The Main Market of the Jamaica Stock Exchange declined in trading on Friday as the Junior Market JSE USD market closed moderately higher as trading ended with the number of stocks changing hands falling, with the value of stocks traded jumping sharply over the previous trading day, resulting in prices of 38 shares rising and 37 declining.

At the close of trading, the JSE Combined Market Index climbed 2,597.12 points to 345,237.37, the All Jamaican Composite Index shed 593.72 points to close at 372,663.47, the JSE Main Index lost 2,896.26 points to 332,678.04. The Junior Market Index popped 3.60 points to 3,795.20, after hitting 3,875 points in the first thirty minutes of trading and the JSE USD Market Index rose 4.79 points to lock up trading at 259.99.

At the close of trading, the JSE Combined Market Index climbed 2,597.12 points to 345,237.37, the All Jamaican Composite Index shed 593.72 points to close at 372,663.47, the JSE Main Index lost 2,896.26 points to 332,678.04. The Junior Market Index popped 3.60 points to 3,795.20, after hitting 3,875 points in the first thirty minutes of trading and the JSE USD Market Index rose 4.79 points to lock up trading at 259.99.

At the close of trading, 21,088,796 shares were exchanged in all three markets, down from 57,568,397 units on Thursday, with the value of stocks traded on the Junior and Main markets amounted to $117.77 million, up from $110.86, million on the previous trading day and the JSE USD market closed with an exchange of 361,086 shares for US$18,726 compared to 310,053 units at US$11,086 on Thursday.

Trading in the Main Market was dominated by Wigton Windfarm led trading with 5.96 million shares, followed by Transjamaican Highway with 1.70 million units and Palace Amusement with 588,579 shares.

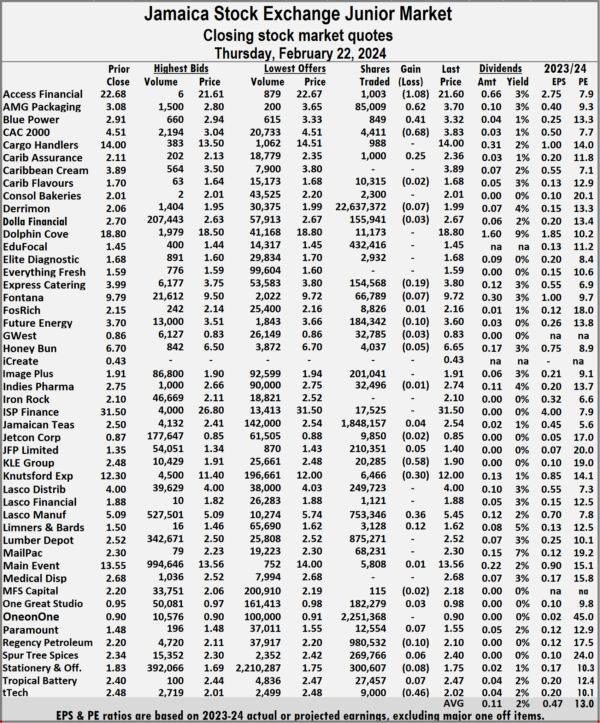

In the Junior Market, Lasco Manufacturing led trading with 4.48 million shares, followed by Stationery and Office Supplies with 990,778 units and Future Energy 579,426 stock units.

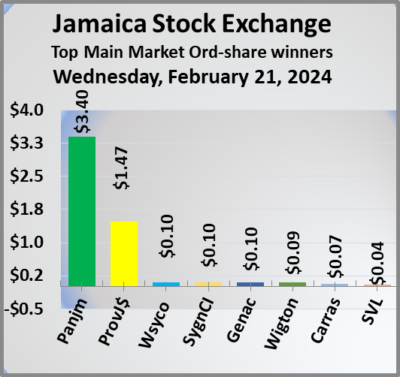

At the close of trading, the Main Market listed Guardian Holdings increased $5.80 in closing at $369, Jamaica Broilers popped 96 cents to close at $33.99, Mayberry Jamaican Equities gained 89 cents to end at $10.89, MPC Caribbean Clean Energy popped $4.75 in closing at $95.75 and NCB Financial gained $2 to close at $69.50.

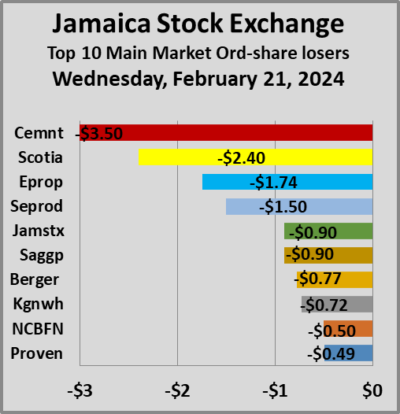

The Main Market Jamaica Producers, fell $1 to $22, Massy Holdings sank $2.80 to close at $94, Proven Investments lost $1.74 and ended at $23.01 and Seprod dropped $2.25 to close at $80.70.

The Main Market Jamaica Producers, fell $1 to $22, Massy Holdings sank $2.80 to close at $94, Proven Investments lost $1.74 and ended at $23.01 and Seprod dropped $2.25 to close at $80.70.

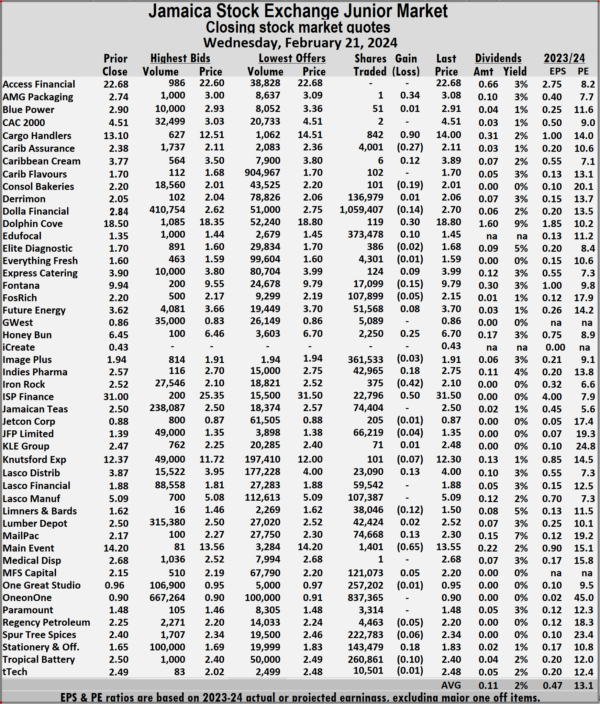

At the end of trading, the Junior Market listed Cargo Handlers gained 51 cents to end at $14.51, CAC 2000 rallied 17 cents to $4, Consolidated Bakeries popped 19 cents to $2.20, Express Catering rose 18 cents in closing at $3.98, Honey Bun gained 20 cents to end at $6.85, Lasco Distributors climbed 35 cents to close at $4.35 and tTech advanced 20 cents and ended at $2.22. At the same time, Knutsford Express declined 60 cents in closing at $11.40, Lasco Manufacturing skidded 36 cents to end at $5.09 and Paramount Trading fell 25 cents to $1.30.

In the preference segment, Productive Business Solutions 9.75% preference share dipped $3.45 and ended at $115.

The market’s PE ratio, the most popular measure used to determine the value of stocks, ended at 21.3 on 2022-23 earnings and 14.4 times those for 2023-24 at the close of trading. ICInsider.com PE ratio chart and the more detailed daily charts provide investors with regularly updated information to help decision-making.

The PE ratio chart covers all ordinary shares on the Jamaica Stock Exchange, grouped by industry, allowing for easy comparisons between the same sector companies and the overall market. The EPS & PE ratios are based on 2023 and 2024 actual or projected earnings, excluding major one off items.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

The net asset value of each company is reported as a guide for investors to assess the value of stocks based on this measure quickly. The chart also shows daily changes in stock prices and the percentage year to date price movement based on the last traded prices.

Dividends paid or payable and yields for each company are shown in the Main and Junior Markets’ daily report charts, along with the closing volume pertaining to the highest bid and the lowest offer for each company.

Archives for February 2024

Trading jumps on Trinidad Stock Exchange

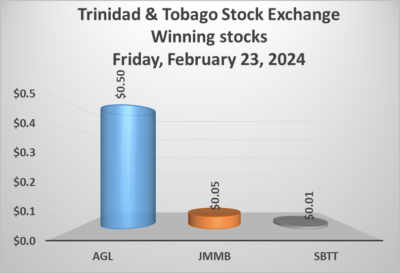

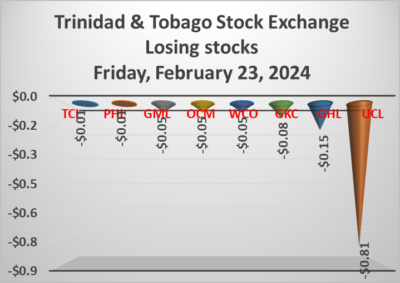

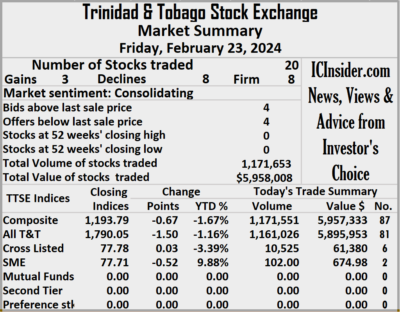

Trading ended on the Trinidad and Tobago Stock Exchange on Friday, with a 55 percent rise in the volume of stocks traded valued at 294 percent more than on Thursday and resulting in the trading of 20 securities compared with 19 on Thursday, ending with prices of three stocks rising, eight declining and nine remaining unchanged.

The market closed trading on Friday following an exchange of 1,171,653 shares for $5,958,008 compared with 755,042 stock units at $1,513,708 on Thursday.

The market closed trading on Friday following an exchange of 1,171,653 shares for $5,958,008 compared with 755,042 stock units at $1,513,708 on Thursday.

An average of 58,583 shares were traded at $297,900 compared with 39,739 stock units at $79,669 on Thursday, with trading month to date averaging 18,805 shares at $147,958 compared with 15,237 units at $134,511 on the previous day and an average for January of 15,998 shares at $167,627.

The Composite Index lost 0.67 points to end trading at 1,193.79, the All T&T Index skidded 1.50 points to close trading at 1,790.05, the SME Index lost 0.52 points to finish at 77.71 and the Cross-Listed Index rallied 0.03 points to end at 77.78.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Agostini’s climbed 50 cents to $68.50, with 288 shares being traded, CinemaOne ended at $6.45 after an exchange of 100 stock units, Endeavour Holdings ended at $14.99 with trading in just two shares. First Citizens Group ended at $49.75, with 543 stocks passing through the market, FirstCaribbean International Bank remained at $7.05 after a transfer of 7,232 shares, GraceKennedy dipped 8 cents to $4 with 2,193 units clearing the market. Guardian Holdings lost 15 cents in closing at $18 after an exchange of 300 stocks, Guardian Media shed 5 cents and ended at $2.25 after 805 stock units crossed the market, JMMB Group rose 5 cents to close at $1.45 with investors trading 1,100 shares. Massy Holdings remained at $4.30 after an exchange of 1,034,420 stocks, National Enterprises ended at $3.90 with investors dealing in 14,002 units, National Flour Mills remained at $2.10 with a transfer of 8,800 stocks.

At the close, Agostini’s climbed 50 cents to $68.50, with 288 shares being traded, CinemaOne ended at $6.45 after an exchange of 100 stock units, Endeavour Holdings ended at $14.99 with trading in just two shares. First Citizens Group ended at $49.75, with 543 stocks passing through the market, FirstCaribbean International Bank remained at $7.05 after a transfer of 7,232 shares, GraceKennedy dipped 8 cents to $4 with 2,193 units clearing the market. Guardian Holdings lost 15 cents in closing at $18 after an exchange of 300 stocks, Guardian Media shed 5 cents and ended at $2.25 after 805 stock units crossed the market, JMMB Group rose 5 cents to close at $1.45 with investors trading 1,100 shares. Massy Holdings remained at $4.30 after an exchange of 1,034,420 stocks, National Enterprises ended at $3.90 with investors dealing in 14,002 units, National Flour Mills remained at $2.10 with a transfer of 8,800 stocks.  One Caribbean Media slipped 5 cents to close at $3.40, with 1,000 shares changing hands, Prestige Holdings fell 1 cent to end at $10.29 with traders dealing in 1,075 units, Republic Financial ended at $120.03 in an exchange of 6,049 stocks. Scotiabank rallied 1 cent to $73.40 with investors trading 2,269 stock units, Trinidad & Tobago NGL ended at $9.10 with an exchange of 4,065 shares, Trinidad Cement skidded 1 cent in closing at $2.86 after trading 70,538 stocks. Unilever Caribbean sank 81 cents to close at $11 as investors exchanged 11,862 units and West Indian Tobacco declined 5 cents and ended at $8.95 with 5,010 stock units changing hands.

One Caribbean Media slipped 5 cents to close at $3.40, with 1,000 shares changing hands, Prestige Holdings fell 1 cent to end at $10.29 with traders dealing in 1,075 units, Republic Financial ended at $120.03 in an exchange of 6,049 stocks. Scotiabank rallied 1 cent to $73.40 with investors trading 2,269 stock units, Trinidad & Tobago NGL ended at $9.10 with an exchange of 4,065 shares, Trinidad Cement skidded 1 cent in closing at $2.86 after trading 70,538 stocks. Unilever Caribbean sank 81 cents to close at $11 as investors exchanged 11,862 units and West Indian Tobacco declined 5 cents and ended at $8.95 with 5,010 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

JSE USD Market falls

Trading on the Jamaica Stock Exchange US dollar market ended on Thursday, with the volume of stocks exchanged declining 38 percent after 89 percent fewer US dollars changed hands than on Wednesday and resulting in trading in eight securities, compared to six on Wednesday with prices of three rising, two declining and three ending unchanged.

Trading closed with an exchange of 310,053 shares for US$11,086 up from 497,176 units at US$96,746 on Wednesday.

Trading closed with an exchange of 310,053 shares for US$11,086 up from 497,176 units at US$96,746 on Wednesday.

Trading averaged 38,757 shares at US$1,386 versus 82,863 shares at US$16,124 on Wednesday, with a month to date average of 55,399 shares for US$7,287 compared with 56,785 units at US$7,779 on the previous trading day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index declined 5.65 points to end at 255.20.

The PE Ratio, a measure used in the computation of appropriate stock values, averages 9.8. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ending with bids higher than their last selling prices and two with lower offers.

At the close, Margaritaville popped 1.78 cents to close at 12.78 US cents after an exchange of 51 stocks, Proven Investments sank 1.4 cents to 13.6 US cents with investors swapping 3,109 units,  Sterling Investments fell 0.25 of a cent and ended at 1.45 US cents with a transfer of 10,000 shares. Sygnus Credit Investments ended at 8.87 US cents in an exchange of 1,000 stock units, Sygnus Real Estate Finance USD share ended at 7 US cents in switching owners of 285 shares and Transjamaican Highway remained at 2 US cents as investors exchanged 291,661 units.

Sterling Investments fell 0.25 of a cent and ended at 1.45 US cents with a transfer of 10,000 shares. Sygnus Credit Investments ended at 8.87 US cents in an exchange of 1,000 stock units, Sygnus Real Estate Finance USD share ended at 7 US cents in switching owners of 285 shares and Transjamaican Highway remained at 2 US cents as investors exchanged 291,661 units.

In the preference segment, JMMB Group US8.5% preference share rallied 7.9 cents to close at US$1.149, with 3,900 stocks crossing the market and JMMB Group 5.75% rose 10 cents to end at US$1.91 with investors transferring 47 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Gains for Trinidad Stock Exchange

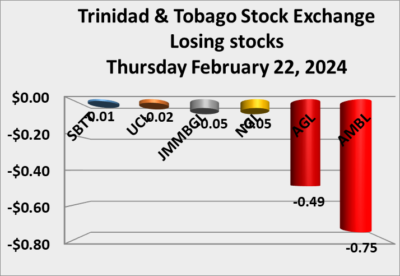

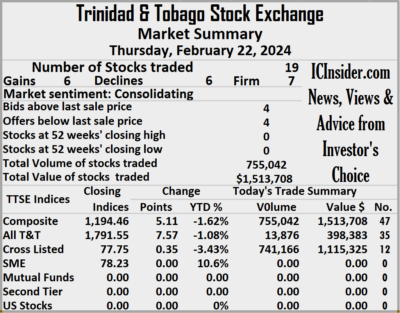

Rising stock pushed the Trinidad and Tobago Stock Exchange higher on Thursday, following a 392 percent surge in the volume of stocks traded valued 25 percent more than on Wednesday, resulting in 19 securities trading down from 20 on Wednesday and ending with prices of six stocks rising, six declining and seven remaining unchanged.

The market closed with an exchange of 755,042 shares for $1,513,708 up from 153,516 stock units at $1,210,050 on Wednesday.

An average of 39,739 shares were traded at $79,669 compared to 7,676 units at $60,502 on Wednesday, with trading month to date averaging 15,237 shares at $134,511 compared with 12,955 units at $139,615 on the previous day and January with an average for of 15,998 shares at $167,627.

The Composite Index advanced 5.11 points to conclude trading at 1,194.46, the All T&T Index gained 7.57 points to finish at 1,791.55, the SME Index remained unchanged at 78.23 and the Cross-Listed Index popped 0.35 points to finish at 77.75.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Agostini’s shed 49 cents to end at $68 after an exchange of 50 stocks, Angostura Holdings rose $1 to $20 with a transfer of 1,150 units, Ansa McAl rallied $3.38 and ended at $55 while exchanging 100 shares. Ansa Merchant Bank dropped 75 cents to close at $42.50 with investors trading 65 stock units, First Citizens Group ended at $49.75 after an exchange of 199 shares, FirstCaribbean International Bank ended at $7.05 with traders dealing in 6,103 stocks. GraceKennedy increased 8 cents to close at $4.08, with 59 units crossing the market, Guardian Holdings ended at $18.15 in trading 250 stock units, JMMB Group sank 5 cents in closing at $1.40, with 730,704 shares changing hands. Massy Holdings remained at $4.30 with investors swapping 3,732 units, National Enterprises climbed 10 cents to $3.90 after 3,590 stocks passed through the market,  NCB Financial popped 4 cents to end at $3.10 as investors exchanged 4,300 stock units. Point Lisas ended at $3.99 and closed with an exchange of 300 shares, Prestige Holdings remained at $10.30 with investors trading 119 stock units, Republic Financial ended at $120.03 after exchanging 2,461 units. Scotiabank slipped 1 cent to $73.39 with investors dealing in 82 stock units, Trinidad & Tobago NGL fell 5 cents and ended at $9.10 in an exchange of 1,200 shares, Unilever Caribbean dipped 2 cents to end at $11.81 in clearing the market of150 stocks and West Indian Tobacco gained 10 cents in closing at $9 in switching ownership of 428 units.

NCB Financial popped 4 cents to end at $3.10 as investors exchanged 4,300 stock units. Point Lisas ended at $3.99 and closed with an exchange of 300 shares, Prestige Holdings remained at $10.30 with investors trading 119 stock units, Republic Financial ended at $120.03 after exchanging 2,461 units. Scotiabank slipped 1 cent to $73.39 with investors dealing in 82 stock units, Trinidad & Tobago NGL fell 5 cents and ended at $9.10 in an exchange of 1,200 shares, Unilever Caribbean dipped 2 cents to end at $11.81 in clearing the market of150 stocks and West Indian Tobacco gained 10 cents in closing at $9 in switching ownership of 428 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading climbs on JSE USD market

Trading on the Jamaica Stock Exchange US dollar market ended on Wednesday, with the volume of stocks changing hands rising 51 percent after 105 percent more dollars changed hands compared to Tuesday and resulting in trading in six securities, compared to four on Tuesday with prices of two rising, three declining and one ending unchanged.

The market closed with an exchange of 497,176 shares for US$96,746 compared to 328,443 units at US$47,111 on Tuesday.

The market closed with an exchange of 497,176 shares for US$96,746 compared to 328,443 units at US$47,111 on Tuesday.

Trading averaged 82,863 units at US$16,124 compared to 82,111 shares at US$11,778 on Tuesday, with a month to date average of 56,785 shares at US$7,779 compared with 55,047 units at US$7,223 on the previous day and January with an average of 42,169 units for US$5,037.

The US Denominated Equities Index increased 1.47 points to culminate at 260.85.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Proven Investments advanced 0.21 of a cent to end at 15 US cents, with 182,392 stock units clearing the market,  Sygnus Credit Investments popped 0.07 of a cent to close at 8.87 US cents with investors exchanging 10,449 shares, Sygnus Real Estate Finance USD share sank 0.2 of a cent to close at 7 US cents after 1,000 stocks were traded and Transjamaican Highway declined 0.05 of a cent in closing at 2 US cents with investors dealing in 247,238 units.

Sygnus Credit Investments popped 0.07 of a cent to close at 8.87 US cents with investors exchanging 10,449 shares, Sygnus Real Estate Finance USD share sank 0.2 of a cent to close at 7 US cents after 1,000 stocks were traded and Transjamaican Highway declined 0.05 of a cent in closing at 2 US cents with investors dealing in 247,238 units.

In the preference segment, JMMB Group US8.5% preference share fell 1 cent and ended at US$1.07 in an exchange of 51,500 shares and JMMB Group 5.75% ended at US$1.81 with investors trading 4,597 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

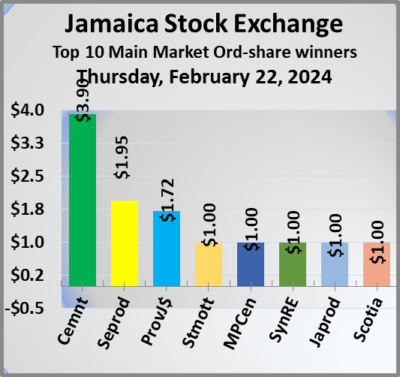

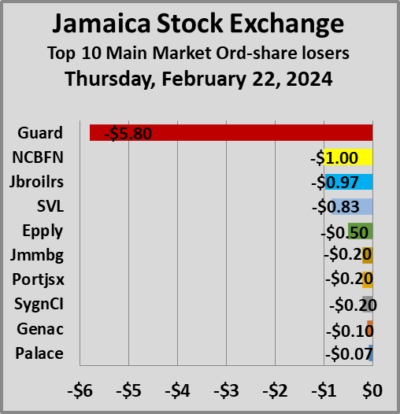

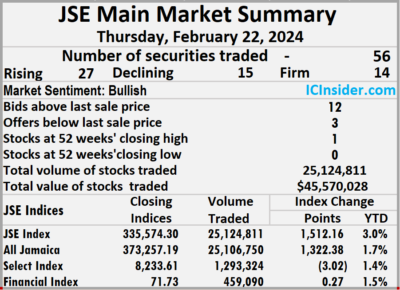

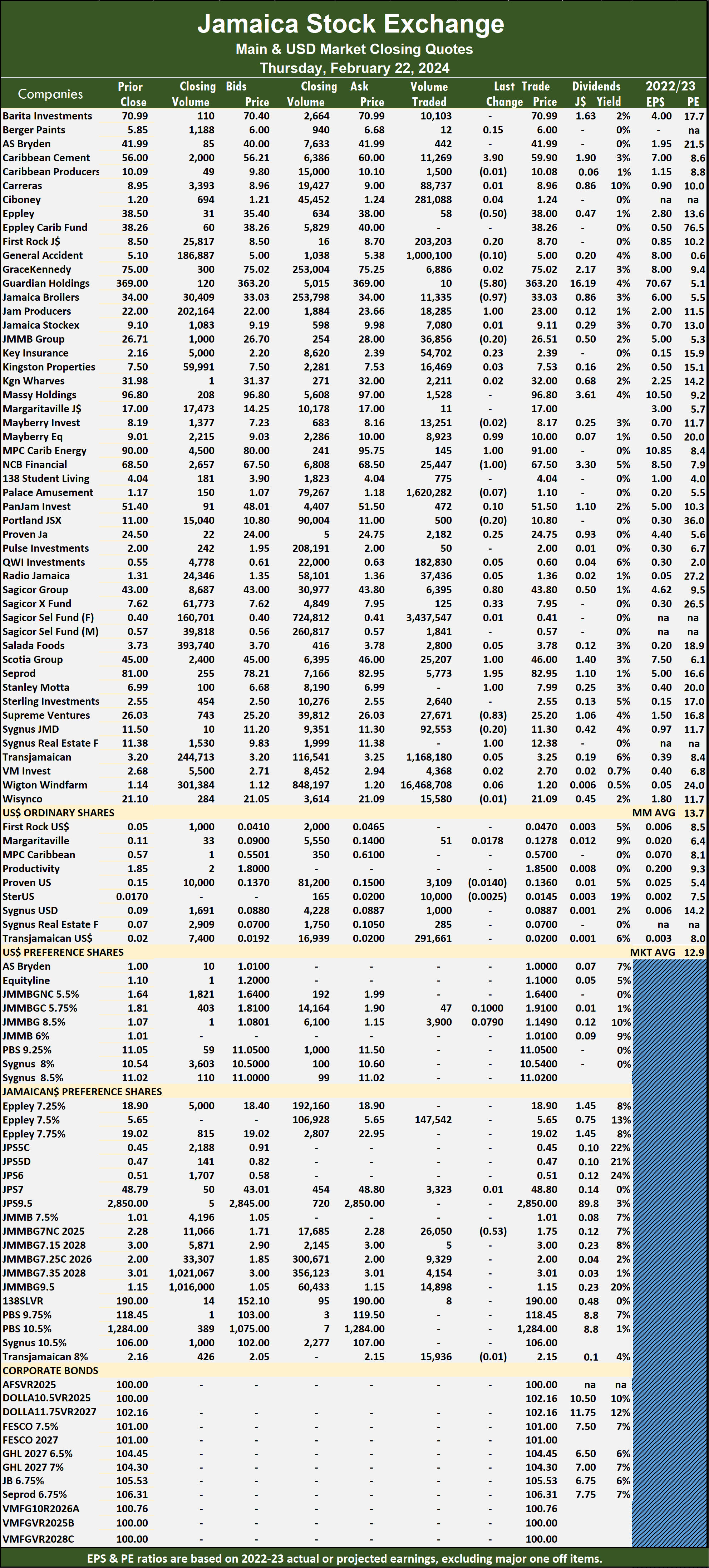

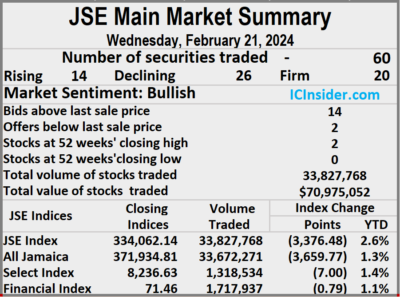

The market closed on Thursday with 25,124,811 shares being exchanged for $45,570,028 versus 33,827,768 units at $70,975,052 on Wednesday.

The market closed on Thursday with 25,124,811 shares being exchanged for $45,570,028 versus 33,827,768 units at $70,975,052 on Wednesday. The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with their financial year, ending around August 2024.

The Main Market ended trading with an average PE Ratio of 13.7. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with their financial year, ending around August 2024. MPC Caribbean Clean Energy rose $1 and ended at $91 with an exchange of 145 stocks, NCB Financial shed $1 to end at $67.50 in switching ownership of 25,447 stock units, Sagicor Group advanced 80 cents in closing at $43.80 with traders dealing in 6,395 shares. Sagicor Real Estate Fund climbed 33 cents to close at $7.95 in an exchange of 125 units, Scotia Group rallied $1 to $46, with 25,207 stocks crossing the market, Seprod popped $1.95 in closing at $82.95 in trading 5,773 stock units and Supreme Ventures declined by 83 cents to end at $25.20, with 27,671 shares crossing the exchange.

MPC Caribbean Clean Energy rose $1 and ended at $91 with an exchange of 145 stocks, NCB Financial shed $1 to end at $67.50 in switching ownership of 25,447 stock units, Sagicor Group advanced 80 cents in closing at $43.80 with traders dealing in 6,395 shares. Sagicor Real Estate Fund climbed 33 cents to close at $7.95 in an exchange of 125 units, Scotia Group rallied $1 to $46, with 25,207 stocks crossing the market, Seprod popped $1.95 in closing at $82.95 in trading 5,773 stock units and Supreme Ventures declined by 83 cents to end at $25.20, with 27,671 shares crossing the exchange. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

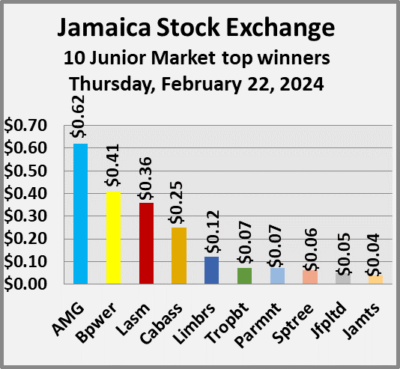

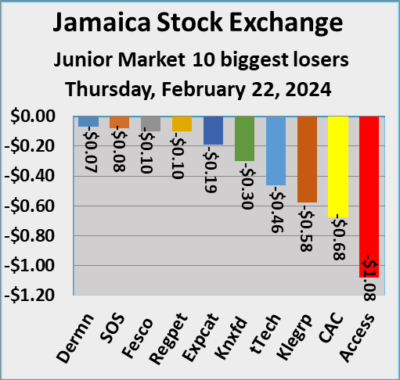

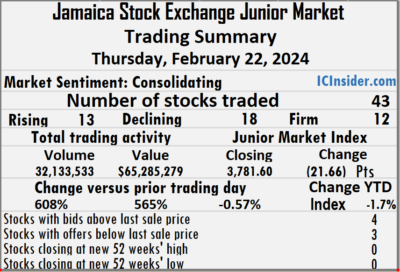

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading ended with an exchange of 32,133,533 shares for $65,285,279 up from 4,540,074 units at $9,824,488 on Wednesday.

Trading ended with an exchange of 32,133,533 shares for $65,285,279 up from 4,540,074 units at $9,824,488 on Wednesday. The Junior Market ended trading with an average PE Ratio of 13, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

The Junior Market ended trading with an average PE Ratio of 13, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024. KLE Group shed 58 cents to close at $1.90 after an exchange of 20,285 units, Knutsford Express sank 30 cents and ended at $12 with a transfer of 6,466 stocks. Lasco Manufacturing increased 36 cents to end at $5.45, with 753,346 units crossing the market as the supply of the stocks has sharply declined with only five offers to sell less than 80,000 shares on the board at the close. Limners and Bards popped 12 cents in closing at $1.62 with traders dealing in 3,128 shares, Regency Petroleum dripped 10 cents to $2.10, with 980,532 stock units changing hands, Stationery and Office Supplies declined 8 cents to close at $1.75 in trading 300,607 shares and tTech shed 46 cents and ended at $2.02 after a transfer of 9,000 stock units.

KLE Group shed 58 cents to close at $1.90 after an exchange of 20,285 units, Knutsford Express sank 30 cents and ended at $12 with a transfer of 6,466 stocks. Lasco Manufacturing increased 36 cents to end at $5.45, with 753,346 units crossing the market as the supply of the stocks has sharply declined with only five offers to sell less than 80,000 shares on the board at the close. Limners and Bards popped 12 cents in closing at $1.62 with traders dealing in 3,128 shares, Regency Petroleum dripped 10 cents to $2.10, with 980,532 stock units changing hands, Stationery and Office Supplies declined 8 cents to close at $1.75 in trading 300,607 shares and tTech shed 46 cents and ended at $2.02 after a transfer of 9,000 stock units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of the market, the JSE Combined Market Index jumped by 1,228.47 points to 347,834.49, the All Jamaican Composite Index rallied 1,322.38 points to 373,257.19, the JSE Main Index rose 1,512.16 points to end at 335,574.30 points. The Junior Market Index skidded 21.66 points to end trading at 3,781.60 and the JSE USD Market Index sank 5.50 points to culminate at 255.20.

At the close of the market, the JSE Combined Market Index jumped by 1,228.47 points to 347,834.49, the All Jamaican Composite Index rallied 1,322.38 points to 373,257.19, the JSE Main Index rose 1,512.16 points to end at 335,574.30 points. The Junior Market Index skidded 21.66 points to end trading at 3,781.60 and the JSE USD Market Index sank 5.50 points to culminate at 255.20. At the close of trading, the Main Market listed, Caribbean Cement increased $3.90 to end at $59.90, Jamaica Producers popped $1 to close at $23, Mayberry Jamaican Equities gained 99 cents to $10. MPC Caribbean Clean Energy rose $1 and ended at $91, Sagicor Group advanced 80 cents in closing at $43.80, Scotia Group rallied $1 to $46, Seprod popped $1.95 in closing at $82.95 and Supreme Ventures declined 83 cents to end at $25.20.

At the close of trading, the Main Market listed, Caribbean Cement increased $3.90 to end at $59.90, Jamaica Producers popped $1 to close at $23, Mayberry Jamaican Equities gained 99 cents to $10. MPC Caribbean Clean Energy rose $1 and ended at $91, Sagicor Group advanced 80 cents in closing at $43.80, Scotia Group rallied $1 to $46, Seprod popped $1.95 in closing at $82.95 and Supreme Ventures declined 83 cents to end at $25.20.  Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. The market closed with 33,827,768 shares being traded for $70,975,052 compared with 44,551,752 units at $385,321,406 on Tuesday.

The market closed with 33,827,768 shares being traded for $70,975,052 compared with 44,551,752 units at $385,321,406 on Tuesday. The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

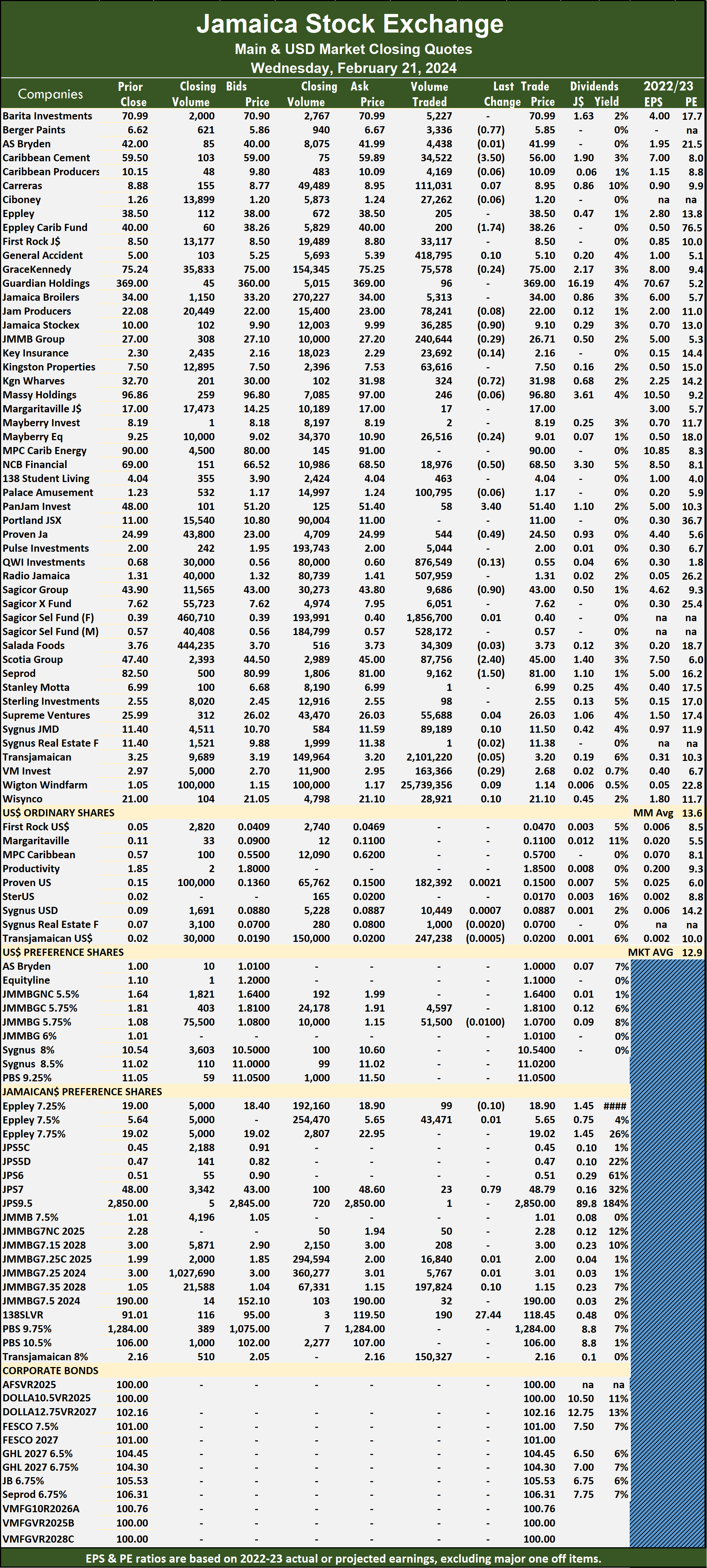

The Main Market ended trading with an average PE Ratio of 13.6. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024. Pan Jamaica advanced $3.40 in closing at $51.40 with traders dealing in 58 stocks, Proven Investments skidded 49 cents to end at $24.50, with 544 stock units changing hands, Sagicor Group declined 90 cents to $43 with an exchange of 9,686 shares. Scotia Group fell $2.40 to $45 with 87,756 stocks clearing the market and Seprod dipped $1.50 to close at $81 while exchanging 9,162 units.

Pan Jamaica advanced $3.40 in closing at $51.40 with traders dealing in 58 stocks, Proven Investments skidded 49 cents to end at $24.50, with 544 stock units changing hands, Sagicor Group declined 90 cents to $43 with an exchange of 9,686 shares. Scotia Group fell $2.40 to $45 with 87,756 stocks clearing the market and Seprod dipped $1.50 to close at $81 while exchanging 9,162 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

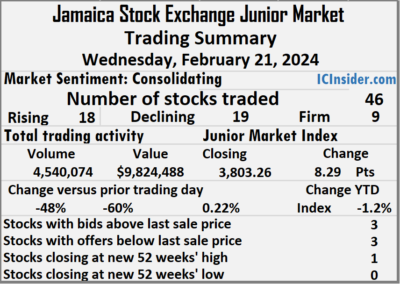

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The Junior Market trading ended on Wednesday with 4,540,074 shares at $9,824,488 versus 8,723,426 units at $24,310,202 on Tuesday.

The Junior Market trading ended on Wednesday with 4,540,074 shares at $9,824,488 versus 8,723,426 units at $24,310,202 on Tuesday. Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three with lower offers.

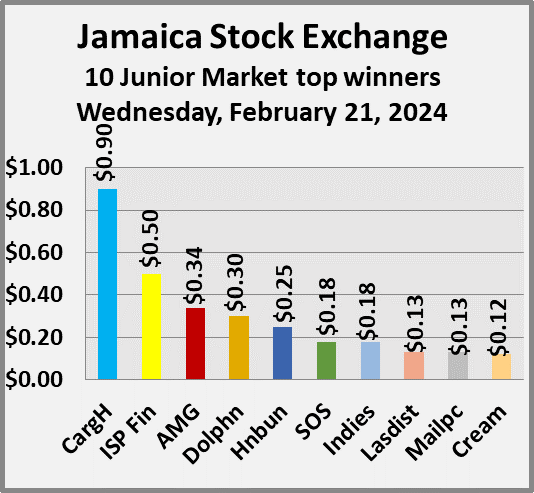

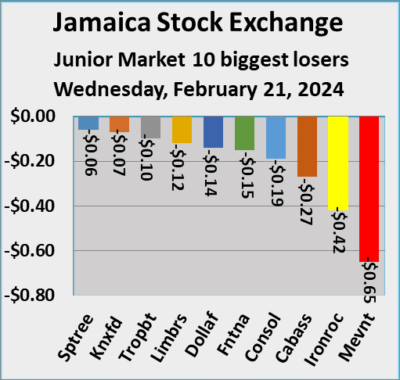

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and three with lower offers. Honey Bun rose 25 cents and ended at $6.70, with 2,250 stock units crossing the market. Indies Pharma climbed 18 cents in closing at $2.75 with investors trading 42,965 shares, Iron Rock Insurance fell 42 cents to close at $2.10 in an exchange of 375 units, ISP Finance increased by 50 cents to end at $31.50, with 22,796 stock units changing hands. Lasco Distributors popped 13 cents to $4 after an exchange of 23,090 shares, Limners and Bards dropped 12 cents to close at $1.50 with investors swapping 38,046 shares, Mailpac Group gained 13 cents and ended at $2.30 in switching ownership of 74,668 stock units. Main Event skidded 65 cents in closing at $13.55 after an exchange of 1,401 stocks, Stationery and Office Supplies advanced 18 cents to end at $1.83 following the trading of 143,479 units and Tropical Battery declined 10 cents to $2.40 after an exchange of 260,861 stocks.

Honey Bun rose 25 cents and ended at $6.70, with 2,250 stock units crossing the market. Indies Pharma climbed 18 cents in closing at $2.75 with investors trading 42,965 shares, Iron Rock Insurance fell 42 cents to close at $2.10 in an exchange of 375 units, ISP Finance increased by 50 cents to end at $31.50, with 22,796 stock units changing hands. Lasco Distributors popped 13 cents to $4 after an exchange of 23,090 shares, Limners and Bards dropped 12 cents to close at $1.50 with investors swapping 38,046 shares, Mailpac Group gained 13 cents and ended at $2.30 in switching ownership of 74,668 stock units. Main Event skidded 65 cents in closing at $13.55 after an exchange of 1,401 stocks, Stationery and Office Supplies advanced 18 cents to end at $1.83 following the trading of 143,479 units and Tropical Battery declined 10 cents to $2.40 after an exchange of 260,861 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.