Many investors in the growing pool of equity-linked managed Funds are losing out on good returns being enjoyed by others in the Unit Trust industry because they fail to focus regularly eyes on their investment and compare the performance of their investment against others.

Investors wanting to enjoy stock market-like gains with reduced risk have several options, but paying attention to past performance can make a big difference between ordinary or excellent returns.

Investors wanting to enjoy stock market-like gains with reduced risk have several options, but paying attention to past performance can make a big difference between ordinary or excellent returns.

Investors should review the performance of their investment regularly at least once per year to see how well theirs stack up with similar forms of investment. This applies to stocks, Unit Trusts, money market instruments or any other forms of investment.

A good example is the long-term top unit trust performer Barita’s Capital Growth Fund that gained the most for the year to September, with an increase of 43.15 percent, outperforming by far the 23.69 percent posted in the corresponding period in 2018. The Fund’s twelve-month growth was an attractive 52.67 percent, the highest of all the local equity Funds.

New kid on the block JN Mutual Funds Global Equity Fund holds the number 2 spot with growth of 35.91 percent to October 2 and gained just over 31 percent for the last twelve months, followed by  Sagicor Investments’ Sigma Equity Fund with, growth of 31.31 percent and sits at number 3 for 2019 to date but that is lower than the 36.47 percent at the similar point in 2018. VM’s Wealth Classic Equity Growth portfolio is the fourth-best performing Fund in 2019 with a gain of 29.78 percent and is significantly up on the 16.42 percent increase in the 2018 period. NCB’s E Fund is next with 29.26 percent for 2019, a huge turnaround compared to last year’s mere 2.96 percent gain.

Sagicor Investments’ Sigma Equity Fund with, growth of 31.31 percent and sits at number 3 for 2019 to date but that is lower than the 36.47 percent at the similar point in 2018. VM’s Wealth Classic Equity Growth portfolio is the fourth-best performing Fund in 2019 with a gain of 29.78 percent and is significantly up on the 16.42 percent increase in the 2018 period. NCB’s E Fund is next with 29.26 percent for 2019, a huge turnaround compared to last year’s mere 2.96 percent gain.

Barita’s Capital Growth Fund that led the pack with growth for the twelve-month period is followed by Sagicor’s Sigma Equity Fund with 39.84 percent and in third place, VMWealth Classic Equity with 33.96 percent.

Scotia Premium Growth Fund delivered a 23.14 percent growth while JMMB Income & Growth Fund had gains of 22.64 percent for the nine months to September. Sigma Global Venture Equity Fund delivered gains of 18.22 percent for the year to September and 17.60 percent for the 12 months.

The bottom three performing equity Funds for the year to September are JN Global Diversified Income with 11.26 percent growth and a twelve-month growth of 9.10 percent as of October 2, JMMB Optimum Capital generated just 15.7 percent gains for the nine months, and 11.44 percent for the past 12 months.

The three best performing Funds, Sagicor’s Sigma Equity, Scotia’s Premium Growth and Barita’s Capital Growth, have been and continue to outperform the other players in the market over the long term, despite encountering periodic blips in their performance due to local and external economic conditions.

For the past 5 years to the end of 2018, the three best performing Funds were Sagicor’s Sigma Equity, Scotia’s Premium Growth and Barita’s Capital Growth, and for the 10 years to 2018, the same three Funds have been the top performers.

Barita’s unit trust leads this year

Sagicor Fund is Jamaica’s top unit trust

Sagicor Equity linked Unit Trust delivered almost 600% gain in 10 years.

Sagicor Equity Unit Trust is Jamaica’s leading unit trust equity portfolio for the past six and ten years periods. In second place is Scotia Unit Trust, followed by Barita, data compiled by IC Insider.com shows.

For the past 6 years, Sagicor delivered gains of 339 percent and 581 percent over the past 10 years with nearly three months to go for the period. Scotia Unit Trust had gains of 237 percent for the near 6 year period and 429 percent for the 10 year, period with just under three months of the period to go. Barita is third with 341 for the near ten years and 209 for the 6 years period.

The Jamaica Stock Exchange main market gained 31 percent to Friday October 12 and the Junior Market 23 percent and the year still has more than 2 months to go. At look at the unit trust performance as disclosed in Friday’s Financial Gleaner, dated October 12, shows, Barita Unit Trust leading all others with an increase of 29.77 percent followed by Victoria Mutual Fund with a return of 25.28 percent and Sagicor coming in third at 18.95 percent.

Scotia Investments Capital growth Fund tops in 2017.

With interest rates at the lowest levels on record and the increased risk for ordinary Jamaicans to invest in US dollars with two ways movement of the local currency, more persons are looking at the stock market as a viable alternative. Not everyone is equipped to buy stocks directly. Equity based unit trust schemes are useful alternatives for investors to look at if they are not comfortable with investing directly in stocks listed on the local market. These schemes invest in a variety of stocks and keep some funds liquid to be able to meet persons cashing out. This latter factor alone usually ensures that unit trust will find it tough to beat the market. But that should not be of major concern to many investors who would not be able to benefit from the power that stocks can deliver to one’s portfolio. Put another way if an individual investors decided that they are not conversant with stocks and therefore invested their funds in fixed interest securities at say 5 percent per annum but got say 20 percent from a stock fund as opposed to 30 percent from the stock market they would still be far better off than not owning some instruments that are exposed to the stock market.

One period’s performance is not the best guide to selecting a unit trust to invest in. In 2017, Scotia Premium Growth Fund recorded gains of more than 37 percent for their investors to be the number 1 performer, after rising 25 percent for 2016. The Scotia Fund, displaced Barita Capital Growth Fund, the 2016 front runner that ended at

number 6 in 2017, while still delivering a 21.5 percent return, down slightly from 26.7 percent in 2016. Funds delivering good performance over longer periods are far better guide in selecting a unit trust for investment.

number 6 in 2017, while still delivering a 21.5 percent return, down slightly from 26.7 percent in 2016. Funds delivering good performance over longer periods are far better guide in selecting a unit trust for investment.Over the past 5 years to 2017, no one unit Trust has been consistently the top performer. Barita has held number one spot in 2013 with 11.79 percent, they were number 2 in 2014 with 9.13 percent, three in 2015 with 51.27 percent and number one in 2016 with 22 percent but fell to 6th position in 2017 and are now number 1 in 2018. Scotia Premium Growth were no 1 in 2017, number 2 in 2016 with an increase of 26 percent, number 2 in 2015 with a 62.7 percent increase, 3 in 2014 with an increase of 8.3 percent, 3 in 2013 with a decline of 3.8 percent and are now 4 in 2018 to date. Sigma Unit Trust was number one in 2014 with a gain of 12.6 percent and in 2015 with 89 percent, number 4 in 2016 with negative 2.7 percent growth, second place in in 2017 and number 3 in 2018 so far.

Scotia Premium Growth up 37% in 2017

Scotia Investments was the top performing unit trust in 2017.

The Jamaica stock market enjoyed strong growth between 2015 and 2017 with several stocks recording more than 100 percent gains in each of the years. The vast majority of Jamaicans have not participated in the gains offered by the market.

The vast majority of Jamaicans have not enjoyed the benefits of investing directly in the stock market because they do not fully understand it while some are just scared to lose their money. Many investors have taken the hassle or concerns out of investing directly in stocks by investing in equity based unit trust schemes that have delivered better gains than those in the fixed income market.

For while the combined market index of the Jamaica Stock Exchange racked up gains of 43 percent in 2017, the top performing equity based fund, Scotia’s Premium Growth Fund recorded gains of 37 percent for their investors in 2017 on top of a 25 percent gain in 2016. The Scotia Fund displaced Barita’s Capital Growth Fund, the 2016 front runner that ended at number 6 in 2017, delivering a 21.5 percent return, down slightly from 26.7 percent in 2016

Many investors have benefit from the strong performance of the local stock market in a number of ways. Pension funds that a large number of Jamaicans are members of, hold shares of many companies on the Jamaica Stock Exchange (JSE). There are also insurance company funds that rely on the shares as part of their investment portfolios. The National Insurance Scheme also invests in these companies and many more Jamaicans benefit from the market’s performance than they may be aware of. Others persons invest through unit trusts to enjoy the growth in the market and thus lower their risk. How does this work?

Barita Unit Trust equity drop from #1 in 206 to 6th spot in 2017 with a gain of 21.5%

A unit trust is a pooled investment scheme that allows anyone without expert knowledge and time to invest in a diverse portfolios of most stocks, to invest in them and therefore benefit from the gains that the funds can deliver. The investments, which comprise local and foreign equities, bonds, corporate paper, government securities, real estate, among others, are professionally managed to optimize gains for the investor.

Investing in a unit trust is an attractive option as the portfolios are not only diverse but they also cater to those with or without an appetite for risk. A few of the benefits to be derived are tax free gains, depending on the portfolio, lower levels of market volatility given the mix of securities in each portfolio as well as other perquisites.

From year to year, the performance of investments in equity based unit trust funds may in part reflect the highs and lows of the economy, the percentage share of investments in the local stock market shares and fixed income funds. Most importantly, the management of the funds can make a big difference as can be seen from the varied performance of funds in Jamaica. Additionally, in recent years there have been new players entering the market and new products being offered, thereby creating greater diversity so as to capture new investors and a greater share of the market of the non-investing market.

At present, there are eight schemes managed locally, namely Barita Unit Trust, JMMB Fund Managers, JN Fund Managers, NCB Capital Markets, Proven Fund Managers, Sagicor Investments, Scotia investments Jamaica and Victoria Wealth Management. All offer varied slate of funds denominated in Jamaican dollars and US dollars. Sagicor Investments has fifteen (15) portfolios, the most diverse of all, followed by Barita Unit Trust, JMMB and NCB, VM, Scotia and newcomer Proven.

Funds under management as at October 2017 stood at $229 billion with Sagicor still commanding the lion’s share with Scotia and NCB holding their double-digit portion while the others shared the remainder of the pie.

In the next article, IC Insider.com will look at the performance of the unit trust equities’ portfolio in 2017 compared to previous years to give investors a better view of the best performing funds.

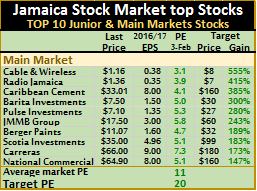

10 TOP JSE main market stocks for 2017

It is not always that main market stocks are more attractive buys than those in the junior market, but that is what is happening currently. Strong gains, in 2016 to end of January this year, in junior market companies, resulted in Jamaica Stock Exchange main market having stocks with better values than in the junior market.

It is not always that main market stocks are more attractive buys than those in the junior market, but that is what is happening currently. Strong gains, in 2016 to end of January this year, in junior market companies, resulted in Jamaica Stock Exchange main market having stocks with better values than in the junior market.

The end result is that unlike other years when the junior market stocks tended to outperform those of in the main market by a ratio of 2 to 1, this year could see both markets gaining roughly the same.

The big question, of course, is what will be the accepted PE of the market? Currently, while the average for 2016 is 17 for the main market and the ratio based on 2017 estimated earnings is 11, with 11 stocks selling above this level, Jamaica Producers and Kingston Wharves have PE ratios over 30 times 2017 earnings.

The main market faces turbulence currently as the market is sitting just below a major resistance level around 243,000 points on the All Jamaica Index. If it can overcome this level, then it will encounter resistance around the 265,000 mark.

The TOP 10 list includes 4 financial sector stocks, two communication stocks and two from the manufacturing sector.

Cable & Wireless has made considerable progress in recent years, moving from major annual losses to a stage where they reported a small profit in fiscal year 2016 to March and should break even for the nine months to December, the new financial year end. Revenues have been climbing at double digit pace and should increase even more with the upturn in economic activity and with more persons being employed. The company recently raised rates on a number of its services that should help move revenues upwards. They have also made considerable recovery in their cellular customer base and have expanded it, generating increased revenues as a result. IC Insider.com forecast calls for a profit in 2017 with growth in 2018 as well.

Cable & Wireless has made considerable progress in recent years, moving from major annual losses to a stage where they reported a small profit in fiscal year 2016 to March and should break even for the nine months to December, the new financial year end. Revenues have been climbing at double digit pace and should increase even more with the upturn in economic activity and with more persons being employed. The company recently raised rates on a number of its services that should help move revenues upwards. They have also made considerable recovery in their cellular customer base and have expanded it, generating increased revenues as a result. IC Insider.com forecast calls for a profit in 2017 with growth in 2018 as well.

On this basis, the stock is set to make solid gains. The only factor preventing that is a strong possibility that the parent company may move with an offer for the minority shares that would place a cap on the upside.

Radio Jamaica is under selling pressure as investors ignore the fundamentals and an improving economy that could result in increased profits and growth in the stock. The merger with the Gleaner was predicated a great deal on cost cutting. The group is doing just that and should benefit from a stronger marketing team and from increased advertising as businesses augment their advertising spend.

Caribbean Cement cut cost sharply in 2016 and saw growth in local sales for the first six months. However, closure of the plant for upgrading resulted in lost sales in the third quarter but sales recovered in the fourth quarter. Going into 2017, the cost savings should reduce operating cost and boost gross profit margins. Increased economic activity and lower cost of capital is leading to an uptick in the construction sector and consequently, an increase in demand for cement. The stock remains highly undervalued and has room for major gains ahead.

Barita is one of the top IC Insider’s stock for growth over the next 12 months in the main market.

Pulse Investments reported earnings of $1.35 last year and 32 cents for the September quarter that places the stock in the undervalued category even as the price climbed to $7.10 recently. It could go higher, but a bit of the earnings flow from revaluation surplus on property and that may cause some investors to discount the earnings. In a very bullish market, that may not matter much, for many investors. One positive, is that the cash flow statement shows cash inflows growing at a much higher level than in 2015.

Keith Duncan, Group Chief Executive Officer of JMMB.

Berger Paints had a very good run to December last year, with strong gains in profit as revenues grew attractively. Growth should continue into 2018 fiscal year, helped by increased building activity and an improving economy. Dividend payment should be high, thus boosting yields.

Scotia Investments should benefit in much the same way as Barita Investments. The investment bank reported earnings of $1.27 for the October quarter and IC Insider.com forecast is $4.96 for 2017. The increase should benefit from widening net interest income, as interest rates soften and more funds generated are added to the pool of interest earning pool as well as from growth in unit trust funds that will engender higher fee income, in addition to robust stock market activities that will also enhance fee income for the brokerage arm. On the negative side, the revaluation now taking place in the local currency could negatively affect earnings from trading in this area.

Carreras is one of the few stocks that have languished at the old price while many others have recorded active gains. The company just announced an interim payment of $2.20 bringing the payment since August last year to $5.40. The full year’s amount is likely to be in the order of $7.60 for a yield on the current price of 11.5 percent. This yield will not last as investors are going to eventually push it downward by bidding the price up as an income substitute. IC Insider’s forecast

is for earnings of $9 per share for the 2018 fiscal year. The stock may well languish at current levels for a while. The longer it stays the better for those investors who may want to add it to their portfolio.

is for earnings of $9 per share for the 2018 fiscal year. The stock may well languish at current levels for a while. The longer it stays the better for those investors who may want to add it to their portfolio.National Commercial Bank reported impressive profit results for their December quarter with a jump of 49 percent to $3.56 billion with earnings per share ending at $1.45, up from 96 cents in 2016. IC Insider.com forecast earnings of $8 per share for the current year. NCB declared an increase in its interim dividend payment from 50 cents in 2016 to 60 cents per ordinary stock unit payable in February. The payment represents 42.76 percent of the first quarter profits and is an indication of future payment.

Persons associated with this article may have an interest in the companies commented on.

More choices for investors

Barita

There were times, not so long ago, when things in the local financial markets were much simpler than they are now. Well up to just a few years ago there were only three unit trust companies operating and about 6 or 7 schemes. At the end of 2014 there were 22 different unit trust offerings and currently there are 27.

NCB Capital Markets added two new ones this year and Barita has just launched two new ones. By the end of 2015 the field is likely to get even more crowded with a number of institutions already indicating that they will be launching new schemes, included are JMMB Securities and Stocks and Securities. Part of the reason for the mush rooming of these schemes is occasioned by the dictates of the IMF and the World Bank who considered the risk financial institutions were taking by issuing repos using government securities as the flip side of the trades as too high and could pose major problems to the financial system. The result is a change in the rules that now require smaller amounts of funds to be routed through managed schemes, where the liability is left with the investors rather than the financial institutions, as is now the case. The market has also changed, with investors looking for a greater number of opportunities to invest in.

Barita Unit Trust is the latest entity to launch new schemes, bringing their suite of schemes to 6 in April. The latest are; the Barita US$ FX Growth Portfolio which invests mainly in international equity, and the Barita JA$ Real Estate Portfolio which invests primarily in commercial and residential buildings for lease or sale.

The US$ FX Growth Portfolio is a US Dollar denominated equity portfolio with investments in foreign currency ordinary and preference shares of countries within the Commonwealth, Caricom and the United States and may extend to other sovereign governments as prescribed by the Financial Services Commission and the Bank of Jamaica. A minimum purchase of 100 units is required to open an account, the current price per unit is US$1.

The real estate portfolio is JA$ denominated with investments in commercial or residential buildings for lease or sale and may also become financiers of real property developments and or participate in construction or financing of such structures.

Real Estate Portfolio investments must be held for a minimum of three years with a moratorium of 6 months’ notice required for encashment of the investment. At the launch, the managers stated that the fund has started off with an investment in 138 Student Living shares that are listed on the Jamaica Stock Exchange (JSE). A minimum purchase of 100 units is required to open an account and the current price is $5,000 per unit.

How the new funds will perform is left to time. What is known is the Cameron Burnett who is associated with the US dollar equity fund, has been investing in the overseas’ market for several years successfully, the fund should benefit from his experience. Hopefully, they will be able to navigate what is set to be a choppy period ahead for the US stock market, with interest rates set to go up.

Locally, real estate values should grow at an increasing pace as the government keeps the target of a balance fiscal operation firmly in sight and be committed to achieving it, which will lead to lower interest rates and higher asset values.

Barita Unit Trust is a subsidiary of Barita Investments a JSE listed stock.

Barita Faces challenges but..

Barita Investments profit after tax dropped 21 percent to $46 million for the quarter ending December 2014 compared to the similar period in 2013, from total revenues of $345 million and net operating revenues of $177 million. In 2013, the company that is involved in stockbroker and fund management reported net operating profit of $165 million but increase expenses helped to pull down profit for the quarter.

Barita Investments profit after tax dropped 21 percent to $46 million for the quarter ending December 2014 compared to the similar period in 2013, from total revenues of $345 million and net operating revenues of $177 million. In 2013, the company that is involved in stockbroker and fund management reported net operating profit of $165 million but increase expenses helped to pull down profit for the quarter.

Interest Income contributed $230 million to revenues, 15 percent below the prior year, while related interest expense remained flat at $168 million.

Barita is suffering from a mixture of assets priced for shorter periods than the funds clients’ invest with them. According to Chairman Rita Humphreys, “in an environment where interest rates have decreased, our liability costs have been similarly reduced resulting in our interest expense decreasing to prior year levels. However, with our investment portfolio comprising of approximately fifty percent variable instruments, our interest income has decreased at a faster rate. This has resulted in a significant contraction in our margins resulting in a recorded net interest income of $62 million, approximately 36 percent down from prior year.”

Fees and Commission income rose 65 percent above prior year to $38 million, with improvement coming from the subsidiary Barita Unit Trusts. Additionally, trading gains were 600 percent above prior year at $48 million compared to only $8 million in 2013. Depreciation of the Jamaican resulted in translation gains of $21 million down from $29 million prior year.

“Staff and administrative expenses contributed to a 16 percent increase in operational costs when compared to the same period last year. Staff costs increased by 10 percent which was triggered primarily by additional human resources and remuneration adjustments. Administrative costs were 25 percent higher than last year, with the main contributors being financial support for our charity arm the Barita Education Foundation and client support expenses,” the report to shareholders stated.

Interest rate developments, with Treasury bill rates continuing to fall and the change in the method relating to the repo business could put further pressure on income for a while. At the end of the quarter fair value reserve amounted to $107 million which could be realised in subsequent quarters and thus boost earnings. Falling T-Bill rates should result in gains in longer term Jamaican fixed interest rates securities and pickup in interest now seen in the Jamaica stock exchange is likely to hand Barita increased fee income during the balance of 2014.