Companies with earnings that are consistently growing are usually the best dividend paying stocks to invest in if income is a prime objective. They will have more room to make increased dividend payments in the future.

Investors looking for the best dividend paying stocks on the Jamaica Stock Exchange should take the above factors into consideration. It is also a good factor to consider when buying stocks that are likely to increase in value over time.

Investors looking for the best dividend paying stocks on the Jamaica Stock Exchange should take the above factors into consideration. It is also a good factor to consider when buying stocks that are likely to increase in value over time.

On the Jamaica Stock Exchange, the Main Market, Carreras is the king of dividend payment with a yield of 11 percent based on the latest stock price of $8 in 2023, followed by Transjamaican Highway and at 7 percent, Scotia Group at 5 percent based on the last dividend paid of 40 cents and annualised, at a then stock price of $34. What is interesting about Scotia is the traditional metric is for the company to pay between 40 to 50 percent of profits.

Scotia historically pays just above 40 percent of profit, but that seems to have been interrupted as a result of the negative impact that flowed from the Covid 9 economic dislocation.  The company reported earnings of $5.54 and that would suggest an annual dividend of $2.20 which would translate to a dividend yield of 6.7 percent with 2024 likely to be higher.

The company reported earnings of $5.54 and that would suggest an annual dividend of $2.20 which would translate to a dividend yield of 6.7 percent with 2024 likely to be higher.

The Junior Market has two stocks with attractive yields Dolphin Cove and MailPac at 7 percent each. The payout for MailPac represent a full years’ profit.

Yields may have dipped in some cases but that does not change the longer term prospects.

Top 5 JSE dividend paying stocks now

Mailpac drops out of IC TOP15 stock listing

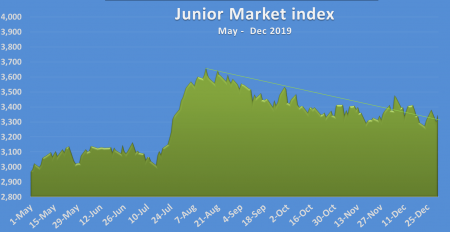

Stocks left to languish at depressed prices for months are coming back to life as some investors are now seeing the light of the huge potential profit in Junior Market stocks compared to their senior counter paths in the Main Market.

The Main Market slipped a bit to end the first half of January, with a modest loss but technical indicator points to it heading towards the 460,000 points level on the All Jamaica Composite Index, soon. The Junior Market is up 2.4 percent since the 2020 close and is a few points away from the level reached at the close of March 5 last year, having surpassed the April high, as the bullish golden cross takes full hold on the market to launch a big rally.

The Main Market slipped a bit to end the first half of January, with a modest loss but technical indicator points to it heading towards the 460,000 points level on the All Jamaica Composite Index, soon. The Junior Market is up 2.4 percent since the 2020 close and is a few points away from the level reached at the close of March 5 last year, having surpassed the April high, as the bullish golden cross takes full hold on the market to launch a big rally.

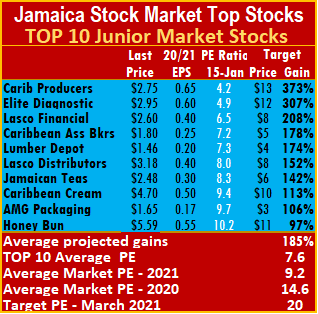

During this past week, IC TOP 15 selections MailPac, Caribbean Cream and Jamaican Teas all posted gains with Mailpac hitting a series of record highs this past week and closed at $3.75 up 30.6 percent since the end of 2020 and is now well outside of the 2021 Top 15 list for Junior Market stocks. The stocks still have much room for growth in the year to benefit from a strong increase in revenues. Caribbean Cream posted continued growth in sales for the November quarter and almost doubled profit for the nine months period and increased it by 37.5 percent for the third quarter.

The stock gained 50 cents at the close on Friday but traded as high as $5 during the week and moved from fifth spot last week to ninth position on the 2020/21 TOP10 list. Jamaican Teas gained 25 percent since December and seems poised to move higher as interest in the stock grows since the announcement of a three for one stock split late last year. An indication of increased interest is the exchange of 4 million shares on Friday. The stock moved from the fourth position last week to seventh this past week as it gained 24 percent for the week.

The stock gained 50 cents at the close on Friday but traded as high as $5 during the week and moved from fifth spot last week to ninth position on the 2020/21 TOP10 list. Jamaican Teas gained 25 percent since December and seems poised to move higher as interest in the stock grows since the announcement of a three for one stock split late last year. An indication of increased interest is the exchange of 4 million shares on Friday. The stock moved from the fourth position last week to seventh this past week as it gained 24 percent for the week.

Lasco Manufacturing rose in the past week and moved out of the TOP10 Junior Market ranks, with Honey Bun replacing it.

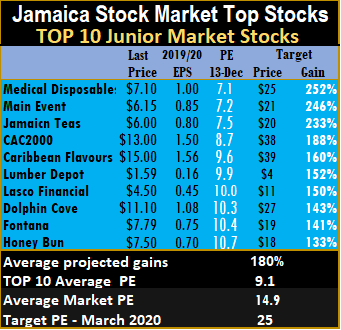

The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings.

The current TOP 10 report is based on earnings for 2020/21 as there are substantial gains ahead, for many stocks in the listings.

Investors should be on the lookout for new quarterly results with Express Catering and Margaritavillle and should release results this week. Before the month ends, expect results from Caribbean Cement, QWI, NCB Financial, Barita and the three Lasco companies.

The top three stocks in the Junior Market with the potential to gain between 208 to 373 percent are Lasco Financial, followed by Caribbean Producers and Elite Diagnostic. With expected gains of 125 to 315 percent, the top three Main Market stocks are, Berger Paints followed by Grace Kennedy and Jamaica Broilers.

The local stock market’s targeted average PE ratio is 20 based on profits of companies reporting full year’s results, from now to the second quarter in 2021. The Junior and Main markets are currently trading well below the market average, indicating strong gains ahead. The JSE Main Market ended the week, with an overall PE of 16.4 and the Junior Market 14.6, based on ICInsider.com’s projected 2020-21 earnings.  The PE ratio for the Junior Market Top 10 stocks average a mere 7.6 at just 52 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.2 or 56 percent of the PE of that market.

The PE ratio for the Junior Market Top 10 stocks average a mere 7.6 at just 52 percent of the market average. The Main Market TOP 10 stocks trade at a PE of 9.2 or 56 percent of the PE of that market.

The average projected gain for the Junior Market IC TOP 10 stocks is 185 percent and 130 percent for the JSE Main Market, based on 2020-21 earnings. IC TOP10 stocks are likely to deliver the best returns up to March 2021 and ranked in order of potential gains, based on likely gain for each company, taking into account the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in movements in and out of the lists weekly. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

Mailpac Q3 profit surges 129%

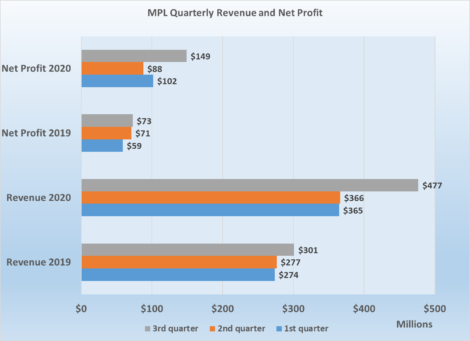

MailPac Group (MGL) continues to enjoy increasing strong profit growth despite the current pandemic, with revenue jumping 58 percent in the September quarter over the 2019 quarter and profit more than doubling.

Mailpac dominated trading on Thursday with 84% of the total volume of the market on Tuesday.

The company recorded net profit of $149 million for the quarter, a solid 129 percent jump from the $65 million the operation recorded for the September 2019 quarter. For the year-to-date, there was an even more sizeable growth of 150 percent, moving from $203 million in 2019 to $339 at the end of September 2020.

Revenues grew 58 percent over the September 2019 quarter, from $301 million to $477 million, and grew a stunning 30 percent over the June 2020 quarter with revenues of $366 million. For the year to September, revenues rose to $1.2 billion, 42 percent more than the $851 million recorded at the end of September 2019.

Gross profit rose to 50 percent from 44 percent in the June quarter but fell to 48 percent for the nine months compared to 52 percent in 2019.

Direct expenses jumped 57 percent from $150 million for the September 2019 quarter to $236 million for the September 2020 quarter and 15 percent over the June 2020 quarter. For the year to date, the expenses climbed by 52 percent from $410 million in 2019 to $623 million in 2020. Gross profit stood at $240 million for the quarter ending September 2020, up from $150 million in 2019 and $584 million for the year to date versus $442 million in 2019.

Administrative, selling and promotion expenses increased 22 percent over the second quarter and slipped two percent from the September 2019 quarterly figure of $86 million to $84 million. The Executive Chairman attributes the increase in expenses in the third quarter over the second quarter to its expanding operations, the partnership with PriceSmart presumably one such notable factor.

Administrative, selling and promotion expenses increased 22 percent over the second quarter and slipped two percent from the September 2019 quarterly figure of $86 million to $84 million. The Executive Chairman attributes the increase in expenses in the third quarter over the second quarter to its expanding operations, the partnership with PriceSmart presumably one such notable factor.

For the nine months to September, selling and promotion expenses amount to $30 million, up from $29 million in 2019, while administrative and general expenses dropped to $199 million, from $218 million in 2019. Overall, these expenses were down seven percent from $246 in 2019 to $228 million at the end of September 2020. The effect, operating profit, rose a strong 140 percent over the comparative quarter to $157 million from $65 million in 2019 and an 82 percent increase for the nine-month period, moving from $195 million to $356 million.

Finance costs rose for the quarter from $352,000 in 2019 to $11 million in 2020, while the nine months to September ended at $31 million from $3 million for 2019.

Mailpac CEO Khary Robinson.

Gross cash flow brought in $346 million but MGL recorded trade and other payables increase of $127 million, spent $12 million on the acquisition of fixed assets and paid $225 million in dividends to end with cash and equivalents of $309 million at the end of September. Shareholders’ equity stood at $467 million. Current assets ended the period at $369 million and Current liabilities at $185 million.

Earnings per share came out at 6 cents for the quarter and 14 cents to September. IC Insider.com is forecasting Mailpac will end the year at 20 cents per share for PE of 11 times earnings and they should go on to earn 33 cents in 2021.

At the IPO, the company projected a profit of $317 million in 2020, while IC Insider.com projected $356 and 14 cents per share. The nine months’ results are just below our full year’s forecast.

The stock is priced below the average of the Junior Market of 12 and offers strong upside potential. The strong current growth continues the trend since 2017, when revenues grew 12.2 percent, 25.7 percent in 2018 and 28.8 percent for the first half of 2019. The company offers a convenient way to shop and far less costly than traditional ways. Listing on the stock exchange provides greater credibility that augurs well for increased business. MGL provides clients with physical addresses in Miami, Florida, where they can receive all goods purchased are flown to Jamaica. The company clears all goods and delivers them to the customers at their homes or for collection.

On the negative side, the main asset owned is the brand and technology that drives the business. Other entities could break into the market and squeeze profit margin longer term.

Coming off a robust third quarter, MGL is entering what is normally the busiest time of the year for the company that should continue the solid growth experienced in 2020 so far.

The stock currently trades at $2.13 on the Junior Market of the Jamaica Stock Exchange. The company paid an interim dividend of 5 cents per share in July 2020 and 5 cents per share in October and more is expected, with the company promising at the time of the IPO that the Directors intend to pursue a dividend policy that projects an annual dividend of up to 75 percent of net profits available for distribution.

The top profit performers for 2020

Its earnings season for Jamaican stocks and usually most companies would have posted first-quarter results already. The Jamaica Stock Exchange has permitted companies to publish results later, due to the Coronavirus outbreak and the disruption caused to businesses.

Caribbean Flavours Derrimon’s subsidiary

Some results have been lower than for last year’s first quarter, but a number of them have posted robust increases. Outstanding results published last week were led by Grace Kennedy with a 50.6 percent spike in profit before tax, to $1.99 billion for the March quarter, while profit after tax attributable to shareholders of the group rose an impressive 47 percent, to $1.32 billion. tTech’s profit for the March quarter climbed 5,375 percent from $758,000 to $4.15 million as revenues rose a healthy 32 percent. Revenues grew 33 percent to $149 million at Caribbean Flavours while profits before tax rose 31 percent to $19 million from $14.4 million, profit after tax rose 19 percent to $14.2 million. The first-quarter profit is 45 percent of the 2019 full-year results.

Revenues at 138 Student Living climbed 29 percent to $278 million for the February quarter and 71 percent to $734 million for the half-year, with profit ending at $87 million, for earnings per share (EPS) of 21 cents for the quarter, up from a loss of $68 million in 2019. Profit for the half-year to February was $270 million, with EPS of 65 cents, up from a loss of $67 million in 2019. Profit at Eppley jumped 541 percent over the 2019 outturn of just $6 million after-tax to $40 million, with EPS of 21 cents.

Kingston Wharves profit rose 22%.

Kingston Wharves results for the quarter ended in March rose two percent to $1.9 billion, over the corresponding period in 2019 while net profit attributable to shareholders increased 22 percent or $101 million over the prior year, to $554 million. Sterling Investments reported a profit of US$4.6 million, versus a loss of US$7.2 million in the March 2019 period as a significant swing around in exchange gains pushed earnings higher for the March 2020 period.

Prior to this past week, Barita Investments reported a 25 percent rise in March quarter profit and 96 percent increase in the half-year results, profit for the first quarter at Derrimon Trading rose 34 percent to 91.6 million from a 5.5 percent rise in sales revenues, a rise of $18 million in other revenue and a drop in finance cost from $58 million to $49 million. iCreate increased revenues by 106 percent to $24.5 million for the three months to March with net Profit of $1.25 million, up from a loss of $1.48 million made in 2019. Pulse Investments profit rose 136 percent for the March quarter profit and 121 percent for the, nine months to March, Seprod profit for the March quarter increased 103 percent and Mailpac Group reported 71 percent increase in first-quarter profit

Lumber Depot set to leave IC TOP 10

Newly listed Lumber Depot traded for the first time after listing on Friday to close at $1.59, up 32.5 percent from the IPO issue price of $1.20. The stock remains in the TOP Junior Market listing at 6th position from third, last week, but may not be in it much longer.

Newly listed Lumber Depot traded for the first time after listing on Friday to close at $1.59, up 32.5 percent from the IPO issue price of $1.20. The stock remains in the TOP Junior Market listing at 6th position from third, last week, but may not be in it much longer.

Honey Bun that jumped ship at the end of the prior week, returns to sit at 10th spot with the fall of tTech while the JSE Main Market welcomed back Stanley Motta to the TOP 10 at the expense of NCB Financial.

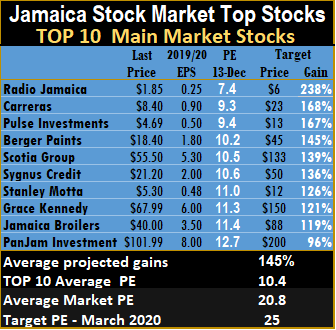

IC Insider.com has upgraded the target PE ratios to 25 with several stocks trading at that around 22 currently. The average projected gains for the IC TOP 10 stocks are 187 percent for Junior Market stocks and 145 percent for JSE Main market Top 10 companies.

The top three Junior Market stocks are Medical Disposables with projected gains of 252 percent, followed by Main Event with a potential appreciation of 246 percent and Jamaican Teas with 233 percent.

Radio Jamaica holds the lead of Main Market stocks with projected gains of 238 percent, followed by Carreras in the number two spot with projected growth of 168 percent and Pulse Investments with likely increases of 167 percent is next.

The JSE Main Market closed the week, with an overall PE of 20.8 and the Junior Market at 14.9, based on current year’s earnings. The PE ratio for Junior Market Top 10 stocks averages 9.1 with the Main Market PE at 10.4.

The TOP 10 stocks now trade at a discount of 39 percent of the average for Junior Market stocks and Main Market stocks trade at a discount of 50 percent to the overall market.

IC TOP 10 stocks are likely to deliver the best returns to March next year.  Projected earnings, along with the PE ratio for each company’s current fiscal year, are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Future values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

Projected earnings, along with the PE ratio for each company’s current fiscal year, are used in determining potential gains with the likely gains ranked in descending order with highest-ranked being the most attractive. Future values will change as stock prices fluctuate and will result in movements of the selection in and out of the lists for most weeks. Earnings per share are revised on an ongoing basis as new information is received that can result in changes in and out of the list.

This report is compiled by persons who may have an interest in the securities commented on.

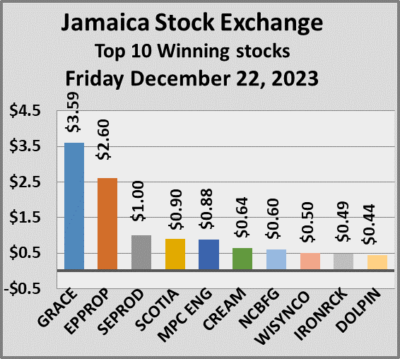

At the close of trading on Thursday, the JSE Combined Market Index climbed 1712.97 points to close at 335,019.68, the All Jamaican Composite Index climbed by 1,622.28 points to close at 359,057.05, the JSE Main Index rose 1,118.96 points in ending trading at 321,725.63. The Junior Market Index jumped 75.77 points to 3,801.37 and the JSE USD Market Index gained 2.97 points to end the day at 244.14.

At the close of trading on Thursday, the JSE Combined Market Index climbed 1712.97 points to close at 335,019.68, the All Jamaican Composite Index climbed by 1,622.28 points to close at 359,057.05, the JSE Main Index rose 1,118.96 points in ending trading at 321,725.63. The Junior Market Index jumped 75.77 points to 3,801.37 and the JSE USD Market Index gained 2.97 points to end the day at 244.14. At the close of the market, some of the major Main Market stocks that rose are AS Bryden rallied $2.49 to close at $42.99, Caribbean Cement advanced $1.74 to end at $53, Mayberry Group climbed $1.16 in closing at $7.6 and Scotia Group advanced $1.46 and ended at $41.46.

At the close of the market, some of the major Main Market stocks that rose are AS Bryden rallied $2.49 to close at $42.99, Caribbean Cement advanced $1.74 to end at $53, Mayberry Group climbed $1.16 in closing at $7.6 and Scotia Group advanced $1.46 and ended at $41.46. Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The value of stocks traded on the Junior and Main markets surged to $527.23 million compared with a mere $48.29 million on Thursday. The JSE USD market closed after 159,494 shares were traded, for US$2,742 compared to 6,525 units at US$320 on Thursday.

The value of stocks traded on the Junior and Main markets surged to $527.23 million compared with a mere $48.29 million on Thursday. The JSE USD market closed after 159,494 shares were traded, for US$2,742 compared to 6,525 units at US$320 on Thursday. the JSE Main Index rallied by 812.63 points to end trading at 316,798.45. The Junior Market Index rallied 45.75 points to end the day at 3,728.14 and the JSE USD Market Index skidded 2.03 points to wrap up trading at 221.10.

the JSE Main Index rallied by 812.63 points to end trading at 316,798.45. The Junior Market Index rallied 45.75 points to end the day at 3,728.14 and the JSE USD Market Index skidded 2.03 points to wrap up trading at 221.10. The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

The net asset value of each company is reported as a guide to quickly assess the value of stocks based on this measure. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

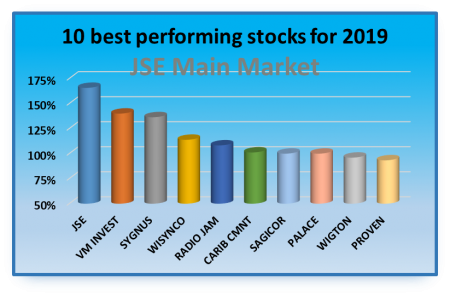

The Jamaica Stock Market has moved from the best performing in the world in 2018 to one of the worse performing in 2020. The fall from grace had to do far less with local factors but more so with global developments. Nevertheless, Main Market listed

The Jamaica Stock Market has moved from the best performing in the world in 2018 to one of the worse performing in 2020. The fall from grace had to do far less with local factors but more so with global developments. Nevertheless, Main Market listed  The Junior Market suffered badly, with ten stocks losing upwards of 39 percent out of a list of 33 stocks that declined for the year. The Junior Market was partially saved by two stocks, one that was listed in December 2019 and one listed in the last half of 2020. Mailpac was listed in December 2019 and rose 36 percent in 2020, followed by Tropical Battery by 28 percent as the two leading Junior Market winners. With tax losses as the only major asset of worth, Ciboney came in third and more than doubled with a rise of 118 percent. The Main Market had 32 stocks declining during the year, with losses going as high as 63 percent.

The Junior Market suffered badly, with ten stocks losing upwards of 39 percent out of a list of 33 stocks that declined for the year. The Junior Market was partially saved by two stocks, one that was listed in December 2019 and one listed in the last half of 2020. Mailpac was listed in December 2019 and rose 36 percent in 2020, followed by Tropical Battery by 28 percent as the two leading Junior Market winners. With tax losses as the only major asset of worth, Ciboney came in third and more than doubled with a rise of 118 percent. The Main Market had 32 stocks declining during the year, with losses going as high as 63 percent. In 2020, both of the Jamaica Stock Exchange major markets were down, with the Junior Market just edging out the Main Market index with a lower decline of 21 percent versus 22.6 percent. Even though 2020 was not a great year, some investors made money by buying stocks at rock bottom prices when many investors were dumping earlier in the year.

In 2020, both of the Jamaica Stock Exchange major markets were down, with the Junior Market just edging out the Main Market index with a lower decline of 21 percent versus 22.6 percent. Even though 2020 was not a great year, some investors made money by buying stocks at rock bottom prices when many investors were dumping earlier in the year. Since bottoming in March, the Junior Market is up 30 percent and the Main Market 16.6 percent by the end of the year. There are strong signals pointing to an upward move for both markets as they transitioned from a consolidating phase when investors were assessing developments in the economy and the stock market to a more bullish state since the latter months of 2020.

Since bottoming in March, the Junior Market is up 30 percent and the Main Market 16.6 percent by the end of the year. There are strong signals pointing to an upward move for both markets as they transitioned from a consolidating phase when investors were assessing developments in the economy and the stock market to a more bullish state since the latter months of 2020.