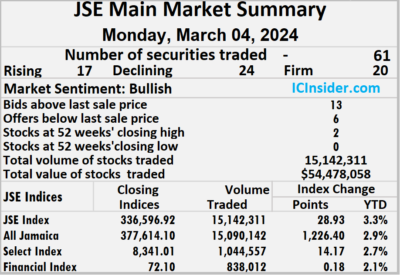

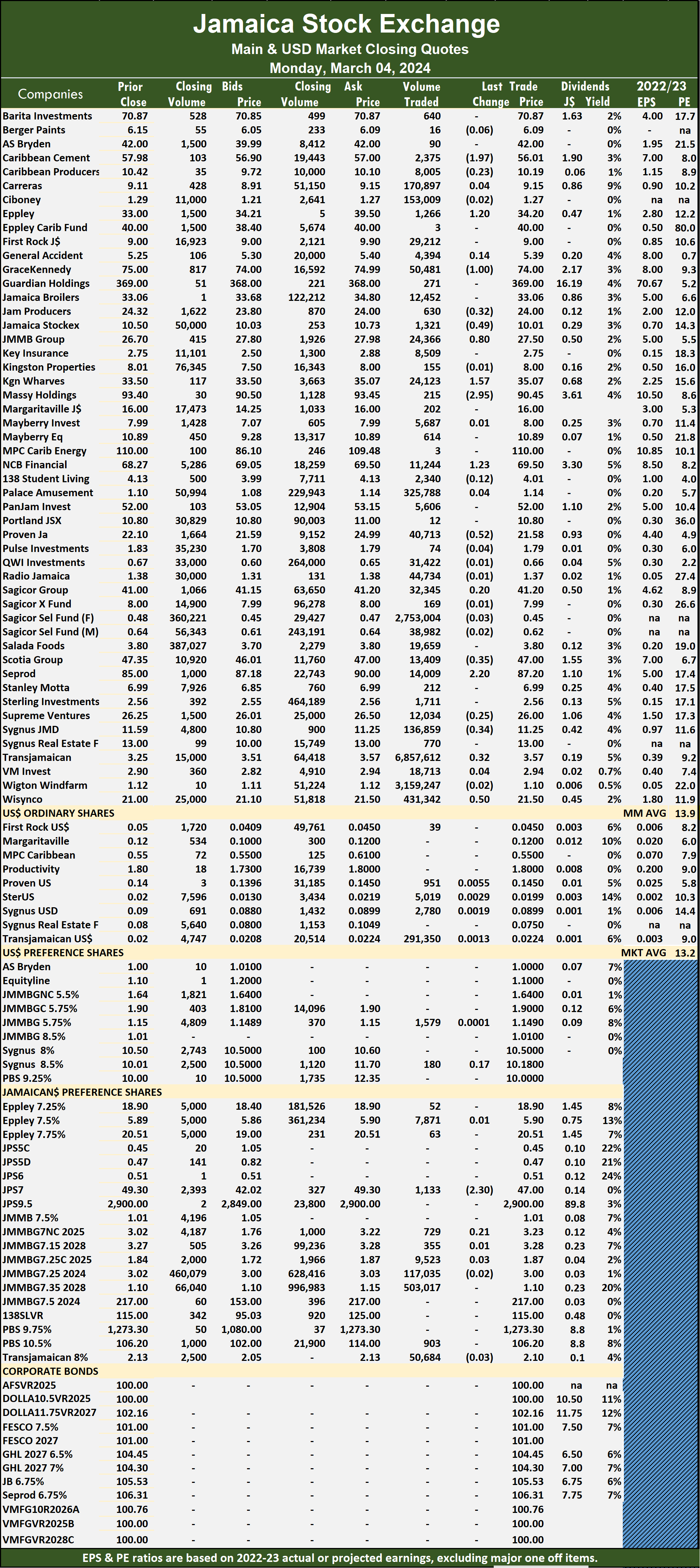

Trading on the Jamaica Stock Exchange Main Market ended on Monday, with the volume of stocks traded declining 27 percent with a 42 percent lower value than on Friday, following trading in 61 securities up from 59 on Friday, with prices of 17 stocks rising, 24 declining and 20 ending unchanged.

Investors traded 15,142,311 shares for $54,478,058, well down on 20,803,919 units at $94,602,958 on Friday.

Investors traded 15,142,311 shares for $54,478,058, well down on 20,803,919 units at $94,602,958 on Friday.

Trading averaged 248,235 shares at $893,083 compared to 352,609 units at $1,603,440 on Friday and month to date, an average of 299,552 units at $1,242,342 compared with February that closed with an average of 385,143 units at $3,418,046.

Transjamaican Highway led trading with 6.86 million shares for 45.3 percent of total volume followed by Wigton Windfarm with 3.16 million units for 20.9 percent of the day’s trade and Sagicor Select Financial Fund with 2.75 million units for 18.2 percent of the day’s trade.

The All Jamaican Composite Index rose 1,226.40 points to end the day at 377,614.10, the JSE Main Index increased 28.93 points to close at 336,596.92 and the JSE Financial Index increased 0.18 points to 72.10.

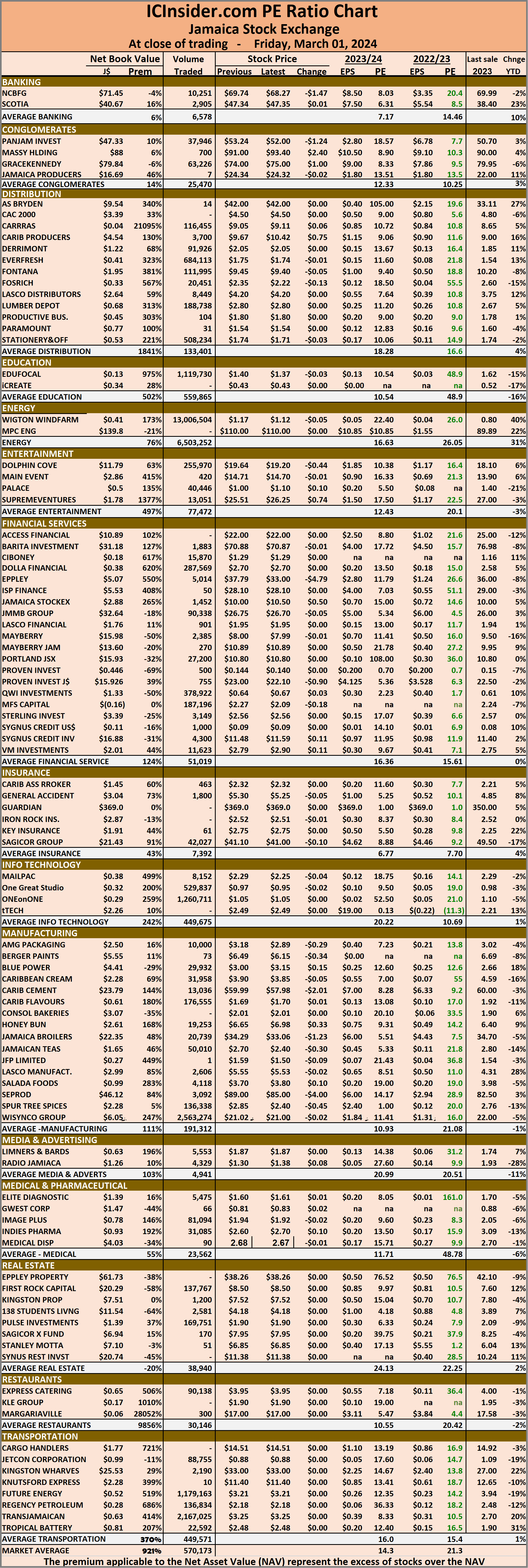

The Main Market ended trading with an average PE Ratio of 13.9. The JSE Main and USD Market PE ratios are based on the last traded prices and earnings forecasts by ICInsider.com for companies with the financial year ending around August 2024.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and six with lower offers.

Investor’s Choice bid-offer indicator shows 13 stocks ended with bids higher than their last selling prices and six with lower offers.

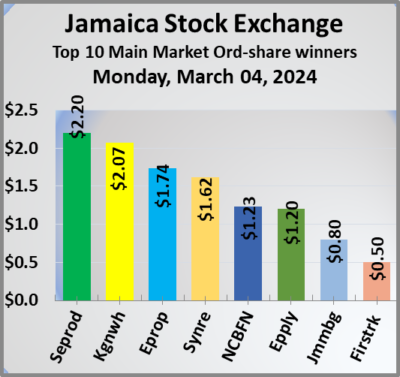

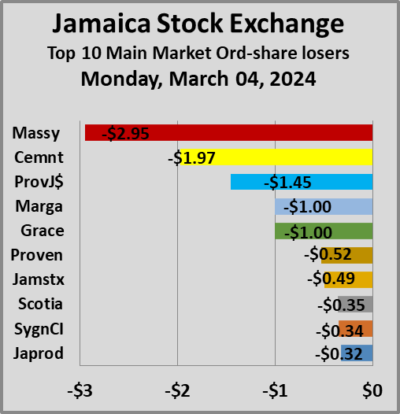

At the close, Caribbean Cement lost $1.97 to end at $56.01 as investors exchanged 2,375 stock units, Eppley increased $1.20 to $34.20 with 1,266 shares clearing the market, GraceKennedy dropped $1 and ended at $74 with investors dealing in 50,481 units. Jamaica Producers fell 32 cents in closing at $24 with 630 stocks crossing the market, Jamaica Stock Exchange declined 49 cents to close at $10.01 while exchanging 1,321 units, JMMB Group climbed 80 cents to $27.50 with investors transferring 24,366 stocks. Kingston Wharves rose $1.57 in closing at $35.07 trading 24,123 shares, Massy Holdings sank $2.95 to close at $90.45 in an exchange of 215 stock units, NCB Financial advanced $1.23 and ended at $69.50 and closed with an exchange of 11,244 shares.  Proven Investments shed 52 cents to end at $21.58 with an exchange of 40,713 stock units, Scotia Group dipped 35 cents in closing at $47 after 13,409 stocks passed through the market, Seprod popped $2.20 to $87.20 after exchanging 14,009 units. Sygnus Credit Investments skidded 34 cents to close at $11.25 with investors trading 136,859 stocks, Transjamaican Highway rallied 32 cents and ended at a 52 weeks’ high of $3.57 in an exchange of 6,857,612 shares and Wisynco Group gained 50 cents to end at $21.50 with traders dealing in 431,342 units.

Proven Investments shed 52 cents to end at $21.58 with an exchange of 40,713 stock units, Scotia Group dipped 35 cents in closing at $47 after 13,409 stocks passed through the market, Seprod popped $2.20 to $87.20 after exchanging 14,009 units. Sygnus Credit Investments skidded 34 cents to close at $11.25 with investors trading 136,859 stocks, Transjamaican Highway rallied 32 cents and ended at a 52 weeks’ high of $3.57 in an exchange of 6,857,612 shares and Wisynco Group gained 50 cents to end at $21.50 with traders dealing in 431,342 units.

In the preference segment, Jamaica Public Service 7% fell $2.30 to $47 after 1,133 stock units crossed the exchange.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading drops on Trinidad Exchange

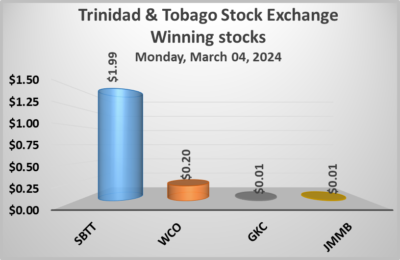

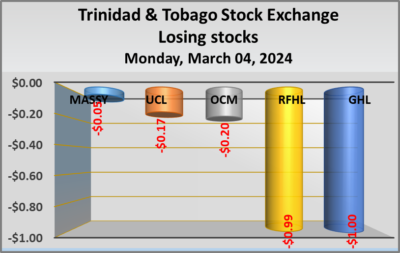

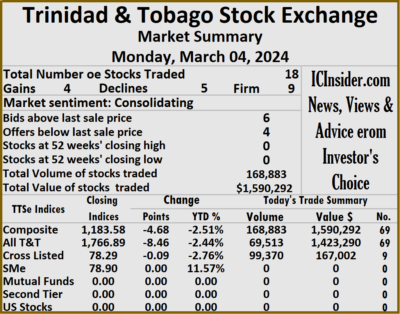

Trading ended on the Trinidad and Tobago Stock Exchange on Monday, with the volume of stocks traded declining 46 percent valued 31 percent lower than on Friday resulting in 18 securities trading compared with 16 on Friday and ending with prices of four stocks rising, five declining and nine remaining unchanged.

The market closed with an exchange of 168,883 shares at $1,590,292 versus 310,273 stock units at $2,302,568 on Friday.

The market closed with an exchange of 168,883 shares at $1,590,292 versus 310,273 stock units at $2,302,568 on Friday.

An average of 9,382 shares were traded at $88,350 compared to 19,392 units at $143,911 on Friday. Trading month to date averaged 14,093 shares at $114,479 compared with an average for February of 21,839 shares at $159,828.

The Composite Index sank 4.68 points to 1,183.58, the All T&T Index dropped 8.46 points to settle at 1,766.89, the SME Index remained at 78.90 and the Cross-Listed Index lost 0.09 points to settle at 78.29.

Investor’s Choice bid-offer indicator shows six stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Agostini’s ended at $68.50, with 20 shares crossing the market, Ansa McAl remained at $53 with investors swapping 500 stocks, First Citizens Group ended at $49.21, with 40 shares changing hands. FirstCaribbean International Bank ended at $7.05 in trading 9 stocks, GraceKennedy advanced 1 cent to end at $3.99 after a transfer of 10,000 shares, Guardian Holdings dropped $1 in closing at $17 after trading 5,808 stock units. JMMB Group popped 1 cent to $1.45 with investors dealing in 89,361 units, Massy Holdings fell 5 cents to close at $4.32 in an exchange of 29,543 stocks, National Enterprises ended at $3.90 and closed with an exchange of 1,000 shares. National Flour Mills remained at $2 after an exchange of 468 stock units, One Caribbean Media slipped 20 cents to $3.01 with investors trading 1,395 units, Prestige Holdings ended at $10.50 in switching ownership of 13,024 stocks.

At the close, Agostini’s ended at $68.50, with 20 shares crossing the market, Ansa McAl remained at $53 with investors swapping 500 stocks, First Citizens Group ended at $49.21, with 40 shares changing hands. FirstCaribbean International Bank ended at $7.05 in trading 9 stocks, GraceKennedy advanced 1 cent to end at $3.99 after a transfer of 10,000 shares, Guardian Holdings dropped $1 in closing at $17 after trading 5,808 stock units. JMMB Group popped 1 cent to $1.45 with investors dealing in 89,361 units, Massy Holdings fell 5 cents to close at $4.32 in an exchange of 29,543 stocks, National Enterprises ended at $3.90 and closed with an exchange of 1,000 shares. National Flour Mills remained at $2 after an exchange of 468 stock units, One Caribbean Media slipped 20 cents to $3.01 with investors trading 1,395 units, Prestige Holdings ended at $10.50 in switching ownership of 13,024 stocks.  Republic Financial shed 99 cents in closing at $119 with traders dealing in 7,702 units, Scotiabank rallied $1.99 to close at $72 after an exchange of 170 stocks, Trinidad & Tobago NGL remained at $9 with a transfer of 9,042 shares. Trinidad Cement remained at $3 as investors exchanged 2 stock units, Unilever Caribbean lost 17 cents in closing at $11.60 with 599 shares clearing the market and West Indian Tobacco increased 20 cents and ended at $9.20 with investors transferring 200 stock units.

Republic Financial shed 99 cents in closing at $119 with traders dealing in 7,702 units, Scotiabank rallied $1.99 to close at $72 after an exchange of 170 stocks, Trinidad & Tobago NGL remained at $9 with a transfer of 9,042 shares. Trinidad Cement remained at $3 as investors exchanged 2 stock units, Unilever Caribbean lost 17 cents in closing at $11.60 with 599 shares clearing the market and West Indian Tobacco increased 20 cents and ended at $9.20 with investors transferring 200 stock units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Trading rises on the JSE USD market

Trading on the Jamaica Stock Exchange US dollar market ended on Friday, with the volume of stocks exchanged rising 40 percent after 48 percent fewer US dollars changed hands compared with Thursday, resulting in trading in eight securities, compared to seven on Thursday with prices of two rising, four declining and two ending unchanged.

The market closed with an exchange of 30,628 shares for US$3,928 compared with 21,861 units at US$7,612 on Thursday.

The market closed with an exchange of 30,628 shares for US$3,928 compared with 21,861 units at US$7,612 on Thursday.

Trading averaged 3,829 units at US$491 compared with 3,123 shares at US$1,087 on Thursday, compared with February with an average of 46,765 units for US$6,084.

The US Denominated Equities Index dropped 5.26 points to end the day at 258.25.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.8. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, Margaritaville climbed 0.25 of one cent and ended at 12 US cents after a transfer of 300 units, Productive Business Solutions ended at US$1.80 after 104 stocks passed through the market, Proven Investments declined 0.49 of one cent to end at 13.95 US cents in switching ownership of 500 shares.  Sterling Investments fell 0.29 of a cent in closing at 1.7 US cents, with 329 stock units crossing the market, Sygnus Credit Investments dropped 0.17 of a cent to close at 8.8 US cents with investors transferring 1,000 shares and Transjamaican Highway rose 0.01 of a cent to 2.11 US cents after trading of 26,564 stocks.

Sterling Investments fell 0.29 of a cent in closing at 1.7 US cents, with 329 stock units crossing the market, Sygnus Credit Investments dropped 0.17 of a cent to close at 8.8 US cents with investors transferring 1,000 shares and Transjamaican Highway rose 0.01 of a cent to 2.11 US cents after trading of 26,564 stocks.

In the preference segment, JMMB Group US8.5% preference share remained at US$1.1489 with an exchange of 1,732 units and Productive Business Solutions 9.25% preference share lost US$1.50 and ended at US$10, with 99 stock units changing hands.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

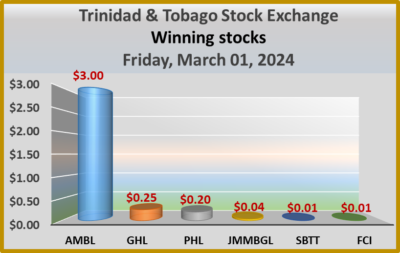

Positive March open for Trinidad Exchange

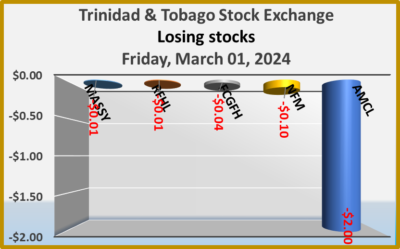

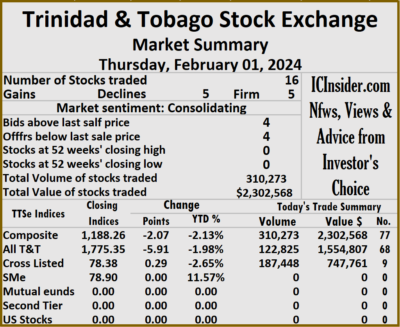

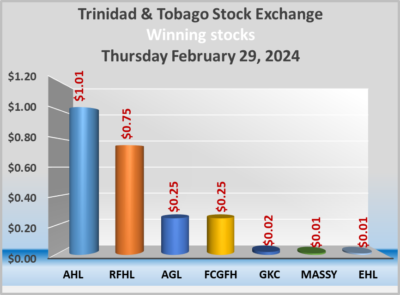

Trading ended on the Trinidad and Tobago Stock Exchange on Friday, as it started March positively with the volume of stocks that were traded rising 268 percent valued 157 percent more than on Thursday resulting in 16 securities changing hands compared to 14 on Thursday, and ending with prices of six stocks rising, five declining and five remaining unchanged.

Trading ended on the Trinidad and Tobago Stock Exchange on Friday, as it started March positively with the volume of stocks that were traded rising 268 percent valued 157 percent more than on Thursday resulting in 16 securities changing hands compared to 14 on Thursday, and ending with prices of six stocks rising, five declining and five remaining unchanged.

The market closed with an exchange of 310,273 shares for $2,302,568 compared to 84,203 stock units at $896,314 on Thursday.

An average of 19,392 shares were traded at $143,911 compared to 6,015 units at $64,022 on Thursday, compared with an average for February of 21,839 shares at $159,82.

The Composite Index dipped 2.07 points to end at 1,188.26, the All T&T Index shed 5.91 points to wrap up trading at 1,775.35, at the same time, the SME Index was unchanged at 78.90 and the Cross-Listed Index popped 0.29 points to settle at 78.38.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

Investor’s Choice bid-offer indicator shows four stocks ended with bids higher than their last selling prices and four with lower offers.

At the close, Angostura Holdings ended at $20 with investors dealing in 2,880 stock units, Ansa McAl lost $2 to close at $53 in an exchange of 530 shares, Ansa Merchant Bank rose $3 and ended at $45.50 after 50 units passed through the market. First Citizens Group dipped 4 cents in closing at $49.21 in switching ownership of 9,144 stock units, FirstCaribbean International Bank added 1 cent to close at $7.05 while exchanging 980 shares, GraceKennedy ended at $3.98 in trading 185,955 stock units. Guardian Holdings popped 25 cents to end at $18, with 5,826 units crossing the exchange, JMMB Group increased 4 cents in closing at $1.44 with investors transferring 513 stocks, Massy Holdings sank 1 cent and ended at $4.37 in an exchange of 81,918 units. National Enterprises ended at $3.90 after 655 shares passed through the market, National Flour Mills skidded 10 cents to $2 after an exchange of 9,083 stock units, Prestige Holdings rallied 20 cents to $10.50 with investors trading 5,092 stocks. Republic Financial slipped 1 cent to $119.99, with 3,564 units crossing the market, Scotiabank gained 1 cent in closing at $70.01 after 236 shares were traded, Trinidad & Tobago NGL remained at $9 after a transfer of 2,690 stock units and Unilever Caribbean ended at $11.77 as investors exchanged 1,157 stocks.

Massy Holdings sank 1 cent and ended at $4.37 in an exchange of 81,918 units. National Enterprises ended at $3.90 after 655 shares passed through the market, National Flour Mills skidded 10 cents to $2 after an exchange of 9,083 stock units, Prestige Holdings rallied 20 cents to $10.50 with investors trading 5,092 stocks. Republic Financial slipped 1 cent to $119.99, with 3,564 units crossing the market, Scotiabank gained 1 cent in closing at $70.01 after 236 shares were traded, Trinidad & Tobago NGL remained at $9 after a transfer of 2,690 stock units and Unilever Caribbean ended at $11.77 as investors exchanged 1,157 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

Record close for JSE USD market

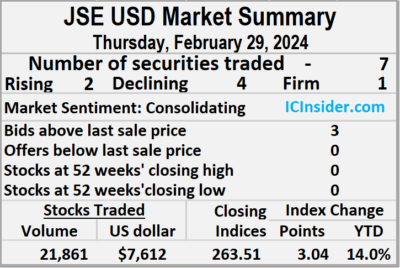

The Jamaica Stock Exchange US dollar market ended at a record close on Thursday with the volume of stocks traded declining by 83 percent after a 70 percent drop in the amount of dollars changing hands on Wednesday, resulting in trading in seven securities, compared to five on Wednesday with prices of two rising, four declining and one ending unchanged.

The market closed with an exchange of 21,861 shares for US$7,612 compared to 125,830 units at US$25,026 on Wednesday.

The market closed with an exchange of 21,861 shares for US$7,612 compared to 125,830 units at US$25,026 on Wednesday.

Trading averaged 3,123 units at US$1,087 versus 25,166 shares at US$5,005 on Wednesday, with a month to date average of 46,765 shares at US$6,084 compared with 49,133 units at US$6,355 on the previous day and January that ended with an average of 46,765 units for US$6,084.

The US Denominated Equities Index popped 3.04 points to close at a record high of 263.47.

The PE Ratio, a measure used in computing appropriate stock values, averages 9.8. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and none with a lower offer.

At the close, First Rock Real Estate USD share gained 0.4 of one cent and ended at 4.5 US cents after investors finished trading 200 stocks, Margaritaville dropped 1.03 cents to 11.75 US cents while exchanging 325 units,  Productive Business Solutions sank 5 cents to end at US$1.80 with an exchange of 3,157 shares. Proven Investments remained at 14.44 US cents after 1,046 stock units changed hands, Sygnus Credit Investments popped 0.07 of a cent to close at 8.97 US cents after a transfer of 100 shares and Transjamaican Highway skidded 0.01 of a cent to 2.1 US cents in switching ownership of 16,019 units.

Productive Business Solutions sank 5 cents to end at US$1.80 with an exchange of 3,157 shares. Proven Investments remained at 14.44 US cents after 1,046 stock units changed hands, Sygnus Credit Investments popped 0.07 of a cent to close at 8.97 US cents after a transfer of 100 shares and Transjamaican Highway skidded 0.01 of a cent to 2.1 US cents in switching ownership of 16,019 units.

In the preference segment, JMMB Group US8.5% preference share lost 0.01 of a cent to close at US$1.1489 with investors dealing in 1,014 stocks.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

One falling stock sinks Trinidad Exchange

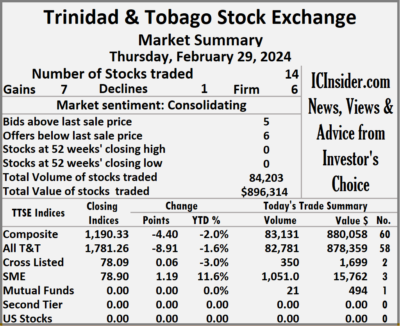

The Trinidad and Tobago Stock Exchange closed out February, with the volume of stocks trading on Thursday rising 11 percent but with a 43 percent lower value than on Wednesday resulting in 14 securities trading compared with 17 on Wednesday and ending with prices of seven stocks rising, only one declining and six remaining unchanged.

Republic Financial was the only stocks to fall on Thursday.

The market closed trading with an exchange of 84,203 shares for $896,314 compared to 75,574 stock units at $1,559,727 on Wednesday.

An average of 6,015 shares were traded at $64,022 compared to 4,446 units at $91,749 on Wednesday, with trading month to date averaging 21,839 shares at $159,828 compared with 22,609 units at $164,485 on the previous day and an average for January of 15,998 shares at $167,627.

The Composite Index declined 4.40 points to close at 1,190.33, the All T&T Index skidded 8.91 points to end trading at 1,781.26, the SME Index advanced 1.19 points to end the day at 78.90 and the Cross-Listed Index rallied 0.06 points to end the day at 78.09.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and six with lower offers.

Investor’s Choice bid-offer indicator shows five stocks ended with bids higher than their last selling prices and six with lower offers.

At the close, Agostini’s increased 25 cents to end at $68.50 in switching ownership of 1,620 units, Angostura Holdings climbed $1.01 in closing at $20 with investors trading 2,283 stocks, Calypso Macro Investment Fund ended at $23.50, with 21 shares crossing the market. Endeavour Holdings popped 1 cent and ended at $15 with traders dealing in 1,051 stock units, First Citizens Group rose by 25 cents to close at $49.25, with 1,290 shares crossing the exchange, FirstCaribbean International Bank remained at $7.04 with investors swapping 100 stocks.  GraceKennedy rose 2 cents to end at $3.98 with an exchange of 250 units, Guardian Holdings remained at $17.75 and closed with an exchange of 585 stock units, Massy Holdings rallied 1 cent and ended at $4.38 with investors transferring 63,192 shares. Prestige Holdings ended at $10.30 in an exchange of 787 stocks, Republic Financial gained 75 cents to close at $120 after trading 2,125 units, Scotiabank dropped $3 to close at $70 with a transfer of 180 stock units. Trinidad & Tobago NGL remained at $9 after 10,619 shares passed through the market and Unilever Caribbean ended at $11.77 after a transfer of 100 units.

GraceKennedy rose 2 cents to end at $3.98 with an exchange of 250 units, Guardian Holdings remained at $17.75 and closed with an exchange of 585 stock units, Massy Holdings rallied 1 cent and ended at $4.38 with investors transferring 63,192 shares. Prestige Holdings ended at $10.30 in an exchange of 787 stocks, Republic Financial gained 75 cents to close at $120 after trading 2,125 units, Scotiabank dropped $3 to close at $70 with a transfer of 180 stock units. Trinidad & Tobago NGL remained at $9 after 10,619 shares passed through the market and Unilever Caribbean ended at $11.77 after a transfer of 100 units.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

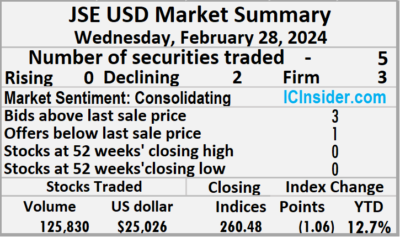

JSE USD trading bounces

Trading on the Jamaica Stock Exchange US dollar market ended on Wednesday, with a 1,853 percent jump in the volume of stocks exchanged following 234 percent more US dollars passing through the market than on Tuesday and resulting in trading in five securities, compared to seven on Tuesday with prices of no rising, two declining and three ending unchanged.

The market closed with an exchange of 125,830 shares for US$25,026 compared to 6,443 units at US$7,499 on Tuesday.

The market closed with an exchange of 125,830 shares for US$25,026 compared to 6,443 units at US$7,499 on Tuesday.

Trading averaged 25,166 units at US$5,005 versus 920 shares at US$1,071 on Tuesday, with a month to date average of 49,133 shares at US$6,355 compared with 50,100 units at US$6,410 on the previous day and January that ended with an average of 42,169 units for US$5,037.

The US Denominated Equities Index slipped 1.06 points to settle at 260.48.

The PE Ratio, a measure used in computing appropriate stock values, averages 10. The PE ratio is computed based on the last traded price divided by projected earnings done by ICInsider.com for companies with their financial year ending and or around August 2024.

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and one with a lower offer.

At the close, Proven Investments dipped 0.06 of a cent in closing at 14.44 US cents with investors trading 275 stocks, Sygnus Credit Investments remained at 8.9 US cents with an exchange of 5,448 units and Transjamaican Highway fell 0.02 of a cent to end at 2.11 US cents in trading 109,605 shares.

At the close, Proven Investments dipped 0.06 of a cent in closing at 14.44 US cents with investors trading 275 stocks, Sygnus Credit Investments remained at 8.9 US cents with an exchange of 5,448 units and Transjamaican Highway fell 0.02 of a cent to end at 2.11 US cents in trading 109,605 shares.

In the preference segment, JMMB Group US8.5% preference share ended at US$1.149 in switching ownership of 9,519 stock units and Productive Business Solutions 9.25% preference share remained at US$11.50, with 983 shares crossing the market.

Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

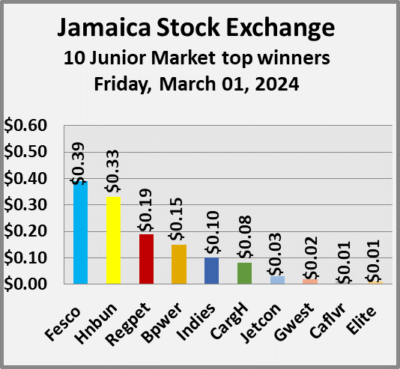

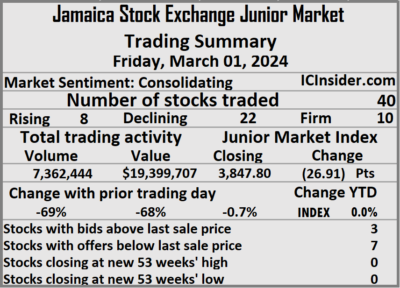

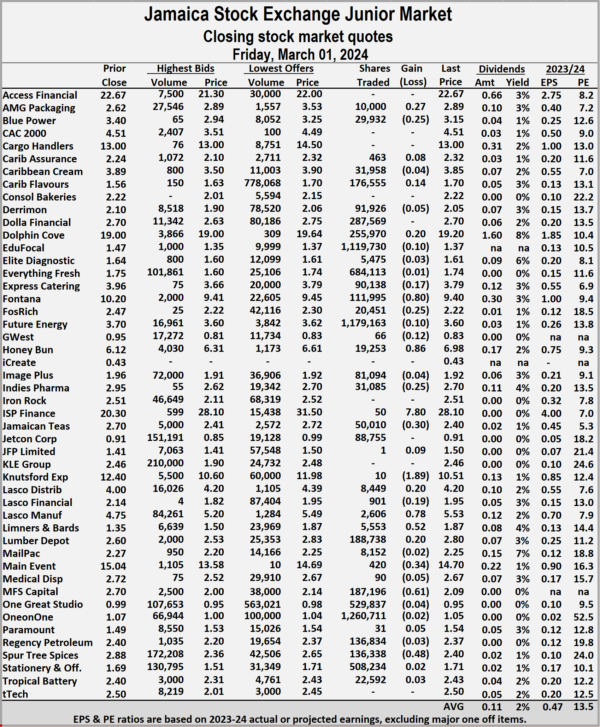

The market closed on the day of March with an exchange of 7,362,444 shares for $19,399,707 compared with 23,801,250 units at $60,698,281 on Thursday, with an average of 184,061 shares at $484,993, compared with 528,917 stock units at $1,348,851 on Thursday and February with an average of 253,246 units at $637,481.

The market closed on the day of March with an exchange of 7,362,444 shares for $19,399,707 compared with 23,801,250 units at $60,698,281 on Thursday, with an average of 184,061 shares at $484,993, compared with 528,917 stock units at $1,348,851 on Thursday and February with an average of 253,246 units at $637,481. Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and seven with lower offers.

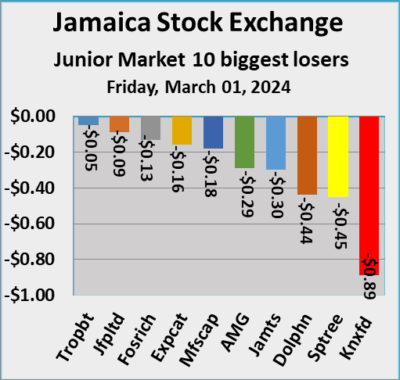

Investor’s Choice bid-offer indicator shows three stocks ended with bids higher than their last selling prices and seven with lower offers. Honey Bun rose 33 cents in closing at $6.98 with investors swapping 19,253 units, Indies Pharma rallied 10 cents and ended at $2.70 in an exchange of 31,085 stock units, Jamaican Teas shed 30 cents to end at $2.40, with 50,010 shares passing through the market. JFP Ltd declined 9 cents to close at $1.50 in an exchange of one stock unit, Knutsford Express fell $1.09 to $10.51, with 10 stocks MFS Capital Partners lost 18 cents to end at $2.09 trading 187,196 stock units. Regency Petroleum declined 7 cents in closing at $2.37 after 136,834 shares crossed the market and Spur Tree Spices shed 45 cents to close at $2.40 after a transfer of 136,338 units.

Honey Bun rose 33 cents in closing at $6.98 with investors swapping 19,253 units, Indies Pharma rallied 10 cents and ended at $2.70 in an exchange of 31,085 stock units, Jamaican Teas shed 30 cents to end at $2.40, with 50,010 shares passing through the market. JFP Ltd declined 9 cents to close at $1.50 in an exchange of one stock unit, Knutsford Express fell $1.09 to $10.51, with 10 stocks MFS Capital Partners lost 18 cents to end at $2.09 trading 187,196 stock units. Regency Petroleum declined 7 cents in closing at $2.37 after 136,834 shares crossed the market and Spur Tree Spices shed 45 cents to close at $2.40 after a transfer of 136,338 units. Prices of securities trading are those for the last transaction of each stock unless otherwise stated.

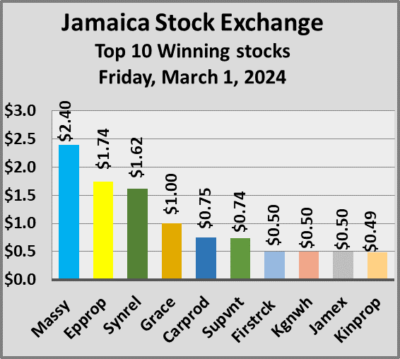

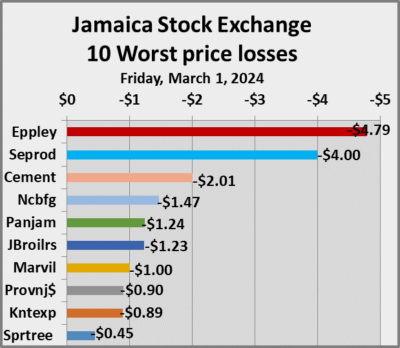

Prices of securities trading are those for the last transaction of each stock unless otherwise stated. Trading ended for the week, with the JSE Combined Market Index rising 198.41 points to 349,346.11, the All Jamaican Composite Index skidded 245.25 points to end at 376,387.70, the JSE Main Index rallied 462.86 points to 336,567.99. The Junior Market Index fell 26.91 points to close at 3,847.80 and the JSE USD Market Index skidded 5.22 points to conclude trading at 258.25.

Trading ended for the week, with the JSE Combined Market Index rising 198.41 points to 349,346.11, the All Jamaican Composite Index skidded 245.25 points to end at 376,387.70, the JSE Main Index rallied 462.86 points to 336,567.99. The Junior Market Index fell 26.91 points to close at 3,847.80 and the JSE USD Market Index skidded 5.22 points to conclude trading at 258.25. In the preference segment, Jamaica Public Service 9.5% gained $50 to close at $2,900, 138 Student Living preference share advanced $12.08 to end at $217 and Productive Business Solutions 10.5% preference share lost $1.69 in closing at $1273.30.

In the preference segment, Jamaica Public Service 9.5% gained $50 to close at $2,900, 138 Student Living preference share advanced $12.08 to end at $217 and Productive Business Solutions 10.5% preference share lost $1.69 in closing at $1273.30. Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock.

Investors who buy when the price of a stock is close to the average will find that they are not inclined to overpay for a stock. At the close of trading, the JSE Combined Market Index climbed 341.07 points to close at 349,147.70, the All Jamaican Composite Index climbed 1,486.05 points to end at 376,632.95, the JSE Main Index increased 228.87 points to settle at 336,105.13. The Junior Market Index popped 14.44 points to wrap up trading at 3,874.71 and the JSE USD Market Index skidded 2.46 points to settle at 263.47.

At the close of trading, the JSE Combined Market Index climbed 341.07 points to close at 349,147.70, the All Jamaican Composite Index climbed 1,486.05 points to end at 376,632.95, the JSE Main Index increased 228.87 points to settle at 336,105.13. The Junior Market Index popped 14.44 points to wrap up trading at 3,874.71 and the JSE USD Market Index skidded 2.46 points to settle at 263.47. In the Junior Market, Spur Tree Spices led trading with 4.80 million shares followed by JFP Ltd with 4.25 million units, Regency Petroleum ended with 3.34 million stock units, Fosrich closed trading with 2.11 million units, Lasco Distributors closed with 1.95 million stocks and ONE on ONE Educational exchanged 1.02 million units.

In the Junior Market, Spur Tree Spices led trading with 4.80 million shares followed by JFP Ltd with 4.25 million units, Regency Petroleum ended with 3.34 million stock units, Fosrich closed trading with 2.11 million units, Lasco Distributors closed with 1.95 million stocks and ONE on ONE Educational exchanged 1.02 million units. Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.

Investors need pertinent information to navigate numerous investment options successfully in the stock market. The ICInsider.com PE ratio chart and the more detailed daily report charts provide investors with regularly updated information to help decision-making.