A likely 6 percent growth in Jamaica’s economy in 2022 helped several Main Market stocks to overcome a sharp rise in interest rates to record gains between two and 82 percent after the Jamaica Stock Exchange started 2022 tentatively,  with the market index gaining just two percent at its peak in mid-May after which the JSE Main Index dropped 10.2 percent for the year as Bank of Jamaica pushed interest rates higher during the year.

with the market index gaining just two percent at its peak in mid-May after which the JSE Main Index dropped 10.2 percent for the year as Bank of Jamaica pushed interest rates higher during the year.

The first real sign of change in the market was after investors pushed Treasury bills rates to peak in April, seven months before the country’s central did. Stock prices started to slip in May, sending the market into reverse from then until year end, except for the last two weeks when there was a near 6 percent rebound.

Although the market declined for the year, the market ended the year with gains in 22 stocks, compared with 25 losers that fell from 3 percent to 40 percent, with Salada Foods being the worst performer, following a 38 percent fall in  NCB Financial despite profit jumping sharply over that of 2021. The group recorded huge unrealised investment losses net of gains that wiped out the traditionally reported profit of $40 billion and left a deficit of $7.6 billion for the fiscal year that reduced shareholders’ equity from $161.5 billion to $149.5 billion, and resulted in continued dividend suspension, that may have encouraged more pressure on the stock than usual. Massy Holdings and VM Investments both declined by 35 percent for the year. 1834 Investments was the top stock resulting from its acquisition by Radio Jamaica, productive Business Solutions delivered gains of 64 percent, followed by Supreme Ventures, with 62 percent, both flowing from solid increases in profit for the period to September last year.

NCB Financial despite profit jumping sharply over that of 2021. The group recorded huge unrealised investment losses net of gains that wiped out the traditionally reported profit of $40 billion and left a deficit of $7.6 billion for the fiscal year that reduced shareholders’ equity from $161.5 billion to $149.5 billion, and resulted in continued dividend suspension, that may have encouraged more pressure on the stock than usual. Massy Holdings and VM Investments both declined by 35 percent for the year. 1834 Investments was the top stock resulting from its acquisition by Radio Jamaica, productive Business Solutions delivered gains of 64 percent, followed by Supreme Ventures, with 62 percent, both flowing from solid increases in profit for the period to September last year.

Mayberry Jamaica shed 50m Lumber shares

Lumber Depot dominated trading with

Lumber Depot, the 2019 spinoff of the Junior Market listed Blue Power, reported record first quarter results to July, with profit of $72 million, up from $30 million in 2020, with earnings per share of 10 cents and attracted increased buying in the stock as the results hit the exchange on September 8.

Mayberry Jamaican Equities (MJE) pounced on the renewed buying interest and sold just under 50 million units in the market up to October 20.MJE slashed their holdings of 181,538,726 shares, with 25.7 percent of total issued capital at the end of July to 132,468,464, but they remained the largest shareholder at 18.76 percent.

Over the same period, Blue Power Group, the second largest shareholder, reduced their 101,989,250 holdings to 14.4412 percent to 98,989,250 or 14.02 percent. Blue power in January held 113,989,250 shares, with a 16.14 percent holding. Kenneth Benjamin, a director of Blue Power, holdings in January of 49.95 million rose to 59,954,650 units or 8.4893 percent but slipped to 58.4 million in October.

Since October 20, the average daily trade in the stock has been 773,546 units, with the lowest trade, 522,227, on the 21 of the month.

QWI best performing listed fund

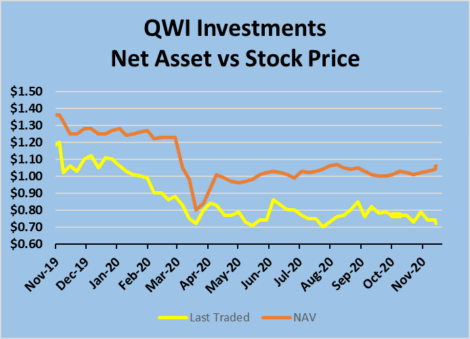

As of Friday, the worst-performing equity-based listed fund has the highest valuation relative to net asset value (NAV). The best performing fund is currently beating the performance of local stocks by a huge margin, following outperforming the market in 2019, but has the highest discount to NAV currently.

Since the start of the year, QWI Investments NAV outperformed the local stocks with the NAV down 16.5 percent while local stocks are down on average 31 percent, with investors marking the price down more than other equity funds. Mayberry Jamaican Equities NAV is down 38 percent from the start of the year, to underperform the market, but the stock is selling now selling at a moderate to the NAV. The NAV for Sagicor Select Funds – Financial is down 28 percent for the year so far, while the Manufacturing & Distribution fund is down 23 percent but the discount to NAV is far lower than QWI.

Since the start of the year, QWI Investments NAV outperformed the local stocks with the NAV down 16.5 percent while local stocks are down on average 31 percent, with investors marking the price down more than other equity funds. Mayberry Jamaican Equities NAV is down 38 percent from the start of the year, to underperform the market, but the stock is selling now selling at a moderate to the NAV. The NAV for Sagicor Select Funds – Financial is down 28 percent for the year so far, while the Manufacturing & Distribution fund is down 23 percent but the discount to NAV is far lower than QWI.

The disparities in valuing the stocks in the sector is a reminder that making money in stocks is not as difficult as many think, sometimes it requires observance, patience and a bit of logic and here history can be an excellent teacher.

Commodities such as stocks, currencies and other traded assets form patterns over time, persons following these patterns well can profit from them above the average.

When there are major variations from normal patterns, prices will move in one direction or the other and this is one way to make big gains for the keen observer. This is the situation now evident in the stocks of listed funds. When coupled with positive bullish technical signals for the Junior and Main Market, persons investing in some of these funds could do very well in the new few months. The same applies to equity-linked unit trust that declined in value, with the fall of local stock prices earlier this year.

Stocks trading at a valuation below the market or below the historical valuation usually indicate undervaluation and are candidates for gains. The reverse is also true, suggesting that investors should consider selling these if the situation exists.

The patterns shown by local listed funds makes for interesting reading suggesting there is money to be made by investing in some of them.

Mayberry Jamaican Equities is the worse performing listed fund in 2020,

QWI Investments announced its NAV per share as of November 20, at $1.06, a gain of 2 cents for the past week. At the same time, the stock closed at 72 cents, a discount of 32 percent to the net asset value. While the NAV increased, the stock price has fallen to stretch the already overly deep discount. A return of the stock price to NAV would provide a return of 41 percent on the current stock price.

Sagicor Select Funds – Financial NAV this week is 83.8 cents, with the stock at 64 cents on Friday, for a discount of 23.6 percent. At the end of September, the NAV was 83 cents and the stock price 60 cents for a discount of 28 percent. The NAV is at a discount of 12 percent for the Manufacturing & Distribution fund with NAV of 79.7 cents with the stock price on Friday closing at 70 cents, at the end of September, the stock traded at 70 cents with the NAV at 79 cents, with a discount of 12.4 percent.

Mayberry Jamaican Equities discount to NAV at November 18 is 12.8 percent with the NAV at $8.80 and the stock priced at $7.80, at the end of September the NAV was $8.30 and priced at par with the last traded price of $8.30.

The discount to net asset value for QWI narrowed in June, widened again in August but narrowed again in September and has now widened again, with the value rising and the price dropping. The average discount from the start in October 2019 is 21 percent with a low of 5 percent on March 27 and a high of 33 percent in July. The average discount from the start of trading is 18 percent up to the end of June, which is closer to the discount of the others.

All Jamaica claims 411,546 – Thursday

The main market of the Jamaica Stock Exchange broke through 410,000 mark based on movement of the All Jamaica Composite Index in early trading on Wednesday and moved higher by 3,093.31 points to a record 411,545.91.

The main market of the Jamaica Stock Exchange broke through 410,000 mark based on movement of the All Jamaica Composite Index in early trading on Wednesday and moved higher by 3,093.31 points to a record 411,545.91.

The JSE Index that jumped to a record 374,251.61 in early trading moved on to 374,964.90 with gains of 2,818.36, The Junior Market rose 19.93 points to 3,401.72. Grace Kennedy raced to an all-time high of $75, NCB Financial moved up to a record of $131, Supreme Ventures climbed to $21.70, JMMB Group jumped to $35 and Mayberry Jamaican Equities traded at $12.

The main market broke through all resistance points, with the last being 400,000 points with the next big one being 510,000 points region. If it got there in 2018, would represent a gain of 24 percent from current levels and lift the gains for the year to 60 percent.

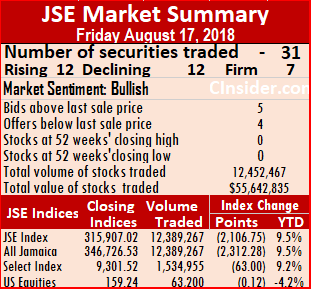

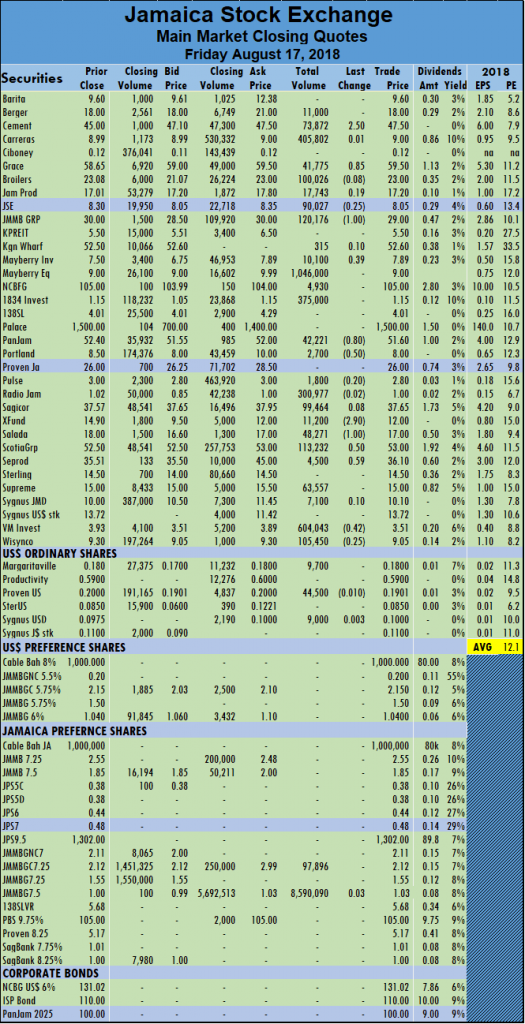

JSE stocks retreat from Thursday’s record

Mayberry Jamaican Equities traded 1M shares & the price hits a new high of $10 but retreated by Friday’s close.

The All Jamaican Composite Index of the Jamaica Stock Exchange and the JSE index fell more than 2,000 points as main market stocks retreated from Thursday’s record close as the market set its sight on breaking through the 350,000 mark this coming week.

At the close, the All Jamaican Composite Index dropped 2,312.28 points to 346,726.53 and the JSE Index dived 2,106.75 points to 315,907.02. Market activities resulted in 31 securities trading including 3 in the US dollar market compared to 27 securities trading on Thursday.

At the end of trading, the prices of 12 stocks rose, 12 declined and 7 traded unchanged. Trading in the main market ended with 12,389,267 units valued $54,066,117, compared to 7,549,926 units valued at $378,631,059 on Thursday.

The day’s volume was led by, JMMB Group 7.5% preference share concluded trading at $1.03, with 8,590,090 shares with 69.3 percent of the traded volume, followed by Mayberry Equities that closed at $9 in trading 1,046,000 shares,  for just 8.4 percent of the day’s volume after trading at an intraday high of $10 and Supreme Ventures with 604,043 units and 4.9 percent of the main market volume.

for just 8.4 percent of the day’s volume after trading at an intraday high of $10 and Supreme Ventures with 604,043 units and 4.9 percent of the main market volume.

Stocks with major price changes| Caribbean Cement jumped $2.50 and finished at $47.50, trading 73,872 shares, Grace Kennedy rose 85 cents and ended trading at $59.50, with 41,775 shares, JMMB Group lost $1 and ended at $29, exchanging 120,176 shares, Mayberry Investments gained 39 cents to settle at $7.89, with 10,100 units, PanJam Investment fell 80 cents and concluded trading 42,221 shares and closed at $51.60, Portland JSX lost 50 cents and ended at $8 trading 2,700 units, Sagicor Real Estate Fund dived $2.90 to $12, with 11,200 shares, Salada Foods shed $1 to close at $17, in exchanging 48,271 units, Scotia Group rose 50 cents in traded 113,232 shares to close at $53, Seprod finished trading 4,500 shares, and gained 59 cents to close at $36.10, ended at $15, with 21,164 shares after losing 30 cents,  Victoria Mutual Investments lost 42 cents in concluding trading at $3.51, with 604,043 stock units and Wisynco Group fell 25 cents and finished trading 105,450 shares to end at $9.05.

Victoria Mutual Investments lost 42 cents in concluding trading at $3.51, with 604,043 stock units and Wisynco Group fell 25 cents and finished trading 105,450 shares to end at $9.05.

Trading in the US dollar market closed with Margaritaville traded 9,700 shares and ended at 18 US cents Proven Investments trading 44,500 shares, falling 0.09 cent and closed at 19.01 US cents and Sygnus Credit Investments traded 9,000 shares and rose 0.03 cent to 10 US cents. The JSE USD Equities Index slipped 0.12 points to end at 159.24.

Trading resulted in an average of 492,474 units valued at over $1,930,933, in contrast to 290,382 shares valued at $14,562,733 on Thursday. For the month to date an average of 231,530 shares valued at an average of $4,665,985 versus 211,092 shares valued at an average of $4,956,066 on Thursday. July closed with an average of 169,022 units valued at $3,514,756, for each security traded.

IC bid-offer Indicator| At the end of trading, the Choice bid-offer indicator reading shows 5 stocks ended with bids higher than their last selling prices and 4 closing with lower offers.

More records for JSE main market

Mayberry Jamaican Equities traded for the first time after a successful IPO at $9.82 and NCB Financial traded at $102, for a gain of $1.48 to help to main market to new record high in early trading on Tuesday.

Mayberry Jamaican Equities traded for the first time after a successful IPO at $9.82 and NCB Financial traded at $102, for a gain of $1.48 to help to main market to new record high in early trading on Tuesday.

The Mayberry Jamaican Equities trade was for 1,000 units and resulted in a gain of $2.26 or 29.89 percent gain on the IPO price of $7.56. NCB traded just 35,991 shares.

With just 45 minutes of trading elapsing, the All Jamaican Composite Index advanced by 1,476.90 points to a record high of 342,356.79 and the JSE Index gained 1,345.62 points to close at 311,925.68. The Junior market was down by 17.75 points to 3,088.81.

accounting policy that will result in gains or losses in investments whether realized or not going straight to the profit and loss account. With growth in the stock market Barita should benefit in two ways, increased value of the portfolio, for example, 48 million JSE shares owned increasing around $100 million in the December quarter so far but Barita is said to also own shares in NCB that has risen sharply in price for the quarter. The equity linked unit trust will garner more fee income based purely on the fact that the portfolio would have grown based on gains in stock price. The other financial stock to be watched is Key Insurance that has traded over 21 million shares so far with the stock having a bid of $4 to buy over 911,000 shares. The movement in the Key shares seems like the start of an aggressive stance an investor, watch developments in this one keenly.

accounting policy that will result in gains or losses in investments whether realized or not going straight to the profit and loss account. With growth in the stock market Barita should benefit in two ways, increased value of the portfolio, for example, 48 million JSE shares owned increasing around $100 million in the December quarter so far but Barita is said to also own shares in NCB that has risen sharply in price for the quarter. The equity linked unit trust will garner more fee income based purely on the fact that the portfolio would have grown based on gains in stock price. The other financial stock to be watched is Key Insurance that has traded over 21 million shares so far with the stock having a bid of $4 to buy over 911,000 shares. The movement in the Key shares seems like the start of an aggressive stance an investor, watch developments in this one keenly.