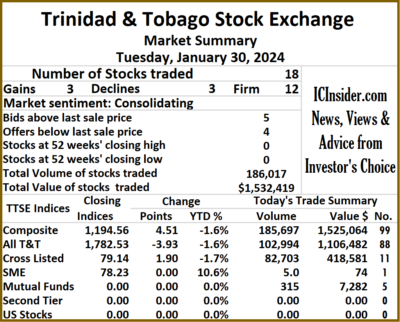

Trading ended on the Trinidad and Tobago Stock Exchange on Tuesday, with an 86 percent decline in the volume of stocks traded valued 78 percent less than on Monday and resulting in trading in 18 securities up from 11 on Monday and ending with prices of three stocks rising, three declining and 12 remaining unchanged.

The market closed trading on Tuesday with an exchange of 186,017 shares for $1,532,419, down from 1,358,627 stock units at $7,041,372 on Monday.

The market closed trading on Tuesday with an exchange of 186,017 shares for $1,532,419, down from 1,358,627 stock units at $7,041,372 on Monday.

Trading averaged 10,334 shares at $85,134 compared to 123,512 units at $640,125 on Monday, with trading month to date averaging 16,482 shares at $173,889 compared with 16,839 units at $179,044 on the previous day and an average for December of 17,065 shares at $239,371.

The Composite Index climbed 4.51 points to 1,194.56, the All T&T Index declined 3.93 points to conclude trading at 1,782.53, the SME Index remained unchanged at 78.23 and the Cross-Listed Index advanced 1.90 points to 79.14.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Agostini’s remained at $68.50 after investors ended trading 236 shares, Ansa McAl ended at $56.80, with an exchange of 54 shares, Calypso Macro Investment Fund ended at $23.15 in trading 315 stocks. Endeavour Holdings remained at $14.75 after just 5 units crossed the exchange, First Citizens remained at $50 with investors dealing in 2,394 stocks, FirstCaribbean International Bank ended at $7.05 with an exchange of 53,074 shares. JMMB Group shed 10 cents to end at $1.30, with investors trading 26,680 stock units, L.J. Williams B share ended at $2.20 with an exchange of 1,000 units, Massy Holdings popped 1 cent to $4.45, with 19,513 shares crossing the market. National Enterprises remained at $3.75 as investors exchanged 39,203 stock units, NCB Financial popped 34 cents in closing at $3.35 after a transfer of 2,949 units,

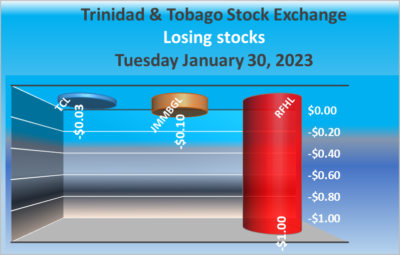

At the close, Agostini’s remained at $68.50 after investors ended trading 236 shares, Ansa McAl ended at $56.80, with an exchange of 54 shares, Calypso Macro Investment Fund ended at $23.15 in trading 315 stocks. Endeavour Holdings remained at $14.75 after just 5 units crossed the exchange, First Citizens remained at $50 with investors dealing in 2,394 stocks, FirstCaribbean International Bank ended at $7.05 with an exchange of 53,074 shares. JMMB Group shed 10 cents to end at $1.30, with investors trading 26,680 stock units, L.J. Williams B share ended at $2.20 with an exchange of 1,000 units, Massy Holdings popped 1 cent to $4.45, with 19,513 shares crossing the market. National Enterprises remained at $3.75 as investors exchanged 39,203 stock units, NCB Financial popped 34 cents in closing at $3.35 after a transfer of 2,949 units,  One Caribbean Media ended at $3.45, with 10,197 stocks traded. Republic Financial lost $1 to end at $119 after an exchange of 3,616 shares, Scotiabank remained at $69 with a transfer of 664 stocks, Trinidad & Tobago NGL ended at $10 after investors exchanged 3,459 stock units. Trinidad Cement dipped 3 cents to $3.25 in switching ownership of 3,000 stock units, Unilever Caribbean remained at $11.93, with 370 shares crossing the market and West Indian Tobacco gained 23 cents in closing at $8.75 in an exchange of 19,288 stocks.

One Caribbean Media ended at $3.45, with 10,197 stocks traded. Republic Financial lost $1 to end at $119 after an exchange of 3,616 shares, Scotiabank remained at $69 with a transfer of 664 stocks, Trinidad & Tobago NGL ended at $10 after investors exchanged 3,459 stock units. Trinidad Cement dipped 3 cents to $3.25 in switching ownership of 3,000 stock units, Unilever Caribbean remained at $11.93, with 370 shares crossing the market and West Indian Tobacco gained 23 cents in closing at $8.75 in an exchange of 19,288 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Archives for January 2024

Mixed trading on Trinidad Exchange

More gains for JSE USD Market

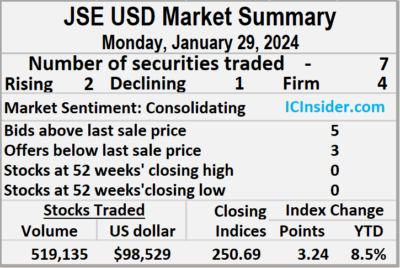

Trading on the Jamaica Stock Exchange US dollar market ended on Monday, with a 23 percent decline in the volume of stocks that were exchanged after 265 percent more US dollars changed hands than Friday, resulting in trading in seven securities, compared to six on the prior trading day with prices of two rising, one declining and four ending unchanged.

The market closed with an exchange of 519,135 shares for US$98,529 compared to 670,997 units at US$26,968 on Friday.

The market closed with an exchange of 519,135 shares for US$98,529 compared to 670,997 units at US$26,968 on Friday.

Trading averaged 74,162 stock units at US$14,076 versus 111,833 shares at US$4,495 on Friday, with a month to date average of 42,458 shares at US$5,106 compared with 40,528 units at US$4,560 on the previous day and December that ended with an average of 28,010 units for US$1,403.

The US Denominated Equities Index climbed 3.24 points to lock up trading at 250.69, with a gain of 8.5 percent for the year to date.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.7. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, First Rock Real Estate USD share ended at 5 US cents with investors swapping 995 units,  Margaritaville rose 1.5 cents to end at 11.5 US cents with 17,321 stocks, crossing the market, Proven Investments ended at 13.5 US cents after investors traded 6,017 shares. Sygnus Credit Investments ended at 8.98 US cents 89 stock units passed through the market and Transjamaican Highway gained 0.01 of a cent to close at 2 US cents after exchanging 418,713 shares.

Margaritaville rose 1.5 cents to end at 11.5 US cents with 17,321 stocks, crossing the market, Proven Investments ended at 13.5 US cents after investors traded 6,017 shares. Sygnus Credit Investments ended at 8.98 US cents 89 stock units passed through the market and Transjamaican Highway gained 0.01 of a cent to close at 2 US cents after exchanging 418,713 shares.

In the preference segment, JMMB US8.5% preference share fell 3 cents to US$1 in trading 75,000 stocks and Sygnus Credit Investments E 8.5% remained at US$11.788 after an exchange of 1,000 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading surges on T&T Stock Exchange

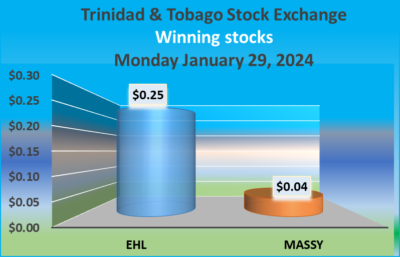

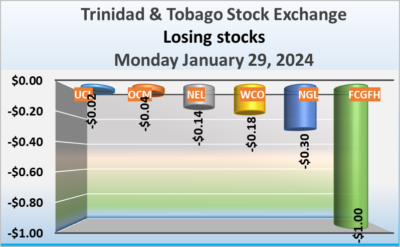

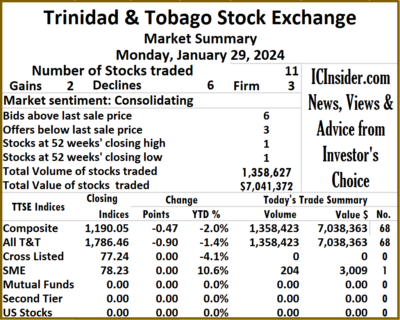

Trading surged on the Trinidad and Tobago Stock Exchange on Monday, with a 3,166 percent jump in the volume of stocks changing hands valued 1,190 percent more than on Friday, resulting in an exchange of only 11 securities compared with 19 on Friday, with prices of two stocks rising, six declining and three ending unchanged.

The market closed with an exchange 1,358,627 shares at $7,041,372 up from just 41,595 stock units at $545,819 on Friday.

The market closed with an exchange 1,358,627 shares at $7,041,372 up from just 41,595 stock units at $545,819 on Friday.

An average of 123,512 shares were traded at $640,125 compared with 2,189 units at $28,727 on Friday, with trading month to date averaging 16,839 shares at $179,044 compared with 12,915 units at $162,075 on the previous trading day and December with an average of 17,065 shares at $239,371.

The Composite Index shed 0.47 points to close at 1,190.05, the All T&T Index declined 0.90 points to finish at  1,786.46, the SME Index remained unchanged at 78.23 and the Cross-Listed Index remained unchanged at 77.24.

1,786.46, the SME Index remained unchanged at 78.23 and the Cross-Listed Index remained unchanged at 77.24.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and three with lower offers.

At the close, Endeavour Holdings rose 25 cents to A 52 weeks’ high of $14.75 as investors exchanged 204 units, First Citizens Group sank $1 and ended at $50 after a transfer of 3,709 stocks, Massy Holdings popped 4 cents to end at $4.44 with trading of 1,260,259 shares. National Enterprises dipped 14 cents to $3.75 while exchanging 30,072 stock units, National Flour Mills ended at $2 with investors trading 45,000 shares,  One Caribbean Media lost 4 cents to close at $3.45, with 430 units crossing the exchange. Republic Financial remained at $120 with investors trading 5,207 stocks, Scotiabank remained at $69 in switching ownership of 4,655 stock units, Trinidad & Tobago NGL declined 30 cents in closing at a 52 weeks’ low of $10, with 7,936 shares crossing the market. Unilever Caribbean shed 2 cents to close at $11.93 with a transfer of 82 units and West Indian Tobacco fell 18 cents to $8.52 with investors swapping 1,073 stocks.

One Caribbean Media lost 4 cents to close at $3.45, with 430 units crossing the exchange. Republic Financial remained at $120 with investors trading 5,207 stocks, Scotiabank remained at $69 in switching ownership of 4,655 stock units, Trinidad & Tobago NGL declined 30 cents in closing at a 52 weeks’ low of $10, with 7,936 shares crossing the market. Unilever Caribbean shed 2 cents to close at $11.93 with a transfer of 82 units and West Indian Tobacco fell 18 cents to $8.52 with investors swapping 1,073 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Volume jumps on JSE USD Market

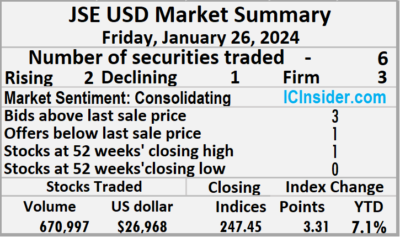

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks exchanged rising 460 percent after 12 percent fewer US dollars changed hands than on Thursday, resulting from trading in six securities, compared to eight on Thursday with prices of two rising, one declining and three ending unchanged.

The market closed trading of 670,997 shares for US$26,968 up from 119,808 units at US$30,732 on Thursday.

The market closed trading of 670,997 shares for US$26,968 up from 119,808 units at US$30,732 on Thursday.

Trading ended with an average of 111,833 units at US$4,495 compared with 14,976 shares at US$3,842 on Thursday. Trading month to date averages 40,528 shares at US$4,560 compared to 36,603 units at US$4,564 on the previous day and December that ended with an average of 28,010 units for US$1,403.

The US Denominated Equities Index gained 3.31 points to close at 247.45.

The PE Ratio, a measure used in computing appropriate stock values, averages 10.6. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August ents c2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, First Rock Real Estate USD share gained 0.99 of one cent in closing at 5 US cents in switching ownership of 70,000 stocks, Proven Investments remained at 13.5 US cents with 2,044 stock units clearing the market,  Sterling Investments ended trading at 1.5 US cents with an exchange of 13,714 shares and Transjamaican Highway popped 0.11 of a cent and ended at 1.99 US cents, with 584,238 stock units changing hands.

Sterling Investments ended trading at 1.5 US cents with an exchange of 13,714 shares and Transjamaican Highway popped 0.11 of a cent and ended at 1.99 US cents, with 584,238 stock units changing hands.

In the preference segment, Sygnus Credit Investments US 8% climbed 50 to end at a record high of US$10.50 after an exchange of a mere one share and Sygnus Credit Investments E 8.5% declined 21.2 cent to US$11.788 with investors transferring 1,000 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

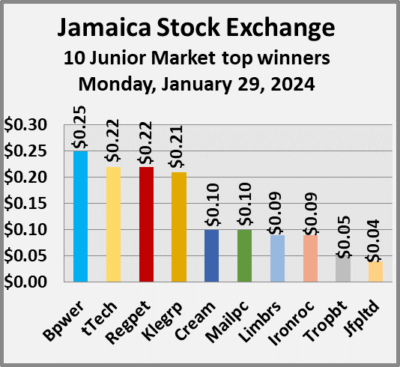

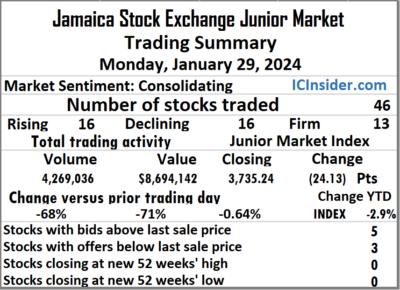

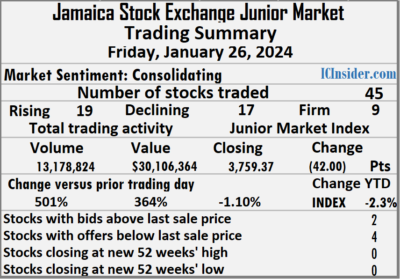

The main market closed with trading of 4,269,036 shares for $8,694,142 down from 13,178,824 units at $30,106,364 on Friday.

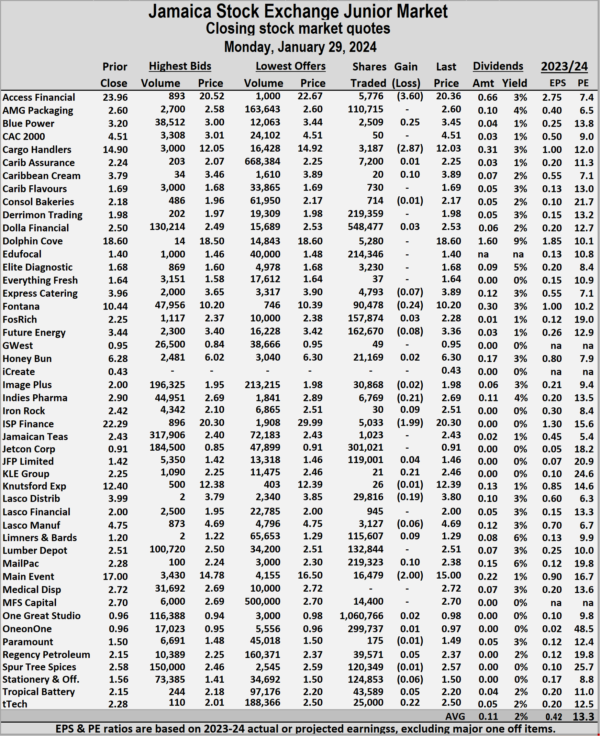

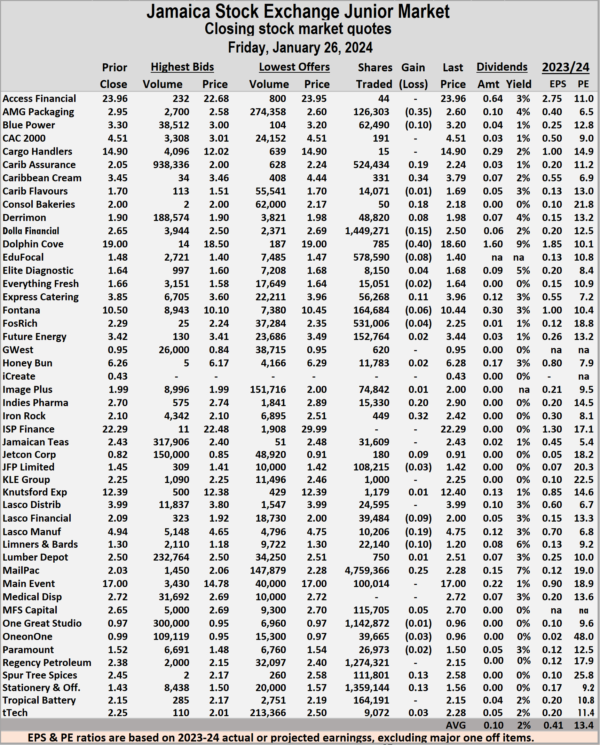

The main market closed with trading of 4,269,036 shares for $8,694,142 down from 13,178,824 units at $30,106,364 on Friday. The Junior Market ended trading with an average PE Ratio of 13.3, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024.

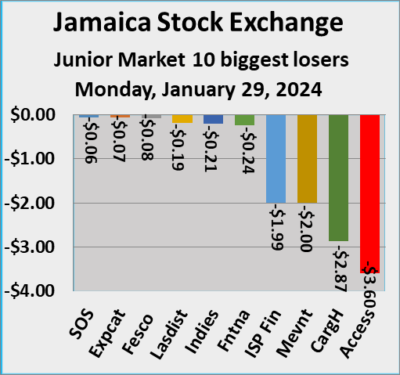

The Junior Market ended trading with an average PE Ratio of 13.3, based on last traded prices in conjunction with earnings projected by ICInsider.com for the financial years ending around August 2024. Lasco Distributors fell by 19 cents in closing at $3.80 after 29,816 units passed through the market, Limners and Bards rose 9 cents to $1.29, after trading at an intraday 52 weeks’ low of $1.13 with 115,607 stock units changing hands. Mailpac Group advanced 10 cents and ended at $2.38 as investors traded 219,323 shares, Main Event dipped $2 to $15 after a transfer of 16,479 stock units, Regency Petroleum gained 22 cents to close at $2.37 after exchanging 39,571 units and tTech popped 22 cents to $2.50 with investors dealing in 25,000 stock units.

Lasco Distributors fell by 19 cents in closing at $3.80 after 29,816 units passed through the market, Limners and Bards rose 9 cents to $1.29, after trading at an intraday 52 weeks’ low of $1.13 with 115,607 stock units changing hands. Mailpac Group advanced 10 cents and ended at $2.38 as investors traded 219,323 shares, Main Event dipped $2 to $15 after a transfer of 16,479 stock units, Regency Petroleum gained 22 cents to close at $2.37 after exchanging 39,571 units and tTech popped 22 cents to $2.50 with investors dealing in 25,000 stock units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

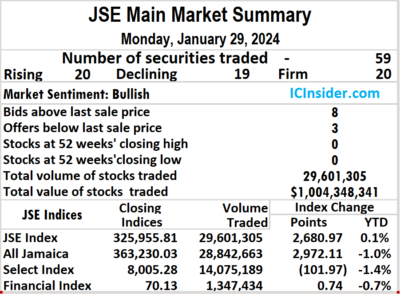

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with an exchange of 29,601,305 shares for a massive $1,004,348,955, up sharply from just 9,369,749 stock units at $95,805,466 on Friday.

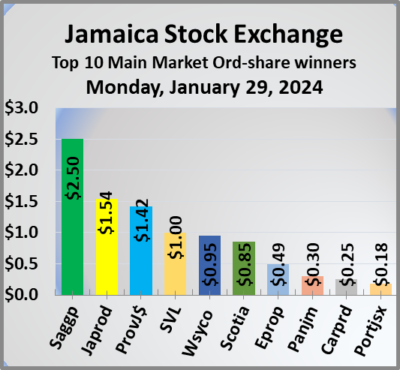

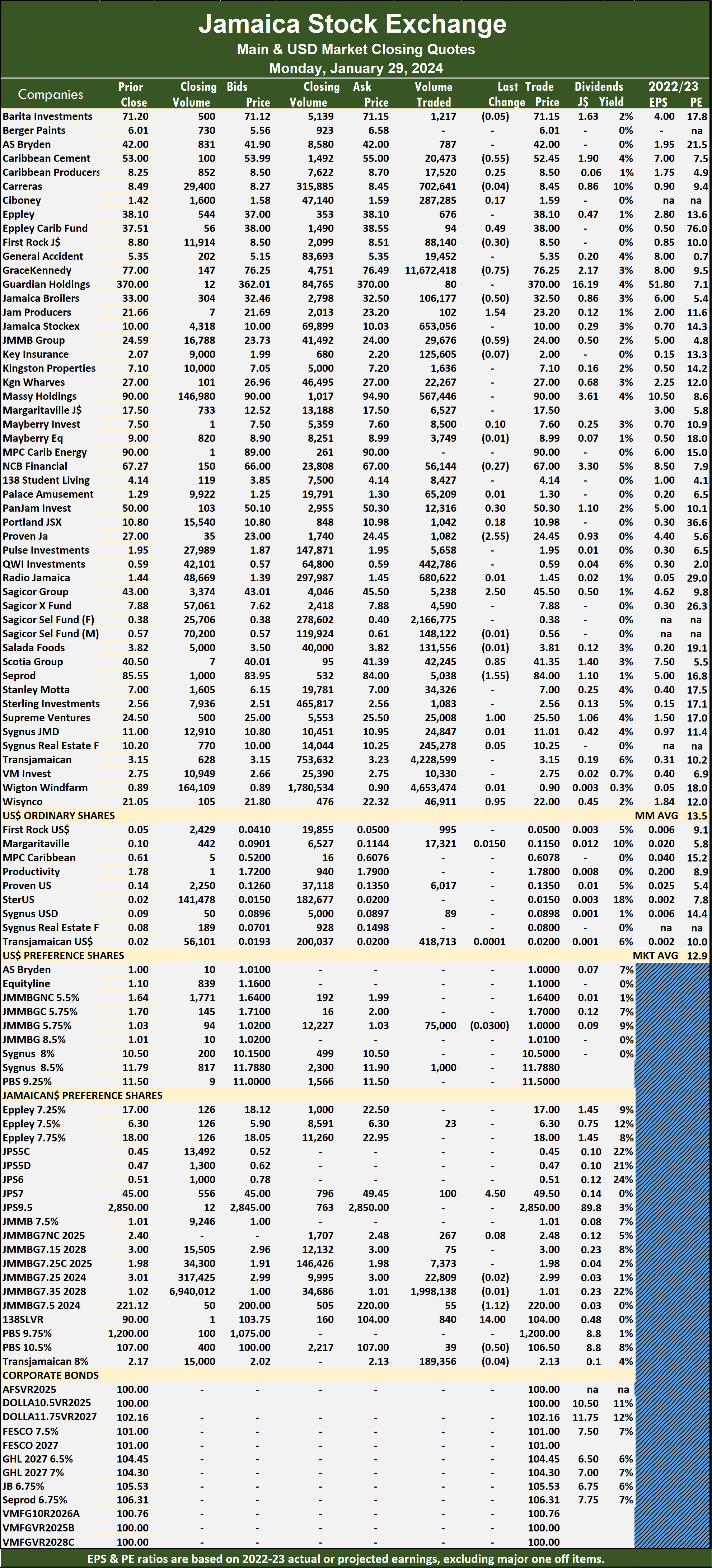

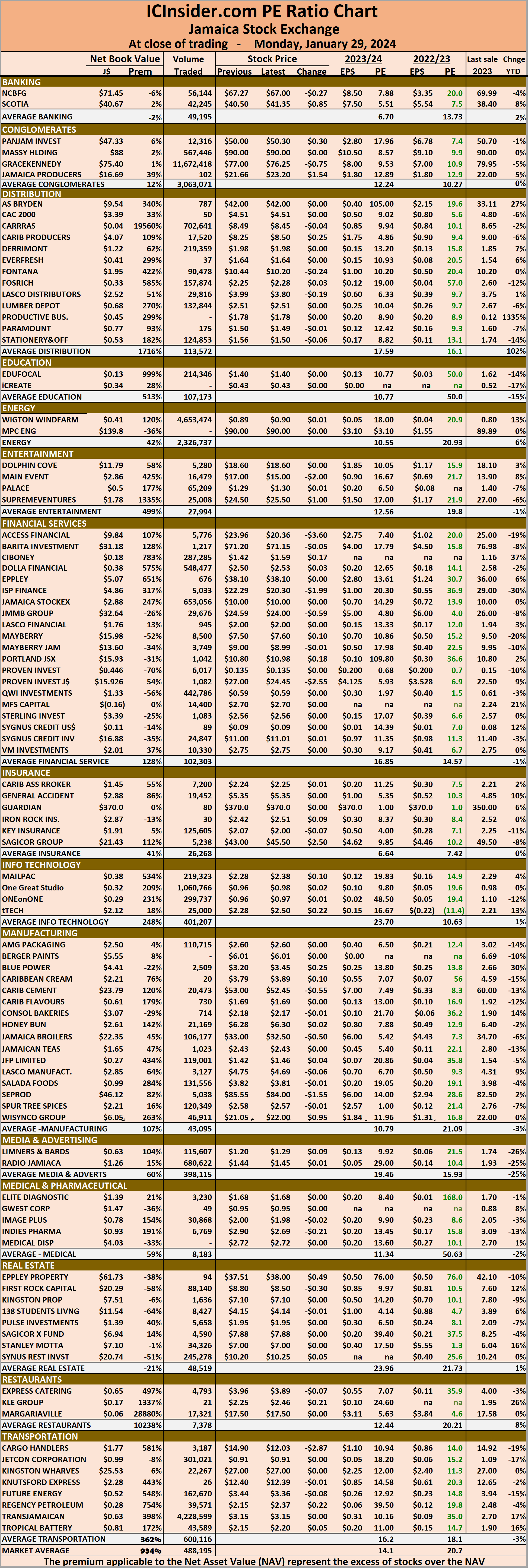

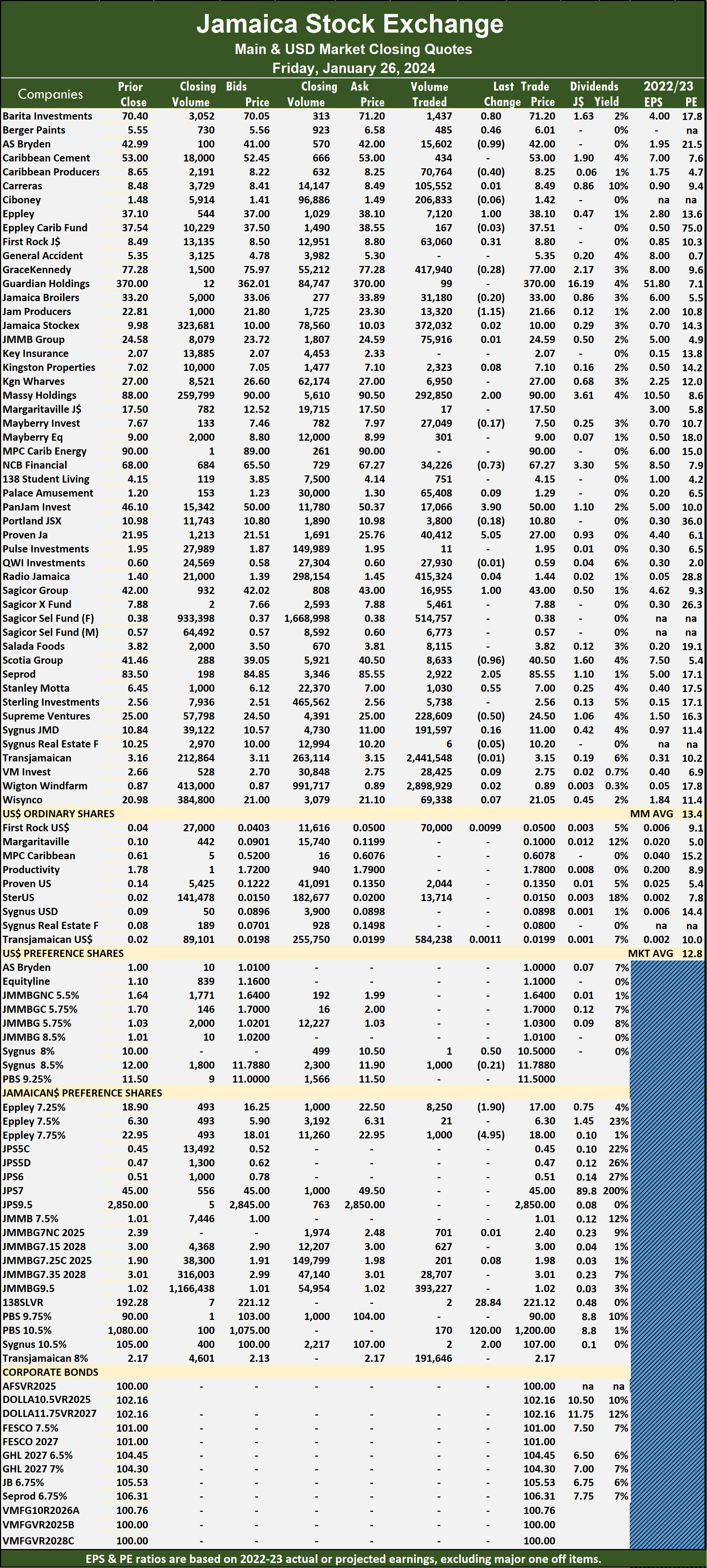

The market closed with an exchange of 29,601,305 shares for a massive $1,004,348,955, up sharply from just 9,369,749 stock units at $95,805,466 on Friday. The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and the USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with their financial year ending around August 2024.

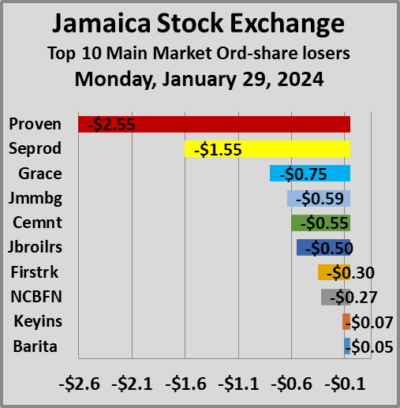

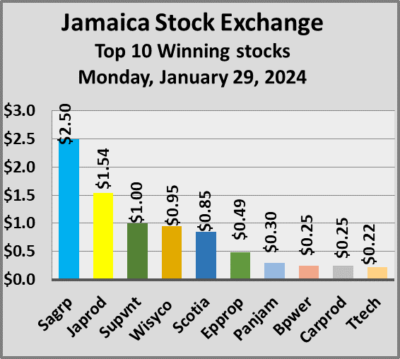

The Main Market ended trading with an average PE Ratio of 13.5. The JSE Main and the USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with their financial year ending around August 2024. Sagicor Group climbed $2.50 in closing at $45.50 in an exchange of 5,238 stock units, Scotia Group rose 85 cents to $41.35, with 42,245 stocks changing hands, Seprod dropped $1.55 in closing at $84 after an exchange of 5,038 units. Supreme Ventures gained $1 to end at $25.50 with investors dealing in 25,008 stocks and Wisynco Group rallied 95 cents and ended at $22 with a transfer of 46,911 shares.

Sagicor Group climbed $2.50 in closing at $45.50 in an exchange of 5,238 stock units, Scotia Group rose 85 cents to $41.35, with 42,245 stocks changing hands, Seprod dropped $1.55 in closing at $84 after an exchange of 5,038 units. Supreme Ventures gained $1 to end at $25.50 with investors dealing in 25,008 stocks and Wisynco Group rallied 95 cents and ended at $22 with a transfer of 46,911 shares. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

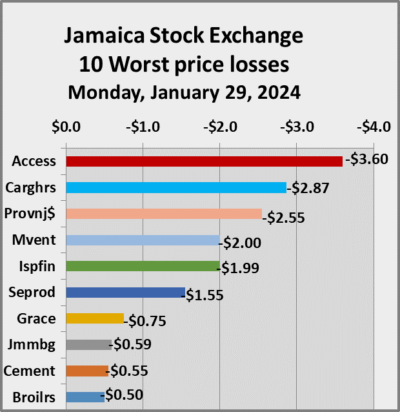

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. At the close of market activity, the Jamaica Stock Exchange Combined Market Index climbed 2,303.01 points to finish the day at 338,407.78, the All Jamaican Composite Index popped 2,972.11 points to close at 363,230.03, the JSE Main Index gained 2,680.97 points to finish at 325,955.81. The Junior Market Index dropped 24.13 points to 3,735.24 and the JSE USD Market Index climbed 3.24 points to 250.69.

At the close of market activity, the Jamaica Stock Exchange Combined Market Index climbed 2,303.01 points to finish the day at 338,407.78, the All Jamaican Composite Index popped 2,972.11 points to close at 363,230.03, the JSE Main Index gained 2,680.97 points to finish at 325,955.81. The Junior Market Index dropped 24.13 points to 3,735.24 and the JSE USD Market Index climbed 3.24 points to 250.69. At the close of the market, some of the major Main Market stocks that rose are Jamaica Producers popped $1.54 to $23.20, Sagicor Group climbed $2.50 in closing at $45.50, Scotia Group rose 85 cents to $41.35 Supreme Ventures gained $1 to end at $25.50 and Wisynco Group rallied 95 cents and ended at $22.

At the close of the market, some of the major Main Market stocks that rose are Jamaica Producers popped $1.54 to $23.20, Sagicor Group climbed $2.50 in closing at $45.50, Scotia Group rose 85 cents to $41.35 Supreme Ventures gained $1 to end at $25.50 and Wisynco Group rallied 95 cents and ended at $22. Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

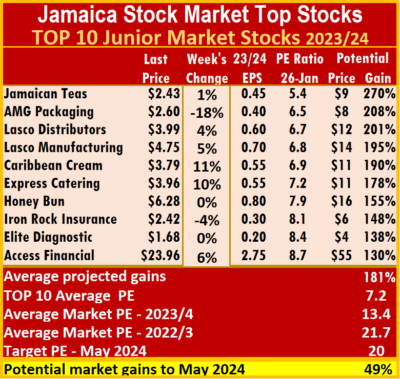

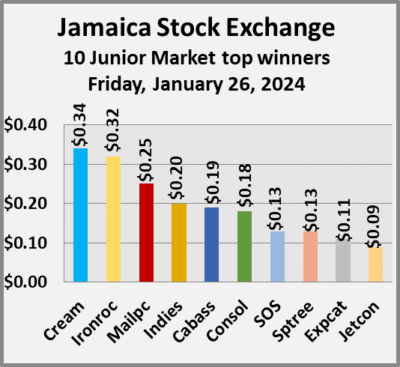

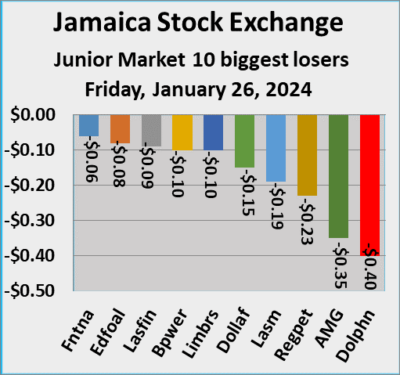

Investors should use the chart to help make rational decisions when investing in stocks close to the average for the sector and not going too far from it unless there are compelling reasons to do so. This approach helps to remove emotions from investment decisions and place them on fundamentals while at the same time not being too far from the majority of investors. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. Two stocks with a notable gain in the Junior Market TOP 10 are Caribbean Cream rising 11 percent to close at $3.79 and Express Catering rose 10 percent to $3.96. AMG Packaging skidded 18 percent to close at $2.60. In the Main Market, there were three stocks with outsize movements. 138 Student Living jumped 19 percent to $4.15 followed by a 13 percent rise respectively for General Accident to $5.35 and Margaritaville to $17.50.

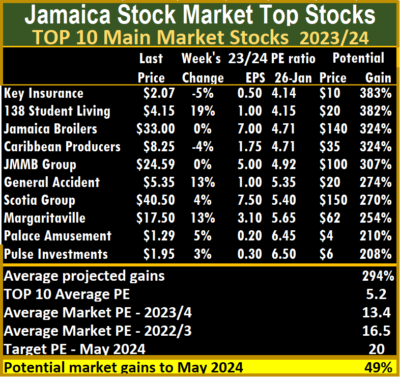

Two stocks with a notable gain in the Junior Market TOP 10 are Caribbean Cream rising 11 percent to close at $3.79 and Express Catering rose 10 percent to $3.96. AMG Packaging skidded 18 percent to close at $2.60. In the Main Market, there were three stocks with outsize movements. 138 Student Living jumped 19 percent to $4.15 followed by a 13 percent rise respectively for General Accident to $5.35 and Margaritaville to $17.50. The Main Market ICTOP10 is projected to gain an average of 294 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 181 percent over the same time frame.

The Main Market ICTOP10 is projected to gain an average of 294 percent by May 2024, based on 2023 forecasted earnings, providing better values than the Junior Market with the potential to gain 181 percent over the same time frame. ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes.

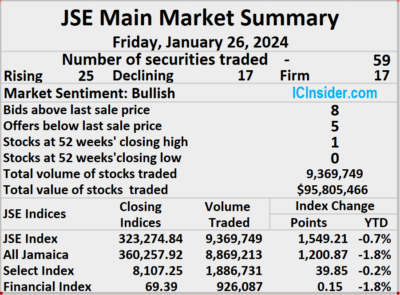

ICTOP10 focuses on likely yearly winners, accordingly, the list includes some of the best companies in the market, but this is not always so. ICInsider.com ranks stocks based on projected earnings, allowing investors to focus on the most undervalued stocks and helping to remove emotions in selecting stocks for investments that often result in costly mistakes. The market closed with 9,369,749 shares trading valued at $95,805,466 compared with 20,842,200 units at $90,178,686 on Thursday.

The market closed with 9,369,749 shares trading valued at $95,805,466 compared with 20,842,200 units at $90,178,686 on Thursday. Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and five with lower offers.

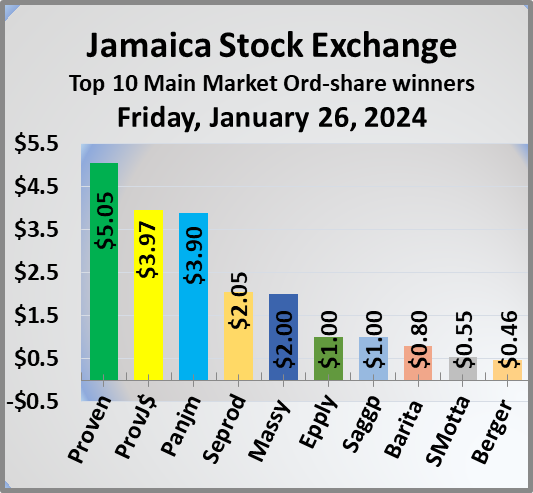

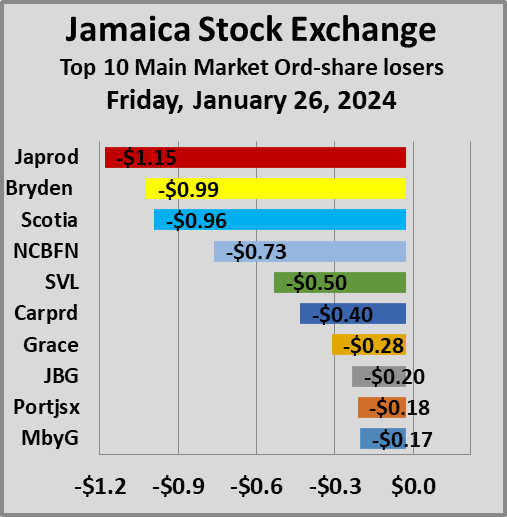

Investor’s Choice bid-offer indicator shows eight stocks ending with bids higher than their last selling prices and five with lower offers. Scotia Group skidded 96 cents to end at $40.50 with a transfer of 8,633 shares, Seprod climbed $2.05 in closing at $85.55 while trading 2,922 stock units, Stanley Motta increased 55 cents and ended at $7, after hitting an intraday 52 weeks’ high of $8 and ended with 1,030 units crossing the exchange and Supreme Ventures dipped 50 cents to $24.50 with traders dealing in 228,609 stocks.

Scotia Group skidded 96 cents to end at $40.50 with a transfer of 8,633 shares, Seprod climbed $2.05 in closing at $85.55 while trading 2,922 stock units, Stanley Motta increased 55 cents and ended at $7, after hitting an intraday 52 weeks’ high of $8 and ended with 1,030 units crossing the exchange and Supreme Ventures dipped 50 cents to $24.50 with traders dealing in 228,609 stocks. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. The market closed with trading of 13,178,824 shares for $30,106,364 up from 2,193,612 units at $6,494,237 on Thursday.

The market closed with trading of 13,178,824 shares for $30,106,364 up from 2,193,612 units at $6,494,237 on Thursday. Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows two stocks ended with bids higher than their last selling prices and four with lower offers. Iron Rock Insurance increased 32 cents and ended at $2.42 with 449 shares crossing the exchange, Jetcon Corporation popped 9 cents in closing at 91 cents with investors transferring 180 units, Lasco Financial shed 9 cents to end at $2, with 39,484 stocks clearing the market. Lasco Manufacturing declined 19 cents in closing at $4.75 while exchanging 10,206 stock units, Limners and Bards fell 10 cents to $1.20 and closed after an exchange of 22,140 shares, after hitting a 52 weeks’ low of $1.18, Mailpac Group advanced 25 cents to close at $2.28 with an exchange of 4,759,366 units. MFS Capital Partners rose 5 cents to end at $2.70 after 115,705 stocks passed through the market, Regency Petroleum dropped 23 cents and ended at $2.15 as investors exchanged 1,274,321 stock units, Spur Tree Spices rallied 13 cents to $2.58 in trading 111,801 shares and Stationery and Office Supplies increased 13 cents to close at $1.56 after a transfer of 1,359,144 stock units following a fall of the stock to a 52 weeks’ low of $1.41.

Iron Rock Insurance increased 32 cents and ended at $2.42 with 449 shares crossing the exchange, Jetcon Corporation popped 9 cents in closing at 91 cents with investors transferring 180 units, Lasco Financial shed 9 cents to end at $2, with 39,484 stocks clearing the market. Lasco Manufacturing declined 19 cents in closing at $4.75 while exchanging 10,206 stock units, Limners and Bards fell 10 cents to $1.20 and closed after an exchange of 22,140 shares, after hitting a 52 weeks’ low of $1.18, Mailpac Group advanced 25 cents to close at $2.28 with an exchange of 4,759,366 units. MFS Capital Partners rose 5 cents to end at $2.70 after 115,705 stocks passed through the market, Regency Petroleum dropped 23 cents and ended at $2.15 as investors exchanged 1,274,321 stock units, Spur Tree Spices rallied 13 cents to $2.58 in trading 111,801 shares and Stationery and Office Supplies increased 13 cents to close at $1.56 after a transfer of 1,359,144 stock units following a fall of the stock to a 52 weeks’ low of $1.41. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.