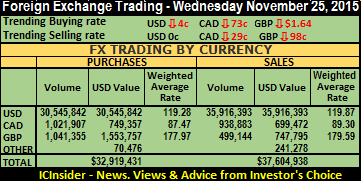

Trading in Jamaica’s foreign exchange market saw US$4.7 million more funds flowing out of the market than the amount entering on Wednesday but the Jamaican dollar held against the US and gained against others. At the close of trading, the equivalent of US$32,919,431 was bought by dealers, compared with US$38,773,432 on Tuesday, while they sold the equivalent of US$37,604,938 versus US$32,724,247 previously.

Trading in Jamaica’s foreign exchange market saw US$4.7 million more funds flowing out of the market than the amount entering on Wednesday but the Jamaican dollar held against the US and gained against others. At the close of trading, the equivalent of US$32,919,431 was bought by dealers, compared with US$38,773,432 on Tuesday, while they sold the equivalent of US$37,604,938 versus US$32,724,247 previously.

In US dollar trading , dealers bought US$30,545,842 compared to US$33,795,098 on Tuesday. The buying rate for the US dollar decline 4 cents to $119.28 and US$35,916,393 was sold versus US$30,120,276 on Tuesday, the selling rate was unchanged at $119.87.  The Canadian dollar buying rate fell 73 cents to end at $87.47 with dealers buying C$1,021,907 and selling C$938,883, at an average rate that shed 29 cents to $89.30. The rate for buying the British Pound fell $1.64 to $177.97 for the purchase of £1,041,355, while £499,144 was sold, with the rate falling 98 cents to $179.59. At the end of trading, it took J$127.55 to purchase the Euro, a rise of 27 cents from Tuesday’s rate, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$125.05 for an increase of 39 cents from Tuesday’s rate. The US dollar equivalent of other currencies traded, amounts to US$70,476 being bought, while US$241,278 was sold.

The Canadian dollar buying rate fell 73 cents to end at $87.47 with dealers buying C$1,021,907 and selling C$938,883, at an average rate that shed 29 cents to $89.30. The rate for buying the British Pound fell $1.64 to $177.97 for the purchase of £1,041,355, while £499,144 was sold, with the rate falling 98 cents to $179.59. At the end of trading, it took J$127.55 to purchase the Euro, a rise of 27 cents from Tuesday’s rate, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$125.05 for an increase of 39 cents from Tuesday’s rate. The US dollar equivalent of other currencies traded, amounts to US$70,476 being bought, while US$241,278 was sold.

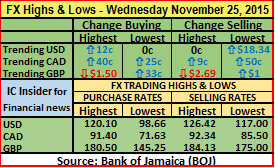

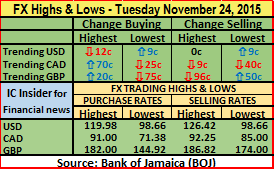

Highs & Lows| On Wednesday, the highest buying rate for the US dollar rose 12 cents to $120.10, the lowest buying rate was unchanged at $98.66 and the highest selling rate remained at $126.42.  The lowest selling rate jumped $18.34 to $117. The highest buying rate for the Canadian dollar rose 40 cents to end at $91.40, the lowest buying rate gained 25 cents to $71.63, the highest selling rate is up 9 cents to at $92.34 and the lowest selling rate ended higher by 50 cents to $85.50. The highest buying rate for the British Pound, dropped $1.50 to end at $180.50. The lowest buying rate increased by 33 cents to $145.25, the highest selling rate dropped $2.69 to $184.23 and the lowest selling rate rose $1 to end at $175.

The lowest selling rate jumped $18.34 to $117. The highest buying rate for the Canadian dollar rose 40 cents to end at $91.40, the lowest buying rate gained 25 cents to $71.63, the highest selling rate is up 9 cents to at $92.34 and the lowest selling rate ended higher by 50 cents to $85.50. The highest buying rate for the British Pound, dropped $1.50 to end at $180.50. The lowest buying rate increased by 33 cents to $145.25, the highest selling rate dropped $2.69 to $184.23 and the lowest selling rate rose $1 to end at $175.

Archives for November 2015

J$ firm vs US up on others – Wednesday

J$ almost firm vs US on Tuesday

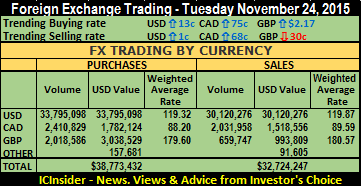

Trading of foreign currencies in Jamaica’s foreign exchange market saw US$6 million more funds flowing out of the market than the amount that entered on Tuesday leading to slippage in the rate for the Jamaican dollar against the US and the Canadian dollars. At the close of trading, the equivalent of US$38,773,432 was bought by dealers, compared with US$40,009,733 on Monday, while they sold the equivalent of US$32,724,247 versus US$32,908,156 previously.

Trading of foreign currencies in Jamaica’s foreign exchange market saw US$6 million more funds flowing out of the market than the amount that entered on Tuesday leading to slippage in the rate for the Jamaican dollar against the US and the Canadian dollars. At the close of trading, the equivalent of US$38,773,432 was bought by dealers, compared with US$40,009,733 on Monday, while they sold the equivalent of US$32,724,247 versus US$32,908,156 previously.

In US dollar trading , dealers bought US$33,795,098 compared to US$36,075,775 on Monday. The buying rate for the US dollar rose 13 cents to $119.32 and US$30,120,276 was sold versus US$30,594,536 on Monday, the selling rate gained 1 cent to end at $119.87. The Canadian dollar buying rate rose 75 cents to end at $88.20 with dealers buying C$2,410,829 and selling C$2,031,958, at an average rate that gained 68 cents to $89.59. The rate for buying the British Pound rallied by $2.17 to $179.60 for the purchase of £2,018,586, while £659,747 was sold, with the rate falling 30 cents to $180.57. At the end of trading, it took J$127.28 to purchase the Euro, a fall of 70 cents from Monday’s rate, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$124.66 for a decline $1.14 from Monday’s rate. The US dollar equivalent of other currencies traded, amounts to US$157,681 being bought, while US$91,605 was sold.

The Canadian dollar buying rate rose 75 cents to end at $88.20 with dealers buying C$2,410,829 and selling C$2,031,958, at an average rate that gained 68 cents to $89.59. The rate for buying the British Pound rallied by $2.17 to $179.60 for the purchase of £2,018,586, while £659,747 was sold, with the rate falling 30 cents to $180.57. At the end of trading, it took J$127.28 to purchase the Euro, a fall of 70 cents from Monday’s rate, according to data from Bank of Jamaica, while dealers purchased the European common currency at J$124.66 for a decline $1.14 from Monday’s rate. The US dollar equivalent of other currencies traded, amounts to US$157,681 being bought, while US$91,605 was sold.

Highs & Lows| On Tuesday, the highest buying rate for the US dollar lost 12 cents to $119.98, the lowest buying rate gained 9 cents to $98.66, the highest selling rate remained at $126.42. The lowest selling rate rose 9 cents to $98.66. The highest buying rate for the Canadian dollar rose 70 cents to end at $91, the lowest buying rate fell 25 cents to $71.38, the highest selling rate eased 9 cents to at $92.25 and the lowest selling rate ended lower by 40 cents to $85. The highest buying rate for the British Pound, gained 20 cents to end at $182. The lowest buying rate closed 75 cents lower at $144.92, the highest selling rate dropped 96 cents to $186.82 and the lowest selling rate rose 50 cents to end at $174.

The lowest selling rate rose 9 cents to $98.66. The highest buying rate for the Canadian dollar rose 70 cents to end at $91, the lowest buying rate fell 25 cents to $71.38, the highest selling rate eased 9 cents to at $92.25 and the lowest selling rate ended lower by 40 cents to $85. The highest buying rate for the British Pound, gained 20 cents to end at $182. The lowest buying rate closed 75 cents lower at $144.92, the highest selling rate dropped 96 cents to $186.82 and the lowest selling rate rose 50 cents to end at $174.

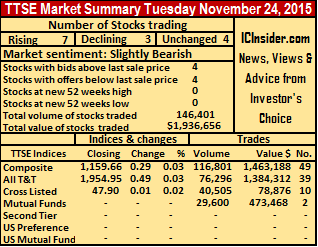

7 TTSE’s stocks gain 3 lost on Tuesday

Trading on the Trinidad and Tobago Stock Exchange remains elevated on Tuesday, ending with 14 active securities of which 7 stocks closing higher, 3 declined and 4 remained unchanged as 146,401 shares changed hands for a value of $1,936,656.

Trading on the Trinidad and Tobago Stock Exchange remains elevated on Tuesday, ending with 14 active securities of which 7 stocks closing higher, 3 declined and 4 remained unchanged as 146,401 shares changed hands for a value of $1,936,656.

At the close, the Composite Index ending with a rose of 0.29 points at 1,159.66 the

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 4 stocks with the bid higher than the last selling price and 4 stocks with offers that were lower.

Gains| Clico Investment Fund closed with 19,600 shares valued at $ 442,568 changing hands, 1 cent higher at $22.58, First Citizens Bank traded 2,733 shares to close with a gain of 2 cents at $35.02, Grace Kennedy had 10,345 units changing hands at $3.75, for a 15 cents gain. One Caribbean Media traded 100 shares and gained 5 cents to end at $22.05, Praetorian Property Mutual Fund contributed 10,000 shares and rose 2 cents to end at $3.09. Sagicor Financial Corporation closed with 2,726 shares changing hands at $6.03 for a 1 cent gain and Trinidad and Tobago NGL closed with a gain of 45 cents, at $22.01 as 48,585 shares changed hands for a value of $1,055,700.

Declines| Ansa Merchant Bank traded 887 units to close 2 cents lower at $38.65, Guardian Holdings with 14,116 shares changing hands, closed with a loss of 1 cent at $12.90 and JMMB Group fell 3 cents to end at 50 cents while trading 20,000 units.

Declines| Ansa Merchant Bank traded 887 units to close 2 cents lower at $38.65, Guardian Holdings with 14,116 shares changing hands, closed with a loss of 1 cent at $12.90 and JMMB Group fell 3 cents to end at 50 cents while trading 20,000 units.

Firm Trades| National Commercial Bank contributed 5,069 shares at a closing price of $1.95, Prestige Holdings traded 489 units to end at $10.05, Scotia Investments closed at $1.59, with 2,365 shares changing hands and infrequent trader L.J. Williams B share traded 9,386 units to close at 97 cents.

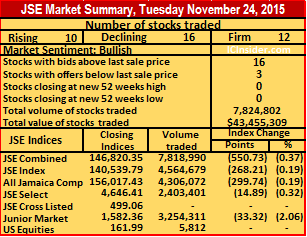

JSE falls in mid-morning

In early trading on the Jamaica Stock Exchange market indices slipped with the all Jamaica Composite Index falling 368.56 points to 155,948.61 at 10.45 am on Tuesday morning.  The JSE Market Index lost 329.79 points to 140,478.21, the JSE combined index fell 333.67 points to be at 147,037.41 and the junior market index shed 2.50 points to 1,613.18.

The JSE Market Index lost 329.79 points to 140,478.21, the JSE combined index fell 333.67 points to be at 147,037.41 and the junior market index shed 2.50 points to 1,613.18.

Trading volumes have been low with 75 minutes of the market opening. Cable & Wireless traded the most with 365,236 units and last traded at $1.40, Sagicor Group had 720,061 units trading at $16.90, Jamaica Money Market Brokers 8.50% preference share with 233,938 units at $4.60 with a huge gain of $1.05.

In trading 27 securities have changed hands with a volume of 1,926,677 units as 9 stocks gained and 12 declined.

Jump in Gleaner’s Q3 profits by 70%

The Gleaner Company, producers of Jamaica’s oldest newspaper, earned increased profits for its September quarter. The North Street based institution earned $27 million profit for the quarter, 70 per cent more profit than a year ago.

The Gleaner Company, producers of Jamaica’s oldest newspaper, earned increased profits for its September quarter. The North Street based institution earned $27 million profit for the quarter, 70 per cent more profit than a year ago.

The 2015 results are commendable as its revenues dipped to $777 million or 9 percent less than a year earlier in the quarter, including a fall of $26 million in investment income to $54 million for the quarter while media income fell $68 million for the same period.

For the nine-months, the Gleaner made $130 million net profit or 122 per cent more than the $58.6 million earned a year earlier. Revenues continued its downward drift by 5.6 percent to $2.38 billion, partially helped by a fall of $34 million in investment income to $90 million while media income fell $120 million for the same period

Gleaner enjoyed other operating income of $61 million and $63 million in 2014 as a result of gains on foreign exchange on investments and Finance income includes interest on loans. Consequently, the profit resulted from efficiency gains in slashing administrative and ‘other operating’ expenses during the quarter.

Interestingly, however, with the jump in profit the company ended the quarter with $93 million in cash flow down from $164 million from operation in 2014 period and ended with $37.7 million cash in the bank at September 2015 and $42 million September 2014 and $772 million in investments up from $690 million at September 2014.

The Gleaner continues to prepare its media operations for the merger with the Radio Jamaica Group, another legacy media entity. It will create one of the largest broadcast and print media entities in the Anglophone Caribbean. Plans to merge were announced on August 5, 2015, with the merger is expected to be concluded by year-end, subject to the approval of a splintered shareholders of Radio Jamaica. There is little doubt that the Gleaner’s shareholders will not approve, with the company’s Chairman in control of a large block of the Gleaner’s shares.

The Gleaner continues to prepare its media operations for the merger with the Radio Jamaica Group, another legacy media entity. It will create one of the largest broadcast and print media entities in the Anglophone Caribbean. Plans to merge were announced on August 5, 2015, with the merger is expected to be concluded by year-end, subject to the approval of a splintered shareholders of Radio Jamaica. There is little doubt that the Gleaner’s shareholders will not approve, with the company’s Chairman in control of a large block of the Gleaner’s shares.

Net asset at the end of September is $2.32 per share. The stock is priced at $1.90, with earnings per share of 10.76 cents for the nine months period and 2.27 cents for the quarter. The company seems on target to earn 20 cents per share, for the full year.

Gleaner’s shareholders will get the equivalent of a third of each of the RJR existing shares as well us retain shares in the remnants of the Gleaner with net assets around $1.70 per share, if the merger proceeds. But the overall gains will be well in above the current combined value of $3.53 based on the $5.20 price of RJR shares last sold at with indication of further rise to come, based on a big jump RJR’s revenues and profit in the September quarter.

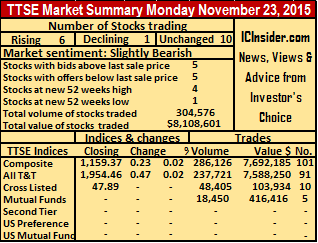

6 TTSE’s stocks rise 1 fall on Monday

At the close, the Composite Index ending with a rose of 0.23 points at 1,159.37 the

IC bid-offer Indicator| At the end of trading the Investor’s Choice bid-offer indicator had 5 stocks with the bid higher than the last selling price and 5 stocks with offers that were lower.

Gains| Clico Investment Fund closed with 18,450 shares valued at $416,416 changing hands 1 cent higher at $22.57, National Flour Mills gained 1 cent, to end at a 52 weeks’ high of $2.22 with 1,600 units changing hands. Prestige Holdings traded 8 units to end with a gain of 5 cents at $10.05, a new 52 weeks’ high. Trinidad and Tobago NGL closed with a gain of 1 cent, at $21.56 as 19,444 shares changed hands for a value of $419,200. Trinidad Cement gained 4 cents, in ending at a 52 weeks’ high of $4.20, with 75,700 units changing hands for $317,940 and Unilever Caribbean ended with 9,630 shares valued at $655,033 trading, to gain of 2 cents, for a new 52 weeks’ high of $68.03.

Declines| National Enterprises ended trading with 7,380 shares to close with a loss of 1 cent at $16.49, a new 52 weeks’ low.

Firm Trades| First Citizens Bank traded 12,214 shares to close at $35, Guardian Holdings with 2,200 shares changing hands closed at $12.91, National Commercial Bank contributed 46,000 shares at a closing price of $1.95,

One Caribbean Media traded 100 shares at $22. Republic Bank closed at $112 with 209 shares changing hands, Sagicor Financial Corporation closed with 2,350 shares changing hands at $6.02, Scotiabank ended with at $62.50 while 79,236 units for a value of $4,952,250 were traded. Scotia Investments closed at $1.59, with only 55 shares changing hands and infrequent trader L.J. Williams $0.10 A added 25,000 shares to close at 25 cents and West Indian Tobacco traded just 5,000 shares carrying a value of $630,745 to close at $126.11.

One Caribbean Media traded 100 shares at $22. Republic Bank closed at $112 with 209 shares changing hands, Sagicor Financial Corporation closed with 2,350 shares changing hands at $6.02, Scotiabank ended with at $62.50 while 79,236 units for a value of $4,952,250 were traded. Scotia Investments closed at $1.59, with only 55 shares changing hands and infrequent trader L.J. Williams $0.10 A added 25,000 shares to close at 25 cents and West Indian Tobacco traded just 5,000 shares carrying a value of $630,745 to close at $126.11.