Shareholders of Alliance Financial Services will offer later this month just over 1.25 billion shares to the public for purchase at $1.59 each, for a total consideration of $1.99 billion.

The Invitation opens at 9 am on December 28 and will close at 4 pm January 11, subject to the Selling Shareholders’ right to close the issue at any time after it on the Opening Date once the shares are fully subscribed.

The Invitation opens at 9 am on December 28 and will close at 4 pm January 11, subject to the Selling Shareholders’ right to close the issue at any time after it on the Opening Date once the shares are fully subscribed.

During its sixteen (16) years of operation, the company has grown to become a notable Cambio and remittance service provider in Jamaica.

The company reported a $709 million profit for the year to September 2020, from revenues of $1.5 billion. The 2020 profit equates to earnings per share of 11.3 cents for a PE of 14 but using the 2019 earnings the PE would have been 12.7, with both below the Jamaica Stock Exchange Main Market average of 17.

JMMB Securities are brokers for the offer.

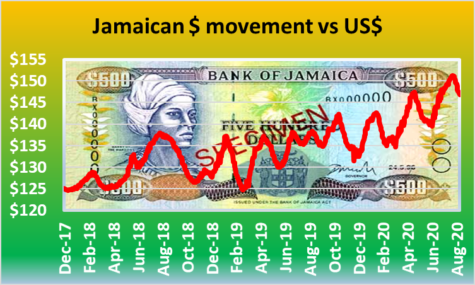

Jamaican$ improved value

The Jamaican dollar closed trading on Tuesday at $145.91 to one US dollar, with dealers selling US$60 million after buying US$51.4 million at an average rate of $144.81. The improved value for the local currency compares with the August 19 low of $151.27 for each US dollar.

On Monday, dealers sold US$36.5 million at an average of $146.89, while dealers bought just US$23.2 million, at an average rate of $144.02.

On Monday, dealers sold US$36.5 million at an average of $146.89, while dealers bought just US$23.2 million, at an average rate of $144.02.

The big sellers on Tuesday were Bank of Nova Scotia, US$9.6 million at an average of $147.23 after buying a mere US$2.3 million at $142.04. JN Bank bought just $336,000 at $138.16 each and sold US$4.4 million at $142.14 each and National Commercial Bank bought US$6.5 million at an average of $144.79 and sold US$14.4 million at $145.42. JMMB Bank bought US$8.7 million at $143.34 and sold only US$688,334 at $146.19 while JMMB Securities bought US$6.4 million at $146.72 each and sold US$7 million at $146.99. Чтобы играть в онлайн казино России безопасно и без ограничений, пользователям нужно пройти специальную идентификацию. В процессе проверки, казино онлайн России может убедиться, что игрок настоящий и ему можно доверять. Стоит отметить, что в рейтинге по отзывам мобильное казино на реальные деньги используют современные технологии шифрования, а также ответственно относятся к конфиденциальности данных игроков. Это позволяет игрокам быть уверенными, что они могут играть анонимно, а их паспортные данные не будут переданы третьим лицам.

General public oversubscribed GWest 100%

GWest complex in Montego Bay,

The level of oversubscription by the general public is amazing for company that is its infancy and generating a loss in its current fiscal year, with limited data on which to judge future earnings. Details of the level of subscription for the IPO was released by the broker for the issue, JMMB Securities.

Applications totaling 1334, were received for shares valued at $599,310,000. All the shares that were reserved were fully taken up, while General Public for which 69.7 million shares at $2.50 each, were available to purchase, received the first 10,000 shares applied for and 45.941 percent of the balance.

Dr. Konrad Kirlew, chairman of GWest.

Elsewhere, IC Insider.com gathers that VM Investments received applications in the range of more than 3,000, but less than 5,000, with the basis of allocation to be considered by the board on Thursday.

GWest Oversubscribed

GWest complex in Montego Bay,

The Initial Public Offering of 170 million shares by Gwest Corporation is oversubscribed with the offer closed at 4:30 pm on Thursday, December 7, the broker JMMB Securities advised the Jamaica Stock Exchange.

The offer was for 169.7 million shares at $2.50 each. The offer opened on December 7 and was scheduled to close on December 21.

GWest offer included 36,000,000 Shares reserved for the lead broker, JMMB Securities or its clients, 64,000,000 Shares were reserved for Jamaica Money Market Brokers’ Pension and Client Funds Investment Management Unit, 19,400,000 Shares for GWest clients and suppliers and 600,000 Shares for independent directors, the Mentor and employees of the Company and 69.7 million shares for the general public.

Word reaching IC Insider.com is that the offer for Wisynco Group has so far attracted around $18 billion in subscriptions but the principals want to have the widest distribution of shareholders possible, hence the continuing opening of the issue.

The GWest shares will be listed on the Junior Market of the Jamaica Stock Exchange.

GWest IPO is here

The initial Public Offer (IPO) of shares in the Montego Bay based GWest Corporation is now out with 169.7 million shares offered for sale at $2.50 each. The offer opens on December 7 and is scheduled to close on December 21.

The initial Public Offer (IPO) of shares in the Montego Bay based GWest Corporation is now out with 169.7 million shares offered for sale at $2.50 each. The offer opens on December 7 and is scheduled to close on December 21.

With FosRich and Wisynco opening next week as well it could result in record of 4 IPOs being opened within the same week on the Jamaica Stock Exchange. During July, Express Catering opening on July 12, Stationery and Office Supplies that opened on July 19, Proven Investments with a rights issue opened on July 3, Productivity Business Solutions with an ordinary share issue and a preference share issue that opened on July 5.

GWest offer includes 36,000,000 Shares reserved for the lead broker, JMMB Securities or its clients, 64,000,000 Shares reserved for Jamaica Money Market Brokers’ Pension and Client Funds Investment Management Unit. 19,400,000 Shares are for GWest clients and suppliers and 600,000 Shares for independent directors, the Mentor and employees of the Company. This leaves 69.7 million shares for applications by the general public. If any of the Reserved Shares in any category are not subscribed by the persons entitled to them, they will be made available for subscription by the general public.

Dr. Konrad Kirlew, chairman of GWest.

If the Invitation is successful in raising at least J$250,000,000 and the Shares will be admitted to trade on the Junior Market of the JSE.

The primary purpose of the Company is to provide integrated medical health care services and facilities. The Company established 5 medical businesses under the common “GWest Medical” brand. GWest Corporation owns the GWest Centre, a 4-storey multipurpose commercial complex catering primarily to medical professionals and medical services and in which its owned services will be located. The GWest concept is to provide a wide range of complementary international quality best practice medical services in one location,

The Company will be providing the following medical services to complement those offered by owners and lessees in the GWest Centre:

1. General Practitioner and Specialist Suite (operational since June 2017)

2. A 2,200 square feet Urgent Care Centre (operational since November 2017)

3. Medical Laboratory (to be opened by January 2018)

4. A 5,000 square feet 8-Bed Inpatient Unit (to be opened by September 2018)

5. In addition, its 100% subsidiary company GWest Surgery Centre Limited will own and operate an 8,500 square feet Outpatient Surgery Centre (to be opened September 2018), including two modern operating theatres and two procedure rooms.

The Company has approximately 18,111 square feet of space leased to tenants for periods of 3 to 10 years with lease rates denominated in United States currency, ranging from US$20 to US$22 per square feet. The lease payments are subject to annual increases at a rate of up to 0.5% per annum.

GWest complex in Montego Bay,

Directors include Dr. Konrad Kirlew, chairman, Dr. Leyford Doonquah, Dennis Samuels businessman Denise Crichton-Samuels managing director of Cornwall Medical and Dental Supplies, Peter Pearson, former partner PriceWaterhouseCoopers. Elva Williams-Richard, Chartered Accountant, Wayne Gentles, Accountant, and Mark Hart Businessman and Wayne Wray who is the mentor and director.

The shares are really based of forecast which are vastly different than the historical results. For the year to March 2017 profit reported was $181 million but it includes a large gain on revaluation of the unsold property, amounting to $205 million. The profit was mainly based on income of sale of property. A loss of $29 million was made in the six months to September and for the full year to March 2018 a loss of $111 million is projected, swinging sharply to a profit of $166 million in 2019 and $388 million in 2020 as revenues rise from an estimated $158 million in 2018 to $803 million in 2019 to $1.2 billion in 2020.

Net book value is just $287 million, representing 324,848,485 shares, with net book value of just 88 cents per share, the stock is priced at 3 times book value which can be considered high for a company yet to start showing profit from ongoing operations. The stock is also priced at a high PE of nearly 7.5 times projected 2019 earnings which is way above most other stocks in the market, with a renowned operating track record.

Iron Rock IPO hits market shortly

Iron Rock Insurance is one of 5 junior market companies poised to hit the market between February and March, ahead of the deadline for the ending of the tax break, accorded junior market companies.

Iron Rock Insurance is one of 5 junior market companies poised to hit the market between February and March, ahead of the deadline for the ending of the tax break, accorded junior market companies.

Iron Rock is expected to be capitalized at just under $500 million and has as two of its principals William McConnell formerly managing director of Lascelles deMercado who use to own Globe Insurance Company and Evan Thwaites former of Globe Insurance.

Informed sources tell IC Insider that the prospectus should be out by the February 22, with the issue to be opened before the end of the month.

Mayberry Investments are the brokers for Iron Rock while JMMB Securities is handling two issues. The new listings if they are all approved, will raise the number of junior market listings to 34 and the number of companies listed to 30. In contrast the main market and the US dollar market has 35 companies listed plus a number of preference shares issued by companies with ordinary share listing.

The main market has almost stagnated and seems set to contract with two main market companies, that of Hardware and Lumber and Desnoes and Geddes look set to be delisted.

Declining stocks outpace advancers

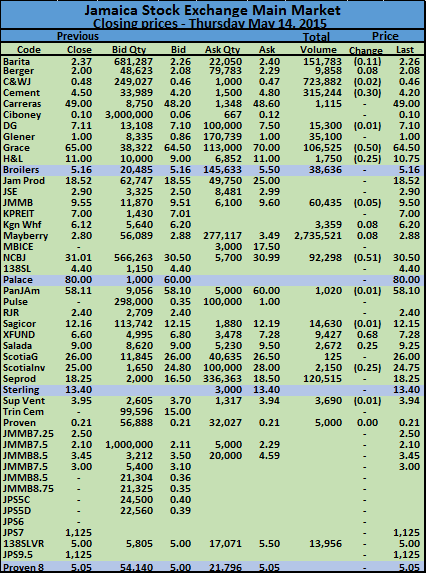

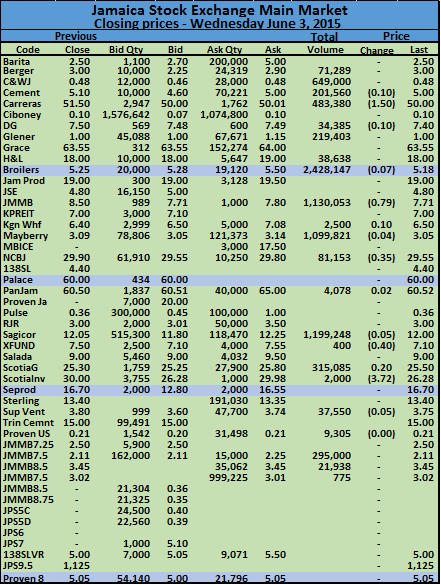

Activity on the Jamaica Stock Exchange, resulted in the prices of 10 stocks rising, 13 declining as 33 securities changed hands, ending in 9,407,399 units trading, valued at $83,136,775, with 4 stocks closing at 52 weeks’ high, in all market segments.

The JSE Market Index lost 787.71 points to 98,401.83, the JSE All Jamaican Composite index declined 880.45 points to close at 108,925.75 and the JSE combined index dropped by 631.19 points to end at 100,937.41.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 15 stocks with bids higher than their last selling prices and 9 with offers that were lower. The indication is for fluidity in price movements on Thursday and the likelihood of declining stocks out numbering advancing ones.

IC bid-offer Indicator| At the end of trading, in the main and junior markets, the Investor’s Choice bid-offer indicator shows 15 stocks with bids higher than their last selling prices and 9 with offers that were lower. The indication is for fluidity in price movements on Thursday and the likelihood of declining stocks out numbering advancing ones.

In trading, Berger Paints traded 71,289 units at $3, Caribbean Cement had 201,560 units trading at $5 after dropping 10 cents. Interestingly, even as Cable & Wireless posted a large loss after taking a $7 billion one off extra ordinary expense hit, the stock traded 649,000 units between 50 cents and the closing price of 48 cents, the same as on Tuesday. Carreras traded 483,380 units at $50, after falling $1.50, Gleaner Company had 219,403 shares trading at $1, Hardware & Lumber closed with 38,638 shares trading unchanged at $18, Jamaica Broilers having 2,428,147 units trading with the price holding at $5.18 after slipping from $5.50 earlier in the day, to end the day down 7 cents. JMMB Group lost 79 cents while it traded 1,130,033 units as the price closed at $7.71, following poor profit results in the final quarter of the fiscal year to March. Mayberry Investments had 1,099,821 units trading 4 cents lower at $3.05. One million units of the stock were sold by JMMB Securities and Mayberry bought them for in house purposes. National Commercial Bank ended with 81,153 units changing hands 35 cents down at $29.55, Pan Jamaican Investment traded 4,078 units 2 cents higher for a new 52 weeks’ high of $60.52. Sagicor Group had 1,199,248 shares trading at $12, after slipping 5 cents, Scotia Group had 315,085 units changing hands to end 250 cents higher at $25.50 and Jamaica Money Market Brokers 7.50% preference shares closed with 295,000 units trading to end at $2.11.

Mayberry Investments had 1,099,821 units trading 4 cents lower at $3.05. One million units of the stock were sold by JMMB Securities and Mayberry bought them for in house purposes. National Commercial Bank ended with 81,153 units changing hands 35 cents down at $29.55, Pan Jamaican Investment traded 4,078 units 2 cents higher for a new 52 weeks’ high of $60.52. Sagicor Group had 1,199,248 shares trading at $12, after slipping 5 cents, Scotia Group had 315,085 units changing hands to end 250 cents higher at $25.50 and Jamaica Money Market Brokers 7.50% preference shares closed with 295,000 units trading to end at $2.11.

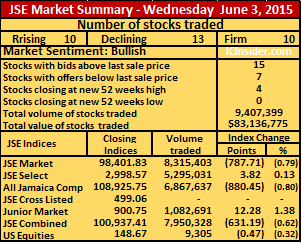

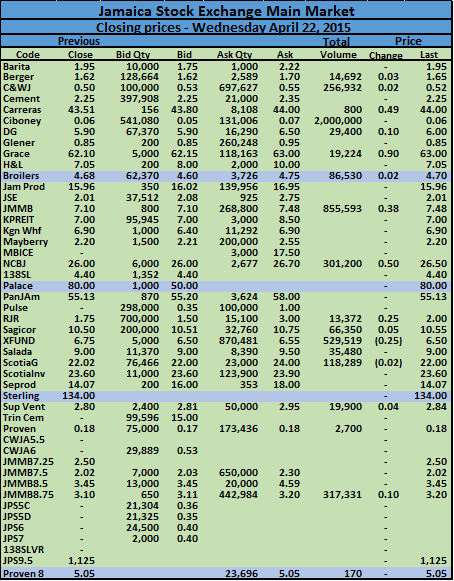

JSE to repeat today’s gains on Thursday

The Investors Choice bid-offer Indicator shows 11 stocks with bids higher than their last selling prices and 2 with offers that were lower, in the main and junior markets. IC Indicator reading is suggesting that the number of trades on Thursday should see another day of many more stocks rising than falling.

Activity on the Jamaica Stock Exchange, resulted in 23 securities changing hands and ending with 4,735,155 units trading, valued at $24,434,254, in all market segments. National Commercial Bank, closed at a new 52 weeks’ high of $26.50 with 301,200 shares changing hands at 50 cents higher than on Tuesday and ahead of the company reporting six months results and dividend payment on Thursday.

Main Market| The JSE Market Index gained 474.33 points to 86,299.76, the JSE All Jamaican Composite index rose 530.32 points to close at 95,205.43 and the JSE combined index gained 446.19 points to close at 87,994.37.

Main Market| The JSE Market Index gained 474.33 points to 86,299.76, the JSE All Jamaican Composite index rose 530.32 points to close at 95,205.43 and the JSE combined index gained 446.19 points to close at 87,994.37.Cable & Wireless with 256,932 units traded at 52 cents and ended with the bid at 53 cents to buy 100,000 shares. Ciboney Group traded 2,000,000 shares at 6, Desnoes & Geddes gained 10 cents and traded 29,400 at $6 with an offer at $6.50 at the close. Grace Kennedy with 19,224 shares that traded closed at 90 cents higher at $63, Jamaica Broilers had 86,530 shares trading to close at $4.70,

JMMB Group traded 855,593 ordinary shares for 38 cents higher at $7.48. The stock had JMMB Securities on the offer selling 268,800 units at $7.48, 5000 units at $7.50 and 34,655 shares at $8.50 as the lowest offers posted at the end of trading.The broker posted small buy orders from $7.03 to $7.10. Victoria Mutual Wealth Management sold the bulk of the shares to trade with Sagiocr Investments being the major buyer of them.

Radio Jamaica traded 13,372 shares at $2 to gain 25 cents, Sagicor Group traded 66,350 shares

to close at $10.55 while gaining 10 cents in the process but traded as high as $10.75 before the close. Sagicor Real Estate X Fund had 529,519 units changing hands to close at $6.50, after shedding 25 cents. Salada Foods traded 35,480 at $9, Scotia Group saw 118,289 units, closing at $22, Supreme Ventures 19,900 units traded 4 cents higher at $2.84 and Jamaica Money Market Brokers 8.75% preference share, traded 317,331 units at $3.20 with an increase of 10 cents.

to close at $10.55 while gaining 10 cents in the process but traded as high as $10.75 before the close. Sagicor Real Estate X Fund had 529,519 units changing hands to close at $6.50, after shedding 25 cents. Salada Foods traded 35,480 at $9, Scotia Group saw 118,289 units, closing at $22, Supreme Ventures 19,900 units traded 4 cents higher at $2.84 and Jamaica Money Market Brokers 8.75% preference share, traded 317,331 units at $3.20 with an increase of 10 cents.