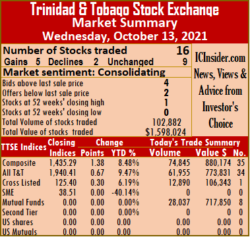

Activity fell markedly on the Trinidad and Tobago Stock Exchange on Wednesday after fewer securities traded and resulted in 76 percent fewer shares changing hands with 63 percent lower value than on Tuesday, leaving more stocks rising than falling at the close.

Sixteen securities traded down from 20 on Tuesday at the close, with five rising, two declining and nine remaining unchanged. The Composite Index popped 1.38 points to 1,435.29, the All T&T Index rose 0.67 points to close at 1,940.41 and the Cross-Listed Index added 0.30 points to settle at 125.40.

Sixteen securities traded down from 20 on Tuesday at the close, with five rising, two declining and nine remaining unchanged. The Composite Index popped 1.38 points to 1,435.29, the All T&T Index rose 0.67 points to close at 1,940.41 and the Cross-Listed Index added 0.30 points to settle at 125.40.

A total of 102,882 shares traded, for $1,598,024 down from 422,298 units at $4,331,345 on Tuesday. An average of 6,430 units traded at $99,877, down from 21,115 at $216,567 on Tuesday, with trading month to date averaging 40,560 units at $288,030 compared to 44,201 units at $308,100. The average trade for September amounts to 36,606 units at $425,940.

Investor’s Choice bid-offer indicator shows four stocks ending, with bids higher than their last selling prices and two with lower offers.

At the close, Agostini’s traded 1,000 shares at $24.50, Angostura Holdings remained at $17.10, with an exchange of 200 stock units, Ansa McAl popped 30 cents to $57.80 in exchanging 30 units.  Calypso Macro Investment Fund added 1 cent in closing at a 52 weeks’ high of $16.51 with an exchange of 1,600 stock units, Clico Investment Fund spiked 13 cents to $26.23 while exchanging 26,437 stock units, Guardian Holdings dipped 15 cents to end at $32.60, in exchanging 9,385 units. Massy Holdings shed 50 cents and ended at $84 in trading 1,085 shares, National Enterprises remained at $3.25 with 625 stocks changing hands, National Flour Mills rallied 7 cents to close at $2.11 in exchanging 2,329 stocks. NCB Financial Group remained at $8.25 after trading 12,890 stock units, One Caribbean Media closed at $4.86, with 41,200 shares crossing the exchange, Republic Financial Holdings remained at $135.70 in an exchange of 208 units. Scotiabank traded 155 stocks at $62, Trinidad & Tobago NGL remained at $17.50, with 4,362 stock units crossing the market, Unilever Caribbean finished trading at $16.40, with 1,176 units changing hands and West Indian Tobacco inched 1 cent higher to $30.93 with the swapping of 200 shares.

Calypso Macro Investment Fund added 1 cent in closing at a 52 weeks’ high of $16.51 with an exchange of 1,600 stock units, Clico Investment Fund spiked 13 cents to $26.23 while exchanging 26,437 stock units, Guardian Holdings dipped 15 cents to end at $32.60, in exchanging 9,385 units. Massy Holdings shed 50 cents and ended at $84 in trading 1,085 shares, National Enterprises remained at $3.25 with 625 stocks changing hands, National Flour Mills rallied 7 cents to close at $2.11 in exchanging 2,329 stocks. NCB Financial Group remained at $8.25 after trading 12,890 stock units, One Caribbean Media closed at $4.86, with 41,200 shares crossing the exchange, Republic Financial Holdings remained at $135.70 in an exchange of 208 units. Scotiabank traded 155 stocks at $62, Trinidad & Tobago NGL remained at $17.50, with 4,362 stock units crossing the market, Unilever Caribbean finished trading at $16.40, with 1,176 units changing hands and West Indian Tobacco inched 1 cent higher to $30.93 with the swapping of 200 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading volume drops on TTSE

Trading volume bounced on Tuesday

The volume of shares traded soared by 1,258 percent as 1,032 percent more funds chased after stocks on Tuesday over Monday, resulting in an even number of stocks rising and falling at the close of the JSE USD market.

Trading ended with six securities changing hands, up from five on Monday with an equal split of two between rising stocks and those declining and closing unchanged.

Trading ended with six securities changing hands, up from five on Monday with an equal split of two between rising stocks and those declining and closing unchanged.

The JSE US Denominated Equities Index rallied 1.43 points to end at 185.24.

The PE Ratio, a measure that computes appropriate stock values, averages 11.5 based on ICInsider.com’s 2021-22 earnings forecast.

Overall, 176,358 shares traded for US$17,759 compared to just 12,988 units at US$1,569 on Monday. Trading averaged 29,393 units at US$2,960, compared to 2,598 shares at US$314 on Monday and month to date an average of 45,324 at US$6,043 in contrast to 47,600 units at US$6,484 on Monday. September ended with an average of 853,681 units for US$132,197.

Investor’s Choice bid-offer indicator shows three stocks ended with a bid higher than their last selling prices and one with a lower offer.

At the close, First Rock Capital settled at 7 US cents with an exchange of 12,674 shares, Margaritaville fell 0.49 of a cent to 9.5 US cents with 742 stocks traded, Proven Investments rose 1.6 cents to 24.6 US cents with a transfer of 2,455 units. Sterling Investments gained 0.09 of a cent to close at 2.09 US cents with 17,131 stock units passing through the market, Sygnus Credit Investments USD share declined by 2 cents to settle at 11 US cents with 142,800 stocks changing hands and Sygnus Real Estate Finance USD share finished unchanged at 14 US cents with 556 shares crossing the exchange.

Proven Investments rose 1.6 cents to 24.6 US cents with a transfer of 2,455 units. Sterling Investments gained 0.09 of a cent to close at 2.09 US cents with 17,131 stock units passing through the market, Sygnus Credit Investments USD share declined by 2 cents to settle at 11 US cents with 142,800 stocks changing hands and Sygnus Real Estate Finance USD share finished unchanged at 14 US cents with 556 shares crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

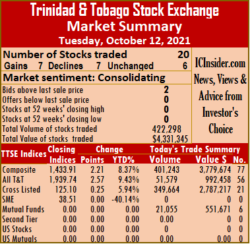

Rising and declining stocks tie

Market activity ended on Tuesday and resulted in an equal number of stocks rising and falling at the close of trading, after trading 94 percent more shares, valued 36 percent less than on Monday, at the close of the Trinidad and Tobago Stock Exchange.

Trinidad & Tobago Stock Exchange Head Quarters

At the close, 20 securities traded, up from 17 on Monday, with seven rising and falling respectively and six remaining unchanged.

The Composite Index gained 2.21 points to close at 1,433.91, the All T&T Index rallied 2.57 points to 1,939.74 and the Cross-Listed Index advanced 0.25 points to settle at 125.10.

A total of 422,298 shares traded for $4,331,345 compared to 217,596 units at $6,809,352 on Monday. An average of 1,115 units traded at $216,567 versus 12,80 at $400,550 on Monday, and the month to date averaging 44,201 units at $308,100 versus 47,752 units at $322,182. The average trade for September amounted to 36,606 units at $425,940.

Investor’s Choice bid-offer indicator shows two stocks ending with higher bids than their last selling prices and none with a lower offer.

At the close, Agostini’s traded 11,905 shares at $24.50, Angostura Holdings fell 1 cent to end at $17.10, with 7,595 stock units changing hands, Ansa McAl advanced 45 cents to $57.50 after exchanging 419 stocks. Clico Investment Fund climbed 10 cents to $26.10 with the swapping of 21,055 units, First Citizens Bank remained at $50.60 in trading 2,460 shares, FirstCaribbean International Bank traded 160 stock units at $6.50. GraceKennedy rose 4 cents to end at $6.30, with 36,000 stocks crossing the market, Guardian Holdings declined 5 cents to $32.75 in exchanging 228 units, JMMB Group increased 2 cents to close at $2.24 after trading 2,230 stock units.  L.J. Williams B share remained at $1.50 with 725 units crossing the market, Massy Holdings dropped 30 cents to $84.50, trading 315 shares, National Enterprises ended at $3.25 in an exchange of 3,000 stocks. National Flour Mills lost 2 cents in ending at $2.04 while exchanging 225 shares, NCB Financial Group rallied 5 cents to $8.25 trading 311,274 stock units, Prestige Holdings remained at $7.25 in switching ownership of 1,447 stocks. Scotiabank jumped $1 to $62 after 255 units crossed the market, Trinidad & Tobago NGL shed 4 cents in closing at $17.50, with 16,621 shares changing hands, Trinidad Cement dipped 5 cents to $4 trading 5,000 stock units. Unilever Caribbean popped 10 cents to close at $16.40 after an exchange of 230 stocks and West Indian Tobacco lost 2 cents to end at $30.92 in switching ownership of 1,154 units.

L.J. Williams B share remained at $1.50 with 725 units crossing the market, Massy Holdings dropped 30 cents to $84.50, trading 315 shares, National Enterprises ended at $3.25 in an exchange of 3,000 stocks. National Flour Mills lost 2 cents in ending at $2.04 while exchanging 225 shares, NCB Financial Group rallied 5 cents to $8.25 trading 311,274 stock units, Prestige Holdings remained at $7.25 in switching ownership of 1,447 stocks. Scotiabank jumped $1 to $62 after 255 units crossed the market, Trinidad & Tobago NGL shed 4 cents in closing at $17.50, with 16,621 shares changing hands, Trinidad Cement dipped 5 cents to $4 trading 5,000 stock units. Unilever Caribbean popped 10 cents to close at $16.40 after an exchange of 230 stocks and West Indian Tobacco lost 2 cents to end at $30.92 in switching ownership of 1,154 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading plunged on JSE USD market

Trading on the USD market ended on Monday with more decline in the volume of stocks following on Friday’s fall from Thursday levels, with 92 percent fewer shares changing hands on Monday valued 72 percent less than on Friday and resulting in falling stocks outnumbering rising ones and leading the market into a decline.

Five securities traded compared to eight on Friday, with prices of one rising, three falling and one ending unchanged. The US Denominated Equities Index dropped 2.55 points to end at 183.81.

Five securities traded compared to eight on Friday, with prices of one rising, three falling and one ending unchanged. The US Denominated Equities Index dropped 2.55 points to end at 183.81.

The PE Ratio, a measure that computes appropriate stock values, averages 11.6 based on ICInsider.com’s forecast of 2021-22 earnings.

Overall, 12,988 shares traded for US$1,569 down from 154,078 units at US$5,567 on Friday. Trading averaged 2,598 units at US$314 compared to 19,260 shares at US$696 on Friday and the month to date averages 47,600 at US$6,484 versus 53,681 units at US$7,317 on Friday. September ended with an average of 853,681 units for US$132,197.

Investor’s Choice bid-offer indicator shows two stocks ending with bids higher than their last selling prices and none, with lower offers.

At the close, First Rock Capital settled at 7 US cents with 415 shares changing hands, Margaritaville declined 0.01 of a cent to end at 9.99 US cents with 1,037 stocks traded, Proven Investments fell 1 cent to 23 US cents with a transfer of 1,496 stock units. Sygnus Credit Investments USD share dipped half a cent to 13 US cents with investors swapping 8,540 units and Transjamaican Highway gained 0.06 of a cent to close at 0.9 US cents with 1,500 stock units crossing the exchange.

At the close, First Rock Capital settled at 7 US cents with 415 shares changing hands, Margaritaville declined 0.01 of a cent to end at 9.99 US cents with 1,037 stocks traded, Proven Investments fell 1 cent to 23 US cents with a transfer of 1,496 stock units. Sygnus Credit Investments USD share dipped half a cent to 13 US cents with investors swapping 8,540 units and Transjamaican Highway gained 0.06 of a cent to close at 0.9 US cents with 1,500 stock units crossing the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

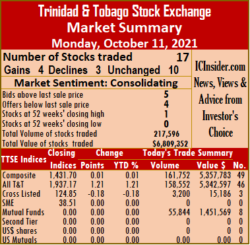

Steady trading in Port of Spain

Market activity ended on Monday with fairly steady trading that resulted in slightly more stocks rising than falling and Angostura Holdings closing at a 52 weeks’ high at the close of trading on the Trinidad and Tobago Stock Exchange.

At the close, 17 securities traded compared to 18 on Friday, with four stocks rising, three declining and 10 remaining unchanged. The Composite Index inched 0.01 points up to 1,431.70, the All T&T Index popped 1.21 points to close at 1,937.17 and the Cross-Listed Index declined 0.18 points to settle at 124.85.

At the close, 17 securities traded compared to 18 on Friday, with four stocks rising, three declining and 10 remaining unchanged. The Composite Index inched 0.01 points up to 1,431.70, the All T&T Index popped 1.21 points to close at 1,937.17 and the Cross-Listed Index declined 0.18 points to settle at 124.85.

A total of 217,596 shares traded, for $6,809,352 compared to 219,988 units at $5,740,431 on Friday. An average of 12,800 units traded at $400,550 versus 12,222 at $318,913 on Friday, with the month to date averaging 47,752 units at $322,182 versus 53,011 units at $310,392. The average trade for September amounts to 36,606 units at $425,940.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and four stocks with lower offers.

At the close, Agostini’s ended at $24.50 in trading 78,437 shares, Angostura Holdings rose 1 cent to end a 52 weeks’ high of $17.11 with an exchange of 150 stock units, Ansa McAl climbed 4 cents to $57.05 after 287 stocks crossed the market. Ansa Merchant Bank remained at $41 in clearing the market with 150 units, Clico Investment Fund advanced 5 cents to $26 after finishing trading of 55,844 stock units,  First Citizens Bank remained at $50.60 in switching ownership of 2,000 stocks. GraceKennedy fell 4 cents to end at $6.26 while exchanging 2,000 shares, Guardian Holdings ended unchanged at $32.80 after exchanging 1,753 shares, JMMB Group dropped 3 cents to $2.22, with 1,200 stocks changing hands. Massy Holdings had an exchange of 1,000 units at $84.80, National Enterprises rose 1 cent to $3.25 trading 6,000 stock units, Point Lisas remained at $3 with the swapping of 800 shares. Republic Financial Holdings ended at $135.70 after 3,837 shares crossed the market, Scotiabank lost 5 cents to end at $61 in an exchange of 35,400 stock units, Trinidad & Tobago NGL remained at $17.54 in exchanging 23,815 stocks. Trinidad Cement traded 4,447 units at $4.05 and West Indian Tobacco closed at $30.94 with the swapping of 476 units.

First Citizens Bank remained at $50.60 in switching ownership of 2,000 stocks. GraceKennedy fell 4 cents to end at $6.26 while exchanging 2,000 shares, Guardian Holdings ended unchanged at $32.80 after exchanging 1,753 shares, JMMB Group dropped 3 cents to $2.22, with 1,200 stocks changing hands. Massy Holdings had an exchange of 1,000 units at $84.80, National Enterprises rose 1 cent to $3.25 trading 6,000 stock units, Point Lisas remained at $3 with the swapping of 800 shares. Republic Financial Holdings ended at $135.70 after 3,837 shares crossed the market, Scotiabank lost 5 cents to end at $61 in an exchange of 35,400 stock units, Trinidad & Tobago NGL remained at $17.54 in exchanging 23,815 stocks. Trinidad Cement traded 4,447 units at $4.05 and West Indian Tobacco closed at $30.94 with the swapping of 476 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

New ICTOP10 100% plus winner

Caribbean Producers raced to the top of ICTOP10 listings last week after the company released full year results resulting in ICInsider.com upgrading earnings from 65 cents per share to $1.20 for the current year. The stock price promptly surged to close at $6.60 after hitting a high of $7.50 on Friday and gaining 136 percent for the year to date and remaining in the number one position on the Main Market list with much room to cover before full valuation.

Watch these stocks that are expected to release quarterly financial statements this coming week, in addition to CPJ that is in demand and Sygnus Credit Investments that has limited stocks on offer. Caribbean Cream’s half year results are due by Friday and should be showing earnings around 40 cents per share if the first quarter trend continues. Also expected by Friday are AMG Packaging, Express Catering, Knutsford Express and Paramount Trading.

Watch these stocks that are expected to release quarterly financial statements this coming week, in addition to CPJ that is in demand and Sygnus Credit Investments that has limited stocks on offer. Caribbean Cream’s half year results are due by Friday and should be showing earnings around 40 cents per share if the first quarter trend continues. Also expected by Friday are AMG Packaging, Express Catering, Knutsford Express and Paramount Trading.

Elsewhere, in the Junior Market, AMG Packaging rose 13.5 percent from $1.70 to $1.93, Access Financial dropped from $20 to $18.60, Caribbean Cream moved from $7 to $6.37, Dolphin Cove slipped from $10 last week to $9.69 and Stationery and Office Supplies fell from $6.49 to $6.

In the Main Market, Caribbean Producers rose 20 percent from $5.50 to $6.60, Guardian Holding fell from $582 to $577 after hitting a low during the week of $511, Sygnus Credit Investment rose 6 percent from $15.98 to $16.96 and Victoria Mutual Investments that moved from $5.45 to $6.

In the Main Market, Caribbean Producers rose 20 percent from $5.50 to $6.60, Guardian Holding fell from $582 to $577 after hitting a low during the week of $511, Sygnus Credit Investment rose 6 percent from $15.98 to $16.96 and Victoria Mutual Investments that moved from $5.45 to $6.

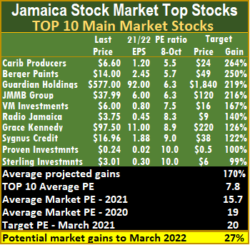

The top three Main Market stocks are Caribbean Producers, followed by Berger Paints and Guardian Holdings, with expected gains of 219 to 264 percent for the three, versus last weeks’ 216 to 336 percent.

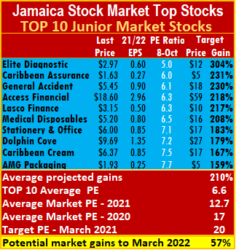

The top three stocks in the Junior Market are Elite Diagnostic, followed by Caribbean Assurance and General Accident. All three have the potential to gain between 230 and 304 percent, from 217 percent and 300 percent last week.

The average gains projected for the TOP 10 Junior Market stocks moved from 203 percent to 210 percent and Main Market stocks moved from 180 percent to 170 percent.

The average gains projected for the TOP 10 Junior Market stocks moved from 203 percent to 210 percent and Main Market stocks moved from 180 percent to 170 percent.

The Junior Market closed the week with an average PE 12.7 based on ICInsider.com’s 2021-22 earnings and currently trades well below the target of 20 and the historical average of 17 to March this year based on 2020 earnings. The TOP 10 stocks trade at a PE of 6.6, with a 52 percent discount to that market’s PE.

The overall Junior Market can gain 57 percent to March next year, based on an average PE of 20 and 34 percent based on an average PE of 17. Five stocks are trading above this level and two at a PE around the 16 level and 16.7, indicating that many others will rise above the 17 mark.

The JSE Main Market ended the week with an overall PE of 15.7, a little distance from 19 the market ended at in March, suggesting a 27 percent rise at a PE of 19 and 21 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.6, with a 49 percent discount to the PE of that market, well off the potential of 20, but 12 stocks trade above a PE of 19, with most of them over 20, suggesting that the accepted multiple maybe around 25 times current year’s earnings.

The JSE Main Market ended the week with an overall PE of 15.7, a little distance from 19 the market ended at in March, suggesting a 27 percent rise at a PE of 19 and 21 percent at a PE of 20 from now to March 2022. The Main Market TOP 10 trades at a PE of 7.6, with a 49 percent discount to the PE of that market, well off the potential of 20, but 12 stocks trade above a PE of 19, with most of them over 20, suggesting that the accepted multiple maybe around 25 times current year’s earnings.

ICTOP10 is not intended to select the best stocks in the market but ones that are most likely to be the best winners within fifteen months.  ICInsider.com ranks stocks to highlight the winners from the rest, allowing investors to focus on potential winners, helping to remove emotional attachments to stocks that often result in costly mistakes.

ICInsider.com ranks stocks to highlight the winners from the rest, allowing investors to focus on potential winners, helping to remove emotional attachments to stocks that often result in costly mistakes.

IC TOP10 stocks are likely to deliver the best returns up to March 2022 and ranked in order of potential gains, based on likely increase for each company, considering the earnings and PE ratios for the current fiscal year. Expected values will change as stock prices fluctuate and result in weekly movements in and out of the lists. Revisions to earnings per share are ongoing, based on receipt of new information.

Persons who compiled this report may have an interest in securities commented on in this report.

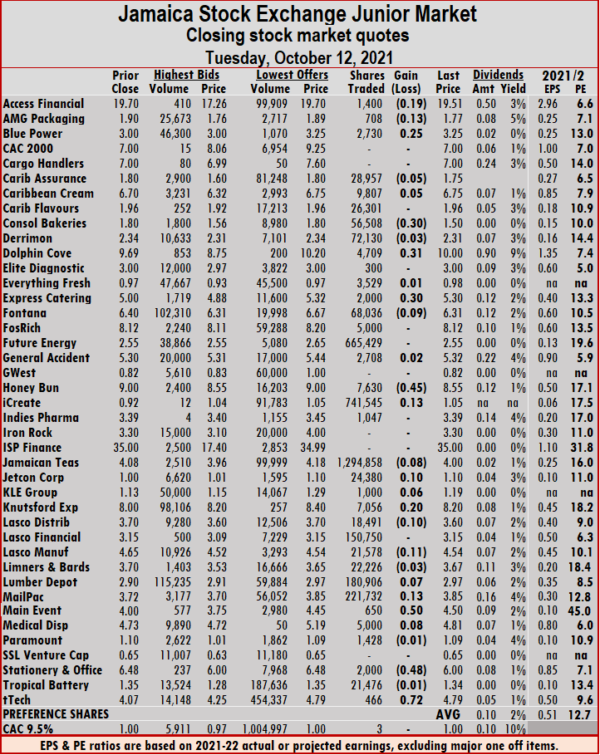

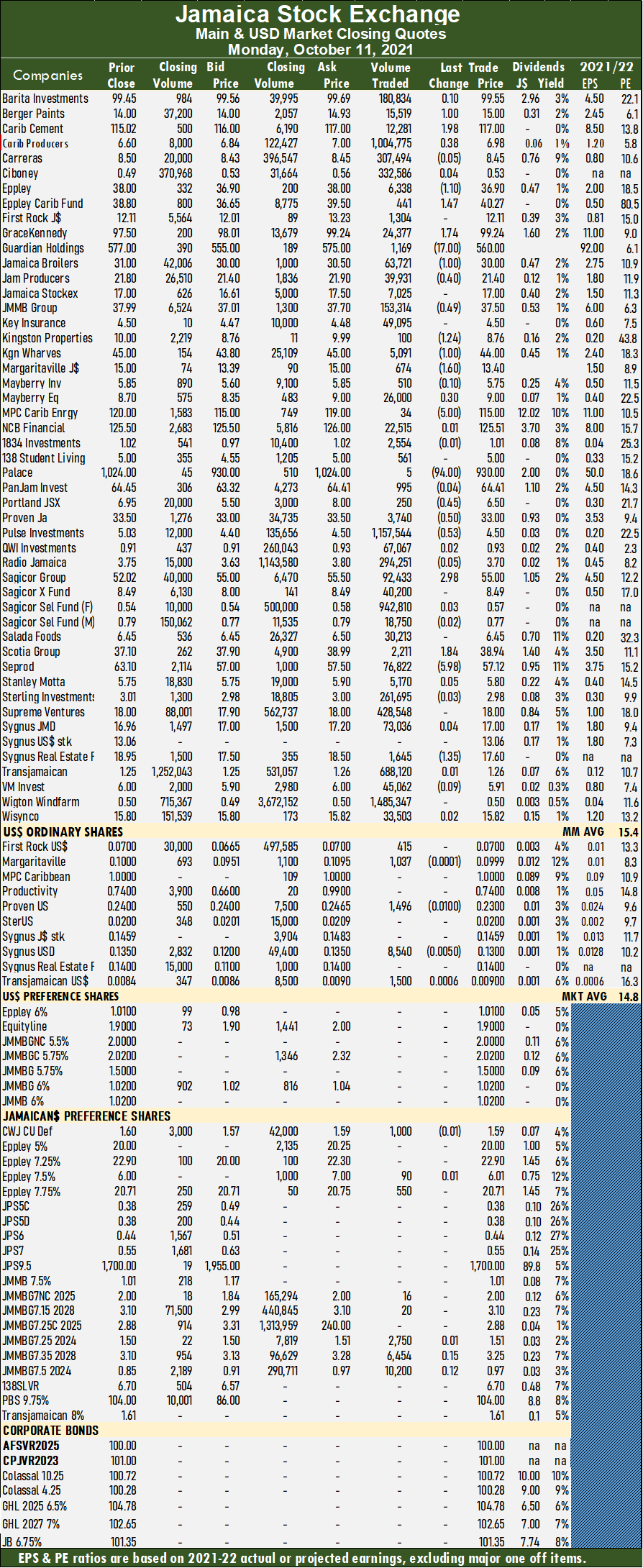

Thirty six securities traded compared to 37 on Monday and ended, with 15 rising, 14 declining and seven, closing unchanged.

Thirty six securities traded compared to 37 on Monday and ended, with 15 rising, 14 declining and seven, closing unchanged. At the close, Access Financial shed 19 cents at $19.51 in trading 1,400 shares, AMG Packaging declined 13 cents to $1.77, with 08 stocks crossing the exchange, Blue Power gained 25 cents to end at $3.25 in an exchange of 2,730 units. Caribbean Assurance Brokers fell 5 cents to $1.75 after 28,957 stock units crossed the market, Caribbean Cream popped 5 cents to $6.75, with an exchange of 9,807 units, Consolidated Bakeries dropped 30 cents in closing at $1.50 in switching ownership of 56,508 shares. Dolphin Cove rallied 31 cents to $10 while exchanging 4,709 stock units, Express Catering spiked 30 cents to $5.30 with the swapping of 2,000 stocks, Fontana fell 9 cents to $6.31, with 68,036 shares changing hands. Honey Bun fell 45 cents to $8.55 in exchanging 7,630 stocks, iCreate increased 13 cents to $1.05 trading 741,545 units, Jamaican Teas lost 8 cents in closing at $4 with an exchange of 1,294,858 stock units. Jetcon Corporation rose 10 cents to $1.10 after exchanging 24,380 stock units, KLE Group climbed 6 cents to close at $1.19, trading 1,000 shares, Knutsford Express advanced 20 cents to $8.20, with 7,056 units crossing the market. Lasco Distributors declined 10 cents to $3.60 after exchanging 18,491 stocks, Lasco Manufacturing shed 11 cents in closing at $4.54 after trading 21,578 units, Lumber Depot rose 7 cents to $2.97 trading 180,906 shares.

At the close, Access Financial shed 19 cents at $19.51 in trading 1,400 shares, AMG Packaging declined 13 cents to $1.77, with 08 stocks crossing the exchange, Blue Power gained 25 cents to end at $3.25 in an exchange of 2,730 units. Caribbean Assurance Brokers fell 5 cents to $1.75 after 28,957 stock units crossed the market, Caribbean Cream popped 5 cents to $6.75, with an exchange of 9,807 units, Consolidated Bakeries dropped 30 cents in closing at $1.50 in switching ownership of 56,508 shares. Dolphin Cove rallied 31 cents to $10 while exchanging 4,709 stock units, Express Catering spiked 30 cents to $5.30 with the swapping of 2,000 stocks, Fontana fell 9 cents to $6.31, with 68,036 shares changing hands. Honey Bun fell 45 cents to $8.55 in exchanging 7,630 stocks, iCreate increased 13 cents to $1.05 trading 741,545 units, Jamaican Teas lost 8 cents in closing at $4 with an exchange of 1,294,858 stock units. Jetcon Corporation rose 10 cents to $1.10 after exchanging 24,380 stock units, KLE Group climbed 6 cents to close at $1.19, trading 1,000 shares, Knutsford Express advanced 20 cents to $8.20, with 7,056 units crossing the market. Lasco Distributors declined 10 cents to $3.60 after exchanging 18,491 stocks, Lasco Manufacturing shed 11 cents in closing at $4.54 after trading 21,578 units, Lumber Depot rose 7 cents to $2.97 trading 180,906 shares.  Mailpac Group climbed 13 cents to $3.85 with the swapping of 221,732 stock units, Main Event rallied 50 cents to $4.50 trading 650 stocks, Medical Disposables popped 8 cents to close at $4.81 in switching ownership of 5,000 shares. Stationery and Office Supplies dropped 48 cents to $6, with 2,000 stocks clearing the market and tTech spiked 72 cents to $4.79 while exchanging 466 units.

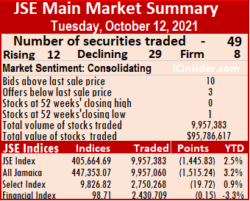

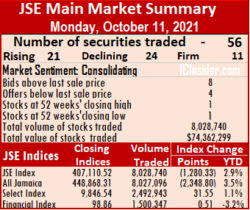

Mailpac Group climbed 13 cents to $3.85 with the swapping of 221,732 stock units, Main Event rallied 50 cents to $4.50 trading 650 stocks, Medical Disposables popped 8 cents to close at $4.81 in switching ownership of 5,000 shares. Stationery and Office Supplies dropped 48 cents to $6, with 2,000 stocks clearing the market and tTech spiked 72 cents to $4.79 while exchanging 466 units. The All Jamaican Composite Index shed 1,515.24 points to 447,353.07, the JSE Main Index dropped 1,445.83 points to 405,664.69 and the JSE Financial Index lost 0.15 points to end at 98.71.

The All Jamaican Composite Index shed 1,515.24 points to 447,353.07, the JSE Main Index dropped 1,445.83 points to 405,664.69 and the JSE Financial Index lost 0.15 points to end at 98.71. September closed with an average of 335,669 units at $7,507,404.Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and three with lower offers.

September closed with an average of 335,669 units at $7,507,404.Investor’s Choice bid-offer indicator shows ten stocks ended with bids higher than their last selling prices and three with lower offers. Scotia Group declined $2.24 to a 52 week’s low of $36.70 in transferring 167,009 units, Seprod gained 39 cents in closing at $57.51 with 29,054 shares clearing the market and Sygnus Credit Investments picked up 24 cents to end at $17.24 in exchanging 124,241 stocks.

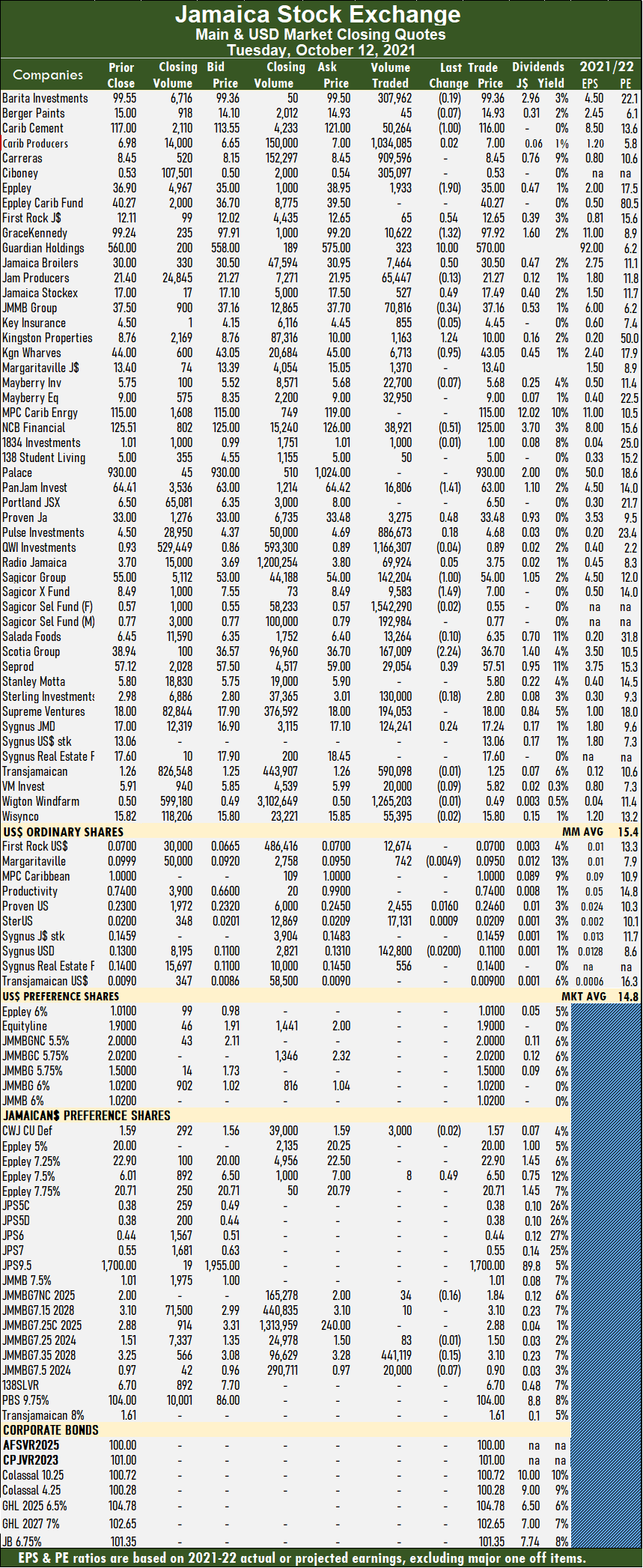

Scotia Group declined $2.24 to a 52 week’s low of $36.70 in transferring 167,009 units, Seprod gained 39 cents in closing at $57.51 with 29,054 shares clearing the market and Sygnus Credit Investments picked up 24 cents to end at $17.24 in exchanging 124,241 stocks. After spiking to 453,200.45 at the market’s opening, the All Jamaican Composite Index ended up falling 2,348.80 points to settle at 448,868.31, the Main Index declined 1,280.33 points to 407,110.52 and the JSE Financial Index popped 0.51 points to end at 98.86.

After spiking to 453,200.45 at the market’s opening, the All Jamaican Composite Index ended up falling 2,348.80 points to settle at 448,868.31, the Main Index declined 1,280.33 points to 407,110.52 and the JSE Financial Index popped 0.51 points to end at 98.86. Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows eight stocks ended with bids higher than their last selling prices and four with lower offers. Pulse Investments dipped 53 cents to close at $4.50 with 1,157,544 shares crossing the market, Sagicor Group spiked $2.98 in closing at $55 after 92,433 stocks cleared the market, Scotia Group rose $1.84 to $38.94 with an exchange of 2,211 stock units. Seprod declined $5.98 to $57.12 with 76,822 units changing hands and Sygnus Real Estate Finance shed $1.35 to end at $17.60 in switching ownership of 1,645 stocks.

Pulse Investments dipped 53 cents to close at $4.50 with 1,157,544 shares crossing the market, Sagicor Group spiked $2.98 in closing at $55 after 92,433 stocks cleared the market, Scotia Group rose $1.84 to $38.94 with an exchange of 2,211 stock units. Seprod declined $5.98 to $57.12 with 76,822 units changing hands and Sygnus Real Estate Finance shed $1.35 to end at $17.60 in switching ownership of 1,645 stocks. Similar to trading on Friday, 37 securities traded and ended with the prices of 15 rising, 18 eclining and four closing unchanged.

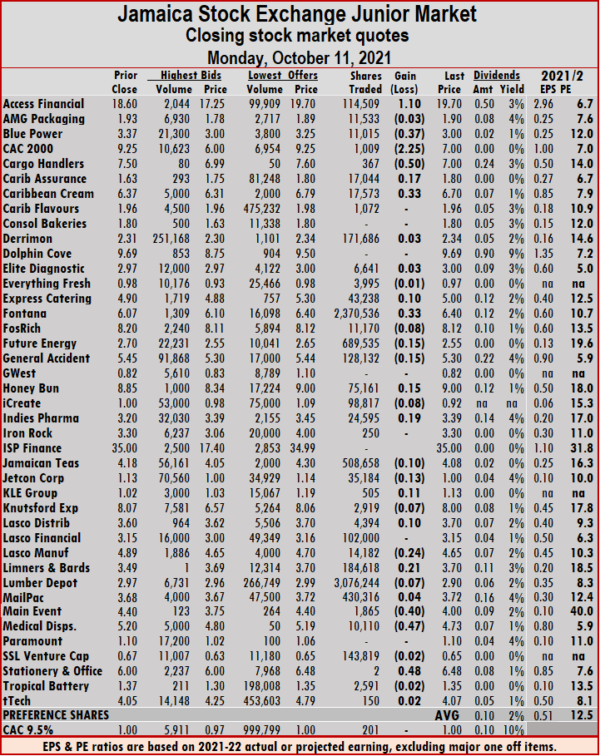

Similar to trading on Friday, 37 securities traded and ended with the prices of 15 rising, 18 eclining and four closing unchanged. Cargo Handlers dropped 50 cents to $7, with 367 units crossing the exchange, Caribbean Assurance Brokers rallied 17 cents to $1.80, with 17,044 stock units clearing the market, Caribbean Cream spiked 33 cents to $6.70 after 17,573 stocks changed hands. Express Catering popped 10 cents to $5 in an exchange of 43,238 shares, Fontana rose 33 cents in closing at $6.40 with 2,370,536 units changing hands, Fosrich lost 8 cents to close at $8.12 in trading 11,170 units. Future Energy Source dropped 15 cents to $2.55 with the swapping of 689,535 stock units, General Accident declined 15 cents to $5.30 after exchanging 128,132 shares, Honey Bun climbed 15 cents to $9 in exchanging 75,161 stocks. iCreate dropped 8 cents to 92 cents after 98,817 shares crossed the market, Indies Pharma advanced 19 cents to $3.39 after trading 24,595 units, Jamaican Teas fell 10 cents to $4.08, with 508,658 stocks changing hands. Jetcon Corporation shed 13 cents in closing at $1 after switching ownership of 35,184 stock units, KLE Group popped 11 cents to $1.13 while exchanging 505 units, Knutsford Express lost 7 cents in ending at $8 after 2,919 stock units changed hands, Lasco Distributors popped 10 cents to close at $3.70, with 4,394 stocks clearing the market.

Cargo Handlers dropped 50 cents to $7, with 367 units crossing the exchange, Caribbean Assurance Brokers rallied 17 cents to $1.80, with 17,044 stock units clearing the market, Caribbean Cream spiked 33 cents to $6.70 after 17,573 stocks changed hands. Express Catering popped 10 cents to $5 in an exchange of 43,238 shares, Fontana rose 33 cents in closing at $6.40 with 2,370,536 units changing hands, Fosrich lost 8 cents to close at $8.12 in trading 11,170 units. Future Energy Source dropped 15 cents to $2.55 with the swapping of 689,535 stock units, General Accident declined 15 cents to $5.30 after exchanging 128,132 shares, Honey Bun climbed 15 cents to $9 in exchanging 75,161 stocks. iCreate dropped 8 cents to 92 cents after 98,817 shares crossed the market, Indies Pharma advanced 19 cents to $3.39 after trading 24,595 units, Jamaican Teas fell 10 cents to $4.08, with 508,658 stocks changing hands. Jetcon Corporation shed 13 cents in closing at $1 after switching ownership of 35,184 stock units, KLE Group popped 11 cents to $1.13 while exchanging 505 units, Knutsford Express lost 7 cents in ending at $8 after 2,919 stock units changed hands, Lasco Distributors popped 10 cents to close at $3.70, with 4,394 stocks clearing the market.  Lasco Manufacturing dropped 24 cents to end at $4.65 trading 14,182 shares, Limners and Bards spiked 21 cents to $3.70 with an exchange of 184,618 stocks, Lumber Depot declined 7 cents to close at $2.90 after trading 3,076,244 units, Main Event lost 40 cents in closing at $4 after exchanging 1,865 shares, Medical Disposables shed 47 cents to $4.73 with the swapping of 10,110 stock units and Stationery and Office Supplies climbed 48 cents to $6.48 in an exchange of two shares.

Lasco Manufacturing dropped 24 cents to end at $4.65 trading 14,182 shares, Limners and Bards spiked 21 cents to $3.70 with an exchange of 184,618 stocks, Lumber Depot declined 7 cents to close at $2.90 after trading 3,076,244 units, Main Event lost 40 cents in closing at $4 after exchanging 1,865 shares, Medical Disposables shed 47 cents to $4.73 with the swapping of 10,110 stock units and Stationery and Office Supplies climbed 48 cents to $6.48 in an exchange of two shares.