The recent initial publicly offered stock, JFP Limited listed on the Jamaica Stock Exchange on Monday and closed 31 percent higher than the issue price of $1, but the move up was just barely able to keep the junior market from falling at the close, with the Combined Index diving 10,223.74 points to 400,884.61 after Massy Holdings dropped in price.

The All Jamaican Composite Index declined a more moderate 1,713.39 points to settle at 438,421.97, JSE Main Index dropped 10,931.95 points to 389,939.30, while the Junior Market Index added just 2.59 points to end the week at 4032.48, after rising to 4,109 points shortly after the market opened.

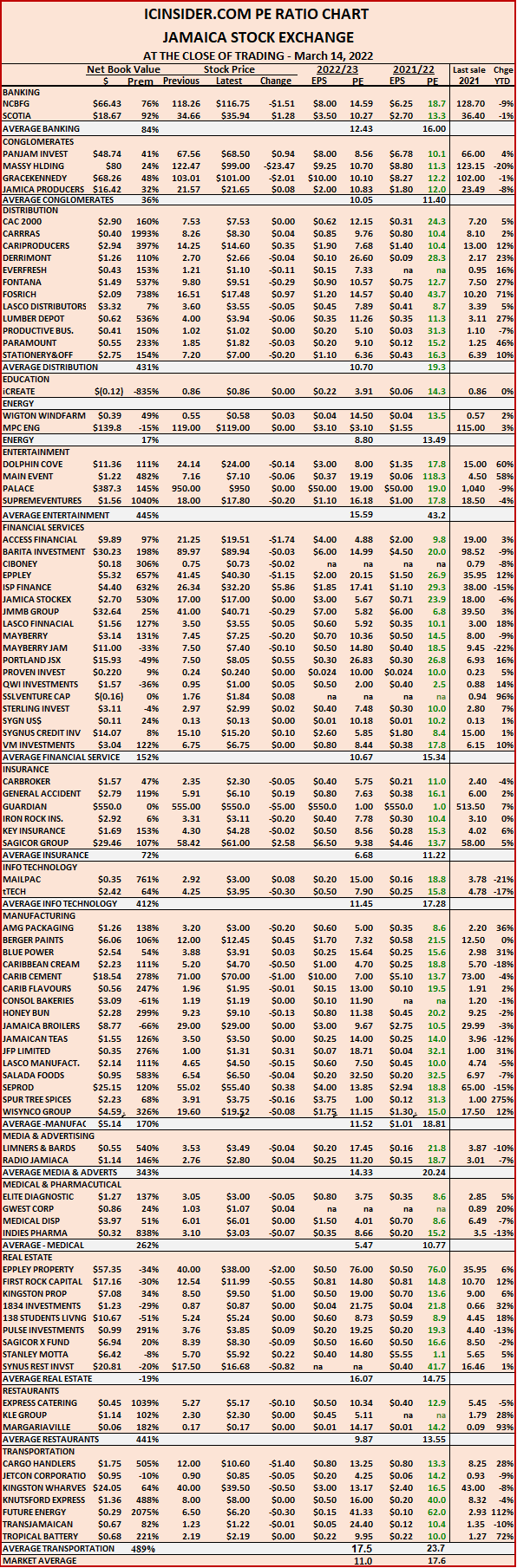

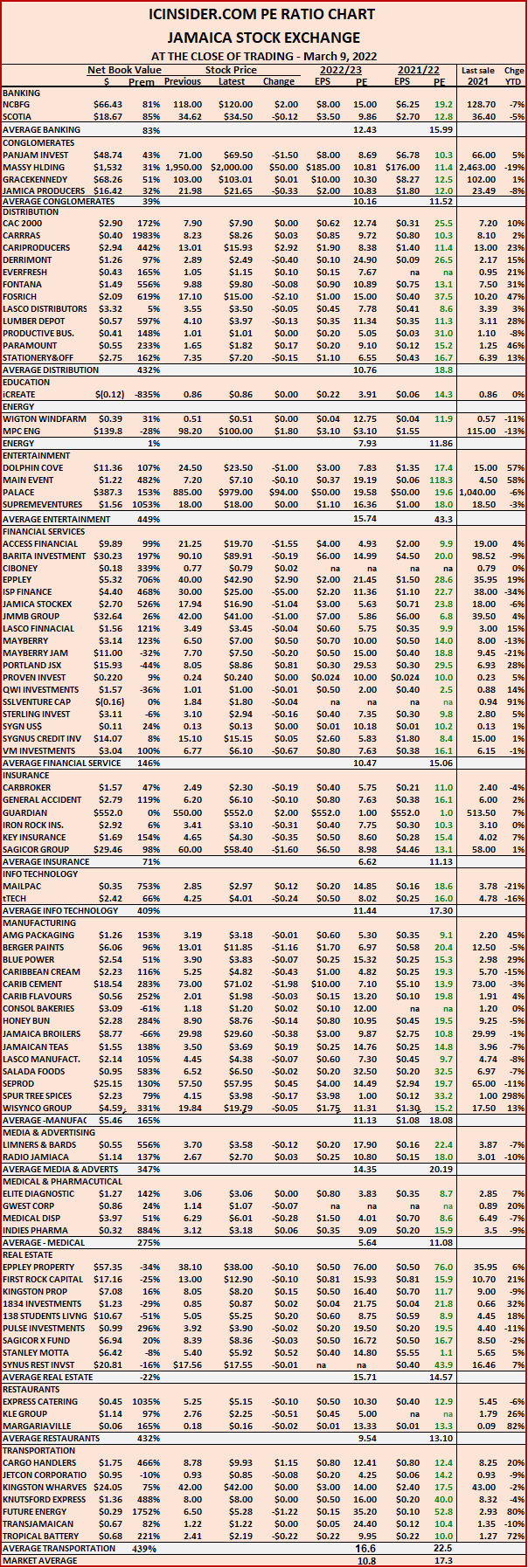

The market’s PE ratio ended at 17.6 based on 2021-22 earnings and 11 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart along with the more detailed daily report charts, provide investors with regularly updated information to help with decision making.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market.

The net asset value of each company is reported as a guide to easily assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

JFP jumps 31% Massy drags down JSE Index

Cargo Handlers exits ICTOP10 with 33% gain

Cargo Handlers returned to ICTOP10 listing last week and was another winner with gains of 33 percent, sufficient to move it out of the top flight Junior Market stocks. The stock joins a long list of high performance ICTOP10 stocks, including the 32 percent gain in Tropical Battery stock in the previous week.

Caribbean Assurance Brokers come back in the Junior Market list, while Sterling Investments makes it back to the Main Market listing at the expense of TransJamacian Highway after just one week, but investors should keep an eye for this one.

Caribbean Assurance Brokers come back in the Junior Market list, while Sterling Investments makes it back to the Main Market listing at the expense of TransJamacian Highway after just one week, but investors should keep an eye for this one.

In a week when the Junior Market dropped 297 points in three days that pushed the index down to 3,871 points, it bounced on the last two days to close over 4,031, still 137 points from the record of 4,168.16, at the end of the previous week. Meanwhile, the Main Market continues to consolidate around support at 440,000 points measured by the All Jamaica Composite Index.

Recent IPOs JFP limited and EducFocal are set to list on Monday and Tuesday coming following the oversubscribed initial public offers.

During the past week, the Junior Market TOP10 listed Access Financial, Lasco Financial and Iron Rock Insurance gained 6 percent each while Medical Disposables fell 9 percent and Tropical Battery slipped 5 percent. In the Main Market, the primary movers are Guardian Holdings with a 4 percent gain, while JMMB Group fell 7 percent and Proven Investments declined by 5 percent.

During the past week, the Junior Market TOP10 listed Access Financial, Lasco Financial and Iron Rock Insurance gained 6 percent each while Medical Disposables fell 9 percent and Tropical Battery slipped 5 percent. In the Main Market, the primary movers are Guardian Holdings with a 4 percent gain, while JMMB Group fell 7 percent and Proven Investments declined by 5 percent.

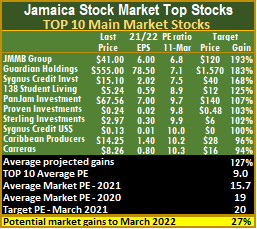

The potential gains for the TOP 10 Junior Market stocks remained for a second week at 105 percent, much lower than the Main Market at 127 percent, an indication that the Main Market is undervalued. The top three stocks in the Junior Market are Medical Disposables followed by Elite Diagnostic and Lasco Distributors to gain between 122 and 133 percent, compared to 121 and 126 percent, previously.

The potential gains for Main Market stocks moved from 124 percent last week to this weeks’ 127 percent, with the top three being JMMB Group followed by Guardian Holdings and Sygnus Credit Investments all projected to gain between 168 and 193 percent versus 161 and 193 percent last week.

The potential gains for Main Market stocks moved from 124 percent last week to this weeks’ 127 percent, with the top three being JMMB Group followed by Guardian Holdings and Sygnus Credit Investments all projected to gain between 168 and 193 percent versus 161 and 193 percent last week.

The average PE for Junior Market has surpassed the average of 17 times 2020 earnings achieved at the end of March last year in moving to 19 based on ICInsider.com’s 2021-22 earnings and is ahead of the JSE Main and USD Markets at 15.7 well off from 19 in 2021. The TOP 10 stocks trade at a PE of a mere 9, with a 48 percent discount to that market’s average.

All the stocks in the Junior Market can gain just 5 percent to the end of March this year, based on an average PE of 20. About a third of Junior Market stocks with positive earnings are trading at or above this level, averaging around 23.

The average PE for the JSE Main Market is 21 percent less than the PE of 19 at the end of March and 24 percent below the target of 20 to the end of March this year. The Main Market TOP 10 average PE is 9 representing a 43 percent discount to the market, well below the potential of 20. Around 15 stocks or a thirty percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times current year’s earnings. The depressed PE of the main market may be indicating that bigger investors are reluctant to be aggressive in buying into the market currently with inflation, rising interest rates and war populating the headlines.

The average PE for the JSE Main Market is 21 percent less than the PE of 19 at the end of March and 24 percent below the target of 20 to the end of March this year. The Main Market TOP 10 average PE is 9 representing a 43 percent discount to the market, well below the potential of 20. Around 15 stocks or a thirty percent of the market trade at or above a PE of 19, with most over 20, for an average roundabout 25, suggesting that the accepted multiple is between 20 and 25 times current year’s earnings. The depressed PE of the main market may be indicating that bigger investors are reluctant to be aggressive in buying into the market currently with inflation, rising interest rates and war populating the headlines.

ICTOP10 focuses on likely yearly winners, accordingly, the list may or may not include the best companies in the market. ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks based on projected earnings to highlight winners from the rest, allowing investors to focus on potential winning stocks and helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on the possible increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

JFP lists on Monday

Trading of shares that were recently offered to the public in JFP Limited, will commence on Monday on the Junior Market of the Jamaica Stock Exchange and bring the total listings on the market to 44 and will move to 45 on Tuesday after the listing of Edufocal.

Trading of shares that were recently offered to the public in JFP Limited, will commence on Monday on the Junior Market of the Jamaica Stock Exchange and bring the total listings on the market to 44 and will move to 45 on Tuesday after the listing of Edufocal.

A total of 280 million ordinary shares were offered to the public with the issuing opening on February 21 and closed the offer being oversubscribed.

JFP production

Employee Reserve Pool applicants received 100 percent of their application with the balance not applied for was made available for Key Partner Reserve Pool who received all they applied for. GK Investments Reserve Pool applicants got all shares applied for, applicants from the General Public got 12,500 shares plus approximately 22.8 percent of the excess shares applied for above the Base Allotment. The oversubscription should provide a bounce for the stock when it opens.

Edufocal lists on Tuesday

Trading of shares in EduFocal that offered 129,689,219 ordinary shares to the public on March 3, will commence on Tuesday as the company shares will be listed on the Jamaica Stock Exchange Junior Market on that day and will bring the total listings on the market to 45.

The offer was oversubscribed, with Key Strategic Partners in this reserved pool will receive all their predetermined amount.

The offer was oversubscribed, with Key Strategic Partners in this reserved pool will receive all their predetermined amount.

Applicants who applied for more than their predetermined amount will receive a pro-rata allocation of approximately 59.67 percent of the excess shares for which they applied, with any excess transferred to the General Public Pool.

All applicants from the General Public received 10,000 shares and approximately 16.57 percent of the excess shares.

Although the offer was handily oversubscribed, ICInsider.com gathers there were applications that came in after the close just after the issue opened and closed minutes after opening so there is added demand that should provide a bounce for the stock.

Bounce for Jamaica Stock Exchange

The Jamaica Stock Exchange made headway at the close on Friday, with the JSE Main Index adding 876.40 points to settle at 400,871.3 and the Combined Index gaining 1618.02 points to 411,108.40, but the All Jamaican Composite Index declined 2,112.90 points to settle at 440,135.36, while the Junior Market made great strides in the past two days with the market Index adding another 90.51 points on Friday following Thursday’s 70.26 points rise to end the week at 4031.89.

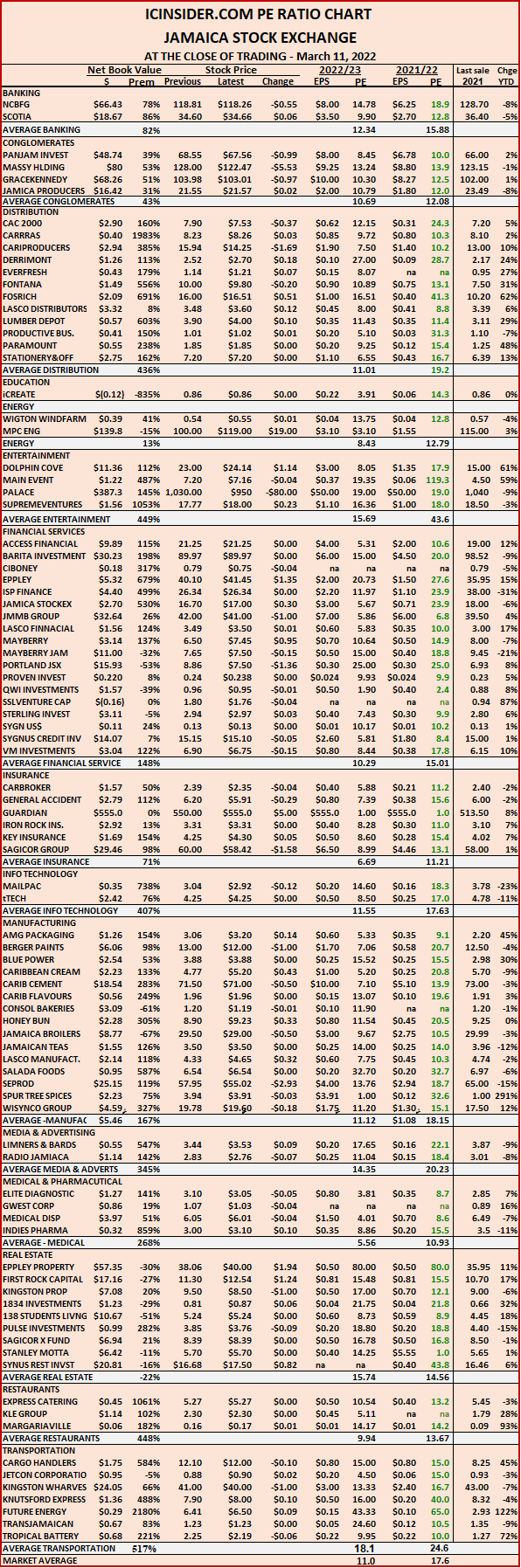

The market’s PE ratio ended at 17.6 based on 2021-22 earnings and 11 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart along with the more detailed daily report charts, provide investors with regularly updated information to help with decision making.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so.  Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market.

The net asset value of each company is reported as a guide to easily assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Massy pushes JSE Main Index sharply higher

The Jamaica Stock Exchange got a huge bolt in trading on Thursday, with the JSE Main Index adding 11,265.05 points to settle at 399,994.85 after Massy Holdings stock jumped$28 to $128 following the 20 for one stock split. The Combined Index gained 11,173.78 points to 409,490.33, the All Jamaican Composite Index rallied 1,744.16 points to 442,248.26 and The Junior Market almost reversed Wednesday’s 76 points loss by adding 70.26 points on Thursday to end at 3941.38.

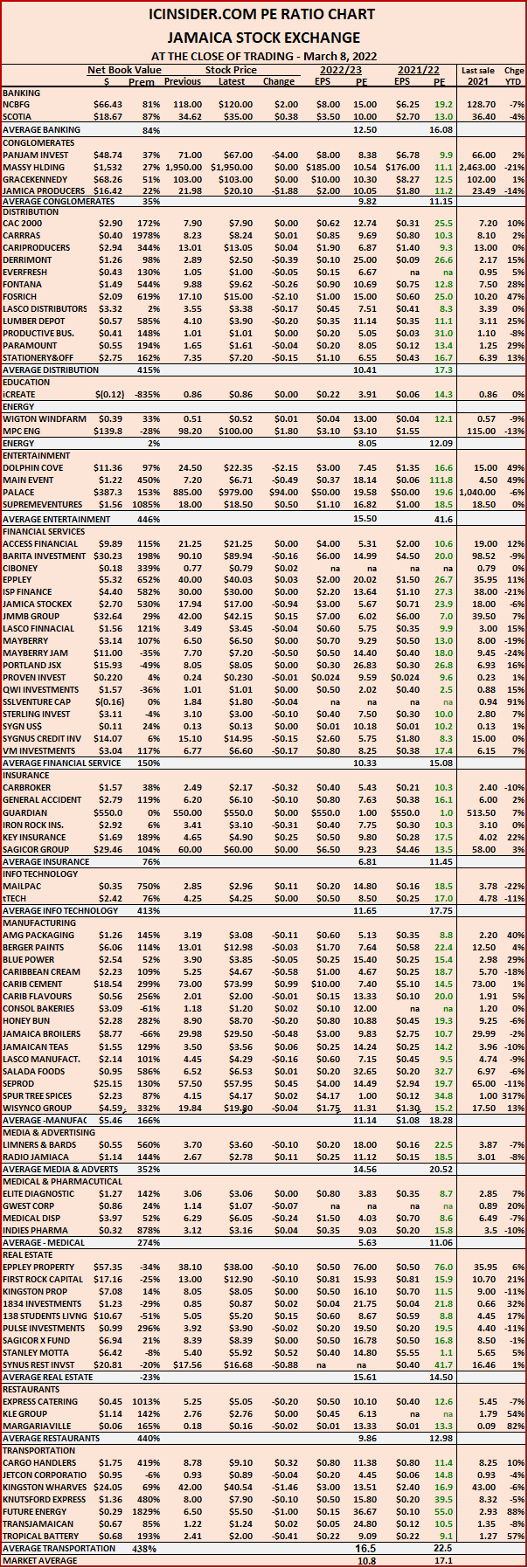

The market’s PE ratio ended at 17.6 based on 2021-22 earnings and 11 times those for 2022-23 at the close of the Jamaica Stock Exchange market activity.

The market’s PE ratio ended at 17.6 based on 2021-22 earnings and 11 times those for 2022-23 at the close of the Jamaica Stock Exchange market activity.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart along with the more detailed daily report charts, provide investors with regularly updated information to help with decision making.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market.

The net asset value of each company is reported as a guide to easily assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show closing volume for the bids and offers.

The net asset value of each company is reported as a guide to easily assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Fesco raised $1 billion for expansion

Future Energy Source Company (FESCO), secured debt financing for One Billion Dollars, the company informed the Jamaica Stock Exchange to be used for general corporate purposes that support FESCO’s growth objectives.

The facility is a five years corporate bond to be listed on the Private Market of the Jamaica Stock Exchange, with NCB Capital Markets acting as Arranger. The proceeds will be utilized including working capital, operating expenses and capital expenditure related to the expansion of its dealership network and service station footprint and funding the entry into the consumer cooking gas and LPG market.

The facility is a five years corporate bond to be listed on the Private Market of the Jamaica Stock Exchange, with NCB Capital Markets acting as Arranger. The proceeds will be utilized including working capital, operating expenses and capital expenditure related to the expansion of its dealership network and service station footprint and funding the entry into the consumer cooking gas and LPG market.

Fesco recently traded at an all-time high of $8.49 but closed on Wednesday at $5.28 after listing in April 2021 at just 80 cents per share. The company reported revenues of $8 billion for the nine months to December last year, almost doubling the $4.45 billion in the corresponding 2020 period and generating a profit of $171 million versus $92 million before tax.

Included in the expansion plans is the equipping large industrial corporate customers with digitally equipped tanks that will dispense fuel based on individual cards for each driver that will easily track usage for each vehicle as well as the acquisition of cooking gas cylinders in preparation for starting delivery of that service. According to CEO Jeremy Barnes, the plan is to have 22 branded stations within three years.

The company currently has 16 Fesco branded service stations in operation, with the newest one on Beechwood Avenue in Kingston the only one owned and operated by them.

Jamaica Stock Exchange markets drop

The Jamaica Stock Exchange suffered all round losses on Wednesday, with the Junior Market dropping another 71 points to end at 3,871.12 coming from a record high of 4,185.95 points last Friday.

Jamaica Stock Exchange Main Market index slipped, with the Combined Index falling 1,434.66 points to 398,316.55, the All Jamaican Composite Index declined 1,032.87 points to 440,504 and the JSE Main Index fell 817.05 points to settle at 388,729.80.

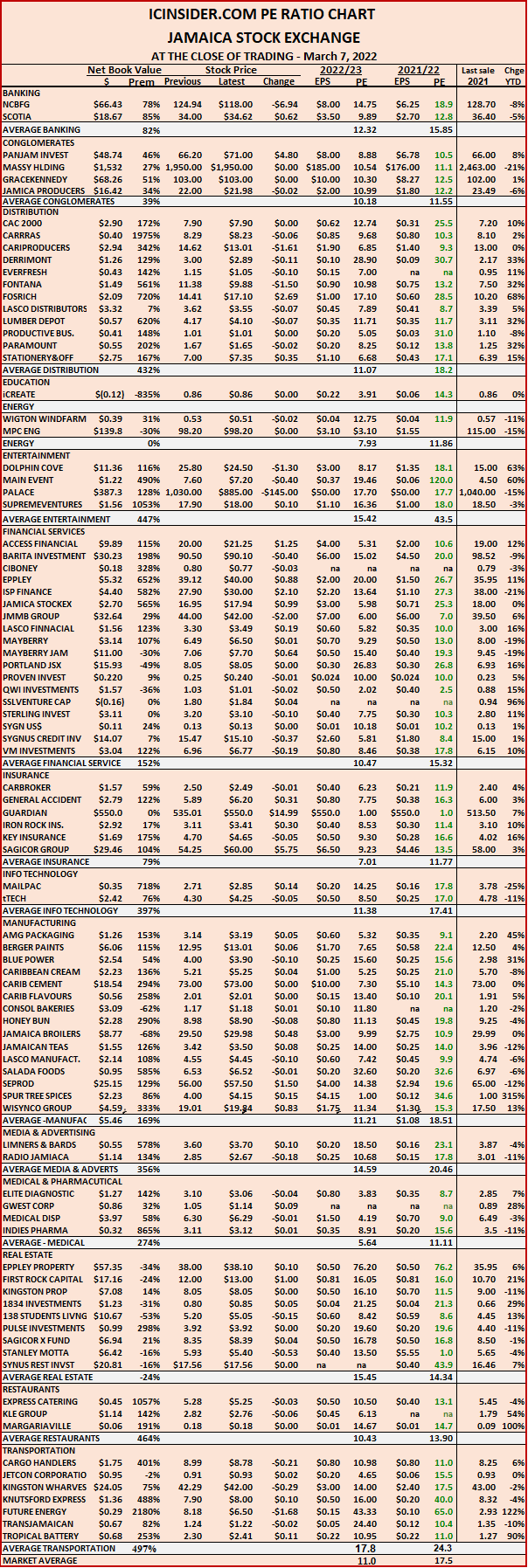

The market’s PE ratio ended at 17.3 based on 2021-22 earnings and 10.8 times those for 2022-23 at the close of market activity on the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart along with the more detailed daily report charts, provide investors with regularly updated information to help with decision making.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market.

The net asset value of each company is reported as a guide to easily assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Junior Market plunges 221 points in 2 days

Several stocks in the Junior Market that reached astronomical levels last week suffered a sharp reversal with the market index dropping 129.55 points on Monday followed by 91.49 points and Tuesday to settle at 3,947.12 as some of the recent highflying stocks suffered sharp retreat.

Jamaica Stock Exchange Main Market stocks maintained their consolidation posture. The Combined Index rose 652.77 points to 399,751.21, the All Jamaican Composite Index popped 814.75 points to 441,536.97 the JSE Main Index rallied 1,556.37 points to settle at 389,546.85

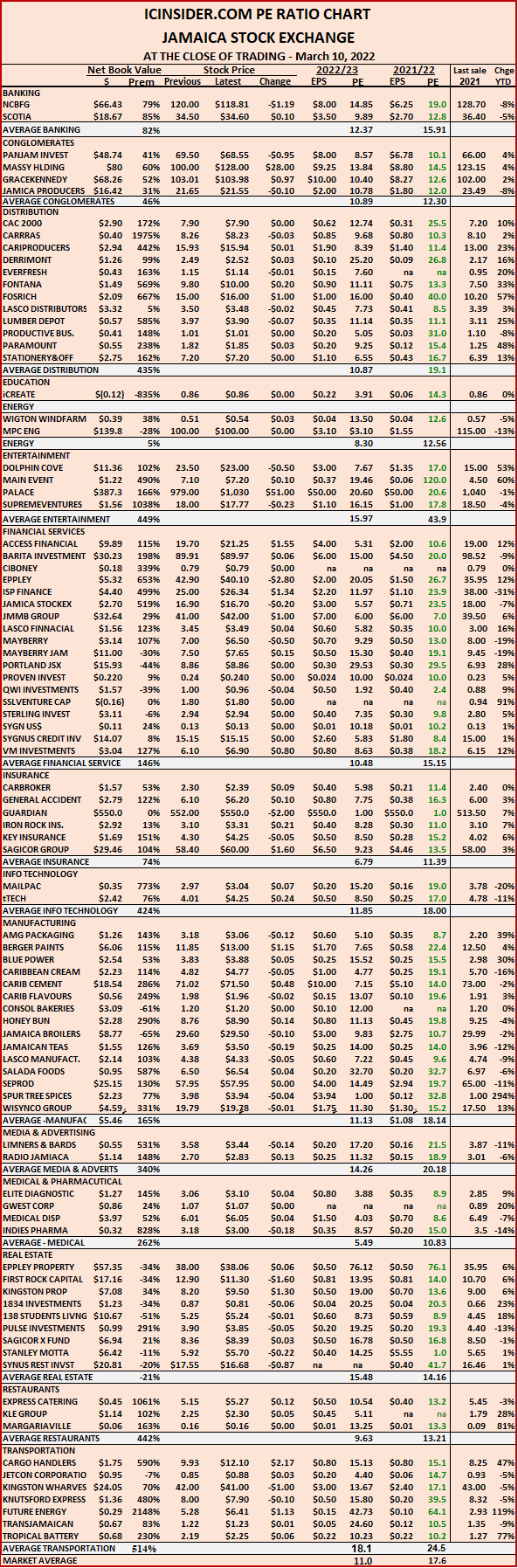

The market’s PE ratio ended at 17.1 based on 2021-22 earnings and 10.8 times those for 2022-23 at the close of market activity on the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart along with the more detailed daily report charts, provide investors with regularly updated information to help with decision making.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market.

The net asset value of each company is reported as a guide to easily assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.

Juniors plunge 130 points, majors steady

Several Junior Market stocks that reached astronomical levels last week suffered sharp reversals on Monday, with trading in several stocks being halted in the early morning session and the market closed in sending the junior market index that surged last week to record intraday high of 4,185.95 and closed at 4,168.16, down sharply today slashed 129.55 points to closed at 4,038.61.

Jamaica Stock Exchange Main Market stocks maintained their consolidation posture, with the Combined Index falling 571.27 points to 399,098.44, the All Jamaican Composite Index gained 1,130.32 points to end at 440,722.22 and the JSE Main Index rallied 607.57 points to settle at 387,990.48. The market’s PE ratio ended at 17.5 based on 2021-22 earnings and 11 times those for 2022-23 at the close of the Jamaica Stock Exchange.

Investors need a series of measures and pertinent information to successfully navigate the many investment choices in the local stock market. The ICInsider.com PE ratio chart along with the more detailed daily report charts, provide investors with regularly updated information to help with decision making.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

Investors should make use of the chart to help make rational investment decisions, by investing in stocks that are close to the average for the sector and not going too far from it, unless there are compelling reasons to do so. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. This approach helps to take emotions out of the investment decision and put in on fundamentals while at the same time not being too far from the majority of investors.

The ICInsider.com PE Ratio chart covers all ordinary shares listed on the Jamaica Stock Exchange and shows companies grouped on an industry basis, allowing for easy comparisons between same sector companies as well as the overall market.

The net asset value of each company is reported as a guide to easily assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices. Dividends payable and yields for each company are shown in the Main and Junior Markets’ daily report charts that show closing volume for the bids and offers.

The EPS & PE ratios are based on 2021 and 2022 actual or projected earnings, excluding major one off items. The PE Ratio is the most popular measure used to determine the value of stocks.