In a week when the Junior Market slipped just one percent after 32 points fall and the Main Market nearly 4,000 points for a fall of just under one percent, there was little change to the ICTOP10 listings, but change there was.

Jetcon Corporation came into the TOP10 in the prior week and enjoyed a modest pickup from 91 cents and is overtaken by tTech after the price fell from $4.70 last week to $4.20 this past week.

Jetcon Corporation came into the TOP10 in the prior week and enjoyed a modest pickup from 91 cents and is overtaken by tTech after the price fell from $4.70 last week to $4.20 this past week.

The highlights for this past week are Future Energy Source, Sygnus Credit Investments, after posting full year profit, Radio Jamaica, with Lumber Depot coming into focus, Fontana, Scotia Group and Jamaica Broilers that all released quarterly results with differing outcomes.

Following the release of outstanding first quarter and full year results last week, Sygnus Credit Investments announced a dividend of 0.262 of a US cent payable on October 15, but the stock price pulled back from $16.30 last week to $15.16. Radio Jamaica made some recovery to close the week at $3.58, up from $3.17. The company also announced a 2 cents dividend to be paid in mid-October, but the stocks appear to stay below $4 for a while, with demand currently weak above $3.50.

Elsewhere, Future Energy Source, a former ICInsider.com BUY RATED stock that underwent a sharp pullback last week to $2.05 rose this past week to $2.51 as buying interest remains strong. Lumber Depot sits just below the ICTOP10 Junior Market stocks, after posting strong first quarter results that rose 140 percent over the 2020 first quarter, with ICInsider.com projecting earnings now at 35 cents per share, up from 27 cents previously, for the current year and the potential for the price to double into early 2022. Fontana reported increased earnings of $512 million, up from $277 million with earnings per share of 41 cents, just 4 cents below ICInsider.com forecast. Jamaica Broilers posted lower first quarter profit of $275 million, down from $383 million as the Jamaican and Haitian segments posted lower profits, but the USA segment enjoyed an 84 percent jump.

Elsewhere, Future Energy Source, a former ICInsider.com BUY RATED stock that underwent a sharp pullback last week to $2.05 rose this past week to $2.51 as buying interest remains strong. Lumber Depot sits just below the ICTOP10 Junior Market stocks, after posting strong first quarter results that rose 140 percent over the 2020 first quarter, with ICInsider.com projecting earnings now at 35 cents per share, up from 27 cents previously, for the current year and the potential for the price to double into early 2022. Fontana reported increased earnings of $512 million, up from $277 million with earnings per share of 41 cents, just 4 cents below ICInsider.com forecast. Jamaica Broilers posted lower first quarter profit of $275 million, down from $383 million as the Jamaican and Haitian segments posted lower profits, but the USA segment enjoyed an 84 percent jump.  Scotia Group reported profit of $2.8 billion an increase of 81 percent over the depressed 2020 third quarter and slightly more than the $2.7 billion generated in the April quarter, the group seems on target to earn around $3.50 per share for the year.

Scotia Group reported profit of $2.8 billion an increase of 81 percent over the depressed 2020 third quarter and slightly more than the $2.7 billion generated in the April quarter, the group seems on target to earn around $3.50 per share for the year.

The top three Main Market stocks are, Berger Paints followed by JMMB Group and Guardian Holdings, with expected gains of 202 to 290 percent, versus last weeks’ 209 to 286 percent.

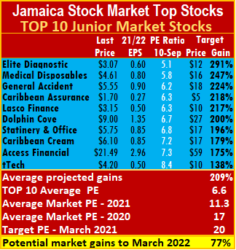

The top three stocks in the Junior Market are Elite Diagnostic, followed by Medical Disposables and General Accident. All three have the potential to gain between 224 percent and 291 percent, compared to 233 and 275 percent last week.

This past week, the average gains projected for the Junior Market rose from 198 percent to 209 percent and Main Market stocks moved from 173 percent to 170 percent.

The Junior Market closed the week with an average PE of 11.3 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the historical average of 17 for the period to March this year based on 2020 earnings.  The TOP 10 trades at a PE of 6.6, with a 42 percent discount to that market’s PE and the potential to rise 77 percent to March next year, based on an average PE of 20.

The TOP 10 trades at a PE of 6.6, with a 42 percent discount to that market’s PE and the potential to rise 77 percent to March next year, based on an average PE of 20.

The JSE Main Market ended the week with an overall PE of 16, a little distance from 19 the market ended at in March, suggesting a 19 percent rise at a PE of 19 and 25 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.7, with a 52 percent discount to the PE of that market, well off the potential of 20.

ICTOP10 stocks are not intended to be a selection of the best stocks in the market but are most likely to be the best winners within a fifteen-month period. ICInsider.com ranks stocks to filter out the bigger winners from the rest, allowing investors to focus on potentially huge winners, helping to keep out emotional attachments to stocks that often result in costly mistakes being made. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

ICTOP10 stocks are not intended to be a selection of the best stocks in the market but are most likely to be the best winners within a fifteen-month period. ICInsider.com ranks stocks to filter out the bigger winners from the rest, allowing investors to focus on potentially huge winners, helping to keep out emotional attachments to stocks that often result in costly mistakes being made. IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.