, Trinidad & Tobago NGL increased 4 cents to $16.49 in trading 4,591 stocks, Trinidad Cement remained at $3.91 trading 2,700 stock units. Unilever Caribbean had a switch in ownership of 148 units at $16.40 and West Indian Tobacco remained at $31 while exchanging 88 shares. Jetcon Corporation came into the TOP10 in the prior week and enjoyed a modest pickup from 91 cents and is overtaken by

Jetcon Corporation came into the TOP10 in the prior week and enjoyed a modest pickup from 91 cents and is overtaken by Elsewhere, Future Energy Source, a former ICInsider.com BUY RATED stock that underwent a sharp pullback last week to $2.05 rose this past week to $2.51 as buying interest remains strong. Lumber Depot sits just below the ICTOP10 Junior Market stocks, after posting strong first quarter results that rose 140 percent over the 2020 first quarter, with ICInsider.com projecting earnings now at 35 cents per share, up from 27 cents previously, for the current year and the potential for the price to double into early 2022. Fontana reported increased earnings of $512 million, up from $277 million with earnings per share of 41 cents, just 4 cents below ICInsider.com forecast. Jamaica Broilers posted lower first quarter profit of $275 million, down from $383 million as the Jamaican and Haitian segments posted lower profits, but the USA segment enjoyed an 84 percent jump.

Elsewhere, Future Energy Source, a former ICInsider.com BUY RATED stock that underwent a sharp pullback last week to $2.05 rose this past week to $2.51 as buying interest remains strong. Lumber Depot sits just below the ICTOP10 Junior Market stocks, after posting strong first quarter results that rose 140 percent over the 2020 first quarter, with ICInsider.com projecting earnings now at 35 cents per share, up from 27 cents previously, for the current year and the potential for the price to double into early 2022. Fontana reported increased earnings of $512 million, up from $277 million with earnings per share of 41 cents, just 4 cents below ICInsider.com forecast. Jamaica Broilers posted lower first quarter profit of $275 million, down from $383 million as the Jamaican and Haitian segments posted lower profits, but the USA segment enjoyed an 84 percent jump.  Scotia Group reported profit of $2.8 billion an increase of 81 percent over the depressed 2020 third quarter and slightly more than the $2.7 billion generated in the April quarter, the group seems on target to earn around $3.50 per share for the year.

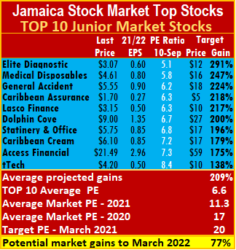

Scotia Group reported profit of $2.8 billion an increase of 81 percent over the depressed 2020 third quarter and slightly more than the $2.7 billion generated in the April quarter, the group seems on target to earn around $3.50 per share for the year. The TOP 10 trades at a PE of 6.6, with a 42 percent discount to that market’s PE and the potential to rise 77 percent to March next year, based on an average PE of 20.

The TOP 10 trades at a PE of 6.6, with a 42 percent discount to that market’s PE and the potential to rise 77 percent to March next year, based on an average PE of 20. ICTOP10 stocks are not intended to be a selection of the best stocks in the market but are most likely to be the best winners within a fifteen-month period. ICInsider.com ranks stocks to filter out the bigger winners from the rest, allowing investors to focus on potentially huge winners, helping to keep out emotional attachments to stocks that often result in costly mistakes being made. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

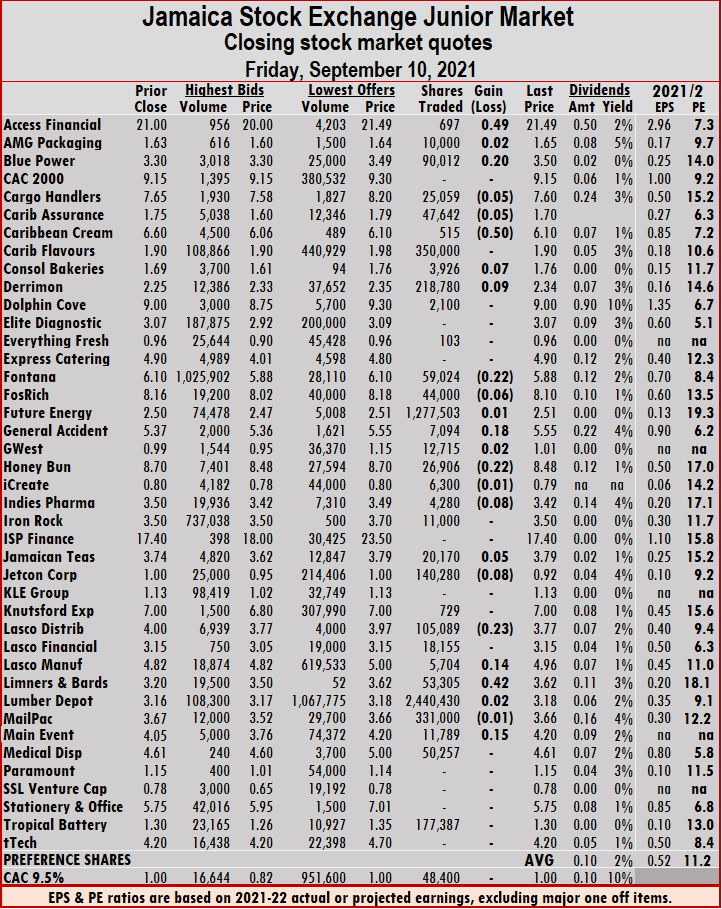

ICTOP10 stocks are not intended to be a selection of the best stocks in the market but are most likely to be the best winners within a fifteen-month period. ICInsider.com ranks stocks to filter out the bigger winners from the rest, allowing investors to focus on potentially huge winners, helping to keep out emotional attachments to stocks that often result in costly mistakes being made. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information. Market activity led to 33 securities trading down from 38 on Thursday, with 13 rising, 11 declining and nine, closing unchanged.

Market activity led to 33 securities trading down from 38 on Thursday, with 13 rising, 11 declining and nine, closing unchanged. Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and four with lower offers. Lasco Distributors shed 23 cents to end at $3.77, with 105,089 units crossing the exchange, Lasco Manufacturing increased 14 cents to $4.96 after 5,704 stocks changed hands, Limners and Bards advanced 42 cents to $3.62, with 53,305 stocks crossing the market. Lumber Depot popped 2 cents to $3.18 while exchanging 2,440,430 units as a major shareholder seems to be offloading stocks and Main Event climbed 15 cents in closing at $4.20 in trading 11,789 stock units.

Lasco Distributors shed 23 cents to end at $3.77, with 105,089 units crossing the exchange, Lasco Manufacturing increased 14 cents to $4.96 after 5,704 stocks changed hands, Limners and Bards advanced 42 cents to $3.62, with 53,305 stocks crossing the market. Lumber Depot popped 2 cents to $3.18 while exchanging 2,440,430 units as a major shareholder seems to be offloading stocks and Main Event climbed 15 cents in closing at $4.20 in trading 11,789 stock units. The market closed with 13,470,929 shares trading for $130,674,709 versus 12,534,457 units at $121,087,956 on Thursday. Pulse Investments led trading with 36.6 percent of total volume after trading 4.93 million shares, followed by Transjamaican Highway 22.5 percent, with 3.03 million units and Wigton Windfarm 13.1 percent, with 1.76 million units changing hands.

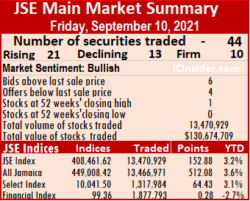

The market closed with 13,470,929 shares trading for $130,674,709 versus 12,534,457 units at $121,087,956 on Thursday. Pulse Investments led trading with 36.6 percent of total volume after trading 4.93 million shares, followed by Transjamaican Highway 22.5 percent, with 3.03 million units and Wigton Windfarm 13.1 percent, with 1.76 million units changing hands. Trading ended with 44 securities compared to 51 on Thursday, with 21 stocks rising, 13 declining and 10 ending unchanged.

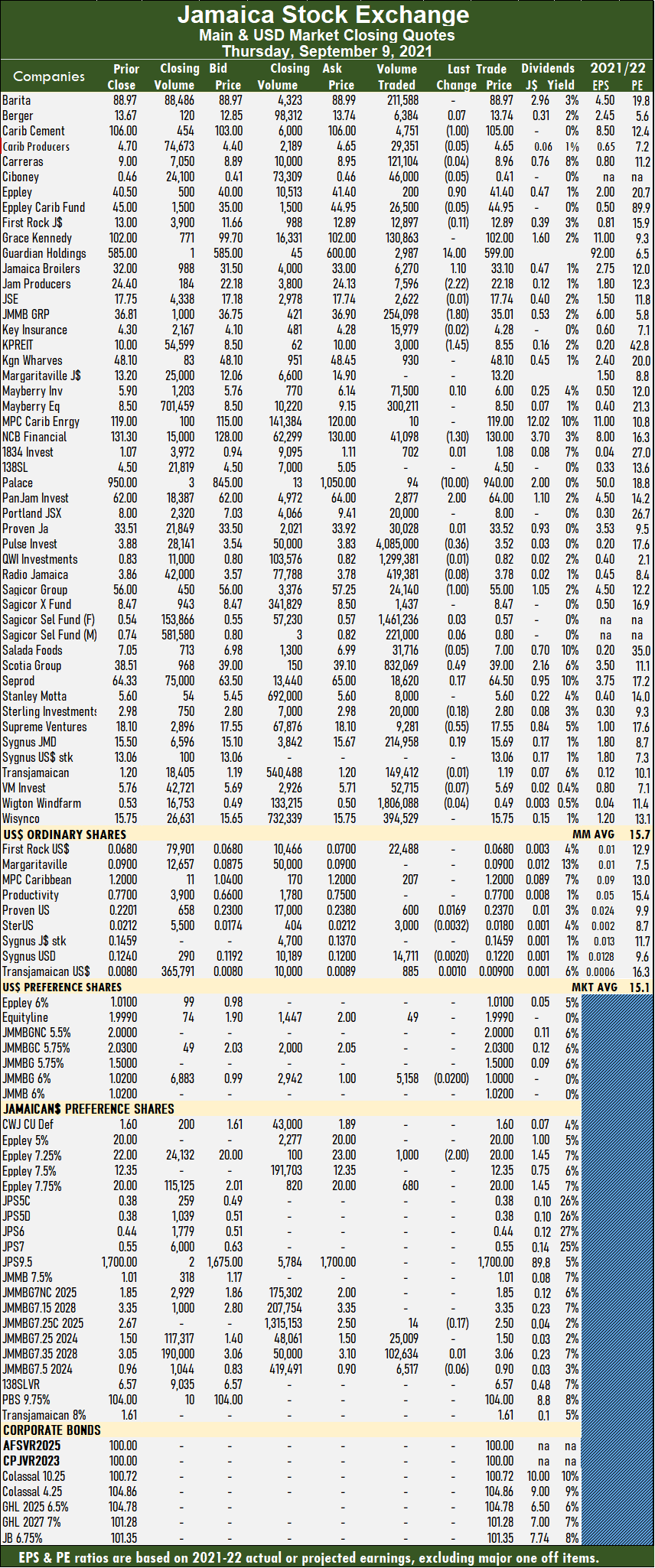

Trading ended with 44 securities compared to 51 on Thursday, with 21 stocks rising, 13 declining and 10 ending unchanged. Pulse Investments rose 58 cents in closing at $4.10 with 4,934,043 shares crossing the market. Scotia Group rallied 50 cents to $39.50 in exchanging 38,983 stocks, Seprod spiked 50 cents to $65 with the swapping of 176,170 units, Supreme Ventures popped 55 cents to $18.10 with 34,730 stock units crossing the market and Sygnus Credit Investments fell 53 cents to $15.16 in trading 43,083 shares.

Pulse Investments rose 58 cents in closing at $4.10 with 4,934,043 shares crossing the market. Scotia Group rallied 50 cents to $39.50 in exchanging 38,983 stocks, Seprod spiked 50 cents to $65 with the swapping of 176,170 units, Supreme Ventures popped 55 cents to $18.10 with 34,730 stock units crossing the market and Sygnus Credit Investments fell 53 cents to $15.16 in trading 43,083 shares. Trading ended with seven securities changing hands, compared to eight on Thursday, with prices of two rising, three declining, and two remaining unchanged.

Trading ended with seven securities changing hands, compared to eight on Thursday, with prices of two rising, three declining, and two remaining unchanged. At the close, First Rock Capital remained at 6.8 US cents after exchanging 15,600 shares, MPC Caribbean Clean Energy fell 16 cents in ending at US$1.04 in an exchange of 11 stocks, Proven Investments climbed 0.3 of a cent in closing at 24 US cents after trading 195,540 units. Sterling Investments declined 0.06 of a cent to end at 1.74 US cents after crossing the market with 3,600 stock units, Sygnus Credit Investments US$ share advanced 0.3 of a cent to 12.5 US cents in exchanging 20,489 stock units and Transjamaican Highway dropped 0.02 of a cent to close at 0.88 US cents after trading 255,000 shares.

At the close, First Rock Capital remained at 6.8 US cents after exchanging 15,600 shares, MPC Caribbean Clean Energy fell 16 cents in ending at US$1.04 in an exchange of 11 stocks, Proven Investments climbed 0.3 of a cent in closing at 24 US cents after trading 195,540 units. Sterling Investments declined 0.06 of a cent to end at 1.74 US cents after crossing the market with 3,600 stock units, Sygnus Credit Investments US$ share advanced 0.3 of a cent to 12.5 US cents in exchanging 20,489 stock units and Transjamaican Highway dropped 0.02 of a cent to close at 0.88 US cents after trading 255,000 shares. GraceKennedy closed at $6.25 in exchanging 40,237 shares, Guardian Holdings ended at $32.95, after 10,000 stocks changed hands, JMMB Group advanced 11 cents to $2.22, with 23,100 stock units crossing the market. Massy Holdings climbed 5 cents to $82.10 after swapping 500 shares, Republic Financial Holdings slipped 1 cent to $135.45 while exchanging 2,414 units, Scotiabank remained at $59.02, with 3,333 stocks clearing the market. Trinidad & Tobago NGL lost 5 cents to end at $16.45, with 26,636 units changing hands, Trinidad Cement closed at $3.91 in an exchange of 1,847 stock units, Unilever Caribbean traded 148 stocks at $16.40 and West Indian Tobacco remained at $31 in switching ownership of 3,301 shares.

GraceKennedy closed at $6.25 in exchanging 40,237 shares, Guardian Holdings ended at $32.95, after 10,000 stocks changed hands, JMMB Group advanced 11 cents to $2.22, with 23,100 stock units crossing the market. Massy Holdings climbed 5 cents to $82.10 after swapping 500 shares, Republic Financial Holdings slipped 1 cent to $135.45 while exchanging 2,414 units, Scotiabank remained at $59.02, with 3,333 stocks clearing the market. Trinidad & Tobago NGL lost 5 cents to end at $16.45, with 26,636 units changing hands, Trinidad Cement closed at $3.91 in an exchange of 1,847 stock units, Unilever Caribbean traded 148 stocks at $16.40 and West Indian Tobacco remained at $31 in switching ownership of 3,301 shares.

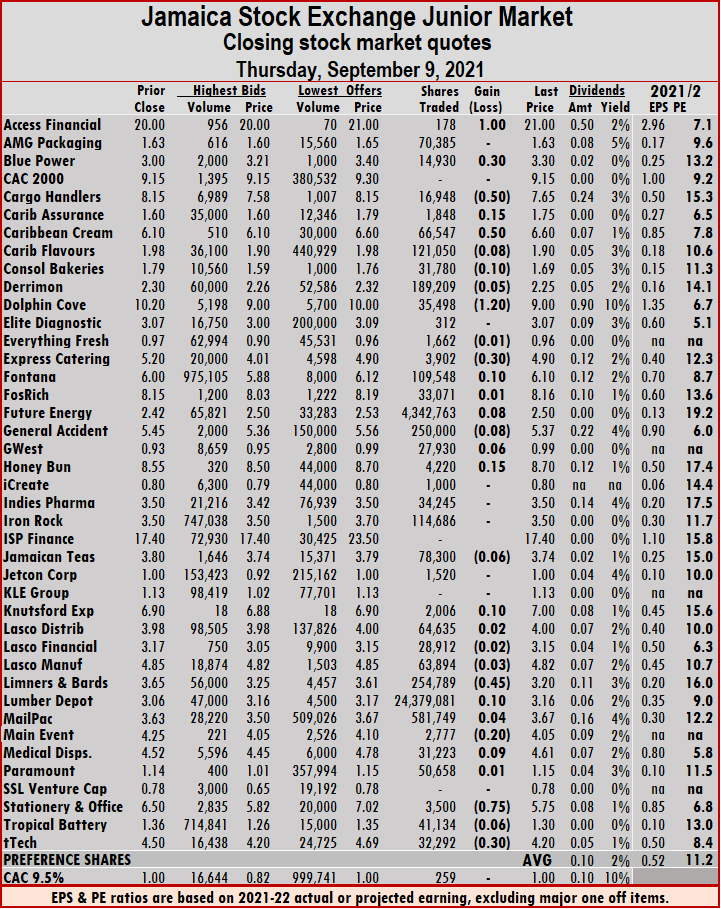

At the close, Access Financial jumped $1 to $21 in trading 178 shares, Blue Power popped 30 cents to $3.30 with an exchange of 14,930 stocks, Cargo Handlers dropped 50 cents to $7.65 with 16,948 stock units changing hands. Caribbean Assurance Brokers advanced 15 cents to $1.75 with 1,848 units traded after the stock traded at an intraday low of $1.52. Caribbean Cream gained 50 cents to close at $6.60 with a transfer of 66,547 shares, Caribbean Flavours slipped 8 cents to $1.90 with 121,050 stocks passing through the market. Consolidated Bakeries lost 10 cents to end at $1.69 with an exchange of 31,780 units, Derrimon Trading declined 5 cents to $2.25, with 189,209 shares changing hands, Dolphin Cove fell $1.20 to $9 with 35,498 stocks traded. Express Catering dropped 30 cents to $4.90 with a transfer of 3,902 units, Fontana advanced 10 cents to $6.10 with investor switching ownership of 109,548 stock units, Future Energy Source rose 8 cents to $2.50 with an exchange of 4,342,763 shares. General Accident slipped 8 cents to $5.37 with 250,000 units changing hands, GWest Corporation increased 6 cents to 99 cents with 27,930 stock units traded, Honey Bun gained 15 cents to close at $8.70 with a transfer of 4,220 shares. Jamaican Teas slipped 6 cents to $3.74 with 78,300 stocks passing through the market, Knutsford Express climbed 10 cents to $7 with an exchange of 2,006 units, Limners and Bards shed 45 cents to close at $3.20 with 254,789 stock units changing hands.

At the close, Access Financial jumped $1 to $21 in trading 178 shares, Blue Power popped 30 cents to $3.30 with an exchange of 14,930 stocks, Cargo Handlers dropped 50 cents to $7.65 with 16,948 stock units changing hands. Caribbean Assurance Brokers advanced 15 cents to $1.75 with 1,848 units traded after the stock traded at an intraday low of $1.52. Caribbean Cream gained 50 cents to close at $6.60 with a transfer of 66,547 shares, Caribbean Flavours slipped 8 cents to $1.90 with 121,050 stocks passing through the market. Consolidated Bakeries lost 10 cents to end at $1.69 with an exchange of 31,780 units, Derrimon Trading declined 5 cents to $2.25, with 189,209 shares changing hands, Dolphin Cove fell $1.20 to $9 with 35,498 stocks traded. Express Catering dropped 30 cents to $4.90 with a transfer of 3,902 units, Fontana advanced 10 cents to $6.10 with investor switching ownership of 109,548 stock units, Future Energy Source rose 8 cents to $2.50 with an exchange of 4,342,763 shares. General Accident slipped 8 cents to $5.37 with 250,000 units changing hands, GWest Corporation increased 6 cents to 99 cents with 27,930 stock units traded, Honey Bun gained 15 cents to close at $8.70 with a transfer of 4,220 shares. Jamaican Teas slipped 6 cents to $3.74 with 78,300 stocks passing through the market, Knutsford Express climbed 10 cents to $7 with an exchange of 2,006 units, Limners and Bards shed 45 cents to close at $3.20 with 254,789 stock units changing hands.  Lumber Depot rose 10 cents to $3.16 with 24,379,081 shares traded, Main Event dropped 20 cents to $4.05 with a transfer of 2,777 units, Medical Disposables added 9 cents to $4.61 with a transfer of 31,223 stock units. Stationery and Office Supplies shed 75 cents to finish at $5.75 with investors switching ownership of 3,500 stocks, Tropical Battery lost 6 cents to end at $1.30 with 41,134 units changing hands and tTech fell 30 cents to $4.20 with 32,292 shares crossing the exchange.

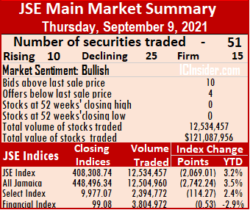

Lumber Depot rose 10 cents to $3.16 with 24,379,081 shares traded, Main Event dropped 20 cents to $4.05 with a transfer of 2,777 units, Medical Disposables added 9 cents to $4.61 with a transfer of 31,223 stock units. Stationery and Office Supplies shed 75 cents to finish at $5.75 with investors switching ownership of 3,500 stocks, Tropical Battery lost 6 cents to end at $1.30 with 41,134 units changing hands and tTech fell 30 cents to $4.20 with 32,292 shares crossing the exchange. The All Jamaican Composite Index dropped 2,742.24 points to close at 448,496.34, the Main Index declined 2,069.01 points to 408,308.74 and the JSE Financial Index shed 0.53 points to end 99.08.

The All Jamaican Composite Index dropped 2,742.24 points to close at 448,496.34, the Main Index declined 2,069.01 points to 408,308.74 and the JSE Financial Index shed 0.53 points to end 99.08. Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows ten stocks ending with bids higher than their last selling prices and four with lower offers. PanJam Investment increased $2 to end at $64 in an exchange of 2,877 shares, Pulse Investments dropped 36 cents to $3.52 after exchanging 4,085,000 stock units, Sagicor Group fell $1 to $55 while exchanging 24,140 stocks. Scotia Group popped 49 cents in closing at $39 with an exchange of 832,069 shares after the price hit a 52 weeks’ intraday low of $38 and Supreme Ventures shed 55 cents to close at $17.55, trading 9,281 units.

PanJam Investment increased $2 to end at $64 in an exchange of 2,877 shares, Pulse Investments dropped 36 cents to $3.52 after exchanging 4,085,000 stock units, Sagicor Group fell $1 to $55 while exchanging 24,140 stocks. Scotia Group popped 49 cents in closing at $39 with an exchange of 832,069 shares after the price hit a 52 weeks’ intraday low of $38 and Supreme Ventures shed 55 cents to close at $17.55, trading 9,281 units. Guardian Holdings fell 5 cents to $32.95 while trading 8,148 units, Guardian Media remained at $3.10 with the swapping of 71,421 units, JMMB Group dropped 4 cents to $2.11 after 200,000 stocks crossed the market. Massy Holdings popped 3 cents to $82.05 in exchange of 4,162 stock units, National Enterprises slipped 15 cents to close at $3.25, with 38,293 shares changing hands, National Flour Mills had an exchange of 4,090 units at $1.90. One Caribbean Media remained at $4.86 exchanging 67,357 units, Republic Financial Holdings popped 1 cent to $135.46, after 237 shares crossed the exchange, Scotiabank close trading of 2,550 stocks at $59.02. Trinidad & Tobago NGL remained at $16.50 trading 6,087 stock units, Trinidad Cement lost 9 cents trading 650 units at $3.91, Unilever Caribbean remained at $16.40, with 1,831 shares crossing the market and West Indian Tobacco remained at $31 in exchanging 9,890 stock units.

Guardian Holdings fell 5 cents to $32.95 while trading 8,148 units, Guardian Media remained at $3.10 with the swapping of 71,421 units, JMMB Group dropped 4 cents to $2.11 after 200,000 stocks crossed the market. Massy Holdings popped 3 cents to $82.05 in exchange of 4,162 stock units, National Enterprises slipped 15 cents to close at $3.25, with 38,293 shares changing hands, National Flour Mills had an exchange of 4,090 units at $1.90. One Caribbean Media remained at $4.86 exchanging 67,357 units, Republic Financial Holdings popped 1 cent to $135.46, after 237 shares crossed the exchange, Scotiabank close trading of 2,550 stocks at $59.02. Trinidad & Tobago NGL remained at $16.50 trading 6,087 stock units, Trinidad Cement lost 9 cents trading 650 units at $3.91, Unilever Caribbean remained at $16.40, with 1,831 shares crossing the market and West Indian Tobacco remained at $31 in exchanging 9,890 stock units.