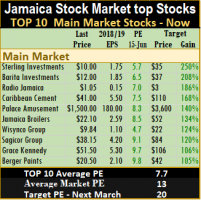

Jamaica Broilers returns to the main market TOP 10 list with a fall in the price to $22.10 by the end of the week from $26.30 last week and CAC 2000 returns after last been on the list, in December.

Jamaica Broilers returns to the main market TOP 10 list with a fall in the price to $22.10 by the end of the week from $26.30 last week and CAC 2000 returns after last been on the list, in December.

CAC replaced Medical Disposables while JMMB Group moved up to $29.45 to be replaced by Jamaica Broilers.

During the week the main market traded at a record close on two days but closed the week below the record high. The main market saw new buying interest coming in for a number of stocks, at the same time that supply for them have dried up. Interest rates on Treasury bills fell in the June auction and inflation remains negative for the year to May. With those developments the main market seems poised to move to more records in the weeks ahead. Strong upward movement is also being signaled by the fact that, the market is breaking out of a wedge formation.

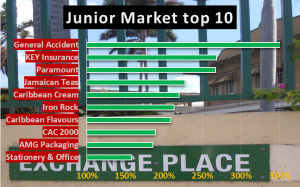

The junior market broke through a declining resistance line during the early part of the week but retreated by week end. Technical indicators are pointing to a strong upward movement, with a golden cross approaching, with the long term moving average line set to cross over the medium and short term lines not too far away.

The junior market broke through a declining resistance line during the early part of the week but retreated by week end. Technical indicators are pointing to a strong upward movement, with a golden cross approaching, with the long term moving average line set to cross over the medium and short term lines not too far away.

The past week was very eventful for the Jamaica Stock market as the main market surged to new all-time highs and the Junior Market surged more than 100 points in the early part of the week and broke through resistance before pulling back.

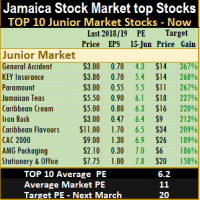

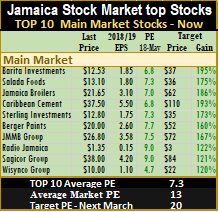

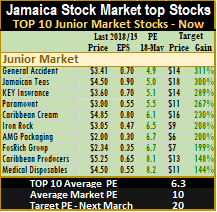

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6.2 compared to an average PE for the overall main market of 11, based on 2018 estimated earnings. The main market PE is 7.7 for the top stocks, compared to a market average of 12.7.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 44 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings and main market stocks traded at a discount of 41 percent to the market.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 44 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings and main market stocks traded at a discount of 41 percent to the market.

Stocks to Watch CAC 2000 reported strong half year results during the past week, with the second quarter more than doubling even after accounting for cost associated with issuing new preference shares. NCB Financial sits just below the TOP 10 list and has good growth prospects for patient investors. During the week, the price moved to $100 where there is some selling but that level could be taken out during the coming week and pave the way for more gains.

PanJam Investment could move higher this week as there is very limited supply of the stock on offer. Investors should also keep an eye out for Sygnus Credit shares that list on Monday and should see a slight bounce in the price. Others worth watching include Caribbean Cement, Berger Paints and Grace Kennedy for which there was increased demand by the end of the week. In the Junior Market, Stationery and Office Supplies could decline further during the week but could find support in the mid $6 to low $7 region before rebounding. Jamaican Teas came in for buying in the week but supply has been limited and could result in more gains for the stock that traded at a record close of $5.50 during the week.

PanJam Investment could move higher this week as there is very limited supply of the stock on offer. Investors should also keep an eye out for Sygnus Credit shares that list on Monday and should see a slight bounce in the price. Others worth watching include Caribbean Cement, Berger Paints and Grace Kennedy for which there was increased demand by the end of the week. In the Junior Market, Stationery and Office Supplies could decline further during the week but could find support in the mid $6 to low $7 region before rebounding. Jamaican Teas came in for buying in the week but supply has been limited and could result in more gains for the stock that traded at a record close of $5.50 during the week.

Grace & Carib Producers back in TOP 10

the past week was very eventful for the Jamaica Stock market as the main market surged to a new all-time high and the Junior market surges more than 100 points in the early part of the week and broke through resistance before pulling back.

the past week was very eventful for the Jamaica Stock market as the main market surged to a new all-time high and the Junior market surges more than 100 points in the early part of the week and broke through resistance before pulling back.

Importantly, although the results for the first quarter of 2018 for many companies did not show strong gains while some showed declines compare with 2017, both the junior and main markets are at points to break out of a wedge formation. The moves are bias to the upside.

Medical Disposables jumped to $5 from $4.30 last week and was eased out of the top stocks and replaced by Caribbean Producers. Stationery and Office Supplies fell by the end of the week to $7.80, moving up on the list in the process,  the order book of the stock suggest further decline before it bottoms out. Jamaican Teas price moved to $5.25 during the latter part of the week as demands picks up and supplies appear to have been declining, but by the end of the week it closed at $5.

the order book of the stock suggest further decline before it bottoms out. Jamaican Teas price moved to $5.25 during the latter part of the week as demands picks up and supplies appear to have been declining, but by the end of the week it closed at $5.

In the main market, Jamaica broilers jumped to a record close of $26.30 on Friday, up from $21 at the end of the prior week and moved well outside the top 10 list, replaced by Grace Kennedy that slipped 50 cents in price by week end.

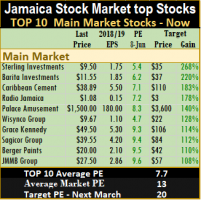

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6,2 compared to an average PE for the overall main market of 11, based on 2018 estimated earnings. The main market PE is 7.6 for the top stocks, compared to a market average of 13.

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6,2 compared to an average PE for the overall main market of 11, based on 2018 estimated earnings. The main market PE is 7.6 for the top stocks, compared to a market average of 13.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 44 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings and main market stocks traded at a discount of 41 percent to the market.

Stocks to watch. Scotia Group reported half year results during the past week, but there was nothing about them for investors to be excited about, as they showed lower profits in the April quarter than a year ago period.

The stock price pulled back sharply on release of the results. The stock yields a dividend of 4 percent which is higher than treasuries and this could be an attraction for some investors while they await return to profit growth. NCB sits just below the TOP 10 list and has good growth prospects for patient investors. PanJam Investment that IC Insider.com reported on in a separate article last week caught the eyes of some investors who moved the price up to $51.98 and it could go higher this week has there is very limited supply for this one. Investors should also keep an eye out for Sygnus Credit that could have its shares listed by next week.

The stock price pulled back sharply on release of the results. The stock yields a dividend of 4 percent which is higher than treasuries and this could be an attraction for some investors while they await return to profit growth. NCB sits just below the TOP 10 list and has good growth prospects for patient investors. PanJam Investment that IC Insider.com reported on in a separate article last week caught the eyes of some investors who moved the price up to $51.98 and it could go higher this week has there is very limited supply for this one. Investors should also keep an eye out for Sygnus Credit that could have its shares listed by next week.

Good news push TOP 10 stocks

There were no new entrants this past week, to the TOP 10 list of stocks on the Jamaican Stock Exchange, but there was some good news with the acquisition by Stationery and Office Supplies of a book making business.

There were no new entrants this past week, to the TOP 10 list of stocks on the Jamaican Stock Exchange, but there was some good news with the acquisition by Stationery and Office Supplies of a book making business.

The acquisition is set to add to profit in year one, and investors responded by driving the stock to a new high. The stock that was facing some challenge to get bids around the $5.50 level, the stock traded at in the past few weeks, jumped to $6 on the same day the announcement was made. With annual sales estimated around $130 million that could rise with greater focus on the operations and more capital available to support it, IC Insder.com has up graded the earnings to 90 cents for this year. The company is one of a number of Junior Market listings expected to post positive gains in the 2018 first quart over that of 2017.

The other good news for the market was a further fall in Treasury bill rates and another month of slightly negative inflation for March with the first quarter inflation also being negative. While the main market hit two new record highs during the week. While the JSE main market is caught up in a wedge formation and waiting for a big break out which could happen any time, the Junior Market that was in a downward drift from late 2017 now seems to have support from the 200 day and 120 day moving averages with the short term moving average now above both longer term ones. The market is being steered by two support lines with one going back to 2010 and another going back to early 2014.

The other good news for the market was a further fall in Treasury bill rates and another month of slightly negative inflation for March with the first quarter inflation also being negative. While the main market hit two new record highs during the week. While the JSE main market is caught up in a wedge formation and waiting for a big break out which could happen any time, the Junior Market that was in a downward drift from late 2017 now seems to have support from the 200 day and 120 day moving averages with the short term moving average now above both longer term ones. The market is being steered by two support lines with one going back to 2010 and another going back to early 2014.

Investors pressured recently listed Elite Diagnostic during the week as they reacted negatively to the December quarter results with lower profit that the previous year’s results.  Investors seemed to have responded the Berger Paints bullish reading in the annual report as they bought the stock in increasing volumes during the week, leaving the price at $19. The Managing Director had reported that “the outlook for 2018 and beyond is extremely positive. The Berger brand remains strong and continues to dominate the local market with strong brand equity and a reputation for quality. With GDP projected to grow by at least 1.5% in 2018, construction activity and the demand for coatings is expected to remain relatively strong for the next two to three years. Plans are already being implemented to expand the company’s local distribution and product range as well as to improve our level of customer service and responsiveness. In 2018, there will also be greater emphasis on building out exports by targeting new markets in Central America and the Greater CARICOM region.”

Investors seemed to have responded the Berger Paints bullish reading in the annual report as they bought the stock in increasing volumes during the week, leaving the price at $19. The Managing Director had reported that “the outlook for 2018 and beyond is extremely positive. The Berger brand remains strong and continues to dominate the local market with strong brand equity and a reputation for quality. With GDP projected to grow by at least 1.5% in 2018, construction activity and the demand for coatings is expected to remain relatively strong for the next two to three years. Plans are already being implemented to expand the company’s local distribution and product range as well as to improve our level of customer service and responsiveness. In 2018, there will also be greater emphasis on building out exports by targeting new markets in Central America and the Greater CARICOM region.”

Palace Amusement continues to enjoy expanded interest from investors with the continued success of the movie Black Panther.

After more than two months of showing it still has two showings per day in all three cinemas, but the attraction for the stock is much more than this movie.

After more than two months of showing it still has two showings per day in all three cinemas, but the attraction for the stock is much more than this movie.

Strong buying came in for Barita Investments at $9.50 during the week. JMMB Group gained more ground, as the block out period for insiders to trade in the stock closes and the stock moved up to $28.32, resistance is just over $31 an area investors should be on the lookout for in the short run.

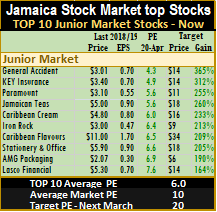

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6 compared to an average PE for the overall main market of 10 based on 2018 estimated earnings. The main market PE remains at 7 for the top stocks, compared to a market average of 12.7.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 40 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings and main market stocks traded at a discount of 42 percent to the market.

Palace, Grace out NCB & PanJam in TOP 10

There were no entrants or exists from to the Junior Market TOP 10 list but Palace Amusement more than doubled during the week rising 132 percent and left the list along with Grace Kennedy that rose to $51.50. The two are replaced by NCB Financial and PanJam Investment.

There were no entrants or exists from to the Junior Market TOP 10 list but Palace Amusement more than doubled during the week rising 132 percent and left the list along with Grace Kennedy that rose to $51.50. The two are replaced by NCB Financial and PanJam Investment.

PanJam released 2017 audited financial statements with increased earnings of 29 percent to $4.13 billion, from ongoing operations resulting in earnings per share of $3.93. The group is expected to continue to enjoy increased earnings in 2018.

The main market hit record highs during the week but pulled back as the market move closer to resistance level in a long term channel.  It just a matter of time for the break out to take place, regardless the channel points upwards for the market. Profit results for 2018 first quarter, will be important in helping to fuel the break out but with Treasury bill rates falling to 3.16 percent on the 182 days instrument during the past week, an important leg for a rally to come, is in place.

It just a matter of time for the break out to take place, regardless the channel points upwards for the market. Profit results for 2018 first quarter, will be important in helping to fuel the break out but with Treasury bill rates falling to 3.16 percent on the 182 days instrument during the past week, an important leg for a rally to come, is in place.

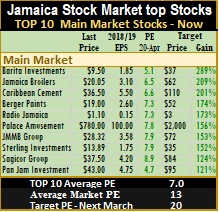

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6.3 compared to an average PE for the overall main market is 10 based on 2018 estimated earnings. At the same time the main market ended the week with a PE of 6.7 for the top stocks compared to a market average of close to 12.

At the same time the main market ended the week with a PE of 6.7 for the top stocks compared to a market average of close to 12.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 37 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be, of 20 times earnings and main market stocks traded at a discount of 45 percent to the market

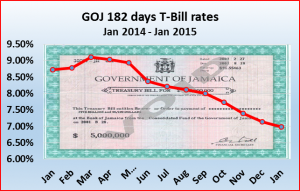

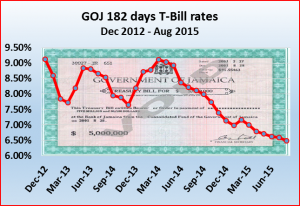

Treasury bill rates continue slide

Interest rates fell in the latest issues of Treasury bill that were on offer on Wednesday continuing a slow decent since the start of 2015 but a much steeper decline form March last year. The two offerings for $400m each, attracted bids for over $940 million each with a total of 1.93 billion.

Interest rates fell in the latest issues of Treasury bill that were on offer on Wednesday continuing a slow decent since the start of 2015 but a much steeper decline form March last year. The two offerings for $400m each, attracted bids for over $940 million each with a total of 1.93 billion.

The 91 days instrument cleared at an average of 6.352 percent down from July’s average of 6.44 percent with bids between 5.93 percent to 6.4304 percent were fully accepted while the 182 days yielded an average 6.49 percent a decline from July’s average of 6.60 percent with bids between 6.2 to 6.55 percent being fully allotted.

The declines come against the back ground of Bank of Jamaica (BOJ) 0.25 percent cut in its 30 days CD rates effective on Tuesday. There is no indication in the Treasury bill average rate that the BOJ move had any noticeable impact, although the rate of decline this time around is steeper than the previous three.

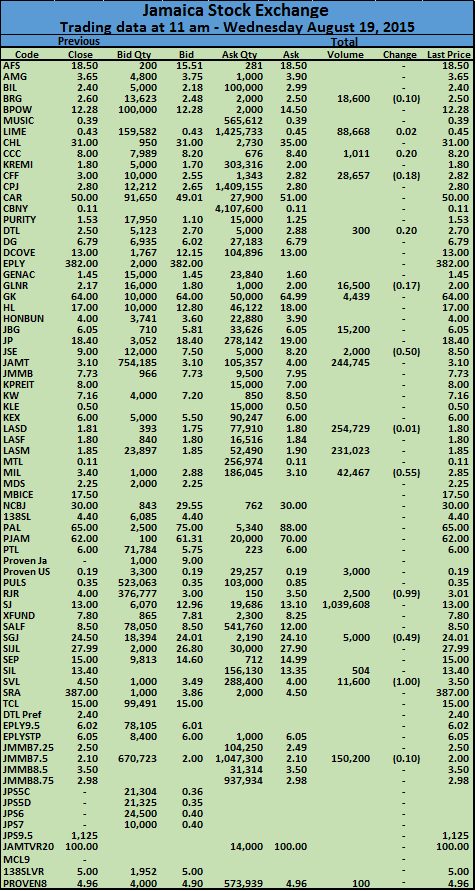

Big drop for JSE Wednesday morning

The Jamaica Stock market suffered large losses in the morning session up to 11 am, in the process the All Jamaica Index trades at 110,281.78 to fall by 2,012.29 points, JSE Market Index declined 1,800.35 points to 99,614.99. The combined index fell 1,738.30 points to be at 103,101.32 and the junior market index 1,013.25, down 4.50 points.

Today the Treasury bill bid in the monthly auction is opened. This is a day when investors’ minds are historically not focused on the stock market as they await the outcome of interest rates, as well as how successful their bidding turn out to be. The sluggishness in trading in the morning session, could be related to this development. At the close of trading on Tuesday the signals were for a weaker market on Wednesday, today’s slowness should come as no great surprise.

Today the Treasury bill bid in the monthly auction is opened. This is a day when investors’ minds are historically not focused on the stock market as they await the outcome of interest rates, as well as how successful their bidding turn out to be. The sluggishness in trading in the morning session, could be related to this development. At the close of trading on Tuesday the signals were for a weaker market on Wednesday, today’s slowness should come as no great surprise.

On a day when there were few stocks rising, Cable & Wireless buck the trend with a rise to 45 cents with only 88,668 units, Caribbean Cement traded only 1,011 units at $8.20 for a 20 cents rise, Scotia Group fell back from $24.50 to $24.01 with just 5,000 shares and contributed a large portion of the fall in the indices, Jamaica Stock Exchange that traded at a new high of $9 on Tuesday traded just 2,000 shares at $8.50 but the stock has an offer at $8.20. Mayberry fell 55 cents to $2.85, with 42,467 shares, Radio Jamaica traded 2,500 shares with a loss of 99 cents to $3.01 and Supreme Ventures traded at 11,600 shares and fell $1 to $3.50.

A total of 21 securities with a volume of only 2,160,851 units have traded with 10 stocks declining versus 3 that rose.

T-bill rates drop sharply

The average rate for the 90 day Treasury bill instrument came out at 7.66 percent at today’s auction, down sharply from the May auction which came out at an average of 8.2 percent as Government sought to raise $400 million for this time frame but the auction saw $851 million chasing after the amount available. The 180 day instrument which averaged 8.932 percent in May plummeted to 8.365 percent as $877 million chased after the $400 million available.

The average rate for the 90 day Treasury bill instrument came out at 7.66 percent at today’s auction, down sharply from the May auction which came out at an average of 8.2 percent as Government sought to raise $400 million for this time frame but the auction saw $851 million chasing after the amount available. The 180 day instrument which averaged 8.932 percent in May plummeted to 8.365 percent as $877 million chased after the $400 million available.

Also on offer was a 30 day instrument to raise $400 million which provided an average rate of 6.797 percent as $534,303,700 chased after the $400 million that was available. The previous 30 day Treasury bill issued cleared at an average rate of 6.99 percent, in May this year.

That will change as the weeks roll on, it may be that investors are now taking a break for May, this coming week could have the answer.

That will change as the weeks roll on, it may be that investors are now taking a break for May, this coming week could have the answer.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 38 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings and main market stocks traded at a discount of 45 percent to the market.

IC Insider.com’s TOP 10 stocks now trade at an average discount of 38 percent to the average for the Junior Market Top stocks but it’s a third of what the average PE for the year is likely to be of 20 times earnings and main market stocks traded at a discount of 45 percent to the market.