After nearly three years in the doldrums and on life support, helped by a number of popular and well patronized movies, Palace Amusement surged back to life in the December 2022 quarter when it made the first quarterly profit since March 2020. The profit back then was $44 million from revenues of $255 million, with the latest results surpassing it and easing much of the pain and nervousness the company and its staff encountered over the past three years.

Carib Cinema, the flagship for Palace Amusement.

“The company staged three block-buster pictures in the same Quarter – Woman King, Black Panther 2: Wankanda Forever and Avatar 2: The Way of Water; Our patrons’ response was close to 215,000 visits in the Quarter and this helped to push the overall attendance at the end of the six months to over 80 percent of pre-pandemic numbers,” the company’s management stated in a report accompanying the financials.

Palace aced the December quarter with revenues of $486 million, up 222 percent from just $151 million in 2021 and $736 million for the half year, up 218 percent from a mere $232 million in 2021. Accumulated profit of $304 million at June 2019, melted away by $772 million of losses, to a deficit of $468 million up to September last year as revenues were lower than cost, but profit surged to $79 million in the December quarter from a massive loss of $112 million in 2021 and for the half year a profit of $25 million from a loss of $191 million in 2021.

While revenues surged over 200 percent, direct expenses rose a more modest 98 percent in the December quarter and 97 percent, year to date, helping to swell the profit for both periods, but administrative expenses fell from $75 million to $47 million in the quarter and from $104 million for the half year to $75 million. Finance cost rose from $12 million in the 2021 last quarter to $14 million and from $17 million to $28 million for the half year. Legal and professional fees is one of the major areas of cost reduction in the period, dropping from $44 million to just $2 million for the six months period.

Segment Results show revenues of $266 million for Carib Cinema, up from just $91 million in 2021, with a profit of $11 million versus a $21 million loss in 2021. Cineplex had no revenues in 2021 but suffered a loss of $14 million and bounced back in 2022 with revenues of $99 million and profit of $20 million. Sunshine Palace generated revenues of $203 million versus $54 million in 2021 with profit of $41 million compared with a loss of $35 million in 2021. The 2022 revenues include $43 million classified as other activities for Sunshine Palace. Multiplex delivered revenues of $143 million in 2022, up from just $35 million in 2021 with a profit of $20 million versus a loss of $23 million in 2021.

Cash flow brought in $53 million compared with outflows of $163 million in 2021 and helped in boosting funds on hand at the end of the calendar year.

Palace Multiplex in Montego Bay.

From all that can be seen movies are still attracting patronage with what have been described as some good films and by the end of the fiscal year in June, the company seems set to be on its way to justifying their new bankers backing the company with a $700 million loan some of which was used to close out the Scotiabank loan and when the full history of this period unfolds the name Carol Lee, the financial controller will be high on the list for helping to save and restore the company to financial health.

The company now boast equity of $404 million thanks to the above profit and some $772 million in revaluation surplus, with $606 million of it coming in 2020. The company has some more lifting to do to steer them out of the woods while hoping that there will be no major setback in the recovery as they have $756 million in long term debt to be cleared in addition to $60 million of short term loans. There are halfway there with cash funds of $379 million on hand that should grow in the second half of the fiscal year. Palace also has accounts payable amounting to $435 million at the end of 2022 which is up from $386 million at the end of December 2021 and is covered by current assets of $481 million.

At this year’s annual general meeting, shareholders approved a 600 to 1 split as a result the stock trades x-split starting Monday, February 27, with the record date of February 28. The split will take the total number of shares to 862 million from 1.437 million currently.

The company should deliver earnings for the full year ending in June at around $100 per share.

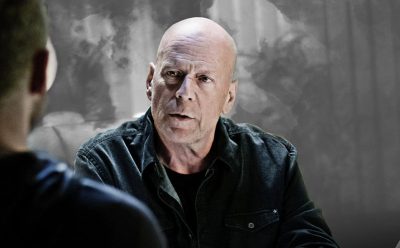

The big winners for the year to July are,

The big winners for the year to July are,  The big losers in the main market are,

The big losers in the main market are,

Second quarter results may not be good enough to push the stock much higher but when the growth in other comprehensive income is factored in, the stocks is still extremely cheap.

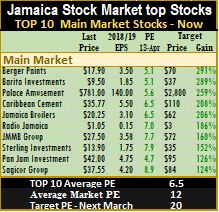

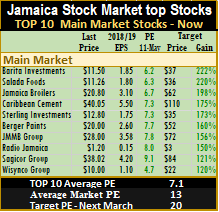

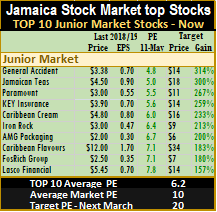

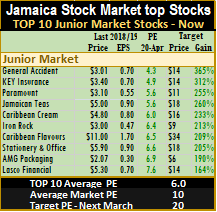

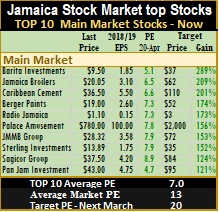

Second quarter results may not be good enough to push the stock much higher but when the growth in other comprehensive income is factored in, the stocks is still extremely cheap. At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6.2 compared to an average PE for the overall main market of 10 based on 2018 estimated earnings. The main market PE is 7.2 for the top stocks, compared to a market average of 13.

At the close of Friday, the average PE ratio for Junior Market Top stocks ended at 6.2 compared to an average PE for the overall main market of 10 based on 2018 estimated earnings. The main market PE is 7.2 for the top stocks, compared to a market average of 13.

The popularity of the Palace Amusement’s the Avengers Infinity War, now showing on the company’s cinema circuit has elicited some fictitious email now in circulation offering members of the public the chance to win free tickets to the blockbuster, Avengers showing.

The popularity of the Palace Amusement’s the Avengers Infinity War, now showing on the company’s cinema circuit has elicited some fictitious email now in circulation offering members of the public the chance to win free tickets to the blockbuster, Avengers showing. There were no new entrants this past week, to the TOP 10 list of stocks on the Jamaican Stock Exchange, but there was some good news with the acquisition by

There were no new entrants this past week, to the TOP 10 list of stocks on the Jamaican Stock Exchange, but there was some good news with the acquisition by  The other good news for the market was a further fall in

The other good news for the market was a further fall in  Investors seemed to have responded the

Investors seemed to have responded the

After more than two months of showing it still has two showings per day in all three cinemas, but the attraction for the stock is much more than this movie.

After more than two months of showing it still has two showings per day in all three cinemas, but the attraction for the stock is much more than this movie.

In 2018, there will also be greater emphasis on building out exports by targeting new markets in Central America and the Greater CARICOM region,” the Managing Director reported.

In 2018, there will also be greater emphasis on building out exports by targeting new markets in Central America and the Greater CARICOM region,” the Managing Director reported.