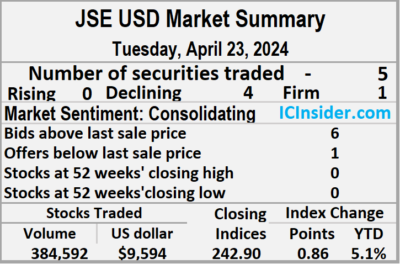

Trading picked up on the Jamaica Stock Exchange US dollar market on Tuesday, with a 222 percent rise in the volume of stocks changing hands with an 18 percent lower value than on Monday and resulting in trading in five securities, down from nine on Monday with prices of four declining and one ending unchanged.

The market closed with an exchange of 384,592 shares for US$9,594 compared to 119,368 units at US$11,630 on Monday.

The market closed with an exchange of 384,592 shares for US$9,594 compared to 119,368 units at US$11,630 on Monday.

Trading averaged 76,918 units at US$1,919 up from 13,263 shares at US$1,292 on Monday, with a month to date average of 38,621 shares at US$2,319 compared with 37,077 units at US$2,335 on the previous day and March with an average of 49,394 units for US$3,593.

The US Denominated Equities Index rose 0.86 points to end the day at 242.90.

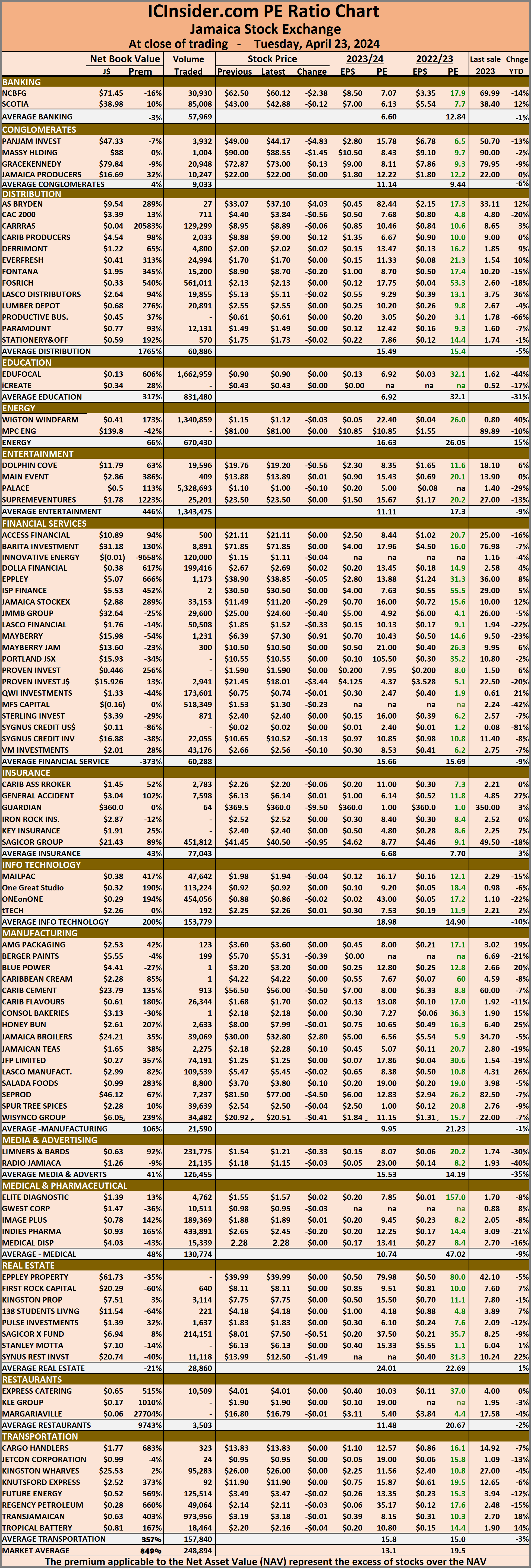

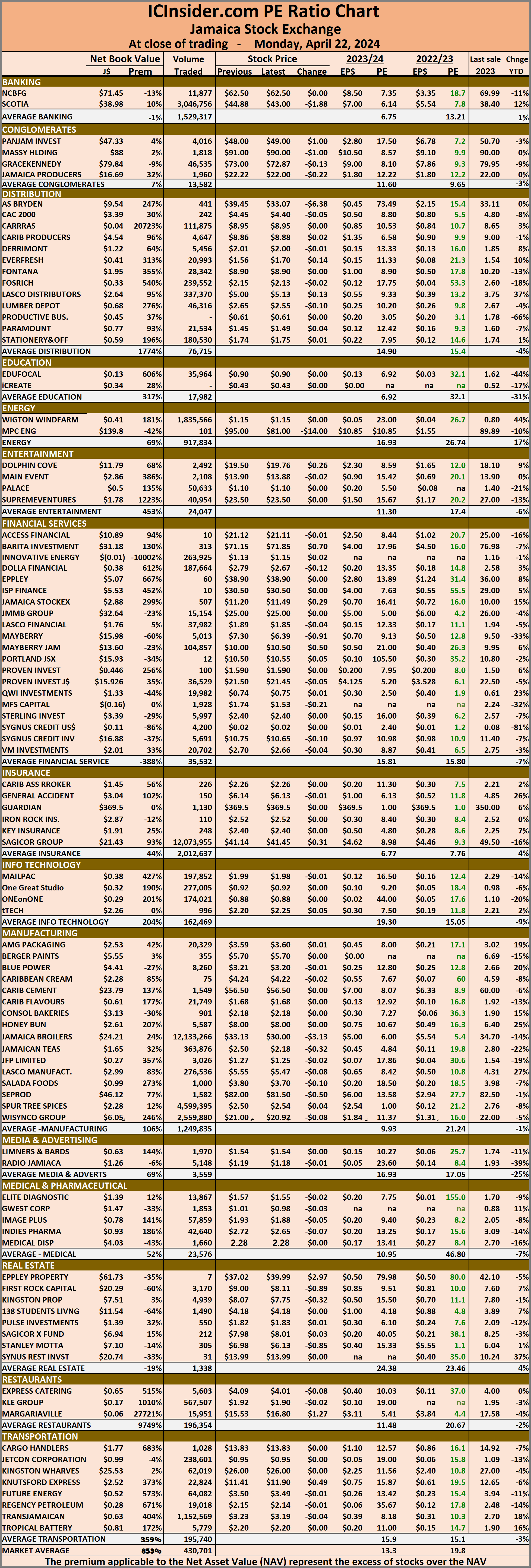

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden ended at 22.49 US cents in an exchange of just one share, Proven Investments fell 0.05 of a cent in closing at 14.7 US cents after 132 stocks passed through the market, Sygnus Credit Investments shed 0.25 of one cent to end at 8 US cents with investors transferring 722 stocks and Transjamaican Highway sank 0.07 of a cent to close at 2.1 US cents with 383,637 units crossing the market.

At the close, AS Bryden ended at 22.49 US cents in an exchange of just one share, Proven Investments fell 0.05 of a cent in closing at 14.7 US cents after 132 stocks passed through the market, Sygnus Credit Investments shed 0.25 of one cent to end at 8 US cents with investors transferring 722 stocks and Transjamaican Highway sank 0.07 of a cent to close at 2.1 US cents with 383,637 units crossing the market.

In the preference segment, Productive Business Solutions 9.25% preference share dipped 20 cents and ended at US$11 with traders dealing in 100 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

No winners for JSE USD market

Declining Trinidad Stock Exchange

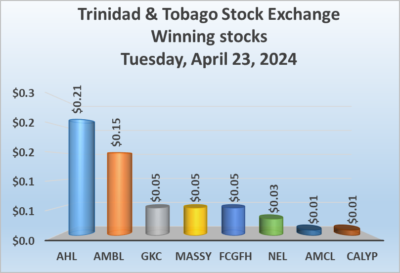

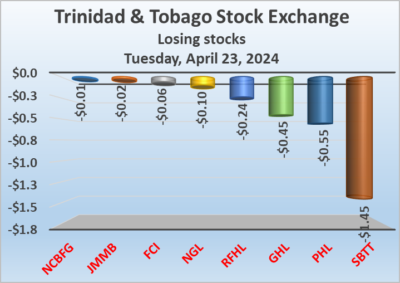

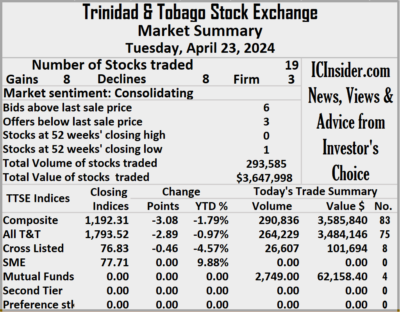

Stocks registered a blow to the Trinidad and Tobago Stock Exchange on Tuesday, notwithstanding an equal number of stocks rising and declining and ending with a 67 percent rise in the volume of stocks traded with a 69 percent higher value than Monday’s, resulting in 19 securities trading, up from 17 on Monday and ending with prices of eight stocks rising, eight declining and three remaining unchanged.

The market closed with an exchange of 293,585 shares for $3,647,998, up from 175,637 stock units at $2,164,910 on Monday.

The market closed with an exchange of 293,585 shares for $3,647,998, up from 175,637 stock units at $2,164,910 on Monday.

An average of 15,452 shares were traded at $192,000 compared with 10,332 units at $127,348 on Monday, with trading month to date averaging 15,432 shares at $168,035 compared to 15,430 units at $166,342 on the previous day compared with an average of 28,236 shares at $236,496 in March.

The Composite Index declined 3.08 points to culminate at 1,192.31, the All T&T Index lost 2.89 points to end at 1,793.52, the SME Index remained unchanged at 77.71 and the Cross-Listed Index dropped 0.46 points to wrap-up trading at 76.83.

Investor’s Choice bid-offer indicator shows six stocks ending with bids higher than their last selling prices and three with lower offers.

At the close, Agostini’s remained at $69 with traders dealing in 19,392 shares, Angostura Holdings rose 21 cents to close at $22.95 after 1,775 shares passed through the market, Ansa McAl popped 1 cent and ended at $55.01 with a transfer of 500 stocks. Ansa Merchant Bank rallied 15 cents to finish at $45.30 with 7,381 units clearing the market, Calypso Macro Investment Fund gained 1 cent to close at $22.61 in an exchange of 2,749 shares, First Citizens Group rose 5 cents to end at $48.30, with 1,706 units changing hands. FirstCaribbean International Bank fell 6 cents to $6.95 with investors trading 151 stocks, GraceKennedy rallied 5 cents to close at $3.95 after 23,225 stock units crossed the market, Guardian Holdings shed 45 cents to finish at $18.05 with investors trading 1,470 shares. JMMB Group fell 2 cents and ended at $1.43 after closing with an exchange of 14 stock units, Massy Holdings advanced 5 cents to close at $4.35 after a transfer of 205,900 stocks,

At the close, Agostini’s remained at $69 with traders dealing in 19,392 shares, Angostura Holdings rose 21 cents to close at $22.95 after 1,775 shares passed through the market, Ansa McAl popped 1 cent and ended at $55.01 with a transfer of 500 stocks. Ansa Merchant Bank rallied 15 cents to finish at $45.30 with 7,381 units clearing the market, Calypso Macro Investment Fund gained 1 cent to close at $22.61 in an exchange of 2,749 shares, First Citizens Group rose 5 cents to end at $48.30, with 1,706 units changing hands. FirstCaribbean International Bank fell 6 cents to $6.95 with investors trading 151 stocks, GraceKennedy rallied 5 cents to close at $3.95 after 23,225 stock units crossed the market, Guardian Holdings shed 45 cents to finish at $18.05 with investors trading 1,470 shares. JMMB Group fell 2 cents and ended at $1.43 after closing with an exchange of 14 stock units, Massy Holdings advanced 5 cents to close at $4.35 after a transfer of 205,900 stocks,  National Enterprises popped 3 cents to end at $3.85 in switching ownership of 11,061 units. National Flour Mills ended at $2.20 after an exchange of 2,000 stocks, NCB Financial dropped 1 cent and ended at $3.09 in trading 3,217 shares, Prestige Holdings shed 55 cents in closing at $13, with 773 stock units crossing the exchange. Republic Financial declined 24 cents to end at $118.26 after investors traded 5,047 units, Scotiabank sank $1.45 to finish at $67.55 with an exchange of 451 shares, Trinidad & Tobago NGL dipped 10 cents to $8.50, with 6,754 units crossing the market and Unilever Caribbean ended at $11.56 after an exchange of 19 stocks.

National Enterprises popped 3 cents to end at $3.85 in switching ownership of 11,061 units. National Flour Mills ended at $2.20 after an exchange of 2,000 stocks, NCB Financial dropped 1 cent and ended at $3.09 in trading 3,217 shares, Prestige Holdings shed 55 cents in closing at $13, with 773 stock units crossing the exchange. Republic Financial declined 24 cents to end at $118.26 after investors traded 5,047 units, Scotiabank sank $1.45 to finish at $67.55 with an exchange of 451 shares, Trinidad & Tobago NGL dipped 10 cents to $8.50, with 6,754 units crossing the market and Unilever Caribbean ended at $11.56 after an exchange of 19 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on the JSE USD market

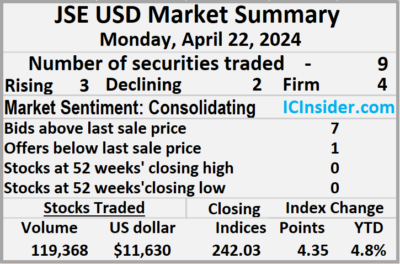

Trading closed with a big drop in the volume and value of stocks changing hands on the Jamaica Stock Exchange US dollar market on Monday, with the volume plunging 86 percent with a 77 percent lower value than on Friday and resulting in trading in nine securities, compared to eight on Friday with prices of three rising, two declining and four ending unchanged.

The market closed with an exchange of 119,368 shares for US$11,630 compared to 880,808 units at US$49,826 on Friday.

The market closed with an exchange of 119,368 shares for US$11,630 compared to 880,808 units at US$49,826 on Friday.

Trading averaged 13,263 shares at US$1,292 down from 110,101 units at US$6,228 on Friday, with a month to date average of 37,077 shares at US$2,335 compared with 38,941 units at US$2,417 on the previous trading day and March that ended with an average of 49,394 units for US$3,593.

The US Denominated Equities Index climbed 4.33 points to wrap up trading at 242.03.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.4. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows seven stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, AS Bryden remained at 22.49 US cents after an exchange of 434 shares, First Rock Real Estate USD share dipped 0.05 of a cent to 4.5 US cents with investors transferring 15,951 stocks, Margaritaville ended at 10 US cents and closed after 1,228 shares changed hands. Productive Business Solutions ended at US$1.59 with investors dealing in 100 stock units,  Proven Investments popped 0.75 of one cent to 14.75 US cents, with 40,160 shares crossing the exchange, Sterling Investments lost 0.2 of a cent and ended at 1.5 US cents with traders dealing in 4,200 stock units. Sygnus Credit Investments popped 0.28 of one cent to close at 8.25 US cents in an exchange of 50,407 units and Transjamaican Highway climbed 0.17 of a cent to finish at 2.17 US cents with investors trading 6,858 stock units.

Proven Investments popped 0.75 of one cent to 14.75 US cents, with 40,160 shares crossing the exchange, Sterling Investments lost 0.2 of a cent and ended at 1.5 US cents with traders dealing in 4,200 stock units. Sygnus Credit Investments popped 0.28 of one cent to close at 8.25 US cents in an exchange of 50,407 units and Transjamaican Highway climbed 0.17 of a cent to finish at 2.17 US cents with investors trading 6,858 stock units.

In the preference segment, Sygnus Credit Investments E8.5% remained at US$10.70 with an exchange of 30 shares.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices tumble on Trinidad Exchange on Monday

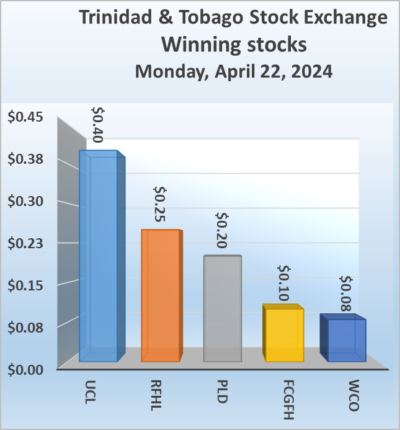

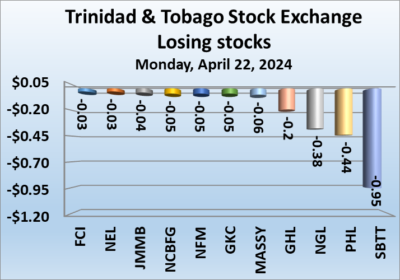

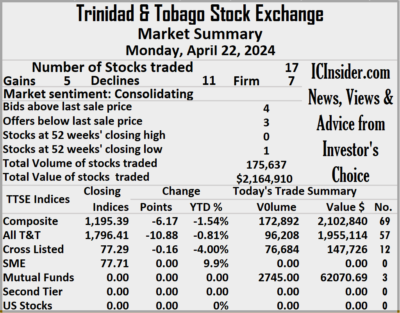

Falling stocks clobbered those rising at the end of trading on the Trinidad and Tobago Stock Exchange on Monday, with the volume of stocks traded declining 80 percent valued 70 percent less than on Friday and similar to Friday a total of 17 securities were traded and ending with prices of five stocks rising, 11 declining and one remaining unchanged.

The market closed with an exchange of 175,637 shares at $2,164,910 down from 888,399 stock units at $7,274,583 on Friday.

The market closed with an exchange of 175,637 shares at $2,164,910 down from 888,399 stock units at $7,274,583 on Friday.

An average of 10,332 shares were traded at $127,348 compared to 52,259 units at $427,917 on Friday, with trading month to date averaging 15,430 shares at $166,342 compared to 15,774 units at $168,973 on the previous day and an average for March of 28,236 shares at $236,496.

The Composite Index sank 6.17 points to finish at 1,195.39, the All T&T Index fell 10.88 points to close at 1,796.41, the SME Index ended unchanged at 77.71 and the Cross-Listed Index skidded 0.16 points to close at 77.29.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Calypso Macro Investment Fund ended at $22.60 with 2,745 shares crossing the market, First Citizens Group increased 10 cents to $48.25 as investors exchanged 2,230 units, FirstCaribbean International Bank shed 3 cents to finish at $7.01 after 799 stocks passed through the market. GraceKennedy fell 5 cents in closing at $3.90 after an exchange of 13,000 stock units, Guardian Holdings lost 20 cents to end at $18.50 with investors trading 200 shares, JMMB Group declined 4 cents to close at $1.45, with 62,385 stocks crossing the market. Massy Holdings sank 6 cents to $4.30 with an exchange of 39,050 units, National Enterprises slipped 3 cents to finish at $3.82 and closed with an exchange of 2,790 stock units, National Flour Mills dropped 5 cents and ended at $2.20 with traders dealing in 1,500 shares. NCB Financial skidded 5 cents to close at $3.10 in switching ownership of 500 stocks, Point Lisas popped 20 cents to end at $3.70 with investors dealing in 237 units, Prestige Holdings dipped 44 cents in closing at $13.55 with a transfer of 30,238 stock units.

GraceKennedy fell 5 cents in closing at $3.90 after an exchange of 13,000 stock units, Guardian Holdings lost 20 cents to end at $18.50 with investors trading 200 shares, JMMB Group declined 4 cents to close at $1.45, with 62,385 stocks crossing the market. Massy Holdings sank 6 cents to $4.30 with an exchange of 39,050 units, National Enterprises slipped 3 cents to finish at $3.82 and closed with an exchange of 2,790 stock units, National Flour Mills dropped 5 cents and ended at $2.20 with traders dealing in 1,500 shares. NCB Financial skidded 5 cents to close at $3.10 in switching ownership of 500 stocks, Point Lisas popped 20 cents to end at $3.70 with investors dealing in 237 units, Prestige Holdings dipped 44 cents in closing at $13.55 with a transfer of 30,238 stock units.  Republic Financial advanced 25 cents to $118.50 after trading 681 shares, Scotiabank fell 95 cents to end at $69, with 17,051 stocks crossing the exchange, Trinidad & Tobago NGL slipped 38 cents in closing at a 52 weeks’ low of $8.60, with 1,600 stock units changing hands. Unilever Caribbean rose 40 cents and ended at $11.56 in trading 250 stocks and West Indian Tobacco gained 8 cents to close at $11.15 with 381 units clearing the market.

Republic Financial advanced 25 cents to $118.50 after trading 681 shares, Scotiabank fell 95 cents to end at $69, with 17,051 stocks crossing the exchange, Trinidad & Tobago NGL slipped 38 cents in closing at a 52 weeks’ low of $8.60, with 1,600 stock units changing hands. Unilever Caribbean rose 40 cents and ended at $11.56 in trading 250 stocks and West Indian Tobacco gained 8 cents to close at $11.15 with 381 units clearing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

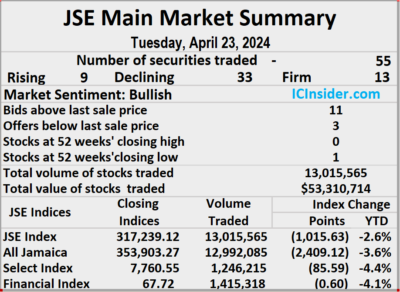

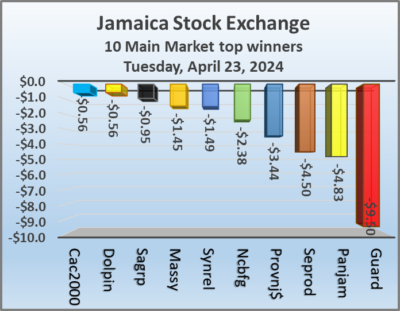

The market closed with the trading of 13,015,565 shares for $53,310,714 compared with 35,464,663 units at $1,090,378,097 on Monday.

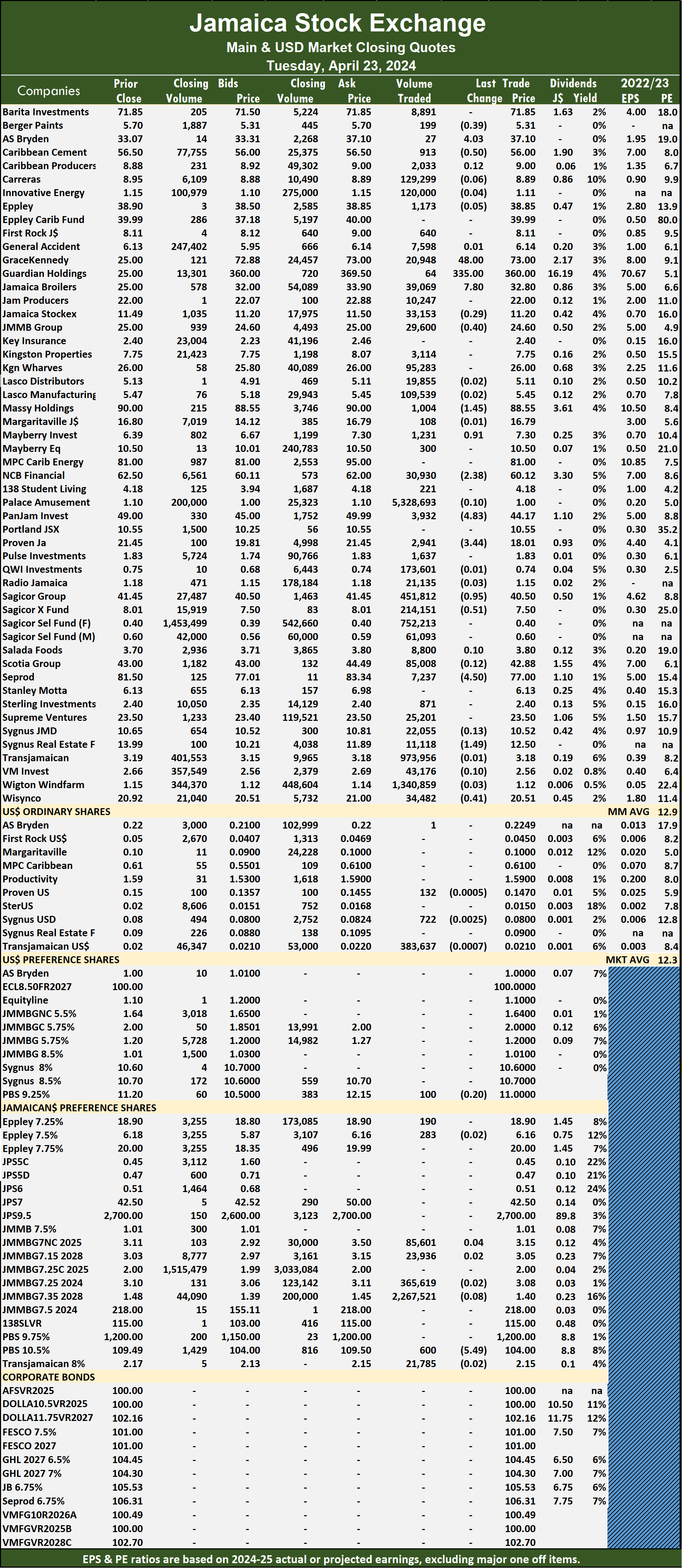

The market closed with the trading of 13,015,565 shares for $53,310,714 compared with 35,464,663 units at $1,090,378,097 on Monday. The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025.

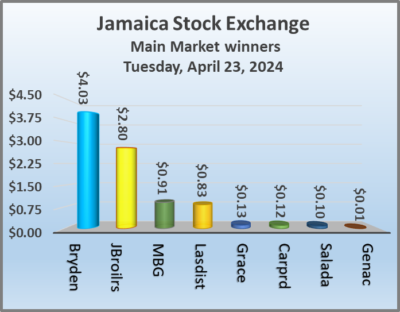

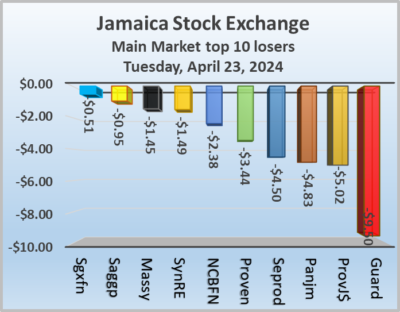

The Main Market ended trading with an average PE Ratio of 12.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2025. Mayberry Group popped 91 cents to close at $7.30 in trading 1,231 stocks, NCB Financial lost $2.38 in closing at $60.12 after exchanging 30,930 shares. Pan Jamaica dropped $4.83 to end at $44.17 with investors swapping 3,932 stocks, Proven Investments skidded $3.44 and ended at a 52 weeks’ low of $18.01 in an exchange of 2,941 units, Sagicor Group declined 95 cents to finish at $40.50 with investors trading 451,812 stock units. Sagicor Real Estate Fund dropped 51 cents to $7.50 after a transfer of 214,151 shares, Seprod dipped $4.50 to finish at $77, with 7,237 stocks crossing the market, Sygnus Real Estate Finance sank $1.49 and ended at $12.50 with an exchange of 11,118 units and Wisynco Group declined 41 cents to close at $20.51, with 34,482 stock units crossing the market.

Mayberry Group popped 91 cents to close at $7.30 in trading 1,231 stocks, NCB Financial lost $2.38 in closing at $60.12 after exchanging 30,930 shares. Pan Jamaica dropped $4.83 to end at $44.17 with investors swapping 3,932 stocks, Proven Investments skidded $3.44 and ended at a 52 weeks’ low of $18.01 in an exchange of 2,941 units, Sagicor Group declined 95 cents to finish at $40.50 with investors trading 451,812 stock units. Sagicor Real Estate Fund dropped 51 cents to $7.50 after a transfer of 214,151 shares, Seprod dipped $4.50 to finish at $77, with 7,237 stocks crossing the market, Sygnus Real Estate Finance sank $1.49 and ended at $12.50 with an exchange of 11,118 units and Wisynco Group declined 41 cents to close at $20.51, with 34,482 stock units crossing the market. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

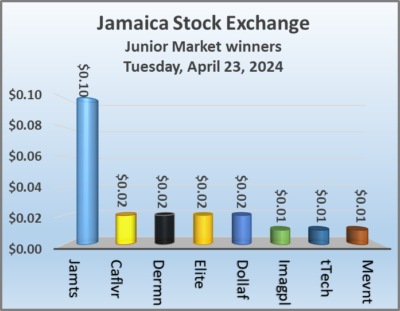

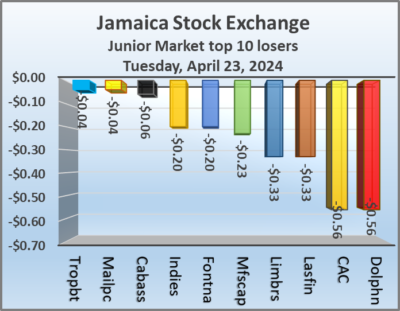

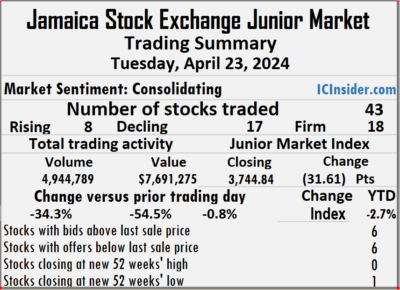

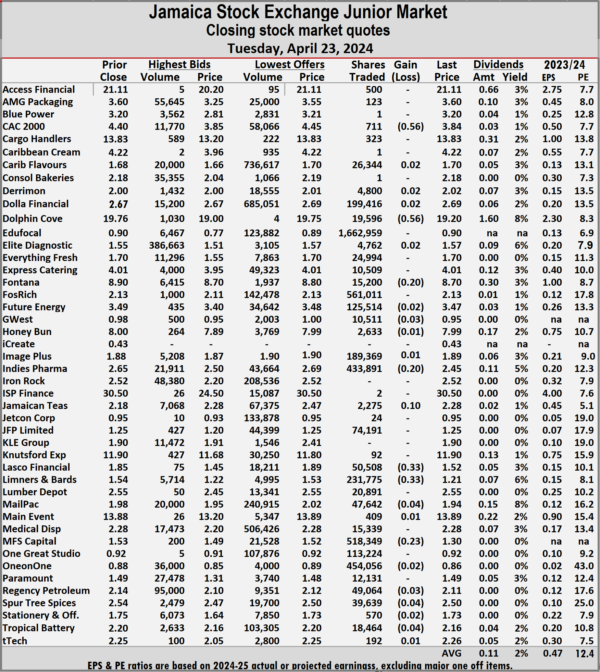

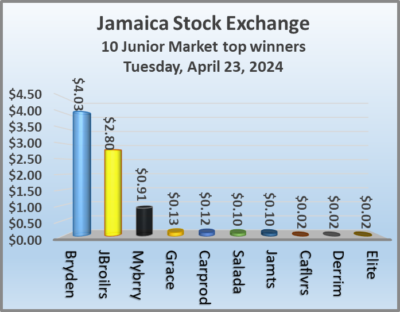

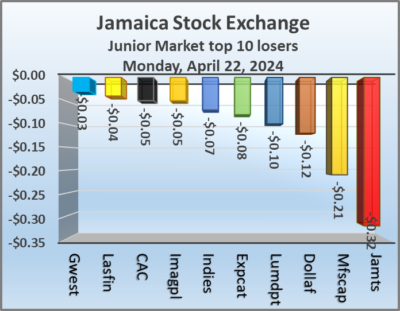

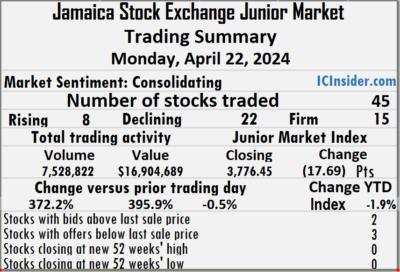

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.  The market closed trading of 4,944,789 shares for $7,691,275 compared with 7,528,822 stock units at $16,904,689 on Monday.

The market closed trading of 4,944,789 shares for $7,691,275 compared with 7,528,822 stock units at $16,904,689 on Monday. At the close of trading, the Junior Market Index declined 31.61 points to cease trading at 3,744.84.

At the close of trading, the Junior Market Index declined 31.61 points to cease trading at 3,744.84. Jamaican Teas rallied 10 cents to finish at $2.28 after a transfer of 2,275 stocks. Lasco Financial sank 33 cents and ended at $1.52 with 50,508 shares clearing the market, Limners and Bards dropped 33 cents to $1.21 with an exchange of 231,775 stock units. Mailpac Group skidded 4 cents to close at $1.94 after a transfer of 47,642 shares, MFS Capital Partners dipped 23 cents to finish at a 52 weeks’ low of $1.30 after 518,349 shares crossed the market, Spur Tree Spices fell 4 cents to end at $2.50 and closed after 39,639 stocks changed hands and Tropical Battery dipped 4 cents in closing at $2.16 in an exchange of 18,464 units.

Jamaican Teas rallied 10 cents to finish at $2.28 after a transfer of 2,275 stocks. Lasco Financial sank 33 cents and ended at $1.52 with 50,508 shares clearing the market, Limners and Bards dropped 33 cents to $1.21 with an exchange of 231,775 stock units. Mailpac Group skidded 4 cents to close at $1.94 after a transfer of 47,642 shares, MFS Capital Partners dipped 23 cents to finish at a 52 weeks’ low of $1.30 after 518,349 shares crossed the market, Spur Tree Spices fell 4 cents to end at $2.50 and closed after 39,639 stocks changed hands and Tropical Battery dipped 4 cents in closing at $2.16 in an exchange of 18,464 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of trading, the JSE Combined Market Index fell 1,193.93 points to close at 330,210.8, the All Jamaican Composite Index skidded 2,409.12 points to 353,903.27, the JSE Main Index declined by 1,015.63 points to close at 317,239.12. The Junior Market Index declined 31.61 points to lock up trading at 3,744.84 and the JSE USD Market Index sank 0.69 points to end at 241.34.

At the close of trading, the JSE Combined Market Index fell 1,193.93 points to close at 330,210.8, the All Jamaican Composite Index skidded 2,409.12 points to 353,903.27, the JSE Main Index declined by 1,015.63 points to close at 317,239.12. The Junior Market Index declined 31.61 points to lock up trading at 3,744.84 and the JSE USD Market Index sank 0.69 points to end at 241.34. In the preference segment, Sygnus Credit Investments C10.5% sank $5.49 to close at $104.

In the preference segment, Sygnus Credit Investments C10.5% sank $5.49 to close at $104. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

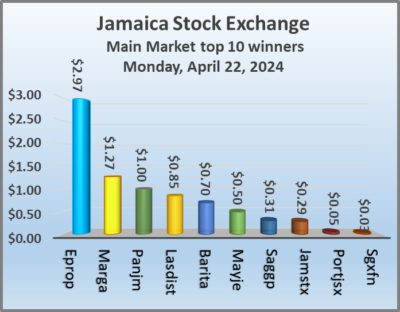

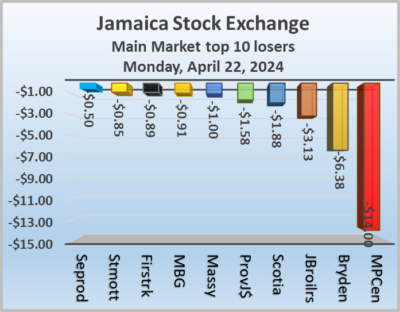

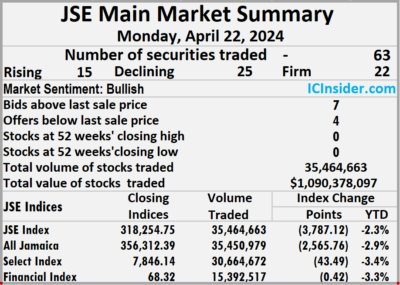

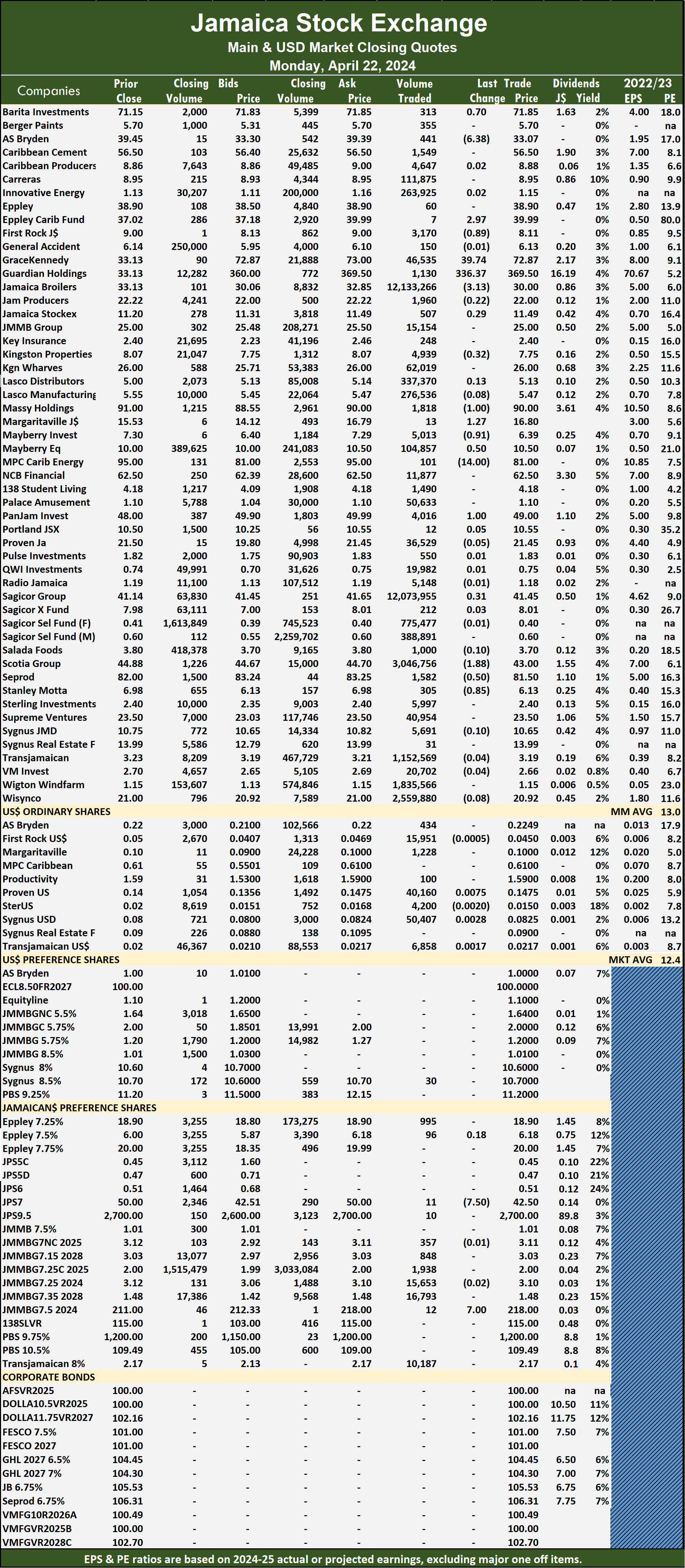

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed on Monday with 35,464,663 shares being traded for $1,090,378,097 in comparison to just 4,649,405 units at $79,455,741 on Friday.

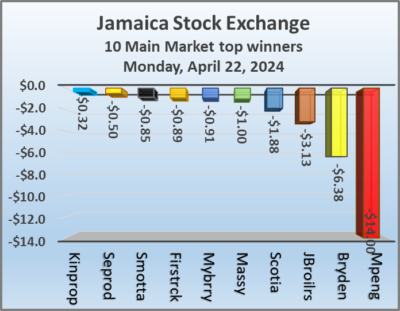

The market closed on Monday with 35,464,663 shares being traded for $1,090,378,097 in comparison to just 4,649,405 units at $79,455,741 on Friday. The All Jamaican Composite Index sank by 2,565.76 points to end trading at 356,312.39, the JSE Main Index dropped 3,787.12 points to 318,254.75 and the JSE Financial Index slipped by 0.42 points to end at 68.32.

The All Jamaican Composite Index sank by 2,565.76 points to end trading at 356,312.39, the JSE Main Index dropped 3,787.12 points to 318,254.75 and the JSE Financial Index slipped by 0.42 points to end at 68.32. Kingston Properties dropped 32 cents to $7.75, with 4,939 stocks changing hands. Margaritaville rallied $1.27 in closing at $16.80 as investors exchanged 13 units, Massy Holdings shed $1 to end at $90 after 1,818 stock units crossed the market, Mayberry Group declined 91 cents to finish at $6.39 in an exchange of 5,013 shares. Mayberry Jamaican Equities popped 50 cents and ended at $10.50 with investors trading 104,857 units, MPC Caribbean Clean Energy lost $14 to close at $81 with an exchange of 101 stocks, Pan Jamaica popped $1 to end at $49 after 4,016 stock units passed through the market. Sagicor Group increased 31 cents to $41.45 after a transfer of 12,073,955 shares, Scotia Group skidded $1.88 to end at $43 with investors dealing in 3,046,756 units, Seprod dipped 50 cents in closing at $81.50 after an exchange of 1,582 stocks and Stanley Motta sank 85 cents and ended at $6.13 closed at 305 stock units.

Kingston Properties dropped 32 cents to $7.75, with 4,939 stocks changing hands. Margaritaville rallied $1.27 in closing at $16.80 as investors exchanged 13 units, Massy Holdings shed $1 to end at $90 after 1,818 stock units crossed the market, Mayberry Group declined 91 cents to finish at $6.39 in an exchange of 5,013 shares. Mayberry Jamaican Equities popped 50 cents and ended at $10.50 with investors trading 104,857 units, MPC Caribbean Clean Energy lost $14 to close at $81 with an exchange of 101 stocks, Pan Jamaica popped $1 to end at $49 after 4,016 stock units passed through the market. Sagicor Group increased 31 cents to $41.45 after a transfer of 12,073,955 shares, Scotia Group skidded $1.88 to end at $43 with investors dealing in 3,046,756 units, Seprod dipped 50 cents in closing at $81.50 after an exchange of 1,582 stocks and Stanley Motta sank 85 cents and ended at $6.13 closed at 305 stock units. In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 after exchanging 11 shares and 138 Student Living preference share advanced $7 to close at $218 with investors transferring 12 units.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 after exchanging 11 shares and 138 Student Living preference share advanced $7 to close at $218 with investors transferring 12 units. The market closed with an exchange of 7,528,822 shares for $16,904,689, up from 1,594,451 units at $3,409,014 on Friday.

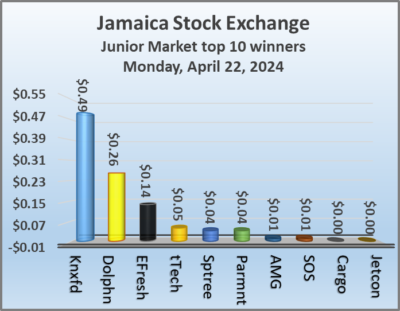

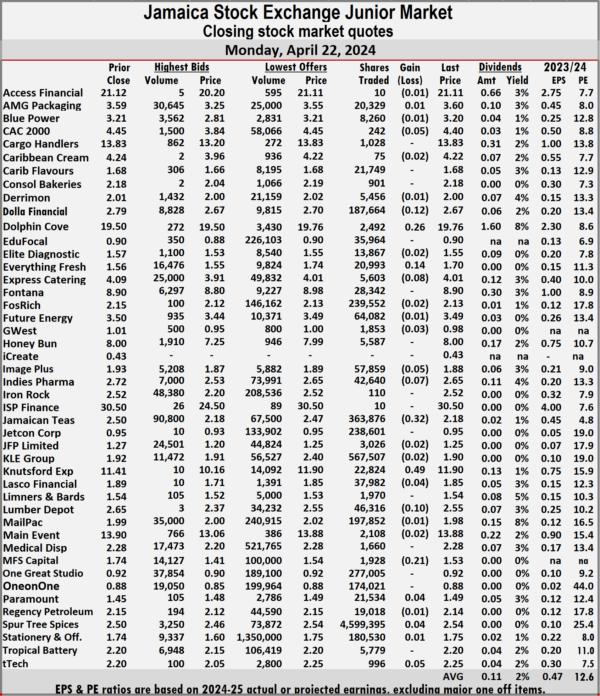

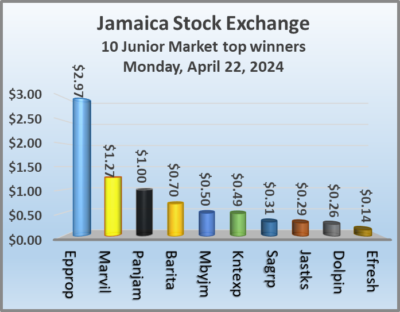

The market closed with an exchange of 7,528,822 shares for $16,904,689, up from 1,594,451 units at $3,409,014 on Friday. The Junior Market ended trading with an average PE Ratio of 12.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025.

The Junior Market ended trading with an average PE Ratio of 12.6, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2025. Indies Pharma dipped 7 cents and ended at $2.65, with 42,640 stocks crossing the market, Jamaican Teas sank 32 cents to $2.18 with an exchange of 363,876 stock units, Knutsford Express gained 49 cents to end at $11.90 after 22,824 shares passed through the market. Lumber Depot dipped 10 cents in closing at $2.55 with investors dealing in 46,316 stock units, MFS Capital Partners slipped 21 cents to close at $1.53 with a transfer of 1,928 stocks and tTech rose 5 cents to finish at $2.25 and closed with an exchange of 996 units.

Indies Pharma dipped 7 cents and ended at $2.65, with 42,640 stocks crossing the market, Jamaican Teas sank 32 cents to $2.18 with an exchange of 363,876 stock units, Knutsford Express gained 49 cents to end at $11.90 after 22,824 shares passed through the market. Lumber Depot dipped 10 cents in closing at $2.55 with investors dealing in 46,316 stock units, MFS Capital Partners slipped 21 cents to close at $1.53 with a transfer of 1,928 stocks and tTech rose 5 cents to finish at $2.25 and closed with an exchange of 996 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of the market, the JSE Combined Market Index dropped 3,753.71 points to 331,404.71, the All Jamaican Composite Index declined 2,565.76 points to end at 356,312.39, the JSE Main Index shed 3,787.12 points to finish at 318,254.75. The Junior Market Index dipped 17.69 points to finish at 3,776.45 and the JSE USD Market Index gained 4.33 points to finish at 242.03.

At the close of the market, the JSE Combined Market Index dropped 3,753.71 points to 331,404.71, the All Jamaican Composite Index declined 2,565.76 points to end at 356,312.39, the JSE Main Index shed 3,787.12 points to finish at 318,254.75. The Junior Market Index dipped 17.69 points to finish at 3,776.45 and the JSE USD Market Index gained 4.33 points to finish at 242.03. In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 and 138 Student Living preference share advanced $7 to close at $218.

In the preference segment, Jamaica Public Service 7% declined $7.50 to finish at $42.50 and 138 Student Living preference share advanced $7 to close at $218. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.